CALHOUN, Ga., Oct. 26 /PRNewswire-FirstCall/ -- Mohawk Industries,

Inc. (NYSE:MHK) today announced 2006 third quarter net earnings of

$127,708,000 and diluted earnings per share (EPS) of $1.88 (both

10% above last year), in accordance with U.S. Generally Accepted

Accounting Principles (GAAP). Adjusted net earnings for the third

quarter of 2006 were $123,948,000 and adjusted EPS were $1.82 per

share. The adjusted net earnings exclude a stock option charge that

was not required in 2005 increasing net earnings by $1,855,000 and

exclude a partially-paid refund from U.S. Customs decreasing net

earnings by $5,615,000. Net sales for the quarter were

$2,024,019,000 an increase of 19% from 2005. The sales growth

resulted from the Unilin acquisition, hard surface sales growth,

and price increases. For the first nine months of 2006, net

earnings were $326,342,000 (14% above last year) and EPS were $4.80

(13% above last year), in accordance with U.S. GAAP. Adjusted net

earnings for the first nine months of 2006 were $322,525,000 and

adjusted EPS were $4.74 per share. The adjusted net earnings

exclude a stock option charge that was not required in 2005

increasing net earnings by $5,701,000 and exclude a partially-paid

refund from U.S. Customs decreasing net earnings by $9,518,000.

This increase is attributable to the Unilin acquisition, strong

hard surface sales growth and price increases. In commenting on the

quarter results, Jeffrey S. Lorberbaum, Chairman and CEO, stated:

"I am pleased with our results for the quarter in light of the

current business environment. With 19% sales growth, higher gross

margins and a 10% improvement in EPS over last year, our third

quarter was positive. Our business is better balanced to minimize

the impact of changing economic and industry cycles than in the

past. The diversification of our product offering with a full line

of soft and hard products, participation in all sales channels of

residential and commercial, and our broader geographic exposure in

Europe improve our position. During the quarter the slowing U.S.

economy impacted our business. Both residential replacement and new

residential construction weakened through the quarter and the

commercial business continued positive trends. Raw material costs

increased in the third quarter and remained high even though oil

costs declined. A stronger European economy and improved U.S.

laminate sales have benefited our business. We see weaker industry

demand levels with the postponement of new home purchases and

redecorating projects in the near term. Recent changes in gasoline

prices have positively affected consumers and some retail

categories. This could improve large discretionary purchases and

positively affect retail flooring sales. Interest rates should

remain favorable, consumer confidence should recover, and the

industry demand for flooring should improve in the long term. The

Mohawk segment sales results were disappointing as industry sales

slowed substantially. Sales declined 1% with margins impacted by

higher costs and lower volumes. We began implementing a price

increase to offset higher raw material costs during the quarter.

Both new and replacement residential carpet declined significantly

from the prior year with commercial carpet continuing to grow. As

all levels of the industry try to stimulate consumer purchases, we

see more promotional activity. With the lower sales levels, cost

reduction plans are being implemented to reduce manufacturing

labor, SG&A and other discretionary spending. Production

schedules have been reduced to reflect lower demand and control

inventory levels. We could see improvement in our raw material

costs if the worldwide demand for commodity chemicals doesn't

impact prices and lower oil prices continue. During the third

quarter, we closed a staple yarn facility incurring $500,000 of

costs related to the closing. We will continue to review the

business and adjust to the changing environment. Our Dal-Tile

segment sales had solid performance growing 11% during the quarter.

Even with slowing industry growth, we anticipate increasing our

share due to prior investments in sales, product, and distribution.

