Quorum Information Technologies Inc. (TSX-V: QIS) (“Quorum”), a

North American SaaS Software and Services company providing

essential enterprise solutions that automotive dealerships and

Original Equipment Manufacturers (“OEMs”) rely on for their

operations, released its results today for the second quarter of

2024, ended June 30, 2024. Financial references are expressed in

Canadian dollars unless otherwise indicated. Please refer to the

MD&A and Financial Statements posted onto SEDAR related to

non-IFRS measures and risk factors.

“We are pleased to report that our profitable

growth strategy and better company-wide cost management has

resulted in Q2 2024 Adjusted EBITDA of $2.0 million, up 18% as

compared to the prior year and Adjusted Cash Income of $1.5

million, up 39% as compared to the prior year. Our SaaS Revenue

grew by 2% as compared to Q2 2023 with total revenue maintaining

steady,” stated Maury Marks, President and CEO. “The execution of

our strategy delivered three consecutive quarters of Adjusted

EBITDA margin of 20% and higher. Our improved profitably enabled us

to pay down $3.0 million on our BDC Capital Facility during Q3

2024, reducing the Facility balance from $8.3 million as of June

30, 2024, to $5.3 million.”

“I want to express my gratitude to our

employees, whose dedication was key to achieving our Q2 2024 plan

and strong quarterly results,” said Mr. Marks. "Their hard work is

enhanced by our integrated suite of 13 essential software solutions

and services. This product suite is crucial to our profitable

growth strategy, as it facilitates product cross-selling and plays

a vital role in driving the success of our dealerships, thereby

increasing value for both Quorum and its customers.”

Consolidated Results for Q2

2024

|

|

Q2 2024 |

%Change |

Q2 2023 |

|

YTD 2024 |

%Change |

YTD 2023 |

|

Total Revenue |

$ |

9,950,948 |

|

(1 |

%) |

$ |

10,035,849 |

|

|

$ |

20,013,739 |

|

0 |

% |

$ |

19,942,327 |

|

|

SaaS Revenue |

$ |

7,235,908 |

|

2 |

% |

$ |

7,073,872 |

|

|

$ |

14,432,144 |

|

2 |

% |

$ |

14,099,652 |

|

|

BDC Revenue |

$ |

2,453,293 |

|

(11 |

%) |

$ |

2,764,958 |

|

|

$ |

4,966,863 |

|

(10 |

%) |

$ |

5,529,693 |

|

|

Recurring Revenue |

$ |

9,689,201 |

|

(2 |

%) |

$ |

9,838,830 |

|

|

$ |

19,399,007 |

|

(1 |

%) |

$ |

19,629,345 |

|

|

Gross Margin |

$ |

4,927,762 |

|

1 |

% |

$ |

4,861,606 |

|

|

$ |

10,013,243 |

|

5 |

% |

$ |

9,499,875 |

|

|

Gross Margin % |

|

50 |

% |

|

|

48 |

% |

|

|

50 |

% |

|

|

48 |

% |

|

Net Income per Share |

$ |

0.005 |

|

|

$ |

0.029 |

|

|

$ |

0.021 |

|

|

$ |

0.022 |

|

|

Net Income1 |

$ |

388,966 |

|

(82 |

%) |

$ |

2,160,909 |

|

|

$ |

1,512,887 |

|

(6 |

%) |

$ |

1,601,000 |

|

|

Adjusted Net Income (Loss)2 |

$ |

388,966 |

|

2 |

% |

$ |

379,486 |

|

|

$ |

1,512,887 |

|

939 |

% |

$ |

(180,423 |

) |

|

Adjusted EBITDA |

$ |

1,951,742 |

|

18 |

% |

$ |

1,655,963 |

|

|

$ |

4,093,437 |

|

37 |

% |

$ |

2,988,040 |

|

|

Adjusted EBITDA Margin |

|

20 |

% |

|

|

17 |

% |

|

|

20 |

% |

|

|

15 |

% |

|

Adjusted Cash Income |

$ |

1,451,415 |

|

39 |

% |

$ |

1,045,202 |

|

|

$ |

3,121,213 |

|

92 |

% |

$ |

1,622,433 |

|

|

Adjusted Cash Income Margin |

|

15 |

% |

|

|

10 |

% |

|

|

16 |

% |

|

|

8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________1 Adjusted EBITDA – Net income

(loss) before interest and financing costs, taxes, depreciation,

amortization, stock-based compensation, foreign exchange gains and

losses, impairment, gain on bargain purchase, one-time acquisition

related expenses and restructuring expenses.2 Adjusted Cash Income

(“ACI”) (non-GAAP) – Adjusted EBITDA less capitalized salaries and

overhead.3 Net income for both Q2 2023 and YTD 2023 includes a gain

on bargain purchase of $1.8M due to the acquisition of VINN.4

Adjusted Net Income (Loss) (non-GAAP) – Net income (loss) before

impairment and gain on bargain purchase.

Second Quarter Results

- Revenue remained relatively consistent at $10.0 million in Q2

2024 compared to Q2 2023.

- SaaS revenue increased by 2% to $7.2 million in Q2 2024

compared to $7.1 million in Q2 2023.

- Gross margin increased by 1% to $4.9 million in Q2 2024

compared to Q2 2023. Gross margin has been 50% or higher for two

consecutive quarters.

- Adjusted EBITDA was $2.0 million in Q2 2024 compared to $1.7

million in Q2 2023, an increase of $0.3 million. This represented

an Adjusted EBITDA margin expansion of 3% from 17% in Q2 2023 to

20% in Q2 2024.

