UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| |

☐ |

Preliminary Proxy Statement |

| |

☐ |

Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| |

☐ |

Definitive Proxy Statement |

| |

☒ |

Definitive Additional Materials |

| |

☐ |

Soliciting Material Pursuant to §240.14a-12 |

Nuveen New York AMT-Free Quality Municipal Income Fund

(Exact Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| |

☐ |

Fee paid previously with preliminary materials. |

| |

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and

0-11. |

nuveen A TIAA Company Nuveen New York AMT-Free Quality Municipal Income Fund (NRK) July 25, 2024 Institutional Shareholder Services

Presentation

NUVEEN CLOSED-END FUNDS Our approach and mindset Nuveen’s closed-end funds (CEFs) are designed to be long-term investments that

help shareholders, many of whom are retirees or individuals nearing retirement, plan for their financial future by providing consistent, attractive income throughout multiple market cycles. Nuveen CEFs offer a broad opportunity for diversification

and exposure to asset classes and strategies that retail shareholders normally would not be able to access. CEFs are designed to provide shareholders an investment structure that can deliver enhanced income and returns over time with liquidity

provided through an exchange listing. Market factors and investor sentiment can turn negative for CEFs impacting secondary market prices, even as funds successfully deliver on their primary investment objective. For CEF investors, attractive and

reliable distributions are what matter. Volatile market conditions, like equity and fixed income markets in 2022 which had historical negative performance, can cause CEFs to trade at deeper discounts, yet these strategies perform over the life of

the fund. When it comes to governance, there is no substitute for experience–the best way to protect the long-term interests of all CEF shareholders is by nominating a competent, knowledgeable board with CEF-specific experience. 2

GUIDING QUESTIONS 1. Is change warranted? 2. If change is warranted, who is best to effect change? 3

Is change warranted? We do not believe change is warranted. As evidenced by NRK’s past and current performance, the Board maintains

confidence in its ability, the investment manager’s ability and the Fund’s ability to perform over the long term. NRK continues to deliver on its objectives of generating tax-exempt income and enhancing value for all shareholders. nuveen 4

Is change warranted? There is no merit to the dissident’s proposals to seat three trustees and terminate Nuveen as Fund manager. In

fact, Karpus has chosen Nuveen’s municipal investment team as manager for approximately 23% of its clients’ $3.8B in AUM — the single largest manager allocation for Karpus’ client assets. A differentiated fund offering with a

strong track record of success. Since inception in 2002, NRK has delivered strong results relative to peers1 and benchmarks, and continues to deliver attractive, reliable distributions which include double—and in some cases

triple—tax-exempt income for New York residents. NRK is the only AMT-free offering in the New York peer category. NRK has outperformed peer average returns on both NAV and market price over the trailing 1-, 3-, 5- and 10-year periods. 8.34%

Since inception annualized distribution rate on $15 offering price 100% Distribution rate increase resulting from enhanced distribution program implemented in October 2023 678 bps Discount narrowing since enhanced distribution program announcement2

1.04%3 Competitive fees and expenses with a total expense ratio that is 7 bps lower than peers’ Nuveen 1 See Appendix for peer group 2 Enhanced distributions announced October 23, 2023 3 Total expense ratio — see slide 21 for peer

comparison 5

Nuveen Board Nominees are fiduciaries who are delivering long-term value to shareholders and have a record of taking thoughtful,

proactive actions to enhance outcomes for all shareholders. Since 2012, the Board has: Authorized 58 CEF mergers, producing highly scaled funds in respective asset classes with: Lower fees (breakpoint pricing methodology) Enhanced trading

efficiencies Tightened bid/ask spreads in the secondary market Authorized liquidations, mandate adjustments and mergers into open-end funds Approved an innovative complex-wide management fee schedule to share platform economies of scale, resulting

in lower management fees for fund shareholders. Approved an enhanced distribution program to support secondary market trading through higher cash flows to shareholders: Recent distribution increases across the entire Nuveen fund complex have spurred

secondary market trading and added momentum to discount narrowing already underway Approved complex-wide share repurchase program: Shares repurchased when there are material supply/demand imbalances Bids layered in below market to show depth to the

book which can impact supply/demand without share repurchases; Established a robust and dedicated IR program to increase awareness, engagement, and advocacy for CEFs. Nuveen 6

ISS Five Factor Framework Distributions Total Shareholder Return NAV Premium / Discount Fees & Expenses Corporate Governance 7

Five Factor Framework: Distributions KEY DISTRIBUTION METRICS NAV Distribution Rate 6.93% As of June 28, 2024 4.95% PEER AVG. Market

