0000102037false00001020372023-08-012023-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________________________________

FORM 8-K

____________________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 1, 2023

____________________________________________

UNIVERSAL CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________

| | | | | | | | | | | | | | |

| Virginia | | 001-00652 | | 54-0414210 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | |

| 9201 Forest Hill Avenue, | Richmond, | Virginia | | 23235 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code

(804) 359-9311

Not applicable

(Former name or former address, if changed since last report)

____________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbols | Name of Exchange on which registered |

| Common Stock, no par value | UVV | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

Universal Corporation (the “Company”) issued a press release on August 2, 2023, discussing its results for the quarter ended June 30, 2023. The press release is attached as Exhibit 99.1 and is incorporated by reference into this Item 2.02.

Item 5.07. Submission of Matters to a Vote of Security Holders.

At the 2023 Annual Meeting of Shareholders (the "2023 Annual Meeting"), held August 1, 2023, the Company’s shareholders (i) elected each of the persons listed below as a director for a term of two or three years, (ii) approved a non-binding advisory resolution approving the compensation of the Company’s named executive officers, (iii) provided a non-binding advisory vote on the frequency of the non-binding advisory vote on the compensation of the Company's named executive officers, (iv) ratified the appointment of Ernst & Young LLP as the independent registered public accounting firm for the fiscal year ending March 31, 2024, and (v) approved the Universal Corporation 2023 Stock Incentive Plan.

As of June 6, 2023, the Company had 24,623,593 shares of common stock outstanding, each of which was entitled to one vote per share. The majority of shares entitled to vote constituted a quorum.

The Company’s shareholders voted as follows:

Proposal 1 - Election of Directors. | | | | | | | | | | | | | | | | | | | | |

| | For | | Withheld | | Broker Non-Votes |

| | | | | | |

| George C. Freeman, III (two year term) | | 19,142,194 | | 204,007 | | 2,641,753 |

| | | | | | |

| Lennart R Freeman (two year term) | | 19,115,861 | | 230,340 | | 2,641,753 |

| | | | | | |

| Thomas H. Johnson (three year term) | | 15,289,839 | | 4,056,362 | | 2,641,753 |

| | | | | | |

| Arthur J. Schick, Jr. (three year term) | | 19,209,738 | | 136,463 | | 2,641,753 |

| | | | | | |

| Jacqueline T. Williams (three year term) | | 18,961,772 | | 384,429 | | 2,641,753 |

| | | | | | |

Messrs. Johnson and Schick and Ms. Williams were elected to three-year terms. Messrs. G. Freeman and L. Freeman were elected to two-year terms. The terms of office of the following directors continued after the 2023 Annual Meeting: Diana F. Cantor, Michael T. Lawton, Robert C. Sledd, and Thomas H. Tullidge, Jr..

Proposal 2 - Approval of a non-binding advisory resolution approving the compensation of the Company’s named executive officers.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| | | | | | |

| 18,844,407 | | 415,083 | | 86,711 | | 2,641,753 |

Proposal 3 - A non-binding advisory vote on the frequency (every one, two or three years) of the non-binding advisory vote on the compensation of the Company's named executive officers.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 1 Year | | 2 Years | | 3 Years | | Abstain | | Broker Non-Votes |

| | | | | | | | |

| 17,231,911 | | 41,006 | | 2,023,495 | | 49,789 | | 2,641,753 |

Proposal 4 - Ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm for the fiscal year ending March 31, 2024.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| | | | | | |

| 21,714,659 | | 215,952 | | 57,343 | | — |

Proposal 5 - Approval of the Universal Corporation 2023 Stock Incentive Plan.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstain | | Broker Non-Votes |

| | | | | | |

| 18,562,399 | | 716,074 | | 67,728 | | 2,641,753 |

Item 8.01. Other Events.

Effective August 1, 2023, the Company’s Board of Directors appointed Thomas H. Johnson as the Lead Independent Director to serve until the Company’s next Annual Meeting of Shareholders which is expected to be held August 6, 2024.

On August 2, 2023, the Company issued a press release announcing a quarterly dividend for the Company’s common stock. The press release is attached as Exhibit 99.2 and is incorporated by reference into this Item 8.01.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibits | | |

| | | |

| No. | | Description |

| | | |

| 99.1 | | |

| | | |

| 99.2 | | |

| | | |

| 101 | | Interactive Data File (submitted electronically herewith).* |

| | | |

| | | 101.INS XBRL Instance Document - the instance document does not appear in the Interactive Data File because its Inline XBRL tags are embedded within the Inline XBRL document. 101.SCH XBRL Taxonomy Extension Schema Document 101.CAL XBRL Taxonomy Extension Calculation Linkbase Document 101.DEF XBRL Taxonomy Extension Definition Linkbase Document 101.LAB XBRL Taxonomy Extension Label Linkbase Document 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document In accordance with Rule 406T of Regulation S-T, the Inline XBRL related information in Exhibit 101 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section and shall not be part of any registration or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. |

| | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

__________

*Filed herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | UNIVERSAL CORPORATION |

