UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of May, 2024

Commission File Number: 001-39937

ZIM Integrated Shipping Services Ltd.

(Exact Name of Registrant as Specified in Its Charter)

9 Andrei Sakharov Street

P.O. Box 15067

Matam, Haifa 3190500, Israel

+972 (4) 865-2000

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

On May 28, 2024, and in connection with the payment of a dividend previously announced by the Company, that is expected to be

distributed on June 11, 2024, to the Company’s shareholders of record on June 4, 2024, (the “Dividend”), the Company has issued a press release announcing that certain shareholders of the Company may be eligible to a reduced Israeli withholding tax

with respect to their share of the Dividend in accordance with a previously obtained tax ruling from the Israeli Tax Authority (the “Ruling”), as extended. A copy of this press release is attached herewith as Exhibit 99.1.

In addition, and in accordance with the Ruling and the Company’s press release, A copy of the following forms in connection

with the distribution of the Dividend: (i) “Declaration of Status for Israeli Income Tax Purposes”; (ii) “Beneficiary’s Details”; and (iii) “Beneficiary’s Details – Controlling Person” are attached herewith as Exhibits 99.2, 99.3 and 99.4,

respectively.

The information in this Form 6-K (including Exhibits 99.1, 99.2, 99.3 and 99.4) shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned, thereunto duly authorized.

|

|

ZIM INTEGRATED SHIPPING SERVICES LTD.

|

|

|

|

|

|

|

By:

|

/s/ Noam Nativ

|

|

|

|

Noam Nativ

|

|

|

|

EVP General Counsel and Corporate Secretary

|

Date: May 28, 2024

EXHIBIT INDEX

ZIM Updates on Withholding Tax Procedures on June 2024 Cash

Dividend

Haifa, Israel, May 28, 2024 – ZIM Integrated Shipping Services Ltd. (NYSE: ZIM) (“ZIM” or the “Company”), a global container liner shipping company, hereby updates that in connection with the dividend distribution expected to take place on June 11, 2024, as previously announced by the Company on

May 21, 2024 (the “Dividend”), it had obtained an extension of its previously obtained tax ruling from the Israeli Tax Authority, or ITA, with respect to the tax withholding procedures relating to the payment of the Dividend to the Company’s

shareholders (the “Ruling”).

As a result of the Ruling, certain shareholders of the Company (“Shareholders”) may be eligible to a reduced Israeli withholding tax

rate with respect to their share of this Dividend, in comparison to the generally applicable withholding tax rate (the “Reduced Withholding Tax Rate”), under certain terms and conditions as set forth below.

The description provided below is not intended to constitute a complete analysis of withholding tax rate

procedures relating to the distribution of the Dividend, nor does it address the actual tax liability of any of the Shareholders, but merely relates to the Israeli withholding tax procedures relating to the distribution of the Dividend. Other than

the Dividend previously declared by the Company to be paid on June 11, 2024, there is no guarantee the Company will declare additional dividends in the future.

Shareholders are advised to consult their own tax and financial advisors concerning the tax consequences of each

particular situation, as well as any tax consequences that may arise under the laws of any state, local, foreign or other taxing jurisdiction. For the avoidance of doubt, the Agent IBI Trust Management (whose information is provided below)

has been retained by ZIM for the purpose of coordinating certain procedures relating to the Ruling, and it is NOT intended that the Agent will provide any tax advice to any of the Shareholders, who are encouraged to consult their own tax and

financial advisors.

Forms required to be submitted to the Agent in connection with the Ruling as

described below are attached as exhibits 99.2, 99.3 and 99.4 to Company’s Current Report on Form 6-K filed with the Securities and Exchange Commission (SEC) on May 28, 2024, (www.sec.gov) and can also be found on the Company’s website here.

Background

On May 21, 2024, ZIM announced a dividend payment of $0.23 per ordinary share (approximately $28.0 million), to holders of the

ordinary shares as of June 4, 2024. Payment of the Dividend is expected to be made on June 11, 2024 (the "Payment Date").

