TSX VENTURE COMPANIES

ALTAIR VENTURES INCORPORATED ("AVX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 20092

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced October 9, 2009:

Number of Shares: 2,840,000 flow-through shares

2,975,000 non flow-through shares

Purchase Price: $0.17 per flow-through share

$0.15 per non flow-through share

Warrants: 1,420,000 (flow-through offering) share

purchase warrants to purchase 1,420,000

common shares at $0.25 per share for a one

year period.

1,487,500 (unit offering) share purchase

warrants to purchase 1,487,500 common shares

at $0.22 per share for a one year period.

Number of Placees: 10 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Enrico Giustra P 200,000 f/t

Robert A. Archer Y 60,000 f/t

Robert A. Archer Y 65,000 nf/t

Platoro Resources Corp.

(Robert A. Archer) Y 60,000 f/t

Platoro Resources Corp.

(Robert A. Archer) Y 65,000 nf/t

Finders' Fees: Limited Market Dealer Inc. - $20,400.00

Karim Sayani - $1,428.00

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

ANDOVER VENTURES INC. ("AOX")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 45,000 shares at a deemed price of $0.333 per share to settle

outstanding debt for $15,000.00.

Number of Creditors: 1 Creditor

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

--------------------------------------------------------------------------

APELLA RESOURCES INC. ("APA")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: December 16, 2009

TSX Venture Tier 1 Company

Effective at the opening, December 16, 2009, shares of the Company resumed

trading, an announcement having been made over Market News Publishing.

TSX-X

--------------------------------------------------------------------------

ATOCHA RESOURCES INC. ("ATT")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 15, 2009:

Number of Shares: 2,500,000 flow-through shares

Purchase Price: $0.16 per share

Warrants: 2,500,000 share purchase warrants to purchase

2,500,000 shares

Warrant Exercise Price: $.20 for a one year period

$0.25 in the second year

Number of Placees: 5 placees

Finder's Fee: Limited Market Dealer Inc. will receive a 5%

cash finder's fee in the amount of $17,500,

10% in Broker Warrants that are exercisable

into 218,750 units at a price of $0.16 per

unit. Each unit has the same terms as the

offering and a due diligence fee of

$21,000.00.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

CARDIOCOMM SOLUTIONS, INC. ("EKG")

BULLETIN TYPE: Shares for Debt

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 3,250,000 shares to settle outstanding debt for $162,500.

Number of Creditors: 3 Creditors

Insider / Pro Group Participation:

Insider=Y / Amount Deemed Price

Creditor Progroup=P Owing per Share # of Shares

Anatoly Langer Y $75,000 $0.05 1,500,000

Etienne Grima Y $50,000 $0.05 1,000,000

Healthcare Works Inc. Y $37,500 $0.05 750,000

(Anatoly Langer)

The Company shall issue a news release when the shares are issued and the

debt extinguished.

TSX-X

--------------------------------------------------------------------------

COLUMBIA YUKON EXPLORATIONS INC. ("CYU")

BULLETIN TYPE: Company Tier Reclassification

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

In accordance with Policy 2.5, the Company has met the requirements for a

Tier 1 company. Therefore, effective December 17, 2009, the Company's Tier

classification will change from Tier 2 to:

Classification

Tier 1

TSX-X

--------------------------------------------------------------------------

CYPRESS DEVELOPMENT CORP. ("CYP")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 7, 2009:

First Tranche:

Number of Shares: 10,479,000 shares

Purchase Price: $0.15 per share

Warrants: 10,479,000 share purchase warrants to

purchase 10,479,000 shares

Warrant Exercise Price: $0.20 for a two year period

Number of Placees: 44 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Ron Tkatchuk P 115,000

Finders' Fees: $50,400 cash payable to Raymond James Ltd.

$3,150 cash payable to Ted Dusyk

$2,467.50 cash payable to Fab Carella

$2,100 cash payable to Julie Boileau

$13,020 cash payable to Canaccord Capital

Corp.