| | (Registrant) |

| | | | |

| Date: | August 2, 2023 | By: | /s/ Preston D. Wigner | |

| | | Preston D. Wigner | |

| | | Vice President, General Counsel, and Secretary |

Exhibit Index

| | | | | | | | |

| Exhibit | | |

| Number | | Document |

| | |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 101 | | Interactive Data File (submitted electronically herewith).* |

| | |

| | 101.INS XBRL Instance Document - the instance document does not appear in the Interactive Data File because its Inline XBRL tags are embedded within the Inline XBRL document. 101.SCH XBRL Taxonomy Extension Schema Document 101.CAL XBRL Taxonomy Extension Calculation Linkbase Document 101.DEF XBRL Taxonomy Extension Definition Linkbase Document 101.LAB XBRL Taxonomy Extension Label Linkbase Document 101.PRE XBRL Taxonomy Extension Presentation Linkbase Document In accordance with Rule 406T of Regulation S-T, the Inline XBRL related information in Exhibit 101 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section and shall not be part of any registration or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. |

| | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) |

__________

*Filed herewith

Exhibit 99.1

P.O. Box 25099 ~ Richmond, VA 23260 ~ Phone: (804) 359-9311 ~ Fax: (804) 254-3584

______________________________________________________________________________________________________

P R E S S R E L E A S E

| | | | | | | | | | | |

| CONTACT: | Universal Corporation Investor Relations | RELEASE: | 4:16 p.m. ET |

| Phone: (804) 359-9311 | | |

| Fax: (804) 254-3584 | | |

| Email: investor@universalleaf.com | | |

Universal Corporation Reports First Quarter Results

Richmond, VA August 2, 2023 / PRNEWSWIRE

___________________________________________________________________________________

George C. Freeman, III, Chairman, President, and Chief Executive Officer of Universal Corporation (NYSE:UVV), stated, “Our tobacco operations performed well and are off to a good start for our fiscal year 2024. Segment operating income was higher for our Tobacco Operations segment in the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022, even though we did not have the benefit of large shipments of carryover tobacco from certain origins that we had in first quarter of fiscal year 2023. Demand for leaf tobacco from our customers remains strong, and our level of uncommitted tobacco inventory was 16% of tobacco inventory at June 30, 2023. We are forecasting increased leaf tobacco production in fiscal year 2024, compared to fiscal year 2023, and believe that even with that increased production, leaf tobacco will remain in an undersupply position.

“We are pleased with the ongoing progress we are making to integrate our plant-based ingredients platform, and we continue to execute on our strategy to invest in and expand the platform’s capabilities for future growth in existing and new products. For the quarter ended June 30, 2023, the platform faced soft demand, due to high customer inventory levels, and our earnings for the platform were below our expectations. We believe that many of our customers are continuing to draw down on their raw materials inventories after building inventories to protect against prior supply chain uncertainties. These inventory challenges have been more extensive and persistent in duration than we had forecasted. In addition, the expansion of the platform’s capabilities has added to our costs, while a sharp drop in certain new crop raw material prices resulted in inventory write-downs in the quarter ended June 30, 2023. We continue to believe the inventory challenges are temporary and expect excess inventory levels held by our customers to eventually work down. One of the main objectives of our current investments in our plant-based ingredients platform is to expand our portfolio to include more value-added products for our customers.

Universal Corporation

Page 2

We believe that we are well-positioned to capitalize on demand from our customers, and that with the investments we are making, we are a stronger partner for current and future customers due to the expanded range of capabilities and products that we can offer them. We are encouraged by ongoing customer engagements regarding existing business and new business opportunities.

“Our costs, notably interest costs and prices for green leaf tobacco, remained high in the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022. Interest costs were more than double on higher interest rates in the first quarter of fiscal year 2024, compared to the same quarter in fiscal year 2023. Our debt balances, the sum of notes payable and overdrafts and long-term obligations, were relatively flat in the quarter ended June 30, 2023, compared to the same quarter in the prior fiscal year, as working capital requirements to fund larger tobacco crops and higher green tobacco prices were partially offset by increased customer deposits.

“We continue to make transparency around our sustainability efforts and goals a priority. We recently completed our annual submission to the global non-profit organization CDP regarding climate change, forestry, and water risk to provide more information on our achievements in these areas to our stakeholders. We continue to work with third parties to verify our emissions and establish our pathway to net zero through the identification and prioritization of high-impact projects throughout our footprint.”

| | | | | | | | | | | | | | | | | | | | | | | |

| FINANCIAL HIGHLIGHTS | | | | | | | |

| Three Months Ended June 30, | | Change |

| (in millions of dollars, except per share data) | 2023 | | 2022 | | $ | | % |

| | | | | | | |

| Consolidated Results | | | | | | | |

| Sales and other operating revenue | $ | 517.7 | | | $ | 429.8 | | | $ | 87.9 | | | 20 | % |

| Cost of goods sold | $ | 431.2 | | | $ | 350.1 | | | $ | 81.1 | | | 23 | % |

| Gross Profit Margin | 16.7 | % | | 18.5 | % | | | | -183 bps |

| Selling, general and administrative expenses | $ | 75.5 | | | $ | 66.5 | | | $ | 9.0 | | | 14 | % |

