Current Report Filing (8-k)

29 April 2023 - 7:08AM

Edgar (US Regulatory)

0001326160false0000017797falseApril 26, 20238-K☐☐☐☐☐00013261602023-04-262023-04-260001326160duk:DukeEnergyProgressMember2023-04-262023-04-260001326160us-gaap:CommonStockMember2023-04-262023-04-260001326160duk:JuniorSubordinatedDebentures5.625CouponDueSeptember2078Member2023-04-262023-04-260001326160duk:DepositaryShareMember2023-04-262023-04-260001326160duk:A310SeniorNotesDue2028Member2023-04-262023-04-260001326160duk:A385SeniorNotesDue2034Member2023-04-262023-04-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 26, 2023 | | | | | | | | | | | |

| Commission File Number | Registrant, State of Incorporation or Organization,

Address of Principal Executive Offices, Telephone Number and Zip Code | IRS Employer Identification No. |

| | |

| 1-32853 | DUKE ENERGY CORPORATION | 20-2777218 |

(a Delaware corporation)

550 South Tryon Street

Charlotte, North Carolina 28202-1803

704-382-3853

| | | | | | | | | | | |

| 1-3382 | DUKE ENERGY PROGRESS, LLC | 56-0165465 |

(a North Carolina limited liability company)

410 South Wilmington Street

Raleigh, North Carolina 27601-1748

704-382-3853

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | | | | | | |

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: | | |

| Registrant | | Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered | | |

| Duke Energy | | Common Stock, $0.001 par value | | DUK | | New York Stock Exchange LLC | | |

| | | | | | | | |

| | | | | | | | |

| Duke Energy | | 5.625% Junior Subordinated Debentures due September 15, 2078 | | DUKB | | New York Stock Exchange LLC | | |

| | | | | | | | |

| Duke Energy | | Depositary Shares | | DUK PR A | | New York Stock Exchange LLC | | |

| | each representing a 1/1,000th interest in a share of 5.75% Series A Cumulative Redeemable Perpetual Preferred Stock, par value $0.001 per share | | | | | | |

| Duke Energy | | 3.10% Senior Notes due 2028 | | DUK 28A | | New York Stock Exchange LLC | | |

| Duke Energy | | 3.85% Senior Notes due 2034 | | DUK34 | | New York Stock Exchange LLC | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure.

On April 26, 2023, Duke Energy Progress, LLC (“DEP”) reached a partial settlement with the Public Staff – North Carolina Utilities Commission (the “Public Staff”) in connection with DEP’s Performance Based Regulation (“PBR”) application filed with the North Carolina Utilities Commission (the “NCUC”) on October 6, 2022. Additionally, on April 27, 2023, DEP and the Public Staff filed a Transmission Cost Allocation Agreement and Stipulation of Settlement (together with the partial settlement, the “Stipulations”). On April 28, 2023, DEP filed testimony consistent with the Stipulations. The Stipulations include, among other things, (i) agreement on prudence of plant-related investments as of March 31, 2023, subject to Public Staff audit of final supplemental updates , (ii) agreement on capital projects and related costs to be included in the 3-year multi-year rate plan, (iii) the acceptance of depreciation rates proposed by DEP, with certain adjustments, and (iv) support for full recovery of Grid Improvement Plan deferred costs over 18 years with a debt return during the deferral period and a full weighted-average cost of capital return during the amortization period.

The Stipulations do not include an agreement on return on equity, capitalization structure, or recovery of deferred costs resulting from the COVID-19 pandemic, among other items. The Stipulations are subject to the review and approval of the NCUC. An evidentiary hearing to review the Stipulations and remaining issues in the case has been rescheduled to commence on May 4, 2023. An overview providing additional detail on the Stipulations is attached to this Form 8-K as Exhibit 99.1. The information in Exhibit 99.1 is being furnished pursuant to this Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

104 Cover Page Interactive Data File (the cover page XBRL tags are embedded in the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| |

| DUKE ENERGY CORPORATION |

| Date: April 28, 2023 | By: /s/ David S. Maltz |

| Name: David S. Maltz |

| Title: Vice President, Legal, Chief Governance Officer

and Assistant Corporate Secretary |

| |

| DUKE ENERGY PROGRESS, LLC |

| Date: April 28, 2023 | By: /s/ David S. Maltz |

| Name: David S. Maltz |

| Title: Vice President, Legal, Chief Governance Officer

and Assistant Secretary |

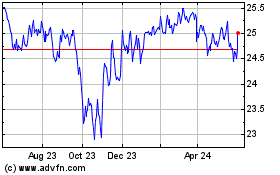

Duke Energy (NYSE:DUK-A)

Historical Stock Chart

From Jun 2024 to Jul 2024

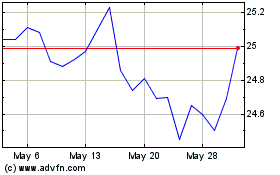

Duke Energy (NYSE:DUK-A)

Historical Stock Chart

From Jul 2023 to Jul 2024