Mohawk Industries, Inc. Announces Second Quarter Earnings CALHOUN,

Ga., July 20 /PRNewswire-FirstCall/ -- Mohawk Industries, Inc.

(NYSE:MHK) today announced 2005 second quarter net earnings of

$93,811,000 and diluted earnings per share (EPS) of $1.39 (both 8%

above last year). This compares to $87,158,000 in net earnings and

$1.29 in EPS for the second quarter of 2004. Net sales for the

quarter were $1,624,692,000 in 2005 compared to net sales of

$1,485,897,000 in 2004, an increase of 9%. The growth in EPS

resulted from selling price increases, lower selling, general and

administrative expenses as a percent of net sales and growing hard

surface sales partially offset by continuing raw material and

energy cost increases. The net sales growth was attributable to

price increases and internal growth. The Mohawk segment net sales

of $1,184,914,000 in the second quarter of 2005 were up 7% from

$1,105,493,000. This was primarily attributable to increases in

prices as well as growth in commercial and hard surface sales. The

Dal-Tile segment net sales of $439,778,000 in the second quarter

grew 16% from $380,404,000 primarily as a result of internal growth

and improved product mix. EPS for the first half of 2005 was $2.42

and net earnings were $163,831,000 (both 7% above last year)

compared to EPS of $2.27 and $153,465,000 in net earnings for the

first half of 2004. This increase in EPS and net earnings is

attributable to selling price increases, lower selling, general and

administrative expenses as a percent of net sales and growing hard

surface sales partially offset by continuing raw material and

energy cost increases. Net sales for the first half of 2005 were

$3,117,914,000, representing an 8% increase over the first half of

2004 sales of $2,875,622,000. This sales growth was attributable to

price increases and internal growth. In commenting on the first

quarter results, Jeffrey S. Lorberbaum, Chairman and CEO, stated,

"Mohawk turned in another strong performance for the quarter. I am

especially pleased with the excellent Dal-Tile performance which

continues to exceed our expectations. The 15.8% operating margin is

one of the highest we have recorded. Our investments in Dal-Tile

including the expansion of our manufacturing plants in Muskogee and

Mexico, adding distribution points and opening new design galleries

are continuing as planned. This should support continued growth in

the ceramic tile business and increase capacity to satisfy our

customers' requirements. The Mohawk segment also reported good

results for the quarter with both the commercial and residential

new construction business expanding as demand remains strong. We

continue to broaden our carpet tile offerings through our Lees and

Mohawk brands. Carpet tile is a growing category among designers

and architects. Our retail replacement business was soft during the

quarter as a result of fewer consumers shopping in retail stores.

Sales of our Home products are still under pressure as we have

exited some marginal products and some customers have reduced their

inventory levels. The profitability is in line with the Mohawk

segment and we are investigating alternatives to maximize our

business. Price increases were implemented in the second quarter as

a result of raw material and energy cost increases. This impacts

our margins as the timing of price increases lags behind the cost

increases. Many of the raw material cost increases appear to have

moderated during the quarter. However, increases in oil costs and

worldwide commodity demand could further affect our costs. Our new

SmartStrand(TM) carpet introduction with Dupont(TM) Sorona(R) is

being implemented across the country and has been well received in

the marketplace. The product is targeted for the mid to high-end

market with comprehensive merchandising and advertising programs.

Many of the sample displays are in the process of being installed

across the country. Additional products will be introduced by the

end of the year. I am also proud to announce that Mohawk won two

awards at Neocon, the national commercial show, for innovative

products in our Karastan and Lees divisions. In addition,

FloorCovering News presented Mohawk awards for the Carpet

Manufacturer of the Year and the Overall Floorcovering Manufacturer

of the Year. We recently announced the acquisition of Unilin, who

is leader in high-end laminate in both the U.S. and European

market. We expect to close in the fourth quarter this year. This is

the second significant step, after our 2002 Dal-Tile acquisition,

in broadening our participation in the hard surface flooring

market. Unilin is the only fully integrated U.S. manufacturer with

a history of innovation and cutting edge products. Unilin's

management will remain in place and lead our laminate efforts. Our

leverage at 24% debt to capitalization provided the opportunity to

acquire Unilin. We are in the process of obtaining regulatory

approvals for the combination in the United States and Europe. The

combined management team is developing a long-term strategy to

maximize our laminate business. We expect the acquisition to be

slightly accretive in 2006." A strong housing market and declining

unemployment continue to support the overall economy. Our business

in the residential new construction and commercial markets has

continued to show strength. Other economic factors such as high oil

and gasoline prices have affected our retail replacement business.

Future raw material and energy prices are not predictable and may

affect our industry. After considering these factors, the third

quarter earnings forecast is from $1.71 to $1.80 EPS. Certain of

the statements in the immediately preceding paragraphs,

particularly anticipating future performance, business prospects,

growth and operating strategies, proposed acquisitions, and similar

matters, and those that include the words "believes,"

"anticipates," "forecasts," "estimates," or similar expressions

constitute "forward-looking statements." For those statements,

Mohawk claims the protection of the safe harbor for forward-

looking statements contained in the Private Securities Litigation

Reform Act of 1995. There can be no assurance that the

forward-looking statements will be accurate because they are based

on many assumptions, which involve risks and uncertainties. The

following important factors could cause future results to differ:

changes in economic or industry conditions; competition; raw

material and energy prices; timing and level of capital

expenditures; integration of acquisitions; introduction of new

products; rationalization of operations; and other risks identified

in Mohawk's SEC reports and public announcements. Mohawk is a

leading supplier of flooring for both residential and commercial

applications. Mohawk offers a complete selection of broadloom

carpet, ceramic tile, wood, stone, laminate, vinyl, rugs and other

home products. These products are marketed under the premier brands

in the industry, which include Mohawk, Karastan, Ralph Lauren,

Lees, Bigelow, Dal-Tile and American Olean. Mohawk's unique

merchandising and marketing assist our customers in creating the

consumers' dream. Mohawk provides a premium level of service with

its own trucking fleet and over 250 local distribution locations.