$18,112.50 cash payable to Union Securities

Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

DEQ SYSTEMS CORP. ("DEQ")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: December 16, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange (the "Exchange") has been advised that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated December 14,

2009, the Company may repurchase for cancellation up to 3,450,000 common

shares in its own capital stock, representing approximately 5% of the

Company's issued and outstanding common shares. The purchases are to be

made through the facilities of the Exchange for the period starting on

December 21, 2009 and ending on December 20, 2010. Purchases pursuant to

the bid will be made by Canaccord Capital Corporation on behalf of the

Company.

DEQ SYSTEMES CORP. ("DEQ")

TYPE DU BULLETIN : Offre de rachat dans le cours normal des activites

DATE DU BULLETIN : Le 16 decembre 2009

Societe du groupe 1 de TSX Croissance

Bourse de croissance TSX (la "Bourse") a ete avisee qu'en vertu d'un avis

d'intention de proceder a une offre de rachat dans le cours normal des

activites date du 14 decembre 2009, la societe peut racheter pour fin

d'annulation, jusqu'a 3 450 000 actions ordinaires de son capital,

representant approximativement 5 % des actions emises et en circulation de

la societe. Les achats seront effectues par l'entremise de la Bourse

durant la periode debutant le 21 decembre 2009 et se terminant le 20

decembre 2010. Les achats en vertu de l'offre seront effectues par le

biais de Corporation Canaccord Capital pour le compte de la societe.

TSX-X

--------------------------------------------------------------------------

FORUM URANIUM CORP. ("FDC")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 10, 2009:

Number of Shares: 6,016,666 shares

Purchase Price: $0.12 per share

Number of Placees: 3 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Qwest Energy 2009 II

Flow-Through Limited

Partnership Y 2,100,000

Finder's Fee: $25,200 cash and (i)210,000 warrants payable

to Barrington Capital Corp.

(i) Warrants are exercisable at $0.20 per

share for one year.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

GALE FORCE PETROLEUM INC. ("GFP")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the documentation relating to

an Asset Purchase Agreement dated September 10, 2008 between Kripa Energy

Inc. ("Kripa") and the Company, whereby the Company has sold its Woodnorth

Property for a consideration of $1,200,000 cash in addition to $300,000

already received on August 5, 2008 for the option to purchase the

property.

For further information, please refer to the Company's news release dated

September 11, 2008.

PETROLE GALE FORCE INC. ("GFP")

TYPE DE BULLETIN : Convention de vente d'actif ou convention de vente

d'actions

DATE DU BULLETIN : Le 16 decembre 2009

Societe du groupe 2 de TSX Croissance

Bourse de croissance TSX a accepte le depot de documents en vertu d'une

convention d'achat d'actif datee du 10 septembre 2008 entre Kripa Energy

Inc. ("Kripa") et la societe, en vertu de laquelle la societe a vendu sa

propriete Woodnorth en consideration de 1 200 000 $ en especes en plus de

300 000 $ deja recu le 5 août 2008 relativement a une option d'achat de la

propriete.

Pour de plus amples informations, veuillez vous referer au communique de

presse emis par la societe le 11 septembre 2008.

TSX-X

--------------------------------------------------------------------------

GOLD HAWK RESOURCES INC. ("GHK")

(formerly Gold Hawk Resources Inc. ("CGK"))

BULLETIN TYPE: Consolidation, Symbol Change

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

Pursuant to a special resolution passed by shareholders November 9, 2009,

the Company has consolidated its capital on a twenty-five (25) old for one

(1) new basis and has subsequently increased its authorized capital. The

name of the Company has not been changed.

Effective at the opening Thursday, December 17, 2009, the common shares of

the Company will commence trading on TSX Venture Exchange on a

consolidated basis. The Company is classified as an

'Exploration/Development' company.

