SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

27

April 2017

LLOYDS BANKING GROUP

plc

(Translation of registrant's name into

English)

5th Floor

25 Gresham Street

London

EC2V 7HN

United Kingdom

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F..X.. Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No ..X..

If

"Yes" is marked, indicate below the file number assigned to the

registrant in connection with Rule

12g3-2(b):

82- ________

Index

to Exhibits

Item

No.

1 Regulatory News Service Announcement, dated 27 April

2017

re: 1st

Quarter Results

Lloyds

Banking Group plc

Q1 2017

Interim Management Statement

27

April 2017

|

HIGHLIGHTS FOR THE THREE MONTHS ENDED 31 MARCH 2017

|

|

|

|

Strong underlying performance with significant improvement in

statutory profit and returns

|

|

●

Increase in underlying profit to

£2.1 billion with an underlying return on tangible equity

of 15.1 per cent

|

|

●

Positive operating jaws while credit

quality remains strong with asset quality ratio of 12 basis

points

|

|

●

Statutory profit before tax increased to

£1.3 billion; statutory return on tangible equity of 8.8

per cent

|

|

●

Strong balance sheet maintained with CET1

ratio of 14.5 per cent (pre dividend accrual)

|

|

●

Tangible net assets per share increased to

56.5 pence driven by strong underlying profit

|

|

|

|

Our differentiated UK focused business model continues to

deliver

|

|

●

Simple, efficient and low risk business

model providing competitive advantage

|

|

●

Strong capital generation of

0.7 percentage points

|

|

●

UK government shareholding now below 2

per cent

|

|

|

|

On track to deliver the Group financial targets for 2017 with

longer term guidance maintained

|

|

●

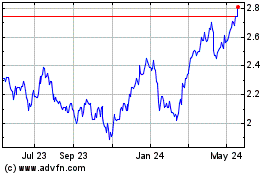

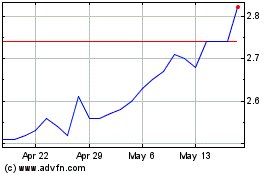

Net interest margin for the year now expected

to be close to 2.80 per cent (pre MBNA)

|

|

●

Expect open book mortgage balances to

stabilise and then grow to close the year in line with 31 December

2016

|

|

●

Asset quality ratio for the year now expected

to be inside existing 25 basis points guidance (pre

MBNA)

|

|

●

Expect 2017 capital generation to be at the

top end of the 170-200 basis points ongoing guidance

range

|

|

●

Continue to target a cost:income ratio of

around 45 per cent exiting 2019 with reductions every

year

|

|

●

Expect to generate a statutory return on

tangible equity of between 13.5 and 15.0 per cent in

2019

|

GROUP CHIEF EXECUTIVE'S STATEMENT

In the

first three months of this year we have delivered strong financial

performance with increased underlying profit, a significant

improvement in statutory profit and returns, and strong capital

generation. These results continue to demonstrate the strength of

our customer focused, simple and low risk business model and our

ability to respond to a challenging operating

environment.

The UK

economy continues to benefit from low unemployment and reduced

levels of indebtedness, and asset quality remains strong and is

stable across the portfolio. We remain committed to supporting the

people, businesses and communities in the UK through our Helping

Britain Prosper Plan and putting customers first. As announced

earlier this month, we are determined that the victims of HBOS

Reading are fairly, swiftly and appropriately compensated and we

have set aside a provision of £100 million in our first

quarter results.

We

continue to make good progress against our strategic priorities of

creating the best customer experience; becoming simpler and more

efficient; and delivering sustainable growth; and we remain on

track to deliver the Group financial targets for 2017, whilst

maintaining our longer term guidance.

António

Horta-Osório

Group Chief Executive

CONSOLIDATED INCOME STATEMENT − UNDERLYING BASIS

|

|

|

Three months ended

|

|

Three

months ended

|

|

|

|

Three

months ended

|

|

|

|

|

|

|

31 Mar

|

|

31

Mar

|

|

|

|

31

Dec

|

|

|

|

|

|

|

2017

|

|

2016

|

|

Change

|

|

2016

|

|

Change

|

|

|

|

|

£ million

|

|

£ million

|

|

%

|

|

£ million

|

|

%

|

|

|

Net

interest income

|

|

2,928

|

|

2,906

|

|

1

|

|

2,805

|

|

4

|

|

|

Other

income

|

|

1,482

|

|

1,477

|

|

-

|

|

1,545

|

|

(4)

|

|

|

Total income

|

|

4,410

|

|

4,383

|

|

1

|

|

4,350

|

|

1

|

|

|

Operating

lease depreciation

|

|

(232)

|

|

(193)

|

|

(20)

|

|

(226)

|

|

(3)

|

|

|

Net income

|

|

4,178

|

|

4,190

|

|

-

|

|

4,124

|

|

1

|

|

|

Operating

costs

|

|

(1,968)

|

|

(1,987)

|

|

1

|

|

(2,134)

|

|

8

|

|

|

Impairment

|

|

(127)

|

|

(149)

|

|

15

|

|

(196)

|

|

35

|

|

|

Underlying profit

|

|

2,083

|

|

2,054

|

|

1

|

|

1,794

|

|

16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Volatility

and other items

|

|

(229)

|

|

(1,285)

|

|

|

|

(346)

|

|

|

|

|

Payment

protection insurance provision

|

|

(350)

|

|

-

|

|

|

|

-

|

|

|

|

|

Other

conduct provisions

|

|

(200)

|

|

(115)

|

|

|

|

(475)

|

|

|

|

|

Statutory profit before tax

|

|

1,304

|

|

654

|

|

99

|

|

973

|

|

34

|

|

|

Taxation

|

|

(414)

|

|

(123)

|

|

|

|

(535)

|

|

|

|

|

Profit for the period

|

|

890

|

|

531

|

|

68

|

|

438

|

|

103

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings

per share

|

|

1.1p

|

|

0.6p

|

|

83

|

|

0.4p

|

|

175

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banking

net interest margin

|

|

2.80%

|

|

2.74%

|

|

6bp

|

|

2.68%

|

|

12bp

|

|

|

Average

interest-earning banking assets

|

|

£431bn

|

|

£438bn

|

|

(2)

|

|

£434bn

|

|

(1)

