BULLETIN TYPE: Notice to Issuers

BULLETIN DATE: January 7, 2011

Re: Expedited Private Placements

TSX Venture Exchange ("TSXV") is publishing this Notice to Issuers to

clarify certain of our requirements and procedures related to Expedited

Private Placements (being a private placement that meets all of the

eligibility requirements set forth in section 5.2 of Policy 4.1 of the TSXV

Corporate Finance Manual and Part III of Form 4B - Notice of Private

Placement).

It has come to the attention of TSXV that the provisions of Part 5 of

Policy 4.1 have erroneously been interpreted by some issuers and their

advisors as permitting an issuer to close an Expedited Private Placement

prior to the issuer having completed the filing requirements prescribed by

section 5.4 of Policy 4.1. In this regard, TSXV advises as follows:

1. An Issuer must complete the filing requirements prescribed by section

5.4 of Policy 4.1 before closing an Expedited Private Placement.

2. An Issuer may close an Expedited Private Placement once it has completed

the filing requirements prescribed by section 5.4 of Policy 4.1 (i.e.

closing may occur prior to TSXV providing its final acceptance of the

private placement). It should be noted, however, that TSXV recommends,

but does not require, that an issuer wait until it has received TSXV's

final acceptance of the private placement before closing an Expedited

Private Placement.

3. Where TSXV reviews the filings associated with an Expedited Private

Placement and determines that the private placement does not: (a) meet

the eligibility requirements for an Expedited Private Placement; or (b)

comply with any other requirement of TSXV, TSXV may require that the

issuer unwind the private placement (if it has already been closed) or

take such other actions or be subject to such other sanctions as may be

prescribed by TSXV.

If you have any questions about this bulletin, please contact:

In British Columbia: Zafar Khan, Phone: 604-602-6982

Fax: 604-844-7502

In Alberta: Roy Homyshin, Phone: 403-218-2826

Fax: 403-234-4211

In Ontario: Tim Babcock, Phone: 416-365-2202

Fax: 416-365-2224

In Quebec: Louis Doyle, Phone: 514-788-2407

Fax: 514-788-2407

TYPE DE BULLETIN: Avis aux emetteurs

DATE DU BULLETIN: Le 7 janvier 2011

Objet: Placements prives acceleres

La Bourse de croissance TSX (la "Bourse") publie le present avis aux

emetteurs afin de clarifier certaines de ses exigences et procedures

relatives aux placements prives acceleres, soit les placements prives qui

repondent aux criteres d'admissibilite enonces au paragraphe 5.2 de la

Politique 4.1 - Placements prives et a la partie III du formulaire 4B -

Avis de placement prive du Guide de financement des societes de la Bourse

de croissance TSX.

La Bourse a constate que certains emetteurs et leurs conseillers

considerent a tort que les dispositions de la partie 5 de la Politique 4.1

permettent a un emetteur de proceder a la cloture d'un placement prive

accelere avant que l'emetteur ait respecte les exigences de depot

prescrites par le paragraphe 5.4 de la Politique 4.1. La Bourse tient a

preciser ce qui suit a cet egard:

1. L'emetteur doit respecter les exigences de depot enoncees au paragraphe

5.4 de la Politique 4.1 avant de proceder a la cloture d'un placement

prive accelere.

2. L'emetteur peut proceder a la cloture d'un placement prive accelere des

qu'il a rempli les exigences de depot enoncees au paragraphe 5.4 de la

Politique 4.1. La cloture du placement prive accelere peut avoir lieu

avant que la Bourse ait donne son consentement definitif a l'egard du

placement prive, mais la Bourse recommande, sans l'exiger, que

l'emetteur attende d'avoir recu ce consentement avant de proceder a la

cloture.

3. Si apres avoir examine les documents relatifs a un placement prive

deposes suivant la procedure de depot accelere, la Bourse etablit que le

placement prive a) ne repond pas aux criteres d'admissibilite a cette

procedure ou b) ne respecte pas ses autres exigences, la Bourse peut

obliger l'emetteur a annuler le placement prive (si la cloture a deja eu

lieu) ou a prendre les autres mesures ou a subir les autres sanctions

qu'elle peut prescrire. Toute question concernant le present bulletin

peut etre adressee aux personnes suivantes:

En Colombie-Britannique: Zafar Khan, telephone: 604-602-6982

Telecopieur: 604-844-7502

En Alberta: Roy Homyshin, telephone: 403-218-2826

telecopieur: 403-234-4211

En Ontario: Tim Babcock, telephone: 416-365-2202

telecopieur: 416-365-2224

Au Quebec: Louis Doyle, telephone: 514-788-2407

telecopieur: 514-788-2407

---------------------------------------------------------------------------

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: January 6, 2011

TSX Venture Company

A Cease Trade Order has been issued by the Alberta Securities Commission on

January 6, 2011 against the following company for failing to file the

documents indicated within the required time period:

Symbol Tier Company Failure to File Period

Ending

(Y/M/D)

DVS 2 Diversified Annual Audited Financial

Industries Ltd. Statements 10/08/31

Annual Management's Discussion

and Analysis 10/08/31

Certification of Annual Filings 10/08/31

Upon revocation of the Cease Trade Order, the Company's shares will remain

suspended until the Company meets TSX Venture Exchange requirements.

Members are prohibited from trading in the securities of the Company during

the period of the suspension or until further notice.

