TotalEnergies Energy Outlook 2024

Regulatory News:

To contribute to the public debate on the energy transition,

TotalEnergies (Paris:TTE) (LSE:TTE) (NYSE:TTE) is publishing the

6th edition of its "TotalEnergies Energy Outlook", which presents

three scenarios for the possible evolution of the demand and the

global energy system up to 2050 (documents available at this

link).

TotalEnergies Energy Outlook 2024

This year, in addition to the Momentum and Rupture scenarios

presented in previous editions of its Energy Outlook, TotalEnergies

has developed a new scenario, Trends, which reflects the current

trajectory of the various countries up to 2030 and our anticipation

of technological developments and public policies in line with

current trends. This scenario enables us to present the expected

evolution of the energy system up to 2050 in line with current

trends and the efforts still required to achieve the objectives of

the Paris Agreement.

Access to energy essential to meet development needs

Today, around 4.5 billion people have access to a level of

energy that is below what is deemed necessary for satisfactory

human development, particularly in terms of access to healthcare

and education.

Demographic forecasts indicate that the world's population will

increase by 1.7 billion by 2050, in India and the Global South.

Ensuring sufficient access to energy for the world's entire

population today requires tripling the energy available in the

least developed countries. Taking into account their expected

population growth, by 2050 they will need four times more energy

than today. Our collective challenge is therefore to reduce

greenhouse gas emissions while responding to the legitimate demand

for more energy for the population of emerging countries.

An energy transition underway but which ought to be

accelerated

Since 2000, we have experienced a decoupling between GDP growth

and energy demand growth. Electricity has grown faster than the

other energies, and renewables have accelerated their growth since

2015. However, demand for coal, which is often domestic and

inexpensive, continues to grow, and energy intensity gains (1.4%

per year observed over 2000-2022) remain below the ambition set at

COP28 (3% to 4% per year).

Analysis by geographical zone shows that rising living

standards, particularly in India and China, are the main drivers of

the increase in energy demand in recent years.

Two major developments occurred in the last 20 years that will

shape the energy transition: the shale gas and oil revolution in

the United States has transformed the energy landscape in the

United States and around the world; and a few low-carbon

technologies, in particular solar panels and electric vehicles,

have made sufficient progress to be deployed on a large scale and

be cost-competitive for consumers, provided that, at the same time,

electricity networks receive sufficient investment.

3 scenarios for the next thirty years

The Trends scenario reflects the current trajectory of

the various countries up to 2030 and incorporates our anticipation

of future technological and public policy developments in line with

current trends. It accounts for the recent acceleration in the

penetration of mature decarbonization technologies: solar and wind

power to produce electricity, electric vehicles and heat pumps to

use it, particularly in China. However, infrastructure constraints

(in particular electricity grids) and geopolitical tensions are

limiting their large-scale deployment. This scenario yields an

estimated temperature increase between +2.6° and +2.7°C by

2100.

TotalEnergies' Momentum scenario is a forward-looking

approach integrating the decarbonization strategies of NZ50

countries, as well as the NDCs (Nationally Determined

Contributions) of other countries. It implies: (i) electrification

of final demand in NZ50 countries and China, (ii) phasing-out coal

in NZ50 countries, a sharp reduction in China and only slight

growth in this energy source in the Global South countries, (iii)

the use of natural gas as a transitional energy source for

electricity and industry in all countries, and (iv) the deployment

of new energies in non-electrifiable sectors (e.g. decarbonized

hydrogen in industry and transport, sustainable fuels in aviation

and marine) in NZ50 countries and China. In this scenario, fossil

fuels still cover half of the growth in energy demand in the Global

South, due to insufficient low-carbon investment. This scenario

yields an estimated temperature increase between +2.2° and +2.3°C

by 2100.

Rupture is a normative scenario designed to achieve a

temperature increase of less than 2°C by 2100. For example, moving

from Trends to Rupture requires an 80% increase in installed solar

and wind power capacity in India and the Global South by 2030.

Beyond 2040, all decarbonization levers are applied globally, in

particular the deployment of new energies and CCUS. In this

scenario, decarbonized technologies are deployed globally according

to their merit curve. This scenario yields an estimated temperature

increase between +1.7° and +1.8°C by 2100.

To move from Trends to Rupture, the world should collectively

give priority to existing technologies offering an acceptable

abatement cost. In particular, public decision-makers should step

up international cooperation to ensure that the cheapest

technologies are available globally, and that financial instruments

adapted to developing countries are deployed.

"To keep pace with the growth in energy demand which is

essential to the legitimate improvement in the standard of living

of the emerging countries’ population while simultaneously reducing

greenhouse gas emissions, public policies and the players in the

energy chain must give priority to mature and sufficiently

affordable low-carbon technologies and cooperate to deploy them

across the globe. This is the way to combine economic and social

development with the acceleration of the energy transition," said

Aurélien Hamelle, Managing Director Strategy &

Sustainability.

The main messages of the TotalEnergies

Energy Outlook 2024 are as follows:

1. Reliable and affordable energy access is essential to Human

Development, and yet remains widely unequal across countries.