|

|

|

Cost:income

ratio

|

|

47.1%

|

|

47.4%

|

|

(0.3)pp

|

|

51.7%

|

|

(4.6)pp

|

|

|

Asset

quality ratio

|

|

0.12%

|

|

0.14%

|

|

(2)bp

|

|

0.17%

|

|

(5)bp

|

|

|

Return

on risk-weighted assets

|

|

3.93%

|

|

3.70%

|

|

23bp

|

|

3.26%

|

|

67bp

|

|

|

Underlying

return on tangible equity

|

|

15.1%

|

|

15.0%

|

|

0.1pp

|

|

12.8%

|

|

2.3pp

|

|

|

Statutory

return on tangible equity

|

|

8.8%

|

|

5.7%

|

|

3.1pp

|

|

4.7%

|

|

4.1pp

|

|

|

Statutory

return on required equity

|

|

8.2%

|

|

4.4%

|

|

3.8pp

|

|

3.5%

|

|

4.7pp

|

|

BALANCE SHEET AND KEY RATIOS

|

|

|

At 31 Mar

|

|

At 31 Dec

|

|

Change

|

|

|

|

|

2017

|

|

2016

|

|

%

|

|

|

Loans

and advances to customers

1

|

|

£445bn

|

|

£450bn

|

|

(1)

|

|

|

Customer

deposits

2

|

|

£415bn

|

|

£413bn

|

|

-

|

|

|

Loan to

deposit ratio

|

|

107%

|

|

109%

|

|

(2)pp

|

|

|

Total

assets

|

|

£817bn

|

|

£818bn

|

|

-

|

|

|

Common

equity tier 1 ratio pre 2017 dividend accrual

3

|

|

14.5%

|

|

13.8%

|

|

0.7pp

|

|

|

Common

equity tier 1 ratio

3

|

|

14.3%

|

|

13.8%

|

|

0.5pp

|

|

|

Transitional

total capital ratio

|

|

21.9%

|

|

21.4%

|

|

0.5pp

|

|

|

Leverage

ratio

3

|

|

5.0%

|

|

5.0%

|

|

-

|

|

|

Risk-weighted

assets

|

|

£214bn

|

|

£216bn

|

|

(1)

|

|

|

Tangible

net assets per share

|

|

56.5p

|

|

54.8p

|

|

1.7p

|

|

|

|

|

|

1

|

Excludes

reverse repos of £11.2 billion (31 December 2016:

£8.3 billion).

|

|

2

|

Excludes

repos of £0.4 billion (31 December 2016:

£2.5 billion).

|

|

3

|

The

common equity tier 1 and leverage ratios at 31 December 2016

were reported on a pro forma basis, including the dividend paid by

the Insurance business in February 2017 relating to 2016

earnings.

|

REVIEW OF FINANCIAL PERFORMANCE

Strong underlying performance with significant improvement in

statutory profit and returns

The

Group's underlying profit in the quarter was £2,083 million, 1

per cent higher than the first quarter of 2016, with higher total

income, a further reduction in operating costs and lower impairment

charges. The underlying return on tangible equity remains strong at

15.1 per cent (2016: 15.0 per cent).

Statutory

profit before tax increased to £1,304 million, given the

strong underlying profit and significant reduction in below the

line items. Statutory profit after tax was £890 million and

the return on tangible equity improved to 8.8 per cent (2016: 5.7

per cent).

The

Group's CET1 ratio improved to 14.3 per cent (31 December

2016: 13.8 per cent). The Group generated 0.7 percentage

points of CET1 capital in the quarter pre dividend accrual.

Tangible net assets per share increased to 56.5 pence

(31 December 2016: 54.8 pence).

Total income

|

|

|

Three months ended

|

|

Three

months ended

|

|

|

|

Three

months ended

|

|

|

|

|

|

31 Mar

|

|

31

Mar

|

|

|

|

31

Dec

|

|

|

|

|

|

2017

|

|

2016

|

|

Change

|

|

2016

|

|

Change

|

|

|

|

£ million

|

|

£ million

|

|

%

|

|

£ million

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

2,928

|

|

2,906

|

|

1

|

|

2,805

|

|

4

|

|

Other

income

|

|

1,482

|

|

1,477

|

|

-

|

|

1,545

|

|

(4)

|

|

Total income

|

|

4,410

|

|

4,383

|

|

1

|

|

4,350

|

|

1

|

|

Operating

lease depreciation¹

|

|

(232)

|

|

(193)

|

|

(20)

|

|

(226)

|

|

(3)

|

|

Net income

|

|

4,178

|

|

4,190

|

|

-

|

|

4,124

|

|

1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banking

net interest margin

|

|

2.80%

|

|

2.74%

|

|

6bp

|

|

2.68%

|

|

12bp

|

|

Average

interest-earning banking assets

|

|

£430.9bn

|

|

£438.2bn

|

|

(2)

|

|

£434.0bn

|

|

(1)

|

|

|

|

|

1

|

Net of

gains on disposal of leased assets.

|

Total

income increased slightly to £4,410 million with small

increases in both net interest income and other

income.

Net

interest income was 1 per cent higher at £2,928 million

reflecting the 6 basis point improvement in net interest margin

partly offset by a 2 per cent reduction in average interest-earning

banking assets. The improvement in net interest margin was driven

by further reductions in wholesale funding and deposit costs, which

more than offset the continued pressure from asset pricing. The

increase in both net interest income and net interest margin from

the fourth quarter 2016 was predominantly driven by lower deposit

costs following pricing actions taken in December. Non-banking net

interest expense reduced to £47 million compared with

£84 million in the first quarter of 2016, due to lower

costs from past liability management exercises and other items. The

Group now expects the net interest margin for the year to be close

to 2.80 per cent, excluding MBNA.

Other

income of £1,482 million was slightly up on the first quarter

of 2016 (£1,477 million). This increase was largely driven by

Consumer Finance following further contract hire fleet leasing

growth in the Lex Autolease business, with slightly weaker Retail

and Commercial Banking income whilst Insurance income was stable

year-on-year and included the benefit of further bulk annuity

transactions.

