Latin Metals Inc. (

“Latin Metals”

or the

“Company”) -

(TSXV: LMS)

(

OTCQB: LMSQF) announces that due to strong

investor interest in its non-brokered private placement (the

“Financing”) of units (each, a “Unit”) announced on September 21,

2022, it is upsizing the Financing to up to 12,000,000 Units at a

subscription price of $0.10 per Unit, to raise total gross proceeds

of up to $1.2 million. Under the amended terms of the

Financing, each Unit will now consist of one common share in the

capital of Latin Metals (each, a “Share”) and one common share

purchase warrant, each warrant entitling the holder thereof to

purchase one Share at a price of $0.20 per Share for a period

of 36 months from the closing of the Financing. Certain directors

and officers of the Company are expected to subscribe for

approximately 4,950,000 Units under the Financing (for gross

proceeds of $495,000).

The proceeds of the

Financing are intended to fund ongoing exploration at the Company’s

mineral projects in Argentina and Peru and for general working

capital.

The Company may pay

finder’s fees on all or a portion of the Financing, consisting of a

cash commission equal to up to 7% of the total gross proceeds

raised and finder’s warrants equal to up to 7% of the total number

of Units issued, where each finder’s warrant will entitle the

holder thereof to purchase one Share at a price of $0.10 per Share

for a period of 12 months from the closing of the Financing.

All securities issued

in connection with the Financing will be subject to a hold period

of four-months and one day in Canada. The Financing is subject to

the receipt of all necessary approvals including final acceptance

for filing of the Financing by the TSX Venture Exchange

(the “TSXV”) and any applicable securities regulatory

authorities. Any participation by directors or officers in the

Financing is considered a related party transaction within the

meaning of Multilateral Instrument 61-101 Protection of Minority

Security Holders in Special Transactions (“MI 61-101”). The related

party transaction will be exempt from the formal valuation and

minority shareholder approval requirements of MI 61-101, as neither

the fair market value of the securities to be issued under the

Financing nor the consideration to be paid by the directors and

officers will exceed 25% of the Company’s market

capitalization.

This news release does

not constitute an offer of sale of any of the foregoing securities

in the United States. None of the foregoing securities have been

and will not be registered under the U.S. Securities Act of 1933,

as amended (the “1933 Act”) or any applicable state securities laws

and may not be offered or sold in the United States or to, or for

the account or benefit of, U.S. persons (as defined in

Regulation S under the 1933 Act) or persons in the United

States absent registration or an applicable exemption from such

registration requirements. This news release does not constitute an

offer to sell or the solicitation of an offer to buy nor will there

be any sale of the foregoing securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful.

On Behalf of the Board

of Directors of

LATIN METALS INC.

“Keith Henderson”

President & CEO

For further details on the Company readers are

referred to the Company’s web site (www.latin-metals.com) and its

Canadian regulatory filings on SEDAR at www.sedar.com.

For further information, please contact:

Keith Henderson

Suite 890999 West Hastings StreetVancouver, BC, V6C 2W2

Phone: 604-638-3456E-mail: info@latin-metals.com

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

This news release contains forward-looking

statements and forward-looking information (collectively,

“forward-looking statements”) within the meaning of applicable

Canadian and U.S. securities legislation. All statements, other

than statements of historical fact, included herein including,

without limitation, statements regarding the closing of the

Financing, the participation of directors and officers in the

Financing, the use of proceeds of the Financing, anticipated

exploration program results from exploration activities, the

discovery and delineation of mineral deposits/resources/reserves,

and the anticipated business plans and timing of future activities

of the Company, are forward-looking statements. Although the

Company believes that such statements are reasonable, it can give

no assurance that such expectations will prove to be correct.

Often, but not always, forward looking statements can be identified

by words such as “pro forma”, “plans”, “expects”, “may”, “will”,

“should”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, “believes”, “potential” or variations of

such words including negative variations thereof, and phrases that

refer to certain actions, events or results that may, could, would,

might or will occur or be taken or achieved. In making the

forward-looking statements in this news release, the Company has

applied several material assumptions, including without limitation,

that it will obtain final TSXV acceptance for the Financing and the

required corporate approvals for same, that market fundamentals

will result in sustained precious metals and copper demand and

prices, the receipt of any necessary permits, licenses and

regulatory approvals in connection with the future development of

the Company’s projects in a timely manner, the availability of

financing on suitable terms for the development, construction and

continued operation of the Company’s projects, and the Company’s

ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and

unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of the Company to

differ materially from any future results, performance or

achievements expressed or implied by the forward-looking

statements. Such risks and other factors include, among others,

operating and technical difficulties in connection with mineral

exploration and development and mine development activities at the

Company’s projects, estimation or realization of mineral reserves

and mineral resources, requirements for additional capital, future

prices of precious metals and copper, changes in general economic

conditions, changes in the financial markets and in the demand and

market price for commodities, lack of investor interest in future

financings, possible variations in ore grade or recovery rates,

possible failures of plants, equipment or processes to operate as

anticipated, accidents, labour disputes and other risks of the

mining industry, delays or the inability of the Company to obtain

any necessary permits, consents or authorizations required,

including of the TSXV, financing or other planned activities,

changes in laws, regulations and policies affecting mining

operations, currency fluctuations, title disputes or claims

limitations on insurance coverage and the timing and possible

outcome of pending litigation, environmental issues and

liabilities, risks relating to epidemics or pandemics such as

COVID-19, including the impact of COVID-19 on the Company's

business, risks related to joint venture operations, and risks

related to the integration of acquisitions, as well as those

factors discussed under the heading “Risk Factors” in the Company’s

latest Management Discussion and Analysis and other filings of the

Company with the Canadian Securities Authorities, copies of which

can be found under the Company’s profile on the SEDAR website

at www.sedar.com.

Readers are cautioned not to place undue

reliance on forward looking statements. Except as otherwise

required by law, the Company undertakes no obligation to update any

of the forward-looking statements in this news release or

incorporated by reference herein.

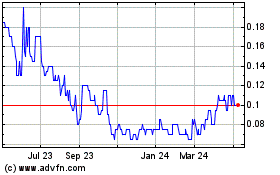

Latin Metals (TSXV:LMS)

Historical Stock Chart

From Mar 2024 to Apr 2024

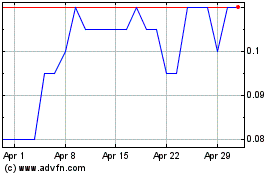

Latin Metals (TSXV:LMS)

Historical Stock Chart

From Apr 2023 to Apr 2024