General Withholding Tax Treatment under Israeli Law

As set out in the Company’s Annual Report on Form 20-F filed with the Commission on March 13, 2024, with respect to dividends

sourced from regular earnings, under the Israeli Tax Ordinance and regulations issued under the Israeli Tax Ordinance (collectively, "ITO"), the current Israeli rate of withholding tax on dividends paid by an Israeli company is 30% for distributions

to a "substantial shareholder" (in general, being someone who holds, directly or indirectly, by himself or together with others, at least 10% of one or more of the means of control in the company) and 25% with respect to distributions to all other

holders of Ordinary Shares (“Withholding Tax”). Notwithstanding the foregoing, as a result of the Ruling and subject to its terms and conditions, certain Shareholders, both Israeli and non-Israeli, may be eligible to a reduced Israeli withholding tax

rate on their share of this dividend distribution, in comparison to the generally applicable withholding tax rate described above, (the “Reduced Withholding Tax Rate”), under certain terms and conditions as set forth below.

Summary of the Main Terms of the Ruling

The following is a summary of some of the key terms of the Ruling. It is emphasized that the

description below does not purport to exhaust all the terms and conditions included in the Ruling and is not a complete translation of the Ruling. In order to enjoy the Reduced Withholding Tax Rate, Shareholders must comply with all the terms of

the Ruling, a copy of which in the Hebrew language as well as an unofficial non-binding English translation thereof can be obtained free of charge by email by approaching the Agent (as defined below) at the contact details provided below.

|

1. |

On the Payment Date the Company will withhold 25% of the Dividend amount and will remit the tax amount to the Agent, to be handled by the Agent in accordance with

the terms and conditions of the Ruling.

|

|

2. |

The remaining 75% of the Dividend amount will be remitted by the Company to its transfer agent, Equiniti Trust Company, LLC (formerly named American Stock Transfer

& Trust Company, LLC), which will transfer the said amount to the Shareholders (including through brokers who hold in brokerage accounts ZIM shares on behalf of Shareholders).

|

|

3. |

A Shareholder who is a resident of a country with which Israel has a tax treaty (“Treaty State”) (based on a declaration to be provided by such Shareholder) and is

the beneficial owner of the Dividend, as well as a Shareholder who is a foreign (i.e., non-Israeli) resident of a country with which Israel does NOT have a tax treaty and is the beneficial owner of the

Dividend, may apply to the Agent requesting a Reduced Tax Withholding Rate. Such application must be received by the Agent between the Payment Date and July 7, 2024 ("Change of Rate Period").

|

|

4. |

A Shareholder who declared that he or she is a resident of a Treaty State and is the beneficial owner of the Dividend may apply to the Agent during the Change of

Rate Period only (subject to complying with all the documentation requirements detailed below) requesting the receipt of the monetary difference between the tax amount remitted to the Agent (at a rate of 25%) and the amount represented by the

withholding tax rate set forth in the tax treaty between Israel and such Treaty State or by the limited withholding tax rate applicable to such dividend payment under the ITO, to the extent applicable.

|

|

5. |

A Shareholder who did not declare that it, he or she is a resident of a Treaty State and is the beneficial owner of the Dividend, may apply to the Agent during the

Change of Rate Period only (subject to complying with all the documentation requirements detailed below) requesting the receipt of the monetary difference between the tax amount remitted to the Agent (at a rate of 25%) and the amount

represented by the withholding tax rate applicable to such dividend payment under the ITO or by the limited withholding tax rate applicable to such dividend payment under the ITO, to the extent applicable.

|

|

6. |

Any Shareholder who

claims to be entitled to a Reduced Tax Withholding Rate in accordance with the foregoing, will be required to provide the Agent with all relevant documentation as detailed in the Ruling and attached as exhibits 99.2, 99.3 and 99.4 to the

Company’s Current Report on form 6-K filed on May 28, 2024 with the Securities and Exchange Commission (SEC) on no later than July 7, 2024 (the end of the Change of Rate Period), including but not limited to, bank account details to which

the dividend payment should be transferred, number of ZIM shares owned by the Shareholder in such account, identification document, and confirmation of residence for the tax year 2023 issued by the taxing authority of the state of tax

residence.

|

|

7. |

In addition to the foregoing, the Shareholder will provide a written declaration in the form annexed to this announcement which will include declarations as to the

following: (i) the Shareholder's tax residence for the tax year 2023, (ii) the Shareholder's beneficial ownership of the dividend, (iii) the investment in ZIM shares has not been made through a permanent establishment in Israel, (iv) the

holding of ZIM shares is made for the Shareholder's own account and not for the account of others, and (v) the payment will not be made to a permanent establishment of the Shareholder outside of the Shareholder's tax residence.

|

|

8. |

A non-Israeli corporate Shareholder (excluding a Shareholder covered by section 9 below) that requests a Reduced Tax Withholding Rate, will also need to provide the