| | | | | | | |

| Operating income (loss) | $ | 11.0 | | | $ | 13.3 | | | $ | (2.2) | | | (17) | % |

| | | | | | | |

| Diluted earnings (loss) per share (as reported) | $ | (0.08) | | | $ | 0.27 | | | $ | (0.35) | | | (130) | % |

| Adjusted diluted earnings (loss) per share (non-GAAP)* | $ | (0.08) | | | $ | 0.25 | | | $ | (0.33) | | | (132) | % |

| Segment Results | | | | | | | |

| Tobacco operations sales and other operating revenues | $ | 443.9 | | | $ | 348.1 | | | $ | 95.8 | | | 28 | % |

| Tobacco operations operating income | $ | 8.9 | | | $ | 8.1 | | | $ | 0.8 | | | 9 | % |

| Ingredients operations sales and other operating revenues | $ | 73.8 | | | $ | 81.8 | | | $ | (7.9) | | | (10) | % |

| Ingredient operations operating income (loss) | $ | (2.0) | | | $ | 4.6 | | | $ | (6.6) | | | (144) | % |

*See Reconciliation of Certain Non-GAAP Financial Measures in Other Items below.

Net loss for the quarter ended June 30, 2023, was $(2.1) million, or $(0.08) per diluted share, compared with net income of $6.8 million, or $0.27 per diluted share, for the quarter ended June 30, 2022. Excluding certain other non-recurring items, detailed in Other Items below, net income and diluted earnings per share decreased by $8.2 million and $0.33, respectively, for the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022. Operating income of $11.0 million for the quarter ended June 30, 2023, decreased by $2.2 million, compared to operating income of $13.3 million for the quarter ended June 30, 2022.

Universal Corporation

Page 3

Consolidated revenues increased by $87.9 million to $517.7 million for the three months ended June 30, 2023, compared to the same period in fiscal year 2023, on higher tobacco sales prices and a favorable product and geographic mix in our Tobacco Operations segment.

TOBACCO OPERATIONS

The first fiscal quarter is historically a slow quarter for our tobacco businesses. Operating income for the Tobacco Operations segment increased by $0.8 million to $8.9 million for the quarter ended June 30, 2023, compared with the quarter ended June 30, 2022. Although tobacco sales volumes were down, Tobacco Operations segment operating income was up largely on a more favorable product and geographic mix in the quarter ended June 30, 2023, compared to the same quarter in the prior fiscal year, when a large amount of carryover tobacco crops were shipped. Prices for green leaf tobacco in the quarter ended June 30, 2023, were also higher than in the quarter ended June 30, 2022. Carryover crop shipments were significantly lower in Brazil in the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022. In Europe, sales volumes and revenues were up due to shipment timing and a favorable product mix in the quarter ended June 30, 2023, compared to the same quarter in the prior fiscal year. Carryover crop shipments were up in North America due to shipment timing in the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022. Results for our oriental tobacco joint venture were down significantly in the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022, on unfavorable foreign currency comparisons and higher interest expenses. Selling, general, and administrative expenses for the Tobacco Operations segment were higher in the quarter ended June 30, 2023, compared to June 30, 2022, primarily on higher compensation costs and higher provisions on advances to suppliers following adverse weather conditions in Africa. Revenues for the Tobacco Operations segment of $443.9 million for the quarter ended June 30, 2023, were up $95.8 million, compared to the same period in the prior fiscal year, on higher tobacco sales prices and a favorable product and geographic mix.

INGREDIENTS OPERATIONS

Operating loss for the Ingredients Operations segment was $(2.0) million for the quarter ended June 30, 2023, compared to operating income of $4.6 million for the quarter ended June 30, 2022. Sales for all of our businesses in this segment were down in the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022, on lower demand due to our customers continuing to carry high inventory levels. Prices for some key raw materials were down in the quarter ended June 30, 2023, compared to the quarter ended June 30, 2022. Inventory write-downs for the Ingredients Operations segment were higher in the quarter ended June 30, 2023, compared to the same quarter in the prior fiscal year, on the changes in customer demand and new crop raw material prices. Selling, general, and administrative expenses for this segment increased in the quarter ended June 30, 2023, compared to the same quarter in the prior fiscal year, largely on higher labor costs and investments in product development capabilities. Revenues for the Ingredients Operations segment of $73.8 million for the quarter ended June 30, 2023, were down $7.9 million compared to the quarter ended June 30, 2022, largely on lower sales volumes.

OTHER ITEMS

Cost of goods sold in the quarter ended June 30, 2023, increased by 23% to $431.2 million, compared with the same period in the prior fiscal year, largely due to higher green tobacco costs. Selling, general, and administrative costs for the quarter ended June 30, 2023, increased by $9.0 million to $75.5 million, compared to the same period in the prior fiscal year, primarily on weakening of the U.S. dollar,

Universal Corporation

Page 4

increased compensation costs, and higher provisions on advances to suppliers. Interest expense for the quarter ended June 30, 2023, increased by $8.8 million to $15.5 million on increased costs from higher interest rates.