---------------------------------------------------------------------------

ALBERTA OILSANDS INC. ("AOS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 22, 2010:

Number of Shares: 470,000 flow-through shares

Purchase Price: $0.64 per share

Number of Placee: 1 placee

No Insider / Pro Group Participation

Finder's Fee: Trimor Capital Corp. - $18,048 cash

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

ALEXANDER MINING PLC ("AXD")

BULLETIN TYPE: New Listing-Shares

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

Effective at the opening January 10, 2011, the Ordinary shares of the

Company will commence trading on TSX Venture Exchange. The Company is

classified as a 'Mineral Processing / Technology' company.

The Company is presently trading on the Alternative Investment Market of

the London Stock Exchange.

Corporate Jurisdiction: England and Wales

Capitalization: 240,000,000 Ordinary shares with par value of

GBPPounds Sterling 0.10 of which 135,486,542

Ordinary shares are issued and outstanding

Escrowed Shares: 1,635,900 Ordinary shares

Transfer Agent: Equity Financial Trust Company

Trading Symbol: AXD

CUSIP Number: G0224R103

Sponsoring Member: Haywood Securities Inc.

For further information, please refer to the Company's Application for

Listing dated December 30, 2010.

Company Contact: Terence Cross

Company Address: 1st Floor, 35 Piccadilly, London

W1J 0DW, United Kingdom

Company Phone Number: +44 (0) 20 7292 1300

Company Fax Number: +44 (0) 20 7292 1313

Company Email Address: admin@alexandermining.com

---------------------------------------------------------------------------

ARCTURUS VENTURES INC. ("AZN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the fourth and final tranche of a Non-Brokered Private Placement announced

December 7, 2010 and December 14, 2010:

Number of Shares: 1,423,523 non-flow-through shares

Purchase Price: $0.105 per share

Warrants: 1,423,523 share purchase warrants to purchase

1,423,523 shares

Warrant Exercise Price: $0.14 for a two year period

Number of Placees: 12 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Julie Catling P 50,000

Finder's Fee: Macquarie Private Wealth will receive a

finder's fee of $3,150 and 40,000 Broker

Warrants that are exercisable into common

shares at $0.14 per share for a two year

period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

BIG RED DIAMOND CORPORATION ("DIA")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

an Agreement dated December 10, 2010 between Ressources Vanstar Inc. and

the Company, whereby the Company acquired a 100% interest in 26 claims in

the Kipawa Rare Earth property, located south of Rouyn-Noranda in the

province of Quebec, in consideration of $5,000 and 300,000 common shares.

Please refer to the Company's press release dated December 14, 2010.

CORPORATION BIG RED DIAMOND ("DIA")

TYPE DE BULLETIN: Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN: Le 7 janvier 2011

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

convention datee du 10 decembre 2010, entre Ressources Vanstar inc. et la

societe, selon laquelle la societe a acquis une participation de 100 % dans

26 claims dans la propriete de terres rares Kipawa situee au sud de Rouyn-

Noranda dans la province de Quebec, en consideration de 5 000 $ et de 300

000 actions ordinaires.

Veuillez-vous referer au communique de presse emis par la societe le 14

decembre 2010.

---------------------------------------------------------------------------

BIG RED DIAMOND CORPORATION ("DIA")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

an Agreement dated November 29, 2010, whereby the Company acquired a 100%

interest in 18 claims in four Rare Earth properties, located north-eastern

of British-Columbia, in consideration of $35,000 and 1,000,000 common

shares.

Please refer to the Company's press release dated November 30, 2010.

CORPORATION BIG RED DIAMOND ("DIA")

TYPE DE BULLETIN: Convention d'achat de propriete, d'actif ou d'actions

DATE DU BULLETIN: Le 7 janvier 2011

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

convention datee du 29 novembre 2010 selon laquelle la societe a acquis une

participation de 100 % dans 18 claims dans quatre proprietes de terres

rares au nord-est de la Colombie-Britannique, en consideration de 35 000 $

et de 1 000 000 d'actions ordinaires.

Veuillez-vous referer au communique de presse emis par la societe le 30

novembre 2010.

---------------------------------------------------------------------------

BIRCH LAKE ENERGY INC. ("BLK")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 22, 2010:

Number of Securities: 5,000,000 units ("Units")

Each Unit consists of 1 common share and ╜

common share purchase warrant

Purchase Price: $0.20 per Unit

Warrants: 2,500,000 share purchase warrants to purchase

2,500,000 shares

Warrant Exercise Price: $0.50 for up to 8 months from date of issuance

Warrants are also subject to an early exercise

provision as detailed in the Company's press

release dated December 10, 2010

Number of Placees: 53 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

David Stadnyk Y 62,500

William H. Petrie Sr. Y 200,000

Andrew Grimmett P 40,000

Paul Saks P 100,000

Dalena Blaeser P 12,500

Stephanie Weterings P 12,500

Thomas Seltzer P 175,000

Frank Eckert P 12,500

Robert J. Sheppartd P 50,000

Brian Buckley P 125,000

Lydia Dragich P 125,000

Colette Wood P 25,000

Catherine Seltzer P 118,750

E Alan Knowles P 100,000

Dominik Spooner P 50,000

Traci Treleaven P 50,000

Allison Pepter P 12,500

Sarine Mustapha P 50,000

Richard Moore P 125,000

Michael Mansfield P 175,000

Finder's Fee: $16,200 cash and 81,000 non-transferrable

warrants ("Finder Warrants") payable to

Macquarie Private Wealth Inc.

