Bauer Performance Sports Ltd. (TSX:BAU) ("Bauer" or the "Company") today

announced its interim financial results for the first quarter of fiscal 2014

ended August 31, 2013. All figures are in U.S. dollars.

----------------------------------------------------------------------------

US$ 000,000's except

per share data and % Three months ended

----------------------------------------------------------------------------

Change vs. prior

Aug 31, 2013 Aug 31, 2012 period

----------------------------------------------------------------------------

Revenues $154.0 $148.3 4%

----------------------------------------------------------------------------

Gross profit 59.7 60.3 -1%

----------------------------------------------------------------------------

Adjusted Gross Profit(i) 61.5 61.0 1%

----------------------------------------------------------------------------

Adjusted EBITDA(i) 36.9 37.9 -3%

----------------------------------------------------------------------------

Net income (loss) 21.3 16.0 33%

----------------------------------------------------------------------------

Adjusted Net Income(i) 23.1 22.9 1%

----------------------------------------------------------------------------

Earnings (Loss) per share

(diluted) $0.57 $0.45 27%

----------------------------------------------------------------------------

Adjusted EPS(i) $0.63 $0.65 -3%

----------------------------------------------------------------------------

(i)Note: Adjusted Gross Profit, Adjusted EBITDA, Adjusted Net Income/Loss and

Adjusted EPS are non-IFRS measures. For the relevant definitions and

reconciliations to reported results, please see "Non-IFRS Measures" at the end

of this news release and in the Company's Management's Discussion and Analysis

("MD&A") for the most recent period.

Bauer's overall revenues increased by 4% in the first quarter of fiscal 2014.

This increase was fueled primarily by strong performance in apparel, lacrosse,

and roller hockey as well as several ice hockey equipment categories. Apparel

revenues increased by 57% driven by strong growth in off-ice team apparel, base

layer performance apparel, lifestyle apparel, and the addition of hockey and

soccer uniform sales. Lacrosse sales increased 43% driven by strong demand for

the new CASCADE "R" helmet, growth in our MAVERIK equipment line, and an

additional month of Cascade sales compared to the first quarter of fiscal 2013.

Roller hockey sales grew 47% driven by strong skate sales. Ice hockey equipment

sales grew in key categories such as sticks, protective equipment, and

replacement steel blades; however, this was offset by the fact that the prior

year included the initial launch of BAUER's third family of ice hockey

equipment, NEXUS, resulting in a 2% decline in ice hockey equipment sales versus

the prior year. High levels of retail inventory in the hockey marketplace also

contributed to the lower ice hockey equipment revenues in the quarter.

Overall revenues from the North American market grew by 3% in the first quarter

of fiscal 2014, while sales outside North America grew by 7%.

In addition to Bauer's strong first quarter results, the Company also announced

that it has obtained $70.1 million of booking orders for its 2013 "Holiday"

season (October 2013 - March 2014), an increase of 9% on a currency neutral

basis (7% including the impact of foreign currency) over the 2012 "Holiday"

season, reflecting the continuing enthusiasm for BAUER's innovative products.

"Our diversified platform, and our dedication to delivering innovative, high

quality, performance enhancing products continues to drive growth," said Kevin

Davis, President and Chief Executive Officer of Bauer. "Customer demand for our

products remains very strong, and we continue to take share in this challenging

marketplace. We are extremely pleased with the increase in booking orders and

expect that 2014 will be another record year for our top and bottom line

performance as the headwinds which have been impacting our revenues are

beginning to dissipate."

Adjusted Gross Profit in the first quarter of fiscal 2014 increased slightly to

$61.5 million. Adjusted Gross Profit as a percentage of revenues decreased to

39.9%, compared to 41.1% in the comparative period of fiscal 2013, primarily due

to growth in uniforms which have lower gross profit margins compared to our

other equipment and apparel categories.

