By Brent Kendall and Drew FitzGerald

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 7, 2018).

WASHINGTON -- A federal appeals court voiced skepticism Thursday

of the Justice Department's bid to roll back AT&T Inc.'s

acquisition of Time Warner.

During an oral argument that spanned nearly two hours, all three

judges on a panel of the U.S. Court of Appeals for the District of

Columbia Circuit asked tough questions of the DOJ, which argues the

more than $80 billion deal will harm competition in the pay-TV

industry.

The judges repeatedly noted that the court could rule for the

government only if the trial judge made obvious and serious errors

in siding with AT&T.

"Our standard is clear error," said Judge Judith Rogers.

"Where is the plain error?" Judge David Sentelle asked, then

later suggested to the Justice Department that there wasn't

one.

The department sued last year to block the transaction, one of

the biggest government merger lawsuits in recent memory. U.S.

District Judge Richard Leon roundly rejected the government's

claims in June following a six-week trial. The companies completed

the transaction a few days later, but the government is continuing

to challenge it.

The so-called vertical deal combined AT&T's wireless and

pay-TV businesses -- including satellite service DirecTV -- with

Time Warner's entertainment portfolio: the Warner Bros. movie

studio, HBO and the Turner networks, which include TBS, TNT and

CNN.

Both at trial and on appeal, the Justice Department's primary

contentions focused on the Turner networks, arguing that AT&T

could raise its rivals' costs by charging more for those channels

once it owned them. A negotiation impasse would have a silver

lining for AT&T, because any potential blackout of Turner on

other pay-TV systems could lead subscribers to switch to an

AT&T-owned service, the department alleged.

With the combination of AT&T and Time Warner, "the nation's

largest TV distributor and a TV programmer with critically

important content will be able to extract hundreds of millions of

dollars more for TV programming because they can threaten to poach

the rivals' customers if they don't pay up," Justice Department

lawyer Michael Murray said Thursday.

The appeals court, however, questioned whether the threat of a

blackout of the Turner networks really was a credible threat for

AT&T to make.

"If you have any empty threat of a blackout, you're not going to

get a heck of a lot of leverage out of that," Judge Sentelle

said.

Judge Robert Wilkins questioned whether the blackout threat was

removed from the equation because Turner has pledged that it will

submit to arbitration any programming disputes over network

carriage fees. He cited factual findings made by the trial court

that the arbitration pledge would have a real-world impact on the

marketplace and the bargaining position of the parties.

"How can we just ignore that?" Judge Wilkins asked.

Mr. Murray said there were too many uncertainties surrounding

AT&T's arbitration offer and that it wasn't an adequate

solution.

It isn't clear whether other pay-TV providers are eager or

willing to arbitrate with AT&T in the event of a pricing

dispute. AT&T said earlier this year that only a handful of the

roughly 1,000 cable, satellite and online TV distributors had

accepted that offer, which it modeled after similar agreements

offered previously by Comcast Corp. when that company took control

of NBCUniversal in 2011.

Judge Wilkins later suggested that the trial judge may have made

some errors in his 172-page decision for AT&T, but he

questioned whether they were substantial enough to change the

outcome or require that the case be sent back to the trial court

for more proceedings.

Peter Keisler, a lawyer representing AT&T, argued the

government's case against the deal fell apart during trial. And he

said Turner's promise to arbitrate disputes with other pay-TV

distributors takes the threat of a blackout "off the table."

"We will honor it," Mr. Keisler said. "We don't make an offer

like this in the marketplace and intend to say, 'We had our fingers

crossed behind our back when we made it.'"

An AT&T spokesman said in a statement that "distributors

collectively serving more than 10 million pay-TV customers have

accepted Turner's binding offer for arbitration and we expect other

distributors to do the same as their contracts come up for renewal

over the next several years."

A ruling is expected in the coming months. AT&T has agreed

to temporary rules that would make it easier to unwind the deal if

the D.C. Circuit were to reverse Judge Leon's decision. Those

conditions expire on Feb. 28.

Justice antitrust chief Makan Delrahim attended Thursday's

hearing, sometimes passing notes to Mr. Murray at the lectern.

AT&T Chief Executive Randall Stephenson was in Washington,

D.C., Thursday but didn't come to court, though the company's

general counsel, David McAtee, watched his litigators defend the

case.

Write to Brent Kendall at brent.kendall@wsj.com and Drew

FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

December 07, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

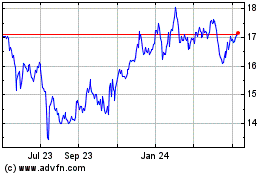

AT&T (NYSE:T)

Historical Stock Chart

From Mar 2024 to May 2024

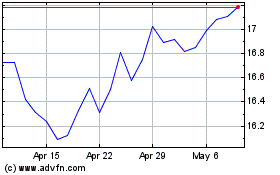

AT&T (NYSE:T)

Historical Stock Chart

From May 2023 to May 2024