$29,200 cash and 146,000 Finder Warrants

payable to Haywood Securities Inc.

$3,200 cash and 16,000 Finder Warrants payable

to PI Financial Corp.

$7,200 cash and 36,000 Finder Warrants payable

to Merchant Equities Capital Corp.

$11,200 cash and 56,000 Finder Warrants

payable to Jean Dan Management Ltd.

Each Finder Warrant is exercisable for one

common share at a price of $0.20 for up to 1

year from closing.

---------------------------------------------------------------------------

BORDER PETROLEUM CORP. ("BOR")

BULLETIN TYPE: Halt

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

Effective at 6:02 a.m. PST, January 7, 2011, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

BROOKEMONT CAPITAL INC. ("BKT")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation in connection

with a Property Purchase Agreement dated December 31, 2010 between the

Company and 0895459 BC Ltd. (S. M. Arshad Amin) whereby the Company has

acquired 15 mineral claims located within the Cariboo Gold Region, British

Columbia. Consideration is $15,000 and 3,000,000 common shares.

Asia Asset Management Inc. (Munir Ali / Alida Ali) will receive a finder's

fee of 228,260 common shares.

---------------------------------------------------------------------------

CLEANFIELD ALTERNATIVE ENERGY INC. ("AIR")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 267,124 common shares at a deemed value of $0.20 per share to settle

outstanding debt for $53,424.66.

Number of Creditors: 3 Creditors

The Company shall issue a news release when the shares are issued and the

debt extinguished.

---------------------------------------------------------------------------

ERIN VENTURES INC. ("EV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 7, 2010:

Number of Securities: 6,000,000 units ("Units")

Each Unit consists of one common share and one

share purchase warrant.

Purchase Price: $0.10 per Unit

Warrants: 6,000,000 share purchase warrants to purchase

16,500,000 shares

Warrant Exercise Price: $0.15 for a one year period

$0.25 in the second year

Number of Placees: 29 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Units

Steven Wright P 100,000

Gary Winters P 100,000

Ivano Veschini P 100,000

Finder's Fee: $10,000 cash payable to Precious Metals

Investments

$10,000 cash payable to Canaccord Genuity

Corp.

$40,000 cash payable to D D Mercantile Corp

---------------------------------------------------------------------------

FOCUS METALS INC. ("FMS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with respect

to a Non-Brokered Private Placement, announced on December 17, 2010

Number of Shares: 5,000,000 common shares

Purchase Price: $0.25 per common share

Warrants: 2,500,000 warrants to purchase 2,500,000

common shares

Warrants Exercise Price: $0.35 per share for a period of 24 months

following the closing of the Private Placement

Number of Placees: 26 placees

Finder's Fee: $90,360, plus 400,000 warrants (each

exercisable into one common share at a price

of $0.25 for a period of two years) payable to

Allyson Taylor Partners Inc.

The Company has announced the closing by way of a press release dated

December 23, 2010.

LES METAUX FOCUS INC. ("FMS")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 7 janvier 2011

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 17

decembre 2010:

Nombre d'actions: 5 000 000 d'actions ordinaires

Prix: 0,25 $ par action ordinaire

Bons de souscription: 2 500 000 bons permettant d'acquerir 2 500 000

actions ordinaires

Prix d'exercice des bons: 0,35 $ l'action pendant une periode de 24 mois

suivant la cloture du placement prive

Nombre de souscripteurs: 26 souscripteurs

Honoraires d'intermediation: Allyson Taylor Partners Inc. a recu 90 360 $

en especes et 400 000 bons de souscription,

chacun permettant d'acquerir une action

ordinaire de la societe au prix de 0,25 $

l'action pendant une periode de 24 mois

suivant la cloture du placement prive.

La societe a annonce la cloture du placement prive par voie d'un communique

de presse date du 23 decembre 2010.

---------------------------------------------------------------------------

FOCUS METALS INC. ("FMS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with respect

to a Non-Brokered Flow-Through Private Placement, announced on December 17,

2010

Number of Shares: 6,666,668 common shares

Purchase Price: $0.30 per common share

Warrants: 3,333,334 warrants to purchase 3,333,334

common shares

Warrants Exercise Price: $0.40 per share for a period of 24 months

following the closing of the Private Placement

Number of Placees: 20 placees

Finder's Fee: $160,000, plus 533,333 warrants (each

exercisable into one common share at a price

of $0.30 for a period of two years) payable to

Allyson Taylor Partners Inc.

The Company has announced the closing by way of a press release dated

December 30, 2010.

LES METAUX FOCUS INC. ("FMS")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 7 janvier 2011

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 17

decembre 2010:

Nombre d'actions: 6 666 668 actions ordinaires

Prix: 0,30 $ par action ordinaire

Bons de souscription: 3 333 334 bons permettant d'acquerir 3 333 334

actions ordinaires

Prix d'exercice des bons: 0,40 $ l'action pendant une periode de 24 mois

suivant la cloture du placement prive

Nombre de souscripteurs: 20 souscripteurs

Honoraires d'intermediation: Allyson Taylor Partners Inc. a recu 160 000 $

en especes et 533 333 bons de souscription,

chacun permettant d'acquerir une action

ordinaire de la societe au prix de 0,30 $

l'action pendant une periode de 24 mois

suivant la cloture du placement prive.

La societe a annonce la cloture du placement prive par voie d'un communique

de presse date du 30 decembre 2010.