Price Distribution Rate 7.47% As of June 28, 2024 5.50% PEER AVG. 1-Year Distribution Change +100.0% As of June 28, 2024 +29.2% PEER AVG. NRK has delivered superior returns and attractive tax-free distributions since its November 2002 inception

date. Distributions have totaled $14.60 per share since inception, which equates to an 8.34% annualized rate on the original $15 offering price, with over 99% of those distributions being tax-free income. Since October 2023, NRK has increased

distributions by 100% as part of an enhanced distribution program across the Nuveen CEF complex, designed to provide investors with significantly higher cash flows during a challenging market environment while helping support secondary market

prices. As part of the enhanced distribution for NRK, distributions are currently expected to include over 50% tax-free income. NRK’s distribution rate on NAV and market price is at the top of the peer category and meaningfully higher than the

peer average. Since announcing the enhanced distribution on October 23, 2023, NRK’s discount has narrowed by 678 basis points compared to a peer average of 601 basis points, over the same period. nuveen 8

Five Factor Framework: Total Shareholder Returns NRK has outperformed peers over all meaningful time periods. NRK has outperformed peer

total return averages on both NAV and market price over each trailing 1-, 3-, 5- and 10-year periods ended 6/30/2024. On market price, NRK has significantly outperformed the peer average over each time period: 1-YEAR 630 BPS 3-YEAR 377 BPS 5-YEAR

258 BPS 10-YEAR 121 BPS Peer-Relative Total Returns1 NAV 15% 10% 5% 0% -5% -10% 1-Year 3-Year 5-Year 10-Year 3.43% 3.35% -3.92% -4.44% -0.14% -0.62% 2.50% 2.39% MARKET PRICE 1-Year 3-Year 5-Year 10-Year 12.52% 6.22% -3.53% -7.30% 1.15% -1.43% 3.12%

1.91% NRK Peer Average 1 Morningstar returns as of 6/30/2024. Returns over periods greater than one year are annualized. nuveen 9

Five Factor Framework: Total Shareholder Returns NRK has performed well compared to peers through and after the unaffected date. The

unaffected date, 11/6/2023, is the day prior to Karpus filing its initial 13D on 11/7/2023. NRK has outperformed peer total return averages on both NAV and market price over each trailing 1-, 3-, and 5-year periods ended 11/6/2023, and since the

unaffected date through 6/30/2024, NRK has performed substantially in-line with peers and Nuveen’s other NY leveraged fund, NAN. Based on NRK’s substantially similar performance relative to NAN and peers since the unaffected date, we do

not believe the dissident’s filing of a 13D had any meaningful impact on NRK’s performance. Peer-Relative Total Returns Through and After Unaffected Date NAV 25% 15% 5% -5% -15% 1-Year 3-Year 5-Year Unaffected to 6/30 4.05% 3.93% 4.04%

-5.80% -5.48% -6.33% -0.48% -0.48% -1.09% 12.68% 12.68% 13.50% 1-Year 3-Year 5-Year Unaffected to 6/30 2.62% 2.15% -2.39% -6.24% -6.69% -8.77% 0.21% -0.16% -2.27% 21.54% 19.48% 20.29% NRK NAN Peer Average 1 Morningstar returns for periods greater

than one-year returns are annualized. nuveen 10

Five Factor Framework: Total Shareholder Returns Over time, NRK has outperformed its benchmark - S&P Municipal Bond NY Index. In the

last 10 calendar years, NRK outperformed its benchmark in 8 of those years by significant amounts. Even with the unprecedented interest rate environment in 2022, NRK outperformed its benchmark over the trailing 10-year period ended 6/30/2024 (2.50%

vs. 2.36%). As fixed-income markets continue to recover from the 2022 environment, we expect NRK’s benchmark relative performance will continue to outperform. Benchmark-Relative NAV Total Returns1 20% 10% 0% -10% -20% 2023 2022 2021 2020 2019

2018 2017 2016 2015 2014 8.83% 6.83% -18.52% -8.59% 3.41% 2.10% 5.50% 4.35% 10.69% 6.99% 0.57% 0.92% 6.98% 4.85% 0.94% 0.56% 5.36% 3.66% 15.71% 8.68% NRK S&P Municipal Bond NY Index 1 Morningstar NAV returns as of 6/30/2024. Returns over periods

greater than one year are annualized. nuveen 11

Five Factor Framework: Net Asset Value (NAV) Premium/Discount PREMIUM / DISCOUNTS Against a challenging macroeconomic backdrop, discount

levels for NRK and peers reached historically wide levels in October 2023. NRK’s Board and management team took action in October 2023 and implemented an enhanced distribution program. NRK’s three distribution increases since October 2023

have had the intended impact of narrowing its discount relative to peers. Discounts (a/o 6/30) NRK Peers Difference Current -7.2% -10.1% 2.9% 52-Week Avg -12.3% -12.7% 0.4% Narrowing* 678 bps 601 bps 78 bps Improving market conditions since November