Agent with its updated shareholders register as of June 4, 2024, and a statement confirming that more than 75% of its shareholders, directly or indirectly, are individuals of its state of residence for the tax year 2023.

|

|

9. |

A publicly traded non-Israeli corporate Shareholder whose shares are traded on a stock market outside of Israel and is a resident of a Treaty State, or a direct or

indirect subsidiary of such Shareholder, will also provide the Agent with a declaration that it is a resident of such Treaty State or another non-Israeli state for the tax year 2023, as applicable.

|

|

10. |

An Israeli corporate Shareholder which is entitled to a Reduced Tax Withholding Rate (including an exemption from withholding tax at source), will be able to apply

to the Agent no later than July 7, 2024 (the end of the Change of Rate Period) and enclose an applicable valid ITA issued certificate setting forth a Reduced Tax Withholding Rate or an exemption from withholding tax. In addition, such

Shareholder will enclose its certificate of incorporation and all other documents required as set forth above, mutatis mutandis as requested by the Agent.

|

|

11. |

The Agent is entitled to request from the Shareholders applying for a Reduced Tax Withholding Rate additional documents in its discretion insofar as they are

required to establish the tax residence of the Shareholder or its entitlement to exemption and/or to a Reduced Tax Withholding Rate.

|

|

12. |

Notwithstanding the foregoing, no refund of excess tax withholding shall be affected by the Agent with respect to any Shareholder holding more than 5% of the issued

share capital of the Company, or whose entitlement to dividend from the Company pursuant to the Dividend exceeds $500,000, other than in accordance with a specific approval issued by the ITA.

|

|

13. |

The transfer of the amounts withheld, excluding the amounts returned to the Shareholders, as aforementioned, shall be conducted by the Agent. Subject to receipt by

the Agent of your required documentation, the Agent will return the amounts withheld to the Shareholders as detailed above to the account at which the dividend payment was made within 30 days from the date the amounts withheld are paid to the

ITA.

|

|

14. |

The Ruling is aimed to address solely the issue of tax withholding procedures and should not be construed as setting the actual tax liability of any Shareholder

with respect to the Dividend or otherwise.

|

Appointment of Israeli Tax Withholding Agent

In order to facilitate the implementation of the procedures set forth in the Ruling for the benefit of

its Shareholders, the Company appointed IBI Trust Management to serve as a processing agent for the benefit of the Shareholders in connection with the distribution of the Dividend (the “Agent”). Contact

information of the Agent is provided at the bottom of this announcement. We encourage you to contact the Agent if you need any clarifications in filling-in the forms required under the Ruling to obtain a Reduced

Withholding Tax Rate, or if you have any questions concerning the process. Please note that the Agent will not provide any tax advice to any Shareholder, who should consult their own tax and financial advisors.

In order to be eligible to benefit from a Reduced Withholding Tax Rate, Shareholders must provide the Agent with all documentation required under the Ruling not later than July 7, 2024. The relevant forms included in the Ruling are and attached as exhibits 99.2, 99.3 and 99.4 to the Company’s Current Report on form 6-K filed on May 28, 2024 with the SEC.

If a Shareholder fails to provide the Agent with all the documentation required by July 7, 2024, the Agent

will not be able to attend to such Shareholder's application and will not be able to return any amounts originally remitted on behalf of such Shareholder nor provide any confirmation of tax withholding to such a Shareholder, either in connection

with the Ruling or in connection with any other tax filing by such Shareholder.

ZIM's Agent Contact Information:

IBI Trust Management

Tel No: +972-3-5193896, +972 506 209 410

Email: ZimDividend@ibi.co.il

About ZIM

Founded in Israel in 1945, ZIM (NYSE: ZIM) is a leading global container

liner shipping company with established operations in more than 90 countries serving approximately 33,000 customers in over 300 ports worldwide. ZIM leverages digital strategies and a commitment to ESG values to provide customers innovative

seaborne transportation and logistics services and exceptional customer experience. ZIM’s differentiated global-niche strategy, based on agile fleet management and deployment, covers major trade routes with a focus on select markets where the

company holds competitive advantages. Additional information about ZIM is available at www.ZIM.com.

ZIM Contacts

Media:

Avner Shats

ZIM Integrated Shipping Services Ltd.

+972-4-865-2520

shats.avner@zim.com

Investor Relations:

Elana Holzman

ZIM Integrated Shipping Services Ltd.

