UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to §240.14a-12 |

The Taiwan Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

| ☒ |

|

No fee required. |

|

|

| ☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

| |

|

(1) |

|

Title of each class of securities to which transaction applies: |

|

|

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies: |

|

|

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was

determined): |

|

|

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction: |

|

|

|

|

|

(5) |

|

Total fee paid: |

|

|

|

| ☐ |

|

|

|

Fee paid previously with preliminary materials. |

|

|

|

| ☐ |

|

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by

registration statement number, or the form or schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount previously paid: |

|

|

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.: |

|

|

|

|

|

(3) |

|

Filing Party: |

|

|

|

|

|

(4) |

|

Date Filed: |

THE TAIWAN FUND, INC.

c/o State Street Bank and Trust Company

One Congress Building, One Congress Street, Suite 1, Boston, Massachusetts 02114-2016

For questions about the Proxy Statement, please call (800) 426-5523

March 5, 2024

Dear Stockholder:

The Annual Meeting of Stockholders of The Taiwan Fund, Inc. (the “Fund”) will be held at the Inn at Hastings Park, 2027 Massachusetts Avenue,

Lexington, MA 02421 on Tuesday, April 16, 2024 at 9:00 a.m., Eastern time. A Notice and Proxy Statement regarding the Meeting, instructions for how to join the Meeting, the proxy card for your vote, and a postage prepaid envelope in which

to return your proxy card are enclosed.

At the Meeting you, as a stockholder of the Fund, will be asked by the Board of Directors to vote on one

Proposal: the election of five Directors.

The Board of Directors recommends that you vote “FOR” the Proposal.

Respectfully,

Brian F. Link

Secretary

|

|

|

|

|

|

|

STOCKHOLDERS ARE STRONGLY URGED TO VOTE BY TELEPHONE, BY INTERNET OR BY SIGNING AND MAILING THE ENCLOSED PROXY CARD IN THE

ENVELOPE PROVIDED FOR THAT PURPOSE TO ENSURE A QUORUM AT THE MEETING. |

|

|

THE TAIWAN FUND, INC.

Notice of the Annual Meeting of Stockholders

April 16, 2024

To the Stockholders of The

Taiwan Fund, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of The Taiwan Fund, Inc. (the

“Fund”) will be held at the Inn at Hastings Park, 2027 Massachusetts Avenue, Lexington, MA 02421 on April 16, 2024 at 9:00 a.m., Eastern time, for the following purposes:

| (1) |

To elect five Directors to serve for the ensuing year; and |

| (2) |

To transact such other business as may properly come before the Meeting or any adjournments thereof.

|

The Board of Directors has fixed the close of business on February 23, 2024 as the record date for the determination of

stockholders entitled to notice of and to vote at the Meeting or any adjournments thereof. The enclosed proxy is being solicited by the Board of Directors of the Fund.

You are cordially invited to attend the Meeting.

Stockholders

who do not expect to participate in the Meeting in person are requested to vote by telephone, by Internet or by completing, dating and signing the enclosed form of proxy and returning it promptly in the envelope provided for that purpose.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE MEETING ON APRIL 16, 2024: This Notice and the

Proxy Statement are available on the Internet at https://www.proxy-direct.com/twn-33787.

By order of the Board of

Directors

BRIAN F. LINK

Secretary

March 5, 2024

PROXY STATEMENT

THE TAIWAN FUND, INC.

INTRODUCTION

This Proxy Statement is

furnished in connection with the solicitation of proxies by the Board of Directors of The Taiwan Fund, Inc. (the “Fund” or “Corporation”) for use at the Annual Meeting of Stockholders (the “Meeting”), to be held at the

Inn at Hastings Park, 2027 Massachusetts Avenue, Lexington, MA 02421 on April 16, 2024 at 9:00 a.m., Eastern time, and at any adjournments thereof.

This Proxy Statement and the form of proxy card are being mailed to stockholders on or about March 5, 2024. Any stockholder giving a proxy has the power

to revoke it by executing a superseding proxy by phone, Internet or mail following the process described on the proxy card or by submitting a notice of revocation to the Fund prior to the date of the Meeting or at the Meeting. All properly executed

proxies received in time for the Meeting will be voted as specified in the proxy or, if no specification is made, FOR the Proposal. If your shares are held by a broker and you do not instruct your broker how you want your shares to be voted, your

shares will be voted as specified by the broker on the Proposal.

The presence at the Meeting or by proxy of stockholders entitled to cast one third of

the votes entitled to be cast thereat constitutes a quorum at all meetings of the stockholders. For purposes of determining the presence of a quorum for transacting business at the Meeting, executed proxies returned without marking a vote on the

Proposal will be treated as shares that are present for quorum purposes. Abstentions are included in the determination of the number of shares present at the Meeting for purposes of determining the presence of a quorum. If a stockholder is

present at the Meeting but does not cast a vote, the stockholder’s shares will count towards a quorum but will have no effect on the Proposal. In the event a quorum is not present at the Meeting, or in the event

that a quorum is present at the Meeting but sufficient votes to approve the Proposal are not received, holders of a majority of the stock present at the Meeting or by proxy have power to adjourn the meeting from time to time to a date not more than

120 days after the original record date without notice other than announcement at the Meeting. The chairman of the Meeting also may adjourn the Meeting from time to time. Any adjournment may be made to a date not more than 120 days after the

original record date without notice other than announcement at the Meeting. At such adjourned meeting at which a quorum is present, any business may be transacted which might have been transacted at the Meeting as originally notified. The Fund may

set a subsequent record date and give notice of it to stockholders, in which case the meeting may be held not more than 120 days beyond the subsequent record date.