---------------------------------------------------------------------------

GEO MINERALS LTD. ("GM")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to an

Agreement dated November 15, 2010 between GEO Minerals Ltd. (the "Company")

and Blair Naughty (the "Vendor"), whereby the Company is acquiring a 100%

interest in the Onstrike claims, located in northwestern Quebec. In

consideration, the Company will pay $10,000 and 500,000 shares to the

Vendor.

The Agreement is subject to a net smelter return royalty of 2% payable to

the Vendor, half of which (1%) may be re-purchased at any time by the

Company for a payment of $1,000,000.

Insider / Pro Group Participation: N/A

---------------------------------------------------------------------------

GITENNES EXPLORATION INC. ("GIT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 15, 2010:

Number of Shares: 4,000,000 shares

Purchase Price: $0.07 per share

Warrants: 4,000,000 share purchase warrants to purchase

4,000,000 shares

Warrant Exercise Price: $0.10 for a one year period

$0.20 in the second six month period

Number of Placees: 23 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Jerry Blackwell Y 42,857

Finders' Fees: Haywood Securities Inc. - $3,640.00

Syndicated Capital Corp. (Salman Jamal) û

$840.00

Canaccord Genuity corp. - $1,360.80

Ramy Holdings Inc. (Keith McKenzie) û

$3,200.00

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

GOLD REACH RESOURCES LTD. ("GRV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 15, 2010 and December

6, 2010:

Number of Shares: 2,884,345 flow-through shares

475,000 non flow-through shares

Purchase Price: $0.55 per flow-through share

$0.42 per non flow-through share

Warrants: 3,359,345 share purchase warrants to purchase

3,359,345 shares

Warrant Exercise Price: $0.60 for a two year period

Number of Placees: 46 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert J. Bebluk P 60,000

Conrad Swanson Y 600,000

MineralFields Group Y 854,545

Kinder S Deo Y 60,000

Pat Glazier Y 150,000

James Pettit Y 55,000

Finders' Fees: $32,900 and 59,818 Finder Warrants payable to

Limited Market Dealer Inc.

$9,903.25 and 18,585 Finder Warrants payable

to Odlum Brown Ltd.

$22,148 and 40,600 Finder Warrants payable to

Raymond James Ltd.

$1,051.05 and 1,911 Finder Warrants payable to

Jennings Capital Inc.

$1,732.50 and 3,150 Finder Warrants payable to

Union Securities Ltd.

$7,350 and 17,500 Finder Warrants payable to

Legace Capital

- Each Finder Warrant is exercisable into one

common share at $0.60 for a two year period

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

---------------------------------------------------------------------------

HAWTHORNE GOLD CORP. ("HGC")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: January 7, 2011

TSX Venture Tier 1 Company

Effective at 7:00 a.m., PST, January 7, 2011, shares of the Company resumed

trading, an announcement having been made over Stockwatch.

---------------------------------------------------------------------------

ISEEMEDIA INC. ("IEE")

BULLETIN TYPE: Halt

BULLETIN DATE: January 7, 2011

TSX Venture Tier 1 Company

Effective at 7:57 a.m. PST, January 7, 2011, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

J.A.G. LTEE (LES MINES) ("JML")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation with respect

to a Non-Brokered Private Placement announced on October 4, 2010

Number of Shares: 1,000,000 common shares

Purchase Price: $0.15 common share

Warrants: 1,000,000 warrants to purchase 1,000,000

common shares

Warrants Exercise Price: $0.25 per share for a 12-month period

Number of Placees: 8 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / Number of shares

Le Groupe Gethe Inc. (Pierre Gevry) Y 80,000

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release dated December 30, 2010

LES MINES J.A.G. LTEE ("JML")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 7 janvier 2011

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier tel qu'annonce le 4

octobre 2010:

Nombre d'actions: 1 000 000 d'actions ordinaires

Prix: 0,15 $ par action ordinaire

Bons de souscription: 1 000 000 de bons de souscription permettant

de souscrire a 1 000 000 d'actions ordinaires

Prix d'exercice des bons: 0,25 $ par action pour une periode de 12 mois

Nombre de souscripteurs: 8 souscripteurs

Participation Initie / Groupe Pro:

Initie=Y /

Nom GroupePro=P / Nombre d'actions

Le Groupe Gethe Inc. (Pierre Gevry) Y 80 000

La societe a confirme la cloture du placement prive mentionne ci-dessus par

voie d'un communique de presse date du 30 decembre 2010.

---------------------------------------------------------------------------

KOOTENAY GOLD INC. ("KTN")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 9, 2010:

Number of Shares: 7,059,000 shares

Purchase Price: $0.85 per share

Warrants: 3,529,500 share purchase warrants to purchase

3,529,500 shares

Warrant Exercise Price: $1.20 for a two year period

Number of Placees: 19 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Howard Katz P 47,000

James Anderson P 40,000

Finders' Fees: Union Securities Ltd. - $120,000

Cherwell Partners Limited (Philip Matias) -

$7,500

Paolo Bernasconi - $10,200

Advisory Fee: M Partners Inc. - $75,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly. Note

that in certain circumstances the Exchange may later extend the expiry date

of the warrants, if they are less than the maximum permitted term.)

---------------------------------------------------------------------------

LONGREACH OIL AND GAS LIMITED ("LOI")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 131,331 common shares at a deemed value of $1.26 per share to settle

outstanding debt for $165,477.06.

