Established in 2014, Cheche Technology has

pioneered digitizing and empowering the insurance ecosystem to

transform industry performance and consumer experience in China

through its national transaction platform and SaaS offerings.

Cheche Technology’s primary focus lies in the

P&C insurance market in China, in which auto insurance is the

largest, high-growth sector with an estimated RMB 1.1 trillion

(approximately $159.5 billion) of total auto insurance premiums by

2026[1].

Cheche Technology expects its unaudited annual

revenue for the year ended December 31, 2022 to be approximately

RMB 2.5 billion (approximately $360 million).

The proposed transaction represents a pre-money

equity value of $760 million for Cheche Technology and an implied

pro forma enterprise value of approximately $841 million for the

combined company.

Cheche Technology Inc. (“Cheche Technology”), China’s leading

auto insurance technology platform, and Prime Impact Acquisition I

("Prime Impact") (NYSE: PIAI), a publicly traded special purpose

acquisition company, today announced that they have entered into a

definitive business combination agreement (the “Business

Combination Agreement”) that will result in Cheche Technology

becoming a publicly listed company (the “Proposed Transaction”).

Upon closing, the combined company (the “Combined Company”) will be

listed on Nasdaq under the new ticker symbol CCG. The Combined

Company will continue to be led by Lei Zhang, Founder and Chief

Executive Officer of Cheche Technology, and other key executive

leadership members.

Cheche Technology has created a unique ecosystem with powerful,

self-reinforcing network effects. As of June 30, 2022, Cheche

Technology had facilitated a broad range of auto insurance

transactions covering over 4,000 vehicle makes with approximately

100 insurance carriers, 400 third-party platforms, and 820,000

referral partners in its ecosystem.

Cheche Technology has scaled its business with a

technology-driven, capital-efficient approach and facilitated the

issuance of insurance policies with gross written premiums of RMB

11.1 billion (approximately $1.6 billion) in 2021, with estimated

growth of 36.3% to RMB 15.2 billion (approximately $2.2 billion) in

20222. Cheche Technology’s track record of strong growth has been

largely organic and highly efficient from a marketing standpoint,

with a substantial amount of business generated through

word-of-mouth referrals and local industry relationships. Cheche

Technology expects its unaudited annual revenue for the year ended

December 31, 2022 to be approximately RMB 2.5 billion

(approximately $360 million).

Cheche Technology has leveraged its technology capabilities,

extensive data sets and understanding of China’s insurance industry

to develop and launch two cloud-based SaaS solutions for insurance

carriers and intermediaries: Sky Frontier and Digital Surge.

Digital Surge is an intelligent one-stop SaaS product that helps

insurance intermediaries enhance operating efficiency and meet

evolving regulatory requirements. Sky Frontier is an AI-based, SaaS

analytics engine that helps insurance carriers optimize

underwriting and pricing strategies based on market data and

proprietary insights. Through its unique SaaS offerings, Cheche

Technology is well-positioned to capture significant opportunities

resulting from the accelerating digitalization of the auto

insurance market in China.

Management Commentary

Dixon R. Doll, Co-Founder, GP Emeritus, DCM, Director of

Prime Impact “Based on my many years of successfully investing

in Chinese technology companies, I am very supportive of the

transaction with Cheche Technology. I believe in the Prime Impact

team’s ability to support Cheche Technology’s entry into the public

markets and their ability to continuing growing and innovating in

the Chinese insurance sector.”

Mark Long, Co-Founder, Co-CEO and CFO of Prime Impact “We

are very excited to be working with Lei and his excellent team at

Cheche Technology in their next chapter of growth and innovation.

We have great respect for the platform that Lei and his technical

team have built and the trusted relationships they have developed

throughout the industry over the last eight years. We appreciate

Lei’s strategy of leveraging their extensive insurance transaction

platform to provide scalable SaaS and AI-enable analytic solutions

to key stakeholders in the insurance ecosystem. We believe the

Cheche Technology transaction platform and suite of SaaS solutions

can deliver improvements in efficiency, pricing and risk management

and create significant value for their partners, customers and

stakeholders.”