The Board of Directors has fixed the close of business on February 23, 2024 as the record date for the determination of stockholders entitled to notice

of and to vote at the Meeting and at any adjournments thereof. Stockholders on the record date will be

1

entitled to one vote for each share held, with no shares having cumulative voting rights. As of the record date, the Fund had outstanding 7,216,948 shares of common stock.

Management of the Fund knows of no item of business other than the item mentioned in the Proposal of the Notice of Meeting that will be eligible to be

presented for consideration at the Meeting. If any other matter is properly presented, it is the intention of the persons named in the enclosed proxy to vote in accordance with their best judgment.

The Fund will furnish, without charge, a copy of its semi-annual report for the period ended February 28, 2023 or its annual report for the fiscal

year ended August 31, 2023 to any stockholder requesting such report. Requests for the semi-annual or annual reports should be made in writing to The Taiwan Fund, Inc., c/o State Street Bank and Trust Company, One Congress

Building, One Congress Street, Suite 1, Boston, Massachusetts 02114-2016, Attention: Brian F. Link, or by accessing the Fund’s website at www.thetaiwanfund.com or by calling (800) 426-5523.

2

IMPORTANT INFORMATION

The Proxy Statement discusses important matters affecting the Fund. Please take the time to read the Proxy Statement, and then cast your vote. You may

obtain additional copies of the Notice of Meeting, Proxy Statement and form of proxy card by calling (800) 426-5523 or by accessing

https://www.proxy-direct.com/twn-33787.

There are multiple ways to vote. Choose the method that is most convenient for

you. To vote by telephone or Internet, follow the instructions provided on the proxy card. To vote by mail, simply fill out the proxy card and return it in the enclosed postage-paid reply envelope. Please do not return your proxy card if you vote

by telephone or Internet. To vote at the Meeting, participate in the Meeting and cast your vote. The Meeting will be held at the Inn at Hastings Park, 2027 Massachusetts Avenue, Lexington, MA 02421 on April 16, 2024 at 9:00 a.m.,

Eastern time.

ELECTION OF DIRECTORS

Persons named in the accompanying form of proxy intend in the absence of contrary instruction to vote all proxies for the election of the five nominees listed

below as Directors of the Fund to serve for the next year, or until their successors are elected and qualified. Each of the nominees for Director has consented to be named in this Proxy Statement and to serve as a director of the Fund if elected.

The Board of Directors of the Fund has no reason to believe that any of the nominees named below will become unavailable for election as a Director, but if that should occur before the Annual Meeting for the Fund, the persons named as proxies in the

proxy cards will vote for such persons as the Board of Directors of the Fund may recommend. None of the Directors is an “interested person” of the Fund (as defined in Section 2(a)(19) of the Investment Company Act of 1940, as amended

(the “1940 Act”) (each an “Independent Director”)).

3

Information Concerning the Nominees

The following table sets forth certain information concerning each of the nominees as a director. Each nominee is currently serving as a director of the Fund.

|

|

|

|

|

|

|

|

|

|

|

| Name (Age) and Address

of Directors* |

|

Position(s)

Held with

Fund |

|

Director

Since |

|

Principal

Occupation(s) or Employment

During Past Five Years |

|

Number of

Funds in

the

Complex(1)

Overseen

by the

Director |

|

Other

Directorships/

Trusteeships in

Publicly Held

Companies |

| William C. Kirby (73) |

|

Chairman of the

Board and Director |

|

2013 |

|

T. M. Chang Professor of China Studies (2006-present); Chairman, Harvard China Fund (2006-present); Harvard University Distinguished Service Professor (2006-present); and Director, John K.

Fairbank Center for Chinese Studies, Harvard University (2006-2014). |

|

1 |

|

Cabot Corporation. |

|

|

|

|

|

|

| Anthony S. Clark, CFA (71) |

|

Director |

|

2017 |

|

Managing Member, Innovation Capital Management, LLC (2016 to present); Chief Investment Officer of the Pennsylvania State Employees’ Retirement System (2010 to 2013); Deputy Chief Investment Officer of the Pension Benefit

Guaranty Corporation (PBGC) (2009 to 2011). |

|

1 |

|

Director, Aberdeen Japan Equity Fund, Inc. |

4

|

|

|

|

|

|

|

|

|

|

|

| Name (Age) and Address

of Directors* |

|

Position(s)

Held with

Fund |

|

Director

Since |

|

Principal

Occupation(s) or Employment

During Past Five Years |

|

Number of

Funds in

the

Complex(1)

Overseen

by the

Director |

|

Other

Directorships/

Trusteeships in

Publicly Held

Companies |

|

|

|

|

|

|

Thomas G. Kamp,

CFA (62) |

|

Chairman of the Audit Committee and Director |

|

2018 |

|

Member of Board of Advisors for FHL Healthcare Fund (2020–present); Executive Board Member, Southern Methodist University, Lyle School of Engineering (2016 – present); Director and Chairperson, Elim Christian Services

Foundation (2002-present); Director and Chairperson, Finley’s Barkery, SBC (2020– 2022) and; Director and Chairperson, Aker Technologies Inc. (2017-2019).

|

|

1 |

|

None. |

|

|

|

|

|

|

| Warren J. Olsen (67) |

|

Director |

|

2018 |

|

Chairman and Chief Investment Officer, SCB Global Capital Management (2014-present); Vice Chairman and Chief Investment Officer, First Western Financial Inc. (2002-2014). |

|

1 |

|

Aetos Multi-Strategy Arbitrage Fund, LLC; Aetos Distressed Investment Strategies Fund, LLC; Aetos Long/Short Strategies Fund, LLC. |

|

|

|

|

|

|

| Shelley E. Rigger (62) |

|

Director |

|

2016 |

|

Vice President for Academic Affairs and Dean of Faculty (May 2022-present) and Brown Professor of East Asian Politics, Davidson College (1993-present). |

|

1 |

|

None. |

| * |

For purposes of Fund business, all Directors may be contacted at the following address: One Congress Building,

