ProntoForms Reports Q2 2022 Financial Results

18 August 2022 - 9:00PM

ProntoForms Corporation (TSXV: PFM), the global leader in no-code

app development platforms for field teams, announced today its

second quarter (Q2) financial results for the period ended June 30,

2022. All amounts are in US dollars unless otherwise stated.

“We started 2022 with a disappointing Q1. In the

second half of 2021, we added new leadership followed by large

changes to the sales organization. Q2 2022 showed improvement but

didn’t reflect the volume that we expected. We finished Q2 with 9%

annual growth in recurring revenue and 2% over Q1,” said Alvaro

Pombo, Founder and Chief Executive Officer. “After the lag in

bookings in the first half, we are seeing value building up. We had

an important enterprise expansion in Q2 that added over $250,000 of

ARR to bring that customer to over $940,000 in that quarter, and

growth is expected to continue. We are seeing more new and

expansion activity and are confident that we have a capable

enterprise go-to-market structure that is scaling as our enterprise

salespeople ramp.”

Mr. Pombo continued, “We recently passed the $20

million ARR milestone. 51% of the base now comes from

enterprise-size customers (> 2,500 employees) and 41% of the

base comes from customers with greater than $100,000 of ARR each.

The challenge of technician enablement for enterprises is not going

away any time soon.”

“I’m pleased with ProntoForms,” said Chairman

Terence Matthews. “The company is experiencing unprecedented

levels of business activity with partners, clients, evaluations,

and contracts. Our technology comes at the right time to help our

clients significantly improve agility and cost of their field

automation while enabling them to continuously improve their

workflows. This results in better customer and technician

experience yielding higher service reliability and uptime.”

Financial Highlights - 2022 Second

Quarter

- Recurring revenue in Q2 2022

increased by 9% to $4.97 million compared to $4.55 million in Q2

2021 and increased by 2% compared to $4.89 million in Q1 2022.

- Total revenue for Q2 2022 increased

by 8% to $5.21 million compared to $4.84 million in Q2 2021 and

increased by 3% compared to $5.04 million in Q1 2022.

- Gross margin for Q2 2022 was 84% of

total revenue compared to 85% in Q2 2021 and 84% in Q1 2022. Gross

margin on recurring revenue was 89% for Q2 2022 compared to 90% in

Q2 2021 and 99% in Q1 2022.

- Operating loss for Q2 2022 was

$1.32 million, up from an operating loss of $1.07 million in Q2

2021 and down from an operating loss of $1.49 million in Q1

2022.

- Net loss for Q2 2022 was $1.34

million, up from a net loss of $1.12 million in Q2 2021 and down

from a net loss of $1.54 million in Q1 2022.

- As at June 30, 2022, the Company’s

cash and net working capital balances were $7.52 million and $3.59

million respectively with CAD $1.84 million remaining unused on its

CAD $10 million debt facility.

Recent Operational Highlights

- A Fortune 500 oil & gas enterprise has expanded its

multi-year deployment of ProntoForms to reach over 2,000

subscriptions as part of a global Master Services Agreement (MSA)

where ProntoForms is the prime mobile forms solution approved for

use in field operations.

- A global heavy manufacturing enterprise increased its

commitment to ProntoForms by over $250,000 ARR to reach over

$940,000 ARR as a key technology driver for their full asset

lifecycle business model.

- ProntoForms launched new automation capabilities for

SharePoint. In addition, the ProntoForms platform is now available

on Microsoft AppSource.

- Nucleus Research published a third-party ROI evaluation of

PrimeLine Utility Services’ use of ProntoForms. They concluded that

PrimeLine experienced in excess of 1,000% ROI by increasing service

visibility and improving data collection. Read the report

here.

- ProntoForms CEO and Founder was the keynote speaker at

Copperberg’s Field Service Forum. Mr. Pombo discussed the

importance of rapidly automating processes to overcome

macroeconomic challenges in the service landscape.

- ProntoForms announced its EMPOWER’22 user conference that will

take place in Austin, Texas from September 26-27.

- ProntoForms was highlighted in the “Mobility” segment of

Gartner’s Hype Cycle for Oil & Gas 2022 Report. The report

identifies the solutions that technology leaders deploy in the oil

& gas industry.

