New Zealand Energy Corp. (TSX VENTURE:NZ)(OTCQX:NZERF) ("NZEC" or the

"Company"), an oil and natural gas company that is producing, exploring and

developing petroleum prospects in New Zealand, has released the results of its

fourth quarter and fiscal year ended December 31, 2011. Details of the Company's

financial results are described in the Audited Consolidated Financial Statements

and Management's Discussion and Analysis, which, together with further details

on each of the Company's projects, are available on the Company's website at

www.newzealandenergy.com and on SEDAR at www.sedar.com. All amounts are in

Canadian dollars unless otherwise stated.

NZEC has also released the results of its 2011 year-end reserve and resource

estimation and economic evaluation (the "Report"), prepared by Deloitte & Touche

LLP ("AJM Deloitte"). The reserve estimate and economic evaluation was confined

to NZEC's 100% working interest Eltham Permit (PEP 51150) and was based on the

reservoir and production data from the Copper Moki-1 well with a December 31,

2011 cut-off. Regulatory filings associated with the Report are available for

review on SEDAR. NZEC expects to commission a reserve and resource update in the

near term to include exploration and production data from three more wells on

the Copper Moki pad that were drilled in 2012.

FINANCIAL SNAPSHOT

----------------------------------------------------------------------------

For the year ended For the year ended

December 31, 2011 December 31, 2010

$ $

----------------------------------------------------------------------------

Production 11,623 bbl Nil

Sales 9,567 bbl Nil

----------------------------------------------------------------------------

Price 106.83 $/bbl Nil

Production costs 23.44 $/bbl Nil

Royalties 4.96 $/bbl Nil

Net revenue 78.43 $/bbl Nil

----------------------------------------------------------------------------

Revenue $ 974,517 $ Nil

Total comprehensive loss (6,655,829) (10,338,136)

Interest income 119,583 Nil

Loss per share - basic and diluted (0.08) (0.24)

Current assets 19,293,345 6,229,650

Total assets 31,152,804 6,301,322

Total liabilities 1,383,376 371,958

Shareholders' equity $ 29,769,428 $ 5,929,364

----------------------------------------------------------------------------

Note: The abbreviation bbl means barrel or barrels of oil.

On December 10, 2011, the Corporation commenced continuous production from its

Copper Moki-1 well and as such began to recognize revenue from this period.

Incidental revenue generated during the start-up and testing phase of the well

was treated as a cost recovery of the capitalized well development costs. During

the period year December 31, 2011, the Corporation produced and sold 8,603

barrels of oil during the Copper Moki-1 start-up and testing phase for total

recoveries of $950,440. The aggregate volume of oil produced during the year was

20,226 barrels.

During the start-up and testing for Copper Moki-1, the Corporation incurred

various one-off costs to commission the well, resulting in a netback of

$78.43/bbl for the initial production period to December 31, 2011. First quarter

2012 netback numbers are in excess of $90.

RESERVE ESTIMATE

On April 27, 2012, NZEC booked its first oil and gas reserves. The reserve

estimate and economic evaluation was confined to NZEC's 100% working interest

Eltham Permit (PEP 51150) and was based on the reservoir and production data

from the Copper Moki-1 well with a December 31, 2011 cut-off. Regulatory filings

associated with the Report are available for review on SEDAR. NZEC expects to

commission a reserve and resource update in the near term to include the

reservoir and production data from three more wells on the Copper Moki pad that

were drilled in 2012.

Summary of Oil and Gas Reserves

As at December 31, 2011

Forecast Prices and Costs

----------------------------------------------------------------------------

Reserves

----------------------------------------

Light and Medium Oil Natural Gas

----------------------------------------

Gross Remaining Gross Remaining

Reserves Category (Mbbl) (MMcf)

----------------------------------------------------------------------------

Proved

Developed Producing 117.9 125.6

Developed Non-Producing - -

Undeveloped - -

Total Proved 117.9 125.6

----------------------------------------------------------------------------

Probable 103.9 235.5

----------------------------------------------------------------------------

Total Proved + Probable 221.8 361.1

----------------------------------------------------------------------------

Possible 95.4 208.9

----------------------------------------------------------------------------

Total Proved + Probable + Possible 317.2 570.0

----------------------------------------------------------------------------

Notes: Mbbl - thousand barrels of oil. MMcf - million cubic feet of natural

gas. See Cautionary Note Regarding Reserve Estimates.