Excluding the impact of one-time acquisition related charges and share-based

compensation expense, SG&A as a percentage of revenues increased to 15.1% from

14.2% in the comparative quarter last year. This increase was driven primarily

by the effect of adding the SG&A from recently acquired companies in a

seasonally low revenue quarter for these same companies. Adjusted Net Income

grew to $23.1 million and Adjusted EPS was $0.63 per share. The increase in

average shares outstanding in the first quarter of fiscal 2014 relative to the

first quarter of fiscal 2013 due to the issuance of shares to finance the

Cascade acquisition reduced our Q1 Adjusted EPS by three cents per share.

On a trailing twelve-month basis, revenues were $405.2 million, Adjusted Gross

Profit reached $153.5 million or 37.9% of revenues, Adjusted EBITDA was $61.3

million, and Adjusted EPS was $0.98.

The Company continued to manage its balance sheet and generate strong cash flow

as its leverage ratio, defined as net indebtedness divided by EBITDA, reduced to

2.70 compared to 2.78 as of August 31, 2012. As of August 31, 2013 Bauer had

working capital of $267.7 million compared to working capital of $250.4 million

as of August 31, 2012. This year-over-year increase was due primarily to higher

inventories and receivables related to the acquisifations of Inaria

International, Inc. and Combat Sports.

SELECTED HIGHLIGHTS

-- Combat Sports became the exclusive provider of bats for the NCAA

Division I Washington State University ("WSU") baseball program for

three years, beginning with the upcoming 2014 season. WSU plays in the

competitive Pacific-12 Conference (PAC-12), and has made 16 appearances

in the NCAA regional tournament and reached the College World Series

four times. The team has produced 23 Major League Baseball draft picks

in the last five years.

-- BAUER and Hockey Canada announced the next phase of their Grow the Game

partnership, including initial research study results as well as the

creation of pilot programs developed to specifically address the results

of those findings.

CONFERENCE CALL AND WEBCAST

Management will hold a conference call and live audio webcast on Friday October

4, 2013 at 10:00 a.m. (ET) to discuss the Company's fourth quarter and fiscal

year-end results. The call will be hosted by Kevin Davis, President and Chief

Executive Officer and Amir Rosenthal, Chief Financial Officer. Following

management's presentation, there will be a question and answer session for

analysts and investors.

To access the call, please dial 1-888-539-3678 or 1-719-325-2491. The conference

call will also be accessible via webcast at www.bauerperformancesports.com.

A replay of the conference call will be available from 1:00 p.m. ET on October

4, 2013, until midnight ET, October 18, 2013. To access the replay, dial

1-877-870-5176 or 1-858-384-5517, followed by passcode 6619878.

ABOUT BAUER PERFORMANCE SPORTS LTD.

Bauer Performance Sports Ltd. (TSX:BAU) is a leading developer and manufacturer

of ice hockey, roller hockey, lacrosse, baseball and softball equipment as well

as related apparel. The company has the most recognized and strongest brand in

the ice hockey equipment industry, and holds the top market share position in

both ice and roller hockey. Its products are marketed under the BAUER, MISSION,

MAVERIK, CASCADE, INARIA and COMBAT brand names and are distributed by sales

representatives and independent distributors throughout the world. Bauer

Performance Sports is focused on building its leadership position and growing

market share in all product categories through continued innovation at every

level. For more information, visit www.bauerperformancesports.com.

NON-IFRS MEASURES

Adjusted Gross Profit, Adjusted EBITDA, Adjusted Net Income, and Adjusted EPS

are non-IFRS measures. Adjusted Gross Profit is defined as gross profit plus the

following expenses which are part of cost of goods sold: (i) amortization and

depreciation of intangible assets, (ii) non-cash charges to cost of goods sold

resulting from fair market value adjustments to inventory as a result of

business acquisitions, (iii) reserves established to dispose of obsolete

inventory acquired from acquisitions and (iv) other one-time or non-cash items.