For the three months ended June 30, 2023, our consolidated effective income tax rate on pre-tax loss was a benefit of 21.6%. For the three months ended June 30, 2022, our consolidated effective income tax rate on pre-tax income was 54.6%. The consolidated effective income tax rate for the three months ended June 30, 2022, was affected by the sale of our idled Tanzania operations which resulted in $1.1 million of additional income taxes. Without this item, the consolidated effective income tax rate for the three months ended June 30, 2022, would have been approximately 36.2%. Additionally, the sale of our idled Tanzania operations resulted in a $1.8 million reduction to consolidated interest expense related to an uncertain tax position.

Reconciliation of Certain Non-GAAP Financial Measures

The following table sets forth certain non-recurring items included in reported results to reconcile adjusted net income to net income attributable to Universal Corporation:

| | | | | | | | | | | | | | | |

| | | | | |

| | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted Net Income (Loss) and Adjusted Diluted Earnings (Loss) Per Share Reconciliation | | |

| | | | | | | |

| (in thousands) | | | Three Months Ended June 30, |

| | | | | 2023 | | 2022 |

| As Reported: Net income (loss) available to Universal Corporation | | | | | $ | (2,064) | | | $ | 6,830 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Interest expense reversal on uncertain tax position and income tax from sale of operations in Tanzania | | | | | — | | | (1,816) | |

| | | | | | | |

| Total of Non-GAAP adjustments to income (loss) before income taxes | | | | | $ | — | | | $ | (1,816) | |

| | | | | | | |

| Non-GAAP adjustments to income taxes | | | | | | | |

| Income tax expense from sale of operations in Tanzania | | | | | — | | | 1,132 | |

| | | | | | | |

| Total of income tax impacts for Non-GAAP adjustments to income (loss) before income taxes and Non-GAAP adjustment to income taxes | | | | | — | | | 1,132 | |

| | | | | | | |

| As adjusted: Net income (loss) attributable to Universal Corporation (Non-GAAP) | | | | | $ | (2,064) | | | $ | 6,146 | |

| As reported: Diluted earnings (loss) per share | | | | | $ | (0.08) | | | $ | 0.27 | |

| As adjusted: Diluted earnings (loss) per share | | | | | $ | (0.08) | | | $ | 0.25 | |

Universal Corporation

Page 5

Additional information

Amounts described as net income (loss) and earnings (loss) per diluted share in the previous discussion are attributable to Universal Corporation and exclude earnings related to non-controlling interests in subsidiaries. Adjusted operating income (loss), adjusted net income (loss) attributable to Universal Corporation, adjusted diluted earnings (loss) per share, and the total for segment operating income (loss) referred to in this discussion are non-GAAP financial measures. These measures are not financial measures calculated in accordance with GAAP and should not be considered as substitutes for operating income (loss), net income (loss) attributable to Universal Corporation, diluted earnings (loss) per share, cash from operating activities or any other operating or financial performance measure calculated in accordance with GAAP, and may not be comparable to similarly-titled measures reported by other companies. A reconciliation of adjusted operating income (loss) to consolidated operating (income), adjusted net income (loss) attributable to Universal Corporation to consolidated net income (loss) attributable to Universal Corporation and adjusted diluted earnings (loss) per share to diluted earnings (loss) per share are provided in Other Items above. In addition, we have provided a reconciliation of the total for segment operating income (loss) to consolidated operating income (loss) in Note 3 "Segment Information" to the consolidated financial statements. Management evaluates the consolidated Company and segment performance excluding certain significant charges or credits. We believe these non-GAAP financial measures, which exclude items that we believe are not indicative of our core operating results, provide investors with important information that is useful in understanding our business results and trends.

This release includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The Company cautions readers that any statements contained herein regarding financial condition, results of operation, and future business plans, operations, opportunities, and prospects for its performance are forward-looking statements based upon management’s current knowledge and assumptions about future events, and involve risks and uncertainties that could cause actual results, performance, or achievements to be materially different from any anticipated results, prospects, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but are not limited to, impacts of the COVID-19 pandemic and subvariants; success in pursuing strategic investments or acquisitions and integration of new businesses and the impact of these new businesses on future results; product purchased not meeting quality and quantity requirements; our reliance on a few large customers; its ability to maintain effective information technology systems and safeguard confidential information; anticipated levels of demand for and supply of its products and services; costs incurred in providing these products and services including increased transportation costs and delays attributed to global supply chain challenges; timing of shipments to customers; higher inflation rates; changes in market structure; government regulation and other stakeholder expectations; economic and political conditions in the countries in which we and our customers operate, including the ongoing impacts from the conflict in Ukraine; product taxation; industry consolidation and evolution; changes in exchange rates and interest rates; impacts of regulation and litigation on its customers; industry-specific risks related to its plant-based ingredient businesses; exposure to certain regulatory and financial risks related to climate change; changes in estimates and assumptions underlying its critical accounting policies; the promulgation and adoption of new accounting standards, new government regulations and interpretation of existing standards and regulations; and general economic, political, market, and weather conditions. Actual results, therefore, could vary from those expected. A further list and description of these risks, uncertainties, and other factors can be found in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2023, and in other documents the Company files with the Securities and Exchange Commission. This information should be read in conjunction with the Annual Report on Form 10-K for the years ended March 31, 2023. The Company cautions investors not to place undue reliance on any forward-looking statements as these statements speak only as of the date when made, and it undertakes no obligation to update any forward-looking statements made.