One Congress Street, Suite 1, Boston, Massachusetts 02114-2016. |

| (1) |

The term “Fund Complex” means two or more registered investment companies that share the same

investment adviser or principal underwriter or hold themselves out to investors as related companies for the purposes of investment and investor services. |

5

Leadership Structure and Board of Directors

The Board has general oversight responsibility with respect to the business and affairs of the Fund. The Board is responsible for overseeing the operations of

the Fund in accordance with the laws of Maryland, the provisions of the 1940 Act, other applicable laws and the Fund’s Amended Articles of Incorporation. The Board is currently composed of five Independent Directors and one of the Independent

Directors serves as Chairman of the Board.

Generally, the Board acts by majority vote of all of the Directors, including a majority vote of the

Independent Directors if required by applicable law. The Fund’s day-to-day operations are currently managed by Nomura Asset Management U.S.A. Inc. (the

“Adviser”) and other service providers who have been approved by the Board. The Board meets periodically throughout the year to oversee the Fund’s activities, review contractual arrangements with service providers, oversee compliance

with regulatory requirements and review performance. The Board has determined that its leadership structure is appropriate given the size of the Board, the fact that all of the Directors are not interested persons, and the nature of the Fund.

The existing Directors were selected to serve and continue to serve on the Board, based upon their skills, experience, judgment, analytical ability,

diligence, ability to work effectively with other Directors and a commitment to the interests of stockholders and a demonstrated willingness to take an independent and questioning view of management. Each existing Director also has considerable

familiarity with the Fund and State Street Bank and Trust Company (the “Administrator”), and its operations, as well as the special regulatory requirements governing registered investment companies and the special responsibilities of

investment company directors, all as a result of their prior service as a Director of the Fund and, in several cases, as directors of other investment companies. In addition to those qualifications, the following is a brief summary of the specific

experience, qualifications or skills that led to the conclusion that as of the date of this proxy statement, each person identified below should serve as a Director for the Fund. References to the qualifications, attributes and skills of the

Directors are pursuant to requirements of the Securities and Exchange Commission (“SEC”), and do not constitute a holding out by the Board or any Director as having any special expertise and should not be considered to impose any greater

responsibility or liability on any such person or on the Board by reason thereof than the normal responsibility and liability of an investment company board member or board. As required by rules the SEC has adopted under the 1940 Act, the

Fund’s Independent Directors select and nominate all candidates for Independent Director positions.

William C. Kirby. Mr. Kirby has

served as a Director of the Fund since 2013. He is T. M. Chang Professor of China Studies at Harvard University. Mr. Kirby is a historian of modern China, whose work examines China’s business, economic and political development in an

international context. He has served the academic community for over 34 years. Mr. Kirby joined Harvard University in 1992, where he currently serves various positions including Chairman of the Harvard China Fund. He has also served

6

as the Director of the John K. Fairbank Center for Chinese Studies, Dean of the Faculty of Arts and Sciences, Chair of the Council on East Asian Studies and the Director of the National Resource

Center for East Asia for Harvard University. Prior to joining Harvard University, Mr. Kirby served as the Dean of the University College, Director of Asian Studies and Director of International Affairs at Washington University. Mr. Kirby

has published numerous books and articles related to Chinese business and history.

Anthony S. Clark, CFA. Mr. Clark has served as a Director

of the Fund since 2017. He is Managing Member of Innovation Capital Management, LLC since 2016. Mr. Clark served as Chief Investment Officer of the Pennsylvania State Employees’ Retirement System from 2010 to 2013 and Deputy Chief

Investment Officer of the Pension Benefit Guaranty Corporation (PBGC) from 2009 to 2011. Prior to PBGC, Mr. Clark served as Director of Global Equities in the Investment Department of the Howard Hughes Medical Institute (1995 to 2008).

Mr. Clark also serves as Director on the board of Aberdeen Japan Equity Fund, Inc.

Thomas G. Kamp, CFA. Mr. Kamp has served as a

Director of the Fund since 2018. Mr. Kamp has also served as a member of the Board of Advisors for FHL Healthcare Fund since 2020, an Executive Board Member of the Southern Methodist University, Lyle School of Engineering since 2016 and as

Director and Chairperson of Elim Christian Services Foundation since 2002. Mr. Kamp previously served as Director and Chairperson of Finley’s Barkery, SBC from 2020 to 2022 and as Director and Chairperson of Aker Technologies Inc. from

2017 to 2019.

Warren J. Olsen. Mr. Olsen has served as a Director of the Fund since 2018. He is Chairman and Chief Investment Officer at SCB

Global Capital Management. Mr. Olsen served as Vice Chairman and Chief Investment Officer at First Western Financial Inc. between 2002 and 2014. He also served as President and CEO of IBJ Whitehall Asset Management from 1999 to 2002 and

President of Morgan Stanley Funds from 1988 to 1997. Mr. Olsen also serves on the boards of Aetos Multi-Strategy Arbitrage Fund, LLC, Aetos Distressed Investment Strategies Fund, LLC and Aetos Long/Short Strategies Fund, LLC.