Lei Zhang, Founder and CEO of Cheche Technology “It is

our great pleasure to have found Mark and the Prime Impact team

last year. We have since engaged in deep discussions on the growth

and development trajectories our company should take and believe

the seasoned, resourceful Prime Impact team can help us get to the

next levels. With extensive experience in capital markets, mergers

and acquisitions, particularly with a focus on data and technology

centric businesses as well as a profound understanding of the Asian

markets, Mark and his colleagues check all of the boxes of the

great partners we have been looking for on a long-term basis. 2023

has just begun and will be an important year for us, and we can’t

wait to get to work to deliver to our customers better products and

services that we are constantly enhancing and refining to add to

the greater good of the industry, where we hope to continue to

evolve and lead.”

Transaction Overview

The Proposed Transaction values the Combined Company at an

implied pro forma enterprise value of approximately $841 million,

at a price of $10.00 per share, assuming no further redemptions by

Prime Impact shareholders. The Proposed Transaction is expected to

result in gross proceeds of approximately $68 million to Cheche

Technology (assuming no further redemptions by Prime Impact

shareholders), and the potential for additional financing. Upon

closing, Cheche Technology’s shareholders will retain a majority of

the outstanding shares of the Combined Company and Cheche

Technology will designate a majority of proposed directors for the

Combined Company board.

Cheche Technology expects to use proceeds from the Proposed

Transaction to accelerate technology development and new market

entry while also continuing to invest in growth across existing

markets.

The board of directors of both Cheche Technology and Prime

Impact have unanimously approved the Proposed Transaction, which is

expected to be completed in the third quarter of 2023, subject to,

among other things, approval by the shareholders of Prime Impact

and Cheche Technology, and satisfaction (or waiver, as applicable)

of the conditions stated in the Business Combination Agreement,

including regulatory approvals and other customary closing

conditions, including a registration statement on Form F-4 (the

“Registration Statement”) to be filed by the Combined Company being

declared effective by the SEC, and the listing application of the

Combined Company being approved by the Nasdaq Stock Market LLC.

Additional information about the Proposed Transaction, including

a copy of the Business Combination Agreement and an investor

presentation, will be provided in a Current Report on Form 8-K to

be filed by Prime Impact with the SEC and available at

https://www.sec.gov/.

Advisors

Cohen & Company Capital Markets, a division of J.V.B.

Financial Group, LLC is serving as exclusive financial advisor and

lead capital markets advisor to Prime Impact. Goodwin is serving as

International legal advisor to Prime Impact. Zhong Lun Law Firm is

serving as PRC legal advisor to Prime Impact. Wilson Sonsini is

serving as legal advisor to Cheche Technology.

Investor Conference Call and Other Information

Cheche Technology and Prime Impact have recorded a joint

investor conference call discussing the Proposed Transaction.

This release, the investor presentation and the conference call

recording are available on the Prime Impact IR website at

https://ir.primeimpactcapital.com.

About Cheche Technology

Established in 2014 and headquartered in Beijing, China, Cheche

Technology is a leading auto insurance technology platform, with a

nationwide network of around 110 branches licensed to distribute

insurance policies across 24 provinces, autonomous regions and

municipalities in China. Capitalizing on its leading position in

auto insurance transaction services, Cheche Technology has evolved

into a comprehensive, data-driven technology platform that offers a

full suite of services and products for digital insurance

transactions and insurance SaaS solutions in China. Learn more at

https://www.chechegroup.com/en

About Prime Impact

Prime Impact is a Cayman Islands exempted company formed on July

21, 2020 for the purpose of effecting a merger, share exchange,

asset acquisition, share purchase, reorganization, or similar

business combination involving Prime Impact and one or more

businesses. Prime Impact is focused on partnering with experienced

management teams building innovative, data-centric technology or

technology-related companies in key Asian markets with a focus on

the Greater China market. Prime Impact is led by Co-Founder, Co-CEO

and CFO Mark Long and Co-Founder and Co-CEO Michael Cordano. Learn

more at https://ir.primeimpactcapital.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“estimate,” “plan,” “project,” “forecast,” “intend,” “will,”

