Eaton Vance Declares Early Monthly Distributions and Special Distributions for Certain Eaton Vance Closed-End Funds

19 December 2023 - 8:30AM

Business Wire

Eaton Vance closed-end funds (each, a “Fund” and collectively,

the “Funds”) announced distributions today as detailed below.

Declaration – 12/18/2023 Ex-Date –

12/27/2023 Record – 12/28/2023 Payable – 1/15/2024

Fund

Ticker

Monthly

Distribution

Special

Distribution

Total

Distribution

Eaton Vance Floating-Rate Income Trust

EFT

$0.1180

$0.0396

$0.1576

Eaton Vance Senior Floating-Rate Trust

EFR

$0.1210

$0.0000

$0.1210

Eaton Vance Senior Income Trust

EVF

$0.0610

$0.0000

$0.0610

The declaration, record and payment dates of the regular January

distributions have been accelerated for each Fund and a special

distribution is being paid to shareholders of Eaton Vance

Floating-Rate Income Trust to allow each Fund to meet its 2023

distribution requirements for federal excise tax purposes. Each

Fund expects to declare its next regular monthly distribution at

the beginning of February 2024 for payment in February 2024.

The Distribution Rate at Market Price is based on the Fund's

most recent regular distribution per share (annualized) divided by

the Fund’s market price at the end of the period. Fund

distributions may be affected by numerous factors, including

changes in Fund performance, the cost of financing for Funds that

employ leverage, portfolio holdings, realized and projected

returns, and other factors. There can be no assurance that an

unanticipated change in market conditions or other unforeseen

factors will not result in a change in a Fund’s distributions at a

future time.

A portion of the distributions may be comprised of amounts from

sources other than net investment income. If that is the case, you

will be notified in writing. Further information will be available

prior to the payment date at funds.eatonvance.com. The final

determination of tax characteristics of each Fund’s distributions

will occur after the end of the year, at which time it will be

reported to the shareholders.

Eaton Vance applies in-depth fundamental analysis to the active

management of equity, income, alternative and multi-asset

strategies. Eaton Vance’s investment teams follow time-tested

principles of investing that emphasize ongoing risk management, tax

management (where applicable) and the pursuit of consistent

long-term returns. The firm’s investment capabilities encompass the

global capital markets. With a history dating back to 1924, Eaton

Vance is headquartered in Boston and also maintains investment

offices in New York, London, Tokyo and Singapore. For more

information, visit evmanagement.com. Eaton Vance is a part of

Morgan Stanley Investment Management, the asset management division

of Morgan Stanley.

Shares of closed-end funds often trade at a discount from their

net asset value. The market price of Fund shares may vary from net

asset value based on factors affecting the supply and demand for

shares, such as Fund distribution rates relative to similar

investments, investors’ expectations for future distribution

changes, the clarity of the Fund’s investment strategy and future

return expectations, and investors’ confidence in the underlying

markets in which the Fund invests. Fund shares are subject to

investment risk, including possible loss of principal invested. No

Fund is a complete investment program and you may lose money

investing in a Fund. An investment in a Fund may not be appropriate

for all investors. Before investing, prospective investors should

consider carefully the Fund’s investment objective, risks, charges

and expenses.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231218644991/en/

Investor Contact: (800) 262-1122

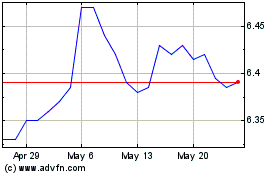

Eaton Vance Senior Income (NYSE:EVF)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eaton Vance Senior Income (NYSE:EVF)

Historical Stock Chart

From Nov 2023 to Nov 2024