Shelley E. Rigger. Ms. Rigger has served as a Director of the Fund since 2016. She has been Vice President for Academic Affairs and Dean of

Faculty at Davidson College since May 2022 and is the Brown Professor of East Asian Studies at Davidson College since 1993. Ms. Rigger has been a visiting Associate Professor at Fudan University’s School of International Relations and

Public Administration in Shanghai, a scholar at National Chengchi University in Taiwan, and a Fulbright Senior Scholar at National Taiwan University. Ms. Rigger graduated magna cum laude from Princeton University’s School of Public and

International Affairs. She also holds a Ph.D. from Harvard University’s Department of Government with fields of specialization in comparative politics, Chinese politics, American politics and government and political anthropology.

Ms. Rigger has published several books and numerous articles related to

7

Taiwanese and Chinese politics, history and business as well as relations among the United States, Taiwan and mainland China. In 2021 she published The Tiger Leading the Dragon: How Taiwan

Propelled China’s Economic Rise.

The Fund does not have a policy regarding Board member’s attendance at the Annual Meeting of

Stockholders. However, all of the Directors of the Board attended the 2023 Annual Meeting of Stockholders.

The Board of Directors of the Fund held four

regular meetings and one special meeting during the fiscal year ended August 31, 2023. For the fiscal year ended August 31, 2023, each Director attended at least seventy-five percent of the aggregate number of meetings held during the

fiscal year of the Board and of any committee on which he or she served.

Audit Committee. The Fund’s Board of Directors has a separately

designated Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which is responsible for reviewing financial and accounting matters. The

Fund’s Audit Committee is composed of directors who are independent (as defined in the New York Stock Exchange, Inc. (“NYSE”) listing standards, as may be modified or supplemented) and not interested persons of the Fund (as defined in

Section 2(a)(19) of the 1940 Act) and its actions are governed by the Fund’s Audit Committee Charter, which is posted on the Fund’s website (www.thetaiwanfund.com). The current members of the Audit Committee are Messrs. Clark,

Kamp, Kirby and Olsen and Ms. Rigger, with Mr. Kamp serving as Chairman and Mr. Olsen serving as Vice Chair of the Audit Committee. The Audit Committee held four regular meetings and one special meeting during the fiscal year ended

August 31, 2023. The Fund’s Board of Directors has designated Mr. Kamp, an Independent Director, as an audit committee financial expert.

Nominating Committee. The Fund’s Board of Directors has a Nominating Committee, which is responsible for recommending individuals to the Board for

nomination as members of the Board and its Committees. The Fund’s Nominating Committee is composed of directors who are independent as independence is defined in the NYSE’s listing standards, as may be modified or supplemented, and are not

interested persons of the Fund (as defined in Section 2(a)(19) of the 1940 Act) and its actions are governed by the Fund’s Nominating Committee Charter, which is posted on the Fund’s website (www.thetaiwanfund.com). Currently, the

Nominating Committee does not solicit recommendations for nominees from stockholders. The Nominating Committee believes that it is not necessary to have such a policy because the Board has had no difficulty identifying qualified candidates to serve

as Directors. The Nominating Committee evaluates a candidate’s qualifications for Board membership and the candidate’s independence from the Fund’s Adviser and other principal service providers. The Nominating Committee does not have

specific minimum qualifications that must be met by candidates recommended by the Nominating Committee and there is not a specific process for identifying such candidates. In nominating candidates, the

8

Nominating Committee takes into consideration such factors as it deems appropriate. These factors may include judgment, skill, diversity, experience with businesses or other organizations of

comparable size, the interplay of the candidate’s experience with the experience of other Board members, requirements of the NYSE and the SEC to maintain a minimum number of independent or non-interested

directors, requirements of the SEC as to disclosure regarding persons designated as having financial expertise on the Fund’s audit committee and the extent to which the candidate generally would be a desirable addition to the Board and any

committees of the Board. The Committee believes the Board generally benefits from diversity of background, experience and views among its members, and considers this a factor in evaluating the composition of the Board, but has not adopted any

specific policy in this regard. The current members of the Nominating Committee are Messrs. Clark, Kamp, Kirby and Olsen and Ms. Rigger, with Ms. Rigger serving as Chair. The Nominating Committee met one time during the fiscal year

ended August 31, 2023.

Valuation Committee. The Fund’s Board of Directors has a Valuation Committee which is responsible for

establishing and monitoring policies and procedures reasonably designed to ensure that the Fund’s assets are valued appropriately, objectively and timely, reflecting current market conditions. The Board has designated the Adviser as the

Valuation Designee for the Fund and is responsible for determining the fair value of investments for which fair valuations are required. The current Directors who are members of the Valuation Committee are Messrs. Clark, Kamp, Kirby and Olsen and

Ms. Rigger, with Mr. Clark serving as Chairman. The Valuation Committee met one time during the fiscal year ended August 31, 2023.

Discount Management Committee. The Fund’s Board of Directors has a Discount Management Committee which is responsible for overseeing and

evaluating the discount at which the Fund’s shares trade below their net asset value. The current members of the Discount Management Committee are Messrs. Clark, Kamp, Kirby and Olsen and Ms. Rigger, with Mr. Kirby serving as

Chairman. The Discount Management Committee held two meetings during the fiscal year ended August 31, 2023.

Risk Oversight

The day-to-day operations of the Fund, including the management of risk, are

performed by third party service providers, such as the Fund’s Adviser and Administrator. The Directors are responsible for overseeing the Fund’s service providers and thus have oversight responsibilities with respect to risk management

performed by those service providers. Risk management seeks to identify and address risks, i.e., events or circumstances that could have material adverse effects on the business, operations, stockholder services, investment performance or reputation

of the Fund. The Fund and its service providers employ a variety of processes, procedures and controls to identify certain of those possible events or circumstances, to lessen the probability of their occurrence and/or to mitigate the effects of

such events or circumstances if they do occur.

