Filed pursuant to Rule 424(b)(2)

Registration No. 333-279371

PROSPECTUS SUPPLEMENT

(to Prospectus dated June 5, 2024)

Danimer Scientific, Inc.

Up to 70,134,322 Shares of Common Stock

This prospectus supplement

and the accompanying prospectus relate to the issuance and sale of up to an aggregate of 70,134,322 shares of Class A common stock, $0.0001

par value per share (“Common Stock”) of Danimer Scientific, Inc. (the “Company,” “Danimer,” “we,”

“our,” or “us”), upon the exercise of warrants issued by us on or about July 12, 2024 as a distribution to holders

of (i) shares of Common Stock, (ii) 3.250% Convertible Senior Notes due 2026 (on an as-converted basis) (the “Convertible Notes”),

and (iii) pre-funded common stock purchase warrants dated March 25, 2024 (on an as-exercised basis) (the “pre-funded warrants”)

on the Record Date (each, a “Warrant” and, collectively, the “Warrants”).

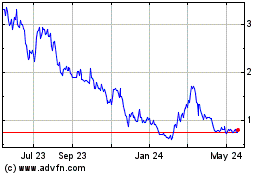

Our Common Stock is listed

on The New York Stock Exchange under the symbol “DNMR”. On July 11, 2024, the last reported sale price of our Common Stock

on the New York Stock Exchange (the “NYSE”) was $0.6045 per share.

The Company is declaring

a distribution (the “Warrant Distribution”) of transferable Warrants at no charge to all of its stockholders of record on

May 13, 2024 (the “Record Date”). The Company is distributing one Warrant for every three shares of Common Stock, subject

to downward rounding, held by stockholders of record on the Record Date. Holders of the Company’s outstanding Convertible Notes

and the Company’s outstanding pre-funded warrants, in each case as of the Record Date, will also receive Warrants on a pass-through

basis as determined in the agreements governing such securities and the Warrant Agreement (defined below). The Warrant Distribution

has been effected on July 12, 2024. Unless earlier redeemed as described herein, the Warrants may be exercised at any time in accordance

with their terms until July 15, 2025. Each Warrant entitles the holder thereof to purchase from us one share of Common Stock (plus the

Bonus Share Fraction (as defined herein), if any) at an initial Exercise Price of $5.00 per Warrant, in each case, subject to certain

adjustments. The Exercise Price shall be paid (a) prior to July 26, 2024, in cash or (b) starting on July 26, 2024, (i) in cash or (ii)

at the election of the Holder (as defined herein), either in cash or, if there are certain issued and outstanding Designated Notes (as

defined herein) as of the relevant Exercise Date, by delivery of Designated Notes. Upon the Bonus Share Expiration Date (as defined herein),

all Designated Notes as of such date will be automatically removed from being Designated Notes.

If Holders exercise Warrants

for cash, the Company will receive the proceeds. See “Use of Proceeds” in this prospectus supplement. If Holders exercise

Warrants through the surrender of Designated Notes, the amount of the Company’s outstanding debt will be reduced.

Based on the number of shares

of Common Stock issued and outstanding as of the Record Date, if all Warrants issued in the Warrant Distribution were exercised, and

if the maximum number of Bonus Share Fractions were issued, we would have 188,166,022 shares of Common Stock issued and outstanding

following the completion of the exercise period for the Warrants. The Company is unable to predict the number of Warrants that will be

exercised, if any, or how many would be exercised through the surrender of Designated Notes instead of cash.

The Warrants have been issued

by the Company pursuant to a Warrant Agreement, dated as of July 12, 2024, between Continental Stock Transfer & Trust Company, as

Warrant Agent, and the Company (the “Warrant Agreement”). The Warrants will be transferable when issued and are expected

to trade over-the-counter. However, there can be no assurance that an orderly, liquid trading market for the Warrants will develop. Any

trading value of the Warrants will be determined by the market.

This prospectus supplement

updates and supplements the information in the accompanying prospectus and is not complete without and may not be delivered or utilized

except in combination with, the accompanying prospectus, including any amendments or supplements thereto. This prospectus supplement

should be read in conjunction with the accompanying prospectus and if there is any inconsistency between the information in the accompanying

prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in the securities

offered by this prospectus supplement involves substantial risks. You should carefully consider the risks described under the “Risk

Factors” section of this prospectus supplement beginning on page S-8 and similar sections in our filings with the Securities

and Exchange Commission (the “Commission”) incorporated by reference herein before buying any of the shares of Common Stock

offered hereby.

Neither the Commission

nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is July

12, 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

IMPORTANT

NOTICE ABOUT INFORMATION IN THIS

PROSPECTUS SUPPLEMENT

AND THE ACCOMPANYING PROSPECTUS

This document is in two

parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also adds to and updates

information contained in the accompanying prospectus and the documents incorporated by reference herein. The second part is the accompanying

prospectus, which gives more general information, some of which may not apply to the offering made pursuant to this prospectus supplement.

Generally, when we refer only to the “prospectus,” we are referring to both parts combined. If the information about this

offering varies between this prospectus supplement and the accompanying prospectus, you should rely on the information in this prospectus

supplement.

Any statement made in this

prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be

deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus

supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus supplement modifies

or supersedes that statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute

a part of this prospectus supplement. Please read “Incorporation of Certain Information by Reference” in this prospectus

supplement.

We urge you to carefully

read this prospectus supplement and the accompanying prospectus, and the documents incorporated by reference herein and therein, before

buying any of the securities being offered under this prospectus supplement. You should rely only on the information contained in this

prospectus supplement and the accompanying prospectus or incorporated by reference herein or therein or contained in a freewriting prospectus

we have prepared. We have not authorized anyone to provide you with different information. No dealer, salesperson or other person is

authorized to give any information or to represent anything not contained in this prospectus supplement and the accompanying prospectus.

You should not rely on any unauthorized information or representation. This prospectus supplement is an offer to sell only the securities

offered hereby, and only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information

in this prospectus supplement and the accompanying prospectus is accurate only as of the date on the front of the applicable document

and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference,

regardless of the date of delivery of this prospectus supplement or the accompanying prospectus, or any sale of a security.

Neither we, nor any of our

respective representatives are making any representation to you regarding the legality of an investment in our securities by you under

applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related aspects of an investment

in our securities. References in this prospectus supplement to the “Company,” “Danimer,” “we,” “our,”

or “us,” refer to Danimer Scientific, Inc. unless otherwise stated or the context otherwise requires.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING STATEMENTS

Certain statements included

in this prospectus supplement, the accompanying prospectus and the information incorporated by reference herein and therein are “forward-looking

statements” within the meaning of the federal securities laws. Forward-looking statements are made based on our expectations and

beliefs concerning future events impacting the Company and therefore involve a number of risks and uncertainties. In addition, any statements

that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions,

are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would” and similar expressions

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. We caution

that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied in

the forward-looking statements.