Q2 Conference Call Date: Date: Thursday, August

18th, 2022Time: 9:00 AM Eastern Time

Participant Dial-in Numbers:Local Toronto – (+1)

647-484-0475Toll Free – (+1) 888-394-8218Conference ID: 9129028

Recording Playback Numbers:Local Toronto– (+1) 647-436-0148Toll

Free – (+1) 888-203-1112Passcode: 9129028Expiry Date: August 25th,

2022, at 11:59pm ESTAbout ProntoForms Corporation

ProntoForms is the global leader in no-code app development

platforms for field teams. The Company's platform enables

organizations to rapidly develop custom mobile apps with context

and intelligence, empowering field teams to reliably complete

complex work more effectively and safely.

The Company’s subscribers harness the intuitive, secure, and

scalable solution to improve asset uptime and CSAT, while also

reducing compliance incidents and work stoppages. The Company is

based in Ottawa, Canada, and trades on the TSXV under the symbol

PFM. ProntoForms is the registered trademark of ProntoForms Inc., a

wholly owned subsidiary of ProntoForms Corporation.

For additional information, please contact:

| Alvaro PomboChief Executive

Officer ProntoForms Corporation 613.599.8288 ext. 1111

apombo@prontoforms.com |

Babak PedramInvestor

RelationsVirtus Advisory Group

Inc.416-644-5081bpedram@virtusadvisory.com |

Certain information in this press release may

constitute forward-looking information. For example, statements

about the Company’s future growth or value, potential benefits of

using the Company’s products, customers’ commitment to use the

Company’s products going forward, the recurring nature of the

Company’s revenues, the revenues anticipated to be received by the

Company from recent contracts referred to above and anticipated

market trends are forward-looking information. This information is

based on current expectations that are subject to significant risks

and uncertainties that are difficult to predict. Actual results

might differ materially from results suggested in any

forward-looking statements. The Company’s business and value may

not grow as anticipated or at all, revenue anticipated from

contracts may not be received due to many risks, including factors

specific to the customer, and anticipated market trends may not

occur or continue. Historical growth levels and results may not be

indicative of future growth levels or results. The Company assumes

no obligation to update the forward-looking statements, or to

update the reasons why actual results could differ from those

reflected in the forward-looking statements unless and until

required by securities laws applicable to the Company. There are a

number of risk factors that could cause future results to differ

materially from those described herein. Please see “Risk

Factors Affecting Future Results” in the Company’s annual

management discussion and analysis dated March 10, 2022 found at

www.sedar.com for a discussion of such factors. Please also refer

to the Company’s management discussion and analysis for the year

ended December 31, 2021 for a description of how the Company

determines and uses ARR. ARR is a key performance indicator used by

the Company and is not meant as an indication such amounts will

necessarily be included in revenues in any given fiscal year.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

