UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM SD

Specialized Disclosure Report

OWENS-ILLINOIS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-9576 |

|

22-2781933 |

|

(State or other jurisdiction of |

|

(Commission |

|

(IRS Employer |

|

incorporation or organization) |

|

file number) |

|

Identification No.) |

|

One Michael Owens Way, Perrysburg, Ohio |

|

43551 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (567) 336-5000

James W. Baehren (567) 336-5000

(Name and telephone number, including area code, of the

person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

x Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014.

Section 1 - Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

A copy of the Conflict Minerals Report for Owens-Illinois, Inc. (the “Company”) is provided as Exhibit 1.01 hereto and is publicly available at www.o-i.com.

Item 1.02 Exhibit

See Item 2.01 below.

Section 2 - Exhibits

Item 2.01 Exhibits

Exhibit 1.01 — Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

OWENS-ILLINOIS, INC. |

|

|

|

|

|

|

|

|

|

Date: June 1, 2015 |

By: |

/s/ James W. Baehren |

|

|

Name: |

James W. Baehren |

|

|

Title: |

Sr. Vice President & General Counsel |

3

Exhibit 1.01

CONFLICT MINERALS REPORT

This report for the reporting period from January 1, 2014 to December 31, 2014 (the “Reporting Period”) is presented to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”) and pursuant to the Company’s Special Disclosure Report on Form SD (“Form SD”).

As permitted by the Rule and Form SD, and pursuant to the guidance regarding compliance with the Rule provided by the staff of the Securities and Exchange Commission (the “SEC”), this report does not include an independent private sector audit of the report.

COMPANY OVERVIEW:

Owens-Illinois, Inc. (the “Company”), through its subsidiaries, is the successor to a business established in 1903. The Company is the largest manufacturer of glass containers in the world with 75 glass manufacturing plants in 21 countries. It competes in the glass container segment of the rigid packaging market and is the leading glass container manufacturer in most of the countries where it has manufacturing facilities.

The Company produces glass containers for alcoholic beverages, including beer, flavored malt beverages, spirits and wine. The Company also produces glass packaging for a variety of food items, soft drinks, teas, juices and pharmaceuticals. The Company manufactures glass containers in a wide range of sizes, shapes and colors and is active in new product development and glass container innovation. The sale of glass containers comprised approximately 99.5% of the Company’s revenues in 2014. The Company believes that there are no conflict minerals that are necessary to any component that the Company manufactures or contracts to manufacture as part of its glass container business.

The Company also manufactures or contracts to manufacture glass making machines, molds and other parts related thereto (hereinafter, “Machine”). The Machine business comprised approximately 0.5% of the Company’s revenues in 2014. The Company has determined that certain conflict minerals as defined in Form SD (meaning cassiterite, columbite-tantalite [also known as coltan], gold, wolframite, and their derivatives, which are limited to tin, tantalum, and tungsten) were necessary to the functionality or production of certain of the Machines that the Company manufactures or contracts to manufacture during the Reporting Period. The Company refers in this report to any such conflict minerals as its “necessary conflict minerals” (other than any conflict minerals that are considered, under the Rule and pursuant to Form SD, to have been outside of the supply chain prior to January 31, 2013).

SUPPLY CHAIN:

The Company does not purchase conflict minerals directly for the manufacture of its products. The Company purchases materials and products through an extensive supply chain and relies on its direct suppliers to provide information to the extent that conflict minerals are contained in components and materials supplied to the Company. Based on the Company’s assessment of its Machine business, the Company believes that certain products manufactured or contracted to manufacture as part of the Machine business contain necessary conflict minerals.

REASONABLE COUNTRY OF ORIGIN INQUIRY:

Because the Company determined that conflict minerals were necessary to the functionality or production of certain products manufactured or contracted to manufacture within the Company’s Machine business, as required under the Rule and pursuant to Form SD, the Company conducted, in good faith, a “reasonable country of origin inquiry” (“RCOI”) reasonably designed to determine whether any of the Company’s necessary conflict minerals originated in the Democratic Republic of the Congo (the “DRC”) or a country that shares an internationally recognized border with the DRC (each, a “Covered Country”) or were from recycled or scrap sources.

Based on the Company’s review of the product categories within the Machine business, the Company focused on the electronics category in connection with possible conflict minerals. The Company identified 90 suppliers within the electronics category during the Reporting Period (the “Electronics Suppliers”). The Company then surveyed the Electronics Suppliers using the Template (as defined below) to obtain information regarding smelters and refiners that provide materials to the Company’s supply chain. In accordance with the Rule, we performed additional due diligence.

Based on the RCOI, the Company determined that it had reason to believe that its necessary conflict minerals may have originated from a Covered Country and may not be from recycled or scrap sources.

DESIGN OF DUE DILIGENCE:

The OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High Risks Areas, Second Edition including the related supplements for gold and for tine, tantalum and tungsten (the “OECD Guidance”) has been recognized by the SEC as a “nationally or internationally recognized due diligence framework”. The Company’s due diligence measures have been designed to conform, in all material respects, with the OECD Guidance.

DUE DILIGENCE STEPS TAKEN:

The Company’s actions have included the following:

A. Management systems

The Company has a Conflict Minerals Policy which has been posted on the Company’s public website. As stated in the Conflict Minerals Policy, the Company is committed to working with its global supply chain to comply with the Rule.