9

Not all risks that may affect the Fund can be identified nor can controls be developed to eliminate or mitigate

their occurrence or effects. It may not be practical or cost effective to eliminate or mitigate certain risks, the processes and controls employed to address certain risks may be limited in their effectiveness, and some risks are simply beyond the

reasonable control of the Fund or the Adviser or other service providers. Moreover, it is necessary to bear certain risks (such as investment-related risks) to achieve the Fund’s goals. As a result of the foregoing and other factors, the

Fund’s ability to manage risk is subject to substantial limitations.

Risk oversight forms part of the Board’s general oversight of the Fund and

is addressed as part of various Board and Committee activities. As part of its regular oversight of the Fund, the Board, directly or through a Committee, interacts with and reviews reports from, among others the Fund’s Adviser, the Fund’s

Administrator, the Fund’s chief compliance officer and its independent registered public accounting firm, as appropriate, regarding risks faced by the Fund. The Board is responsible for overseeing the nature, extent and quality of the services

provided to the Fund by the Adviser and receives information about those services at its regular meetings. In addition, on an annual basis, in connection with its consideration of whether to renew the Advisory Agreement, the Board meets with the

Adviser to review the services provided. Among other things, the Board regularly considers the Adviser’s adherence to the Fund’s investment restrictions and compliance with various Fund policies and procedures and with applicable

securities regulations. The Board has appointed a chief compliance officer who oversees the implementation and testing of the Fund’s compliance program and reports to the Board regarding compliance matters for the Fund and its service

providers. The Board, with the assistance of the Adviser, reviews investment policies and risks in connection with its review of the Fund’s performance. In addition, as part of the Board’s oversight of the Fund’s advisory and other

service provider agreements, the Board may periodically consider risk management aspects of their operations and the functions for which they are responsible.

Stockholder Communications

Stockholders may send

communications to the Fund’s Board of Directors by addressing the communication directly to the Board (or individual Board members) and/or clearly indicating that the communication is for the Board (or individual Board members). The

communication may be sent to such Board member(s) at the address specified for each Director above. Other stockholder communications received by the Fund not directly addressed and sent to the Board will be reviewed and generally responded to by

management, and will be forwarded to the Board only at management’s discretion based on the matters contained therein.

10

Officers of the Fund

The following table provides information concerning each of the officers of the Fund.

|

|

|

|

|

|

|

| Name, Address, and Age |

|

Position(s) Held

with the Fund |

|

Since |

|

Principal Occupation(s) or Employment

During Past Five Years |

| Yuichi Nomoto (51) Nomura Asset Management

U.S.A. Inc. 309 West 49th Street

New York, New York 10019 |

|

President |

|

2022 |

|

President and Chief Executive Officer of Nomura Asset Management U.S.A. Inc. (“Nomura’’); Head of Global Business Strategy Department of Nomura Asset Management Co., Ltd. between April 2022 and March 2023; Managing

Director of Nomura since 2018; Head of Client Services and Marketing of Nomura. from 2016-2020; Executive Director of Nomura from 2016-2018. |

|

|

|

|

| Maria Premole (62) Nomura Asset

Management

U.S.A. Inc.

Worldwide Plaza

309 West 49th Street

New York, NY 10019 |

|

Vice President |

|

2022 |

|

Vice President/Head of U.S. Business Strategy in the Institutional Business Development Department and Latin America Departments since 2019; Vice President of Nomura since 2013. |

|

|

|

|

| Monique Labbe (50) Foreside Management

Services, LLC

Three Canal Plaza, Suite 100 Portland, ME 04101 |

|

Treasurer |

|

2017 |

|

Senior Principal Consultant and Fund Principal Financial Officer Foreside Management Services, LLC (2014-present). |

|

|

|

|

| Brian F. Link (51) State Street Bank and Trust

Company

One Congress Building

One Congress Street, Suite 1 Boston, Massachusetts 02114-2016 |

|

Secretary |

|

2014 |

|

Managing Director and Managing Counsel State Street Bank and Trust Company (October 2023-present); Vice President and Managing Counsel, State Street Bank and Trust Company (2007-October 2023). |

|

|

|

|

| Patrick Keniston (60) Foreside Fund Officer

Services, LLC

Three Canal Plaza, Suite 100 Portland, ME 04101 |

|

Chief

Compliance

Officer |

|

2015 |

|

Senior Principal Consultant and Fund Chief Compliance Officer, Fund Officer Services, LLC (2008-present). |

11

Ownership of Securities

The following table sets forth information regarding the ownership of securities in the Fund by the nominees for Director as of January 31, 2024. Each

nominee is also currently a Director of the Fund.

|

|

|

|

|

| Name of Director |

|

Dollar Range of

Equity

Securities in the

Fund |

|

Aggregate Dollar

Range of Equity

Securities in

All Funds

Overseen or to be

Overseen by

Director

in

the Fund Complex (1) |

| Anthony S. Clark, CFA |

|

$50,001-$100,000 |

|

$50,001-$100,000 |

| Thomas G. Kamp, CFA |

|

Over $100,000 |

|

Over $100,000 |

| William C. Kirby |

|

$50,001-$100,000 |

|

$50,001-$100,000 |

| Warren J. Olsen |

|

$10,001-$50,000 |

|

$10,001-$50,000 |

| Shelley E. Rigger |

|

$10,001-$50,000 |

|

$10,001-$50,000 |

| (1) |

The term “Fund Complex” means two or more registered investment companies that share the same

investment adviser or principal underwriter and hold themselves out to investors as related companies for the purposes of investment and investor services. The Fund is the only investment company in the Fund Complex. |

No Director or any immediate family member of a Director, owned securities in the Fund’s Adviser, or a person directly or indirectly controlling,

controlled by, or under common control with the Adviser.

