International Consolidated Uranium Inc. ("

CUR" or

the "

Company")

(TSXV:

CUR) is pleased to announce that

it has entered into a definitive share purchase agreement (the

“

Agreement”) whereby CUR will acquire a 100%,

undivided interest, in the high-grade Matoush Uranium Project

(“

Matoush” or the “

Property”)

located in the Province of Quebec, Canada.

Key Points:

- High-Grade and Substantial

Historic Resources – Based on a press release issued by

Strateco Resources Inc. (“Strateco”) on December

7, 2012, Matoush was considered to have the following historical

Mineral Resources:

- Indicated Mineral Resources of 586,000 t at an average grade of

0.954% containing 12.329 m lbs of U3O8

- Inferred Mineral Resources of 1,686,000 t at an average grade

of 0.442% containing 16.44 m lbs of U3O8

- This historical estimate is considered to be a “historical

estimate” under National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”) and

is not considered by the Company to be current. See below under the

heading “Global Historical Mineral Resource Table”.

- Advanced Stage

Project – An Updated Preliminary Economic Assessment

on the Property was published in April of 2010 which contemplated

access via a ramp decline, mining using longhole methods followed

by cemented rock fill (CRF).

- Good Exploration

Potential – The Matoush Fault Zone, the structure

that controls the mineralization, has been identified over a strike

length extending 11km southward and 5km northward beyond the

historic resource area. In addition, many of the zones of

mineralization within the historic Mineral Resources are open along

strike and down plunge.

- Proven Mining Jurisdiction

with Uranium Endowment – Quebec

ranks highly as a mining jurisdiction and has seen significant past

expenditures on uranium exploration by both major and junior mining

companies.

- Compelling Acquisition

Structure – Deferred cash and

share based consideration offers potential to reduce the ultimate

total purchase price equity dilution.

Philip Williams, CEO commented, “We are very

pleased to add another high-grade, advanced stage project, in a top

ranked mining jurisdiction, to our global project portfolio. As

with our other projects, Matoush was the subject of significant

past exploration and economic evaluation work. It stands out for

its high-grade and sizeable historical resource, ranking as one of

the highest-grade undeveloped uranium projects outside of the

Athabasca Basin in Saskatchewan as well as its promising

exploration potential. We look forward to bringing a fresh

perspective to development of the project with a focus on

engagement with the local indigenous stakeholders before

undertaking any project level activity. We recognize that uranium

mining can be a lightning rod issue and, as such, it is incumbent

on us to garner social acceptance before attempting to advance a

project. Fortunately, uranium mining in Canada, under the strict

regulation of the Canadian Nuclear Safety Commission, has an

excellent track record with studies showing no significant impacts

to the health of the public living near uranium mines or mills.

Canada's long-standing experience in uranium mining has resulted in

the development of stringent regulations and leading practices for

the protection of health and safety of persons and the environment

which, of course, we intend to adhere to fully.”

Terms of the Share Purchase

Agreement

Pursuant to the Agreement, CUR will acquire 100%

of the shares of a special purpose vehicle (the

“SPV”) that holds a 100%, undivided interest, in

the Property. The SPV, an indirect wholly-owned subsidiary of

certain funds managed or advised by Third Eye Capital Corporation

or its affiliates, acquired the Property free and clear of any

encumbrances pursuant to an approval and vesting order granted by

the Quebec Superior Court dated April 30, 2021 (the

“Vesting Order”). The consideration payable by CUR

pursuant to the Agreement on closing includes the issuance of such

number of common shares in the capital of the Company

(“Shares”) with a value of $3,000,000 at a price

per Share based on the 20-day VWAP of the Shares on the TSX Venture

Exchange (the “TSXV”) up to the date immediately

prior to closing of the transaction, subject to a minimum of

2,000,000 Shares, and a cash payment of $3,500,000. A further

deferred payment is due on or before the six-month anniversary of

closing of the transaction comprised of such number of Shares with

a value of $2,000,000 based on a price per Share based on the

20-day VWAP of the Shares on the TSXV up to the date prior to the

deferred payment and $1,500,000 in cash.

Closing of the transaction is subject to

satisfaction of certain closing conditions including, among other

things, the approval of the TSX Venture Exchange. All securities

issued in connection with the Agreement are subject to a hold

period expiring four months and one day from the date of

issuance.

