Report of Foreign Issuer (6-k)

31 May 2016 - 11:31PM

Edgar (US Regulatory)

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report of Foreign Issuer

pursuant to Rule 13-a-16 or 15d-16

of the Securities Exchange

Act of 1934

FOR THE MONTH

OF May 2016

FORM 6-K

COMMISSION FILE NUMBER

1-15150

The Dome Tower

Suite

3000, 333 - 7th Avenue S.W.

Calgary, Alberta

Canada T2P 2Z1

(403) 298-2200

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Indicate by check mark

whether, by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the securities Exchange Act of 1934.

EXHIBIT

INDEX

| EXHIBIT 99.1 - |

|

News Release

Dated May 31, 2016 - Enerplus Closes Previously Announced Bought Deal Equity Offering |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

ENERPLUS CORPORATION

| BY: |

/s/ |

David A. McCoy |

|

| |

|

David A. McCoy |

|

| |

|

Vice President, General Counsel & Corporate Secretary |

|

| |

|

|

|

DATE: May 31,

2016

Exhibit 99.1

Enerplus Closes Previously Announced Bought Deal Equity Offering

CALGARY, May 31, 2016 /CNW/ - Enerplus Corporation ("Enerplus"

or the "Company") (TSX: ERF, NYSE: ERF) is pleased to announce that it has closed the equity offering (the "Offering")

previously announced on May 10, 2016. Upon closing of the Offering, a total of 33,350,000 common shares were issued at a price

of C$6.90 per share for gross proceeds of C$230,115,000. This includes 4,350,000 common shares issued pursuant to the exercise

by the underwriters of the over-allotment option in full. The syndicate of underwriters was led by BMO Capital Markets, RBC Capital

Markets and TD Securities Inc. The net proceeds from the Offering will be used to reduce indebtedness under Enerplus' bank credit

facility, to fund its capital expenditures and for general corporate purposes.

The common shares were offered by way of a short form prospectus

in all of the provinces and territories of Canada and were also offered by way of private placement in the United States.

The securities offered have not been registered under the

U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements. This news release shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful.

Enerplus is a responsible developer of high quality crude

oil and natural gas assets in Canada and the United States.

Follow @EnerplusCorp on Twitter at https://twitter.com/EnerplusCorp

Ian C. Dundas

President & Chief Executive Officer

Enerplus Corporation

Except for the historical and present factual information

contained herein, the matters set forth in this news release, including words such as "will" and similar expressions,

are forward-looking information that represents management of Enerplus' internal projections, expectations or beliefs concerning

the use of net proceeds from this Offering. The projections, estimates and beliefs contained in such forward-looking statements

necessarily involve known and unknown risks and uncertainties, which may cause Enerplus' actual performance and financial results

in future periods to differ materially from any projections of future performance or results expressed or implied by such forward-looking

statements. These risks and uncertainties include, among other things, those described in Enerplus' filings with the Canadian and

U.S. securities authorities. Accordingly, holders of Enerplus shares and potential investors are cautioned that events or

circumstances could cause results to differ materially from those predicted. The forward-looking information in this news release

is made as of the date hereof and, except as required by law, Enerplus undertakes no obligation to update any forward-looking information.

SOURCE Enerplus Corporation

%CIK: 0001126874

For further information: please contact Investor Relations

at 1-800-319-6462 or e-mail investorrelations@enerplus.com. Shareholders may, upon request, receive a printed copy of our audited

financial statements at any time.

CO: Enerplus Corporation

CNW 09:10e 31-MAY-16

This regulatory filing also includes additional resources:

ex991.pdf

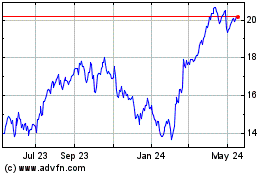

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

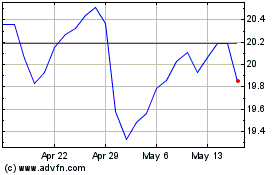

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024