UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

NATURAL GAS SERVICES GROUP, INC.

________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

June 6, 2024

Dear Fellow Natural Gas Services Group Shareholder:

I am writing today to update you on our annual meeting and the proxy materials you recently received.

We appreciate your support of NGS. Your confidence in the Company is important to us, and we take our role as stewards of your capital very seriously. The NGS team works hard to consider the impact of shareholder value on every decision we make. I am honored to have recently joined the Company as your Chief Executive Officer; I’ve served as a director since April 2023 and led the investment as a former partner at our second-largest shareholder, a position initiated in June 2020. I believe in this Company, its leading position in the energy compression market, and most important, our ability to continue to enhance shareholder value in the coming years.

As you know, we recently filed our Annual Proxy Statement ahead of the Company’s annual meeting to be held on June 13, 2024. In that Proxy we outline a number of important action items related to members of our Board of Directors standing for election, ratification of our independent auditors, and our executive compensation plan. We would ask that you carefully review those materials and vote in favor of those items as recommended by your Board of Directors.

In a recent report, Institutional Shareholder Services (“ISS”) raised concerns about our executive compensation plan, primarily related to the retirement payments made to our Chairman and former Chief Executive Officer, Steve Taylor. Attached to this letter is correspondence from Donald J. Tringali, our lead independent director and the Chair of our Compensation Committee, to ISS directly responding to the report. As Don notes, the payments are the result of a legal obligation established nearly a decade ago in a legacy employment contract. While the market practice for executive employment agreements may have changed since then, the obligation remains. The Company completed a successful transition in the CEO office while living up to its responsibility to Steve which was the right thing to do. As Don notes, our current compensation program is based on best corporate governance and compensation practices—we are confident it will have the support of proxy advisors in the coming years. We hope that our explanation of the issue, the long-standing relationship we have with our shareholders, and our recent performance provides the confidence to support our shareholder initiatives at this year’s annual meeting.

Again, we appreciate your interest in and support of Natural Gas Services Group and your review of these additional materials. The Board of Directors respectfully requests that you cast a vote in favor of these key issues.

Sincerely,

NATURAL GAS SERVICES GROUP, INC.

Justin C. Jacobs

Chief Executive Officer and Director

June 6, 2024

Patricia Louise Miranda

Associate Vice President – Governance Research

Kevin Kim

Associate Director – Executive Compensation

Institutional Shareholder Services

702 King Farm Boulevard Suite 400

Rockville, MD 20850

Ref: Natural Gas Services Group, Inc.

ISS Proxy Advisory Services (“ISS”) Report – May 31, 2024 (“Report”)

Natural Gas Services Group Proxy Analysis

Dear Ms. Miranda and Mr. Kim:

I serve as the Lead Independent Director and Chairman of the Compensation Committee on the Natural Gas Services Group, Inc. (“NGS” or the “Company”) Board of Directors (“Board”) and am writing in response to the above referenced Report. I joined the Board at the end of April, 2023 and was appointed Chairman of the Compensation Committee in May and Lead Independent Director in June, 2023.

First, thank you for your analysis regarding the Company’s executive compensation program. At the time of my appointment to the Board, I was aware of the various critical reports ISS had issued regarding executive compensation, and the Company’s responses. I accepted the role of Chairman of the Compensation Committee midway through 2023 with a mandate to, among other things, enhance transparency around the Company’s executive compensation practices.

I write now to provide important information to you and our shareholders which we feel may not have been adequately considered in connection with your issuance of the Report.

Over the past several years – predating my appointment to the Board – the Company’s Board of Directors and Compensation Committee have worked with our shareholders, compensation consultants and management to respond to your critiques of the Company’s executive compensation plan as well as recommendations regarding the program from our shareholders and compensation experts.

As a result of the Company’s responsiveness to shareholder concerns, the Compensation Committee and the Board of Directors have made several adjustments over the years to the compensation program for the Company’s executives. In fact, in recent years, our consistent efforts to address the critiques of proxy advisors such as ISS and suggestions from our shareholders resulted in an increase in overall support for our executive compensation programs as measured by the annual vote of shareholders on NGS’s executive compensation program.

That said, your most recent Report is critical of the Company’s current report on executive compensation presented in the NGS Proxy Statement filed on April 29, 2024. Specifically, you note, “A pay-for-performance misalignment is underscored by concerns regarding the magnitude of retirement cash payments to interim CEO Taylor.” (ISS Proxy Analysis & Benchmark Policy Voting Recommendations, Institutional Shareholder Services, Inc, May 31, 2024, p.1, et.seq., the “ISS Proxy Analysis”.) As a result of this analysis, you recommend shareholders vote against the Advisory Vote to Ratify Named Executive Officers’ Compensation.