Summary of Net Present Value of Future Net Revenue

As at December 31, 2011

Forecast Prices and Costs

----------------------------------------------------------------------------

Unit Value

Net Present Values of Future Net Before Tax

Revenues Before Tax Discounted at

Discounted at (%/year) (%/year)

----------------------------------------------------

0% 5% 10% 10%

Reserves Category (M$) (M$) (M$) ($/boe)

----------------------------------------------------------------------------

Proved

Developed Producing 6,624.0 6,475.4 6,339.2 45.7

Developed Non-

Producing - - - -

Undeveloped - - - -

Total Proved 6,624.0 6,475.4 6,339.2 45.7

----------------------------------------------------------------------------

Probable 7,120.3 6,328.2 5,653.2 39.5

----------------------------------------------------------------------------

Total Proved + Probable 13,744.3 12,803.7 11,992.5 42.5

----------------------------------------------------------------------------

Possible 7,207.5 6,091.9 5,262.1 40.4

----------------------------------------------------------------------------

Total Proved + Probable

+ Possible 20,951.8 18,895.6 17,254.6 41.9

----------------------------------------------------------------------------

Notes: boe - barrels of oil equivalent, calculated as 6 Mcf:1 bbl. See

Cautionary Note Regarding Reserve Estimates.

RECENT DEVELOPMENTS

On April 24, 2012, NZEC entered into a drilling agreement with Ensign

International Energy Services Pty Ltd ("Ensign") pursuant to which Ensign has

committed to drill three exploration wells for NZEC, with the option for up to

five additional wells, in the second half of 2012.

On April 1, 2012, NZEC commenced continuous production from its Copper Moki-2

well. Copper Moki-2 flowed 14,825 barrels of oil and 15,352 thousand cubic feet

("Mcf") of natural gas(1) during a 16-day flow test in February and was

subsequently shut-in for pressure build-up before commencing production in

April. The well is currently producing from natural reservoir pressure out of

the Mt. Messenger formation at an average rate of 581 barrels of oil per day

("bbl/d") and 1,530 Mcf of natural gas(1) per day ("Mcf/d") through a 24/64th

inch choke.

On March 21, 2012, NZEC closed a bought deal financing and over-allotment for

gross proceeds of $63,480,000. Through a syndicate of underwriters led by

Canaccord Genuity Corp. and including Macquarie Capital Markets Canada Ltd.,

Mackie Research Capital Corporation, PI Financial Corp. and Haywood Securities

Inc., NZEC issued 21,160,000 common shares at a price of $3.00 per common share.

The Underwriters elected to exercise their over-allotment option in full. Net

proceeds will be used to explore and develop NZEC's oil and gas properties, for

additional geologic and technical studies, and for other general corporate

purposes.

On February 22, 2012, the Company provided year-end production guidance of 3,000

boe/d.

On February 22, 2012, NZEC entered into a Cooperation Agreement with Te Runanga

o Ngati Ruanui Trust ("TRoNRT"), the iwi (tribe) located in South Taranaki near

NZEC's Alton and Eltham permits. Under the terms of the agreement, TRoNRT will

support NZEC's exploration, development and production activities within the

Ngati Ruanui area and NZEC will contribute to positive cultural, economic and

social outcomes for the development of Ngati Ruanui and its communities. NZEC

and TRoNRT have agreed to establish clear process and communication protocols

and to share relevant environmental and technical information. TRoNRT will

provide relevant cultural advice and support as NZEC moves through the resource

consent, permitting and development process. In addition, NZEC will provide a

right of first opportunity to TRoNRT's members for business, employment,

educational and training opportunities in South Taranaki. The Cooperation

Agreement outlines the parties' desire to build a sustainable and enduring

relationship that promotes the activities and prosperity of NZEC while

developing a sustaining and prosperous environment for TRoNRT.