Potential risks and uncertainties

that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or

implied by forward-looking statements in this prospectus supplement, the accompanying prospectus and the documents incorporated herein

and therein include, but are not limited to, our expectations related to the use of proceeds from the equity offering; reduction in the

number and amount of Convertible Notes remaining outstanding after the exercise of Warrants, if any; our ability to maintain compliance

with the NYSE continued listing requirements; the impact on our business, operations and financial results of pandemics, including COVID-19,

and the ongoing conflicts in Ukraine and in the Middle East (each of which, among other things, may affect many of the items listed below);

the demand for our products and services; revenue growth; effects of competition; supply chain and technology initiatives; inventory

and in-stock positions; state of the economy; state of the credit markets, including mortgages, home equity loans, and consumer credit;

impact of tariffs; demand for credit offerings; management of relationships with our employees, suppliers and vendors, and customers;

international trade disputes, natural disasters, public health issues (including pandemics and related quarantines, shelter-in-place

orders, and similar restrictions), and other business interruptions that could disrupt supply or delivery of, or demand for, our products

or services; continuation of equity programs; net earnings performance; earnings per share; capital allocation and expenditures; liquidity;

return on invested capital; expense leverage; stock-based compensation expense; commodity price inflation and deflation; the ability

to issue debt on terms and at rates acceptable to us; the impact and outcome of investigations, inquiries, claims, and litigation; the

effect of accounting charges; the effect of adopting certain accounting standards; the impact of regulatory changes; financial outlook;

and the integration of acquired companies into our organization and the ability to recognize the anticipated synergies and benefits of

those acquisitions. More information on potential factors that could affect the Company’s financial results is included from time

to time in the Company’s public reports filed with the Securities and Exchange Commission (“SEC”), including the Company’s

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. All forward-looking statements included in

this prospectus supplement are based upon information available to the Company as of the date of this prospectus supplement and speak

only as the date hereof. We assume no obligation to update any forward-looking statements to reflect events or circumstances after

the date of this prospectus supplement.

You should also read carefully

the factors described or referred to in the “Risk Factors” section of this prospectus supplement, the accompanying prospectus

and the information incorporated by reference herein and therein, to better understand the risks and uncertainties inherent in our business

and underlying any forward-looking statements. Any forward-looking statements that we make in this prospectus supplement, the accompanying

prospectus and the information incorporated by reference herein as well as other written or oral statements by us or our authorized officers

on our behalf, speak only as of the date of such statement, and we undertake no obligation to update such statements. Comparisons

of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless

expressed as such, and should only be viewed as historical data.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained

elsewhere in this prospectus supplement. This summary does not contain all of the information that you should consider before deciding

whether to invest in our securities. You should read this entire prospectus supplement carefully, including the “Risk Factors”

section, the accompanying prospectus, and the information incorporated by reference in this prospectus supplement and the accompanying

prospectus, prior to making an investment decision.

The Company

We

are a performance polymer company specializing in bioplastic replacements for traditional petroleum-based plastics. Applications for

biopolymers include additives, aqueous coatings, fibers, filaments, films, thermoforming, and injection-molded articles. We bring together

innovative technologies to deliver biodegradable bioplastic materials to global consumer product companies. We believe that we are the

only commercial company in the bioplastics market to combine the production of a base polymer along with the reactive extrusion capacity

in order to give customers a “drop-in” replacement for a wide variety of petroleum-based plastics. We have core competencies

in polymer formulation and application development, fermentation process engineering, thermocatalysis, chemical engineering and polymer

science. In addition, we have created an extensive intellectual property portfolio to protect our innovations that together with our

technology, serves as a valuable foundation for our business and for future industry collaborations.

Globally, over 800 billion

pounds of plastic are produced each year. Bioplastics are a key segment of the plastics industry and offer a renewably sourced or compostable

replacement for traditional petroleum-based plastics with additional benefits such as biodegradability and enhanced safety. Bioplastics

are used in a wide range of applications, including packaging, adhesives, food additives, food service items and many others. The bioplastics

industry is diverse and rapidly evolving. As companies continue to innovate new bioplastic products to meet existing and future customer

needs, we expect the industry to expand substantially.

We primarily market our

products to consumer packaging brand owners, converters and manufacturers in the plastics industry seeking to address environmental,

public health, renewability, composting and biodegradability concerns arising from customer perceptions and expectations, government

regulations, or other reasons.

We, through our principal

operating subsidiaries, Meredian, Inc., Meredian Bioplastics, Inc., Danimer Scientific, L.L.C., Danimer Bioplastics, Inc., Danimer Scientific

Kentucky, Inc., and Novomer, Inc., bring together innovative technologies to deliver biodegradable bioplastic materials to global consumer

product companies.

Corporate Information

Our principal executive offices

are located at 140 Industrial Boulevard, Bainbridge, Georgia 39817. Our telephone number is (229) 243-7075, and our Internet website

address is www.danimerscientific.com. The content contained in, or that can be accessed through, our website is not part of this prospectus

supplement (other than the documents that we file with the SEC that are expressly incorporated by reference into this prospectus supplement).

See “Incorporation of Certain Information by Reference.”

THE OFFERING

| Issuer: |

Danimer Scientific, Inc.

|

| |

|

| The Warrant Distribution: |

Our Board of Directors declared a distribution

of transferable Warrants at no charge to all of our stockholders. We are distributing, on July 12, 2024, one Warrant for every

three shares of our Common Stock. Holders of our 3.250% Convertible Senior Notes due 2026 (the “Convertible Notes”)

will also receive, at the same time and on the same terms as holders of Common Stock, Warrants without having to convert such

noteholder’s Convertible Notes as if such noteholder held a number of shares of Common Stock equal to the product of (i)

the Conversion Rate (as defined in the indenture for the Convertible Notes) in effect on the Record Date; and (ii) the aggregate

principal amount (expressed in thousands) of Convertible Notes held by such holder on such date. Holders of our pre-funded common

stock purchase warrants dated March 25, 2024 (the “pre-funded warrants”) shall also receive Warrants to the same

extent that a pre-funded warrantholder would have participated therein if such pre-funded warrantholder had held the number of

shares of Common Stock acquirable upon complete exercise of the pre-funded warrant held by such pre-funded warrantholder as of

the Record Date. Each Warrant will entitle the holder thereof (the “Holder”) to purchase, at the Holder’s sole

and exclusive election, at the Exercise Price, one share of Common Stock (the “Basic Warrant Exercise Rate”) plus,

to the extent described below, the Bonus Share Fraction (as defined below), subject to certain adjustments described in “Anti-Dilution

Adjustments” below.

We issued a total of 46,756,215 Warrants

(which represent the right to purchase up to 70,134,322 shares of Common Stock, assuming the maximum number of Bonus Share Fractions

are issued and that no Warrants or shares of Common Stock are rounded down). Our officers, directors, employees, affiliates and advisors

and their respective affiliates who are also stockholders will receive, in their capacity as stockholders, Warrants in respect of

the shares of Common Stock they own as of the Record Date.

