Pearson Boosts Profit; Warns on Outlook-- Update

26 February 2016 - 10:40PM

Dow Jones News

(Rewrites, adds detail.)

By Simon Zekaria

LONDON--Pearson PLC (PSON.LN) on Friday recorded a jump in

full-year profit after earnings were boosted by the landmark sale

of its trophy publishing assets, even as the education products

specialist warned it faces a challenging outlook this year.

London-based Pearson said its 2015 net profit soared to 823

million pounds ($1.15 billion) from GBP471 million the prior year.

Last year, it sold the Financial Times newspaper and its

noncontrolling stake in the publisher of The Economist to fund its

growth across global education, which includes textbooks in Western

markets, digital learning programs and English-language

schools.

Operating profit adjusted for exceptional items rose to GBP723

million from GBP722 million, in line with company guidance.

Adjusted earnings per share increased to 70.3 pence from 66.7

pence.

At 1039 GMT, shares were up 5.5% to 846 pence, valuing the

company at GBP6.59 billion.

Still, Pearson's profit was also hit by impairment charges of

GBP849 million in North America and elsewhere because of difficult

market conditions.

Sales fell 2% year-over-year to GBP4.47 billion, hit by trading

impacts in U.S. higher education--where higher-education

enrollments are falling--U.K. education and South Africa.

Chief Executive John Fallon said the group is suffering from

cyclical conditions across U.S. educational markets and worsening

macro-economic pressures across key emerging market economies such

as Brazil and China.

"It has been a challenging time for Pearson," Mr. Fallon told

reporters.

Last month, Pearson launched fresh cost-savings worth half a

billion dollars and axed 10% of its workforce world-wide. It is

simplifying its structure by merging businesses and focusing on

fewer, bigger opportunities.

For 2016, before costs of its reorganization, it expects to

report adjusted operating profit between GBP580 million and GBP620

million and adjusted earnings per share between 50 pence and 55

pence.

Pearson expects to report adjusted operating profit of GBP800

million in 2018, based on a recovery of its business in the U.K.

and U.S.

Pearson, which makes two-thirds of its sales in North America,

has booked hundreds of millions of dollars in cost savings in

recent years to counter a slowdown in mature educational

markets.

It is boosting its push into emerging markets, such as Brazil

and China, where there is greater demand for learning services. In

those countries, a rising middle class population is investing

heavily in education, including private language schools.

"There are some big structural growth opportunities in

education," said Mr. Fallon, highlighting Pearson's confidence over

its prospects.

Pearson proposed a full-year dividend of 52 pence a share, up 2%

from a year earlier.

"If the restructuring goes to plan, and if Pearson's markets

show the improvement they expect, then investors can look forward

to a very high level of income in the medium term, with hopefully

longer term capital gains driven by an improved business

performance," said Hargreaves Lansdown analyst Steve Clayton.

"But there are a lot of bridges to cross on this journey."

News Corp, which owns Dow Jones & Co., publisher of The Wall

Street Journal, competes with Pearson's book publishing and

education divisions.

Write to Simon Zekaria at simon.zekaria@wsj.com

(END) Dow Jones Newswires

February 26, 2016 06:25 ET (11:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

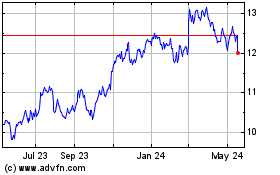

Pearson (NYSE:PSO)

Historical Stock Chart

From Mar 2024 to Apr 2024

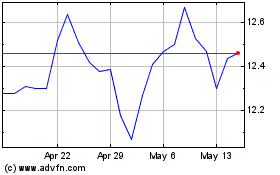

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2023 to Apr 2024