On February 21, 2012, NZEC entered into an agreement with L&M Energy Limited

("L&M") to increase its interest in the Alton Permit from 50% to 65%. NZEC will

earn the additional 15% by funding the collection and processing of 3D seismic

data over approximately 50 km2 of the permit. NZEC is the operator of the

permit.

On February 6, 2012, NZEC reached target depth of 1,441 metres in its Ranui-2

well on its 100% working interest Ranui Permit in the East Coast Basin,

collecting open hole log data and coring the Whangai shale formation across

three intervals.

On December 20, 2011, NZEC commenced trading on the OTCQX International under

the symbol "NZERF".

On December 10, 2011, NZEC commenced continuous production from its Copper

Moki-1 well in the Taranaki Basin. Copper Moki-1 continues to flow from natural

reservoir pressure; production rates have averaged 424 bbl/d and 1,058 Mcf/d(1)

since commencing continuous production. Over the last 30 days, CM-1 has produced

at an average rate of 309 bbl/d and 1,205 Mcf/d(1) through a 24/64th inch choke.

PROPERTY REVIEW

Taranaki Basin

The Taranaki Basin is situated on the west coast of the North Island and is

currently New Zealand's only oil and gas producing basin, producing

approximately 130,000 boe/day from 18 fields. Within the Taranaki Basin, NZEC

has acquired the following PEPs:

-- On March 3, 2011, New Zealand's Minister of Energy granted an assignment

of the Eltham Permit to NZEC. The Eltham Permit covers approximately

92,467 acres (374 km2) of which approximately 31,877 acres (129 km2) are

offshore in shallow water.

-- On June 24, 2011, NZEC entered into the Alton Agreement with AGL

pursuant to which the Corporation agreed to acquire a 50% interest in

the Alton Permit and associated joint venture with L&M, which owns the

other 50% of the permit. Approval for the assignment of the 50% interest

was granted on October 4, 2011. The Alton Permit is adjacent to the

Eltham Permit and covers approximately 119,203 acres (482 km2). On

February 21, 2012, NZEC entered into a subsequent agreement with L&M

whereby NZEC can increase its interest in to the Alton Permit to 65% by

funding the collection and processing 3D seismic data over approximately

50 km2 of the permit.

NZEC has drilled five exploration wells in the Taranaki Basin, one on the Alton

Permit and four from the Copper Moki pad on the Eltham Permit. Copper Moki-1 and

Copper Moki-2 are currently in production. Copper Moki-3 and Copper Moki-4 will

be completed and tested in Q2-2012.

Production

NZEC's Copper Moki-1 well has been flowing from natural reservoir pressure since

December 10, 2011 and has produced more than 67,000 barrels of oil since it was

first tested in August 2011. Production rates have averaged 424 bbl/d and 1,058

Mcf/d(1) since commencing continuous production in December 2011. Over the last

30 production days, Copper Moki-1 has produced at an average rate of 309 bbl/d

and 1,205 Mcf/d(1) through a 24/64th inch choke.

Copper Moki-2 flowed 14,825 barrels of oil and 15,352 Mcf of natural gas(1)

during a 16-day flow test in February and was subsequently shut-in for pressure

build-up. NZEC initiated continuous production from Copper Moki-2 on April 1,

2012. The well is currently producing from natural reservoir pressure out of the

Mt. Messenger formation at an average rate of 581 bbl/d and 1,530 Mcf/d(1)

through a 24/64th inch choke.

Natural gas and associated natural gas liquids are being flared until the

Corporation completes a 2.6-km pipeline and associated production and sales

agreements, with the pipeline scheduled for completion by the end of Q2-2012.