The Matoush Uranium Project

The Property is an advanced stage exploration

project centrally located in the Province of Quebec, 210 km north

of the Cree community of Mistissini and approximately 275 km north

of the town of Chibougamau. The Property currently comprises 413

mining claims covering a total area of 21,670 hectares (217 km2).

The overall project area extends ~24 kilometers from north to south

and up to 12 kilometers in width.

Uranium was first discovered on the Property by

Uranerz Energy Corp. in 1980 with subsequent work by Ditem

Exploration Inc. who optioned the property to Strateco in 2005 who

has held the property since then. Mineralization at Matoush is

similar to Athabasca unconformity type uranium deposits with regard

to its occurrence in Proterozoic sedimentary rocks exhibiting

similar alteration styles and structural controls. A notable

divergence in the nature deposit at Matoush from the typical

Athabasca style deposit is the lack of uranium mineralization at

the actual unconformity. Uranium mineralization at Matoush occurs

primarily in relatively flat lying accumulations between 150m and

600m above the basement unconformity within Indicator Formation

Sandstones where they are breeched by structures. The penetrating

structures have acted as conduits for the flow of mineralizing

fluids and are often themselves associated with more steeply

dipping zones of mineralization. It should be noted that

mineralization is consistent with and roughly the same age as the

Westmoreland Uranium project located in Queensland Australia.

Higher-grade uranium mineralization typically

sits in unit 3 of the host formation, which is a series of active

channel facies, consisting of coarse-grained sandstones and poorly

sorted pebble conglomerates. Unit 3 ranges in thickness from as

little as 11m up to 457m at the western end of the basin with an

increase in lithological heterogeneity as it thickens. The best

grade mineralization is hosted in a pebble conglomerate with

pebbles to 2 cms adjacent to the Matoush fault. High-grade

mineralization has a strong structural control in addition to a

specific host lithology, namely coarse-grained active channel

facies sandstones and conglomerates. To view the table that

includes select high-grade drill results please

visit: https://www.globenewswire.com/NewsRoom/AttachmentNg/9c598427-505b-4adf-ae84-fb2845d09755

Prominent structural controls on mineralization

include the basement penetrating Matoush Fault Zone which has been

shown to host mineralization intermittently along three kilometers

of its strike length. Uranium mineralization is typically

associated with intersections between the Matoush Fault Zone and

apparent paleo aquifers.

The Matoush uranium mineralization occurs within

a much broader alteration envelope and is characterized by

replacement style disseminations and clots of fine-grained

uraninite plus, in the higher-grade areas, semi-massive veins of

uraninite. Yellowish orange, secondary uranophane is also present.

The mineralization is distributed on both sides of the steeply

dipping MFZ but is generally thicker on the south or hanging wall

side. True widths of mineralized zones range from 1 m to 20 m.

Geochemically, the mineralization is characterized by Cr, V, Co,

Ni, Pb, Zn, Cu, Bi, Au, Se and Te. From its original and shallower

drilling, Uranerz recognized a zoned alteration halo up to 50 m

wide developed symmetrically around the Matoush Fault Zone and

consisting of an inner tourmaline zone surrounded by a

magnesium-chlorite and Cr-V muscovite zone. Hematite and limonite

form the outermost halo.

Exploration potential within the project area is

considered positive as mineralization is open to both the north and

south along strike from the existing resource.

Matoush Project example stratigraphic

section showing mineralised lenses. Open along strike and down

plunge. (Roscoe Postle Associates Inc,

2012): https://www.globenewswire.com/NewsRoom/AttachmentNg/e59d3bee-44f8-47b9-98ba-1aeef341352a

In addition, favourable geological units, to

host mineralization, occur abutting the Matoush Fault zone for 5

kilometers north and up to 11 kilometers south of the main zone of

mineralization.

To view the related infographic appearing here

in the release, please

visit: https://www.globenewswire.com/NewsRoom/AttachmentNg/0b535535-54fa-4fc6-bc34-41985fa82f5c

In the Property area, 538 drill holes totaling

approximately 234,707 metres have been completed. These include 415

holes (188,123 m) in the main Matoush historic resource area and

extensions.

Historic Mineral Resources

Roscoe Postle Associates Inc.