Operating costs

|

|

|

Three months ended

|

|

Three

months ended

|

|

|

|

Three

months ended

|

|

|

|

|

|

31 Mar

|

|

31

Mar

|

|

|

|

31

Dec

|

|

|

|

|

|

2017

|

|

2016

|

|

Change

|

|

2016

|

|

Change

|

|

|

|

£ million

|

|

£ million

|

|

%

|

|

£ million

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating

costs

|

|

1,968

|

|

1,987

|

|

1

|

|

2,134

|

|

8

|

|

Cost:income

ratio

|

|

47.1%

|

|

47.4%

|

|

(0.3)pp

|

|

51.7%

|

|

(4.6)pp

|

|

Operating

jaws

|

|

1%

|

|

|

|

|

|

|

|

|

|

Simplification

savings annual run-rate

|

|

1,051

|

|

495

|

|

|

|

947

|

|

|

Operating

costs were 1 per cent lower than in the first quarter of 2016 at

£1,968 million reflecting tight cost control and further

benefits from the Simplification programme. The Group remains on

track to deliver the £1.4 billion of targeted

Simplification run-rate savings by the end of 2017 and has

delivered £1.1 billion of annual run-rate savings to

date.

The

cost:income ratio improved to 47.1 per cent with positive jaws of 1

per cent. The Group continues to expect the cost:income ratio for

2017 to be lower than 2016 (48.7 per cent).

Impairment

|

|

|

Three months ended

|

|

Three

months ended

|

|

|

|

Three

months ended

|

|

|

|

|

|

|

31 Mar

|

|

31

Mar

|

|

|

|

31

Dec

|

|

|

|

|

|

|

2017

|

|

2016

|

|

Change

|

|

2016

|

|

Change

|

|

|

|

|

£ million

|

|

£ million

|

|

%

|

|

£ million

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

impairment charge

|

|

127

|

|

149

|

|

15

|

|

196

|

|

35

|

|

|

Asset

quality ratio

|

|

0.12%

|

|

0.14%

|

|

(2)bp

|

|

0.17%

|

|

(5)bp

|

|

|

Gross

asset quality ratio

|

|

0.23%

|

|

0.22%

|

|

1bp

|

|

0.31%

|

|

(8)bp

|

|

|

Impaired

loans as a % of closing advances

|

|

1.8%

|

|

2.0%

|

|

(0.2)pp

|

|

1.8%

|

|

−

|

|

|

Provisions

as a % of impaired loans

|

|

43.2%

|

|

44.7%

|

|

(1.5)pp

|

|

43.4%

|

|

(0.2)pp

|

|

Credit

quality remains strong and is stable across the portfolio. The

impairment charge was £127 million, compared with £149

million in the first quarter of 2016 and the asset quality ratio

was 12 basis points (2016: 14 basis points) reflecting our prudent

approach to risk and the benefit from debt sales made in the

quarter. The gross asset quality ratio was 23 basis points

(2016: 22 basis points). The Group now expects the asset quality

ratio for the year to be inside our existing guidance of 25 basis

points, excluding MBNA.

Impaired

loans as a percentage of closing advances were 1.8 per cent, in

line with the end of December, with provisions as a percentage of

impaired loans remaining broadly stable at 43 per

cent.

Statutory profit

|

|

|

Three months ended

|

|

Three

months ended

|

|

|

|

Three

months ended

|

|

|

|

|

|

31 Mar

|

|

31

Mar

|

|

|

|

31

Dec

|

|

|

|

|

|

2017

|

|

2016

|

|

Change

|

|

2016

|

|

Change

|

|

|

|

£ million

|

|

£ million

|

|

%

|

|

£ million

|

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Underlying profit

|

|

2,083

|

|

2,054

|

|

1

|

|

1,794

|

|

16

|

|

Volatility

and other items

|

|

|

|

|

|

|

|

|

|

|

|

Enhanced Capital

Notes

|

|

-

|

|

(790)

|

|

|

|

-

|

|

|

|

Market

volatility and asset sales

|

|

12

|

|

(203)

|

|

|

|

46

|

|

|

|

Amortisation of

purchased intangibles

|

|

(23)

|

|

(84)

|

|

|

|

(85)

|

|

|

|

Restructuring

costs

|

|

(157)

|

|

(161)

|

|

|

|

(232)

|

|

|

|

Fair

value unwind

|

|

(61)

|

|

(47)

|

|

|

|

(75)

|

|

|

|

|

|

(229)

|

|

(1,285)

|

|

|

|

(346)

|

|

|

|

Payment

protection insurance provision

|

|

(350)

|

|

-

|

|

|

|

-

|

|

|

|

Other

conduct provisions

|

|

(200)

|

|

(115)

|

|

|

|

(475)

|

|

|

|

Statutory profit before tax

|

|

1,304

|

|

654

|

|

99

|

|

973

|

|

34

|

|

Taxation

|

|

(414)

|

|

(123)

|

|

|

|

(535)

|

|

|

|

Profit for the period

|

|

890

|

|

531

|

|

68

|

|

438

|

|

103

|

Statutory

profit before tax increased to £1,304 million (2016: £654

million).

The

charge of £790 million for Enhanced Capital Notes in the first

quarter of 2016 represented the write-off of the embedded

derivative and the premium paid on the redemption of the remaining

notes.

Market

volatility and asset sales of £12 million included

positive insurance volatility of £3 million compared to

negative £163 million in the first quarter of

2016.

Restructuring

costs were £157 million (2016: £161 million) and

comprised severance costs relating to the Simplification programme,

the announced rationalisation of the non-branch property portfolio

and the work on implementing the ring-fencing

requirements.

As

previously announced to the market, the results include an

additional £350 million PPI provision following the release of

the revised policy statement by the FCA on 2 March 2017. The

additional provision has been taken to reflect the estimated impact

of the policy statement including the revised arrangements for

Plevin cases, which includes a requirement to proactively contact

customers who have previously had their complaints defended, and

which is likely to increase estimated volumes and redress. The

policy statement also confirmed a two month extension to the time

bar to the end of August 2019.

Other

conduct provisions of £200 million include the

£100 million estimated compensation costs for economic

losses, distress and inconvenience caused to the victims of the

HBOS Reading fraud and £100 million for Retail conduct

matters.

Taxation

The tax

charge was £414 million, representing an effective tax rate of

32 per cent. The high effective tax rate reflects the banking

surcharge and restrictions on the deductibility of conduct

provisions.

Return on tangible equity

The

return on tangible equity improved to 8.8 per cent (2016:

5.7 per cent), reflecting the significant increase in

statutory profit after tax in the period. The Group continues to

expect to generate a statutory return on tangible equity of between

13.5 and 15.0 per cent in 2019.