Exploration

Copper Moki-3 reached target depth at 3,167 metres in mid-March and is the

Corporation's first well drilled through to NZEC's deeper exploration target,

the Moki formation. After evaluation, the Corporation identified 12 metres of

net pay within the Mt. Messenger formation and 15 metres of net pay within the

Moki formation. NZEC brought a service rig to site and commenced completion of

Copper Moki-3 on April 25, 2012.

Copper Moki-4 reached target depth of 2,125 metres on April 10, 2012. After

evaluation, the Corporation has decided to perforate and test both the Urenui

and Mt. Messenger formations, and will commence completion activities after

perforating the Moki formation in Copper Moki-3.

East Coast Basin

The East Coast Basin of New Zealand's North Island hosts two highly prospective

shale formations, the Waipawa and Whangai, which are the source of more than 300

oil and gas seeps. Within the East Coast Basin, the following PEPs have been, or

are in the process of being, acquired:

-- On September 3, 2010, NZEC applied to the Minister of Energy for the

East Cape Permit. The application is uncontested and the Corporation

expects the East Cape Permit to be granted to NZEC upon completion of

Crown Mineral's review of the application. The East Cape Permit covers

approximately 1,067,495 onshore acres (4,320 km2) on the northeast tip

of the North Island.

-- On November 24, 2010, the Minister of Energy granted the Castlepoint

Permit to NZEC. The Castlepoint Permit covers approximately 551,042

onshore acres (2,230 km2).

-- On February 22, 2011, NZEC entered into a permit acquisition agreement

with Discovery Geo, pursuant to which Discovery Geo agreed to assign its

100% interest in the Ranui Permit to NZEC upon completion of certain

conditions. Those conditions have been completed and approval for

assignment of the permit was granted on June 27, 2011. The Ranui Permit

is adjacent to the Castlepoint Permit and covers approximately 223,087

acres (903 km2). The Corporation has completed the geophysical and

geochemical studies required to re-enter the Ranui-1 well.

NZEC has completed the coring of two test holes on its 100% working interest

Castlepoint Permit. The Orui (125 metres total depth) and Te Mai (195 metres

total depth) collected data across the Waipawa and Whangai shales. NZEC also

completed a test hole on its 100% working interest Ranui Permit. Ranui-2 was

drilled to 1,440 metres, coring the Whangai shale across several intervals.

OUTLOOK

Taranaki Basin

With two wells in production, NZEC is focused on growing reserves, production

and cash flow by testing Copper Moki-3 and Copper Moki-4 and executing an

aggressive exploration program.

Since Copper Moki-3 is NZEC's first well to be drilled to the Moki formation,

the Corporation plans to thoroughly evaluate the characteristics of the

formation in order to guide its exploration strategy for future Moki targets.

Upon perforation, NZEC's technical team will determine if the formation flows

naturally. If further stimulation is required, additional time will be needed to

allow for a comprehensive evaluation of the Moki formation. Once the Moki

formation is fully assessed the Corporation will determine whether the Mt.

Messenger formation will be tested in Copper Moki-3 or advanced through an

additional well.

NZEC will complete and test Copper Moki-4 once the service rig has finished

completion operations with respect to the Moki formation of Copper Moki-3. If

successful, both wells will be tied into the existing production facilities at

the Copper Moki pad.

NZEC will shortly begin construction of an approximately 2.6-km natural gas

pipeline that will deliver natural gas from the Copper Moki site to a gas

production facility. The pipeline is targeted for completion at the end of

Q2-2012. NZEC is currently producing approximately 2,630 Mcf/d(1) of natural

gas.

NZEC has identified six prospects on 3D seismic similar to Copper Moki, with the

expectation of establishing one pad per prospect with two to four wells per pad.

NZEC has also identified 12 leads on 2D seismic that will be further defined

with the ongoing 3D seismic survey.