Holders may exercise all or a portion of

their Warrants or choose not to exercise any Warrants at all, or may otherwise sell or transfer their Warrants, in each case, in

their sole and absolute discretion, subject to applicable law. |

| |

|

| No Fractional Warrants: |

The Warrant

Agent will not be required to effect any transaction that would result in the issuance of a fraction of a Warrant. If any fractional

Warrant would otherwise be required to be issued, we will round down the total number of Warrants to be issued to the relevant Holder

to the nearest whole number. As a result, stockholders who own a number of shares that is not a whole multiple of three shares will

not receive any Warrants for any shares in excess of the largest whole multiple of three shares owned by them, and stockholders who

own fewer than three shares will not be entitled to any Warrants as a result of holding such shares. For example, stockholders who

own 2, 220 or 440 shares of Common Stock would receive zero, 73 and 146 warrants, respectively. |

| |

|

| Record Date: |

5:00 p.m., New York City time,

May 13, 2024. |

| |

|

| Shares of Common Stock Currently

Outstanding: |

As of

the Record Date, 116,443,200 shares of our Common Stock are issued and outstanding. |

| |

|

| Shares of Common Stock Outstanding

Assuming Complete Exercise of the Warrants: |

We will

not issue any shares of Common Stock directly in the Warrant Distribution. Based on the number of shares of Common Stock outstanding

as of the Record Date, if all 46,756,215 Warrants issued in the Warrant Distribution were exercised and the maximum number of Bonus

Share Fractions were issued, we would have 188,166,022 shares of Common Stock outstanding (in each case, assuming no Warrants or

shares of Common Stock are rounded down). |

| |

|

| Warrant Shares: |

Each Warrant

will be exercisable for one share of our Common Stock plus the Bonus Share Fraction, if any, in each case, subject to certain adjustments

described in the “Anti-Dilution Adjustments” section below. Such number of shares of Common Stock, as it may be adjusted,

is referred to as the “Warrant Exercise Rate.” |

| Bonus Share Fraction: |

Until the Bonus Share

Expiration Date, a Holder exercising its Warrants will receive an additional one-half (0.5) of a share of

Common Stock for each Warrant exercised (the “Bonus Share Fraction”) without payment of any additional

Exercise Price.

The right to receive the Bonus Share Fraction

will expire at 5:00 p.m. New York City time upon the date (the “Bonus Share Expiration Date”) which is the first Business

Day following the last day of the first 30 consecutive Trading Day period in which the daily volume-weighted average price (VWAP)

(as defined in this prospectus supplement under “Description of the Warrants – Certain Definitions”) of the shares

of Common Stock has been at least equal to the then applicable Bonus Share Expiration Trigger Price (as defined below) for 20 Trading

Days (whether or not consecutive) each falling on or after August 1, 2024 (the “Bonus Share Expiration Price Condition”,

and each such 20 Trading Days, a “Qualifying Trading Day”). For the avoidance of doubt, the first possible date on which

the Bonus Share Expiration Date can occur is August 29, 2024, provided that the Bonus Share Expiration Price Condition is met.

Any Warrant exercised with an Exercise Date

(as defined below) after the Bonus Share Expiration Date will not be entitled to any Bonus Share Fraction.

The “Bonus Share Expiration Trigger

Price” is initially $2.00, subject to certain adjustments described in the “Anti-Dilution Adjustments” section

below.

The Company will make a public announcement

of the Bonus Share Expiration Date prior to market open on the Bonus Share Expiration Date in the case of a Bonus Share Expiration

Price Condition. |

| |

|

| No Fractional Shares: |

The Company

will not issue fractional shares of Common Stock or pay cash in lieu thereof. If a stockholder would otherwise be entitled to receive

a fractional number of shares of Common Stock upon exercise of the Warrants, we will round down the total number of shares of Common

Stock to be issued to such stockholder to the nearest whole number. The Company’s calculation shall be determinative. |

| |

|

| Exercise Price: |

$5.00

per Warrant (the “Exercise Price”). The Exercise Price shall be paid (x) prior to July 26, 2024, in cash or (y) starting

on July 26, 2024, (i) in cash or (ii) (if there are Designated Notes as of the relevant Exercise Date) at the election of the Holder,

either in cash or by delivery of Designated Notes. |

| |

|

| Exercise Procedure: |

In order to exercise all or any of the

Warrants, the Holder thereof is required to deliver to the Warrant Agent a duly executed notice of election by 5:00 p.m. New

York City time on a Business Day (an “Exercise Notice” and the date on which such notice is validly submitted, the

“Exercise Date”) and pay the Exercise Price.

For exercises of Warrants, the Exercise Price

shall be paid (x) prior to July 26, 2024, in cash or (y) starting on July 26, 2024, (i) in cash or (ii) if there are Designated Notes

as of the relevant Exercise Date, at the election of the Holder, either in cash or by delivery of certain issued and outstanding

notes designated by the Company from time to time (the “Designated Notes”). In order for an exercise to be valid, the

Exercise Price needs to be paid (by delivering cash, or if applicable, the relevant number of Designated Notes) on the same day as

the exercise of the Warrants.

Record holders of Warrants can exercise Warrants

through the process established by the Warrant Agent. Indirect “street name” holders of Warrants should contact their

broker, bank or other intermediary for information on how to exercise Warrants. |

| Designated Notes: |

Commencing July 26, 2024, the Designated Notes include the Company’s

notes as listed below. |

| |

Title

of Series |

CUSIP

/ ISIN Numbers |

Principal

Amount Outstanding |

Consideration

per $1,000 Principal Amount of Notes Surrendered |

| |

3.250%

Convertible Senior Notes due December 15, 2026 |

236272AA8

/ US236272AA82 |

$240,000,000 |

Exercise

Price valued at aggregate principal amount (regardless of the then current market value of such notes), excluding any accrued and

unpaid interest. |

| |

The Company may add or remove the right to use a particular series of

notes as Designated Notes, provided that the Company will give at least 20 Business Days’ notice before removing a series of

notes from being Designated Notes. If the Company decides to add or remove notes from being Designated Notes, the Company will promptly

make a public announcement, update its website and the corresponding table to reflect the change. In addition, upon the Bonus Share

Expiration Date, all Designated Notes as of such date will be automatically removed from being Designated Notes. |

| |

|

| |

Designated Notes

must be delivered in a principal amount of $1,000 or any whole multiple thereof. Designated

Notes used to pay the Exercise Price shall be valued at their aggregate principal amount

(regardless of the then current market value), excluding any accrued and unpaid interest.

For purposes of payment of the Exercise Price, $1,000 principal amount of Designated Notes

shall be deemed to be equal to the aggregate Exercise Price in respect of 200 Warrants. The

principal amount of any Designated Notes surrendered to exercise Warrants in excess of the

aggregate Exercise Price in respect thereof shall be forfeited to the Company; provided

that if the excess exceeds $1,000, the Company will return any Designated Notes in multiples

of $1,000 principal amount. Any accrued but unpaid interest on any Designated Notes surrendered

to exercise Warrants shall be forfeited unless they are surrendered during the period commencing

on a record date for an interest payment and ending on the day immediately preceding that

interest payment date, in which case interest on the Designated Notes shall be paid to the

holder of record of the Designated Notes as of applicable record date. Any holder that exercises

any Warrants with Designated Notes shall use DTC’s Deposit/Withdrawal At Custodian

(“DWAC”) system to withdraw the Holder’s beneficial interest in the Warrants

being exercised and the Designated Notes being used to pay the Exercise Price and transfer

such Warrants and Designated Notes to the Warrant Agent or the applicable indenture trustee

under the indenture governing the terms of such Designated Notes. See “Description

of the Warrants - Procedures for Exercising Warrants – DWAC Procedures”.

|

| |

|

Issuance of Common Stock Upon Exercise of Warrants: |

If you

are a holder of record of our Common Stock and you exercise your Warrants to purchase Common Stock, our transfer agent will issue

a direct registration account statement representing those shares to you as soon as practicable after the exercise of the Warrants.