Number of Creditors: 1 Creditor

The Company shall issue a news release when the shares are issued and the

debt extinguished.

---------------------------------------------------------------------------

LOON ENERGY CORPORATION ("LNE")

BULLETIN TYPE: Shares for Services

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 3,500,000 shares at a deemed price of $0.13 per share, in

consideration of certain services provided to the company.

Insider / Pro Group Participation:

Insider=Y / Amount Deemed Price

Creditor Progroup=P / Owing per Share # of Shares

Norman Holton Y $130,000 $0.13 1,000,000

Timothy Elliot Y $130,000 $0.13 1,000,000

Jock Graham Y $130,000 $0.13 1,000,000

Edwin Beaman Y $65,000 $0.13 65,000

The Company shall issue a news release when the shares are issued.

---------------------------------------------------------------------------

MEGA PRECIOUS METALS INC. ("MGP")

ROLLING ROCK RESOURCES CORPORATION ("RLL"))

BULLETIN TYPE: Amalgamation, Delist, Correction

BULLETIN DATE: January 7, 2011

TSX Venture Tier 1 Companies

Further to TSX Venture Exchange Bulletin dated December 15, 2010, the

following should have been included:

Pursuant to an Advisory Agreement dated September 20, 2010 between the Mega

Precious and PowerOne Capital Markets Limited ("PowerOne"), Mega Precious

will pay an advisory fee, in connection with the amalgamation, to PowerOne

equal to 2% of the transaction value. As a result, the fee is comprised of

the issuance of 342,200 common shares of Mega Precious.

In addition, the post-amalgamation issued and outstanding shares of Mega

Precious has been amended from 61,178,780 shares to 61,520,980 shares

taking into account the additional 342,200 shares to be issued as indicated

above.

Other than indicated above, the bulletin below remains unaltered.

1. Amalgamation:

Pursuant to special resolutions passed by the shareholders of Rolling Rock

Resources Corporation ("Rolling Rock") on December 7, 2010 and by

Certificate of Amalgamation, issued December 14, 2010, Rolling Rock and

0893573 B.C. LTD ("Mega Subco"), a wholly owned subsidiary of Mega Precious

Metals Inc. ("Mega Precious"), have amalgamated on the following basis:

-- Mega Precious issuing 0.4 common shares for each common share of Rolling

Rock, except for Rolling Rock shares held by Mega Precious and its

Affiliates.

-- Holders of convertible securities of Rolling Rock will receive, upon

exercise, exchange or conversion thereof, 0.4 of a Mega Precious share,

in lieu of each one Rolling Rock share on the terms and conditions set

out in the Rolling Rock Information Circular dated November 7, 2010.

Effective at the opening, Thursday, December 16, 2010, the common shares of

Mega Precious Metals Inc. will commence trading on the TSX Venture

Exchange. The Company is classified as a 'Mineral Exploration &

Development' company.

Mega Precious Post û

Amalgamation Capitalization: Unlimited common shares with no par value of

which 61,178,780 common shares are issued and

outstanding

Escrowed: Nil common shares

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: MGP (UNCHANGED)

CUSIP Number: 58516L 10 8 (UNCHANGED)

Further information on this transaction can be found in the Rolling Rock

Information Circular dated November 5, 2010, and both companies' news

releases dated September 24, 2010, November 1, 2010, December 7, 2010 and

December 14, 2010.

2. Delist:

Effective at the close of business Thursday, December 16, 2010, the common

shares of Rolling Rock Resources Corporation will be delisted from TSX

Venture Exchange at the request of Rolling Rock.

---------------------------------------------------------------------------

MONARCH ENERGY LIMITED ("MNL")

BULLETIN TYPE: Halt

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

Effective at 9:38 a.m. PST, January 7, 2011, trading in the shares of the

Company was halted at the request of the Company, pending receipt and

review of acceptable documentation regarding the change of business and/or

Reverse Take-Over pursuant to Listings Policy 5.2. This regulatory halt is

imposed by Investment Industry Regulatory Organization of Canada, the

Market Regulator of the Exchange pursuant to the provisions of Section

10.9(1) of the Universal Market Integrity Rules.

---------------------------------------------------------------------------

NEW DESTINY MINING CORP ("NED")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated December 20,

2010, has been filed with and accepted by TSX Venture Exchange, and filed

with and receipted by the British Columbia and Alberta Securities

Commissions on December 22, 2010, pursuant to the provisions of the British

Columbia and Alberta Securities Acts.

The gross proceeds received by the Company for the Offering were $678,300

(4,522,000 common shares at $0.15 per share). The Company is classified as

a 'Mineral Exploration' company.

Commence Date: At the opening Tuesday January 11, 2011, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value of

which 9,457,000 common shares are issued and

outstanding

Escrowed Shares: 3,025,000 common shares are subject to 36

month staged release escrow

Transfer Agent: Equity Financial Trust Company

Trading Symbol: NED

CUSIP Number: 64374A101

Agent: Wolverton Securities Ltd.

Greenshoe Option: The Agent has over-allotted the Offering to

the extent of 22,000 shares. The Company has

granted a Greenshoe Option to cover over-

allotments, entitling the Agent to purchase a

total of 22,000 shares at a price of $0.15 per

share.

Agent's Warrants: 361,760 non-transferable share purchase

warrants. One warrant to purchase one share at

$0.15 per share up to January 11, 2013.