“expect,” “anticipate,” “believe,” “seek,” “target” or other

similar expressions that predict or indicate future events or

trends or that are not statements of historical matters. These

forward-looking statements also include, but are not limited to,

statements regarding projections, estimates and forecasts of

revenue and other financial and performance metrics, projections of

market opportunity and expectations, the estimated implied

enterprise value of the Combined Company, Cheche Technology’s

ability to scale and grow its business, the advantages and expected

growth of the Combined Company, the Combined Company’s ability to

source and retain talent, the cash position of the Combined Company

following closing of the Proposed Transaction, Prime Impact’s and

Cheche Technology’s ability to consummate the Proposed Transaction,

and expectations related to the terms and timing of the Proposed

Transaction, as applicable. These statements are based on various

assumptions, whether or not identified in this press release, and

on the current expectations of Prime Impact’s and Cheche

Technology’s management and are not predictions of actual

performance.

These statements involve risks, uncertainties and other factors

that may cause actual results, levels of activity, performance or

achievements to be materially different from those expressed or

implied by these forward-looking statements. Although each of Prime

Impact and Cheche Technology believes that it has a reasonable

basis for each forward-looking statement contained in this press

release, each of Prime Impact and Cheche Technology cautions you

that these statements are based on a combination of facts and

factors currently known and projections of the future, which are

inherently uncertain. In addition, there will be risks and

uncertainties described in the proxy statement/prospectus included

in the Registration Statement relating to the Proposed Transaction,

which is expected to be filed by the Combined Company with the SEC

and other documents filed by the Combined Company or Prime Impact

from time to time with the SEC. These filings may identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements. Neither Prime Impact nor Cheche

Technology can assure you that the forward-looking statements in

this press release will prove to be accurate. These forward-looking

statements are subject to a number of risks and uncertainties,

including, among others, the ability to complete the Proposed

Transaction due to the failure to obtain approval from Prime

Impact’s shareholders or satisfy other closing conditions in the

Business Combination Agreement, the occurrence of any event that

could give rise to the termination of the Business Combination

Agreement, the ability to recognize the anticipated benefits of the

Proposed Transaction, the amount of redemption requests made by

Prime Impact’s public shareholders, costs related to the Proposed

Transaction, the impact of the global COVID-19 pandemic, the risk

that the Proposed Transaction disrupts current plans and operations

as a result of the announcement and consummation of the Proposed

Transaction, the outcome of any potential litigation, government or

regulatory proceedings, and other risks and uncertainties,

including those to be included under the heading “Risk Factors” in

the Registration Statement to be filed by the Combined Company with

the SEC and those included under the heading “Risk Factors” in the

annual report on Form 10-K for year ended December 31, 2021 of

Prime Impact and in its subsequent quarterly reports on Form 10-Q

and other filings with the SEC. There may be additional risks that

neither Prime Impact nor Cheche Technology presently know or that

Prime Impact and Cheche Technology currently believe are immaterial

that could also cause actual results to differ from those contained

in the forward-looking statements. In light of the significant

uncertainties in these forward-looking statements, nothing in this

press release should be regarded as a representation by any person

that the forward-looking statements set forth herein will be

achieved or that any of the contemplated results of such

forward-looking statements will be achieved. The forward-looking

statements in this press release represent the views of Prime

Impact and Cheche Technology as of the date of this press release.

Subsequent events and developments may cause those views to change.

However, while Prime Impact and Cheche Technology may update these

forward-looking statements in the future, there is no current

intention to do so, except to the extent required by applicable

law. You should, therefore, not rely on these forward-looking

statements as representing the views of Prime Impact or Cheche

Technology as of any date subsequent to the date of this press

release. Except as may be required by law, neither Prime Impact nor

Cheche Technology undertakes any duty to update these

forward-looking statements.

