false000004676500000467652024-08-052024-08-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 5, 2024

HELMERICH & PAYNE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| DE | | 1-4221 | | 73-0679879 |

(State or other jurisdiction of

Incorporation) | | (Commission File

Number) | | (I.R.S. Employer

Identification No.) |

222 North Detroit Avenue

Tulsa, OK 74120

(Address of principal executive offices and zip code)

(918) 742-5531

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock ($0.10 par value) | HP | NYSE |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

On August 5, 2024, Helmerich & Payne, Inc. (the “Company”) announced the hiring of J. Kevin Vann as Chief Financial Officer Designate and that Mr. Vann will succeed Mark W. Smith as Senior Vice President and Chief Financial Officer on August 15, 2024, upon Mr. Smith’s previously announced retirement from that position.

Mr. Vann, 53, served as Chief Financial Officer at WPX Energy, Inc. (NYSE: WPX) from 2014 until its 2021 merger with Devon Energy Corporation (NYSE: DVN), and as WPX’s Chief Accounting Officer and Controller from 2012 to 2014. He served as Vice President, Finance and Strategic Planning at Empire Petroleum Corporation (“Empire Petroleum”) (NYSE American: EP) from 2022 to 2023 and has served as a director of Empire Petroleum since 2023.

Mr. Vann’s initial annual base salary will be $580,000 per calendar year. Mr. Vann will be eligible to participate in the Company’s annual short-term cash incentive bonus plan (with an initial target bonus of 100% of base salary), long-term equity incentive plan, retirement, and other benefit plans and programs offered to the Company’s other senior executives. Mr. Vann also will be eligible to enter into the Company’s standard form of Change of Control Agreement applicable to executive officers and certain other employees of the Company.

ITEM 7.01 REGULATION FD DISCLOSURE

On August 5, 2024, the Company issued a press release announcing the hiring of Mr. Vann as Chief Financial Officer Designate. A copy of the press release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated into this Item 7.01 by reference.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, except as otherwise expressly stated in such filing.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| 99.1 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | HELMERICH & PAYNE, INC. | |

| | | |

| By: | /s/ William H. Gault | |

| | Name: | William H. Gault |

| | Title:

Date: | Corporate Secretary

August 5, 2024 |

Exhibit 99.1

August 5, 2024

HELMERICH & PAYNE, INC. ANNOUNCES J. KEVIN VANN AS NEW CHIEF FINANCIAL OFFICER

TULSA, Okla. – August 5, 2024, (Business Wire) – Helmerich & Payne, Inc. (NYSE: HP) today announced the hiring of J. Kevin Vann as the Chief Financial Officer Designate, effective August 5, 2024. Vann will be appointed to succeed Mark W. Smith as Chief Financial Officer (CFO) upon Smith’s retirement from that position, which as previously announced, will occur on August 15, 2024. Vann brings extensive public company financial and accounting experience in the oil and gas industry, which will be instrumental as H&P continues to grow and expand its market presence.

Before joining H&P, he served as Chief Financial Officer at WPX Energy, Inc. (NYSE: WPX) from 2014 to 2021. Prior to becoming Chief Financial Officer for WPX, he served as the company’s Chief Accounting Officer and Controller from 2012 to 2014. From 2007 to 2011, Vann served as Controller of the exploration and production business of The Williams Companies, Inc. (NYSE: WMB) and in various other financial and accounting roles for Williams from 1998 to 2006.

We are excited to welcome Kevin to the H&P team. His experience and vision align with our company’s strategic goals. With Kevin’s background in M&A we are confident that his leadership will continue to maintain and strengthen our existing financial policies, financial strategy and performance as we look forward to closing our planned acquisition of KCA Deutag,” said John Lindsay, President and CEO of H&P. "H&P’s long-term financial discipline is a cornerstone of our ability to fulfill our commitments to customers, shareholders and employees.”

About Helmerich & Payne, Inc.