|

PRONTOFORMS CORPORATION |

|

|

|

|

|

|

|

|

Condensed Interim Consolidated Statements of Loss and Comprehensive

Loss |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

For the three months ended March 31, 2022 and 2021 |

|

|

|

|

|

|

|

|

(in US dollars) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

Six months ended June 30, |

|

|

|

|

2022 |

|

|

2021 |

|

2022 |

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

| |

Recurring revenue |

$ |

4,968,802 |

|

|

4,550,398 |

|

9,859,517 |

|

|

8,856,706 |

|

| |

Professional and other services |

|

242,814 |

|

|

290,649 |

|

393,207 |

|

|

597,804 |

|

| |

|

|

5,211,616 |

|

|

4,841,047 |

|

10,252,725 |

|

|

9,454,510 |

|

| |

|

|

|

|

|

|

|

|

|

Cost of revenue: (1) |

|

|

|

|

|

|

|

| |

Recurring revenue |

|

555,304 |

|

|

451,556 |

|

1,107,376 |

|

|

845,385 |

|

| |

Professional and other services |

|

262,132 |

|

|

292,818 |

|

517,509 |

|

|

574,753 |

|

| |

|

|

817,436 |

|

|

744,374 |

|

1,624,885 |

|

|

1,420,138 |

|

| |

|

|

|

|

|

|

|

|

|

Gross margin |

|

4,394,180 |

|

|

4,096,673 |

|

8,627,840 |

|

|

8,034,372 |

|

| |

|

|

|

|

|

|

|

|

|

Expenses: |

|

|

|

|

|

|

|

| |

Research and development (1) |

|

1,814,774 |

|

|

1,880,988 |

|

3,586,525 |

|

|

3,692,412 |

|

| |

Selling and marketing (1) |

|

2,922,742 |

|

|

2,369,151 |

|

5,856,982 |

|

|

4,668,951 |

|

| |

General and administrative (1) |

|

973,382 |

|

|

911,802 |

|

1,990,756 |

|

|

1,805,253 |

|

| |

|

|

5,710,898 |

|

|

5,161,941 |

|

11,434,263 |

|

|

10,166,616 |

|

| |

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(1,316,718 |

) |

|

(1,065,268 |

) |

(2,806,423 |

) |

|

(2,132,244 |

) |

| |

|

|

|

|

|

|

|

|

|

Foreign exchange loss |

|

29,212 |

|

|

(29,276 |

) |

1,374 |

|

|

(38,950 |

) |

|

Finance costs |

|

(55,127 |

) |

|

(30,072 |

) |

(81,187 |

) |

|

(58,236 |

) |

| |

|

|

|

|

|

|

|

|

|

Net loss and comprehensive loss |

$ |

(1,342,633 |

) |

|

(1,124,616 |

) |

(2,886,236 |

) |

|

(2,229,429 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net loss and comprehensive loss |

|

|

|

|

|

|

|

| |

per common share basic and diluted |

$ |

(0.01 |

) |

|

(0.01 |

) |

(0.02 |

) |

|

(0.02 |

) |

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of common shares |

|

|

|

|

|

|

|

| |

basic and diluted |

|

128,278,739 |

|

|

125,277,003 |

|

128,048,879 |

|

|

124,886,200 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

(1) Amounts include share-based compensation expense as

follows: |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cost of revenue |

$ |

5,040 |

|

|

2,348 |

|

5,359 |

|

|

3,214 |

|

|

Research and development |

|

72,550 |

|

|

32,790 |

|

101,667 |

|

|

82,866 |

|

|

Selling and marketing |

|

116,892 |

|

|

14,080 |

|

170,089 |

|

|

40,326 |

|

|

General and administrative |

|

121,355 |

|

|

64,019 |

|

151,088 |

|

|

149,368 |

|

|

Total share-based compensation expense |

$ |

315,837 |

|

|

113,237 |

|

428,203 |

|

|

275,774 |

|

| |

|

|

|

|

|

|

|

|

|

PRONTOFORMS CORPORATION |

|

|

|

|

|

Condensed Interim Consolidated Statements of Financial

Position |

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 and December 31, 2021 |

|

|

|

|

|

|

|

(in US dollars) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

|

December 31, |

|

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

| |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

| |

Cash and cash equivalents |

$ |

7,518,063 |

|

|

$ |

6,082,289 |

|

|

| |

Accounts receivable |

|

1,961,279 |

|

|

|

3,199,216 |

|

|

| |

Investment tax credits receivable |

|

154,727 |

|

|

|

117,599 |

|

|

| |

Unbilled receivables |

|

59,506 |

|

|

|

36,406 |

|

|

| |

Related party loan receivable |

|

83,382 |

|

|

|

84,757 |

|

|

| |

Prepaid expenses and other receivables |

|

1,468,311 |

|

|

|

907,228 |

|

|

| |

Contract acquisition costs |

|

250,811 |

|

|

|

273,062 |

|

|

| |

|

|

11,496,079 |

|

|

|

10,700,557 |

|

|

| |

|

|

|

|

|

|

|

|

Property, plant and equipment |

|

296,264 |

|

|

|

331,717 |

|

|

|

Contract acquisition costs |

|

123,725 |

|

|

|

157,693 |

|

|

|

Right-of-use asset |

|

275,829 |

|

|

|

403,143 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

$ |

12,191,897 |

|

|

$ |

11,593,110 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Shareholders' Equity |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