2023 have also improved discount levels for both NRK and peers. NAN, Nuveen’s other levered NY CEF, is included in peer figures and has experienced 660 bps of narrowing over the same time period, thanks to similar strategic actions by the Board

and management team. Given NAN’s similar price and discount performance, we do not attribute NRK’s performance to the dissident who owns only a small amount of NAN and has not filed a Form 13D. PREMIUM / DISCOUNT HISTORY ENHANCED

DISTRIBUTION PROGRAM BEGINS 10% 5% 0% -5% -10% -15% -20% -25% Jun-22 Oct-22 Feb-23 Jun-23 Oct-23 Feb-24 Jun-24 Peer Average NRK *Discount narrowing since 10/23/2023, when NRK announced its first distribution increase. nuveen 12

Five Factor Framework: Fees and Expenses1 The Fund Board and Management have taken steps to keep management fees and total expenses low,

thus maximizing returns and providing access to a highly scaled, diversified portfolio of New York municipal bonds. Trustees supported fund mergers, including for NRK, which have provided shareholder’s significant expense economies of scale.

Trustees approved an innovative complex-wide management fee schedule to share platform economies of scale which results in lower management fees for fund shareholders. FEE AND EXPENSE COMPARISON COMMON ASSETS ($MM) MANAGEMENT FEE RATIO TOTAL EXPENSE

RATIO2 NRK $1,069.8 0.967% 1.035% PEER AVERAGE $286.5 1.038% 1.107% DIFFERENCE - -0.071% -0.072% nuveen 1 Broadridge data sourced from Fund’s 2023 financial reports 2 Total expenses excluding leverage related expenses 13

Five Factor Framework: Corporate Governance Experienced, Qualified, Diverse Independent Trustees Deep CEF expertise and relevant career

experiences Track record of stewardship with a history of taking thoughtful governance actions for the benefit of all shareholders None of the Board nominees were members when the control share provisions were adopted – did vote to rescind

Successful Discount- Narrowing Initiatives Distribution and fee-focused programs have resulted in meaningful discount narrowing following period of unprecedented market-wide turbulence NRK’s current discount and 52-week average discount is

narrower than the peer group average as of the end of June 2024 Impactful Distribution Enhancements Attractive, consistent distributions through an enhanced distribution program designed to deliver significantly more income and cash flows to

shareholders, supporting secondary market prices Since October 2023, NRK increased distributions three times with the per share amount increased 100.0% Consistently Lower Fees and Total Expenses Fund mergers have created highly scaled funds that

deliver efficiencies and economies of scale to shareholders NRK is a highly scaled fund that offers lower fees and total expense ratios compared to peer averages nuveen 14

PROPOSAL 1 Karpus is seeking to seat three unqualified, inexperienced nominees 15

Board Oversight The fully independent Board has established various committees designed for deeper engagement by trustees in certain

oversight functions, all with independent trustees and chairs. Committees include: Closed-End Funds and Open-End Funds: Each meets quarterly and is responsible for

assisting the Board in the oversight and monitoring of the Nuveen Funds that are registered as either closed-end or open-end management investment companies. Dividend:

Meets at least quarterly to review policies and authorize distributions for Nuveen Fund shares, including, but not limited to, regular and special dividends, capital gains and ordinary income distributions. Investment: Meets quarterly and is

responsible for the oversight of Nuveen Fund performance, investment risk management and other portfolio-related matters affecting the Nuveen Funds which are not otherwise the jurisdiction of the other Board committees. Nominating and Governance:

Responsible for seeking, identifying and recommending to the Board qualified candidates for election or appointment to the Board. Executive: Meets between regular meetings of the Board and is authorized to exercise all the powers of the Board.

Audit: Meets monthly and assists the Board in the oversight and monitoring of the accounting and reporting policies, processes and practices of the Nuveen Funds, and the audits of the financial statements of the Nuveen Funds. Compliance, Risk

Management and Regulatory Oversight: Meets quarterly and is responsible for the oversight of compliance issues, risk management and other regulatory matters affecting the Nuveen Funds that are not otherwise the jurisdiction of the other committees.