Balance sheet

|

|

|

At 31 Mar

|

|

At 31 Dec

|

|

Change

|

|

|

|

2017

|

|

2016

|

|

%

|

|

|

|

|

|

|

|

|

|

Loans

and advances to customers

1

|

|

£445bn

|

|

£450bn

|

|

(1)

|

|

Customer

deposits

2

|

|

£415bn

|

|

£413bn

|

|

-

|

|

Loan to

deposit ratio

|

|

107%

|

|

109%

|

|

(2)pp

|

|

|

|

|

|

|

|

|

|

Wholesale

funding

|

|

£106bn

|

|

£111bn

|

|

(4)

|

|

Wholesale

funding <1 year maturity

|

|

£31bn

|

|

£35bn

|

|

(13)

|

|

Of

which money-market funding <1 year maturity

3

|

|

£15bn

|

|

£14bn

|

|

12

|

|

Liquidity

coverage ratio - eligible assets

|

|

£133bn

|

|

£121bn

|

|

10

|

|

|

|

|

|

|

|

|

|

Common

equity tier 1 ratio pre 2017 dividend accrual

4

|

|

14.5%

|

|

13.8%

|

|

0.7pp

|

|

Common

equity tier 1 ratio

4

|

|

14.3%

|

|

13.8%

|

|

0.5pp

|

|

Leverage

ratio

4

|

|

5.0%

|

|

5.0%

|

|

-

|

|

|

|

|

|

|

|

|

|

Tangible

net assets per share

|

|

56.5p

|

|

54.8p

|

|

1.7p

|

|

|

|

|

1

|

Excludes

reverse repos of £11.2 billion (31 December 2016:

£8.3 billion).

|

|

2

|

Excludes

repos of £0.4 billion (31 December 2016:

£2.5 billion).

|

|

3

|

Excludes

balances relating to margins of £2.7 billion

(31 December 2016: £3.2 billion) and settlement

accounts of £1.2 billion (31 December 2016:

£1.8 billion).

|

|

4

|

The

common equity tier 1 and leverage ratios at 31 December 2016

were reported on a pro forma basis, including the dividend paid by

the Insurance business in February 2017 relating to 2016

earnings.

|

Loans

and advances to customers were £445 billion compared with

£450 billion at 31 December 2016. We have seen continued net

lending growth in our key targeted growth areas of Consumer Finance

and SME, but this has been more than offset by a reduction in the

Global Corporates segment, driven by ongoing optimisation for

capital and returns, and some contraction in the open and closed

mortgage portfolios. Whilst open book mortgage balances continued

to decline in the first quarter, it is anticipated that balances

will stabilise and then grow to close the year in line with the

position at 31 December 2016.

The

increase in deposit balances was driven by the continued strong

inflows from Commercial clients.

The

Group's liquidity position remains strong. The increase in liquid

assets in the quarter reflects actions taken in anticipation of the

MBNA acquisition.

The

CET1 ratio improved to 14.3 per cent (31 December 2016: 13.8 per

cent). The Group generated 0.7 percentage points of CET1 capital in

the quarter before accruing for 2017 dividends, driven by the

strong underlying financial performance partly offset by conduct

provisions.

The

Group continues to expect ongoing CET1 capital generation of

between 170 and 200 basis points pre dividend. In 2017, capital

generation is expected to be at the top end of this

range.

STATUTORY CONSOLIDATED INCOME STATEMENT AND BALANCE SHEET

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

Threemonthsended

|

|

Threemonthsended

|

|

|

|

|

31 Mar

|

|

31

Mar

|

|

|

|

|

2017

|

|

2016

|

|

|

Income statement

|

|

£ million

|

|

£ million

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

2,363

|

|

2,761

|

|

|

Other

income, net of insurance claims

|

|

2,027

|

|

612

|

|

|

Total income, net of insurance claims

|

|

4,390

|

|

3,373

|

|

|

Total

operating expenses

|

|

(2,980)

|

|

(2,586)

|

|

|

Impairment

|

|

(106)

|

|

(133)

|

|

|

Profit before tax

|

|

1,304

|

|

654

|

|

|

Taxation

|

|

(414)

|

|

(123)

|

|

|

Profit for the period

|

|

890

|

|

531

|

|

|

|

|

|

|

|

|

|

Profit

attributable to ordinary shareholders

|

|

766

|

|

405

|

|

|

Profit

attributable to other equity holders

1

|

|

105

|

|

101

|

|

|

Profit attributable to equity holders

|

|

871

|

|

506

|

|

|

Profit

attributable to non-controlling interests

|

|

19

|

|

25

|

|

|

Profit for the period

|

|

890

|

|

531

|

|

|

|

|

At 31 Mar

|

|

At 31 Dec

|

|

Balance sheet

|

|

2017

|

|

2016

|

|

|

|

£ million

|

|

£ million

|

|

Assets

|

|

|

|

|

|

Cash

and balances at central banks

|

|

56,461

|

|

47,452

|

|

Trading

and other financial assets at fair value through profit or

loss

|

|

166,068

|

|

151,174

|

|

Derivative

financial instruments

|

|

32,589

|

|

36,138

|

|

Loans

and receivables

|

|

465,972

|

|

488,257

|

|

Available-for-sale

financial assets

|

|

54,330

|

|

56,524

|

|

Other

assets

|

|

41,996

|

|

38,248

|

|

Total assets

|

|

817,416

|

|

817,793

|

|

|

|

|

|

|

|

Liabilities

|

|

|

|

|

|

Deposits

from banks

|

|

22,198

|

|

16,384

|

|

Customer

deposits

|

|

415,149

|

|

415,460

|

|

Trading

and other financial liabilities at fair value through profit or

loss

|

|

56,362

|

|

54,504

|

|

Derivative

financial instruments

|

|

32,075

|

|

34,924

|

|

Debt

securities in issue

|

|

73,862

|

|

76,314

|

|

Liabilities

arising from insurance and investment contracts

|

|

117,286

|

|

114,502

|

|

Subordinated

liabilities

|

|

18,969

|

|

19,831

|

|

Other

liabilities

|

|

31,403

|

|

37,059

|

|

Total liabilities

|

|

767,304

|

|

768,978

|

|

|

|

|

|

|

|

Shareholders'

equity

|

|

44,303

|

|

43,020

|

|

Other

equity instruments

|

|

5,355

|

|

5,355

|

|

Non-controlling

interests

|

|

454

|

|

440

|

|

Total equity

|

|

50,112

|

|

48,815

|

|

Total equity and liabilities

|

|

817,416

|

|

817,793

|

|

|

|

|

1

|

The

profit after tax attributable to other equity holders of £105

million (three months to 31 March 2016: £101 million) is

offset in reserves by a tax credit attributable to ordinary

shareholders of £26 million (three months to 31 March 2016:

£20 million).

|

NOTES

1.