Post - Consolidation

Capitalization: unlimited common shares with no par value of

which 13,017,391 common shares are issued and

outstanding

Escrow 518,192 common shares are subject to staged

release escrow

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: GHK (new)

CUSIP Number: 38060Q 20 8 (new)

TSX-X

--------------------------------------------------------------------------

IC POTASH CORP. ("ICP")

(formerly Trigon Uranium Corp. ("TEL"))

BULLETIN TYPE: Reverse Takeover-Completed, Symbol Change, Name Change,

Resume Trading

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

The TSX Venture Exchange has accepted for filing the Company's Reverse

Takeover ('RTO'). Effective at the opening Thursday, December 17, 2209,

the common shares of the Company will resume trading on TSX Venture

Exchange. The RTO includes the following transactions:

RTO:

The Company acquired all of the issued securities of Intercontinental

Potash Corp., which is now a wholly-owned subsidiary of the Company.

For further information on the transaction, please see the Company's

Information Circular dated September 28, 2009.

Name Change:

Pursuant to a resolution passed by shareholders October 26, 2009, the

Company has changed its name as follows. There is no consolidation of

capital.

Effective at the opening Thursday, December 17, 2009, the common shares of

IC Potash Corp. will commence trading on TSX Venture Exchange, and the

common shares of Trigon Uranium Corp. will be delisted.

The Exchange has been advised that the above transactions, approved by

shareholders on October 26, 2009, have been completed.

Capitalization: Unlimited shares with no par value of which

59,397,490 shares are issued and outstanding

Escrowed: 4,681,247 common shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: ICP (new)

CUSIP Number: 44930T 10 9 (new)

The Company is classified as a 'mining' company.

Company Contact: Sidney Himmel

Company Address: Suite 3700, 100 King St. W.

Toronto, ON M5X 1C9

Company Phone Number: (250) 763-5533

Company Fax Number: (250) 763-5255

Company Email Address: sidney.himmel@trigonexploration.com

TSX-X

--------------------------------------------------------------------------

INTERNATIONAL WAYSIDE GOLD MINES LTD. ("WYG")

BULLETIN TYPE: Halt

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

Effective at the opening, December 16, 2009, trading in the shares of the

Company was halted at the request of the Company, pending an announcement;

this regulatory halt is imposed by Investment Industry Regulatory

Organization of Canada, the Market Regulator of the Exchange pursuant to

the provisions of Section 10.9(1) of the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

JAXON MINERALS INC. ("JAX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 10, 2009:

Number of Shares: 2,250,000 flow-through shares

Purchase Price: $0.20 per share

Warrants: 1,125,000 share purchase warrants to purchase

1,125,000 shares

Warrant Exercise Price: $0.30 for a one year period

$0.40 in the second year

Number of Placees: 7 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Leif Smither Y 62,500

Finder's Fee: $24,000 and 200,000 finder options payable to

Limited Market Dealer and $5,000 payable to

Carl Jones

- Each finder option is exercisable at $0.20

for a two year period into one non flow-

through share and one-half share purchase

warrant with the same terms as above

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. (Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.)

TSX-X

--------------------------------------------------------------------------

KING'S BAY GOLD CORPORATION ("KBG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 17, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 19, 2009:

Number of Shares: 2,000,000 flow-through shares

Purchase Price: $0.10 per share

Warrants: 2,000,000 share purchase warrants to purchase

2,000,000 shares

Warrant Exercise Price: $0.13 for a two year period

Number of Placees: 1 placee

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the

warrants, if they are less than the maximum permitted term.

TSX-X

--------------------------------------------------------------------------

LA QUINTA RESOURCES CORPORATION ("LAQ")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 4, 2009:

Number of Shares: 24,400,000 shares

Purchase Price: $0.05 per share

Warrants: 24,400,000 share purchase warrants to

purchase 24,400,000 shares

Warrant Exercise Price: $0.10 for a six month period

$0.15 for the following six months

Number of Placees: 86 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P # of Shares

Greg Amor Y 300,000

Glen Watson Y 100,000

Dustin Henderson Y 1,960,000

Pasquale Di Capo P 1,500,000

Bill Godson P 500,000

David Elliott P 750,000

Finders' Fees: $28,400 cash payable to Haywood Securities

Inc.