At 5:00 p.m. (Eastern Time) on August 2, 2023, the Company will host a conference call to discuss these results. Those wishing to listen to the call may do so by visiting www.universalcorp.com at that time. A replay of the webcast will be available at that site through November 2, 2023. A taped replay of the call will be available through August 16, 2023, by dialing (877) 674-7070. The confirmation number to access the replay is 239241.

Universal Corporation

Page 6

Universal Corporation (NYSE: UVV), headquartered in Richmond, Virginia, is a global business-to-business agri-products supplier to consumer product manufacturers, operating in over 30 countries on five continents. We strive to be the supplier of choice for our customers by leveraging our farmer base, our commitment to a sustainable supply chain, and our ability to provide high-quality, customized, traceable, value-added agri-products essential for our customers’ requirements. We find innovative solutions to serve our customers and have been meeting their agri-product needs for more than 100 years. Our principal focus since our founding in 1918 has been tobacco, and we are the leading global leaf tobacco supplier. Through our plant-based ingredients platform, we provide a variety of value-added manufacturing processes to produce high-quality, specialty vegetable- and fruit-based ingredients as well as botanical extracts and flavorings for the food and beverage end markets. For more information, visit www.universalcorp.com.

Universal Corporation

Page 7

UNIVERSAL CORPORATION

CONSOLIDATED STATEMENTS OF INCOME

(in thousands of dollars, except per share data)

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended June 30, |

| | | | | | 2023 | | 2022 |

| | | | (Unaudited) |

| Sales and other operating revenues | | | | | | $ | 517,722 | | | $ | 429,822 | |

| Costs and expenses | | | | | | | | |

| Cost of goods sold | | | | | | 431,210 | | | 350,104 | |

| Selling, general and administrative expenses | | | | | | 75,477 | | | 66,452 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Operating income | | | | | | 11,035 | | | 13,266 | |

| Equity in pretax earnings (loss) of unconsolidated affiliates | | | | | | (4,166) | | | (553) | |

| Other non-operating income (expense) | | | | | | 725 | | | (62) | |

| Interest income | | | | | | 1,365 | | | 237 | |

| Interest expense | | | | | | 15,543 | | | 6,724 | |

| Income (loss) before income taxes and other items | | | | | | (6,584) | | | 6,164 | |

| Income taxes | | | | | | (1,423) | | | 3,363 | |

| Net income (loss) | | | | | | (5,161) | | | 2,801 | |

| Less: net loss (income) attributable to noncontrolling interests in subsidiaries | | | | | | 3,097 | | | 4,029 | |

| Net income (loss) attributable to Universal Corporation | | | | | | $ | (2,064) | | | $ | 6,830 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Earnings (loss) per share: | | | | | | | | |

| Basic | | | | | | $ | (0.08) | | | $ | 0.28 | |

| Diluted | | | | | | $ | (0.08) | | | $ | 0.27 | |

See accompanying notes.

Universal Corporation

Page 8

UNIVERSAL CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands of dollars)

| | | | | | | | | | | | | | | | | | | | |

| | June 30, | | June 30, | | March 31, |

| | 2023 | | 2022 | | 2023 |

| | (Unaudited) | | (Unaudited) | | |

| ASSETS | | | | | | |

| Current assets | | | | | | |

| Cash and cash equivalents | | $ | 80,518 | | | $ | 86,566 | | | $ | 64,690 | |

| Accounts receivable, net | | 375,564 | | | 319,114 | | | 402,073 | |

| Advances to suppliers, net | | 111,176 | | | 99,875 | | | 170,801 | |

| Accounts receivable—unconsolidated affiliates | | 73,286 | | | 48,512 | | | 12,210 | |

| Inventories—at lower of cost or net realizable value: | | | | | | |

| Tobacco | | 1,100,722 | | | 1,080,362 | | | 833,876 | |

| Other | | 198,730 | | | 198,966 | | | 202,907 | |

| Prepaid income taxes | | 21,640 | | | 11,370 | | | 16,493 | |

| | | | | | |

| Other current assets | | 93,153 | | | 90,380 | | | 99,840 | |

| Total current assets | | 2,054,789 | | | 1,935,145 | | | 1,802,890 | |

| | | | | | |

| Property, plant and equipment | | | | | | |

| Land | | 24,930 | | | 23,872 | | | 24,926 | |

| Buildings | | 312,014 | | | 294,179 | | | 311,138 | |

| Machinery and equipment | | 705,045 | | | 669,967 | | | 689,220 | |

| | 1,041,989 | | | 988,018 | | | 1,025,284 | |

| Less accumulated depreciation | | (685,042) | | | (642,918) | | | (674,122) | |

| | 356,947 | | | 345,100 | | | 351,162 | |

| Other assets | | | | | | |

| Operating lease right-of-use assets | | 36,890 | | | 41,099 | | | 40,505 | |

| Goodwill, net | | 213,893 | | | 213,902 | | | 213,922 | |

| Other intangibles, net | | 77,290 | | | 89,352 | | | 80,101 | |

| Investments in unconsolidated affiliates | | 73,466 | | | 75,188 | | | 76,184 | |

| Deferred income taxes | | 15,187 | | | 14,532 | | | 13,091 | |

| Pension asset | | 10,516 | | | 12,704 | | | 9,984 | |

| Other noncurrent assets | | 48,681 | | | 52,356 | | | 51,343 | |

| | 475,923 | | | 499,133 | | | 485,130 | |

| | | | | | |

| Total assets | | $ | 2,887,659 | | | $ | 2,779,378 | | | $ | 2,639,182 | |

See accompanying notes.