There will be a conference call Thursday, July 21, 2005 at 11:00 AM

Eastern Time. The telephone number to call is 1-800-603-9255 for

US/Canada and 1-706-634-2294 for International/Local. A conference

call replay will also be available until Friday, July 29, 2005 by

dialing 1-800-642-1687 for US/local calls and (706) 645-9291 for

international calls and entering Conference ID # 7842048. DATE FOR

FUTURE PRESS RELEASE AND CONFERENCE CALL: PRESS CONFERENCE RELEASE

CALL 3rd QTR 2005 OCT. 19, 2005 OCT. 20, 2005 11:00AM

(800-603-9255) Contact: Frank H. Boykin, Chief Financial Officer

Mohawk Industries, Inc. (706) 624-2695 MOHAWK INDUSTRIES, INC. AND

SUBSIDIARIES Consolidated Statement of Earnings Data (Amounts in

thousands, except per share data) Three Months Ended Six Months

Ended July 2, July 3, July 2, July 3, 2005 2004 2005 2004 Net sales

$1,624,692 1,485,897 3,117,914 2,875,622 Cost of sales 1,193,183

1,082,578 2,301,703 2,106,757 Gross profit 431,509 403,319 816,211

768,865 Selling, general and administrative expenses 271,020

252,646 532,092 499,153 Operating income 160,489 150,673 284,119

269,712 Interest expense 12,515 13,212 24,391 27,166 Other (income)

expense, net 922 991 2,926 2,413 Earnings before income taxes

147,052 136,470 256,802 240,133 Income taxes 53,241 49,312 92,971

86,668 Net earnings $93,811 87,158 163,831 153,465 Basic earnings

per share $1.40 1.31 2.45 2.30 Weighted-average shares outstanding

66,811 66,742 66,807 66,686 Diluted earnings per share $1.39 1.29

2.42 2.27 Weighted-average common and dilutive potential common

shares outstanding 67,504 67,564 67,598 67,582 Other Financial

Information (Amounts in thousands) Net cash provided by operating

activities $104,079 54,421 154,780 57,682 Depreciation &

amortization $31,497 30,100 63,762 61,110 Capital expenditures

$64,832 25,507 99,353 38,674 Consolidated Balance Sheet Data

(Amounts in thousands) July 2, 2005 July 3, 2004 ASSETS Current

assets: Receivables $775,992 698,852 Inventories 1,125,145 926,396

Prepaid expenses 49,125 43,436 Deferred income taxes 55,311 84,260

Total current assets 2,005,573 1,752,944 Property, plant and

equipment, net 973,627 899,458 Goodwill 1,377,349 1,376,381 Other

assets 333,700 339,287 $4,690,249 4,368,070 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities: Current portion of

long-term debt $183,835 274,459 Accounts payable and accrued

expenses 757,813 715,074 Total current liabilities 941,648 989,533

Long-term debt, less current portion 700,000 709,425 Deferred

income taxes and other long- term liabilities 221,244 213,911 Total

liabilities 1,862,892 1,912,869 Total stockholders' equity

2,827,357 2,455,201 $4,690,249 4,368,070 As of or for the Three As

of or for the Six Segment Information Months Ended Months Ended

(Amounts in thousands) July 2, July 3, July 2, July 3, 2005 2004

2005 2004 Net sales: Mohawk $1,184,914 1,105,493 2,276,260

2,135,935 Dal-Tile 439,778 380,404 841,654 739,687 Consolidated net

sales $1,624,692 1,485,897 3,117,914 2,875,622 Operating income:

Mohawk $95,743 97,050 161,368 168,822 Dal-Tile 69,291 55,895

127,761 105,297 Corporate and eliminations (4,545) (2,272) (5,010)

(4,407) Consolidated operating income $160,489 150,673 284,119

269,712 Assets: Mohawk $2,492,341 2,249,124 Dal-Tile 2,147,812

2,035,850 Corporate and eliminations 50,096 83,096 Consolidated

assets $4,690,249 4,368,070 DATASOURCE: Mohawk Industries, Inc.

CONTACT: Frank H. Boykin, Chief Financial Officer of Mohawk

Industries, Inc., +1-706-624-2695 Web site:

http://www.mohawkind.com/

Copyright

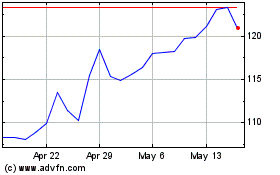

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

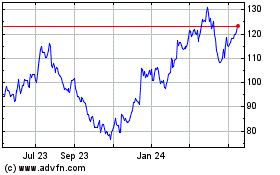

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024