Founded in 1920, Helmerich & Payne, Inc. is committed to delivering industry leading drilling productivity and reliability. H&P operates with the highest level of integrity, safety and innovation to deliver superior results for our customers and returns for shareholders. Through its subsidiaries, the Company designs, fabricates and operates high-performance drilling rigs in conventional and unconventional plays around the world. H&P also develops and implements advanced automation, directional drilling and survey management technologies. For more information, visit www.helmerichpayne.com.

Helmerich & Payne uses its website as a channel of distribution for material company information. Such information is routinely posted and accessible on its Investor Relations website at www.helmerichpayne.com.

# # #

Helmerich & Payne | 222 N. Detroit Ave.

Tulsa, OK 74120 | 918.588.5190 | helmerichpayne.com

Page 2

News Release

August 5, 2024

IR Contact:

Dave Wilson, Vice President of Investor Relations

918-588-5190

investor.relations@hpinc.com

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts included in this news release are forward-looking statements. Forward-looking statements may be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “predict,” “project,” “target,” “continue,” “look forward to,” or the negative thereof or similar terminology, and include, but are not limited to, statements regarding the expected closing of the acquisition (the “Acquisition”) by H&P of KCA Deutag International Limited (“KCAD”).

Forward-looking statements are based upon current plans and expectations that are subject to risks, uncertainties, and assumptions, many of which are beyond our control and any of which could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. The inclusion of such statements should not be regarded as a representation that such plans, estimates, or expectations will be achieved. Factors that could cause actual results to differ materially from those expressed in or implied by such forward-looking statements include, but are not limited to: our ability and the time required to consummate the Acquisition; and the risk that regulatory approvals for the Acquisition are not obtained or are obtained subject to conditions that are not anticipated.

Additional factors that could cause actual results to differ materially from our expectations or results discussed in the forward‑looking statements are disclosed in H&P’s 2023 Annual Report on Form 10-K, including under Part I, Item 1A— “Risk Factors” and Part II, Item 7— “Management’s Discussion and Analysis of Financial Condition and Results of Operations” thereof, as updated by subsequent reports (including the Company’s Quarterly Reports on Form 10-Q) we file with the Securities and Exchange Commission. All forward-looking statements included in this presentation and all subsequent written and oral forward-looking statements, express or implied, are expressly qualified in their entirety by these cautionary statements. All forward-looking statements speak only as of the date they are made and are based on information available at that time. Because of the underlying risks and uncertainties, we caution you against placing undue reliance on these forward-looking statements. We assume no duty to update or revise these forward-looking statements based on changes in internal estimates, expectations or otherwise, except as required by law.

Helmerich & Payne | 222 N. Detroit Ave.

Tulsa, OK 74120 | 918.588.5190 | helmerichpayne.com

Cover Page

|

Aug. 05, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 05, 2024

|

| Entity Registrant Name |

HELMERICH & PAYNE, INC.

|

| Entity Central Index Key |

0000046765

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-4221

|

| Entity Tax Identification Number |

73-0679879

|

| Entity Address, Address Line One |

222 North Detroit Avenue

|

| Entity Address, City or Town |

Tulsa

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

74120

|

| City Area Code |

918

|

| Local Phone Number |

742-5531

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock ($0.10 par value)

|

| Trading Symbol |

HP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

222 North Detroit Avenue

|

| Entity Address, City or Town |

Tulsa

|

| Entity Address, State or Province |

OK

|

| Entity Address, Postal Zip Code |

74120

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

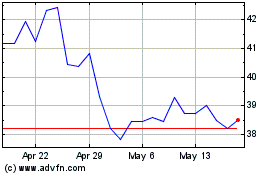

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Oct 2024 to Nov 2024

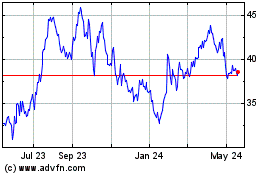

Helmerich and Payne (NYSE:HP)

Historical Stock Chart

From Nov 2023 to Nov 2024