Universal Corporation

Page 9

UNIVERSAL CORPORATION

CONSOLIDATED BALANCE SHEETS

(in thousands of dollars)

| | | | | | | | | | | | | | | | | | | | |

| | June 30, | | June 30, | | March 31, |

| | 2023 | | 2022 | | 2023 |

| | (Unaudited) | | (Unaudited) | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | |

| Current liabilities | | | | | | |

| Notes payable and overdrafts | | $ | 359,832 | | | $ | 454,659 | | | $ | 195,564 | |

| Accounts payable | | 88,362 | | | 121,702 | | | 83,213 | |

| Accounts payable—unconsolidated affiliates | | 1,495 | | | 88 | | | 5,830 | |

| Customer advances and deposits | | 103,436 | | | 19,438 | | | 3,061 | |

| Accrued compensation | | 20,890 | | | 15,933 | | | 33,108 | |

| Income taxes payable | | 5,620 | | | 5,708 | | | 3,274 | |

| Current portion of operating lease liabilities | | 10,673 | | | 10,568 | | | 11,404 | |

| Accrued expenses and other current liabilities | | 127,564 | | | 113,916 | | | 106,533 | |

| Current portion of long-term debt | | — | | | — | | | — | |

| Total current liabilities | | 717,872 | | | 742,012 | | | 441,987 | |

| | | | | | |

| Long-term debt | | 616,948 | | | 518,798 | | | 616,809 | |

| Pensions and other postretirement benefits | | 42,725 | | | 51,528 | | | 42,769 | |

| Long-term operating lease liabilities | | 23,343 | | | 28,727 | | | 25,540 | |

| Other long-term liabilities | | 29,160 | | | 30,024 | | | 32,512 | |

| Deferred income taxes | | 44,432 | | | 48,230 | | | 42,613 | |

| Total liabilities | | 1,474,480 | | | 1,419,319 | | | 1,202,230 | |

| | | | | | |

| Shareholders’ equity | | | | | | |

| Universal Corporation: | | | | | | |

| Preferred stock: | | | | | | |

| Series A Junior Participating Preferred Stock, no par value, 500,000 shares authorized, none issued or outstanding | | — | | | — | | | — | |

| | | | | | |

| Common stock, no par value, 100,000,000 shares authorized 24,636,600 shares issued and outstanding at June 30, 2023 (24,605,889 at June 30, 2022 and 24,555,361 at March 31, 2023) | | 338,445 | | | 332,520 | | | 337,247 | |

| Retained earnings | | 1,114,822 | | | 1,081,309 | | | 1,136,898 | |

| Accumulated other comprehensive loss | | (72,547) | | | (88,066) | | | (77,057) | |

| Total Universal Corporation shareholders' equity | | 1,380,720 | | | 1,325,763 | | | 1,397,088 | |

| Noncontrolling interests in subsidiaries | | 32,459 | | | 34,296 | | | 39,864 | |

| Total shareholders' equity | | 1,413,179 | | | 1,360,059 | | | 1,436,952 | |

| | | | | | |

| Total liabilities and shareholders' equity | | $ | 2,887,659 | | | $ | 2,779,378 | | | $ | 2,639,182 | |

See accompanying notes.

Universal Corporation

Page 10

UNIVERSAL CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of dollars) | | | | | | | | | | | | | | |

| | Three Months Ended June 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net income (loss) | | $ | (5,161) | | | $ | 2,801 | |

| Adjustments to reconcile net income (loss) to net cash used by operating activities: | | | | |

| Depreciation and amortization | | 14,754 | | | 14,129 | |

| | | | |

| Net provision for losses (recoveries) on advances to suppliers | | 1,382 | | | (42) | |

| Inventory writedowns | | 2,327 | | | 4,853 | |

| Stock-based compensation expense | | 3,859 | | | 3,682 | |

| Foreign currency remeasurement (gain) loss, net | | 1,530 | | | (968) | |

| Foreign currency exchange contracts | | 7,803 | | | 9,920 | |

| Deferred income taxes | | (2,406) | | | (3,377) | |

| Equity in net loss (income) of unconsolidated affiliates, net of dividends | | 2,630 | | | 443 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Other, net | | 5 | | | 1,400 | |

| Changes in operating assets and liabilities, net: | | (130,614) | | | (258,612) | |

| Net cash used by operating activities | | (103,891) | | | (225,771) | |

| | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| Purchase of property, plant and equipment | | (17,960) | | | (15,070) | |