(“RPA”), an independent consulting company,

prepared a technical report on the Property in accordance with the

disclosure standards of NI 43-101 entitled “Technical Report on the

Mineral Resource Update for the Matoush Project, Central Québec,

Canada” dated February 12, 2012. The Mineral Resource estimate was

further updated by RPA in December 2012, as disclosed in a press

release of Strateco dated December 7, 2012 (the “Historic

Estimate”) and is considered to be a “historical estimate” under NI

43-101 and is not considered by the Company to be current. See

below under the heading “Global Historical Mineral Resource

Table”.

The Historic Estimate used drill hole data

available as of November 22, 2012. A set of cross-sections and plan

views were used to construct three-dimensional wireframe models at

a cut-off grade of 0.1% U3O8. High-grade values were cut to 9% U3O8

prior to compositing. Variogram parameters were interpreted from

two-metre composited values. Block U3O8 grades within the wireframe

models were estimated by ordinary kriging.

The Historic Estimate was reported to be

contained within six zones: AM-15, MT-22, MT-34, MT-02, MT-06, and

MT-36 as shown in the following

table: https://www.globenewswire.com/NewsRoom/AttachmentNg/774d28b4-95df-40a6-a362-82e2a285026c

Notes:1. CIM definitions were followed for the

Historic Estimate.2. The Historic Estimate was estimated at a

cut-off grade of 0.1% U3O8.3. The Historic Estimate was estimated

using an average long-term uranium price of US$75 per pound.4. A

minimum mining width of 1.5 m was used.5. The MT34A lens is within

both the MT-34 and AM-15 zones.6. Numbers may not add due to

rounding.

Global Historic Mineral Resource

Table

The table below sets out the historical Mineral

Resource estimates for each project CUR currently owns outright or

on which it has announced an option agreement, including Matoush.

The Mineral Resource estimate for each project is considered to be

a “historical estimate” under NI 43-101 and is not considered by

the Company to be current.

To view the table mentioned in the paragraph

above, please

visit: https://www.globenewswire.com/NewsRoom/AttachmentNg/a4d87441-c021-4581-9552-d5d0dd33194f

Technical

Disclosure and Qualified Person

The scientific and technical information

contained in this news release was prepared by Peter Mullens

(FAusIMM), CUR’s VP Business Development, who is a “Qualified

Person” (as defined in NI 43-101).

Each of the above estimates are considered to be

“historical estimates” as defined under NI 43-101, and have been

sourced as follows:

- Ben Lomond: dated as of 1982, and

reported by Mega Uranium Ltd. in a company report entitled

“Technical Report on the Mining Leases Covering the Ben Lomond

Uranium-Molybdenum Deposit Queensland, Australia” dated July 16,

2005;

- Georgetown/Maureen: dated as of

June 25, 2008, and reported by Mega Uranium Ltd. in a company

report entitled “A Review and Resource Estimate of the Maureen

Uranium-Molybdenum Deposit, North Queensland, Australia Held by

Mega Uranium Ltd.” dated June 25, 2008;

- Mountain Lake: dated as of February

15, 2005 and reported by Triex Mineral Corporation in a company

report entitled “Mountain Lake Property Nunavut” dated February 15,

2005;

- Moran Lake: dated as of January 20,

2011 as revised March 10, 2011 and reported by Crosshair

Exploration & Mining Corp. in a company report entitled

“Technical Report on the Central Mineral Belt (CMB) Uranium –

Vanadium Project, Labrador, Canada” dated January 20, 2011 as

revised March 10, 2011;

- Laguna Salada: dated as of May 20,

2011 and reported by U3O8 Corporation in a company report entitled

“NI 43-101 Technical Report Laguna Salada Initial Resource

Estimate” dated May 20, 2011; and

- Dieter Lake: dated 2006 and

reported by Fission Energy Corp. in a company report entitled

“Technical Report on the Dieter Lake Property, Quebec, Canada”

dated October 7, 2011.

- Matoush: dated December 7, 2012 and

reported by Strateco Resources Inc. in a press release dated

December 7, 2012.

In each instance, the historical estimate is

reported using the categories of Mineral Resources and Mineral

Reserves as defined by NI 43-101, but is not considered by the

Company to be current. In each instance, the reliability of the

historical estimate is considered reasonable, but a Qualified

Person has not done sufficient work to classify the historical

estimate as a current Mineral Resource and the Company is not

treating the historical estimate as a current Mineral Resource. The

historical information provides an indication of the exploration

potential of the properties but may not be representative of

expected results.