- Adjusted Cash Income was $1.5 million in Q2 2024 compared to

$1.0 million in Q2 2023, an increase of $0.4 million. This

represented an Adjusted Cash Income margin expansion of 4% from 10%

in Q2 2023 to 15% in Q2 2024.

SaaS-based operational Key Performance

Indicators (“KPIs”) are as follows:

|

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

|

Dealer Rooftop Count - Canada |

1,305 |

1,303 |

1,301 |

1,292 |

1,300 |

|

Dealer Rooftop Count - US |

120 |

125 |

126 |

125 |

114 |

|

Dealer Rooftop Count - Total |

1,425 |

1,428 |

1,427 |

1,417 |

1,414 |

|

MRRPU* |

$1,655 |

$1,651 |

$1,639 |

$1,693 |

$1,706 |

|

|

|

|

|

|

|

*Monthly recurring revenue per unit (“MRRPU”)

implies that, as of the end of Q2 2024, each dealership (“Dealer

Rooftop”) represents approximately $20.5K of SaaS annual recurring

revenue (“ARR”).

The decline in customer rooftop count for Q2

2024 is primarily due to Quorum’s profitable growth strategy which

emphasizes cross-selling over new dealerships acquisitions. While

total rooftop count declined in Q2 2024, MRRPU improved as compared

to prior quarters.

Quorum Q2 2024 Results Conference Call

Details and Investor Presentation

Maury Marks, President and Chief Executive

Officer and Marilyn Bown, Chief Financial Officer will present the

Q2 2024 Results at a conference call with concurrent audio webcast,

scheduled for:

|

Date: |

|

Thursday, August 22nd, 2024 |

|

Time: |

|

11:00 am MT (1:00 pm ET) |

|

Dial-In #: |

|

Toll-Free North America: 1 (888) 660-6411 |

|

Conference ID: |

|

2512218 |

|

Webcast Link: |

|

Quorum Q2 2024 Results Conference Call (Webcast) |

|

|

|

|

An updated Investor Presentation, replay of the results

conference call, and transcripts of the conference call, will also

be available at www.QuorumInformationSystems.com.

About Quorum Information Technologies

Inc.

Quorum is a North American SaaS Software and

Services company providing essential enterprise solutions that

automotive dealerships and Original Equipment Manufacturers

(“OEMs”) rely on for their operations, including:

- Quorum’s Dealership Management System (DMS),

which automates, integrates, and streamlines key processes across

departments in a dealership, and emphasizes revenue generation and

customer satisfaction.

- DealerMine CRM, a sales and service Customer

Relationship Management (“CRM”) system and set of Business

Development Centre services that drives revenue into the critical

sales and service departments in a dealership.

- Autovance, a modern retailing platform that

helps dealerships attract more business through Digital Retailing,

improve in-store profits and closing rates through its desking tool

and maximize their efficiency and CSI through Autovance’s F&I

menu solution.

- Accessible Accessories, a digital retailing

platform that allows franchised dealerships to efficiently increase

their vehicle accessories revenue.

- VINN Automotive, a premier

automotive marketplace that streamlines the vehicle research and

purchase process for vehicle shoppers while helping retailers sell

more efficiently.

Contacts:

Maury MarksPresident and Chief Executive

Officer403-777-0036Maury.Marks@QuorumInfoTech.com

Marilyn BownChief Financial

Officer403-777-0036Marilyn.Bown@QuorumInfoTech.com

Forward-Looking Information

This press release may contain certain

forward-looking statements and forward-looking information

(“forward-looking information”) within the meaning of applicable

Canadian securities laws. Forward-looking information is often, but

not always, identified by the use of words such as “anticipate”,

“believe”, “plan”, “intend”, “objective”, “continuous”, “ongoing”,

“estimate”, “expect”, “may”, “will”, “project”, “should” or similar

words suggesting future outcomes. Quorum believes the expectations

reflected in such forward-looking information are reasonable but no

assurance can be given that these expectations will prove to be

correct and such forward-looking information should not be unduly

relied upon.

Forward-looking information is not a guarantee

of future performance and involves a number of risks and

uncertainties some of which are described herein. Such

forward-looking information necessarily involves known and unknown

risks and uncertainties, which may cause Quorum’s actual

performance and financial results in future periods to differ

materially from any projections of future performance or results

expressed or implied by such forward-looking information.

Quorum has filed its Q2 2024 unaudited condensed

interim consolidated financial statements and notes thereto as at

and for the three months ended June 30, 2024, and accompanying

management and discussion and analysis in accordance with National

Instrument 51-102 – Continuous Disclosure

Obligations adopted by the Canadian securities regulatory

authorities.

Quorum Information Technologies Inc. is traded

on the Toronto Venture Exchange (TSX-V) under the symbol QIS. For

additional information please go

to www.QuorumInformationSystems.com.

Neither the TSX Venture Exchange nor its regulation services

provider (as that term is defined in the policies of the TSX

Venture Exchange) has reviewed this release and neither accepts

responsibility for the adequacy or accuracy of this release.

PDF

available: http://ml.globenewswire.com/Resource/Download/11037088-31a7-42ea-bece-50cc38f27110

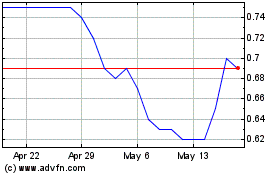

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Nov 2024 to Dec 2024

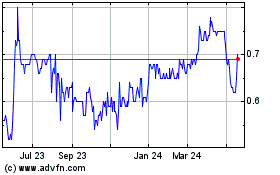

Quorum Information Techn... (TSXV:QIS)

Historical Stock Chart

From Dec 2023 to Dec 2024