With a fully-funded treasury, NZEC is evaluating opportunities to accelerate its

exploration program, including drilling additional wells which may target the

deeper Tikorangi and Kapuni formations. While previous guidance was for six

wells in the Taranaki Basin, NZEC has entered into a rig contract to drill up to

eight wells in the second half of 2012. NZEC also has the ability to move

quickly should the team identify a strategic acquisition, partnership or farm-in

opportunity.

NZEC is completing a 100-km2 3D seismic program over the northern region of the

Eltham and Alton permits. Preparation for the seismic survey is nearly complete

and NZEC intends to initiate the 30-day data acquisition process in early May.

Following data acquisition, NZEC's technical team will take approximately four

months to process and interpret the data and integrate the information into its

technical database. The 3D seismic survey will further define existing targets

and reduce drilling risk while potentially identifying new exploration targets

and expanding NZEC's inventory locations for its 2013 exploration program.

(1) Natural gas and associated natural gas liquids are currently being flared

until the Corporation completes a pipeline and associated production and sales

agreements, with the pipeline targeted for completion by the end of Q2-2012.

East Coast Basin

NZEC has drilled two stratigraphic holes on its 100% working interest

Castlepoint Permit and one stratigraphic hole on its 100% working interest Ranui

Permit. These three stratigraphic test wells will advance NZEC's understanding

of the Waipawa and Whangai formations. A review of the geochemical and physical

properties of the two shale packages will help focus NZEC's exploration strategy

for the East Coast shales.

In addition, NZEC's technical team will reprocess existing East Coast Basin

seismic data and plans to shoot approximately 70 line kilometres of 2D seismic

in the second half of 2012 and complete additional technical studies to further

advance its understanding of the properties. The Corporation's application for

the East Cape Permit is uncontested and NZEC expects the permit to be granted

upon the completion of Crown Minerals' review of the application.

RESULTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2011

Revenue

During the year ended December 31, 2011, the Corporation commenced continuous

production and as such began to recognize revenue during the period. Since

December 10, 2011, the Corporation produced 11,623 barrels of oil and sold 9,567

barrels for total revenues of $1,022,009 or $106.83 per barrel sold. Total

recorded gross production revenue was $974,517 after accounting for royalties of

$47,492 or $4.96 per barrel sold. No revenues or royalties were recognized

during the year ended December 31, 2010.

Expenses and Other Items

Production costs during the year ended December 31, 2011 totalled $224,219 or

$23.44 per barrel. During the start-up and testing for Copper Moki-1, the

Corporation incurred various one-off costs to commissioning costs for the well.

Included in production costs are all site related expenditures, including

applicable equipment rental fees, site services, overheads and labour;

transportation and storage costs including trucking, testing, tank storage,

processing and handling; and port dues as incurred prior to the sale of oil. No

production costs were incurred during the year ended December 31, 2010.

Depreciation and accretion costs incurred during the year ended December 31,

2011 totalled $246,540 or $25.77 per barrel sold. As a result of the Copper

Moki-1 well deemed to have commenced commercial production during the year all

the related costs to the well were reclassified from exploration and evaluation

assets to property, plant and equipment and depreciated using the

unit-of-production method by reference to the ratio of production in the period

to the related total proved and probable reserves of oil and natural gas, taking

into account estimated future development costs necessary to access those

reserves. No depreciation and accretion costs were incurred during the year

ended December 31, 2010.

During the year ended December 31, 2011, the drilling of the Talon-1 well was

completed and total costs incurred amounted to $2,544,131. The Talon-1 well was

drilled pursuant to an agreement to acquire the Corporation's 50% interest in

the permit. The well location was selected by the previous operator based on 2D

seismic data. The well results were not positive and as such did not indicate

any commercially viable reserves, and the well was plugged and abandoned.

Furthermore, management determined that the well would not generate future

economic benefits and decided to write-off all related Talon-1 well costs. No

impairments were incurred or recognized in the year ended December 31, 2010.