The Company has established a management system for conflict minerals including:

· Forming a cross-functional task force that includes representatives from the Company’s legal, finance, procurement and sales functions. The task force focuses on the Company’s conflict minerals compliance initiative.

· Implementing a system of controls and transparency through the use of the Conflict Minerals Reporting Template (the “Template”) developed jointly by the Electronic Industry Citizenship Coalition® (EICC®) and The Global e-Sustainability Initiative (GeSI). The Template was developed to facilitate disclosure and communication of information regarding smelters that provide material to a company’s supply chain.

· Communicating to the Electronics Suppliers to its Machine business the importance of transparency in the Company’s supply chain as well as the Company’s

expectation that the suppliers will complete the Template in order for the Company to comply with its reporting obligations to the SEC.

· Providing reporting channels such as the Company’s Ethics and Compliance Helpline whereby employees and other persons can report violations of laws, regulations or Company policies. The Company’s Ethics and Compliance Helpline is a reporting mechanism which allows for anonymous reporting if the reporter so chooses.

B. Identify and assess risk in the supply chain

The Company reviewed the product categories within the Machine business and focused on the electronics category as potentially containing conflict minerals. The Company identified 90 suppliers within the electronics category during the Reporting Period.

The Company sent a letter to the Electronics Suppliers requesting them to complete the Template. Suppliers were also directed to the EICC’s resources and training documentation.

The Company tracked and monitored responses provided by the Electronics Suppliers. A follow-up letter was sent to Electronics Suppliers who did not respond to the initial letter. The Company assessed the responses received and identified incomplete and inconsistent responses.

C. Design and implement a strategy to respond to risks

For non-responsive suppliers, the Company sent out a follow-up letter. Of the incomplete and inconsistent responses, the Company identified the two largest suppliers of electronics equipment to the Machine business and focused its efforts on following-up with them because they comprised 82% of the electronics equipment-related expenditures by the Machine business. The Company has contacted directly the persons managing the conflict minerals programs for these two suppliers in order to understand their efforts to mitigate any potential risks within their supply chains. As Electronics Suppliers provide updated information to us, we assess any risks described in their disclosures.

D. Carry out independent third party audit of supply chain due diligence at identified points in the supply chain

As a downstream product manufacturer, and in light of the supply chain for the Company’s necessary conflict minerals described above, the Company does not have a direct relationship with the smelters and refiners that produce the conflict minerals contained in components of its products. Accordingly, the Company does not perform or direct independent third party audits of these entities within its supply chain and we rely on the Conflict-Free Sourcing Initiative’s Conflict-Free Smelter Program.

E. Report on supply chain due diligence

This Conflict Minerals Report provides information about the Company’s supply chain due diligence with respect to the SEC’s conflict minerals rule. This Report is an exhibit to the Company’s Form SD which has been filed with the SEC.

DUE DILIGENCE RESULTS:

A. Survey responses

The Company received responses from the Electronics Suppliers that represented 88% of electronics equipment-related expenditures by the Machine business during the Reporting Period. The responses received included the Company’s two largest suppliers of electronics equipment to the Machine business.

Responses from the Electronics Suppliers included the following:

· Their products do not contain conflict minerals.

· Their products do contain conflict minerals but not from Covered Countries.

· Their products do contain conflict minerals from Covered Countries but their due diligence was continuing in order to determine whether the minerals directly or indirectly financed or benefited armed groups in the Covered Countries.

· Their due diligence process relating to conflict minerals was ongoing and their status was unknown.

The Company’s two largest suppliers of electronics equipment to the Machine business indicated that their due diligence was continuing and their status was unknown.

B. Smelters or refiners

The information provided by the Electronics Suppliers (and by their suppliers) to the Company is not sufficient to allow the Company to determine the facilities used to process the necessary conflict minerals in products purchased by the Company from the Electronics Suppliers.

C. Conclusion

After performing the due diligence measures described above for the necessary conflict minerals believed to be present in products in the Company’s Machine business, the Company was unable to determine the country of origin of those necessary conflict minerals or whether those necessary conflict minerals came from recycled or scrap sources. Therefore, pursuant to the Rule and the Form SD, the Company has concluded that its Machine business products are “DRC Conflict Undeterminable”.

STEPS TO BE TAKEN TO MITIGATE RISK:

The Company intends to take the following steps during future compliance periods to mitigate the risk that its necessary conflict minerals could benefit armed groups in the DRC or adjoining countries and to improve the Company’s due diligence:

a. Work with suppliers to promote their understanding of and the Company’s expectations regarding compliance with the SEC’s conflict minerals rule and direct them to training resources to attempt to improve the content of the supplier survey responses.

b. Work with those suppliers that provided information at the overall company level to provide more specific information relating to the products they sell to O-I.

c. Continue to implement and build awareness within the Company regarding the global procurement conflict minerals procedure.

d. Work with trade associations of which the Company is a member such as the National Association of Manufacturers to define and improve best practices and build leverage over the supply chain in accordance with the OECD Guidance.

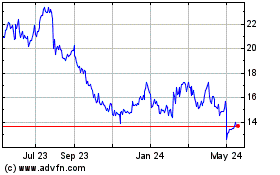

OI Glass (NYSE:OI)

Historical Stock Chart

From Mar 2024 to May 2024

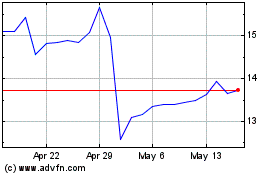

OI Glass (NYSE:OI)

Historical Stock Chart

From May 2023 to May 2024