If your shares are held through a broker, dealer, custodian bank or other nominee and you purchase shares of Common Stock through

exercising Warrants, your account at your nominee will be credited with those shares as soon as practicable following the exercise

of your Warrants. |

| |

|

| Exercise Period: |

Subject

to applicable laws and regulations, the Warrants may be exercised (i) at any time starting on the date of issuance for Warrants exercised

with cash or (ii) at any time starting on July 26, 2024 for Warrants exercised with Designated Notes, if any, in each case until

the earlier of (x) 5:00 p.m. New York City time on the Expiration Date (as defined below) and (y) 5:00 p.m. New York City time on

the Business Day prior to the Redemption Date (as defined below). |

| |

|

| Expiration Date: |

Subject

to the provisions under the heading “Redemption” below, the Warrants will expire and cease to be exercisable at 5:00

p.m. New York City time on July 15, 2025 (the “Expiration Date”). |

| Redemption: |

The Warrants are redeemable

at the Company’s sole option at any time following the last day of the first 30 consecutive Trading

Day period in which the daily VWAP of the shares of Common Stock has been at least equal to the then applicable

Redemption Trigger Price (as defined below) for 20 Trading Days (whether or not consecutive) each falling

on or after August 1, 2024 (the “Redemption Price Condition”). The Company may redeem the Warrants

at its sole option at any time after the Redemption Price Condition has been met, even if the trading price

of the Common Stock subsequently declines.

The Company will provide at least 20 calendar

days’ notice by press release (the “Redemption Notice”) of the date selected for redemption (the “Redemption

Date”). The redemption price upon any redemption shall equal $0.001 per Warrant (the “Redemption Price”).

In the event of a redemption of the Warrants,

Warrants will be exercisable until 5:00 p.m. New York City time on the Business Day immediately preceding the Redemption Date.

The “Redemption Trigger Price”

is initially equal to the Exercise Price, subject to certain adjustments described in “Anti-Dilution Adjustments” below.

|

| Form, Transfer and Exchange: |

Indirect

“street name” holders of Warrants should contact their broker, bank or other intermediary for information on how to transfer

or exercise Warrants. The deadlines of such intermediaries or of the DTC may be earlier than the stated deadlines set

forth in the Warrant Agreement. Record holders of Warrants should contact the Warrant Agent for information on how to

transfer or exercise Warrants. The deadlines established by the Warrant Agent may also be earlier than the stated deadlines

set forth in the Warrant Agreement. |

| |

|

| Anti-Dilution Adjustments: |

The Basic

Warrant Exercise Rate is subject to certain adjustments for events including: (i) stock dividends, splits, subdivisions, reclassifications

and combinations; (ii) other distributions and spinoffs; and (iii) stockholder rights plans. The Bonus Share Fraction, the Bonus

Expiration Trigger Price and the Redemption Trigger Price are subject to proportional adjustment when the Basic Warrant Exercise

Rate is adjusted. |

| |

|

| Use of Proceeds: |

Assuming

that all Warrants distributed are fully exercised for cash, we would receive proceeds of approximately $230.0 million in the

aggregate, net of transaction expenses. We intend to use the proceeds of any Warrant exercises for general corporate purposes, which

may, among other things, include the repayment of debt. Any Designated Notes received upon exercise of a Warrant are expected to

be retired and canceled by the Company. We cannot assure you if Warrants will be exercised for cash or Designated Notes, or the amount,

if any, thereof. |

| |

|

| Absence of a Public Market: |

The Warrants

are new securities and there is no established trading market for the Warrants. Accordingly, there can be no assurances as to the

development or liquidity of any market for the Warrants. The Warrants are expected to trade on the OTCQX commencing on July 15, 2024.

There can be no assurance that any such market will be available for trading of the Warrants. |

| Listing of Shares

of Common Stock: |

Shares of our Common

Stock trade on the NYSE under the symbol “DNMR.” |

| |

|

| Maintenance of Registration

Statement: |

We will

use our commercially reasonable efforts to keep a registration statement effective, subject to certain exceptions, covering the issuance

of the Common Stock issuable upon the exercise of the Warrants. If the registration statement ceases to be effective for any reason

at the time of exercise of any Warrants, the right to exercise Warrants shall be automatically suspended until such registration

statement becomes effective (any such period, an “Exercise Suspension Period”). The Company shall provide notice by press

release, with a copy to the Warrant Agent, of any Exercise Suspension Period. No Bonus Share Expiration Date, and no calculation

of the VWAP for purposes of determining the Bonus Share Expiration Date, shall occur during any Exercise Suspension Period. If the

Expiration Date or a Redemption Date would otherwise fall in an Exercise Suspension Period then, notwithstanding anything to the

contrary in the Warrant Agreement, the Expiration Date or the Redemption Date, as the case may be, shall be extended by the number

of days comprised in such Exercise Suspension Period. |

| |

|

| Rights as a Stockholder: |

Holders

of Warrants do not have any rights as a stockholder with respect to the shares of Common Stock issuable upon exercise of the Warrants

prior to the time such Warrants are validly exercised, and the Exercise Price is paid. |

| |

|

| Settlement: |

Shares

of Common Stock issuable upon exercise of Warrants are expected to be delivered to the applicable Holder as soon as commercially

practicable after the applicable Exercise Date. Holders may not receive the shares within the typical two business day settlement

after exercise of their Warrants. The Company reserves the right to change the settlement mechanics, and timing of settlement, as

needed. |

| |

|

| Governing Law: |

The Warrants and the Warrant

Agreement under which they are issued are governed by the laws of the State of New York. |

| |

|

| Warrant Agent: |

Continental Stock Transfer

& Trust Company |

| |

|

| Calculation Agent: |

ConvEx Capital Markets LLC |

| |

|

| Financial Advisor: |

B. Dyson Capital Advisors |

| |

|

| Risk Factors: |

You should

carefully read the section entitled “Risk Factors” on page S-8 of this prospectus supplement, on page

2 of the accompanying prospectus. |

| |

|

| U.S. Federal Income Tax Consequences: |

You should

carefully read the section entitled “Certain U.S. Federal Income Tax Consequences” on page S-22 of this

prospectus supplement and consult your tax advisors on tax treatment of the Warrants. |

Important Dates

Please

take note of the following important dates and times in connection with the Warrants and shares of Common Stock.

Relevant

Date |

|

Calendar

Date or Method of Determination of Date |

| |

|

| Record

Date for holders of Common Stock to Receive Warrant Distribution: |

|

May 13,

2024 |

| |

|

| Issuance

Date of Warrant Distribution: |

|

July 12,

2024 |

| |

|

|

| Bonus

Share Expiration Date: |

|

The first

Business Day following the last day of the first 30 consecutive Trading Day period, in which the

daily VWAP of the shares of Common Stock has been at least equal to the then applicable Bonus Share

Expiration Trigger Price for 20 Trading Days (whether or not consecutive) each falling on or after

August 1, 2024 (the “Bonus Share Expiration Price Condition”, and each such 20 Trading

Days, a “Qualifying Trading Day”). For the avoidance of doubt, the first possible date

on which the Bonus Share Expiration Date may occur is August 29, 2024, provided that the Bonus Share

Expiration Price Condition is met.

Warrants must be exercised no later than 5:00 p.m. on the Bonus

Share Expiration Date in order to receive the Bonus Share Fraction. |

| |

|

|

| Redemption

Notice Date: |

|

The date

on which the Company issues a Redemption Notice. |

| |

|

| Expiration

Date: |

|

July 15,

2025, unless the Company issues a Redemption Notice. |

| |

|

| Redemption

Date: |

|

After

the Redemption Price Condition has been met, any date elected by the Company upon not less than 20 calendar days’ notice. |

| |

|

| Deadline

for Exercise if the Warrants are Redeemed: |

|

5:00

p.m. New York City time on the Business Day immediately preceding the Redemption Date. |

| |

|

|

| Deadline

for Exercise if the Warrants Expire: |

|

5:00

p.m. New York City time on the Expiration Date. |

| |

|

Dates Warrants can be Exercised

with Cash:

Dates Warrants can be Exercised with Designated Notes: |

|

From the

issuance date of the Warrants until 5:00 p.m. New York City time on the earlier of (x) the Business

Day immediately preceding the Redemption Date and (y) the Expiration Date.

