0001579877FALSE00015798772023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________

FORM 8-K

__________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 7, 2023

_________________________

OUTFRONT Media Inc.

(Exact name of registrant as specified in its charter)

__________________________

| | | | | | | | | | | | | | |

Maryland | | 001-36367 | | 46-4494703 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification Number) |

| | | | | | | | | | | |

90 Park Avenue, 9th Floor | | |

New York, | New York | | 10016 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 297-6400

__________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01, par value | OUT | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On November 7, 2023, OUTFRONT Media Inc. issued a press release announcing the pricing of $450.0 million aggregate principal amount of 7.375% Senior Secured Notes due 2031. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits. The following exhibits are filed herewith:

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| |

| 99.1 | | Press Release dated November 7, 2023. |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit

Number | | Description |

| |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

Y

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

OUTFRONT MEDIA INC. |

| | |

By: | | /s/ Matthew Siegel |

| | Name: | | Matthew Siegel |

| | Title: | | Executive Vice President and |

| | | | Chief Financial Officer |

| | | | |

Date: November 7, 2023

OUTFRONT Media Announces Pricing of Senior Secured Notes Offering

New York, November 7, 2023 — OUTFRONT Media Inc. (NYSE: OUT) today announced that two of its wholly-owned subsidiaries priced a private offering of $450.0 million in aggregate principal amount of 7.375% Senior Secured Notes due 2031 (the “notes”). The notes will be sold at an issue price of 100.0% of the principal amount. The offering is expected to close on November 20, 2023, subject to customary closing conditions.

OUTFRONT Media intends to use the net proceeds from the notes offering to redeem all of its outstanding 6.250% Senior Notes due 2025 (the “2025 notes”) and to pay accrued and unpaid interest on the 2025 notes, if any, to, but excluding, the redemption date, to pay fees and expenses in connection with the notes offering and the 2025 notes redemption; and for general corporate purposes, which may include the repayment, refinancing, redemption or repurchase of existing indebtedness.

The notes will be guaranteed on a senior secured basis by OUTFRONT Media Inc. and each of its direct and indirect subsidiaries that guarantees its senior credit facilities. The notes will also be secured by liens on substantially all of the assets of OUTFRONT Media Inc. and each of its direct and indirect subsidiaries that secure its senior credit facilities, subject to certain exceptions and permitted liens, including the exclusion of equity in Canadian subsidiaries that are pending sale.

The notes were offered and will be sold in a private placement to qualified institutional buyers pursuant to Rule 144A under the Securities Act of 1933, as amended (the “Securities Act”), and to non-U.S. persons in transactions outside the United States pursuant to Regulation S under the Securities Act. The notes have not been, and will not be, registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from the registration requirements of the Securities Act.

This press release does not constitute an offer to sell or the solicitation of an offer to buy the notes, nor shall there be any sale of the notes in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other jurisdiction.

Cautionary Statement Regarding Forward-Looking Statements

OUTFRONT Media Inc. (“we” or “our”) have made statements in this press release that are forward-looking statements within the meaning of the federal securities laws, including the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by the use of forward-looking terminology such as “will,” “intends,” or “expects,” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions relating to our capital resources, portfolio performance and results of operations. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and may not be able to be realized. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: our ability to consummate the notes offering and the 2025 notes redemption; consummating the pending sale of our outdoor advertising business in Canada pursuant to a Share Purchase Agreement, dated October 22, 2023, among OUTFRONT Media Inc., Outfront Canada HoldCo 2 LLC, Outfront Canada Sub LLC and Bell Media Inc. (the “Transaction”)

may be more difficult, costly, or time consuming for OUTFRONT Media Inc. and its management than expected and the anticipated benefits of the Transaction may not be fully realized; the Transaction parties being unable to satisfy closing conditions, including necessary regulatory approval for the Transaction (or obtaining regulatory approval for the Transaction subject to conditions that are not anticipated), which could delay or cause the parties to abandon or terminate the Transaction; declines in advertising and general economic conditions, including the current heightened levels of inflation; the severity and duration of pandemics, and the impact on our business, financial condition and results of operations; competition; government regulation; our ability to implement our digital display platform and deploy digital advertising displays to our transit franchise partners; losses and costs resulting from recalls and product liability, warranty and intellectual property claims; our ability to obtain and renew key municipal contracts on favorable terms; taxes, fees and registration requirements; decreased government compensation for the removal of lawful billboards; content-based restrictions on outdoor advertising; seasonal variations; acquisitions and other strategic transactions that we may pursue could have a negative effect on our results of operations; dependence on our management team and other key employees; diverse risks in our Canadian business; experiencing a cybersecurity incident; changes in regulations and consumer concerns regarding privacy, information security and data, or any failure or perceived failure to comply with these regulations or our internal policies; asset impairment charges for our long-lived assets and goodwill; environmental, health and safety laws and regulations; expectations relating to environmental, social and governance considerations; our substantial indebtedness; restrictions in the agreements governing our indebtedness; incurrence of additional debt; interest rate risk exposure from our variable-rate indebtedness; our ability to generate cash to service our indebtedness; cash available for distributions; our failure to remain qualified to be taxed as a real estate investment trust (“REIT”); REIT distribution requirements; availability of external sources of capital; we may face other tax liabilities even if we remain qualified to be taxed as a REIT; complying with REIT requirements may cause us to liquidate investments or forgo otherwise attractive investments or business opportunities; our ability to contribute certain contracts to a taxable REIT subsidiary (“TRS”); our planned use of TRSs may cause us to fail to remain qualified to be taxed as a REIT; REIT ownership limits; failure to meet the REIT income tests as a result of receiving non-qualifying income; the Internal Revenue Service may deem the gains from sales of our outdoor advertising assets to be subject to a 100% prohibited transaction tax; and other factors described in our filings with the Securities and Exchange Commission (the “SEC”), including but not limited to the section entitled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on February 23, 2023. All forward-looking statements in this press release apply as of the date of this press release or as of the date they were made and, except as required by applicable law, we disclaim any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions or factors, of new information, data, or methods, future events, or other changes.

About OUTFRONT Media Inc.

OUTFRONT leverages the power of technology, location, and creativity to connect brands with consumers outside of their homes through one of the largest and most diverse sets of billboard, transit, and mobile assets in North America. Through its technology platform, OUTFRONT will fundamentally change the ways advertisers engage audiences on-the-go.

| | | | | | | | |

| Contacts: | | |

| | |

Investors: | | Media: |

| Stephan Bisson | | Courtney Richards |

| (212) 297-6573 | | (646) 876-9404 |

| stephan.bisson@outfront.com | | courtney.richards@outfront.com |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

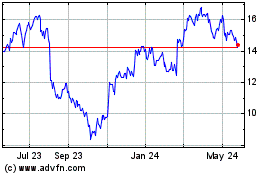

OUTFRONT Media (NYSE:OUT)

Historical Stock Chart

From Apr 2024 to May 2024

OUTFRONT Media (NYSE:OUT)

Historical Stock Chart

From May 2023 to May 2024