International Lithium Corp. (TSX VENTURE:ILC)(TSX VENTURE:ILC.WT)

("ILC" or the "Company") is pleased to announce the completion of

drilling on the Lithium and Rare Metals pegmatite field spanning

the Company's contiguous Mavis Lake and Fairservice claim blocks

near Dryden Ontario.

Key Highlights:

-- 1,753 metres drilled representing an increase of 46% from original 1,200

metre proposed program;

-- 20 holes completed on the Rare Metals pegmatite field spanning the

Company's contiguous Mavis Lake and Fairservice properties;

-- 394 samples collected and shipped for analysis with results expected in

6-8 weeks;

-- Primary objectives were to confirm the historic lithium grades on the

Fairservice property and test the rare metal potential of the Mavis Lake

pegmatites; and

-- Material collected from several pegmatites for preparation as a

certified reference material.

The Company's Mavis Lake - Fairservice property straddles a

continuous pegmatite field exhibiting high-grade, well-evolved,

lithium and tantalum zonation as well as significant levels of

cesium and rubidium. The primary objectives of the drill program

were to confirm the historic lithium grades on the Fairservice

claims and test the rare metal potential of the Mavis Lake claims

highlighted in the recent surface exploration programs. A 1,200

metre drill program was planned, but extended mid-program to

complement and better fulfill the objectives.

Of the 20 holes drilled, 17 intersected one or more intervals of

pegmatite greater than 2 metres and up to 78 metres in

length(i).

At completion, 1,753 metres were drilled across 20 holes with

394 samples collected and shipped for analysis. Results are

anticipated in 6-8 weeks due to laboratory turnaround for the

samples and preparation of a lithium certified reference material

("CRM"). Once completed, the CRM will be available to support

industry recognized QA/QC protocols on all ILC pegmatite

projects.

(i) The true width of the pegmatite intersections as well as the

rare metal grades have not been determined and no inference has

been made to that effect until the analytical results are returned

and a geological interpretation is completed.

Mavis Lake Claim Block

Two field programs were undertaken in 2009 consisting of

detailed mapping and sampling of the known pegmatite occurrences to

assess the lithium (Li), tantalum (Ta) and other rare metals

potential of the Company's 100% owned Mavis Lake property.

Composite channel samples returned 1.24 Wt% Li2O over 5.3 metres

and 1.4 Wt% Li2O over 4.7 metres from Pegmatite #18.

In addition, a lithogeochemical survey over a 1200m by 900m grid

extended the lithium dispersion anomaly (greater than 50 ppm Li) by

1.1kms to 4.5kms in total length. Of special note, 38% (78 of 204

grab samples) graded better than 150 ppm Ta2O5(ii) (tantalum oxide)

demonstrating widespread highly anomalous Tantalum mineralization

(TNR Gold Corp., precursor reporting issuer to ILC spin-out, news

release dated December 9, 2009).

The highest tantalum values came from Pegmatites 13, 14 and 16

which occur within an area of 500 by 800 metres that represents the

known southeastern exploration limit for rare metal mineralization

on the property. This prospective area of elevated tantalum values

is underexplored and open to the east and southeast. Grab samples

from this area returned peak Ta2O5 values of 1349 ppm (0.135%) and

1246 ppm (0.125%) from the No.16 and No.14 pegmatites,

respectively(ii).

(ii) Note: grab samples are by definition selective and are

unlikely to represent average grades on the property.

Fairservice Mining Leases

The Fairservice property consists of 6 Mining Leases totaling

88.4 hectares and is dominated by east trending

spodumene-beryl-tantalite-type pegmatites considered to be part of

the same dyke swarm as on the Company's adjacent Mavis Lake claim

block. Past exploration identified 10 pegmatites (Pegmatite #1-10)

and delineated an historical (non NI 43-101 compliant) resource of

500,000 tons at 1.0% Li2O at Pegmatite #1(iii).

To earn a 100% interest, ILC has agreed to make payments

totaling $120,000 and issuing an aggregate of 500,000 common shares

of ILC over a three-year period and incurring exploration

expenditures totaling $500,000 over a four-year period. The vendor

will retain a 5% Net Profits Interest royalty of which the Company

has the right to purchase in entirety by paying the Vendor the sum

of $1 million.