From July 26, 2024 until 5:00 p.m. New York

City time on the earlier of (x) the Business Day immediately preceding the Redemption Date and (y) the Expiration Date,

provided that there are Designated Notes as of the relevant Exercise Date. For the avoidance of doubt, if there are no Designated

Notes as of the Exercise Date, the Exercise Price must be paid in cash. Upon the Bonus Share Expiration Date, all Designated Notes

as of such date will be automatically removed from being Designated Notes. |

| |

|

| Date of

Payment of Exercise Price for Valid Exercise of Warrants: |

|

The

Exercise Price for the Warrants must be paid (in cash or by delivering Designated Notes, as applicable) prior to 5:00 p.m. New York

City time on the applicable Exercise Date. |

| |

|

| Date of

Payment of Redemption Price for Unexercised Warrants as of Redemption Date: |

|

The

Redemption Date. |

| |

|

| Settlement

Date for exercises of Warrants: |

|

As

soon as commercially practicable following the applicable Exercise Date. |

RISK FACTORS

Investing in our securities

involves risks. Our business is influenced by many factors that are difficult to predict and beyond our control and that involve uncertainties

that may materially affect our results of operations, financial condition or cash flows, or the value of our Common Stock and other securities.

These risks and uncertainties include those described below, as well as in the risk factors and other sections of the documents that

are incorporated by reference in this prospectus supplement, including “Part I, Item 1A. Risk Factors” in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2023. You should carefully consider these risks and uncertainties and all the information

contained or incorporated by reference in this prospectus supplement and the accompanying prospectus before you invest in our common

stock.

Risks Related to This Offering

We may redeem your unexercised Warrants

on or after August 1, 2024 subject to certain conditions, and they will have no value after such redemption.

We may redeem all unexercised

Warrants at our sole option at any time on or after August 1, 2024 and upon meeting certain other conditions, including the Redemption

Price Condition. If we redeem your unexercised Warrants, they will cease to be outstanding after the Redemption Date, they will cease

to trade and they will have no value.

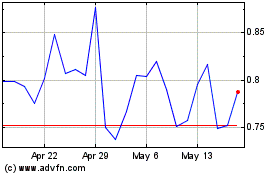

An active public market for the Warrants

may not develop, which would adversely affect the liquidity and market price of the Warrants.

Prior to this Warrant

Distribution, there has been no existing trading market for the Warrants. After we issue the Warrants and they start to trade on

the over-the-counter market, they will be subject to trading dynamics over which we will have no control. An active and orderly

trading market for the Warrants may never develop or, if it develops, it may not be sustained. The trading market for the Warrants may

lack adequate size, liquidity or price transparency or may have an unusually high bid-ask spread, and these factors may affect the price

you receive for your Warrants if decide to sell them.

The trading price for the Warrants may

bear little or no relationship to traditional valuation methods, or to the market price of our Common Stock, and therefore the trading

price of the Warrants may fluctuate significantly following their issuance.

The trading price of the Warrants may have little

or no relationship to, and may be significantly lower, or at times higher, than the price that would otherwise be established using

traditional indicators of value, such as our future prospects and those of our industry in general; future potential revenues, earnings,

cash flows, and other financial and operating information, or multiples thereof; market prices of securities and other financial and

operating information of companies engaged in drug development activities similar to ours; and the views of research analysts. Potential

investors should not buy Warrants in the open market unless they are willing to take the risk that the trading price of the Warrants

could fluctuate and decline significantly.

The price of the Warrants may decline rapidly

and significantly following their distribution.

If there is little or no market

demand for the Warrants once trading begins, the trading price of the Warrants will likely decline following their distribution. Warrants

are being distributed all at once, which could lead to demand and supply imbalances and cause the trading price of the Warrants to decline

rapidly and significantly.

Hedging arrangements relating to the Warrants

may affect the value and volatility of our Common Stock.

In order to hedge their

financial positions, Holders of Warrants may enter into hedging transactions with respect to our Common Stock, may unwind or adjust hedging

transactions and may purchase or sell large blocks of our Common Stock in one or more market transactions. The effect, if any, of these

activities on the trading price of our Common Stock will depend in part on market conditions and cannot be known in advance, but any

of these activities could adversely affect the value and price volatility of our Common Stock.

The settlement process for shares of Common

Stock issuable upon exercise of Warrants is outside of our control and may cause you to lose the value of your investment.

The settlement process with

respect to exercised Warrants refers to the time between exercise of a Warrant and when the issued Common Stock is delivered to your

account, and you become the holder of record of such Common Stock. The settlement process is conducted by outside parties and broker-dealers

and is therefore outside of our control.

Under Rule 15c6-1 of the

Securities Exchange Act of 1934, the standard settlement cycle for most broker-dealer transactions is one business day, unless the parties

to any such trade expressly agree otherwise. We understand that under existing financial industry practices, delivery of the shares of

Common Stock upon exercise of Warrants will likely not occur within one business day, and delivery may take several business days. You

could experience a significant loss of your investment in exercising Warrants if the settlement process takes longer than anticipated

or fails to settle.

Exercising the Warrants is a risky investment

and you may not be able to recover the value of your investment in the Common Stock received upon exercise of the Warrants. You should

be prepared to sustain a total loss of the exercise price of your Warrants.

As of July 11, 2024, the

last reported price of our Common Stock on the NYSE was $0.6045 per share, which is $4.3955 below the Exercise Price of the Warrants.

In order for you to recover the value of your investment in the shares of Common Stock received upon exercise of Warrants (after taking

into account the Bonus Share Fraction during any Bonus Share Period) at the Exercise Price, the value of such shares of Common Stock

must be more than the Exercise Price of such Warrants. If the market value of our Common Stock price declines, you may be unable to resell

your shares at or above the price at which you acquired them through the exercise of Warrants in which case you could experience a loss

of your investment in exercising such Warrants up to a total loss of your investment.

The issuance of Common Stock upon the exercise

of the Warrants may depress our stock price.

We could issue up to 70,134,322

shares of Common Stock in connection with the exercise of Warrants, which would be an approximately 60% increase from our current number

of shares outstanding. The issuance of such additional shares of Common Stock upon exercise of the Warrants, and the resale of such shares

on the open market after their issuance, or the perception that such sales could occur, could result in significant downward pressure

on the price of our shares of Common Stock.

Warrant holders will not be entitled to

any of the rights of holders of our Common Stock.

Holders of Warrants will

not be entitled to any rights with respect to our Common Stock, including, without limitation, voting rights and rights to receive any

dividends or other distributions on our Common Stock. The Warrants merely represent the right to acquire shares of Common Stock at a

fixed price for a limited period of time.

You will have rights with

respect to our Common Stock only if you receive our Common Stock upon exercising the Warrants and only as of the date when you become

an owner of the shares of our Common Stock upon such exercise. For example, if an amendment is proposed to our charter or bylaws requiring

stockholder approval and the record date for determining the stockholders of record entitled to vote on the amendment occurs prior to

the date you are deemed to be the owner of the shares of our Common Stock due upon exercise of your Warrants, you will not be entitled

to vote on the amendment, although you will nevertheless be subject to any changes in the powers, preferences or special rights of our

Common Stock if you later exercise your Warrants.

