Quorum Information Technologies Inc. (TSX VENTURE:QIS) ("Quorum" or the

"Company") today released its Second Quarter (Q2) Fiscal Year (FY) 2013 results.

Quorum delivers its dealership management system (DMS), XSellerator(TM), and

related services to automotive dealerships throughout North America. The Company

is a strategic partner with General Motors Corporation (GM) and an industry

partner with Microsoft. Quorum's XSellerator product is broadly promoted to its

target dealerships throughout North America by these prominent industry

partners. Quorum also supplies its product to Isuzu, Chrysler, Hyundai, Kia,

Nissan, Subaru, NAPA and Bumper to Bumper franchised dealership customers.

Maury Marks, Quorum's President and CEO made the following remarks about the

Company's Q2 FY2013 results:

Some of our most significant measurable sales and operational results in Q2

FY2013 are as follows:

-- Customer Base - Quorum reached 273 active dealership rooftops at the end

of Q2 FY2013.

-- Customers Satisfaction Index (CSI) - our monthly Support Center CSI

survey reported an average of over 95% "very satisfied" with the service

received from our support team.

-- Quorum's first western Customer Conference in Q2 FY2013 was double the

attendance of our eastern Customer Conference hosted in Q4 FY2012.

-- Product - during Q2 FY2013 we general released V4.7.6 which is the

largest new version of XSellerator that the company has ever developed.

This release has approximately 250 changes and enhancements designed to

help dealership productivity and profitability.

-- Manufacturers - Quorum entered into an agreement with Nissan Canada to

participate in Nissan's new certification program. We also entered into

an agreement with General Motors US for their new Dealer Technical

Assistance Program (DTAP).

Financial Results highlights for Q2 FY2013 are as follows:

-- Sales increased by 6% to $1,941K in Q2 FY2013 from $1,831K in Q2 FY2012

due to:

-- An increase of $124K in recurring support revenue as a result from

having 273 active dealership rooftops at the end of Q2 FY2013 versus

263 at the end of Q2 FY2012;

-- A decrease of $54K in net new revenue which was a result of

completing six small installations in Q2 FY2013 as compared to six

larger dealership installations in Q2 FY2012;

-- A decrease in integration revenue of $21K; and

-- An increase of $61K in transitions revenue (dealership server and

platform upgrades).

-- Earnings before interest, taxes, depreciation, amortization, stock-based

compensation and foreign exchange (EBITDA) increased to $234K in Q2

FY2013 from $226K in Q2 FY2012 due to:

-- A $50K increase in margin after direct costs in Q2 FY2013 compared

to Q2 FY2012;

-- A $24K decrease in salaries and benefits expense in Q2 FY2013

compared to Q2 FY2012. The decrease is largely due to proceeds of

$13K received from the Atlantic Canada Opportunities Agency (ACOA)

grant during Q2 FY2013;

-- A $32K increase in general and administrative expense due to the

renegotiating of a contract with Central Consulting Services Inc.

during Q2 FY2012; and

-- A $34K increase in sales and marketing expense due to the added

costs of hosting our first western Customer Conference and our

attendance at the National Independent Automobile Dealers

Association (NIADA) conference during Q2 FY2013.

-- Quorum had a Comprehensive loss of $22K in Q2 FY2013 compared to a

Comprehensive loss of $42K in Q2 FY2012. The improvement is due to:

-- An increase in EBIDTA of $8K in Q2 FY2013 compared to Q2 FY2012.

This increase is offset by increased amortization expense of $27K,

decreased stock option benefits of $5K and increased interest

expense of $11K in Q2 FY2013 compared to Q2 FY2012.

-- Deferred income tax expense of $124K during Q2 FY2013 compared to

$145K in Q2 FY2012.

-- A foreign exchange gain of $62K during Q2 FY2013 compared to a $39K

during Q2 FY2012.

-- Quorum posted its sixteenth consecutive quarter of cash flow positive

results. These results are due to a well-managed cost structure and from

attaining a critical mass of dealerships that generate significant

higher margin recurring support revenues.

The Company had a strong Q2 FY2013 compared to Q2 FY2012. The highlights were a

6% increase in revenue and an $8K increase in EBITDA.

Quorum has filed its Q2 2013 consolidated financial statements and notes thereto

as at and for the period ended June 30, 2013 and accompanying Management's

Discussion and Analysis in accordance with National Instrument 51-102 -

Continuous Disclosure Obligations adopted by the Canadian securities regulatory

authorities. Additional information about Quorum will be available on Quorum's

SEDAR profile at www.sedar.com and Quorum's website at www.QuorumDMS.com.

