Delivers Net Income of $148 Million and record

Adjusted EBITDA of $429 Million

Drives industry-leading 34% YoY Retail Unit

growth, Net Income margin of 4.0%, and industry-leading 11.7%

Adjusted EBITDA margin, a new best for public automotive

retailers

For Q4, Carvana expects a sequential increase

in YoY growth rate for retail units; for full year 2024, Carvana

expects Adjusted EBITDA significantly above the high end of

previous $1.0 - $1.2 Billion range1

Carvana Co. (NYSE: CVNA), the leading e-commerce platform for

buying and selling used cars, today announced financial results for

the quarter ended September 30, 2024. Carvana’s complete third

quarter 2024 financial results and management commentary are

available in the company’s shareholder letter on the quarterly

results page of its Investor Relations website.

“Carvana’s exceptional results underscore our position as the

fastest-growing and most profitable automotive retailer,” said

Ernie Garcia, Carvana founder and CEO. “Our progress in Q3 further

highlights the strength of our vertically integrated business model

and also begins to demonstrate the power of our unique

infrastructure, including the ADESA network. As we integrate our

operations and tap our national footprint, we are not only driving

efficient growth, but also improving customer experiences, reducing

costs, and strengthening our wholesale platform. With just 1% share

in an enormous market, significant capacity to support growth, and

a business that generates positive feedback as it scales, we are

just getting started.”

Q3 2024 Highlights

Carvana’s strong results in Q3 continue to demonstrate the

differentiated benefits of its vertically-integrated business

model2. In Q3 2024, Carvana sold 108,651 retail units (+34% YoY)

for total revenue of $3.655 billion (+32% YoY) while reaching new

profitability milestones, including:

- Net Income of $148 million and Net Income margin of 4.0%

- Record Adjusted EBITDA of $429 million

- Record Adjusted EBITDA margin of 11.7%, a new all-time best for

public automotive retailers

- Record GAAP Operating Income of $337 million

Outlook

Looking toward the fourth quarter, Carvana expects the following

as long as the environment remains stable:

- A sequential increase in its year-over-year growth rate in

retail units sold, and

- Adjusted EBITDA significantly above the high end of its

previously communicated range of $1.0 to $1.2 billion for the full

year 2024.1

Conference Call Details

Carvana will host a conference call today, October 30, 2024, at

5:30 p.m. ET (2:30 p.m. PT) to discuss financial results. To

participate in the live call, analysts and investors should dial

(833) 255-2830 or (412) 902-6715. A live audio webcast of the

conference call along with supplemental financial information will

also be accessible on the company's website at

investors.carvana.com. Following the webcast, an archived version

will also be available on the Investor Relations section of the

company’s website. A telephonic replay of the conference call will

be available until Wednesday, November 6, 2024, by dialing (877)

344-7529 or (412) 317-0088 and entering passcode 9979887#.

________________________ 1 In order to clearly demonstrate our

progress and highlight the most meaningful drivers within our

business, we continue to use forecasted Non-GAAP financial

measures, including forecasted Adjusted EBITDA. We have not

provided a quantitative reconciliation of forecasted GAAP measures

to forecasted Non-GAAP measures within this communication because

we are unable, without making unreasonable efforts, to calculate

one-time or restructuring expenses. These items could materially

affect the computation of forward-looking Net Income (loss). 2 For

additional details please see the “Benefits of Carvana's

Differentiated Business Model” presentation on our Investor

Relations website. Information on our website is not incorporated

by reference into this release.

Forward Looking

Statements

This letter contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

These forward-looking statements reflect Carvana’s current

expectations and projections with respect to, among other things,

its financial condition, results of operations, plans, objectives,

strategy, future performance, and business. These statements may be

preceded by, followed by or include the words "aim," "anticipate,"

"believe," "estimate," "expect," "forecast," "intend," "likely,"

"outlook," "plan," "potential," "project," "projection," "seek,"

"can," "could," "may," "should," "would," "will," the negatives

thereof and other words and terms of similar meaning.