Transactions with and Remuneration of Officers and Directors

The aggregate remuneration, including expenses relating to attendance at board meetings reimbursed by the Fund, paid in cash to Directors not affiliated with

the Adviser, was $310,000 during the fiscal year ended August 31, 2023. During the fiscal year ended August 31, 2023, the Fund paid each Director that is not affiliated with the Fund’s Adviser an annual fee of $30,000 ($40,000 for the

Chairman of the Board and the Chairman of the Audit Committee) plus a fee of $6,000 for attending the quarterly Board and Committee meetings. The Fund pays each Director $2,000 for any meetings held on days separate from the quarterly Board meeting.

12

The following table sets forth the aggregate compensation from the Fund paid to each director during the fiscal

year ended August 31, 2023, as well as the total compensation earned by each director from the Fund Complex.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name of Director |

|

Aggregate

Compensation

From Fund(1) |

|

|

Pension or

Retirement

Benefits

Accrued

As Part of

Fund

Expenses |

|

|

Estimated

Annual

Benefits

Upon

Retirement |

|

|

Total

Compensation

From Fund and

Fund Complex

Paid To

Directors(2) |

|

| Anthony S. Clark, CFA |

|

$ |

58,000 |

|

|

|

— |

|

|

|

— |

|

|

$ |

58,000 |

|

| Thomas G. Kamp, CFA |

|

$ |

68,000 |

|

|

|

— |

|

|

|

— |

|

|

$ |

68,000 |

|

| William C. Kirby |

|

$ |

68,000 |

|

|

|

— |

|

|

|

— |

|

|

$ |

68,000 |

|

| Warren J. Olsen |

|

$ |

58,000 |

|

|

|

— |

|

|

|

— |

|

|

$ |

58,000 |

|

| Shelley E. Rigger |

|

$ |

58,000 |

|

|

|

— |

|

|

|

— |

|

|

$ |

58,000 |

|

| (1) |

Includes compensation paid to Directors by the Fund. The Fund’s Directors did not receive any pension or

retirement benefits as compensation for their service as Directors of the Fund. |

| (2) |

There is one fund in the Fund Complex overseen by the Directors. |

Required Vote

Election of the listed nominees for

Director requires the affirmative vote of the holders of a majority of the shares of common stock of the Fund cast at the Meeting. Pursuant to the Fund’s By-Laws, any Director who is nominated for re-election at the Meeting and is not re-elected at the Meeting will be deemed to have tendered to the Board of Directors his or her resignation as a Director, with such

resignation to take effect 30 days after the date of the Meeting unless the Board of Directors unanimously decides to reject that Director’s tender of resignation, in which case the Director will continue in office until his or her death,

resignation or removal or until his or her successor has been elected and has been qualified.

THE BOARD OF DIRECTORS OF THE FUND RECOMMENDS THAT YOU

VOTE “FOR” THE ELECTION OF THE FIVE NOMINEES FOR DIRECTOR NAMED IN THIS PROXY STATEMENT.

13

GENERAL INFORMATION

Investment Adviser

Nomura Asset Management U.S.A. Inc.

(“Nomura”) acts as the Adviser to the Fund pursuant to an Investment Advisory Agreement, dated September 17, 2022. The principal business address of the Adviser is Worldwide Plaza 309 West 49th Street, 9th Floor New York, New York

10019-7316.

Fund Administration

State Street

Bank and Trust Company acts as Administrator to the Fund pursuant to an Administration Agreement between the Administrator and the Fund. The principal business address of the Administrator is State Street Financial Center, One Congress

Building, 1 Congress Street, Suite 1, Boston, Massachusetts 02114-2016.

Independent Registered Public Accounting Firm

Tait Weller serves as the Fund’s independent registered public accounting firm, auditing and reporting on the annual financial statements of the Fund and

reviewing certain regulatory reports and the Fund’s federal income tax returns. Tait Weller also performs other professional audit and certain allowable non-audit services, including tax services, when

the Fund engages it to do so. Representatives of Tait Weller are not expected to be available at the Meeting.

The engagement of Tait Weller as the

Fund’s independent registered public accounting firm was approved by the Audit Committee of the Board of Directors and ratified by the full Board of Directors.

Audit Fees. For the fiscal years ended August 31, 2023 and August 31, 2022, Tait Weller billed the Fund aggregate fees of $53,000 and

$53,000, respectively, for professional services rendered for the audit of the Fund’s annual financial statements and review of financial statements included in the Fund’s annual report to stockholders.

Audit-Related Fees. For the fiscal years ended August 31, 2023 and August 31, 2022, Tait Weller billed the Fund aggregate fees of $0 and

$0, respectively, for assurances and related services that are reasonably related to the performance of the audit or review of the Fund’s financial statements and are not reported under the section Audit Fees above. Audit-Related Fees

represent procedures applied to the semi-annual financial statement amounts (reading the semi-annual report and valuation and existence procedures on investments) as requested by the Fund’s Audit Committee.

Tax Fees. For the fiscal years ended August 31, 2023 and August 31, 2022, Tait Weller billed the Fund aggregate fees of $13,200 and

$13,200, respectively, for professional services rendered for tax compliance, tax advice, and tax planning. The nature of the

14

services comprising the Tax Fees was the review of the Fund’s income tax returns and tax distribution requirements.

All Other Fees. For the fiscal years ended August 31, 2023 and August 31, 2022, Tait Weller did not bill the Fund any fees for products

and services other than those disclosed above.