+972-4-865-2300

holzman.elana@zim.com

Leon Berman

The IGB Group

212-477-8438

lberman@igbir.com

Exhibit 99.2

ZIM Integrated Shipping Services Ltd.

dividends distribution

CLAIM FOR REDUCED RATE OF WITHHOLDING TAX

IN ISRAEL ON DIVIDEND PAYMENTS TO A NON-ISRAELI TAX RESIDENT

You are receiving this form "Declaration of Status for Israeli Income Tax Purposes" as a holder of shares of ZIM

Integrated Shipping Services Ltd. ("Shares" and “ZIM”), in connection with the payment of dividends to the shareholders of ZIM on June 11, 2024.

By completing this form in a manner that would substantiate your eligibility for a reduced rate of Israeli withholding tax with respect to this dividend

distribution, you will allow ZIM and its Israeli tax agent, to withhold tax in Israel from the dividend distribution made to you at a reduced tax rate.

This form shall be completed and signed by the recipient of the dividend or by an authorized officer or representative of the

recipient.

This claim is made pursuant to the Double Tax Convention between Israel and the country of residence of the recipient of the

dividend.

ZIM's Israeli tax agent contact information:

IBI Trust Management

Tel No: +972-3-5193896, +972 506 209 410

Email: ZimDividend@ibi.co.il

PART A: RECIPIENT DECLARATION

RECIPIENT INFORMATION

|

Full name of the recipient:

|

For Individuals:

Identity Number, Social Security No., or Passport No./ For

Legal Entities: Registration No. /Corporation No.

|

Type of Investor:

Legal Entity ☐ Individual ☐

Trust Beneficiary ☐

|

|

With respect to an individual

|

With respect to a legal entity

|

|

Date of birth

|

The country in which it was incorporated:

The country in which control and management are conducted:

|

|

Country of residence

|

|

Country of citizenship

|

|

Country issuing passport

|

| |

|

Income Tax File number of recipient in place of residence: _______________________________

|

|

Address of local income tax assessing office in recipient’s place of residence: _______________

|

|

The recipient is a fiscal resident of (insert country) _________________ since (insert date). ________.________

|

With regard to an Individual:

I declare that I am not an Israeli resident because (please mark all applicable boxes):

|

☐

|

1.

|

The State of Israel is not my permanent place of residence.

|

|

☐

|

2.

|

The State of Israel is neither my place of residence nor my family's place of residence.

|

|

☐

|

3.

|

My ordinary or permanent place of activity is not within the State of Israel, and I do not have a permanent establishment in the State of Israel.

|

|

☐

|

4.

|

I do not engage in any occupation within the State of Israel.

|

|

☐

|

5.

|

I do not own a business or part of a business within the State of Israel.

|

|

☐

|

6.

|

This year, I did not stay and I do not intend to stay in Israel for 183 days or more.

|

|

☐

|

7.

|

This year, I did not stay in Israel and I also do not intend to stay in Israel for 30 days or more and my total stay in Israel this year and in the two preceding years

will not reach 425 days.

|

|

☐

|

8.

|

I am not insured with the National Insurance Institute in the State of Israel.

|

|

☐

|

9.

|

I am the sole beneficial owner of the dividend income.

|

With regard to a Legal Entity:

I declare that the Legal Entity is a non - Israeli resident because (please mark all applicable boxes):

|

☐

|

1.

|

Over 75% of the shareholders are individuals with the same residency as the Legal Entity (attached declaration of shareholders)

|

|

☐

|

2.

|

It is not registered /incorporated with the Registrar of Companies in Israel.

|

|

☐

|

3.

|

It is not registered with the Registrar of nonprofit organizations in Israel. (Amutot)

|

|

☐

|

4.

|

The control of the legal entity is not executed in Israel.

|

|

☐

|

5.

|

The management of the legal entity is not in Israel.

|

|

☐

|

6.

|

The legal entity does not have a permanent enterprise in Israel and the entity does not have

a permanent establishment in the State of Israel

|

|

☐

|

7.

|

No Israeli resident holds, directly or indirectly via shares or through a trust or in any other manner, alone or with another who is an Israeli

resident, one or more of the "means of control" of the legal entity, as specified below, at a rate exceeding 25%. The term "means of control" refers to the following:

(a) the right to participate in profits;

(b) the right to appoint a director;

(c) the right to vote;

(d) the right to share in the assets of the entity at the time of its liquidation;