Stock-based compensation for the year ended December 31, 2011 totalled

$2,203,548 compared to $9,996,000 recognized in 2010. Of the total non-cash

charge for the year ended December 31, 2011, $1,000,000 related to the IRBA

asset purchase agreement, on the valuation of the shares issued, that was

executed on February 21, 2011. The balance of $1,203,548 primarily related to

the options granted to directors, officers and employees of the Company upon the

completion of the Corporations initial public offering in August 2011. The

entire balance of stock-based compensation recognized in 2010 related to the

issuance and valuation of the Corporations founders shares upon its

incorporation. The common shares were granted to some of the Corporation's

directors and officers in lieu of the services performed and substantial

guarantees provided to assist in obtaining the legal rights to its resource

properties.

General and administrative expenses for the year ended December 31, 2011

totalled $2,583,530 compared to $338,469 incurred in 2010. The general and

administrative expenses incurred during the year related to professional fees,

management fees, consulting fees, travel and promotion, rent, overheads, filing

and insurance costs. The increase over prior year was indicative of a growing

and developing business over a twelve month period as compared to only a 60 day

period being recognized in the prior year due to its the incorporation on

October 29, 2010. The general and administrative costs specifically related to

establishing an operational structure, setting up offices in Vancouver, British

Columbia and Wellington, New Zealand, engaging key personnel and incurring the

necessary professional fees associated with the formation, public listing,

over-all business development of the Corporation.

Finance income for the year ended December 31, 2011 totalled $119,583 compared

to $nil being recognized in 2010. Finance income relates to interest earned on

the Corporations cash and cash equivalent balances held in treasury.

Foreign exchange gains for the year ended December 31, 2011 amounted to $134,934

compared to a foreign exchange loss of $3,667 being realized in 2010. Foreign

exchange gains and losses are a result of currency exchange differences being

recognized on transactions during the period.

Net Loss and Total Comprehensive Loss for the Year

Total expenses and other items for the year ended December 31, 2011 totalled

$7,547,451 compared to $10,338,136 in 2010 representing an over-all decrease of

$2,790,685 or 27%. Net loss for the year ended December 31, 2011 totalled

$6,572,934, after taking into account gross net revenues of $974,517, which

compared to a net loss for the year ended December 31, 2010 of $10,338,136 or an

overall decrease of $3,765,202 or 36%. The Corporation did not recognize any

gross revenues in 2010. After production revenues of $974,517, total

comprehensive loss for the year ended December 31, 2011 totalled $6,655,829,

after taking into account an exchange difference on translation of foreign

currency of $82,895. This compared to a total comprehensive loss for the year

ended December 31, 2010 of $10,338,136 for an over-all decrease of $3,682,307 or

36%.

Based on a weighted average shares outstanding balance of 85,122,879, the

Corporation realized an $0.08 basic and diluted loss per share for the year

ended December 31, 2011. During December 31, 2010, the Corporation realized a

$0.24 basic and diluted loss per share on a weighted average share balance of

43,005,714.

SUMMARY OF QUARTERLY RESULTS

------------------------------------------------------------------

2011 2011

Q4 Q3

$ $

------------------------------------------------------------------

Total assets 31,152,804 33,566,611

Resource properties 6,052,699 9,509,095

Property, plant and equipment 5,509,511 63,421

Working capital 18,030,398 18,699,022

Accumulated deficit (16,911,070) (17,057,134)

Total comprehensive loss (1,258,314(1)) (4,279,538)

Basic earning/(loss) per share 0.01 (0.04)

Diluted earning/(loss) per share 0.01 (0.04)

------------------------------------------------------------------

SUMMARY OF QUARTERLY RESULTS

----------------------------------------------------------------------

2011 2011 2010

Q2 Q1 Q4

$ $ $

----------------------------------------------------------------------

Total assets 10,683,239 11,491,806 6,301,322

Resource properties 4,641,525 3,161,561 60,222

Property, plant and equipment 68,366 65,721 -

Working capital 5,333,999 7,596,329 5,857,692

Accumulated deficit (13,258,649) (12,168,826) (10,338,136)

Total comprehensive loss (773,524) (1,878,754) (10,338,136)

Basic earning/(loss) per share (0.01) (0.03) (0.24)

Diluted earning/(loss) per share (0.01) (0.03) (0.24)

----------------------------------------------------------------------

(1) During the fourth quarter, the Corporation reclassified various

expenditures to exploration and evaluation assets.