Nuveen 16

Board Member Nomination Proposal If change is warranted, who is best to effect change? We do not believe change is warranted. All

incumbent Trustees have deep CEF, investment management, and business leadership experience. They are fiduciaries best positioned to protect and advance the interests of all shareholders by taking strategic and thoughtful actions to meet NRK’s

investment objectives, drive long-term performance and deliver consistent, reliable distributions. There is no substitute for experience. This diverse group of Board Nominees has decades of experience in senior executive roles at leading global

corporations, asset managers and governmental and legal entities, including: Barclays BlackRock U.S. Commodity Futures Trading Commission FedEx Janus Capital Group Morgan Stanley The White House Invesco Sherwin-Williams Company The incumbent

trustees are experienced, prepared, and engaged: 28+ Years of CEF experience 65+ Years of relevant business leadership experience 100% Attendance at board meetings Nuveen 17

Board Member Nomination Proposal Dissident nominees are NOT qualified and stand to add no value for shareholders Overseeing municipal

bond CEFs is complex and requires qualified, experienced stewardship. Karpus Management, Inc. (“Karpus”) has put forward three nominees who fall woefully short of Nuveen’s standards (and broader CEF industry standards) and are lacking

in work experience, board experience, CEF experience, and diversity. Members of Nuveen’s Nominating and Governance Committee reviewed the background and qualifications of the dissident nominees and determined: The incumbent Trustees possess

more direct and relevant experience and would better serve all Fund shareholders. We believe dissident nominees were put forth to serve Karpus’ own interests, which includes their business need for significant share liquidity and their desire

to terminate Nuveen, a highly experienced municipal bond manager, as NRK’s investment advisor. Dissident nominees’ experience: 0 Years of CEF experience 0 Investment fund board experience 0 Public company board experience 0 Relevant fund

management experience Nuveen 18

Board Member Nomination Proposal Dissident nominees are inexperienced and unqualified Steven C. Weitz 0 YEARS OF CLOSED-END FUND EXPERIENCE 0 YEARS OF INVESTMENT FUND BOARD EXPERIENCE 0 YEARS OF PUBLIC COMPANY BOARD EXPERIENCE 0 YEARS OF INVESTMENT MANAGEMENT EXPERIENCE Weitz’ only employment disclosed in his biography

has been at his father’s real estate law firm Mat Small 0 YEARS OF CLOSED-END FUND EXPERIENCE 0 YEARS OF INVESTMENT FUND BOARD EXPERIENCE 0 YEARS OF PUBLIC COMPANY BOARD EXPERIENCE Has delinquent child

support payments and other amounts owed to a former spouse Named in debt collection lawsuits, foreclosure actions, and outstanding tax liens Taylor Gettinger 0 YEARS OF CLOSED-END FUND EXPERIENCE 0 YEARS OF

INVESTMENT FUND BOARD EXPERIENCE 0 YEARS OF PUBLIC COMPANY BOARD EXPERIENCE Nuveen 19

Karpus’ concerning nominees raise questions: Does Karpus truly understand the responsibility of stewarding a municipal bond CEF?

Does Karpus thoroughly vet its candidates? Does Karpus know about the backgrounds of its nominees? If yes, why did it put forth unqualified individuals who would be tasked with upholding a fiduciary obligation to shareholders? Nuveen 20

PROPOSAL 2 Karpus is seeking to terminate the investment management agreement between NRK and Nuveen 21

Investment Management Agreement Termination Proposal Is change warranted? We do not believe change is warranted. Nuveen is a leader in

municipal bonds with over 125 years of experience and is the #1 closed-end fund provider by assets under management. With a legacy of delivering value and taking strategic, shareholder-focused actions, NRK is

best positioned for success with Nuveen as its investment manager. NRK continues to outperform peers across measurement periods with greater distribution rates, higher total shareholder returns, narrower discounts to NAV, and lower total expenses.

DISTRIBUTION RATES OUTPACE PEERS NAV 6.93% 4.95% NRK PEER AVG. MARKET PRICE 7.47% 5.50% NRK PEER AVG. As of June 28, 2024 TOTAL SHAREHOLDER MARKET PRICE RETURNS OUTPERFORM PEERS 1-YEAR 3-YEAR 5-YEAR10-YEAR 630 BPS 377 BPS 258 BPS121 BPS NARROWER DISCOUNT COMPARED TO PEERS DISCOUNT TO NAV 7.2% 10.1% NRK PEER AVG.

DISCOUNT NARROWING SINCE OCTOBER 23, 20231 678BPS 601BPS NRK PEER AVG. As of June 28, 2024 LOWER TOTAL EXPENSES COMPARED TO PEERS MANAGEMENT FEE RATIO 0.97% 1.04% NRK PEER AVG. TOTAL EXPENSE RATIO 1.04% 1.11% NRK PEER AVG. Nuveen 1

Enhanced distributions announced October 23, 2023 22

Investment Management Agreement Termination Proposal If change is warranted, who is best to effect change? Change is not warranted, and

if it were, Nuveen continues to demonstrate its strength as manager of NRK. Karpus brings no experience in managing a CEF or selecting a CEF investment manager to run a municipal bond portfolio. Karpus’ proposal stands to disrupt NRK’s

ongoing ability to deliver on its investment objectives for all shareholders. NRK has outperformed peer average returns on both NAV and market price over trailing 1-,