$12,000 cash payable to Pinetree Capital Ltd

(a TSX listed company).

$6,000 cash payable to PowerOne Capital

Markets Limited.

$2,800 cash payable to PI Financial Corp.

$13,250 cash payable to Canaccord Capital

Corporation.

$4,000 cash payable to CX Capital Partners

(Joseph Carbonaro).

$4,000 cash payable to Research Capital

Corporation.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later extend

the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

--------------------------------------------------------------------------

MEDORO RESOURCES LTD. ("MRS.WT")

BULLETIN TYPE: New Listing-Warrants

BULLETIN DATE: December 16, 2009

TSX Venture Tier 1 Company

Effective at the opening Thursday, December 17, 2009, the warrants of the

Company will commence trading on TSX Venture Exchange. The Company is

classified as a 'Gold Exploration' company.

Corporate Jurisdiction: Yukon Territory

Capitalization: 64,350,000 warrants with no par value of

which 64,350,000 warrants are issued and

outstanding

Transfer Agent: Equity Transfer & Trust Company

Trading Symbol: MRS.WT

CUSIP Number: 58503R 14 2

The warrants were issued pursuant to a brokered private placement. One (1)

warrant entitles the holder to purchase one (1) share at a price of $1.25

per share and will expire on November 3, 2011.

TSX-X

--------------------------------------------------------------------------

NEWMAC RESOURCES INC. ("NER")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated December 16,

2009, it may repurchase for investment purposes, up to 2,681,801 shares in

its own capital stock. The purchases are to be made through the facilities

of TSX Venture Exchange during the period December 21, 2009 to December

20, 2010. Purchases pursuant to the bid will be made by Bolder Investment

Partners Ltd. on behalf of the Company.

TSX-X

--------------------------------------------------------------------------

NOVUS ENERGY INC. ("NVS")

BULLETIN TYPE: Plan of Arrangement

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

The TSX Venture Exchange (the "Exchange") has accepted for filing

documentation pursuant to a Court approved Plan of Arrangement (the

"Arrangement") between Novus Energy Inc. (the "Company") and Ammonite

Energy Ltd. ("Ammonite). Approval of the Arrangement was obtained from

shareholders of Ammonite at a special meeting of shareholders held on

December 10, 2009. Pursuant to the terms of the Arrangement Ammonite

Shareholders will receive 0.825 of a common share of the Company for each

Ammonite share held. For further information, please refer to the Plan of

Arrangement dated November 12, 2009 and the Company's news release dated

December 11, 2009.

TSX-X

--------------------------------------------------------------------------

PARALLEL RESOURCES LTD. ("PAL")

(formerly Parallel Capital Corp. ("PAL"))

BULLETIN TYPE: Name Change

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

Pursuant to a resolution passed by shareholders on November 24, 2009, the

Company has changed its name as follows. There is no consolidation of

capital.

Effective at the opening Thursday, December 17, 2009, the common shares of

Parallel Resources Ltd. will commence trading on TSX Venture Exchange, and

the common shares of Parallel Capital Corp. will be delisted. The Company

is classified as a 'Mining Exploration' company.

Capitalization: unlimited shares with no par value of which

10,880,000 shares are issued and outstanding

Escrow: 2,549,250 escrow shares

Transfer Agent: Computershare Trust Company of Canada

Trading Symbol: PAL (unchanged)

CUSIP Number: 699179 10 7 (new)

TSX-X

--------------------------------------------------------------------------

PIONEERING TECHNOLOGY CORP. ("PTE")

BULLETIN TYPE: Shares for Bonuses

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposal to

issue 925,925 bonus shares at a deemed price of $0.135 per share to the

following insider(s):

Number of Shares

Kevin Callahan 555,555

Laird Comber 370,370

TSX-X

--------------------------------------------------------------------------

RED PINE EXPLORATION INC. ("RPX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced November 20, 2009:

Number of Shares: 17,875,554 flow through shares

10,350,000 non flow through shares

Purchase Price: $0.09 per flow through share

$0.08 per non flow through share

Warrants: 19,287,777 share purchase warrants to

purchase 19,287,777 shares

Warrant Exercise Price: $0.15 for a one year period

Number of Placees: 46 placees

Finder's Fee: an aggregate of $79,903, 175,000 common

shares, 175,000 warrants (exercisable at the

same terms as above) and 777,777 broker

options (each exercisable at a price of $0.09

for a period of 2 years into one common share

and one warrant (exercisable at the same

terms as above), payable to Limited Market

Dealer Inc. and Jones, Gable & Company

Limited

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company has

issued a news release announcing the closing of the private placement and

setting out the expiry dates of the hold period(s). Note that in certain

circumstances the Exchange may later extend the expiry date of the

warrants, if they are less than the maximum permitted term.

TSX-X

--------------------------------------------------------------------------

SEDEX MINING CORP. ("SDN")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to an option agreement dated September 15, 2009 between Sedex

Mining Corp. (the 'Company') and Larry Gervais, pursuant to which the

Company has an option to acquire a 100% undivided interest in one claim (5

units) located in the Reeves Township, Porcupine Mining Division, Ontario

known as the Reeves Property. The total consideration is $25,000 in cash

payments, 200,000 in shares and $8,000 in work commitments in stages over

a four year period as follows:

DATE CASH SHARES WORK EXPENDITURES

Year 1 $2,500 25,000 $2,000

Year 2 $5,000 25,000 $2,000

Year 3 $7,500 25,000 $2,000

Year 4 $10,000 25,000 $2,000

In addition, there is a 3% net smelter return relating to the acquisition.

The Company may, at any time, purchase 1% of the net smelter return for

$1,000,000 in order to reduce the total net smelter return to 2%.

TSX-X

--------------------------------------------------------------------------

SEDEX MINING CORP. ("SDN")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for expedited filing documentation

pertaining to an option agreement dated September 15, 2009 between Sedex

Mining Corp. (the 'Company') and Larry Gervais, pursuant to which the

Company has an option to acquire a 100% undivided interest in one claim (8

units) located in the Godfrey Township, Porcupine Mining Division, Ontario

known as the Godfrey Property. The total consideration is $35,000 in cash

payments, 200,000 in shares and $12,800 in work commitments in stages over

a four year period as follows:

DATE CASH SHARES WORK EXPENDITURES

Year 1 $5,000 50,000 $3,200

Year 2 $7,500 50,000 $3,200

Year 3 $10,000 50,000 $3,200

Year 4 $12,500 50,000 $3,200

In addition, there is a 3% net smelter return relating to the acquisition.

The Company may, at any time, purchase 1% of the net smelter return for

$1,000,000 in order to reduce the total net smelter return to 2%.

TSX-X

--------------------------------------------------------------------------

SNS SILVER CORP. ("SNS")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect to

a Non-Brokered Private Placement announced December 4, 2009:

Number of Shares: 4,305,000 flow-through shares

Purchase Price: $0.20 per flow-through share

Warrants: 2,152,500 share purchase warrants to purchase

2,152,500 shares

Warrant Exercise Price: $0.30 for a one year period

Number of Placees: 16 placees

Finders' Fees: $24,500 and 122,500 warrants payable to

Strand Securities Corporation

$17,500 and 87,500 warrants payable to

Limited Market Dealer Inc.

$1,820 and 9,100 warrants payable to Union

Securities Ltd.

$8,400 payable to Redplug Capital

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

--------------------------------------------------------------------------

TRANS-ORIENT PETROLEUM LTD. ("TOZ")

BULLETIN TYPE: Halt

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

Effective at the opening, December 16, 2009, trading in the shares of the

Company was halted pending delisting; this regulatory halt is imposed by

Investment Industry Regulatory Organization of Canada, the Market

Regulator of the Exchange pursuant to the provisions of Section 10.9(1) of

the Universal Market Integrity Rules.