New Zealand Energy Corporation was incorporated on October 29, 2010, under the

Business Corporations Act of British Columbia. Upon incorporation, 40,000,000

common shares were granted to certain directors and officers of the Corporation

in lieu of the services performed and substantial financial guarantees provided

to assist in obtaining the legal rights to the Castlepoint and East Cape

petroleum exploration permits within the East Coast Basin. The corporation then

raised seed capital of $7,000,000 upon the subsequent issuance of 28,000,000

common shares in Q4-2010 and Q1-2011 to engage in the exploration, acquisition

and development of petroleum and natural gas assets in New Zealand. This

financing was followed by another private placement completed in Q1-2011 for

gross proceeds of $5,257,500 on the issuance of 7,010,000 common shares. The

Corporation entered into an agreement in Q1-2011 with IRBA Consulting pursuant

to which it would acquire certain assets and provide employment to certain

personnel in consideration for CDN $400,000 and the issuance of 2,000,000 common

shares. Also in Q1-2011, upon satisfying the conditions of a deed of assignment,

the Corporation took ownership of its Eltham permit. Further exploration and

evaluation expenditures continued on the Eltham permit throughout fiscal 2011,

which ultimately saw the commercialization of the Copper Moki-1 well in Q4-2011.

All related costs to the Copper Moki-1 well were transferred to property, plant

and equipment in Q4-2011. In Q2-2011, the Corporation agreed to acquire a 50%

interest in the Alton permit for AUD2,000,000 and fund 100% of the Talon-1 well

development costs, which totalled $2,544,131. The Talon-1 well development costs

were written off in Q3-2011 due to management's view that the well would not

provide any future benefits. In Q2-2011, the Corporation completed the

acquisition of its Ranui permit for USD1,000,000 and the issuance of 1,000,000

common shares. Since the Corporation's inception, general and administrative

costs have been incurred to assist in establishing the operating structure,

setting up offices in both Canada and New Zealand, securing key personnel and

general business development.

On behalf of the Board of Directors

John Proust, Chief Executive Officer & Director

About New Zealand Energy Corp.

NZEC is an oil and natural gas company engaged in the production, development

and exploration of petroleum and natural gas assets in New Zealand. NZEC's

property portfolio collectively covers nearly two million acres of conventional

and unconventional prospects in the Taranaki Basin and East Coast Basin of New

Zealand's North Island. The Company's management team has extensive experience

exploring and developing oil and natural gas fields in New Zealand and Canada,

and takes a multi-disciplinary approach to value creation with a track record of

successful discoveries. NZEC plans to add shareholder value by executing a

technically disciplined exploration and development program focused on the

onshore and offshore oil and natural gas resources in the politically and

fiscally stable country of New Zealand. NZEC is listed on the TSX Venture

Exchange under the symbol NZ and on the OTCQX International under the symbol

NZERF. More information is available at www.newzealandenergy.com or by emailing

info@newzealandenergy.com.

Forward-looking Statements

This news release contains certain forward-looking information and

forward-looking statements within the meaning of applicable securities

legislation (collectively "forward-looking statements"). The use of any of the

words "anticipate", "continue", "estimate", "expect", "may", "will", "project",

"propose", "should", "believe", "initiate", "with the objective of", "plan" and

similar expressions are intended to identify forward-looking statements. These

statements involve known and unknown risks, uncertainties and other factors that

may cause actual results or events to differ materially from those anticipated

in such forward-looking statements, including without limitation, the

speculative nature of exploration, appraisal and development of oil and natural

gas properties; uncertainties associated with estimating oil and natural gas

resources; uncertainties in both daily and long-term production rates and

resulting cash flow; volatility in market prices for oil and natural gas;