3-, 5- and 10-year periods NRK’s discount has narrowed significantly following the implementation of Nuveen’s discount

management program Nuveen has doubled distribution rates for NRK shareholders since October 2023 Karpus has never managed a CEF Karpus has no experience in selecting a municipal bond investment manager to run a $1.7 billion portfolio Karpus has

presented no plans or indications of its desired municipal fund manager if the investment management agreement between NRK and Nuveen is terminated Nuveen 23

SUMMARY Is change warranted? No. NRK has outperformed peers over every time period. NRK has delivered attractive, reliable

distributions. NRK Trustees are fiduciaries with relevant experience. NRK continues to meet its investment objectives. NRK is backed by the resources and experience of Nuveen. 24

Independent Trustees for Election 25

Independent Trustees for Election The Nominees for the Fund are independent and highly experienced, focused on delivering long-term

value to all shareholders. The diverse group of Nuveen Nominees possess a broad range of leadership and board experience. JOANNE T. MEDERO Independent Trustee since 2021 Formerly, Managing Director, Government Relations and Public Policy (2009-2020)

and Senior Advisor to the Vice Chairman (2018-2020), BlackRock, Inc. (global investment management firm); formerly, Managing Director, Global Head of Government Relations and Public Policy, Barclays Group (IBIM) (investment banking, investment

management and wealth management businesses)(2006-2009); formerly, Managing Director, Global General Counsel and Corporate Secretary, Barclays Global Investors (global investment management firm) (1996-2006); formerly, Partner, Orrick,

Herrington & Sutcliffe LLP (law firm) (1993-1995); formerly, General Counsel, Commodity Futures Trading Commission (government agency overseeing U.S. derivatives markets) (1989-1993); formerly, Deputy Associate Director/Associate Director

for Legal and Financial Affairs, Office of Presidential Personnel, The White House (1986-1989); Member of the Board of Directors, Baltic-American Freedom Foundation (seeks to provide opportunities for citizens of the Baltic states to gain education

and professional development through exchanges in the U.S.) (since 2019). LOREN M. STARR Independent Trustee since 2024 Independent Consultant/Advisor (since 2021); formerly, Vice Chair, Senior Managing Director (2020–2021), Chief Financial

Officer, Senior Managing Director (2005–2020), Invesco Ltd.; Director (since 2023) and Audit Committee member (since 2024), AMG; formerly, Chair and Member of the Board of Directors (2014–2021), Georgia Leadership Institute for School

Improvement (GLISI); formerly, Chair and Member of the Board of Trustees (2014–2018), Georgia Council on Economic Education (GCEE); Trustee, the College Retirement Equities Fund and Manager, TIAA Separate Account

VA-1 (2022–2023). MATTHEW THORNTON III Independent Trustee since 2020 Formerly, Executive Vice President and Chief Operating Officer (2018-2019), FedEx Freight Corporation, a subsidiary of FedEx

Corporation (FedEx) (provider of transportation, e-commerce and business services through its portfolio of companies); formerly, Senior Vice President, U.S. Operations (2006-2018), Federal Express Corporation,

a subsidiary of FedEx; formerly Member of the Board of Directors (2012-2018), Safe Kids Worldwide® (a non-profit organization dedicated to preventing childhood injuries). Member of the Board of Directors

(since 2014), The Sherwin-Williams Company (develops, manufactures, distributes and sells paints, coatings and related products); Director (since 2020), Crown Castle International (provider of communications infrastructure). Nuveen 26

Independent Trustees Not Up for Election Nuveen 27

Trustees Not Up for Election JOSEPH A. BOATENG Joseph A. Boateng is the Chief Investment Officer for Casey Family Programs since 2007.

Prior to joining Casey Family Programs, he served as Director of U.S. Pension Plans at Johnson & Johnson from 2002 to 2006. He is a board member of the Lumina Foundation and Waterside School, an emeritus board member of Year Up Puget Sound,

member of the Investment Advisory Committee for the Seattle City Employees’ Retirement System, and an investment committee member for The Seattle Foundation. Mr. Boateng received a B.S. from the University of Ghana and an M.B.A. from the

University of California, Los Angeles. Mr. Boateng has served as a CREF Trustee since 2018. Michael A. Forrester was Chief Executive Officer from 2014-2021, a Board member since 2007, and served as Chief Operating Officer (“COO”) from

2007 to 2014, of Copper Rock Capital Partners, LLC. He is a member of the Independent Directors Council Governing Council of the Investment Company Institute. He also serves on the Board of Trustees of the Dexter Southfield School.