| Proceeds from sale of business, net of cash held by the business | | — | | | 1,168 | |

| | | | |

| Proceeds from sale of property, plant and equipment | | 326 | | | 292 | |

| | | | |

| Net cash used by investing activities | | (17,634) | | | (13,610) | |

| | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Issuance of short-term debt, net | | 163,804 | | | 271,663 | |

| | | | |

| | | | |

| Dividends paid to noncontrolling interests | | (4,164) | | | (5,145) | |

| | | | |

| | | | |

| | | | |

| | | | |

| Dividends paid on common stock | | (19,398) | | | (19,155) | |

| | | | |

| Other | | (2,893) | | | (1,892) | |

| Net cash provided (used) by financing activities | | 137,349 | | | 245,471 | |

| | | | |

| Effect of exchange rate changes on cash, restricted cash and cash equivalents | | 4 | | | (1,172) | |

| Net increase (decrease) in cash, restricted cash and cash equivalents | | 15,828 | | | 4,918 | |

| Cash, restricted cash and cash equivalents at beginning of year | | 64,690 | | | 87,648 | |

| | | | |

| Cash, restricted cash and cash equivalents at end of period | | $ | 80,518 | | | $ | 92,566 | |

| | | | |

| Supplemental Information: | | | | |

| Cash and cash equivalents | | $ | 80,518 | | | $ | 86,566 | |

| Restricted cash (Other noncurrent assets) | | — | | | 6,000 | |

| Total cash, restricted cash and cash equivalents | | $ | 80,518 | | | $ | 92,566 | |

See accompanying notes.

Universal Corporation

Page 11

NOTE 1. BASIS OF PRESENTATION

Universal Corporation, which together with its subsidiaries is referred to herein as “Universal” or the “Company,” is a global business-to-business agri-products supplier to consumer product manufacturers. The Company is the leading global leaf tobacco supplier and provides high-quality plant-based ingredients to food and beverage end markets. Because of the seasonal nature of the Company’s business, the results of operations for any fiscal quarter will not necessarily be indicative of results to be expected for other quarters or a full fiscal year. All adjustments necessary to state fairly the results for the period have been included and were of a normal recurring nature. These financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2023 (the “2023 Annual Report on Form 10-K”).

NOTE 2. EARNINGS PER SHARE

The following table sets forth the computation of basic and diluted earnings per share:

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended June 30, |

| (in thousands, except share and per share data) | | | | | | 2023 | | 2022 |

| | | | | | | | |

| Basic Earnings (Loss) Per Share | | | | | | | | |

| Numerator for basic earnings (loss) per share | | | | | | | | |

| Net income (loss) attributable to Universal Corporation | | | | | | $ | (2,064) | | | $ | 6,830 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Denominator for basic earnings (loss) per share | | | | | | | | |

| Weighted average shares outstanding | | | | | | 24,842,171 | | | 24,769,015 | |

| | | | | | | | |

| Basic earnings (loss) per share | | | | | | $ | (0.08) | | | $ | 0.28 | |

| | | | | | | | |

| Diluted Earnings (Loss) Per Share | | | | | | | | |

| Numerator for diluted earnings (loss) per share | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income (loss) attributable to Universal Corporation | | | | | | $ | (2,064) | | | $ | 6,830 | |

| | | | | | | | |

| Denominator for diluted earnings (loss) per share: | | | | | | | | |

| Weighted average shares outstanding | | | | | | 24,842,171 | | | 24,769,015 | |

| Effect of dilutive securities | | | | | | | | |

| | | | | | | | |

| Employee and outside director share-based awards | | | | | | — | | | 166,539 | |

| Denominator for diluted earnings per share | | | | | | 24,842,171 | | | 24,935,554 | |

| | | | | | | | |

| Diluted earnings (loss) per share | | | | | | $ | (0.08) | | | $ | 0.27 | |

Universal Corporation

Page 12

NOTE 3. SEGMENT INFORMATION

The Company conducts operations across two reportable operating segments, Tobacco Operations and Ingredients Operations.

The Tobacco Operations segment activities involve selecting, procuring, processing, packing, storing, shipping, and financing leaf tobacco for sale to, or for the account of, manufacturers of consumer tobacco products throughout the world. Through various operating subsidiaries located in tobacco-growing countries around the world and significant ownership interests in unconsolidated affiliates, the Company processes and/or sells flue-cured and burley tobaccos, dark air-cured tobaccos, and oriental tobaccos. Flue-cured, burley, and oriental tobaccos are used principally in the manufacture of cigarettes, and dark air-cured tobaccos are used mainly in the manufacture of cigars, pipe tobacco, and smokeless tobacco products. Some of these tobacco types are also increasingly used in the manufacture of non-combustible tobacco products that are intended to provide consumers with an alternative to traditional combustible products. The Tobacco Operations segment also provides physical and chemical product testing and smoke testing for tobacco customers. A substantial portion of the Company’s Tobacco Operations' revenues are derived from sales to a limited number of large, multinational cigarette and cigar manufacturers.