Adjusted EBITDA is defined as EBITDA (net income adjusted for income tax

expense, depreciation and amortization, losses related to amendments to the

Company's credit facility, gain or loss on disposal of fixed assets, net

interest expense, deferred financing fees, unrealized gains/losses on derivative

instruments, and realized and unrealized gains/losses related to foreign

exchange revaluation) before restructuring and other one-time or non-cash

charges associated with acquisitions, other one-time or non-cash items, pre-IPO

sponsor fees, costs related to share offerings, as well as share-based payment

expense. Adjusted Net Income is defined as net income adjusted for unrealized

gains/losses related to derivative instruments and unrealized gains/losses

related to foreign exchange revaluation, one-time or non-cash charges associated

with acquisitions, amortization of acquisition related intangible assets for

acquisitions since fiscal 2012, costs related to share offerings, share-based

compensation expense, and other non-cash or one-time items. Adjusted EPS is

defined as Adjusted Net Income/Loss divided by the weighted average diluted

shares outstanding.

Reconciliations of these non-IFRS measures to the relevant reported results can

be found in the Company's MD&A for the first quarter of fiscal 2014.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This press release includes forward-looking statements within the meaning of

applicable securities laws, including with respect to booking orders translating

into realized sales, the Company achieving record top and bottom line

performance for the remainder of fiscal 2014, the ability of the Company to

continue increasing its market share and the dissipation of external factors

which have been negatively impacting the Company's revenues. Forward-looking

statements relate to analyses and other information that are based on forecasts

of future results and estimates of amounts not yet determinable. The words

"may", "will", "would", "should", "could", "expects", "plans", "intends",

"trends", "indications", "anticipates", "believes", "estimates", "predicts",

"likely" or "potential" or the negative or other variations of these words or

other comparable words or phrases, are intended to identify forward looking

statements.

Forward-looking statements, by their nature, are based on assumptions, including

those described herein and are subject to important risks and uncertainties.

Many factors could cause our actual results to differ materially from those

expressed or implied by the forward looking statements, including, without

limitation, the following factors: inability to introduce new and innovative

products, intense competition in the equipment and apparel industries, inability

to introduce technical innovation, inability to protect worldwide intellectual

property rights, inability to translate booking orders into realized sales,

inability to successfully integrate recent acquisitions, decrease in ice hockey,

roller hockey and/or lacrosse participation rates, adverse publicity, reduction

in popularity of the NHL and other professional leagues in which our products

are used, inability to maintain and enhance brands, reliance on third party

suppliers and manufacturers, disruption of distribution chain or loss of

significant customers or suppliers, cost of raw materials and shipping freight

and other cost pressures, a change in the mix or timing of orders placed by

customers, inability to forecast demand for products, inventory shrinkage or

excess inventory, product liability claims and product recalls, compliance with

standards of testing and athletic governing bodies, departure of senior

executives or other key personnel, litigation, employment or union related

matters, fluctuations in the value of certain foreign currencies in relation to

the U.S. dollar, inability to manage foreign exchange derivative instruments,

general economic and market conditions, changes in consumer preferences and the

difficulty in anticipating or forecasting those changes, natural disasters, as

well as the factors identified in the "Risk Factors" section of Bauer's Annual

Information Form dated August 27, 2013 available on SEDAR at www.sedar.com.

Furthermore, unless otherwise stated, the forward looking statements contained

in this press release are made as of the date of this press release, and we have

no intention and undertake no obligation to update or revise any forward looking

statements, whether as a result of new information, future events or otherwise,

except as required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

INVESTOR INQUIRIES

Bauer Performance Sports Ltd.

Amir Rosenthal

Chief Financial Officer

603-610-5802

investors@bauerperformancesports.com

Spinnaker Capital Markets Inc.

Kevin O'Connor / Ali Mahdavi

416-962-3300

ko@spinnakercmi.com

MEDIA INQUIRIES

Bauer Performance Sports Ltd.

Tory Mazzola

Global Communications Manager

603-430-2111

media@bauerperformancesports.com

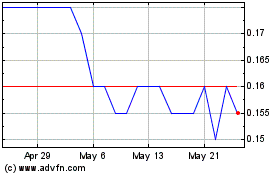

Blue Star Gold (TSXV:BAU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Blue Star Gold (TSXV:BAU)

Historical Stock Chart

From Jul 2023 to Jul 2024