For Ben Lomond, as disclosed in the above noted

technical report, the historical estimate was prepared by The

Australian Atomic Energy Commission (AAEC) using a sectional

method. The parameters used in the selection of the ore intervals

were a minimum true thickness of 0.5 metres and maximum included

waste (true thickness) of 5 metres. Resource zones were outlined on

25 metre sections using groups of intersections, isolated

intersections were not included. The grades from the composites

were area weighted to give the average grade above a threshold of

500 ppm uranium. The area was measured on each 25 metre section to

give the tonnage at a bulk density of 2.603. The Company would need

to conduct an exploration program, including twinning of historical

drill holes in order to verify the Ben Lomond historical estimate

as a current Mineral Resource.

For Georgetown/Maureen, as disclosed in the

above noted technical report, the historical estimate was prepared

by Mining Associates using a block model estimation methodology.

Resource modelling was carried out on a database comprising 94,810

metres of combined drilling. Using a variety of estimation

techniques, a 5x5x5 metre block model was constructed. This defined

the shallow westward-dipping mineralization mantos which contain

the higher grade zones. The Company would need to conduct an

exploration program, including twinning of historical drill holes

in order to verify the Georgetown/Maureen historical estimate as a

current Mineral Resource.

For Mountain Lake, as disclosed in the above

noted technical report, the historical estimate was prepared by

F.R. Hassard, B.A.Sc., P. Eng. (Qualified Person) using the polygon

method. The resource estimate was based on a minimum grade of 0.1%

U3O8, a minimum vertical thickness of 1.0 metre and specific

gravity of 2.5. The Company would need to conduct an exploration

program, including twinning of historical drill holes in order to

verify the Mountain Lake historical estimate as a current Mineral

Resource.

For Moran Lake, as disclosed in the above noted

technical report, the historical estimate was prepared by C.

Stewart Wallis P. Geo, Barry A. Sparkes, P. Geo., Gary H. Giroux,

P. Eng. (Qualified Person) using three-dimensional block models

utilizing ordinary kriging to interpolate grades into each 10m x

10m x 4m high block. For the purpose of the vanadium resource

estimate, a vanadium specific model was created in the Upper C rock

package above the C Zone thrust fault. The vanadium model is based

on a wireframe solid defining the vanadium mineralized envelope

using an external cut-off of approximately 0.1% V2O5. For the

purposes of the estimates, a specific gravity of 2.83 was used. The

Company would need to conduct an exploration program, including

twinning of historical drill holes in order to verify the Moran

Lake historical estimate as a current Mineral Resource.

For Laguna Salada, as disclosed in the above

noted technical report, the historical estimate was prepared by

Coffey Mining Pty. Ltd. using block models utilizing ordinary

kriging to interpolate grades into each 1000m x 1000m x 10m parent

cell. For the purposes of the estimate, bulk density of 1.7t/m³ was

used for Lago Seco and 1.95t/m³ for Guanaco. The Company would need

to conduct an exploration program, including trenching in order to

verify the Laguna Salada historical estimate as a current Mineral

Resource.

For Dieter Lake, as disclosed in the above noted

technical report, the historical estimate was prepared by Davis

& Guo using the Thiessen (Voronoi) polygon method. Data

constraints used were 200 ppm, 500 ppm, and 1000ppm U3O8 over a

minimum of 1 metre thickness. Polygons created had radii of 200

metres. A rock density of 2.67g/cm3 was used. The Company would

need to conduct an exploration program, including twinning of

historical drill holes in order to verify the Dieter Lake

historical estimate as a current Mineral Resource.

For Matoush, as disclosed in the above noted

press release, the historical estimate was prepared by RPA using

block U3O8 grades within a wireframe model that were estimated by

ordinary kriging. The historical estimate was estimated at a

cut-off grade of 0.1% U3O8 and using an average long-term uranium

price of US$75 per pound. Six zones make up the historical estimate

at Matoush: AM-15, MT-34, MT-22, MT-02, MT-06, and MT-36. Each zone

is made up of one or more lenses, most of which strike north (009°)

and dip steeply (87°) to the east. Outlines of the mineralized

lenses were interpreted on ten-metre spaced vertical sections.

Minimum criteria of 0.10% U3O8 over 1.5 m true thickness was used

as a guide. The Company would need to conduct an exploration

program, including twinning of historical drill holes in order to

verify the Matoush historical estimate as a current Mineral

Resource.