The Ingredients Operations segment provides its customers with a broad variety of plant-based ingredients for both human and pet consumption. The Ingredients Operations segment utilizes a variety of value-added manufacturing processes converting raw materials into a wide spectrum of fruit and vegetable juices, concentrates, dehydrated products, flavors, and botanical extracts. Customers for the Ingredients Operations segment include large multinational food and beverage companies, smaller independent manufacturers, and retail organizations. FruitSmart, Silva, and Shank's are the primary operations for the Ingredients Operations segment. FruitSmart manufactures fruit and vegetable juices, purees, concentrates, essences, fibers, seeds, seed oils, and seed powders. Silva is primarily a dehydrated product manufacturer of fruit and vegetable based flakes, dices, granules, powders, and blends. Shank's manufactures flavors and botanical extracts and also offers bottling and custom packaging for customers.

The Company currently evaluates the performance of its segments based on operating income (loss) after allocated overhead expenses, plus equity in the pretax earnings (loss) of unconsolidated affiliates. Operating results for the Company’s reportable segments for each period presented in the consolidated statements of income and comprehensive income were as follows.

| | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended June 30, |

| (in thousands of dollars) | | | | | | 2023 | | 2022 |

| | | | | | | | |

| SALES AND OTHER OPERATING REVENUES | | | | | | | | |

| Tobacco Operations | | | | | | $ | 443,908 | | | $ | 348,063 | |

| Ingredients Operations | | | | | | 73,814 | | | 81,759 | |

| Consolidated sales and other operating revenues | | | | | | $ | 517,722 | | | $ | 429,822 | |

| | | | | | | | |

| OPERATING INCOME (LOSS) | | | | | | | | |

| Tobacco Operations | | | | | | $ | 8,883 | | | $ | 8,116 | |

| Ingredients Operations | | | | | | (2,014) | | | 4,597 | |

| Segment operating income | | | | | | 6,869 | | | 12,713 | |

Deduct: Equity in pretax (earnings) loss of unconsolidated affiliates (1) | | | | | | 4,166 | | | 553 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Consolidated operating income | | | | | | $ | 11,035 | | | $ | 13,266 | |

(1)Equity in pretax earnings (loss) of unconsolidated affiliates is included in segment operating income (Tobacco Operations), but is reported below consolidated operating income and excluded from that total in the consolidated statements of income and comprehensive income.

Exhibit 99.2

P.O. Box 25099 ~ Richmond, VA 23260 ~ phone: (804) 359-9311 ~ fax (804) 254-3584

_____________________________________________________________________________________

P R E S S R E L E A S E

| | | | | | | | | | | |

| CONTACT: | Universal Corporation Investor Relations | RELEASE: | 4:15 p.m. ET |

| Phone: (804) 359-9311 | | |

| Fax: (804) 254-3584 | | |

| Email: investor@universalleaf.com | | |

Universal Corporation Announces Quarterly Dividend

Richmond, VA August 2, 2023 / PRNEWSWIRE

George C. Freeman, III, Chairman, President, and Chief Executive Officer of Universal Corporation (NYSE:UVV), announced today that the Company's Board of Directors declared a quarterly dividend of eighty cents ($0.80) per share on the common shares of the Company, payable November 6, 2023, to common shareholders of record at the close of business on October 9, 2023.

Universal Corporation (NYSE: UVV), headquartered in Richmond, Virginia, is a global business-to-business agri-products supplier to consumer product manufacturers, operating in over 30 countries on five continents. We strive to be the supplier of choice for our customers by leveraging our farmer base, our commitment to a sustainable supply chain, and our ability to provide high-quality, customized, traceable, value-added agri-products essential for our customers’ requirements. We find innovative solutions to serve our customers and have been meeting their agri-product needs for more than 100 years. Our principal focus since our founding in 1918 has been tobacco, and we are the leading global leaf tobacco supplier. Through our plant-based ingredients platform, we provide a variety of value-added manufacturing processes to produce high-quality, specialty vegetable- and fruit-based ingredients as well as botanical extracts and flavorings for the food and beverage end markets. For more information, visit www.universalcorp.com.

# # #

v3.23.2

Cover

|

Aug. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 01, 2023

|

| Entity Registrant Name |

UNIVERSAL CORPORATION

|

| Entity Incorporation, State or Country Code |

VA

|

| Entity File Number |

001-00652

|

| Entity Tax Identification Number |

54-0414210

|

| Entity Address, Address Line One |

9201 Forest Hill Avenue,

|

| Entity Address, City or Town |

Richmond,

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23235

|

| City Area Code |

804

|

| Local Phone Number |

359-9311

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, no par value

|

| Trading Symbol |

UVV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000102037

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

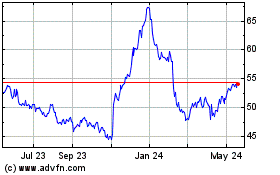

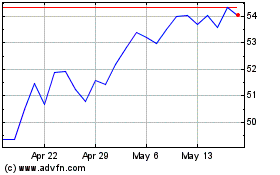

Universal (NYSE:UVV)

Historical Stock Chart

From Apr 2024 to May 2024

Universal (NYSE:UVV)

Historical Stock Chart

From May 2023 to May 2024