Summary of movements in total equity

|

|

|

Shareholders'equity

|

|

Otherequityinstruments

|

|

Non-controllinginterests

|

|

Totalequity

|

|

|

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance

at 1 January 2017

|

|

43,020

|

|

5,355

|

|

440

|

|

48,815

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit

for the period

|

|

871

|

|

-

|

|

19

|

|

890

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

−

|

|

|

Post-retirement

defined benefit pension schemeremeasurements

|

|

440

|

|

-

|

|

-

|

|

440

|

|

|

Movements

in revaluation reserve in respect ofavailable-for-sale financial

assets

|

|

330

|

|

-

|

|

-

|

|

330

|

|

|

Cash

flow hedging reserve

|

|

(37)

|

|

-

|

|

-

|

|

(37)

|

|

|

Currency

translation differences and other

|

|

(9)

|

|

-

|

|

-

|

|

(9)

|

|

|

Tax

|

|

(167)

|

|

-

|

|

-

|

|

(167)

|

|

|

Total other comprehensive income

|

|

557

|

|

-

|

|

-

|

|

557

|

|

|

Total comprehensive income

|

|

1,428

|

|

-

|

|

19

|

|

1,447

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transactions with owners

|

|

|

|

|

|

|

|

|

|

|

Distributions

on other equity instruments, net of tax

|

|

(79)

|

|

-

|

|

-

|

|

(79)

|

|

|

Issue

of ordinary shares

|

|

8

|

|

-

|

|

-

|

|

8

|

|

|

Treasury

shares and employee award schemes

|

|

(74)

|

|

-

|

|

-

|

|

(74)

|

|

|

Changes

in non-controlling interests

|

|

-

|

|

-

|

|

(5)

|

|

(5)

|

|

|

Total transactions with owners

|

|

(145)

|

|

-

|

|

(5)

|

|

(150)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance at 31 March 2017

|

|

44,303

|

|

5,355

|

|

454

|

|

50,112

|

|

2.

Reconciliation between statutory and underlying basis

results

The

tables below set out the reconciliation from the statutory results

to the underlying basis results.

|

|

|

|

|

Removal of:

|

|

|

|

|

|

|

|

|

|

|

|

Lloyds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banking

|

|

Volatility

|

|

|

|

|

|

Other

|

|

|

|

|

|

Group

|

|

and other

|

|

Insurance

|

|

|

|

conduct

|

|

Underlying

|

|

|

|

statutory

|

|

items

1

|

|

gross up

2

|

|

PPI

|

|

provisions

|

|

basis

|

|

Three months ended 31 March 2017

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

2,363

|

|

66

|

|

499

|

|

-

|

|

-

|

|

2,928

|

|

Other

income, net of insurance claims

|

|

2,027

|

|

(21)

|

|

(524)

|

|

-

|

|

-

|

|

1,482

|

|

Total income

|

|

4,390

|

|

45

|

|

(25)

|

|

-

|

|

-

|

|

4,410

|

|

Operating

lease depreciation

|

|

|

|

(232)

|

|

-

|

|

-

|

|

-

|

|

(232)

|

|

Net income

|

|

4,390

|

|

(187)

|

|

(25)

|

|

-

|

|

-

|

|

4,178

|

|

Operating

expenses

3

|

|

(2,980)

|

|

437

|

|

25

|

|

350

|

|

200

|

|

(1,968)

|

|

Impairment

|

|

(106)

|

|

(21)

|

|

-

|

|

-

|

|

-

|

|

(127)

|

|

Profit before tax

|

|

1,304

|

|

229

|

|

-

|

|

350

|

|

200

|

|

2,083

|

|

|

|

|

|

Removal

of:

|

|

|

|

|

|

Lloyds

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banking

|

|

Volatility

|

|

|

|

|

|

Other

|

|

|

|

|

|

Group

|

|

and other

|

|

Insurance

|

|

|

|

conduct

|

|

Underlying

|

|

|

|

statutory

|

|

items

4

|

|

gross up

2

|

|

PPI

|

|

provisions

|

|

basis

|

|

Three

months ended 31 March 2016

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

2,761

|

|

69

|

|

76

|

|

-

|

|

-

|

|

2,906

|

|

Other

income, net of insurance claims

|

|

612

|

|

979

|

|

(114)

|

|

-

|

|

-

|

|

1,477

|

|

Total

income

|

|

3,373

|

|

1,048

|

|

(38)

|

|

-

|

|

-

|

|

4,383

|

|

Operating

lease depreciation

|

|

|

|

(193)

|

|

-

|

|

-

|

|

-

|

|

(193)

|

|

Net

income

|

|

3,373

|

|

855

|

|

(38)

|

|

-

|

|

-

|

|

4,190

|

|

Operating

expenses

3

|

|

(2,586)

|

|

446

|

|

38

|

|

-

|

|

115

|

|

(1,987)

|

|

Impairment

|

|

(133)

|

|

(16)

|

|

|

|

-

|

|

-

|

|

(149)

|

|

Profit

before tax

|

|

654

|

|

1,285

|

|

-

|

|

-

|

|

115

|

|

2,054

|

|

|

|

|

1

|

Comprises

the effects of asset sales (losses of £12 million);

volatile items (gain of £20 million); liability

management (gain of £4 million; the amortisation of

purchased intangibles (£23 million); restructuring costs

(£157 million, comprising severance costs relating to the

Simplification programme, the announced rationalisation of the

non-branch property portfolio and the work on implementing the

ring-fencing requirements); and the fair value unwind and other

items (loss of £61 million).

|

|

2

|

The

Group's insurance businesses' income statements include income and

expenditure which are attributable to the policyholders of the

Group's long-term assurance funds. These items have no impact in

total upon the profit attributable to equity shareholders and, in

order to provide a clearer representation of the underlying trends

within the business, these items are shown net within the

underlying results.

|

|

3

|

The

statutory basis figure is the aggregate of operating costs and

operating lease depreciation.

|

|

4

|

Comprises

the write-off of the ECN embedded derivative and premium paid on

redemption of the remaining notes (loss of £790 million);

the effects of asset sales (loss of £1 million); volatile

items (loss of £201 million); liability management (loss

of £1 million; the amortisation of purchased intangibles

(£84 million); restructuring costs

(£161 million, principally comprising the severance

related costs under phase II of the Simplification programme); and

the fair value unwind and other items (loss of

£47 million).

|

3.