| |

Accounts payable and accrued liabilities |

$ |

2,206,842 |

|

|

$ |

2,533,743 |

|

|

| |

Deferred revenue - current portion |

|

5,394,756 |

|

|

|

5,411,380 |

|

|

| |

Lease obligation - current portion |

|

306,829 |

|

|

|

303,650 |

|

|

| |

|

|

7,908,427 |

|

|

|

8,248,773 |

|

|

| |

|

|

|

|

|

|

|

|

Long-term debt |

|

6,316,459 |

|

|

|

3,261,825 |

|

|

|

Deferred revenue |

|

4,835 |

|

|

|

33,068 |

|

|

|

Lease obligation |

|

26,304 |

|

|

|

184,766 |

|

|

|

|

|

|

14,256,025 |

|

|

|

11,728,432 |

|

|

| |

|

|

|

|

|

|

|

|

Shareholders' equity: |

|

|

|

|

|

|

| |

Share capital |

|

31,457,611 |

|

|

|

31,141,138 |

|

|

| |

Contributed surplus |

|

864,907 |

|

|

|

864,907 |

|

|

| |

Share-based payment reserve |

|

3,185,625 |

|

|

|

2,544,668 |

|

|

| |

Deficit |

|

(37,756,706 |

) |

|

|

(34,870,470 |

) |

|

| |

Accumulated other comprehensive income |

|

184,435 |

|

|

|

184,435 |

|

|

| |

|

|

(2,064,128 |

) |

|

|

(135,322 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

$ |

12,191,897 |

|

|

$ |

11,593,110 |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

PRONTOFORMS CORPORATION |

|

|

|

|

|

|

|

Condensed Interim Consolidated Statements of Cash Flows |

|

|

|

|

|

|

|

|

|

|

|

|

|

For the six months ended June 30, 2022 and 2021 |

|

|

|

|

|

(in US dollars) |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended June 30, |

|

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

| |

|

|

|

|

|

|

|

|

|

Cash (used in) provided by: |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Operating activities: |

|

|

|

|

|

|

| |

Net loss |

$ |

(2,886,236 |

) |

|

$ |

(2,229,429 |

) |

|

| |

Items not involving cash: |

|

|

|

|

|

|

| |

|

Share-based compensation |

|

744,039 |

|

|

|

275,774 |

|

|

| |

|

Accretion on long-term debt |

|

|

|

|

|

|

| |

|

Accretion on lease obligations |

|

11,435 |

|

|

|

19,349 |

|

|

| |

|

Accretion of transaction costs |

|

3,945 |

|

|

|

14,090 |

|

|

| |

|

Amortization of property, plant and equipment |

|

75,727 |

|

|

|

81,461 |

|

|

| |

|

Amortization of right-of-use asset |

|

127,314 |

|

|

|

127,314 |

|

|

| |

|

Unrealized foreign exchange losses |

|

(76,033 |

) |

|

|

31,136 |

|

|

| |

Other finance costs |

|

77,242 |

|

|

|

44,146 |

|

|

| |

Interest paid |

|

(86,012 |

) |

|

|

(49,840 |

) |

|

| |

Interest received |

|

8,770 |

|

|

|

5,694 |

|

|

| |

Lease interest paid |

|

(11,435 |

) |

|

|

(19,349 |

) |

|

| |

Changes in non-cash operating working capital items |

|

301,087 |

|

|

|

847,631 |

|

|

| |

|

|

|

(1,710,157 |

) |

|

|

(852,023 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Financing activities |

|

|

|

|

|

|

| |

Payment of lease obligations |

|

(149,789 |

) |

|

|

(133,114 |

) |

|

| |

Proceeds from drawdown of credit facility |

|

3,178,124 |

|

|

|

- |

|

|

| |

Proceeds from the exercise of options |

|

213,391 |

|

|

|

326,992 |

|

|

| |

|

|

|

3,241,726 |

|

|

|

193,878 |

|

|

| |

|

|

|

|

|

|

|

|

|

Investing activities |

|

|

|

|

|

|

| |

Purchase of property, plant and equipment |

|

(40,274 |

) |

|

|

(36,311 |

) |

|

| |

|

|

|

(40,274 |

) |

|

|

(36,311 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash |

|

(55,521 |

) |

|

|

75,091 |

|

|

| |

|

|

|

|

|

|

|

|

|

Increase in cash and cash equivalents |

|

1,435,774 |

|

|

|

(619,365 |

) |

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, beginning of period |

|

6,082,289 |

|

|

|

7,747,542 |

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents, end of period |

$ |

7,518,063 |

|

|

$ |

7,128,177 |

|

|

| |

|

|

|

|

|

|

|

|

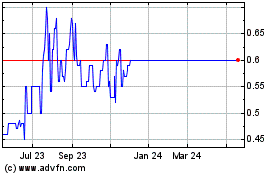

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Nov 2024 to Dec 2024

ProntoForms (TSXV:PFM)

Historical Stock Chart

From Dec 2023 to Dec 2024