For further information, please refer to the Company's Prospectus dated

December 20, 2010.

Company Contact: Bryce A. Clark

Company Address: Suite 200 - 551 Howe Street,

Vancouver, BC, V6C 2C2

Company Phone Number: 604-683-0343

Company Fax Number: 604-683-4499

Company Email Address: b.clark@minniclark.com

---------------------------------------------------------------------------

ODIN MINING AND EXPLORATION LTD. ("ODN")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

Further to our bulletin dated December 21, 2009, TSX Venture Exchange has

accepted an amendment to warrants issued pursuant to a private placement of

18,750,000 shares and 18,750,000 share purchase warrants:

Warrants: 18,750,000 share purchase warrants

Current Warrant

Exercise Terms: $0.20 for an eighteen month period

Amendment: A total of 14,056,875 warrants were exercised

for 14,056,875 additional warrants ("New

Warrant"). Each New Warrant will be

Exercisable for one common share at a price of

$0.30 per share for a two year period. If

after April 24, 2010 the Company's shares

close at $0.45 or more for ten consecutive

trading days, the Company may, upon notice to

the warrant holders, shorten the exercise

period to 30 days from the date of notice.

A total of 4,693,125 warrants remain

unexercised with an exercise price of

$0.20 and an expiry date of June 21, 2011.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the expiry dates of the hold period(s). The

Company must also issue a news release if the private placement does not

close promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

---------------------------------------------------------------------------

OLYMPIA FINANCIAL GROUP INC. ("OLY")

BULLETIN TYPE: Declaration of Dividend

BULLETIN DATE: January 7, 2011

TSX Venture Tier 1 Company

The Issuer has declared the following dividend(s):

Dividend per Share: $0.65

Payable Date: January 31, 2011

Record Date: January 18, 2011

Ex-Dividend Date: January 14, 2011

---------------------------------------------------------------------------

OTTERBURN RESOURCES CORP. ("OBN")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

The Company's Initial Public Offering ('IPO') Prospectus dated November 26,

2010, has been filed with and accepted by TSX Venture Exchange, and filed

with and receipted by the British Columbia and Alberta Securities

Commission on November 29, 2010, pursuant to the provisions of the British

Columbia and Alberta Securities Act.

The gross proceeds received by the Company for the Offering were $502,500

(3,350,000 common shares at $0.15 per share). The Company is classified as

a 'Mineral Exploration' company.

Commence Date: At the opening Monday January 10, 2011, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: Unlimited common shares with no par value of

which 12,951,334 common shares are issued and

outstanding

Escrowed Shares: 3,850,001 common shares are subject to 36

month staged release escrow

Transfer Agent: Equity Transfer and Trust Company

Trading Symbol: OBN

CUSIP Number: 68965T106

Agent: Wolverton Securities Ltd.

Agent's Warrants: 268,000 non-transferable share purchase

warrants. One warrant to purchase one share at

$ 0.15 per share up to 2 years.

For further information, please refer to the Company's Prospectus dated

November 26, 2010.

Company Contact: Darren Devine

Company Address: 906 - 595 Howe Street,

Vancouver, BC, V6C 2T5

Company Phone Number: 604-638-8067

Company Fax Number: 604-648-8105

Company Email Address: darren@chelmercorp.com

---------------------------------------------------------------------------

PHOENIX CANADA OIL COMPANY LIMITED ("PCO")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated January 4,

2010, it may repurchase for cancellation, up to 200,000 shares in its own

capital stock. The purchases are to be made through the facilities of TSX

Venture Exchange during the period January 11, 2011 to January 10, 2012.

Purchases pursuant to the bid will be made by Jones, Gable and Company

Limited on behalf of the Company.

---------------------------------------------------------------------------

QUETZAL ENERGY LTD. ("QEI")

BULLETIN TYPE: Regional Office Change

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

Pursuant to Policy 1.2, TSX Venture Exchange has been advised of, and

accepted the change of the Filing and Regional Office from Toronto, ON to

Calgary, AB.

---------------------------------------------------------------------------

REDWATER ENERGY CORP. ("RED")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 15, 2010 and November

26, 2010:

Number of Shares: 4,566,743 flow-through shares

Purchase Price: $0.42 per unit

Warrants: 2,283,370 share purchase warrants to purchase

2,283,370 shares

Warrant Exercise Price: $0.60 for a period of one year

Number of Placees: 62 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Tom Szutu P 20,500

Bulent Akdil P 47,700

Anthony Lesiak P 25,000

Finder's Fee: All Group Financial - $40,549.15 cash and

96,545 broker warrants

BMO Nesbitt Burns - $2,419.20 cash and 5,760

broker warrants

Octagon Capital Corporation - $ 28,056.00 cash

and 66,800 broker warrants

Canaccord Genuity Corp. - $ 16,545.41 cash and

39,392 broker warrants

Union Securities Ltd. - $44,536.80 cash and

106,040 broker warrants

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

ROCKBRIDGE RESOURCES INC. ("RBE")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the third and final tranche of a Non-Brokered Private Placement announced

November 10, 2010:

Number of Shares: 425,000 non-flow through shares

130,000 flow through shares

Purchase Price: $0.12 per non-flow through share

$0.15 per flow through share

Warrants: 277,500 share purchase warrants to purchase

277,500 shares

Warrant Exercise Price: $0.25 for a one year period

Number of Placees: 5 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Danny Stachiw P 250,000 nft

Finders' Fees: Northern Securities Inc. receives $2,040 and

14,400 non-transferable warrants, each

exercisable at $0.13 on or before May 31,

2011.