Financial Highlights

Six Months Six Months Q2 Ended

Ended June Ended June June 30,

30, 2013 30, 2012 2013

----------------------------------------------------------------------------

Gross revenue $ 3,900,649 $ 3,673,318 $ 1,941,358

Direct costs 1,837,658 1,679,660 910,460

Margin after direct costs 2,062,991 1,993,658 1,030,898

Earnings before interest, taxes,

depreciation and amortization

(EBITDA) 392,061 352,542 234,503

Income (loss) before deferred income

tax expense 2,093 27,591 39,756

Net loss (132,618) (132,565) (84,452)

Comprehensive loss (34,582) (134,217) (22,167)

Basic loss per share $ (0.0034) $ (0.0034) $ (0.0021)

Fully diluted loss per share $ (0.0034) $ (0.0034) $ (0.0021)

Weighted average number of common

shares

Basic 39,298,438 39,298,438 39,298,438

Diluted 39,298,438 39,298,438 39,298,438

XSellerator installations - in the

period 9 12 6

XSellerator active dealership

rooftops 273 263 273

----------------------------------------------------------------------------

Financial Highlights

Q2 Ended Q1 Ended Q1 Ended

June 30, March 31, March 31,

2012 2013 2012

----------------------------------------------------------------------------

Gross revenue $ 1,831,132 $ 1,959,291 $ 1,842,186

Direct costs 850,670 927,198 828,990

Margin after direct costs 980,462 1,032,093 1,013,196

Earnings before interest, taxes,

depreciation and amortization

(EBITDA) 226,086 157,558 126,456

Income (loss) before deferred income

tax expense 65,027 (37,663) (37,436)

Net loss (80,311) (48,166) (52,254)

Comprehensive loss (41,613) (12,415) (92,604)

Basic loss per share $ (0.0020) $ (0.0012) $ (0.0013)

Fully diluted loss per share $ (0.0020) $ (0.0012) $ (0.0013)

Weighted average number of common

shares

Basic 39,298,438 39,298,438 39,298,438

Diluted 39,298,438 39,298,438 39,298,438

XSellerator installations - in the

period 6 3 6

XSellerator active dealership

rooftops 263 271 259

----------------------------------------------------------------------------

About Quorum

Quorum is a North American company focused on developing, marketing,

implementing and supporting its XSellerator product for GM, Isuzu, Chrysler,

Hyundai, KIA, Nissan, Subaru, NAPA and Bumper to Bumper dealerships. XSellerator

is a dealership and customer management software product that automates,

integrates and streamlines every process across departments in a dealership. One

of the select North American suppliers under General Motors' Canada IDMS

program, Quorum is the second largest DMS provider for GM's Canadian dealerships

with 25% of the market. Quorum is a Microsoft Partner in both Canada and the

United States. Quorum Information Technologies Inc. is traded on the Toronto

Venture Exchange (TSX-V) under the symbol QIS. For additional information please

go to www.QuorumDMS.com.

Forward-Looking Information

This press release contains certain forward-looking statements and

forward-looking information ("forward-looking information") within the meaning

of applicable Canadian securities laws. Forward-looking information is often,

but not always, identified by the use of words such as "anticipate", "believe",

"plan", "intend", "objective", "continuous", "ongoing", "estimate", "expect",

"may", "will", "project", "should" or similar words suggesting future outcomes.

In particular, this press release includes forward-looking information relating

to results of operations, plans and objectives, projected costs and business

strategy. Quorum believes the expectations reflected in such forward-looking

information are reasonable but no assurance can be given that these expectations

will prove to be correct and such forward-looking information should not be

unduly relied upon.

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties some of which are described herein.

Such forward-looking information necessarily involves known and unknown risks

and uncertainties, which may cause Quorum's actual performance and financial

results in future periods to differ materially from any projections of future

performance or results expressed or implied by such forward-looking information.

These risks and uncertainties include but are not limited to the risks

identified in Quorum's Management's Discussion and Analysis for the period ended

June 30, 2013. Any forward-looking information is made as of the date hereof

and, except as required by law, Quorum assumes no obligation to publicly update

or revise such information to reflect new information, subsequent or otherwise.

The TSX Venture Exchange does not accept responsibility for the adequacy or

accuracy of this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Quorum Information Technologies Inc.

Maury Marks

403-777-0036 ext 104

MarksM@QuorumDMS.com

www.QuorumDMS.com

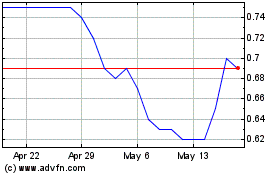

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

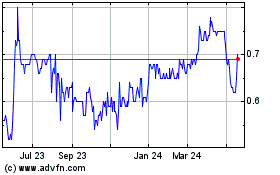

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Dec 2023 to Dec 2024