Mr. Forrester has a B.A. degree from Washington and Lee University. MICHAEL A. FORRESTER Thomas J. Kenny served as an Advisory Director from 2010 to 2011, as Partner from 2004 to 2010, as Managing Director from 1999 to 2004 and as Co-Head from 2002 to 2010 of Goldman Sachs Asset Management’s Global Cash and Fixed Income Portfolio Management team, having worked at Goldman Sachs since 1999. Mr. Kenny is a director and the Chair of the

Finance and Investment Committee of Aflac Incorporated, Director and Finance Committee chair of Sansum Clinic, a Director of ParentSquare, and a member of University of California at Santa Barbara Arts and Lectures Advisory Council. He received a

B.A. from the University of California, Santa Barbara, and an M.S. from Golden Gate University. He is a Chartered Financial Analyst and has served as Chairman of the Board since 2017. THOMAS J. KENNY Nuveen 28

Trustees Not Up for Election AMY B.R. LANCELLOTTA After 30 years of service, Ms. Lancellotta retired at the end of 2019 from the

Investment Company Institute (ICI), which represents regulated investment companies on regulatory, legislative and securities industry initiatives that affect funds and their shareholders. From November 2006 until her retirement,

Ms. Lancellotta served as Managing Director of ICI’s Independent Directors Council (IDC), which supports fund independent directors in fulfilling their responsibilities to promote and protect the interests of fund shareholders. At IDC,

Ms. Lancellotta was responsible for all ICI and IDC activities relating to the fund independent director community. In conjunction with her responsibilities, Ms. Lancellotta advised and represented IDC, ICI, independent directors and the

investment company industry on issues relating to fund governance and the role of fund directors. She also directed and coordinated IDC’s education, communication, governance and policy initiatives. Prior to serving as Managing Director of IDC,

Ms. Lancellotta held various other positions with ICI beginning in 1989. Before joining ICI, Ms. Lancellotta was an associate at two Washington, D.C. law firms. In addition, since 2020, she has been a member of the Board of Directors of

the Jewish Coalition Against Domestic Abuse (JCADA), an organization that seeks to end power-based violence, empower survivors and ensure safe communities. Ms. Lancellotta received a B.A. degree from Pennsylvania State University in 1981 and a

J.D. degree from the National Law Center, George Washington University (currently known as George Washington University Law School) in 1984. Ms. Lancellotta has been a director since 2021. ALBIN F. MOSCHNER Mr. Moschner is a consultant in

the wireless industry and, in July 2012, founded Northcroft Partners, LLC, a management consulting firm that provides operational, management and governance solutions. Prior to founding Northcroft Partners, LLC, Mr. Moschner held various

positions at Leap Wireless International, Inc., a provider of wireless services, where he was as a consultant from February 2011 to July 2012, Chief Operating Officer from July 2008 to February 2011, and Chief Marketing Officer from August 2004 to

June 2008. Before he joined Leap Wireless International, Inc., Mr. Moschner was President of the Verizon Card Services division of Verizon Communications, Inc. from 2000 to 2003, and President of One Point Services at One Point Communications

from 1999 to 2000. Mr. Moschner also served at Zenith Electronics Corporation as Director, President and Chief Executive Officer from 1995 to 1996, and as Director, President and Chief Operating Officer from 1994 to 1995. From 1996 until 2016,

he was a member of the Board of Directors of Wintrust Financial Corporation. Mr. Moschner previously served as the Chairman of the Board of Directors of USA Technologies, Inc. (Director from 2012-2019). He is a board member emeritus of the

Advisory Boards of the Kellogg School of Management (since 1995) and previously served as a board member of the Archdiocese of Chicago Financial Council (2012-2018). Mr. Moschner received a Bachelor of Engineering degree in Electrical

Engineering from The City College of New York in 1974 and a Master of Science degree in Electrical Engineering from Syracuse University in 1979. Mr. Moschner joined the Fund Board in July 2016. Nuveen 29

Trustees Not Up for Election JOHN NELSON Mr. Nelson is on the Board of Directors of Core12, LLC. (since 2008), a private firm which

develops branding, marketing, and communications strategies for clients. Mr. Nelson has extensive experience in global banking and markets, having served in several senior executive positions with ABN AMRO Holdings N.V. and its affiliated

entities and predecessors, including LaSalle Bank Corporation from 1996 to 2008, ultimately serving as Chief Executive Officer of ABN AMRO N.V. North America. During his tenure at the bank, he also served as Global Head of its Financial Markets

Division, which encompassed the bank’s Currency, Commodity, Fixed Income, Emerging Markets, and Derivatives businesses. He was a member of the Foreign Exchange Committee of the Federal Reserve Bank of the United States and during his tenure

with ABN AMRO served as the bank’s representative on various committees of The Bank of Canada, European Central Bank, and The Bank of England. Mr. Nelson previously served as a senior, external advisor to the financial services practice of