Our margins were impacted by the start up expenses of our Oklahoma

expansion and increased transportation costs. We anticipate

transportation costs improving as gasoline costs decline. The start

up phase of the Oklahoma facility is complete and the plant is

expected to be operating near capacity by year-end. Our ceramic

business is well positioned to grow faster than the industry. The

Unilin segment results were strong for the third quarter with good

sales growth in the European laminate business. We also saw the

U.S. laminate sales improve through the quarter as our U.S.

distributors completed their inventory adjustments and purchased

product more in line with their current sales. Our launch of the

Mohawk laminate products continues on track and the first phase is

complete. The third quarter margins were higher due to better

laminate product mix, improvement in the U.S. distributor business,

improved board pricing and productivity, and control of

discretionary spending. We have been pleased with Unilin's

performance since the acquisition was completed. We are managing

our balance sheet with the debt to capitalization ratio improving

to 46% after paying down $168 million of debt during the third

quarter. We have many initiatives focused on improving efficiency,

inventory turns, and working capital management. During the

quarter, the lawsuit filed against us in 2004 that alleges Mohawk

hired undocumented workers to suppress wages was reviewed by the

11th Circuit Court. After reconsidering the case, the Court refused

to dismiss the RICO claims against Mohawk. Mohawk will appeal the

decision and will continue to vigorously defend itself against this

claim." The Company is anticipating continued slow sales in the

fourth quarter that will result in unabsorbed overhead costs and

impact our margin dollars. We are reducing our manufacturing,

administration, and marketing expenses. Our carpet margins will

also be affected by the lag between cost and selling price changes.

Unilin margins will decrease to a more sustainable rate. Based on

these factors, our earnings guidance for the fourth quarter of 2006

is from $1.51 to $1.60 EPS. This guidance does not include the

expected closing of higher cost ceramic production at an estimated

cost of $6,000,000 or the anticipated additional refunds from U.S.

customs. Certain of the statements in the immediately preceding

paragraphs, particularly anticipating future performance, business

prospects, growth and operating strategies, proposed acquisitions,

and similar matters, and those that include the words "could,"

"should," "believes," "anticipates," "forecasts," "estimates," or

similar expressions constitute "forward-looking statements." For

those statements, Mohawk claims the protection of the safe harbor

for forward-looking statements contained in the Private Securities

Litigation Reform Act of 1995. There can be no assurance that the

forward- looking statements will be accurate because they are based

on many assumptions, which involve risks and uncertainties. The

following important factors could cause future results to differ:

changes in economic or industry conditions; competition; raw

material and energy prices; timing and level of capital

expenditures; integration of acquisitions; introduction of new

products; rationalization of operations; litigation and other risks

identified in Mohawk's SEC reports and public announcements. Mohawk

is a leading supplier of flooring for both residential and

commercial applications. Mohawk offers a complete selection of

carpet, ceramic tile, laminate, wood, stone, vinyl, rugs and other

home products. These products are marketed under the premier brands

in the industry, which include Mohawk, Karastan, Ralph Lauren,

Lees, Bigelow, Dal-Tile, American Olean, Unilin and Quick Step.

Mohawk's unique merchandising and marketing assist our customers in

creating the consumers' dream. Mohawk provides a premium level of

service with its own trucking fleet and over 250 local distribution

locations. There will be a conference call Friday, October 27, 2006

at 11:00 AM Eastern Time. The telephone number to call is

1-800-603-9255 for US/Canada and 1-706-634-2294 for

International/Local. A conference call replay will also be

available until November 3, 2006 by dialing 1-800-642-1687 for

US/local calls and 1-706-645-9291 for international calls and

entering Conference ID # 8008744. MOHAWK INDUSTRIES, INC. AND

SUBSIDIARIES Consolidated Statement of Earnings Data Three Months

Ended Nine Months Ended (Amounts in thousands, Sept. 30, Oct. 1,

Sept. 30, Oct. 1, except per share data) 2006 2005 2006 2005 Net

sales $2,024,019 1,697,634 6,007,248 4,815,548 Cost of sales

1,455,508 1,234,680 4,330,015 3,524,060 Gross profit 568,511

462,954 1,677,233 1,291,488 Selling, general and administrative

expenses 345,771 274,052 1,067,547 806,144 Operating income 222,740

188,902 609,686 485,344 Interest expense 44,655 10,775 131,113

35,166 Other (income) expense, net 55 (400) 6,380 2,526 U.S.

