Eaton Vance Tax-Advantaged Dividend Income Fund Report of Earnings as of February 29, 2008

23 April 2008 - 4:11AM

Business Wire

Eaton Vance Tax-Advantaged Dividend Income Fund (NYSE: EVT), a

diversified closed-end investment company, today announced the

earnings of the Fund for the three months ended February 29, 2008

and for the six months ended February 29, 2008. The Fund�s fiscal

year ends on August 31, 2008. For the three months ended February

29, 2008, the Fund had net investment income of $41,980,184 ($0.576

per common share). From this amount, the Fund paid dividends on

preferred shares of $8,507,272 (equal to $0.117 for each common

share), resulting in net investment income after the preferred

dividends of $33,472,912 or $0.459 per common share. For the six

months ended February 29, 2008, the Fund had net investment income

of $61,209,870 ($0.840 per common share). From this amount, the

Fund paid dividends on preferred shares of $17,128,248 (equal to

$0.235 for each common share), resulting in net investment income

after the preferred dividends of $44,081,622 or $0.605 per common

share. In comparison, for the three months ended February 28, 2007,

the Fund had net investment income of $26,189,950 ($0.360 per

common share). From this amount, the Fund paid dividends on

preferred shares of $7,745,602 (equal to $0.106 for each common

share), resulting in net investment income after the preferred

dividends of $18,444,348 or $0.254 per common share. For the six

months ended February 28, 2007 the Fund had net investment income

of $46,152,707 ($0.634 per common share). From this amount, the

Fund paid dividends on preferred shares of $15,636,322 (equal to

$0.215 for each common share), resulting in net investment income

after the preferred dividends of $30,516,385 or $0.419 per common

share. Net realized and unrealized losses for the three months

ended February 29, 2008 were $248,586,640 ($3.413 per common share)

and net realized and unrealized losses for the six months ended

February 29, 2008 were $168,524,558 ($2.311 per common share). In

comparison, net realized and unrealized gains for the three months

ended February 28, 2007 were $25,558,414 ($0.351 per common share)

and net realized and unrealized gains for six months ended February

28, 2007 were $193,255,841 ($2.653 per common share). On February

29, 2008, net assets applicable to common shares of the Fund were

$2,014,101,280. The net asset value per common share on February

29, 2008 was $27.65 based on 72,835,900 common shares outstanding.

In comparison, on February 28, 2007, net assets applicable to

common shares of the Fund were $2,125,952,711. The net asset value

per common share on February 28, 2007 was $29.19 based on

72,835,900 common shares outstanding. The Fund is managed by Eaton

Vance Management, a subsidiary of Eaton Vance Corp, which is listed

on the New York Stock Exchange under the symbol EV. Eaton Vance and

its affiliates had $150.9 billion in assets under management on

March 31, 2008. Eaton Vance Management will make available periodic

summary information regarding portfolio investments. Those

interested should call Eaton Vance Marketing at (800) 262-1122. �

EATON VANCE TAX-ADVANTAGED DIVIDEND INCOME FUND SUMMARY OF RESULTS

OF OPERATIONS (in thousands, except per share amounts) � � � � � �

� Three Months Ended Six Months Ended February 29, February 29,

2008 2007 2008 2007 Gross investment income $47,255 $31,495 $72,031

$56,521 Operating expenses ($5,275) ($5,305) ($10,821) ($10,368)

Net investment income $41,980 $26,190 $61,210 $46,153 Net realized

and unrealized gains (losses) on investments ($248,587) $25,558

($168,525) $193,256 Dividends paid to preferred shareholders

($8,507) ($7,746) ($17,128) ($15,636) Net increase (decrease) in

net assets from operations ($215,114) $44,002 ($124,443) $223,773 �

Earnings per Share Outstanding Gross investment income $0.649

$0.432 $0.989 $0.776 Operating expenses ($0.073) ($0.072) ($0.149)

($0.142) Net investment income $0.576 $0.360 $0.840 $0.634 Net

realized and unrealized gains (losses) on investments ($3.413)

$0.351 ($2.311) $2.653 Dividends paid to preferred shareholders

($0.117) ($0.106) ($0.235) ($0.215) Net increase (decrease) in net

assets from operations ($2.954) $0.605 ($1.706) $3.072 � Net

investment income $0.576 $0.360 $0.840 $0.634 Dividends paid to

preferred shareholders ($0.117) ($0.106) ($0.235) ($0.215) Net

investment income after preferred dividends $0.459 $0.254 $0.605

$0.419 � � Net Asset Value at February 29 (Common Shares ) Net

assets (000) $2,014,101 $2,125,953 Shares outstanding (000) 72,836

72,836 Net asset value per share outstanding $27.65 $29.19 � Market

Value Summary (Common Shares ) Market price on NYSE at February 29

$24.24 $26.59 High market price (period ended February 29) $28.08

$28.30 Low market price (period ended February 29) $23.55 $24.84

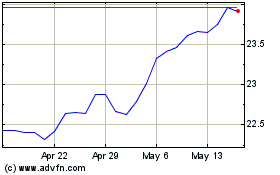

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Eaton Vance Tax Advantag... (NYSE:EVT)

Historical Stock Chart

From Jul 2023 to Jul 2024