Deloitte Consulting LLP. (2012-2104). At Fordham University, he served as a director of The President’s Council (2010-2019) and previously served as a director of The Curran Center for Catholic American Studies (2009-2018). He served as a

trustee and Chairman of The Board of Trustees of Marian University (2011-2013). Mr. Nelson is a graduate of Fordham University and holds a BA in Economics (1984) and an MBA in Finance (1991). Mr. Nelson joined the Fund Board in

September of 2013. TERRY TOTH Mr. Toth is the former Funds’ Independent Chair, formally a Co-Founding Partner of Promus Capital (2008-2017); Director, Quality Control Corporation (since 2012). He was

formerly a Director Fulcrum IT Service LLC (2010-2019) and of Legal & General Investment Management America, Inc. from 2008-2013. From 2004 to 2007, he was Chief Executive Officer and President of Northern Trust Global Investments, and

Executive Vice President of Quantitative Management & Securities Lending from 2000 to 2004. He also formerly served on the Board of the Northern Trust Mutual Funds. He joined Northern Trust in 1994 after serving as Managing Director and

Head of Global Securities Lending at Bankers Trust (1986 to 1994) and Head of Government Trading and Cash Collateral Investment at Northern Trust from 1982 to 1986. He currently serves on the Board of Catalyst Schools of Chicago, previously served

as Board Chair. He is on the Mather Foundation Board (since 2012) where he is also serves as Chair of its Investment Committee. Mr. Toth graduated with a Bachelor of Science degree from the University of Illinois and received his MBA from New

York University. In 2005, he graduated from the CEO Perspectives Program at Northwestern University. Nuveen 30

Trustees Not Up for Election MARGARET L. WOLFF Ms. Wolff retired from Skadden, Arps, Slate, Meagher & Flom LLP in 2014

after more than 30 years of providing client service in the Mergers & Acquisitions Group where she advised boards and senior management on U.S. and international corporate, securities, regulatory and strategic matters, including governance,

shareholder, fiduciary, operational and management issues. Since 2005 she has been a Trustee of New-York Presbyterian Hospital, serving as Chair of the Patient Safety & Quality Committee since 2019

and has served since 2004 as a Trustee and former Chair of The John A. Hartford Foundation. From 2013- 2017, she was a Board member of Travelers Insurance Company of Canada and The Dominion of Canada General Insurance Company. From 2005-2015 she was

trustee of Mt. Holyoke College and served as Vice Chair of the Board from 2011. Ms. Wolff received her Bachelor of Arts from Mt. Holyoke College and her Juris Doctor from Case Western Reserve University School of Law. Ms. Wolff was elected

to the Board in February 2016. BOB YOUNG Mr. Young is the current Funds’ Independent Chair and has more than 30 years of experience in the investment management industry. From 1997 to 2017, he held various positions with J.P. Morgan

Investment Management Inc. (“J.P. Morgan Investment”) and its affiliates (collectively, “J.P. Morgan”). Most recently, he served as Chief Operating Officer and Director of J.P. Morgan Investment (from 2010 to 2016) and as

President and Principal Executive Officer of the J.P. Morgan Funds (from 2013 to 2016). As Chief Operating Officer of J.P. Morgan Investment, Mr. Young led service, administration and business platform support activities for J.P. Morgan’s

domestic retail mutual fund and institutional commingled and separate account businesses and co-led these activities for J.P. Morgan’s global retail and institutional investment management businesses. As

President of the J.P. Morgan Funds, Mr. Young interacted with various service providers to these funds, facilitated the relationship between such funds and their boards, and was directly involved in establishing board agendas, addressing

regulatory matters, and establishing policies and procedures. Before joining J.P. Morgan, Mr. Young, a former Certified Public Accountant (CPA), was a Senior Manager (Audit) with Deloitte & Touche LLP (formerly, Touche Ross LLP), where

he was employed from 1985 to 1996. During his tenure there, he actively participated in creating, and ultimately led, the firm’s midwestern mutual fund practice. Mr. Young holds a Bachelor of Business Administration degree in Accounting

from the University of Dayton and, from 2008 to 2011, he served on the Investment Committee of its Board of Trustees. Mr. Young joined the Board in July of 2017. Nuveen 31

Appendix 32

Leading the way in municipal bonds Since 1898, Nuveen has been financing essential municipal bond projects and building lasting value

for investors. This municipal bond heritage is reflected in the way portfolios are managed today. 125 Experience A rich heritage spanning 125 years remains focused on relative value, principal growth and

tax-aware investing. 23 Research As one of the industry’s largest credit research teams, 23 analysts averaging 21 years of experience are dedicated to municipal investing. $190B1 Presence Market power and

institutional pricing provide an advantage when evaluating and purchasing bonds. Personnel and assets as of 31 Mar 2024. 1 As of 31 Mar 2024. Nuveen assets under management (AUM) is inclusive of underlying investment specialists. Nuveen 33