You will not be permitted to fully exercise

all the Warrants you hold if doing so would cause you to own 9.9% or more of our outstanding Common Stock.

The Ownership Limitation

with respect to the exercise of the Warrants generally provides that without prior written consent of the Company, a Holder will not

be permitted to exercise Warrants for any shares of Common Stock, and the Company shall not be obligated to effect such exercise if,

following such exercise, the Holder would have beneficial ownership of shares of Common Stock of 9.9% or more. No consideration

or repayment will be made to any Holder as a result of an inability to exercise a Warrant in whole or in part because of such ownership

limitations.

To the extent Designated Notes are used

to exercise Warrants, the liquidity of the market for such outstanding series of Designated Notes will be reduced, and market prices

for such outstanding series of Designated Notes may decline as a result.

To the extent the Designated

Notes are used to exercise Warrants, the aggregate principal amount of such series of Designated Notes used will be reduced. A reduction

in the amount of any series of outstanding Designated Notes would likely adversely affect the liquidity of the remaining outstanding

Designated Notes of such series. An issue of securities with a small outstanding principal amount available for trading, or float, generally

commands a lower price than does a comparable issue of securities with a greater float. Therefore, the market price for any series of

Designated Notes that are not used for exercise of Warrants may be adversely affected. A reduced float may also make the trading prices

of any relevant series of Designated Notes lower and may affect the active trading market.

Our registration statement covering the

issuance of Common Stock issuable upon exercise of the Warrants may not be available at times.

We will use our commercially

reasonable efforts to keep a registration statement effective, subject to certain exceptions, covering the issuance of the Common Stock

issuable upon the exercise of the Warrants; however, we are not prohibited from suspending the use of the registration statement and

can suspend it at any time at our discretion as described in this prospectus supplement under the heading “Description of the Warrants

– Registration and Suspension.” If at the time of exercise of Warrants, there is no effective registration statement

covering the issuance of the shares of Common Stock underlying the Warrants, the right to exercise Warrants shall be automatically suspended

until such registration statement becomes effective (any such period, an “Exercise Suspension Period”). The Company shall

provide notice by press release, with a copy to the Warrant Agent, of any Exercise Suspension Period. No Bonus Share Expiration

Date, and no calculation of the VWAP for purposes of determining the Bonus Share Expiration Date, shall occur during any Exercise

Suspension Period. If the Expiration Date or a Redemption Date would otherwise fall in an Exercise Suspension Period, notwithstanding

anything to the contrary in the Warrant Agreement, the Expiration Date or the Redemption Date, as the case may be, shall be extended

by the number of days comprised in such Exercise Suspension Period.

We have broad

discretion in the use of the net proceeds from this offering.

Our management will have

broad discretion in the application of the net proceeds, if any, from this offering, including for any of the purposes described in the

section entitled “Use of Proceeds,” and could spend the net proceeds in ways with which you may not agree. Accordingly, you

will be relying on the judgment of our management with regard to the use of the net proceeds, and you will not have the opportunity,

as part of your investment decision, to assess whether the net proceeds are being used appropriately. It is possible that the net proceeds

will be invested or otherwise used in a way that does not yield a favorable, or any, return for us, or that does not improve our operating

results or enhance the value of our Common Stock or other securities. Because of the number and variability of factors that will determine

our use of any net proceeds from the exercise of Warrants, the ultimate use of such net proceeds may vary substantially from their currently

intended use. The failure of our management to use these net proceeds, if any, effectively could harm our business.

Future sales or other dilution of our equity

may adversely affect the market price of our Common Stock.

The Warrant Agreement does

not restrict us from issuing additional shares of Common Stock to the public or under our equity compensation plans. We regularly evaluate

opportunities to access capital markets, taking into account our capital needs, financial condition, strategic plans and other relevant

considerations. The issuance of additional shares of Common Stock or common equivalent securities in future equity offerings will dilute

the ownership interest of our existing stockholders and may depress the trading value of the Warrants or our Common Stock. There can

be no assurances that we will not in the future determine that it is advisable or necessary to issue additional shares of Common Stock

or other securities convertible or exercisable for shares of Common Stock to fund our business needs. We also expect to continue to use

equity and stock options to compensate our employees and directors and others. The market price of our Common Stock and the Warrants

could decline significantly as a result of such offerings or issuances, or the perception that such offerings or issuances could occur.

The market price for our Common Stock may

be volatile and subject to future declines, and the value of an investment in our Common Stock and corresponding derivative securities

may decline.

The market price of our

shares of Common Stock may be volatile. Fluctuations in our stock price may be unrelated to or not otherwise reflect our historical financial

performance and condition and prospects. The stock market in general can experience considerable price and volume fluctuations due to

changes in general economic conditions or other factors beyond our control, which could impact the future market price of our shares

of Common Stock. These broad market fluctuations may adversely affect the market price of our Common Stock and, in turn, the value of

your investment in this offering. We cannot assure you that the market price of our shares of Common Stock will not be volatile or decline

significantly in the future.

Sales of a substantial number of our shares

of Common Stock in the public markets, or the perception that such sales could occur, could cause our stock price to fall.

Sales of a substantial number

of shares of our Common Stock in the public market, or the perception that these sales might occur, could depress the market price of

our Common Stock and could impair our ability to raise capital through the sale of additional equity securities. As of July 11,

2024, we had 118,031,700 shares of Common Stock outstanding, all of which shares, other than shares held by our directors and certain officers,

were eligible for sale in the public market, subject in some cases to compliance with the requirements of Rule 144 promulgated under

the Securities Act of 1933, as amended, or Rule 144, including the volume limitations and manner of sale requirements. In addition,

shares of Common Stock issuable upon exercise of outstanding options and shares reserved for future issuance under our stock incentive

plans, convertible notes, and privately held warrants will become eligible for sale in the public market to the extent permitted by applicable

vesting requirements and subject in some cases to compliance with the requirements of Rule 144.

The exercise of our outstanding options

and warrants will dilute stockholders and could decrease our stock price.

The exercise of our outstanding

options and warrants may adversely affect our stock price due to sales of a large number of shares or the perception that such sales

could occur. These factors also could make it more difficult to raise funds through future offerings of our securities and could adversely

impact the terms under which we could obtain additional equity capital. Exercise of outstanding options and warrants or any future issuance

of additional shares of Common Stock or other securities, including, but not limited to preferred stock, options, warrants, restricted

stock units or other derivative securities convertible into our Common Stock, may result in significant dilution to our stockholders

and may decrease our stock price.

Because we do not currently intend to pay

cash dividends on our Common Stock, stockholders will benefit from an investment in our Common Stock primarily if it appreciates in value.

We do not currently anticipate

paying any cash dividends on shares of our Common Stock. Any determination to pay dividends in the future would be made by our Board

of Directors and would depend upon results of operations, financial conditions, contractual restrictions, restrictions imposed by applicable

law, and other factors our Board of Directors would deem relevant. Accordingly, realization of a gain on stockholders’ investments

will primarily depend on the appreciation of the price of our Common Stock.

We will require additional capital to support

business growth, and this capital might not be available on favorable terms, or at all.