Ms. Patricia Louise Miranda

Mr. Kevin Kim

Institutional Shareholder Services

June 6, 2024 Page 2

While we appreciate your effort and analysis, the independent directors of Natural Gas Services Group, Inc. believe your analysis does not adequately consider all of the factors that should have been considered, as explained below. As such, we urge NGS Shareholders to vote FOR the Advisory Vote to Ratify Named Executive Officers’ Compensation.

The rationale for support of our executive compensation program is based on the following:

First, the ISS critique is backward-looking and relies on payments emanating from a legacy compensation agreement that is not indicative of the Company’s current compensation program.

Your Report notes, “A pay-for-performance misalignment exists, and sufficient mitigating factors have not been identified for the year in review” (ISS Proxy Analysis, p. 10, emphasis added). While we acknowledge the NGS Proxy Filing of April 29, 2024 may not have provided a complete description of the genesis of the payments to Mr. Taylor, the historical record and publicly available details of the payments provide clear and compelling evidence of sufficient mitigating factors to exclude such extraordinary payments to Mr. Taylor from your analysis of the Company’s normalized executive compensation program.

•The extraordinary payments to Mr. Taylor were made pursuant to a Retirement Agreement (the “2022 Agreement”) between Mr. Taylor and the Company entered into on May 17, 2022 and disclosed in a filing with the U.S. Securities and Exchange Commission on May 19, 2022. The 2022 Agreement superseded Mr. Taylor’s legacy Employment Agreement (the “2015 Employment Agreement”), last amended and restated on April 27, 2015, which obligated the Company to make material payments to Mr. Taylor upon his departure from the Company under certain conditions. While the 2022 Agreement restructured and recharacterized some of the payments that were required under the 2015 Employment Agreement, any “extraordinary” payments made to Mr. Taylor were simply what was contractually required in order for the Company to transition the CEO position. Moreover, the 2022 Agreement required Mr. Taylor to provide a number of ongoing services to the Company and extinguished the Company’s financial obligations under the 2015 Employment Agreement. The termination of the 2015 Employment Agreement, eliminated a contract that ISS found problematic.

•Mr. Taylor’s 2015 Employment Agreement – which created a binding obligation on the Company – was negotiated prior to the current focus on performance-based compensation standards and the advent of rigorous analysis of compensation programs by proxy advisors like ISS. While proxy advisory services chose to criticize legacy contracts and resulting payments to Named Executive Officers (“NEOs”), such criticisms as the sole rationale to recommend a vote against a company’s executive compensation package (as is the case here) does not relieve a company, like NGS, of its obligation to fulfill its commitment resulting from a legally-binding contract.

•The extraordinary payments reported in the current Proxy Statement are not unexpected as they were disclosed in the 2022 Agreement with Mr. Taylor. In fact, the only difference between the 2022 Agreement and the Company’s position today is Mr. Taylor has continued to serve the Company for nearly a year longer than he was expected to under the 2022 Agreement. Due to a number of unexpected personnel changes and a longer-than-anticipated search for a permanent Chief Executive Officer, at the Company’s request, Mr. Taylor returned to the position of interim Chief Executive Officer and remained Chairman well beyond his planned June 30, 2023 retirement date. For Mr. Taylor’s additional service, the Company agreed to extend his monthly salary (as the only form of cash compensation) during the additional service period and granted him an additional 10,101 restricted stock units, well within acceptable compensation practices provided to the CEOs of the current NGS peer group.

•It should also be noted that, even after taking on Interim CEO duties at the request of the Company, Mr. Taylor did not participate in the Company’s incentive plans.

In short, the payments to which ISS objects can be traced to a legal obligation the Company undertook nearly a decade ago, under the 2015 Agreement, which we feel is a sufficient mitigating factor in reviewing the alignment of the Company’s executive compensation with the best interests of the Company’s shareholders. In order to achieve a successful CEO transition, the Board elected to restructure those payments under the 2022 Agreement while at the

Ms. Patricia Louise Miranda

Mr. Kevin Kim

Institutional Shareholder Services

June 6, 2024 Page 3

same time requiring Mr. Taylor to provide certain executive services to the Company during a transition period, improving alignment of the Company’s compensation program with shareholders.

A complete understanding of the history of the contractual relationship between the Company and Mr. Taylor as well as the favorable resolution provided under the 2022 Agreement support a vote IN FAVOR of the Advisory Vote to Ratify Named Executive Officers’ Compensation.

Second, our annual engagement with NGS shareholders regarding our executive compensation program resulted in constructive dialogue with shareholders resulting in improvements to our ongoing executive compensation program.