NRK peer group In total, there are 12 New York municipal CEFs Nuveen is the fund sponsor for 4 of those 12 funds Two Nuveen funds, NNY

and NXN, are unlevered and are not considered direct peers to NRK The remaining funds have similar leverage ratios as NRK and are considered direct peers. Ticker Fund Name NRK Nuveen NY AMT-Free Quality

Municipal Income NAN Nuveen NY Quality Municipal Income BNY BlackRock NY Municipal Income MHN BlackRock MuniHoldings NY Qty MYN BlackRock MuniYield NY Quality ENX Eaton Vance NY Municipal Bond PNF PIMCO NY Municipal Income PNI PIMCO NY Municipal

Income II PYN PIMCO NY Municipal Income III VTN Invesco Tr Inv Gr NY NNY Nuveen NY Municipal Value NXN Nuveen NY Select Tax Free Income Nuveen 34

Nuveen’s corporate governance across its CEFs is designed to protect and advance the best interests of all fund shareholders.

Optimized Board Structure for CEFs Nuveen’s Board of Directors carefully and thoughtfully determined that a classified board structure best serves fund shareholders, as it confers the following benefits: Promotes stability since Trustees with

deep CEF experience serve at all times Protects against abrupt Fund management or structural changes based on short-term profit motives that may harm shareholders Board Refreshment Nominating and Governance Committee that employs a rigorous search

process with an independent nationally recognized search firm to identify and recommend qualified candidates for Board positions Qualifications, experience and diversity of trustee candidates are key factors in the process Six new independent

trustees added over the last four years Majority Vote Standard in Contested Election Adopted after a long and thoughtful review process with advice of outside legal experts Ensures that a significant number of shareholder voices are heard Distinct

structure of CEFs provides important benefits to shareholders but leaves such funds vulnerable to opportunistic traders seeking short-term gains at the expense of remaining shareholders Short-term actions can destroy significant shareholder value,

result in adverse tax consequences and impose substantial costs on long-term shareholders Removal of Control Share By-Law The Board suspended the control share by-law in

February 2022 and formally removed the by-law provision in February 2024. Nuveen 35

We view closed-end funds differently than operating companies, because they function differently

than operating companies. NUVEEN PROXY VOTING GUIDELINES On Closed-End Funds: We recognize that many exchange-listed closed-end funds (“CEFs”) have adopted

particular corporate governance practices that deviate from certain policies set forth in the Guidelines. We believe that the distinctive structure of CEFs can provide important benefits to investors but leaves CEFs uniquely vulnerable to

opportunistic traders seeking short-term gains at the expense of long-term shareholders. Thus, to protect the interests of their long-term shareholders, many CEFs have adopted measures to defend against attacks from short-term oriented activist

investors. As such, in light of the unique nature of CEFs and their differences in corporate governance practices from operating companies, we will consider on a

case-by-case basis proposals involving the adoption of defensive measures by CEFs. This is consistent with our approach to proxy voting that recognizes the importance of

case-by-case analysis to ensure alignment with investment team views and voting in accordance with the best interest of our shareholders. VIEW FULL PROXY VOTING

GUIDELINES* Nuveen *Updated as of December 18, 2023 36

The Truth About Karpus: $3.8B Karpus’ estimated AUM 23.85% Karpus’ ownership of NRK (6/3/2024) 87.24M NRK total shares

outstanding 6.6% Percentage of Karpus’ AUM in NRK Karpus has a significant percentage of total AUM in a single investment. Having invested in CEFs for over 35 years, Karpus is well aware of fund liquidity profiles. Having such a large

investment in NRK prohibits Karpus from a swift exit or swift reduction of their near-24% stake in the Fund. Karpus’ answer to their self-inflicted liquidity issue—turn to the Fund and its

shareholders for a bail out. On behalf of its clients, Karpus has chosen to invest 25% of its $3.8B AUM in Nuveen funds, the largest allocation to a single asset manager for client assets. Karpus has chosen Nuveen’s municipal investment team

for 23% of those total client assets, so why is Karpus now trying to fire Nuveen as investment manager for NRK? Nuveen 37

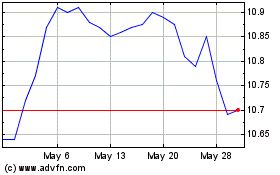

Nuveen New York AMT Free... (NYSE:NRK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Nuveen New York AMT Free... (NYSE:NRK)

Historical Stock Chart

From Feb 2024 to Feb 2025