About International Consolidated

Uranium

International Consolidated Uranium Inc.

(formerly, NxGold Ltd.) is a Vancouver-based exploration and

development company. The Company has entered option agreements to

acquire five uranium projects in Australia, Canada and Argentina

each with significant past expenditures and attractive

characteristics for development; with Mega Uranium Ltd. (TSX:

MGA) the right to acquire a 100% interest in the

Ben Lomond and Georgetown uranium projects in Australia; with

IsoEnergy Ltd. (TSXV: ISO) the right to acquire a

100% interest in the Mountain Lake uranium project in Nunavut,

Canada; with a private individual the right to acquire a 100%

interest in the Moran Lake uranium and vanadium project in

Labrador, Canada; and with U3O8 Corp. (TSXV:

UWE.H), the right to acquire a 100% interest in

the Laguna Salada uranium and vanadium project in Argentina. The

Company entered into the Mountain Lake option agreement with

IsoEnergy on July 16, 2020, and the transaction remains subject to

regulatory approval, as does the transaction with U3O8 Corp. on the

Laguna Salada Project. In addition, the Company owns 80% of the Mt.

Roe gold project located in the Pilbara region of Western Australia

and has entered into an earn-in agreement with Meliadine Gold Ltd.

to earn up to a 70% interest in the Kuulu Project (formerly known

as the Peter Lake Gold Project) in Nunavut.

Philip Williams

President and CEOInternational Consolidated

Uranium Inc.+1 778 383 3057pwilliams@consolidateduranium.com

Neither TSX Venture Exchange nor its Regulations

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Cautionary Statement Regarding

Forward-Looking Information.

This news release contains "forward-looking

information" within the meaning of applicable Canadian securities

legislation. “Forward-looking information” includes, but is not

limited to, statements with respect to activities, events or

developments that the Company expects or anticipates will or may

occur in the future including whether the proposed acquisition will

be completed and the work required to verify the historical

estimates as a current Mineral Resources. Generally, but not

always, forward-looking information and statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or the negative connotation

thereof or variations of such words and phrases or state that

certain actions, events or results “may”, “could”, “would”, “might”

or “will be taken”, “occur” or “be achieved” or the negative

connotation thereof.

Such forward-looking information and statements

are based on numerous assumptions, including that general business

and economic conditions will not change in a material adverse

manner, that financing will be available if and when needed and on

reasonable terms, and that third party contractors, equipment and

supplies and governmental and other approvals required to conduct

the Company’s planned exploration activities will be available on

reasonable terms and in a timely manner. Although the assumptions

made by the Company in providing forward-looking information or

making forward-looking statements are considered reasonable by

management at the time, there can be no assurance that such

assumptions will prove to be accurate.

Forward-looking information and statements also

involve known and unknown risks and uncertainties and other

factors, which may cause actual events or results in future periods

to differ materially from any projections of future events or

results expressed or implied by such forward-looking information or

statements, including, among others: whether the conditions to

completion of the acquisition will be satisfied, negative operating

cash flow and dependence on third party financing, uncertainty of

additional financing, no known mineral reserves or resources,

reliance on key management and other personnel, potential downturns

in economic conditions, actual results of exploration activities

being different than anticipated, changes in exploration programs

based upon results, and risks generally associated with the mineral

exploration industry, environmental risks, changes in laws and

regulations, community relations and delays in obtaining

governmental or other approvals.

Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information

or implied by forward-looking information, there may be other

factors that cause results not to be as anticipated, estimated or

intended. There can be no assurance that forward-looking

information and statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated, estimated or intended. Accordingly, readers should not

place undue reliance on forward-looking statements or information.

The Company undertakes no obligation to update or reissue

forward-looking information as a result of new information or

events except as required by applicable securities laws.

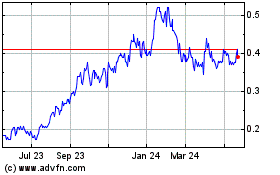

Mega Uranium (TSX:MGA)

Historical Stock Chart

From Dec 2024 to Jan 2025

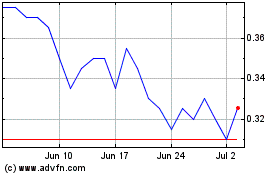

Mega Uranium (TSX:MGA)

Historical Stock Chart

From Jan 2024 to Jan 2025