Our operations or expansion

efforts will require substantial additional financial, operational, and managerial resources and we will need to raise additional funds

to expand our operations. We may seek debt financing or additional equity capital. Additional capital may not be available to us, or

may only be available on terms that adversely affect our existing stockholders, or that restrict our operations.

For example, if we raise

additional funds through issuances of equity or convertible debt securities, our existing stockholders could suffer dilution, and any

new equity securities we issue could have rights, preferences, and privileges superior to those of holders of our Common Stock. Upon

liquidation, holders of our debt securities and lenders with respect to other borrowings will receive distributions of our available

assets prior to the holders of our Common Stock. Since our decision to issue securities in any future offering will depend on market

conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future offerings.

Thus, our stockholders bear the risk of our future offerings reducing the market price of our Common Stock.

Information available in public media that

is published by third parties, including blogs, articles, online forums, message boards and social and other media may include statements

not attributable to, or authorized by, the Company and may not be factual, reliable or accurate.

We have received, and may

continue to receive in the future, media coverage that is published or otherwise disseminated by third parties, including blogs, articles,

online forums, message boards and social and other media. This may include coverage that is not based on facts, or is biased, false,

inaccurate, exaggerated, misleading, taken out of context or not attributable to statements made by our directors, officers or employees.

You should read carefully, evaluate and rely only on the information contained in this prospectus supplement, or incorporated documents

filed with the SEC in determining whether to exercise Warrants for shares of our Common Stock. Information provided by third parties

may not be factual, reliable or accurate and could materially impact the trading price of our Common Stock, which could cause significant

losses to your investments.

There can be no assurance

that we will be able to comply with the continued listing standards of the NYSE.

On

May 21, 2024, we were notified by NYSE Regulation that we were not in compliance with the NYSE’s continued listing criteria because

the average closing price of our Common Stock was less than $1.00 over a 30-day consecutive trading day period ending May 20, 2024. We

are subject to a 180-day cure period and we cannot be certain that we will be able to cure our non-compliance, absent completing a reverse-stock

split, which would require the approval of our stockholders.

If

the NYSE delists our securities from trading on its exchange for failure to meet the listing standards, we and our securityholders could

face significant material adverse consequences including:

| ● | a

limited availability of market quotations for our securities; |

| ● | a

determination that our common stock is a “penny stock,” which will require brokers

trading in common stock to adhere to more stringent rules, possibly resulting in a reduced

level of trading activity in the secondary trading market for shares of our common stock; |

| ● | a

limited amount of analyst coverage; |

| ● | a

decreased ability to issue additional securities or obtain additional financing in the future; |

| ● | the

occurrence of a “Fundamental Change” under the Indenture governing our Convertible

Notes, in which case the holders of the Convertible Notes could require us to repurchase

their Convertible Notes at a purchase price equal to the principal amount of and any accrued

and unpaid interest on such Convertible Notes. |

USE OF PROCEEDS

The net proceeds of this

offering, if any, will be used for general corporate purposes, which may include, among other things, the repayment of debt. Assuming

that the Warrants are fully exercised for cash, we expect that the net proceeds of this offering would be approximately $230.0 million,

after deducting estimated commissions and estimated offering expenses. We cannot assure you that any of the Warrants will be exercised

or that, if any Warrants are exercised, we will use the resulting proceeds in a way with which you agree.

We expect to retire and

cancel any Designated Notes received upon exercise of Warrants.

DESCRIPTION OF THE WARRANTS

On July 12, 2024, the Company

is issuing 46,756,215 Warrants as a distribution to holders of record of (i) shares of Common Stock, (ii) the Convertible Notes, and

(iii) the pre-funded warrants on the Record Date. The Company is distributing one Warrant for every three shares of Common Stock held

by stockholders of record on the Record Date, subject to downward rounding. Holders of the Company’s outstanding Convertible Notes

and the Company’s outstanding pre-funded warrants, in each case as of the Record Date, will also receive, at the same time and

on the same terms as holders of Common Stock, Warrants without having to convert such holder’s Convertible Notes as if such holder

held a number of shares of Common Stock equal to the product of (i) the Conversion Rate (as defined in the indenture for the Convertible

Notes) in effect on the Record Date; and (ii) the aggregate principal amount (expressed in thousands) of Convertible Notes held by such

holder on such date. Holders of the pre-funded warrants shall also receive Warrants to the same extent that a pre-funded warrantholder

would have participated therein if such pre-funded warrantholder had held the number of shares of Common Stock acquirable upon complete

exercise of the pre-funded warrant held by such pre-funded warrantholder as of the Record Date. The Warrants are being issued by the

Company pursuant to the Warrant Agreement. The following description of the Warrants and the Warrant Agreement is only a brief summary

and is qualified in its entirety by reference to the complete description of the terms of the Warrants set forth in the Warrant Agreement

(including the Form of Warrant attached thereto), which has been filed as an exhibit to our Current Report on Form 8-K, filed on the

date of this prospectus supplement. The issuance of the Warrants has not been registered under the Securities Act because the issuance

of a dividend in the form of a Warrant for no consideration is not a sale or disposition of a security or interest in a security

for value pursuant to Section 2(a)(3) of the Securities Act. We expect the Warrants will trade over-the-counter.

Warrant Exercise Rate

Each Warrant represents

the right to purchase from the Company one share of Common Stock (the “Basic Warrant Exercise Rate”) plus the Bonus

Share Fraction, if any as described below, for the applicable Exercise Date for cash at an initial exercise price of $5.00 (the “Exercise

Price”) per Warrant, payable in U.S. dollars.

Until the Bonus Share Fraction

Expiration Date, a holder exercising its Warrants will receive, in addition to the Basic Warrant Exercise Rate, initially, an additional

0.5 shares of Common Stock for each Warrant exercised (subject to adjustment as described herein, the “Bonus Share Fraction”)

without payment of any additional Exercise Price.

The right to receive the

Bonus Share Fraction will expire at 5:00 p.m. New York City time upon the date (the “Bonus Share Expiration Date”) which

is the first Business Day following the first occurrence of a 30 consecutive Trading Day period commencing on or after the distribution

date (i) in which the daily volume-weighted average price (VWAP) of the shares of Common Stock has been at least equal to the then applicable

Bonus Share Expiration Trigger Price for at least 20 Trading Days (whether or not consecutive) each falling on or after August 1, 2024

and (ii) the last day of which is the 20th such Trading Day (the “Bonus Share Expiration Price Condition”). Any Warrant exercised

with an Exercise Date after the Bonus Share Expiration Date will not be entitled to any Bonus Share Fraction. Notwithstanding the foregoing,

the Company may elect to reinstate the right to receive the Bonus Share Fraction after the Bonus Share Expiration Date.

The “Bonus Share Expiration

Trigger Price” is initially $2.00, subject to certain adjustments described in the “Anti-Dilution Adjustments” section

below.

The Basic Warrant Exercise

Rate plus any Bonus Share Fraction is referred to as the Warrant Exercise Rate. The Basic Warrant Exercise Rate, the Bonus Share Fraction

and the Bonus Share Expiration Trigger Price are each subject to certain adjustments described in the “Anti-Dilution Adjustments”

section below.

The Company will make a

public announcement of the Bonus Share Expiration Date prior to market open on the Bonus Share Expiration Date in the case of a Bonus

Price Condition.

Expiration

Except as described below,

the Warrants will expire and cease to be exercisable at 5:00 p.m. New York City time on July 15, 2025 (the “Expiration Date”).