Returns on tangible equity

The

Group's underlying return on tangible equity for three months to 31

March 2017 was 15.1 per cent (2016: 15.0 per cent). The

Group's statutory return on tangible equity for three months to 31

March 2017 was 8.8 per cent (2016: 5.7 per

cent).

|

|

|

Three months ended

|

|

Three

months ended

|

|

|

|

31 Mar

|

|

31

Mar

|

|

|

|

2017

|

|

2016

|

|

|

|

£bn

|

|

£bn

|

|

Underlying return on tangible equity

|

|

|

|

|

|

Average

shareholders' equity

|

|

43.7

|

|

42.3

|

|

Average

intangible assets

|

|

(3.9)

|

|

(4.0)

|

|

Average tangible equity

|

|

39.8

|

|

38.3

|

|

|

|

|

|

|

|

Underlying

profit after tax (£m)

|

|

1,527

|

|

1,490

|

|

Add

back amortisation of intangible assets (post tax)

(£m)

|

|

49

|

|

43

|

|

Less

profit attributable to other equity holders (£m)

|

|

(79)

|

|

(81)

|

|

Less

profit attributable to non-controlling interests

(£m)

|

|

(19)

|

|

(25)

|

|

Adjusted

underlying profit after tax

|

|

1,478

|

|

1,427

|

|

|

|

|

|

|

|

Underlying

return on tangible equity

|

|

15.1%

|

|

15.0%

|

|

|

|

|

|

|

|

Statutory return on tangible equity

|

|

|

|

|

|

Group

statutory profit after tax (£m)

|

|

890

|

|

531

|

|

Add

back amortisation of intangible assets (post tax)

(£m)

|

|

49

|

|

43

|

|

Add

back amortisation of purchased intangible assets (post tax)

(£m)

|

|

26

|

|

73

|

|

Less

profit attributable to other equity holders (£m)

|

|

(79)

|

|

(81)

|

|

Less

profit attributable to non-controlling interests

(£m)

|

|

(19)

|

|

(25)

|

|

Adjusted

statutory profit after tax

|

|

867

|

|

541

|

|

|

|

|

|

|

|

Statutory

return on tangible equity

|

|

8.8%

|

|

5.7%

|

4.

Quarterly underlying basis information

|

|

|

Quarter

|

|

Quarter

|

|

Quarter

|

|

Quarter

|

|

Quarter

|

|

|

|

ended

|

|

ended

|

|

ended

|

|

ended

|

|

ended

|

|

|

|

31 Mar

|

|

31 Dec

|

|

30 Sept

|

|

30 June

|

|

31 Mar

|

|

|

|

2017

|

|

2016

|

|

2016

|

|

2016

|

|

2016

|

|

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

£m

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

interest income

|

|

2,928

|

|

2,805

|

|

2,848

|

|

2,876

|

|

2,906

|

|

Other

income

|

|

1,482

|

|

1,545

|

|

1,427

|

|

1,616

|

|

1,477

|

|

Total income

|

|

4,410

|

|

4,350

|

|

4,275

|

|

4,492

|

|

4,383

|

|

Operating

lease depreciation

|

|

(232)

|

|

(226)

|

|

(241)

|

|

(235)

|

|

(193)

|

|

Net income

|

|

4,178

|

|

4,124

|

|

4,034

|

|

4,257

|

|

4,190

|

|

Operating

costs

|

|

(1,968)

|

|

(2,134)

|

|

(1,918)

|

|

(2,054)

|

|

(1,987)

|

|

Impairment

|

|

(127)

|

|

(196)

|

|

(204)

|

|

(96)

|

|

(149)

|

|

Underlying profit

|

|

2,083

|

|

1,794

|

|

1,912

|

|

2,107

|

|

2,054

|

|

Enhanced

Capital Notes

|

|

-

|

|

-

|

|

-

|

|

-

|

|

(790)

|

|

Market

volatility and asset sales

|

|

12

|

|

46

|

|

265

|

|

331

|

|

(203)

|

|

Amortisation

of purchased intangibles

|

|

(23)

|

|

(85)

|

|

(87)

|

|

(84)

|

|

(84)

|

|

Restructuring

costs

|

|

(157)

|

|

(232)

|

|

(83)

|

|

(146)

|

|

(161)

|

|

Fair

value unwind and other items

|

|

(61)

|

|

(75)

|

|

(46)

|

|

(63)

|

|

(47)

|

|

Payment

protection insurance provision

|

|

(350)

|

|

-

|

|

(1,000)

|

|

-

|

|

-

|

|

Other

conduct provisions

|

|

(200)

|

|

(475)

|

|

(150)

|

|

(345)

|

|

(115)

|

|

Statutory profit before tax

|

|

1,304

|

|

973

|

|

811

|

|

1,800

|

|

654

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Banking

net interest margin

|

|

2.80%

|

|

2.68%

|

|

2.69%

|

|

2.74%

|

|

2.74%

|

|

Average

interest-earning banking assets

|

|

£430.9bn

|

|

£434.0bn

|

|

£435.9bn

|

|

£435.6bn

|

|

£438.2bn

|

|

Cost:income

ratio

|

|

47.1%

|

|

51.7%

|

|

47.5%

|

|

48.2%

|

|

47.4%

|

|

Asset

quality ratio

|

|

0.12%

|

|

0.17%

|

|

0.18%

|

|

0.09%

|

|

0.14%

|

5.