As noted in our current Proxy Statement, the Compensation Committee of the Board of Directors engaged shareholders in discussions regarding the Company’s executive compensation program. The committee, which I chair, contacted approximately 61% of the Company’s shareholders seeking feedback on our compensation program.

In those conversations, shareholders indicated they prefer a CEO compensation program that was in-line with the market and peer metrics and one that emphasized performance-based compensation, input that the Compensation Committee appreciates and will use to further refine our compensation programs for our recently appointed NEOs.

Specifically, shareholders did not raise specific issues with Mr. Taylor’s 2022 Agreement. And, in fact, at the annual meeting on June 15, 2023, shareholders voted to approve the Advisory Vote to Ratify Named Executive Officers’ Compensation which included disclosures regarding compensation related to the 2022 Agreement.

We believe that shareholders appreciate the two decades of stable, visionary leadership that Mr. Taylor provided to Natural Gas Services Group, understand the long-standing legal obligations created under the 2015 Employment Agreement, and applaud the positive steps taken by all parties to better define those obligations in the 2022 Agreement. While these pragmatic items may be beyond the purview of your analysis, we believe shareholders should and will consider these issues when voting in favor of the Advisory Vote to Ratify Named Executive Officers’ Compensation.

Third, Natural Gas Services Group’s normalized executive compensation plan is consistent with proxy advisory guidelines and should be considered when opining on appropriate shareholder action.

As noted earlier, not only does the ISS critical analysis rely on extraordinary payments which have sufficient mitigating factors, the analysis also relies on payments that were the result of a legacy contract and have no relevance to the Company’s executive compensation program going forward.

While we understand the importance of analyzing empirical data in this analytical exercise, the narrative provided in the NGS Proxy Statement regarding the Company’s responsiveness to shareholder input on executive compensation and the specific actions of the Compensation Committee to improve the Company’s executive compensation program are largely ignored in your critique.

Specifically, the Compensation Committee has taken the following actions to further improve the Company’s executive compensation program:

•The compensation package for Mr. Jacobs in his role as Chief Executive Officer is in line with market and the Company’s peer group.

•The Company redesigned its Long-Term Incentive Program (“LTIP”) to conform with market and compensation best practices. Accordingly, in early 2024, the Company granted long-term incentive awards to Mr. Jacobs and Mr. Tucker that are equally split between time-vesting and performance-based vesting awards, with the performance-based vesting awards being subject to relative Total Shareholder Return (“TSR”) performance over the subsequent 3-year period

•For long-term incentive awards that are contingent on the Company’s performance with respect to relative TSR, a minimum performance of 60th percentile will be required to achieve “target” award level.

•Awards will be capped at target if absolute TSR is negative over the performance evaluation period, regardless of relative performance.

Ms. Patricia Louise Miranda

Mr. Kevin Kim

Institutional Shareholder Services

June 6, 2024 Page 4

•No discretionary awards outside of the short- and long-term incentive programs for a period of three years, with the exception of new-hire awards that are consistent with industry practice.

•Adjust the short-term incentive program metrics to reduce the weighting on revenue and increase weighting more closely tied to profitability.

•CD&A disclosure will be enhanced to explain the Company’s decisions more thoroughly, particularly as they relate to peer groups and goal setting.

•The Company will continue to maintain open dialogue with stockholders to help ensure ongoing and continuous shareholder feedback on Company governance matters.

We believe these initiatives, as set forth in the proxy, should have been acknowledged and addressed in your analysis as they fundamentally affect the Company’s current and future compensation program. Instead, the Report seems to rely almost exclusively on the numerical analysis of extraordinary payments emanating from a long-standing legal obligation of the Company that has no connection to its current compensation practices.

We appreciate the opportunity to address this issue with you. I pledge to our shareholders that the Company and the Board of Directors will continue to engage with shareholders on issues critical to good governance and compensation practices and will continue to improve our programs and disclosures as we strive to implement best practices across the corporate governance spectrum.

Thank you for your consideration.

Sincerely,

NATURAL GAS SERVICES GROUP, INC.

Donald J. Tringali

Lead Independent Director & Chair, Compensation Committee

cc: Members – Natural Gas Services Group, Inc Board of Directors

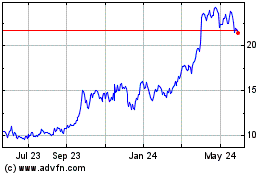

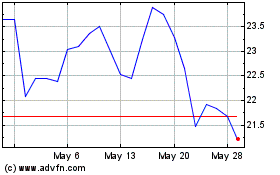

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From May 2024 to Jun 2024

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Jun 2023 to Jun 2024