(e) the right to direct the manner of exercising one of the rights specified above.

|

|

☐

|

8.

|

The legal entity is the sole beneficial owner of the dividend income.

|

DETAILS OF INCOME RECEIVED

Place of receipt (country, city, bank account number, Amount)

|

Country

|

City

|

Bank name and

account number

|

Amount

|

| |

|

|

|

The recipient declares that all the information provided above is accurate and complete.

|

Date of Signature

|

|

Signature of Recipient

|

PART B: CERTIFICATIONOFFOREIGNINCOMETAX AUTHORITY

This part shall be completed and signed by the income tax authorities of the recipient’s place of residence

| |

a. |

the recipient of the income is a fiscal resident of (insert country)_____________;

|

| |

b. |

the recipient regularly reports his income as required, the most recent income tax return filed being for the year__________;

|

| |

c. |

the income concerned ❏ is/ ❏ is not subject to tax in (insert the recipient’s country of residence)_____________.

|

|

Date of Signature

|

|

Signature

|

|

Official Stamp

|

| 2. |

Address of certifying official: _____________________________

|

| 3. |

Position or Title of certifying official:_________________________

|

| 4. |

Name of Income Tax Authority official making this certification:_____________________

|

PART C: DOCUMENTATION

With regard to an Individual - List all documents attached –:

|

2. |

Bank statement from the date of entitlement to the dividend including bank account details of the account holder, bank name and account number and the number of listed shares held by the shareholder.

|

|

3. |

Bank statement from the date of payment of the dividend, including bank account details of the account holder, bank account number and the amount of the dividend received.

|

|

4. |

Required Details Form (form attached).

|

|

5. |

Relevant W9 form (for US Citizens) OR W8BEN form (for Non-US Citizens) filled and signed.

|

With regard to a Legal Entity - List all documents attached:

|

1. |

Copy of Certificate of Incorporation

|

|

2. |

List of shareholders of the Legal Entity and declarations regarding their state of residency for tax purposes.

|

|

3. |

Bank statement from the date of entitlement to the dividend including bank account details of the account holder, bank name and account number and the number of listed shares held by the shareholder.

|

|

4. |

Bank statement from the date of payment of the dividend, including bank account details of the account holder, bank account number and the amount of the dividend received.

|

|

5. |

Required Details Form – attached.

|

|

6. |

Relevant W9 form of the Entity (for US Citizens) OR W8BEN form (for Non-US Citizens) filled and signed (forms attached).

|

|

7. |

Controlling Person Required Details Form (form attached).

|

|

8. |

Copy of passport of the Controlling Person

|

|

9. |

Relevant W9 form of the Controlling person (for US Citizens) OR W8BEN form (for Non-US Citizens) filled and signed.

|

Beneficiary's Details – IBI Trust Management

ZIM

Dear Beneficiary,

IBI Trust Management would like to thank you to for joining us and welcome you onboard.

In order to set up an account on your behalf, please fill out the information requested within the form and send to – ZimDividend@ibi.co.il

Part 1 –

Identification of Beneficiary (in case of Legal Entity, please fill Annex I)

Beneficiary Information:

Full Name of Beneficiary: (First and Last Name/Legal name of the corporation):________________________

__________________________________________________________________________________________

ID/Passport No. /Incorporation No.: ____________________________________________________________

Date of Birth/Incorporation Date: ______________________________________________________________

Place of Birth/Incorporation place: Town: ______________________ Country: ________________________

Current Residence: Address: _________________________________________________________________

Town:______________________

country:____________________ Postal code/zip code: _______________

Mailing

Address: (please only complete if different from above) _____________________________________

Email: ___________________________________________________________________________________

Telephone #1: ____________________________ Telephone #2: ____________________________________

Please attach:

| ✔ |

A copy of your identification card or your passport or your incorporation certificate.

* Israeli Citizen is requested to

provide a copy of the identification card

|

| ✔ |

A proof of ownership of your bank account (void check or any other statement).

|

| ✔ |

Please attach:W-9 / W-8BEN / W-8BEN-E / W-8IMY / W-8EXP / W-8ECI

*such forms can be downloaded from www.irs.gov

|

Part 2 – Country/Jurisdiction of Residence for Tax

Purposes and related Taxpayer Identification Number or equivalent number* (“TIN”)

Please complete the following table indicating (i) what is the Beneficiary tax residence and (ii) the Beneficiary's TIN for each country/jurisdiction

indicated.