The Fund’s Audit Committee Charter requires that the Audit Committee

pre-approve all audit and non-audit services to be provided to the Fund by the Fund’s independent registered public accounting firm; provided, however, that the pre-approval requirement with respect to non-auditing services to the Fund may be waived consistent with the exceptions provided for in the Exchange Act. All of the audit and

tax services described above for which Tait Weller billed the Fund fees for the fiscal years ended August 31, 2023 and August 31, 2022 were pre-approved by the Audit Committee. For the fiscal years

ended August 31, 2023 and August 31, 2022, the Fund’s Audit Committee did not waive the pre-approval requirement of any non-audit services to be provided

to the Fund by Tait Weller.

Tait Weller did not bill any non-audit fees for services rendered to the Fund’s

Adviser or its previous adviser, or any entity controlling, controlled by, or under the common control with the Adviser (or previous adviser) that provides ongoing services to the Fund, for the fiscal years ended August 31, 2023 and

August 31, 2022. For the fiscal year ended August 31, 2022 and for the period September 1, 2022 through September 16, 2022, Allianz Global Investors U.S. LLC was the Fund’s investment adviser.

Audit Committee Report

The Audit Committee has reviewed

and discussed the Fund’s audited financial statements for the fiscal year ended August 31, 2023 with management of the Fund and with Tait Weller, and has discussed with Tait Weller the matters required to be discussed by Public Company

Accounting Oversight Board (“PCAOB”) Standard No. 16 (Communication with Audit Committees), as may be modified or supplemented. The Audit Committee has received the written disclosures and the letter on auditor independence from Tait

Weller required by PCAOB Rule 3526 (Communications with Audit Committees Concerning Independence), as may be modified or supplemented, and has discussed with Tait Weller its independence. Based on the Audit Committee’s review and discussions

referred to in the two preceding sentences, the Audit Committee recommended to the Board of Directors that the audited financial statements of the Fund for the fiscal year ended August 31, 2023 be included in its annual report to stockholders

and the Fund’s annual report filed with the SEC.

Anthony S. Clark, CFA Member of the Audit Committee

Thomas G. Kamp, CFA Chairman of the Audit Committee

William C. Kirby, Member of the Audit Committee

Shelley

E. Rigger, Member of the Audit Committee

Warren J. Olsen, Vice Chairman of the Audit Committee

15

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Set forth below is information with respect to persons who are registered as beneficial owners of more than 5% of the Fund’s outstanding shares as of

February 23, 2024.

|

|

|

|

|

|

|

|

|

|

|

| Title Of Class |

|

Name and Address |

|

Shares |

|

|

Percent

of

Class |

|

| Common Stock |

|

CEDE & CO Bowling Green STN

P. O. Box 20 New York, NY

10274-0020 |

|

|

7,197,253 |

|

|

|

99.73 |

% |

The shares held by Cede & Co. include the accounts set forth below. The information below is based on

publicly available information such as Schedule 13D and 13G disclosures filed with the SEC or other similar regulatory filings from foreign jurisdictions.

|

|

|

|

|

|

|

| Title Of Class |

|

Name and Address of

Beneficial Owner |

|

Amount and Nature of

Beneficial Ownership |

|

Percent

of Class |

| Common Stock |

|

City of London 77 Gracechurch Street,

London England EC3V OAS |

|

Has sole power to vote and dispose of 2,718,783 shares |

|

37.15% |

|

|

|

|

| Common Stock |

|

Lazard Asset Management LLC 30 Rockefeller

Plaza New York, New York 10112 |

|

Has sole power to vote and dispose of 1,193,467 shares |

|

16.31% |

|

|

|

|

| Common Stock |

|

Allspring Global Investments Holdings, LLC 525

Market Street, 10th Fl. San Francisco, CA 94105 |

|

Has sole power to vote and dispose of 849,699 shares |

|

11.61% |

|

|

|

|

| Common Stock |

|

1607 Capital Partners LLC 13 S 13th Street,

Suite 400 Richmond, Virginia 23219 |

|

Has sole power to vote and dispose of 662,740 shares |

|

9.05% |

16

MISCELLANEOUS

Proxies will be solicited by mail and may be solicited in person or by telephone or facsimile or other electronic means, by officers of the Fund or personnel

of the Administrator. The Fund has retained EQ Fund Solutions to assist in the proxy solicitation. The total cost of proxy solicitation services, including legal and printing fees, is estimated at $5,000, plus out-of-pocket expenses. The expenses connected with the solicitation of proxies including proxies solicited by the Fund’s officers or agents at the Meeting, by telephone or by facsimile or other

electronic means will be borne by the Fund. The Fund will reimburse banks, brokers, and other persons holding the Fund’s shares registered in their names or in the names of their nominees for their expenses incurred in sending proxy material to

and obtaining proxies from the beneficial owners of such shares.

In the event that sufficient votes in favor of the Proposal set forth in the Notice of

this Meeting are not received by April 16, 2024, the persons named as attorneys in the enclosed proxy may propose one or more adjournments of the Meeting to permit further solicitation of proxies. Any such adjournment will require the

affirmative vote of the holders of a majority of the shares present at the Meeting or by proxy at the session of the Meeting to be adjourned. The persons named as proxies in the enclosed proxy will vote in favor of such adjournment those proxies

which they are entitled to vote in favor of the Proposal. They will vote against any such adjournment those proxies required to be voted against the Proposal. The chairman of the Meeting also may adjourn the Meeting from time to time. Any

adjournment may be made to a date not more than 120 days after the original record date without notice other than announcement at the Meeting. At such adjourned meeting at which a quorum is present, any business may be transacted which might have

been transacted at the Meeting as originally notified. The costs of any such additional solicitation and of any adjourned session will be borne by the Fund.

