Report of Foreign Issuer (6-k)

20 December 2019 - 11:08PM

Edgar (US Regulatory)

Table of Contents

United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the

Securities Exchange Act of 1934

For the month of

December 2019

Vale S.A.

Praia de Botafogo nº 186, 18º andar, Botafogo

22250-145 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

(Check One) Form 20-F x Form 40-F o

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1))

(Check One) Yes o No x

(Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7))

(Check One) Yes o No x

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

(Check One) Yes o No x

(If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b). 82- .)

Table of Contents

Vale informs on approval by the Board of Directors

Rio de Janeiro, December 19th, 2019 — Vale S.A. (“Vale”) informs that the Board of Directors, at a meeting held today, approved interest on equity, according to the Brazilian Law, considering the end of calendar year, in the gross amount of R$ 7,253,260,000.00, equivalent to R$ 1.414364369 per outstanding common share and per special-class preferred share issued by Vale, based on the number of outstanding shares as of today (5,128,282,469).

This approval does not modify the Board of Directors’ decision of suspending the Shareholder Remuneration Policy, as disclosed in the Press Release of January 27th, 2019.

The allocation of JCP will be decided in due course, which will not occur during the suspension of the Shareholder Remuneration Policy.

Additional information is as follows:

i. The above-mentioned interest on equity was based on balance sheet revenue reserves as of September 30th, 2019, in accordance with the established by the Article 39 of Vale’s bylaws.

ii. Record date for the owners of Vale shares traded on the B3 will be on December 26th, 2019 and for holders of American Depositary Receipts (“ADRs”) traded on the New York Stock Exchange (“NYSE”) will be on December 30th, 2019. The date of payment will be informed in due course.

iii. Vale’s shares will be traded ex-right on the B3 and NYSE starting on December 27th, 2019 (inclusive).

iv. According to the Brazilian Law, the distribution of interest on equity is subject to the deduction of withholding income tax, except for the immune or exempt beneficiaries that prove meeting the legal conditions for the exemption. Any change in the shareholder register regarding tax residence and profile shall be done until December 27th, 2019, to ensure the accurate withholding tax related to the interest on equity announced on this date.

For further information, please contact:

+55-21-3485-3900

Andre Figueiredo: andre.figueiredo@vale.com

Andre Werner: andre.werner@vale.com

Mariana Rocha: mariana.rocha@vale.com

Samir Bassil: samir.bassil@vale.com

This press release may include statements that present Vale’s expectations about future events or results. All statements, when based upon expectations about the future, involve various risks and uncertainties. Vale cannot guarantee that such statements will prove correct. These risks and uncertainties include factors related to the following: (a) the countries where we operate, especially Brazil and Canada; (b) the global economy; (c) the capital markets; (d) the mining and metals prices and their dependence on global industrial production, which is cyclical by nature; and (e) global competition in the markets in which Vale operates. To obtain further information on factors that may lead to results different from those forecast by Vale, please consult the reports Vale files with the U.S. Securities and Exchange Commission (SEC), the Brazilian Comissão de Valores Mobiliários (CVM) and in particular the factors discussed under “Forward-Looking Statements” and “Risk Factors” in Vale’s annual report on Form 20-F.

3

Table of Contents

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Vale S.A.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/ André Figueiredo

|

|

Date: December 19, 2019

|

|

Director of Investor Relations

|

|

|

|

|

|

4

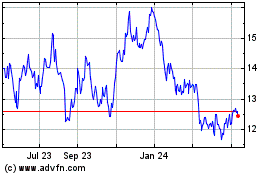

Vale (NYSE:VALE)

Historical Stock Chart

From Mar 2024 to May 2024

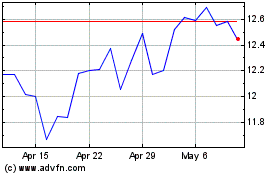

Vale (NYSE:VALE)

Historical Stock Chart

From May 2023 to May 2024