* If a TIN is unavailable please

provide the appropriate reason A, B or C where indicated below:

Reason A - The country/jurisdiction where the Beneficiary is resident does not issue TINs to its residents. Reason

B - The Beneficiary is otherwise unable to obtain a TIN or equivalent number (Please explain why you are unable to obtain a TIN in the below table if you have selected this reason)

Reason C - No TIN is required. (Note. Only select this reason if the

domestic law of the relevant jurisdiction does not require the collection of the TIN issued by such jurisdiction)

| |

Country/Jurisdiction of tax residence

|

TIN

|

If no TIN available enter Reason A, B or C

|

|

1

|

|

|

|

|

2

|

|

|

|

|

3

|

|

|

|

Please explain why you are unable to obtain a TIN if you selected

Reason B above:

|

• |

Please note, additional information may be needed in accordance with the Beneficiary's self-certification above.

|

|

• |

For more information please consult your tax adviser or the information at the OECD automatic exchange of information portal www.oecd.org/tax/automatic-exchange

|

Part 3 – Wire information

Currency of choice:

Attention: you should choose whether you wish to receive the net proceed in NIS or in US dollar. Please note that the wire commission for USD will be

charged in USD.

Please mark only one alternative:

☐ I would like to receive the

Payment in NIS

|

☐ I would like to receive the

payment in US dollar

|

*Additional charges may apply by the receiving bank in case of USD wires such as intermediary bank fee

(Please contact your bank for additional info)

Mandatory details – international wire:

| 1. |

Bank Name : _________________________________________________________________________

|

| 2. |

Account Name : _______________________________________________________________________

|

| 3. |

Account Number : _____________________________________________________________________

|

| 4. |

Swift code : __________________________________________________________________________

|

| 5. |

ABA (routing #) : _____________________________________________________________________

|

| 6. |

IBAN: ______________________________________________________________________________

In case of a Sub-Account:

|

| 7. |

For Further credit to (Account name) :

|

| 8. |

Sub-Account Number: __________________________________________________________________

|

Mandatory details – domestic wire:

| 1. |

Bank Name : __________________________________________________________________________

|

| 2. |

Account Name : ________________________________________________________________________

|

| 3. |

Branch Number : _______________________________________________________________________

|

| 4. |

Account Number : ______________________________________________________________________

|

| 5. |

IBAN: _______________________________________________________________________________

|

Part 4 – Declarations and Signature

I understand that the information supplied by me is covered by the full provisions of the terms and conditions governing my relationship with IBI Trust

Management. (“IBI”).

I acknowledge that the information contained in this form may be provided to the tax authorities of the country/jurisdiction described in this form above

and exchanged with tax authorities of another country/jurisdiction or countries/jurisdictions in which I may be tax resident pursuant to intergovernmental agreements to exchange financial account information.

I certify that I am the Beneficiary) of all the account(s) to which this form relates to.

For natural person only - I declare that I am not holding Senior Public Position1 and I am not a Politically Exposed Person 2and I will update you if the

above will change in the future.

I declare that all statements made in this declaration are, to the best of my knowledge and belief, correct and complete.

I undertake to advise IBI of any change in circumstances which affects the tax residency status of the individual identified in this form and to provide with an updated

form.

Signature: ________________________________________________

Print name: ________________________________________________

Date: ________________________________________________

Note: If you are not the Beneficiary please indicate the capacity in which you are signing the form. If signing under a power of attorney please also attach a certified copy of the power of attorney.

Capacity: _________________________________________________

For additional info, please contact us at: ZimDividend@ibi.co.il

1 "Senior public position"- Including head of state, president, city mayor, judge, member of parliament, senior party member, member of the government, senior officer in

the army or police, senior official in government companies, senior position in international organizations or anyone who performs such a role even if the title is different.

2 "Politically Exposed Person"- Holds a senior public position for the past five years, including a family

member of such a person or a corporation under his control or a business partner of any of the above.

"foreign Politically Exposed Person"- Politically Exposed Person who is a foreign resident.