17

STOCKHOLDER PROPOSALS

In order to submit a stockholder proposal to be considered for inclusion in the Fund’s proxy statement for the Fund’s 2025 Annual Meeting of

Stockholders, stockholder proposals must be received by the Fund (addressed to: The Taiwan Fund, Inc., c/o Secretary of the Fund/State Street Bank and Trust Company, One Congress Building, One Congress Street, Suite 1, Boston,

Massachusetts 02114-2016) not later than November 5, 2024. Any stockholder who desires to bring a proposal at the Fund’s 2025 Annual Meeting of Stockholders without including such proposal in the Fund’s proxy statement, must deliver

written notice thereof to the Secretary of the Fund (addressed to The Taiwan Fund, Inc., c/o Secretary off the Fund/State Street Bank and Trust Company, One Congress Building, One Congress Street, Suite 1, Boston, Massachusetts

02114-2016), not before January 16, 2025 and not later than February 15, 2025.

By order of the Board of Directors,

Brian F. Link

Secretary

The Taiwan Fund, Inc.

c/o State Street Bank and

Trust Company

One Congress Building, One Congress Street, Suite 1, Boston, Massachusetts 02114-2016Boston, Massachusetts 02206

March 5, 2024

18

|

|

|

|

|

| THE TAIWAN FUND, INC. PO Box

43131 Providence, RI 02940-3131 |

|

EVERY VOTE IS IMPORTANT

EASY VOTING OPTIONS: |

|

|

|

|

|

|

|

VOTE ON THE INTERNET

Log on to: www.proxy-direct.com or scan the QR code

Follow the on-screen instructions

available 24 hours |

|

|

|

|

|

|

|

VOTE BY PHONE

Call

1-800-337-3503

Follow the recorded instructions

available 24 hours |

|

|

|

|

|

|

|

VOTE BY MAIL

Vote, sign and date this Proxy

Card and return in the

postage-paid envelope |

|

|

|

|

|

|

|

VOTE IN PERSON

Attend Stockholder Meeting

2027 Massachusetts Avenue, Lexington, MA 02421 on April 16, 2024 |

Please detach at perforation before mailing.

|

|

|

|

|

| PROXY |

|

THE TAIWAN FUND, INC. |

|

|

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 16, 2024

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. The undersigned hereby appoints William C. Kirby and Brian F. Link, and each

of them, the proxies of the undersigned, with full power of substitution to each of them, to vote all shares of The Taiwan Fund, Inc. which the undersigned is entitled to vote at the Annual Meeting of Stockholders of The Taiwan Fund, Inc. to be held

at the Inn at Hastings Park, 2027 Massachusetts Avenue, Lexington, MA 02421 on Tuesday, April 16, 2024 at 9:00 a.m., local time, and at any adjournments thereof, (i) unless otherwise specified in the boxes provided on the reverse side

hereof, for the election of the Directors named on the reverse side and (ii) in their discretion, on any other business which may properly come before the meeting or any adjournments thereof. The undersigned hereby revokes all proxies with

respect to such shares heretofore given. The undersigned acknowledges receipt of the Proxy Statement dated March 5, 2024.

This proxy, when

properly executed, will be voted in the manner directed herein and, absent direction will be voted “FOR” Proposal 1.

|

|

|

|

|

|

|

|

|

VOTE VIA THE INTERNET: www.proxy-direct.com

VOTE VIA

TELEPHONE: 1-800-337-3503 |

TWN_33787_022724

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED ON THE REVERSE SIDE.

EVERY STOCKHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders to be Held on April 16, 2024.

The Proxy Statement and Proxy Card for this meeting are available at: https://www.proxy-direct.com/twn-33787

IF YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU NEED NOT RETURN THIS PROXY CARD

Please detach at perforation before mailing.

|

|

|

|

|

|

TO VOTE MARK BLOCKS BELOW IN BLUE OR BLACK INK AS SHOWN IN THIS EXAMPLE:

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSAL 1: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR |

|

WITHHOLD |

|

FOR ALL |

|

|

| 1. |

|

To elect five Directors to serve for the ensuing year: |

|

|

|

ALL |

|

ALL |

|

EXCEPT |

|

|

|

|

01. |

|

William C. Kirby |

|

02. |

|

Anthony S. Clark |

|

03. Thomas G. Kamp |

|

☐ |

|

☐ |

|

☐ |

|

|

|

|

04. |

|

Warren J. Olsen |

|

05. |

|

Shelley E. Rigger |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark the box “FOR ALL

EXCEPT” and write the nominee’s number on the line

provided. |

|

|

|

|

|

|

|

| B |

|

Authorized Signatures — This section must be completed for your vote to be counted. — Sign and Date Below |

| Note: |

Please sign exactly as your name(s) appear(s) on this Proxy Card, and date it. When shares are held jointly,

each holder should sign. When signing as attorney, executor, administrator, trustee, guardian, officer of corporation or other entity or in another representative capacity, please give the full title under the signature. |

|

|

|

|

|

|

|

|

|

| Date (mm/dd/yyyy) – Please print date below |

|

|

|

Signature 1 – Please keep signature within the box |

|

|

|

Signature 2 – Please keep signature within the box |

| / / |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

xxxxxxxxxxxxxx |

|

TWN 33787 |

|

xxxxxxxx |

|

|

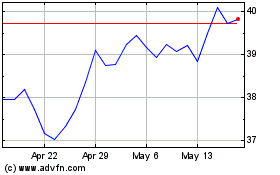

Taiwan (NYSE:TWN)

Historical Stock Chart

From Apr 2024 to May 2024

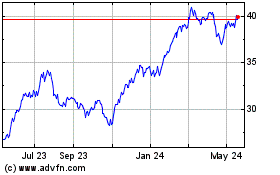

Taiwan (NYSE:TWN)

Historical Stock Chart

From May 2023 to May 2024