(iii) Note: a qualified person has not done sufficient work to classify the

historical estimate as current mineral resources, the issuer is not

treating the historical estimate as current mineral resources and the

historical estimate should not be relied upon.

Mavis Lake - Fairservice Property Area - General

The Mavis Lake - Fairservice property is located 15 km Northeast

of Dryden, Ontario. The property is easily accessed via the

Trans-Canada Highway and a series of logging roads. The claim

blocks comprise a total of 2,624 hectares and cover several known

rare metal pegmatites.

Regional pegmatite mineralization is directly associated with

the strongly peraluminous Ghost Lake Pluton and related pegmatitic

granite dykes. Rare metal mineralization in the Mavis Lake area

occurs in zoned pegmatites hosted by mafic metavolcanic rocks. Rare

metal mineralization has been noted to occur in four zones:

internal beryl zone within the parent of the Ghost Lake pluton that

evolves to the east within the Fairservice and Mavis Lake claim

blocks into external zones of beryl-columbite,

spodumene-beryl-tantalite and albite-type pegmatites. The Mavis

Lake property has reported high-grade well-evolved lithium and

tantalum zonation as well as significant levels of cesium and

rubidium across multiple pegmatite bodies.

John Harrop, P.Geo, is the company's qualified person on the

project as required under NI 43-101 and has reviewed the technical

information contained in this press release.

For more information on the Mavis Lake - Fairservice Project,

the Company's other projects or to help understand the technical

aspects of Lithium and other Rare Metals please visit International

Lithium Corp.'s newly revamped website at

www.internationallitium.com.

ABOUT INTERNATIONAL LITHIUM CORP.

International Lithium Corp. is an international rare element

metals ("REM") mineral exploration company with an outstanding

portfolio of projects, strong management ownership, robust

financial support and a prominent lithium product manufacturer as a

keystone investor.

ILC currently has 9 active REM projects, well balanced between

lithium brines in Argentina and Nevada and hard-rock pegmatites in

Canada and Ireland. The Company's primary focus is the Mariana

lithium brine project, a salar or 'salt lake', covering an

expansive 160 square kilometres and strategically encompassing the

entire basin. Mariana is located in the renowned South American

'Lithium Belt' centred on the junction of Argentina, Bolivia and

Chile that is host to the vast majority of global lithium

resources, reserves and production. The Mariana lithium brine

project ranks as one of the more prospective salars in the

region.

Complementing the Company's lithium brine projects are the REM

pegmatite properties. The key characteristics shared by the

hard-rock REM projects are their limited past exploration,

excellent accessibility, limited assaying for rare metals, clear

potential for additional exploration to add project value and

development potential to meet the global technological growth in

demand for the REM suite of elements.

International Lithium Corp.'s mandate is to increase shareholder

value through aggressive advancement of its core projects and to

source joint venture partners to expand the scope and diversify

risk of its exploration effort.

On behalf of the Board,

Mike Sieb, President - International Lithium Corp.

Statements in this press release other than purely historical

information, historical estimates should not be relied upon,

including statements relating to the Company's future plans and

objectives or expected results, are forward-looking statements.

News release contains certain "Forward-Looking Statements" within

the meaning of Section 21E of the United States Securities Exchange

Act of 1934, as amended. Forward-looking statements are based on

numerous assumptions and are subject to all of the risks and

uncertainties inherent in the Company's business, including risks

inherent in resource exploration and development. As a result,

actual results may vary materially from those described in the

forward-looking statements.

Shares CUSIP: #459820 10 6

Warrant CUSIP: #459820 11 4

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

Contacts: International Lithium Corp. Mike Sieb President (604)

687-7551 or 1-800-667-4470 (604) 687-4670

(FAX)info@internationallithium.comwww.internationallithium.com

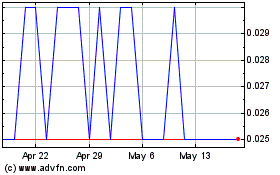

International Lithium (TSXV:ILC)

Historical Stock Chart

From Dec 2024 to Jan 2025

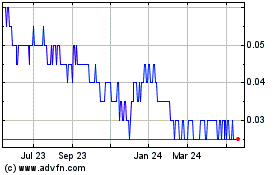

International Lithium (TSXV:ILC)

Historical Stock Chart

From Jan 2024 to Jan 2025