Southwest Lowers Revenue Metric Forecast

09 December 2015 - 3:00AM

Dow Jones News

Southwest Airlines Co. said Tuesday that a key revenue metric

could fall in the current quarter, sending shares lower in early

trading.

The airline estimates its fourth-quarter 2015 operating revenue

per available seat mile to be flat to down 1% compared with the

same period last year. Southwest had given previous guidance for

operating revenue per available seat mile to rise 1%.

Shares, which have risen about 11% this year, declined 4.7% to

$47.16 in early trading.

Still, the airline said its passenger traffic improved 13.9% in

November from the same month a year ago. Capacity increased 9.7%,

while load factor—the percentage of seats filled—rose to a record

for the month at 83.2% compared with 80.1% a year earlier.

Dallas-based Southwest grew into the fourth-largest domestic

carrier over the past four decades by flying exclusively within the

continental U.S. But with dwindling growth opportunities at home,

it has been expanding abroad.

Shares of other airlines also declined in early trading. Delta

Air Lines Inc. fell 1.4%, United Continental Holdings Inc. declined

1.3% and American Air Lines Group Inc. fell 2.2%.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

December 08, 2015 10:45 ET (15:45 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

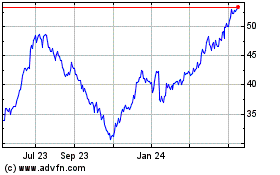

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Delta Air Lines (NYSE:DAL)

Historical Stock Chart

From Jul 2023 to Jul 2024