Tangible net assets per share

The

table below shows the reconciliation between the Group's

shareholders' equity and its tangible net assets.

|

|

|

At 31 Mar

|

|

At 31

Dec

|

|

|

|

2017

|

|

2016

|

|

|

|

£m

|

|

£m

|

|

|

|

|

|

|

|

Shareholders'

equity

|

|

44,303

|

|

43,020

|

|

Goodwill

|

|

(2,016)

|

|

(2,016)

|

|

Intangible

assets

|

|

(1,742)

|

|

(1,681)

|

|

Purchased

value of in-force business

|

|

(331)

|

|

(340)

|

|

Other,

including deferred tax effects

|

|

155

|

|

170

|

|

Tangible net assets

|

|

40,369

|

|

39,153

|

|

|

|

|

|

|

|

Ordinary

shares in issue, excluding Own shares

|

|

71,476m

|

|

71,413m

|

|

Tangible

net assets per share

|

|

56.5p

|

|

54.8p

|

CAPITAL

AND LEVERAGE DISCLOSURES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transitional

|

|

|

|

Fully loaded

|

|

|

|

|

At 31 Mar

|

|

At 31 Dec

|

|

At 31 Mar

|

|

At 31 Dec

|

|

|

|

2017

|

|

2016

|

|

2017

|

|

2016

|

|

Capital resources

|

|

£ million

|

|

£ million

|

|

£ million

|

|

£ million

|

|

Common

equity tier 1

|

|

|

|

|

|

|

|

|

|

Shareholders'

equity per balance sheet

|

|

44,303

|

|

43,020

|

|

44,303

|

|

43,020

|

|

Deconsolidation

adjustments

1

|

|

1,848

|

|

1,342

|

|

1,848

|

|

1,342

|

|

Other

adjustments

|

|

(4,317)

|

|

(3,893)

|

|

(4,317)

|

|

(3,893)

|

|

Deductions

from common equity tier 1

|

|

(11,246)

|

|

(11,185)

|

|

(11,246)

|

|

(11,185)

|

|

Common equity tier 1 capital

|

|

30,588

|

|

29,284

|

|

30,588

|

|

29,284

|

|

|

|

|

|

|

|

|

|

|

|

Additional

tier 1 instruments

|

|

8,075

|

|

8,626

|

|

5,320

|

|

5,320

|

|

Deductions

from tier 1

|

|

(1,292)

|

|

(1,329)

|

|

-

|

|

-

|

|

Total tier 1 capital

|

|

37,371

|

|

36,581

|

|

35,908

|

|

34,604

|

|

|

|

|

|

|

|

|

|

|

|

Tier 2

instruments and eligible provisions

|

|

11,032

|

|

11,113

|

|

7,580

|

|

7,918

|

|

Deductions

from tier 2

|

|

(1,640)

|

|

(1,571)

|

|

(2,932)

|

|

(2,900)

|

|

Total capital resources

|

|

46,763

|

|

46,123

|

|

40,556

|

|

39,622

|

|

|

|

|

|

|

|

|

|

|

|

Total risk-weighted assets

|

|

213,715

|

|

215,534

|

|

213,715

|

|

215,534

|

|

|

|

|

|

|

|

|

|

|

|

Leverage

|

|

|

|

|

|

|

|

|

|

Statutory

balance sheet assets

|

|

|

|

|

|

817,416

|

|

817,793

|

|

Deconsolidation

and other adjustments

1

|

|

|

|

|

|

(160,140)

|

|

(169,370)

|

|

Off-balance

sheet items

|

|

|

|

|

|

58,536

|

|

58,685

|

|

Total exposure measure

|

|

|

|

|

|

715,812

|

|

707,108

|

|

|

|

|

|

|

|

|

|

|

|

Ratios

|

|

|

|

|

|

|

|

|

|

Common

equity tier 1 capital ratio

|

|

14.3%

|

|

13.6%

|

|

14.3%

|

|

13.6%

|

|

Tier 1

capital ratio

|

|

17.5%

|

|

17.0%

|

|

16.8%

|

|

16.1%

|

|

Total

capital ratio

|

|

21.9%

|

|

21.4%

|

|

19.0%

|

|

18.4%

|

|

Leverage

ratio

2

|

|

|

|

|

|

5.0%

|

|

4.9%

|

|

Modified

UK leverage ratio

3

|

|

|

|

|

|

5.4%

|

|

5.2%

|

|

Average

modified UK leverage ratio

4

|

|

|

|

|

|

5.3%

|

|

|

|

Average

modified UK leverage exposure measure

5

|

|

|

|

|

|

663,917

|

|

|

|

|

|

|

1

|

Deconsolidation

adjustments relate to the deconsolidation of certain Group entities

for regulatory capital and leverage purposes, being primarily the

Group's Insurance business.

|

|

2

|

The

countercyclical leverage ratio buffer is currently

nil.

|

|

3

|

The

Group's leverage ratio on a modified basis, excluding qualifying

central bank claims from the exposure measure in accordance with

the rule modification applied to the UK Leverage Ratio

Framework.

|

|

4

|

The

average modified UK leverage ratio is based on the average of the

month end tier 1 capital and modified exposure measures over the

quarter (1 January 2017 to 31 March 2017). The average of 5.3 per

cent reflected a strengthening tier 1 capital position against a

broadly flat exposure measure over the quarter.

|

|

5

|

The

average modified UK leverage exposure measure is based on the

average of the month end exposure measures over the quarter (1

January 2017 to 31 March 2017).

|

|

|

|

The

European Banking Authority (EBA) published revised guidelines on

Pillar 3 disclosure formats and frequency in December 2016. The

guidelines require specific disclosures to be published on a

quarterly basis which the Group has provided through a separate

report ('Q1 2017 Interim Pillar 3 Report'), a copy of which is

located at

www.lloydsbankinggroup.com/investors/financial-performance/other-disclosures

APPENDIX

Summary

of alternative performance measures

The

Group calculates a number of metrics that are used throughout the

banking and insurance industries, on an underlying basis. A

description of these measures and their calculation is set out

below.