Annex I – Legal Entity

Please

provide the Legal Entity's (not applicable to individual account holders) Status by ticking one of the following boxes (please consult with your tax adviser):

1.

|

(a)

|

Financial Institution – Investment Entity

|

|

|

i. |

An Investment Entity located in a Non-Participating Jurisdiction and managed by another Financial Institution

|

☐ |

|

ii. |

Other Investment Entity |

☐ |

|

(b)

|

Financial Institution – Depository Institution, Custodial Institution or Specified Insurance Company

|

☐ |

If you have ticked (a) or (b) above, please provide,

if held, the Account Holder’s Global Intermediary Identification Number (“GIIN”) obtained for FATCA purposes.

|

(c)

|

Active NFE – a corporation the stock of which is regularly traded on an established securities market or a corporation which is a related entity of such a corporation

|

☐ |

If you have ticked (c), please provide the name of the established securities market on which the corporation is regularly Traded:

________________________________

If you are a Related Entity of a regularly traded corporation, please provide the name of the regularly traded corporation that the

Entity in (c) is a Related Entity of: ______________________________

|

(d)

|

Active NFE – a Government Entity or Central Bank

|

☐ |

|

(e)

|

Active NFE – an International Organization

|

☐ |

|

(f)

|

Active NFE – other than (c)-(e) (for example a start-up NFE or a non-profit NFE)

|

☐ |

2. Please fill a separate form for each "Controlling Person"3

3 "controlling person":

(1) An individual with the ability to direct the actions of the corporation, whether alone or together with others or through them,

whether directly or indirectly, including an ability arising from the articles of association of the corporation, by virtue of a contract in writing, verbally or otherwise, or an ability arising from any other source, except for the ability arising

only from the fulfilling of the position of an office holder in the corporation:

(2) Without derogating from the generality of the above said in paragraph (1), an individual will be deemed to be of controlling

interest in the corporation if such person holds 25% or more of any type of means of control, and no other person holds the means of control of that type at a rate which is greater than his/her holdings: for this purpose, ‘holdings’- including

holding together with others as defined in the Securities Law;

(3) Without derogating from the generality of that stated in paragraphs (1) and- (2), in a corporation in which there is no individual

as stated, the chairman of the board of directors in the company and a comparable office holder and the CEO, will be deemed to be as the controlling persons. If there are none of the above, the office holder who holds effective control in the

corporation will be deemed the controlling person.

Beneficiary's Details – Controlling Person – IBI Trust Management

Full Name of the legal entity which I am a Controlling Person1 in:

____________________________________________________

Dear Beneficiary,

As The "Controlling Person" of an entity, please

fill out the information requested within the form.

Part 1 –

Identification of Beneficiary (in case of Legal Entity, please fill Annex I)

Beneficiary Information:

Full Name of Beneficiary: (First and Last Name/Legal name of the corporation):________________________

____________________________________________________________

ID No. /Passport No. /Incorporation No.: ____________________________________________

Date of Birth/Incorporation Date: __________________________________________________

Place of Birth/Incorporation place: Town: ______________________ Country: ____________

Current Residence: Address: ______________________________________________________

Town:______________________

country:____________________ Postal code/zip code: _________

Mailing

Address: (please only complete if different from above) _______________________________

Email: ______________________________________________________________________________

Telephone #1: ____________________________ Telephone #2: ______________________________

1 "controlling person":

(1) An individual with the ability to direct the actions of the corporation, whether alone or together with others or through them, whether directly or indirectly, including an

ability arising from the articles of association of the corporation, by virtue of a contract in writing, verbally or otherwise, or an ability arising from any other source, except for the ability arising only from the fulfilling of the position of

an office holder in the corporation:

(2) Without derogating from the generality of the above said in paragraph (1), an individual will be deemed to be of controlling interest in the corporation if such person

holds 25% or more of any type of means of control, and no other person holds the means of control of that type at a rate which is greater than his/her holdings: for this purpose, ‘holdings’- including holding together with others as defined in the

Securities Law;

(3) Without derogating from the generality of that stated in paragraphs (1) and- (2), in a corporation in which there is no individual as stated, the chairman of the board of

directors in the company and a comparable office holder and the CEO, will be deemed to be as the controlling persons. If there are none of the above, the office holder who holds effective control in the corporation will be deemed the controlling

person.

Please attach:

| ✔ |

A copy of your identification card or your passport or your incorporation certificate.

* Israeli Citizen is requested to

provide a copy of the identification card

|

| ✔ |

Please attach:W-9 / W-8BEN / W-8BEN-E / W-8IMY / W-8EXP / W-8ECI

*such forms can be downloaded from www.irs.gov

|

Part 2 – Country/Jurisdiction of Residence for Tax Purposes and

Related Taxpayer Identification Number or equivalent

number* (“TIN”)

Please complete the following table indicating (i) what is the Beneficiary tax residence and (ii) the Beneficiary's

TIN for each country/jurisdiction indicated.