Customs refund, net (8,834) - (15,066) - Earnings before income

taxes 186,864 178,527 487,259 447,652 Income taxes 59,156 62,764

160,917 160,147 Net earnings $127,708 115,763 326,342 287,505 Basic

earnings per share $1.89 1.73 4.82 4.30 Weighted-average shares

outstanding 67,704 66,865 67,654 66,827 Diluted earnings per share

$1.88 1.71 4.80 4.26 Weighted-average common and dilutive potential

common shares outstanding 68,021 67,519 68,056 67,572 Other

Financial Information (Amounts in thousands) Net cash provided by

operating activities $203,534 173,253 546,241 328,033 Depreciation

& amortization $68,040 31,138 202,674 94,900 Capital

expenditures $41,389 51,448 124,048 150,801 Consolidated Balance

Sheet Data (Amounts in thousands) Sept. 30, 2006 Oct. 1, 2005

ASSETS Current assets: Cash $69,730 - Receivables 958,416 811,628

Inventories 1,275,435 1,116,781 Prepaid expenses 126,895 44,160

Deferred income taxes 55,128 55,311 Total current assets 2,485,604

2,027,880 Property, plant and equipment, net 1,869,273 995,205

Goodwill 2,685,092 1,378,849 Intangibles 1,168,739 319,644 Other

assets 25,933 13,007 $8,234,641 4,734,585 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities: Current portion of

long-term debt $509,151 68,679 Accounts payable and accrued

expenses 1,124,974 776,199 Total current liabilities 1,634,125

844,878 Long-term debt, less current portion 2,438,732 700,000

Deferred income taxes and other long- term liabilities 631,283

230,748 Total liabilities 4,704,140 1,775,626 Total stockholders'

equity 3,530,501 2,958,959 $8,234,641 4,734,585 As of or for the As

of or for the Segment Information Three Months Ended Nine Months

Ended Sept 30, Oct. 1, Sept. 30, Oct. 1, (Amounts in thousands)

2006 2005 2006 2005 Net sales: Mohawk $1,233,833 1,248,216

3,626,371 3,524,477 Dal-Tile 501,241 449,418 1,482,065 1,291,071

Unilin 292,924 - 909,319 - Intersegment eliminations (3,979) -

(10,507) - Consolidated net sales $2,024,019 1,697,634 6,007,248

4,815,548 Operating income: Mohawk $110,505 121,940 275,111 295,631

Dal-Tile 69,642 69,137 213,286 196,898 Unilin 49,748 - 149,424 -

Corporate and intersegment eliminations (7,155) (2,175) (28,135)

(7,185) Consolidated operating income $222,740 188,902 609,686

485,344 Assets: Mohawk $2,597,805 2,509,552 Dal-Tile 2,294,118

2,174,055 Unilin 3,239,804 - Corporate and eliminations 102,914

50,978 Consolidated assets $8,234,641 4,734,585 Reconciliation of

reported net earnings to adjusted net earnings Three Months Nine

Months (Amounts in thousands, except per Ended Ended share data)

Sept. 30, 2006 Sept. 30, 2006 Net earnings reported $127,708

326,342 Adjustments: Stock option expense, net of taxes of $1,064

and $3,327, respectively 1,855 5,701 U.S. Customs refund, net of

taxes of $3,219 and $5,548, respectively (5,615) (9,518) $123,948

322,525 Adjusted net earnings per common share (basic) $1.83 4.77

Adjusted net earnings per common share (diluted) $1.82 4.74 The

Company believes it is useful for itself and investors to review,

as applicable, both GAAP information that includes the stock

compensation impact of SFAS 123R and the U.S. Customs refund, and

the non-GAAP measure that excludes such information in order to

assess the performance of the Company's business for planning and

forecasting in subsequent periods. DATASOURCE: Mohawk Industries,

Inc. CONTACT: Frank H. Boykin, Chief Financial Officer of Mohawk

Industries, Inc., +1-706-624-2695 Web site:

http://www.mohawkind.com/

Copyright

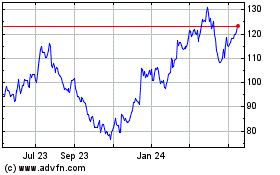

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jun 2024 to Jul 2024

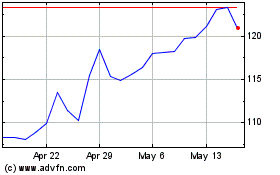

Mohawk Industries (NYSE:MHK)

Historical Stock Chart

From Jul 2023 to Jul 2024