Forward-looking statements include all statements that are not

historical facts, including expectations regarding our operational

and efficiency initiatives and gains, our strategy, expected gross

profit per unit, forecasted results, including forecasted Adjusted

EBITDA, potential infrastructure capacity utilization, efficiency

gains and opportunities to improve our results, including

opportunities to increase our margins and reduce our expenses,

trends or expectations regarding inventory, expected customer

patterns and demand, potential benefits from new technology,

anticipated benefits of integrations, and our long-term financial

goals and growth opportunities. Such forward-looking statements are

subject to various risks and uncertainties. Accordingly, there are

or will be important factors that could cause actual outcomes or

results to differ materially from those indicated in these

statements. Among these factors are risks related to: our ability

to utilize our available infrastructure capacity and realize the

expected benefits therefrom, including increased margins and lower

expenses; the benefits from our initiatives relating to ADESA; our

ability to scale up our business; the larger automotive ecosystem,

including consumer demand, global supply chain challenges, and

other macroeconomic issues; our ability to raise additional capital

and our substantial indebtedness; our history of losses and ability

to maintain profitability in the future; our ability to effectively

manage our rapid growth; our ability to maintain customer service

quality and reputational integrity and enhance our brand; the

seasonal and other fluctuations in our quarterly operating results;

our relationship with DriveTime and its affiliates; the highly

competitive industry in which we participate, which among other

consequences, could impact our long-term growth opportunities; the

changes in prices of new and used vehicles; our ability to

effectively manage our inventory or acquire desirable inventory;

our ability to sell our inventory expeditiously; and the other

risks identified under the “Risk Factors” section in our Annual

Report on Form 10-K for the fiscal year ended December 31,

2023.

There is no assurance that any forward-looking statements will

materialize. You are cautioned not to place undue reliance on

forward-looking statements, which reflect expectations only as of

this date. Carvana does not undertake any obligation to publicly

update or review any forward-looking statement, whether as a result

of new information, future developments, or otherwise.

Use of Non-GAAP Financial

Measures

To supplement the consolidated financial measures, which are

prepared and presented in accordance with GAAP, we also refer to

the following non-GAAP measures in this press release: Adjusted

EBITDA and Adjusted EBITDA Margin.

Adjusted EBITDA is defined as net income plus income tax

(benefit) provision, interest expense, other operating expense,

net, other expense, net, depreciation and amortization expense in

cost of sales and SG&A expenses, share-based compensation

expense in cost of sales and SG&A expenses, and loss on debt

extinguishment, minus revenue related to our Root Warrants and gain

on debt extinguishment. Adjusted EBITDA margin is Adjusted EBITDA

as a percentage of total revenues.

We believe that these metrics are useful measures to us and to

our investors because they exclude certain financial, capital

structure, and non-cash items that we do not believe directly

reflect our core operations and may not be indicative of our

recurring operations, in part because they may vary widely across

time and within our industry independent of the performance of our

core operations. We believe that excluding these items enables us

to more effectively evaluate our performance period-over-period and

relative to our competitors.

For the Three Months Ended (dollars in millions, except

per unit amounts) Sep 30, 2024 Sep 30, 2023 Net

income

$

148

$

741

Income tax (benefit) provision

(1

)

29

Interest expense

157

153

Other expense, net

29

3

Loss (Gain) on debt extinguishment

4

(878

)

Operating income

$

337

$

48

Other operating expense, net

1

1

Depreciation and amortization expense in cost of sales

33

42

Depreciation and amortization expense in SG&A expenses

40

45

Share-based compensation expense in cost of sales

1

-

Share-based compensation expense in SG&A expenses

23

18

Root warrant revenue

(6

)

(6

)

Adjusted EBITDA

$

429

$

148

Total revenues

$

3,655

$

2,773

Net income margin

4.0

%

26.7

%

Adjusted EBITDA margin

11.7

%

5.3

%

About Carvana (NYSE: CVNA)

Carvana’s mission is to change the way people buy and sell cars.

Over the past decade, Carvana has revolutionized automotive retail

and delighted millions of customers with an offering that is fun,

fast, and fair. With Carvana, customers can choose from tens of

thousands of vehicles, get financing, trade-in, and complete a

purchase entirely online with the convenience of home delivery or

local pick up in over 300 U.S. markets. Carvana’s vertically

integrated platform is powered by its passionate team, unique

national infrastructure, and purpose-built technology. Carvana is a

Fortune 500 company and is proud to be recognized by Forbes as one

of America’s Best Employers.

For more information, please visit www.carvana.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030656859/en/

Investors: Carvana Mike McKeever investors@carvana.com or

Media: Carvana press@carvana.com

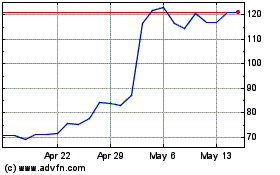

Carvana (NYSE:CVNA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Carvana (NYSE:CVNA)

Historical Stock Chart

From Nov 2023 to Nov 2024