* If a TIN is unavailable please

provide the appropriate reason A, B or C where indicated below:

Reason A - The country/jurisdiction where the Beneficiary is resident does not issue TINs to its residents.

Reason B - The Beneficiary is otherwise unable to obtain a TIN or equivalent number

(Please explain why you are unable to obtain a TIN in the below table if you have selected this reason)

Reason C - No TIN is required. (Note. Only select this reason if the domestic law of the relevant jurisdiction

does not require the collection of the TIN issued by such jurisdiction)

| |

Country/Jurisdiction of tax residence

|

TIN

|

If no TIN available enter Reason A, B or C

|

|

1

|

|

|

|

|

2

|

|

|

|

|

3

|

|

|

|

Please explain why you are unable to obtain a TIN if you selected

Reason B above:

|

• |

Please note, additional information may be needed in accordance with the Beneficiary's self-certification above.

|

|

• |

For more information please consult your tax adviser or the information at the

OECD automatic exchange of information portal www.oecd.org/tax/automatic-exchange

|

Part 3 – Type of Controlling Person

(Please only complete this section if you are tax resident in one or more Reportable Jurisdictions according to the CRS)

|

Please provide the Controlling Person’s Status by ticking the appropriate box.

|

|

|

a. Controlling Person of a legal

person – control by ownership

|

|

|

b. Controlling Person of a legal

person – control by other means

|

|

|

c. Controlling Person of a legal

person – senior managing official

|

|

|

d. Controlling Person of a trust - settlor

|

|

|

e. Controlling Person of a trust – trustee

|

|

|

f. Controlling Person of a trust – protector

|

|

|

g. Controlling Person of a trust – beneficiary

|

|

|

h. Controlling Person of a trust – other

|

|

|

i. Controlling Person of a legal

arrangement (non-trust) – settlor-equivalent

|

|

|

j. Controlling Person of a legal

arrangement (non-trust) – trustee-equivalent

|

|

|

k. Controlling Person of a legal

arrangement (non-trust) – protector-equivalent

|

|

|

l. Controlling Person of a legal

arrangement (non-trust) – beneficiary-equivalent

|

|

|

m. Controlling Person of a legal

arrangement (non-trust) – other-equivalent

|

|

Part 4 – Declarations and Signature

I understand that the information supplied by me is covered by the full provisions of the terms and conditions governing my relationship with IBI Trust

Management (“IBI”).

I acknowledge that the information contained in this form may be provided to the tax authorities of the country/jurisdiction described in this form above

and exchanged with tax authorities of another country/jurisdiction or countries/jurisdictions in which I may be tax resident pursuant to intergovernmental agreements to exchange financial account information.

I certify that I am the Beneficiary of all the account(s) to which this form relates to.

I declare that I am not holding Senior Public Position2 and I am not a Politically Exposed Person 3 and I will update you if the above will change in the

future.

I declare that all statements made in this declaration are, to the best of my knowledge and belief, correct and complete.

I undertake to advise IBI of any change in circumstances which affects the tax residency status of the individual identified in this form and to provide with an updated

form.

Signature: ________________________________________________

Print name: ________________________________________________

Date: ________________________________________________

Note: If you are not the Beneficiary please indicate the capacity in which you are signing the form. If signing under a power of attorney please also attach a certified copy

of the power of attorney.

Capacity: _________________________________________________

For additional info, please contact us at: ZimDividend@ibi.co.il

2 "Senior public position"- Including head of state, president, city mayor, judge, member of parliament,

senior party member, member of the government, senior officer in the army or police, senior official in government companies, senior position in international organizations or anyone who performs such a role even if the title is different.

3 "Politically Exposed Person"- Holds a senior

public position for the past five years, including a family member of such a person or a corporation under his control or a business partner of any of the above.

"foreign Politically Exposed Person"- Politically Exposed Person who is a foreign resident

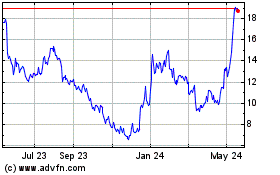

ZIM Integrated Shipping ... (NYSE:ZIM)

Historical Stock Chart

From Jan 2025 to Feb 2025

ZIM Integrated Shipping ... (NYSE:ZIM)

Historical Stock Chart

From Feb 2024 to Feb 2025