Western Asset Mortgage Opportunity Fund Inc. Announces Financial Position as of September 30, 2023

29 November 2023 - 12:00AM

Business Wire

Western Asset Mortgage Opportunity Fund Inc. (NYSE: DMO) today

announced the financial position of the Fund as of September 30,

2023.

Current Q Previous Q Prior Yr Q September

30, 2023 June 30, 2023 September 30, 2022 Total

Assets (a)

$

243.933.771

$

237.934.200

$

243.711.511

Total Net Assets (a)

$

136.171.768

$

136.800.474

$

145.748.553

NAV Per Share of Common Stock (b)

$

11.96

$

12.02

$

12.75

Market Price Per Share

$

10.71

$

10.58

$

11.11

Premium / (Discount)

(10.45

)%

(11.98

)%

(12.86

)%

Outstanding Shares

11.383.541

11.383.541

11.430.895

Total Net Investment Income (c)

$

3.381.432

$

3.117.983

$

3.023.794

Total Net Realized/Unrealized Gain/(Loss) (c)

$

(310.487

)

$

(1.332.047

)

$

(5.184.311

)

Net Increase/(Decrease) in Net Assets From Operations (c)

$

3.070.945

$

1.785.936

$

(2.160.517

)

Earnings per Common Share

Outstanding Total Net Investment Income (c)

$

0.30

$

0.27

$

0.26

Total Net Realized/Unrealized Gain/(Loss) (c)

$

(0.03

)

$

(0.12

)

$

(0.45

)

Net Increase/(Decrease) in Net Assets From Operations (c)

$

0.27

$

0.15

$

(0.19

)

Undistributed/(Overdistributed) Net Investment Income (d)

$

(9.407.817

)

$

(9.089.598

)

$

(7.201.035

)

Undistributed/(Overdistributed) Net Investment Income Per Share (d)

$

(0.83

)

$

(0.80

)

$

(0.63

)

Reverse Repurchase Agreements (d)

$

99.977.000

$

98.190.000

$

89.609.000

Footnotes:

(a) The difference between total assets and total net assets is

due primarily to the Fund’s use of borrowings; total net assets do

not include borrowings. (b) NAVs are calculated as of the close of

business on the last business day in the periods indicated above.

(c) For the quarter indicated. (d) As of the period indicated

above.

This financial data is unaudited.

The Fund files its semi-annual and annual

reports with the Securities and Exchange Commission (“SEC”), as

well as its complete schedule of portfolio holdings for the first

and third quarters of each fiscal year as an exhibit to its reports

on Form N-PORT. These reports are available on the SEC’s website at

www.sec.gov. To obtain information on Forms N-PORT or a semi-annual

or annual report from the Fund, shareholders can call

1-888-777-0102.

Legg Mason Partners Fund Advisor, LLC, is an indirect,

wholly-owned subsidiary of Franklin Resources, Inc. (“Franklin

Resources”).

For more information about the Fund, please call 1-888-777-0102

or consult the Fund’s web site at

www.franklintempleton.com/investments/options/closed-end-funds.

Hard copies of the Fund’s complete audited financial statements are

available free of charge upon request.

Data and commentary provided in this press release are for

informational purposes only. Franklin Resources and its affiliates

do not engage in selling shares of the Fund.

Category: Financials Source: Franklin Resources, Inc. Source:

Legg Mason Closed End Funds

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231128293360/en/

Investor Contact: Fund Investor Services 1-888-777-0102

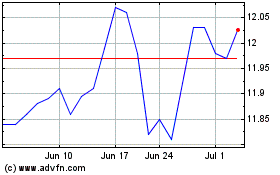

Western Asset Mortgage O... (NYSE:DMO)

Historical Stock Chart

From Jan 2025 to Feb 2025

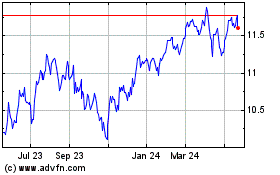

Western Asset Mortgage O... (NYSE:DMO)

Historical Stock Chart

From Feb 2024 to Feb 2025