changes in the cost of operations, including costs of extracting and delivering

oil and natural gas to market, that affect potential profitability of oil and

natural gas exploration; the need to obtain various approvals before exploring

and producing oil and natural gas resources; uncertainty in the timing of

receipt of permits and the Company's ability to extend the permits if required;

exploration hazards and risks inherent in oil and natural gas exploration;

operating hazards and risks inherent in oil and natural gas operations; market

conditions that prevent the Company from raising the funds necessary for

exploration and development on acceptable terms or at all; global financial

market events that cause significant volatility in commodity prices; unexpected

costs or liabilities for environmental matters; competition for, among other

things, capital, acquisitions of resources, skilled personnel, and access to

equipment and services required for exploration, development and production;

changes in exchange rates, laws of New Zealand or laws of Canada affecting

foreign trade, taxation and investment; failure to realize the anticipated

benefits of acquisitions; and other factors as disclosed in documents released

by NZEC as part of its continuous disclosure obligations. Information concerning

reserves may also be deemed to be forward looking as estimates imply that the

reserves described can be profitably produced in the future. NZEC believes the

expectations reflected in those forward-looking statements are reasonable, but

no assurance can be given that these expectations will prove to be correct. Such

forward-looking statements included in this news release should not be unduly

relied upon. These statements speak only as of the date of this news release and

NZEC does not undertake to update any forward-looking statements that are

contained in this news release, except in accordance with applicable securities

laws.

Cautionary Note Regarding Reserve Estimates

The oil and gas reserves calculations and income projections, upon which the

Report was based, were estimated in accordance with the Canadian Oil and Gas

Evaluation Handbook ("COGEH") and National Instrument 51-101 ("NI 51-101"). The

term barrels of oil equivalent ("boe") may be misleading, particularly if used

in isolation. A boe conversion ratio of six Mcf:one bbl was used by NZEC. This

conversion ratio is based on an energy equivalency conversion method primarily

applicable at the burner tip and does not represent a value equivalency at the

wellhead.

Reserves are estimated remaining quantities of oil and natural gas and related

substances anticipated to be recoverable from known accumulations, as of a given

date, based on: the analysis of drilling, geological, geophysical, and

engineering data; the use of established technology; and specified economic

conditions, which are generally accepted as being reasonable. Reserves are

classified according to the degree of certainty associated with the estimates.

Proved Reserves are those reserves that can be estimated with a high degree of

certainty to be recoverable. It is likely that the actual remaining quantities

recovered will exceed the estimated proved reserves. Probable Reserves are those

additional reserves that are less certain to be recovered than proved reserves.

It is equally likely that the actual remaining quantities recovered will be

greater or less than the sum of the estimated proved plus probable reserves.

Possible Reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that the actual

remaining quantities recovered will exceed the sum of the estimated proved plus

probable plus possible reserves.

Revenue projections presented in the Report are based in part on forecasts of

market prices, current exchange rates, inflation, market demand and government

policy which are subject to uncertainties and may in future differ materially

from the forecasts above. Present values of future net revenues documented in

the Report do not necessarily represent the fair market value of the reserves

evaluated in the Report.

The Report also contains forward-looking statements including expectations of

future production and capital expenditures. Information concerning reserves may

also be deemed to be forward looking as estimates imply that the reserves

described can be profitably produced in the future. These statements are based

on current expectations that involve a number of risks and uncertainties, which

could cause the actual results to differ from those anticipated.

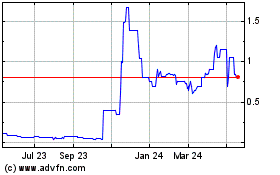

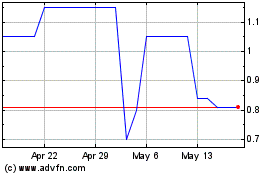

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

New Zealand Energy (TSXV:NZ)

Historical Stock Chart

From Jul 2023 to Jul 2024