Additional Information and Where to Find It

In connection with the Proposed Transaction, Prime Impact and

the Company intend to cause a registration statement on Form F-4 to

be filed with the SEC, which will include a proxy statements to be

distributed to Prime Impact’s shareholders in connection with Prime

Impact’s solicitation for proxies for the vote by Prime Impact’s

shareholders in connection with the Proposed Transaction and other

matters as described in the registration statement, as well as a

prospectus relating to the Company’s securities to be issued in

connection with the Proposed Transaction. Prime Impact’s

shareholders and other interested persons are advised to read, once

available, the preliminary proxy statement/prospectus and any

amendments thereto and, once available, the definitive proxy

statement/prospectus, in connection with Prime Impact’s

solicitation of proxies for its special meeting of shareholders to

be held to approve, among other things, the Proposed Transaction,

because these documents will contain important information about

Prime Impact, the Company and the Proposed Transaction. After the

registration statement is filed and declared effective, Prime

Impact will mail a definitive proxy statement and other relevant

documents to its shareholders as of the record date to be

established for voting on the Proposed Transaction. Shareholders

may also obtain a copy of the preliminary and definitive proxy

statement/prospectus to be included in the registration statement,

once available, as well as other documents filed with the SEC

regarding the Proposed Transaction and other documents filed with

the SEC, without charge, at the SEC’s website located at

www.sec.gov.

Participants in the Solicitation

Prime Impact, Cheche Technology and their respective directors,

executive officers and other members of management and employees

may, under SEC rules, be deemed to be participants in the

solicitations of proxies from Prime Impact’s shareholders in

connection with the Proposed Transaction. Information regarding the

persons who may, under SEC rules, be deemed participants in the

solicitation of Prime Impact’s shareholders in connection with the

Proposed Transaction will be set forth in the proxy

statement/prospectus included in the Registration Statement to be

filed with the SEC in connection with the Proposed Transaction. You

can find more information about Prime Impact’s directors and

executive officers in Prime Impact’s final prospectus related to

its initial public offering dated September 9, 2020. Additional

information regarding the participants in the proxy solicitation

and a description of their direct and indirect interests will be

included in the proxy statement/prospectus when it becomes

available. Shareholders, potential investors and other interested

persons should read the proxy statement/prospectus carefully when

it becomes available before making any voting or investment

decisions. You may obtain free copies of these documents from the

sources indicated above.

No Offer or Solicitation

This press release is not a proxy statement or solicitation of a

proxy, consent or authorization with respect to any securities or

in respect of the potential Transaction, and does not constitute an

offer to sell or the solicitation of an offer to buy any securities

of Prime Impact, the Company or the combined company, or a

solicitation of any vote or approval, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such jurisdiction. No offer of

securities shall be made except by means of a prospectus meeting

the requirements of the Securities Act of 1933, as amended.

All currency conversions in this press release based on an

exchange rate of USD to RMB: 1 to 6.8972, which is the rate on

12/30/22 as set forth in the H.10 statistical release of the U.S.

Federal Reserve Board.

[1] According to an industry report commissioned by Cheche

Technology and prepared by Shanghai iResearch Co., Ltd., China

(“iResearch”)

2 Gross written premiums based on non-GAAP metric

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230130005238/en/

Prime Impact: Mark Long investorinfo@primeimpactcapital.com

(650) 825-6965

Cheche Technology: IR@chechegroup.com Crocker Coulson

crocker.coulson@aummedia.org (646) 652-7185

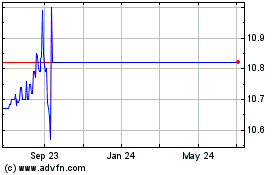

Prime Impact Acquisition I (NYSE:PIAI)

Historical Stock Chart

From Dec 2024 to Jan 2025

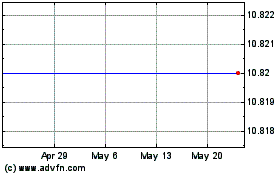

Prime Impact Acquisition I (NYSE:PIAI)

Historical Stock Chart

From Jan 2024 to Jan 2025