TSX-X

--------------------------------------------------------------------------

TAG OIL LTD. ("TAO")

TRANS-ORIENT PETROLEUM LTD. ("TOZ"))

BULLETIN TYPE: Plan of Arrangement, Delist

BULLETIN DATE: December 16, 2009

TSX Venture Tier 1 Company, TSX Venture Tier 2 Company

Plan of Arrangement:

Pursuant to special resolutions passed by the shareholders of Trans

Orient-Petroleum Ltd. ('Trans-Orient') on December 9, 2009, TAG Oil Ltd.

('TAG Oil'), TAG Acquisition Corp. ('TAG Subco') and Trans-Orient have

completed a plan of arrangement pursuant to Part 9, Division 5 of the

Business Corporations Act (British Columbia) (the 'Plan of Arrangement').

The Plan of Arrangement has been completed effective 12:01 a.m. (Vancouver

time) on December 16, 2009, and has resulted in Trans-Orient becoming a

wholly-owned subsidiary of TAG Oil through an amalgamation with TAG's

wholly-owned subsidiary TAG Subco. Outstanding common shares of Trans-

Orient were exchanged for common shares of TAG Oil on the basis of one TAG

Oil common share for every 2.8 Trans-Orient common shares.

Post - Arrangement:

Capitalization: Unlimited shares with no par value of which

29,879,445 shares are issued and outstanding

Escrow: 302,949 Tier 1 Value Security Escrow

Delist:

Effective at the close of business December 17, 2009, the common shares of

Trans-Orient will be delisted from TSX Venture Exchange. The delisting of

the Company's shares results from TAG Oil purchasing 100% of Trans-

Orient's shares pursuant to an Arrangement Agreement dated September 14,

2009 and amended October 7, 2009. Trans-Orient shareholders will receive 1

common share of TAG Oil for every 2.8 Trans-Orient common shares held. For

further information please refer to the information circular of Trans-

Orient dated October 30, 2009 and Trans-Orient's news release dated

December 9, 2009.

TSX-X

--------------------------------------------------------------------------

YALE RESOURCES LTD. ("YLL")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 16, 2009

TSX Venture Tier 2 Company

Can-mex Option Agreement:

TSX Venture Exchange has accepted for filing a property option agreement

dated July 24, 2009 between Can-mex Barite S.A. de C.V. ('Canmex') and the

Company's subsidiary Minera Alta Vista, S.A. de C.V. ('Subco'). Subco has

been granted the option to acquire a 100% interest in nine mineral

concessions located in the Municipality of Suaqui Grande, Sonora State,

Mexico. In consideration the Company will pay $200,000 and issue 1,000,000

shares as follows:

- $10,000 and 100,000 shares payable November 24, 2009

- $15,000 and 100,000 shares payable May 24, 2010

- $15,000 and 100,000 shares payable November 24, 2010

- $20,000 and 100,000 shares payable May 24, 2011

- $20,000 and 100,000 shares payable November 24, 2011

- $40,000 and 100,000 shares Payable May 24, 2012

- $80,000 and 400,000 shares payable November 24, 2012

Minera Pima Option Agreement:

TSX Venture Exchange has accepted for filing a property option agreement

dated October 1, 2009 between Minera Pima de Oro, S.A. de C.V. ('Minera

Pima') and the Company's subsidiary Minera Alta Vista, S.A. de C.V.