Redemption

The Warrants are redeemable

at the Company’s sole option at any time following the last day of the first 30 consecutive Trading Day period (i) in which the

daily VWAP of the shares of Common Stock has been at least equal to the then applicable Redemption Trigger Price (as defined below) for

20 Trading Days (whether or not consecutive) each falling on or after August 1, 2024 and (ii) the last day of which is the 20th such

Trading Day (the “Redemption Price Condition”). The Company may redeem the Warrants at its sole option at any time after

the Redemption Price Condition has been met, even if the trading price of the Common Stock subsequently declines. The “Redemption

Trigger Price” is initially equal to the Exercise Price, subject to proportional adjustment when the Basic Warrant Exercise Rate

is adjusted. See “– Anti-Dilution Adjustments”.

The Company will provide

at least 20 calendar days’ notice by press release (the “Redemption Notice”) of the date selected for redemption (the

“Redemption Date”). The redemption price upon any redemption shall equal $0.001 per Warrant (the “Redemption Price”).

In the event of a redemption

of the Warrants, Warrants will be exercisable until 5:00 p.m. New York City time on the Business Day immediately preceding the Redemption

Date.

Form and Transfer

The Company is issuing the

Warrants in uncertificated, direct registration form. Warrant holders will not be entitled to receive physical certificates. Registration

of ownership will be maintained by the Warrant Agent. If you are a holder of record of shares of Common Stock as of the Record Date,

the Warrant Agent will issue a direct registration account statement representing those Warrants. For holders of shares of Common Stock

as of the Record Date that hold such shares through a broker, dealer, custodian bank or other nominee, the Warrants will be represented

by a global security registered in the name of a depository, which will be the holder of all the Warrants represented by the global security.

Those holders who own beneficial interests in a global Warrant will do so through participants in the depository’s system, and

the rights of these indirect owners will be governed solely by the applicable procedures of the depository and its participants.

The Warrant Agent will not

be required to effect any registration of transfer or exchange that would result in any fraction of a Warrant. If any fractional Warrant

would otherwise be required to be issued, the Company or the Warrant Agent, as applicable, will round down the total number of Warrants

to be issued to the relevant holder to the nearest whole number.

Record owners of Warrants

may transfer Warrants through the process established by the Warrant Agent. Indirect, “street name” holders of Warrants should

contact their broker, bank or other intermediary for information on how to transfer Warrants.

Procedures for Exercising Warrants

All or any part of the Warrants

may be exercised prior to the earlier of (x) 5:00 p.m. New York City time on the Expiration Date and (y) 5:00 p.m. New York City time

on the Business Day prior to the Redemption Date by delivering a completed form of election to purchase shares of Common Stock, which

contains certain representations by the holder of the Warrants, and payment of the Exercise Price (x) at any time starting on the date

of issuance for Warrants, in cash, or (y) at any time starting on July 26, 2024, if there are Designated Notes as of the relevant Exercise

Date, at the election of the Holder, with Designated Notes. Any such delivery that occurs on a day that is not a Business Day or is received

after 5:00 p.m., New York City time, on any given Business Day will be deemed received and exercised on the next succeeding Business

Day. Record owners of Warrants may exercise Warrants through the process established by the Warrant Agent. Indirect, “street name”

holders of Warrants should contact their broker, bank or other intermediary for information on how to exercise Warrants.

If a registration statement

is not effective at any time or from time to time, the right to exercise Warrants shall be automatically suspended until such registration

statement becomes effective as described under “Registration and Suspension” below.

Upon exercise of Warrants,

the Company will issue such whole number of Warrant Shares as the exercising Warrant holder is entitled to receive in connection with

such exercise. If your Warrants are held through a broker, dealer, custodian bank or other nominee and you exercise your Warrants, your

account at your nominee will be credited with those shares following the exercise of your Warrants. If you are a holder of record of

our Common Stock and you exercise your Warrants, our transfer agent will issue a direct registration account statement representing those

shares to you after the exercise of the Warrants.

Without the prior written

consent of the Company (which consent may be withheld in the Company’s sole discretion), a Holder will not be permitted to exercise

Warrants for any shares of Common Stock, and the Company shall not be obligated to effect such exercise if, following such exercise,

the Holder (together with such Holder’s affiliates, and any other persons acting as a group with such Holder and its affiliates)

would beneficially own 9.9% or more of the shares of Common Stock outstanding, including without limitation, through synthetic or derivative

financial instruments that give effect to a direct or indirect ownership in the Common Stock (the “Ownership Limitation”).

No consideration or repayment will be made to any Holder as a result of an inability to exercise a Warrant in whole or in part because

of such ownership limitations. The terms “beneficial ownership” and “group” shall be determined in accordance

with Section 13(d) of the Exchange Act and the rules and regulations promulgated thereunder. For purposes of determining whether the

Ownership Limitation has been reached, a Holder may rely on the number of outstanding shares of Common Stock reflected in (x) the Company’s

most recent periodic or annual report filed with the SEC or (y) any more recent notice published on the Company’s website.

Exercise of Warrants

Using Designated Notes

Designated Notes must be

delivered in a principal amount of $1,000 or any whole multiple thereof. Designated Notes used to pay the Exercise Price shall be valued

at their aggregate principal amount (regardless of the then current market value), excluding any accrued and unpaid interest. For purposes

of payment of the Exercise Price, $1,000 principal amount of Designated Notes shall be deemed to be equal to the aggregate Exercise Price

in respect of 200 Warrants. The principal amount of any Designated Notes surrendered to exercise Warrants in excess of the Exercise Price

shall be forfeited to the Company; provided that if the excess exceeds $1,000, the Company will return any notes in multiples of $1,000

principal amount. Any accrued but unpaid interest on any Designated Notes surrendered to exercise Warrants shall be forfeited unless

they are surrendered during the period commencing on a record date for an interest payment and ending on the day immediately preceding

that interest payment date, in which case interest on the Designated Notes shall be paid to the holder of record of the Designated Notes

as of applicable record date.

The Company may add or remove

the right to use a particular series of notes as Designated Notes, provided that the Company will give at least 20 Business Days’

notice before removing a series of notes from being Designated Notes. If the Company decides to add or remove notes from being Designated

Notes, the Company will promptly make a public announcement, update its website and the corresponding table to reflect the change. In

addition, upon the Bonus Share Expiration Date, all Designated Notes as of such date will be automatically removed from being Designated

Notes.

DWAC Procedures

Any Holder that exercises

any Warrants with Designated Notes shall use DTC’s DWAC (Deposit/Withdrawal At Custodian) system to withdraw the Holder’s

beneficial interest in the Warrants being exercised and the transfer such Designated Notes being used to pay the Exercise Price and transfer

such Warrants and Designated Notes to the Warrant Agent or the applicable indenture trustee under the indenture governing the terms of

such Designated Notes. The procedures for delivering Warrants and Designated Notes pursuant to the DWAC process are described in more

detail in Exhibits B and C to the Warrant Agreement. The Company does not have any control over this process or over the brokers or DTC,

so Holders should consult with their brokers regarding the DWAC process well in advance and leave sufficient time for such process to

be completed. None of the Company, the Warrant Agent or any other person will be responsible for any failure of a Holder to timely exercise

any Warrant due to failure to timely effect the DWAC process.

Amendment

The Warrant Agreement and/or

the Warrant Certificate may be amended without the consent of any Warrant holder to cure any ambiguity, omission, defect or inconsistency,