FirstEnergy Capital Corp. receives $1,200 and

10,000 non-transferable warrants, each

exercisable at $0.13 on or before May 31,

2011.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

(Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.)

---------------------------------------------------------------------------

SANATANA DIAMONDS INC. ("STA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the first and second tranches of a Non-Brokered Private Placement announced

December 15, 2010 and December 17, 2010:

Number of Shares: 10,155,883 flow through shares

Purchase Price: $0.17 per share

Number of Placees: 28 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

James Mackie P 567,647

Brenda Mackie P 300,000

Jeffrey Mackie P 150,000

David Lyall P 294,118

George Guy P 88,235

Finders' Fees: Limited Market Dealer Inc. receives $18,000

and 123,529 non-transferable options, each

exercisable for one non-flow through share at

a price of $0.25 per share for a 12 month

period.

Mackie Research Capital Corp. receives $42,000

and 288,235 non-transferable options, each

exercisable for one non-flow through share at

a price of $0.25 per share for a 12 month

period.

Haywood Securities Inc. receives $3,000 and

20,588 non-transferable options, each

exercisable for one non-flow through share at

a price of $0.25 per share for a 12 month

period.

Secutor Holdings Inc. receives $15,300 and

105,000 non-transferable options, each

exercisable for one non-flow through share at

a price of $0.25 per share for a 12 month

period. David Stadnyk receives $11,190.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

SEAFIELD RESOURCES LTD. ("SFF")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 10, 2010:

Number of Shares: 30,000,000 shares

Purchase Price: $0.50 per share

Warrants: 30,000,000 share purchase warrants to purchase

30,000,000 shares

Warrant Exercise Price: $0.75 for a two year period

Number of Placees: 89 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Anthony Roodenburg Y 500,000

David Lyall P 200,000

Robert Sali P 700,000

Michael Marosits P 100,000

Peter Brown P 200,000

Ivano Veschini P 100,000

David R. Ellis P 40,000

Adam Smith P 40,000

Jeffrey Maser P 35,000

Steve Isenberg P 20,000

R. Brent Dunlop P 150,000

Finder's Fee: an aggregate of $862,500, plus 1,725,000

compensation options (each exercisable at a

price of $0.50 for a period of two years into

one common share and one warrant, with each

warrant further exercisable at a price of

$0.75 for a period of two years into one

common share) payable to Peninsula Merchant

Syndications Corp., David Ellis, Peter

Mathias, Casimir Capital Ltd., M Partners Inc.

and Canccord Genuity Corp.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the

warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

STRATHMORE MINERALS CORP. ("STM")

BULLETIN TYPE: Graduation

BULLETIN DATE: January 7, 2011

TSX Venture Tier 1 Company

TSX Venture Exchange has been advised that the Company's shares will be

listed and commence trading on Toronto Stock Exchange at the opening on

January 10, 2011, under the symbol "STM".

As a result of this Graduation, there will be no further trading under the

symbol "STM" on TSX Venture Exchange after January 7, 2011, and its shares

will be delisted from TSX Venture Exchange at the commencement of trading

on Toronto Stock Exchange.

---------------------------------------------------------------------------

TRAVERSE ENERGY LTD. ("TVL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 2, 2010:

Number of Shares: 2,500,000 flow-through shares

Purchase Price: $0.95 per flow-through share

Number of Placees: 62 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert Libin Y 42,000

Sharon Supple Y 10,000

Reid Hutchinson Y 30,000

David Erickson Y 10,000

LJS Investments Ltd.

(James Smith) Y 131,300

Dallas Claypool P 54,000

Ron Wigham P 740,000

Robert G. Jennings P 50,000

Michael Phippen P 50,000

Judy Becht P 10,000

Peter Dunham P 50,000

Charles Fraser P 50,000

Finder's Fee: Canaccord Genuity Corp. - $23,465 Cash

National Bank Financial - $31,455 Cash

---------------------------------------------------------------------------

TRUECLAIM EXPLORATION INC. ("TRM")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 21, 2010:

Number of Shares: 4,807,692 flow-through shares

Purchase Price: $0.26 per flow-through share

Warrants: 2,403,846 share purchase warrants to purchase

2,403,846 shares

Warrant Exercise Price: $0.40 for an eighteen month period

Number of Placees: 4 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Joe Dwek Y 384,615

Pathway Mining 2010 FT LP Y 961,538

MineralFields 2010 Super FT LP Y 2,435,386

MineralFields 2010 - V Super FT Y 1,026,153

Finder's Fee: $57,500 and 442,307 finder's options payable

to Limited Market Dealer Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

URAGOLD BAY RESOURCES INC. ("UBR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced on December 23, 2010:

Number of Shares: 3,100,000 flow-through common shares

Purchase Price: $0.065 per flow-through common share

Warrants: 1,550,000 warrants to purchase a maximum of

1,550,000 common shares

Warrant Exercise Price: $0.10 per share for a period of 24 months

following the closing of the Private Placement

Number of Placees: 3

Insider / Pro Group Participation: N/A

Finders' Fees: Macquarie Private Wealth Inc. ("Macquarie")

received $20,150 in cash. In addition,

Macquarie received 310,000 warrants, each

allowing the Holder to purchase one common

share at a price of $0.10 per unit over a

24-month period

The Company has confirmed the closing of the above-mentioned Private

Placement by way of a press release.