('Subco'). Subco has been granted the option to acquire two mineral

concessions located in the Municipality of Suaqui Grande, Sonora State,

Mexico. In consideration the Company will pay $200,000 and issue 1,000,000

shares as follows:

- $10,000 and 100,000 shares payable January 9, 2010

- $15,000 and 100,000 shares payable July 9, 2010

- $15,000 and 100,000 shares payable January 9, 2011

- $20,000 and 100,000 shares payable July 9, 2011

- $20,000 and 100,000 shares payable January 9, 2012

- $40,000 and 100,000 shares Payable July 9, 2012

- $80,000 and 400,000 shares payable December 9, 2012

TSX-X

--------------------------------------------------------------------------

NEX COMPANIES

SPHERE RESOURCES INC. ("SPH.H")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 16, 2009

NEX Company

TSX Venture Exchange has accepted for filing documentation pertaining to

an option agreement between Sphere Resources Inc. (the "Company") and

Terry Loney (the "Vendor") whereby the Company has the option to earn up

to a 100% interest in two unpatented mineral claims, comprising a total of

five claims units known as the Scadding properties located near Sudbury,

Ontario. In consideration, the Company will issue a total of 1,300,000

shares over a two year period and complete $680,000 in work expenditures

on the properties over a three year period.

The properties are subject to payment of 2.5% Net Mineral Royalty to the

Vendor. The Company has the right at any time to prepay the above

considerations and exercise its option to acquire the properties. The

Company has the right to purchase from the Vendor the 2.5% Net Mineral

Royalty at any time during the term of the Option Agreement by paying one

million shares of the Company to the Vendor.

Duration Resources Limited or its nominee, an associate of the Company,

has agreed to fund the first year assessment work of $80,000 in return for

a Royalty of 2.5% in accordance with the terms of the Option Agreement. A

finders fee of 290,000 shares is payable to George Grignano.

TSX-X

--------------------------------------------------------------------------

SPHERE RESOURCES INC. ("SPH.H")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: December 16, 2009

NEX Company

TSX Venture Exchange has accepted for filing documentation pertaining to a

Letter of Intent (the "Agreement") with Global Minerals Limited ("Global")

in respect to Mining Claims at the Dome, Byshe and Heyson Townships in the

Red Lake district of Ontario. Global is the beneficial owner of 100% of

the rights, title and interest in and to 13 mining claims (34 units)

situated in Red Lake, Ontario. The Letter of Intent grants the Company the

exclusive right and option to acquire an undivided 75% of the right, title

and interest of Global in and to the Claims on the following terms:

In the First Year:

- A cash payment of $25,000 to Global by December 3, 2009.

- The issue of 500,000 Common stock of the Company to Global not to exceed

90 days after the date of the Agreement.

- Spending $75,000 on exploration by the anniversary date of signing the

Agreement.

In the Second Year:

- A cash payment of $25,000 to Global by the second anniversary date of

signing the Agreement.

- The issue of 500,000 Common stock of the Company to Global.

- Spending $350,000 on exploration by the second anniversary date of

signing the Agreement.

In the Third Year:

- A cash payment of $25,000 to Global by the third anniversary date of

signing of the Agreement.

- The issue of 500,000 Common stock of the Company to Global.

- Spending $500,000 on exploration by the third anniversary date of the

signing the Agreement.

The property consists of 13 unpatented mining claims that cover

approximately 500 hectares within the townships of Dome, Heyson and Byshe.

The Property is located about 1 km east of the Town of Red Lake and 3 km

southwest of Balmertown, Ontario, located in the Municipality of Red Lake,

Ontario.

Duration Resources Limited or it's its nominee, an associate of the

Company, has agreed to fund the assessment work of $100,000 in the first

year and $100,000 in the second year in return for any royalty Sphere

earns resulting from the Letter of Intent. A finders fee of 300,000 shares

is payable to George Grignano.

TSX-X

--------------------------------------------------------------------------

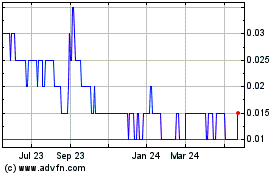

Jaxon Mining (TSXV:JAX)

Historical Stock Chart

From Feb 2025 to Mar 2025

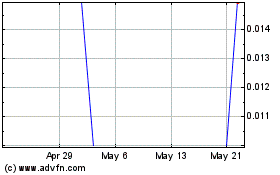

Jaxon Mining (TSXV:JAX)

Historical Stock Chart

From Mar 2024 to Mar 2025