2. Over the last 20 years,

- the energy transition has started globally

- most of the energy demand growth was driven by increasing

living standards

- the US shale revolution has transformed the energy landscape in

the U.S. and worldwide

- A few technologies to decarbonize energy supply are now mature,

and start to be deployed

3. Looking forward to 2050, we have developed 3 scenarios,

differentiated by their depth of decarbonization: Trends, Momentum

et Rupture

- The “Trends” scenario, which takes into account current

trajectories of the various countries up to 2030 and our

anticipation of technological developments and public policies

according to current trends, yields a +2.6-2.7°C temperature

increase by 2100, above the target agreed in Paris.

- The “Momentum” scenario assumes that countries committed

to net carbon neutrality by 2050 reach their objective and yields a

+2.2-2.3°C temperature increase by 2100, still above the target

agreed in Paris.

- The “Rupture” scenario proposes a path to remain well-below

+2°C by 2100 (+1.7-1.8°C). To achieve that objective, existing

decarbonation technologies are deployed rapidly and globally:

advanced economies support the Global South’s energy

transition.

4. Green electrification is the core of the energy transition:

it reduces emissions and losses in the energy system (from 60%

today to ~40% in Rupture).

5. Moving from Trends to Rupture requires pragmatically

deploying decarbonization technologies globally following their

cost and technology merit curve. Priority should be given to

- facilitating global substitution of electricity for fossil

fuels in final demand: EVs, heat pumps – in every country, and

- substituting renewables and flexible gas for coal in

electricity generation – in every country

- accelerating the reduction of methane emissions from fossil

fuel production

6. This in turns would require policy makers focus on

- Allocating subsidies and setting mandates following the cost

and technology merit curve, to minimize cost to their citizens,

hence build societal engagement.

- Eliminating bottlenecks in developing supporting

infrastructure, in particular electricity grids, and accelerating

connection to this infrastructure

- Strengthening international cooperation to deploy the cheapest

available technologies, and develop financial instruments in

developing countries

About TotalEnergies TotalEnergies is a global integrated

energy company that produces and markets energies: oil and

biofuels, natural gas and green gases, renewables and electricity.

Our more than 100,000 employees are committed to provide as many

people as possible with energy that is more reliable, more

affordable and more sustainable. Active in about 120 countries,

TotalEnergies places sustainability at the heart of its strategy,

its projects and its operations.

@TotalEnergies TotalEnergies TotalEnergies

TotalEnergies

Cautionary Note The terms “TotalEnergies”, “TotalEnergies

company” or “Company” in this document are used to designate

TotalEnergies SE and the consolidated entities that are directly or

indirectly controlled by TotalEnergies SE. Likewise, the words

“we”, “us” and “our” may also be used to refer to these entities or

to their employees. The entities in which TotalEnergies SE directly

or indirectly owns a shareholding are separate legal entities. This

document may contain forward-looking information and statements

that are based on a number of economic data and assumptions made in

a given economic, competitive and regulatory environment. They may

prove to be inaccurate in the future and are subject to a number of

risk factors. Neither TotalEnergies SE nor any of its subsidiaries

assumes any obligation to update publicly any forward-looking

information or statement, objectives or trends contained in this

document whether as a result of new information, future events or

otherwise. Information concerning risk factors, that may affect

TotalEnergies’ financial results or activities is provided in the

most recent Universal Registration Document, the French-language

version of which is filed by TotalEnergies SE with the French

securities regulator Autorité des Marchés Financiers (AMF), and in

the Form 20-F filed with the United States Securities and Exchange

Commission (SEC).

Outlook The TotalEnergies Outlook (TEO) sets out

potential scenarios of energy mix evolution at world and regional

levels until 2050, and the associated likely increase in global

average temperature by the end of the century. It is based on

in-house work conducted by the strategy and climate teams of

TotalEnergies, and on data and input from third-party forecasters,

data providers and consultants. The projections contained in the

Trends outlook and the Momentum and Rupture scenarios rely on a set

of assumptions that may or may not materialize in the future. The

TEO is meant to contribute to the debate and discussions around the

energy transition and, while it is taken into consideration by

TotalEnergies to inform its strategic decisions, the TEO is not a

presentation of TotalEnergies’ strategy, which is presented in

other publications (Sustainability and Climate Report, Investors’

presentations).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104717005/en/

TotalEnergies Contacts Media Relations: +33 (0)1 47 44 46

99 l presse@totalenergies.com l @TotalEnergiesPR Investor

Relations: +33 (0)1 47 44 46 46 l ir@totalenergies.com

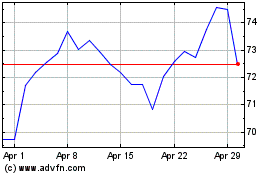

TotalEnergies (NYSE:TTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

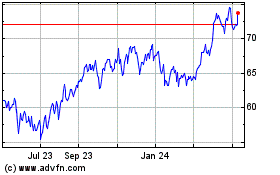

TotalEnergies (NYSE:TTE)

Historical Stock Chart

From Nov 2023 to Nov 2024