RESSOURCES DE LA BAIE D'URAGOLD INC. ("UBR")

TYPE DE BULLETIN: Placement prive sans l'entremise d'un courtier

DATE DU BULLETIN: Le 7 janvier 2011

Societe du groupe 2 de TSX croissance

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive sans l'entremise d'un courtier, tel qu'annonce le 23

decembre 2010:

Nombre d'actions: 3 100 000 actions ordinaires accreditives

Prix: 0,065 $ par action ordinaire accreditive

Bons de souscription: 1 550 000 bons de souscription permettant de

souscrire a 1 550 000 actions ordinaires

Prix d'exercice des bons: 0,10 $ par action pour une periode de 24 mois

suivant la cloture du placement prive.

Nombre de souscripteurs: 3 souscripteurs

Participation des inities / Groupe Pro: S/O

Honoraires d'intermediation: Macquarie Private Wealth inc. ("Macquarie")

a recu 20 150 $ en especes. De plus, Macquarie

a recu 310 000 bons de souscription chacun

permettant au titulaire d'acquerir une action

du placement prive au prix de 0,10 $ l'action

pendant une periode de 24 mois suivant la

cloture.

La societe a confirme la cloture du placement prive precite par voie de

communique de presse.

---------------------------------------------------------------------------

VANOIL ENERGY LTD. ("VEL")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

the third tranche of a Non-Brokered Private Placement announced September

22, 2010:

Number of Shares: 420,000 shares

Purchase Price: $0.50 per share

Number of Placees: 2 placees

Insider / Pro Group Participation:

Insider=Y /

Name # of Shares

Firebird Global Master Fund II Ltd. 400,000

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

WINDARRA MINERALS LTD. ("WRA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 23, 2010:

Number of Shares: 3,044,500 flow-through shares

2,000,000 non-flow-through shares

Purchase Price: $0.20 per flow-through share

$0.15 per non-flow-through share

Number of Placees: 24 placees

Finder's Fee: $54,354 payable to Pollitt & Co. Inc. In

addition there are agent's expenses and

agent's due diligence fees in the amount of

$36,145.84.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company must

issue a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). The Company must also

issue a news release if the private placement does not close promptly.

---------------------------------------------------------------------------

WIN-ELDRICH MINES LIMITED ("WEX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: January 7, 2011

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 19, 2010:

Number of Shares: 1,333,333 shares

Purchase Price: $0.30 per share

Warrants: 666,666 share purchase warrants to purchase

666,666 shares

Warrant Exercise Price: $0.45 for a one year period

Number of Placees: 4 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Lazarus Investment Partners LLP. Y 333,333

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the

warrants, if they are less than the maximum permitted term.

---------------------------------------------------------------------------

ARCLAND RESOURCES INC. ("ADR.H")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: January 7, 2011

NEX Company

Further to TSX Venture Exchange Bulletin dated February 5, 2010, effective

at the opening Monday, January 10, 2011, shares of the Company will resume

trading. The Company has advised the Exchange that the proposed Change of

Business and/or Reverse Takeover will not be proceeding. Please refer to

the Company's news release dated January 6, 2011.

---------------------------------------------------------------------------

CORONET METALS INC. ("CRF.H")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: January 7, 2011

NEX Company

Further to TSX Venture Exchange Bulletin dated December 22, 2010, effective

at 11:32 a.m., PST, January 7, 2011 trading in the shares of the Company

will remain halted pending receipt and review of acceptable documentation

regarding the Change of Business and/or Reverse Takeover pursuant to

Listings Policy 5.2.

---------------------------------------------------------------------------

Regency Gold Corp. ("RAH.H")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: January 7, 2011

NEX Company

TSX Venture Exchange has accepted for filing, a Mineral Lease Agreement and

Option to Purchase Agreement dated December 9, 2010, between the Company,

it's wholly-owned subsidiary Silvio USA Inc. (the "Lessee"), and JR

Exploration, LLC (the "Lessor") pursuant to which the Lessee will lease

unpatented lode mining claims known as the Agate Pass Property located in

Eureka County, Nevada. The Lessor is at arm's length.

For a 100% interest, the Lessee must pay US$350,000 in the first 10 years

at an exchange rate of 1.0175 equaling C$356,125: annual advance royalty

payments beginning with US$10,000 on execution, US$15,000 in year 2,

US$20,000 in year 3, US$25,000 in year 4, US$30,000 in year 5, and

US$50,000 for each of the five years thereafter for a total term of ten

years. This lease may be extended for two additional ten year terms at the

rate of US$50,000 a year. All advance royalty payments will be recoverable

against the 3% NSR if the project is placed into production. There are no

work commitments and no share issuances.

Insider / Pro Group Participation: N/A

---------------------------------------------------------------------------

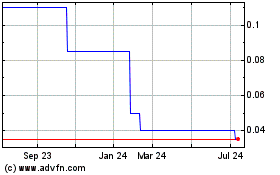

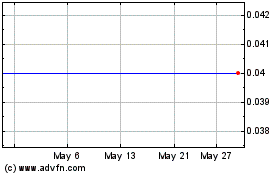

Arcland Resources (TSXV:ADR.H)

Historical Stock Chart

From Feb 2025 to Mar 2025

Arcland Resources (TSXV:ADR.H)

Historical Stock Chart

From Mar 2024 to Mar 2025