|

|

|

|

|

Asset

quality ratio

|

The

underlying impairment charge for the period (on an annualised

basis) in respect of loans and advances to customers after releases

and write-backs, expressed as a percentage of average gross loans

and advances to customers for the period

|

|

|

Banking

net interest margin

|

Banking

net interest income on customer and product balances in the banking

businesses as a percentage of average gross banking

interest-earning assets for the period

|

|

|

Cost:income

ratio

|

Operating

costs as a percentage of net income calculated on an underlying

basis

|

|

|

Gross

asset quality ratio

|

The

underlying impairment charge for the period (on an annualised

basis) in respect of loans and advances to customers before

releases and write-backs expressed as a percentage of average gross

loans and advances to customers for the period

|

|

|

Impaired

loans as a percentage of closing advances

|

Impaired

loans and advances to customers adjusted to exclude Retail and

Consumer Finance loans in recoveries expressed as a percentage of

closing gross loans and advances to customers

|

|

|

Loan to

deposit ratio

|

The

ratio of loans and advances to customers net of allowance for

impairment losses and excluding reverse repurchase agreements

divided by customer deposits excluding repurchase

agreements

|

|

|

Operating

jaws

|

The

difference between the period on period percentage change in net

income and the period on period change in operating costs

calculated on an underlying basis

|

|

|

Present

value of new business premium

|

The

total single premium sales received in the period (on an annualised

basis) plus the discounted value of premiums expected to be

received over the term of the new regular premium

contracts

|

|

|

Required

equity

|

The

amount of shareholders' equity and non-controlling interests

required to achieve a common equity tier 1 ratio of 12.0 per cent

after allowing for regulatory adjustments and

deductions

|

|

|

Return

on assets

|

Underlying

profit before tax divided by average total assets for the

period

|

|

|

Return

on required equity

|

Statutory

profit after tax adjusted to reflect the notional earnings on any

excess or shortfall in equity less the post-tax profit attributable

to other equity holders, divided by the average required equity for

the period

|

|

|

Return

on risk-weighted assets

|

Underlying

profit before tax divided by average risk-weighted

assets

|

|

|

Return

on tangible equity

|

Statutory

profit after tax adjusted to add back amortisation of intangible

assets, and to deduct profit attributable to non-controlling

interests and other equity holders, divided by average tangible net

assets

|

|

|

Tangible

net assets per share

|

Net

assets excluding intangible assets such as goodwill and

acquisition-related intangibles divided by the weighted average

number of ordinary shares in issue

|

|

|

Underlying

profit

|

Statutory

profit adjusted for certain items as detailed in the Basis of

Preparation

|

|

|

Underlying

return on required equity

|

Underlying

profit after tax at the standard UK corporation tax rate adjusted

to reflect the banking tax surcharge and the notional earnings on

any excess or shortfall in equity less the post-tax profit

attributable to other equity holders divided by the average

required equity for the period

|

|

|

Underlying

return on tangible equity

|

Underlying

profit after tax at the standard UK corporation tax rate adjusted

to add back amortisation of intangible assets, and to deduct profit

attributable to non-controlling interests and other equity holders,

divided by average tangible net assets

|

|

|

|

|

|

|

|

|

|

|

BASIS OF PRESENTATION

|

|

This

release covers the results of Lloyds Banking Group plc together

with its subsidiaries (the Group) for the three months ended

31 March 2017.

|

|

Statutory basis:

Statutory information

is set out on page 7. However, a number of factors have had a

significant effect on the comparability of the Group's financial

position and results. Accordingly, the results are also presented

on an underlying basis.

|

|

Underlying basis:

The statutory results

are adjusted for certain items which are listed below, to allow a

comparison of the Group's underlying performance.

−

losses on redemption of the Enhanced Capital Notes and the

volatility in the value of the embedded equity conversion

feature;

−

market volatility and asset sales, which includes the effects of

certain asset sales, the volatility relating to the Group's own

debt and hedging arrangements and that arising in the insurance

businesses and insurance gross up;

−

the unwind of acquisition-related fair value adjustments and the

amortisation of purchased intangible assets;

−

restructuring costs, comprising severance related costs relating to

the Simplification programme, the costs of implementing regulatory

reform and ring-fencing and the rationalisation of the non-branch

property portfolio; and

−

payment protection insurance and other conduct

provisions.

|

|

Unless

otherwise stated, income statement commentaries throughout this

document compare the three months ended 31 March 2017 to the

three months ended 31 March 2016, and the balance sheet

analysis compares the Group balance sheet as at 31 March 2017

to the Group balance sheet as at 31 December

2016.

Alternative performance measures:

The

Group uses a number of alternative performance measures, including

underlying profit, in the discussion of its business performance

and financial position on pages 2 to 6. Further information on

these measures is set out on page 13.

|

FORWARD LOOKING STATEMENTS

This

document contains certain forward looking statements with respect

to the business, strategy and plans of Lloyds Banking Group and its

current goals and expectations relating to its future financial

condition and performance. Statements that are not historical

facts, including statements about Lloyds Banking Group's or its

directors' and/or management's beliefs and expectations, are

forward looking statements. By their nature, forward looking

statements involve risk and uncertainty because they relate to

events and depend upon circumstances that will or may occur in the

future. Factors that could cause actual business, strategy, plans

and/or results (including but not limited to the payment of

dividends) to differ materially from the plans, objectives,

expectations, estimates and intentions expressed in such forward

looking statements made by the Group or on its behalf include, but

are not limited to: general economic and business conditions in the

UK and internationally; market related trends and developments;

fluctuations in interest rates (including low or negative rates),

exchange rates, stock markets and currencies; the ability to access

sufficient sources of capital, liquidity and funding when required;

changes to the Group's credit ratings; the ability to derive cost

savings and other benefits including, but without limitation as a

result of any acquisitions, disposals and other strategic

transactions; changing customer behaviour including consumer

spending, saving and borrowing habits; changes to borrower or

counterparty credit quality; instability in the global financial

markets, including Eurozone instability, the exit by the UK from

the European Union (EU) and the potential for one or more other

countries to exit the EU or the Eurozone and the impact of any

sovereign credit rating downgrade or other sovereign financial

issues; technological changes and risks to cyber security; natural,

pandemic and other disasters, adverse weather and similar

contingencies outside the Group's control; inadequate or failed

internal or external processes or systems; acts of war, other acts

of hostility, terrorist acts and responses to those acts,

geopolitical, pandemic or other such events; changes in laws,

regulations, accounting standards or taxation, including as a

result of the exit by the UK from the EU, or a further possible

referendum on Scottish independence; changes to regulatory capital

or liquidity requirements and similar contingencies outside the

Group's control; the policies, decisions and actions of

governmental or regulatory authorities or courts in the UK, the EU,

the US or elsewhere including the implementation and interpretation

of key legislation and regulation; the ability to attract and

retain senior management and other employees; requirements or

limitations on the Group as a result of HM Treasury's

investment in the Group; actions or omissions by the Group's

directors, management or employees including industrial action;

changes to the Group's post-retirement defined benefit scheme

obligations; the extent of any future impairment charges or

write-downs caused by, but not limited to, depressed asset

valuations, market disruptions and illiquid markets; the value and

effectiveness of any credit protection purchased by the Group; the

inability to hedge certain risks economically; the adequacy of loss

reserves; the actions of competitors, including non-bank financial