SugarBud Craft Growers Corp. (“

SugarBud” or the

“

Company”) (trading as Relentless Resources Ltd.)

is pleased to announce the results of its rights offering (the

“

Rights Offering”) to holders

(“

Shareholders”) of common shares (“

Common

Shares”) of SugarBud. Under the Rights Offering,

Shareholders subscribed for and purchased an aggregate of

110,261,353 units (each, a “

Unit”) for total

approximate proceeds of $7.4 million, of which an aggregate of

approximately $1.5 million worth of Units was purchased by

insiders, management, and key shareholders of the Company. Units

were subscribed for at a price of $0.0675 per Unit. Each Unit will

consist of one Common Share and one half of one Common Share

purchase warrant (a “

Warrant”), with each whole

Warrant entitling the holder thereof to purchase one Common Share

at a price of $0.10 until September 12, 2023.

Mr. Jeff Swainson, Chief Financial Officer of

SugarBud stated: “This highly successful Rights Offering for

proceeds of $7.4 million demonstrates the continued support

provided by SugarBud’s shareholders, and the belief that they have

in our hybrid business model. We previously announced a

$17.65 million non-dilutive credit facility with Farm Credit Canada

and we have now achieved a significant equity investment led by our

devoted insider group and new institutional shareholders. Under a

full development we will have the luxury of an appropriate capital

structure and a very low cost of capital, and at this stage we do

not require any further dilution. In addition to our

successful financings, which demonstrate strong access to capital,

we are moving diligently to finalize Change of Business, to close

the Grunewahl acquisition, and to close the second tranche of the

Inner Spirit investment. Perhaps most importantly, we continue to

execute on the construction of Phase 1 of our 29,800 square foot

Stavely, Alberta aeroponic cannabis cultivation facility, which is

currently progressing on-time and on-budget.”

The Company also announces that it continues to

work diligently with the TSX Venture Exchange

(“TSXV”) to obtain approval in respect of a series

of transactions (the “Transactions”) that will

collectively constitute a “Change of Business” of the Company from

an exclusively oil and gas company to an emerging cannabis and oil

and gas company. The Transactions include, without limitation: (i)

the completion of the Rights Offering; (ii) the acquisition (the

“Acquisition”) of Grunewahl Organics Inc.

(“Grunewahl”); (iii) the second tranche of a

strategic investment with Inner Spirit Holdings Ltd.

(“Inner Spirit”); (iv) the

entering into of a strategic alliance agreement with Inner Spirit

that will govern the on-going business relationship of the parties;

and (v) the appointment of Darren Bondar, Chief Executive

Officer of Inner Spirit, as a director of SugarBud.

Grunewahl is a late stage applicant under Health

Canada’s Access to Cannabis for Medical Purposes Regulations

(“ACMPR”). The Grunewahl Acquisition will

not close until the Company receives approval of “Change of

Business” from the TSXV and current shareholders of Grunewahl will

not receive their SugarBud Common Shares until the Acquisition

closes.

Closing of the Transactions (including the

Rights Offering) is subject to a number of conditions including,

but not limited to: TSXV approval of the Change of Business;

approval of the Transactions by greater than 50.1% of Shareholders

by written consent (which has been achieved); and closing

conditions customary to transactions of the nature of the

Transactions. The Acquisition was approved by Grunewahl’s

shareholders at a special meeting held on September 11, 2018.

The Rights Offering will result in the issuance

of 110,261,353 Common Shares and 55,130,677 Warrants underlying the

Units, following which the Company will have 330,784,059 Common

Shares and 146,001,083 Warrants outstanding. No Units will be

issued in connection with the Rights Offering.

The Company is unable to determine when

Shareholders will receive their Common Shares and Warrants issued

as a result of their participation in the Rights

Offering.

Upon completion of the Transactions, the Company

intends to use the proceeds of the Rights Offering to fund an

aeroponic cannabis cultivation facility at Stavely, Alberta, which

is currently under construction.

Upon completion of the Transactions, the Company

intends to be listed on the TSXV as a Tier 2 Life Sciences Issuer.

Trading in the common shares of the Company is expected to commence

on the TSXV under the name “SugarBud Craft Growers Corp.” and the

symbol “SUGR” following the issuance by the TSXV of its final

bulletin in respect of the Transactions.

The Company also announces that, pursuant to the

terms and conditions of its stock option plan, it has granted an

aggregate of 10,150,000 stock options to purchase Common Shares to

directors and officers of the Company. The options expire five

years from the date of grant and are exercisable at a price of

$0.11 per Common Share. The options vest as to one third on the

grant date and one third on each of the first and second

anniversaries of the grant date.

The Company also announces the resignation of

Stanley Swiatek from the board of directors of the Company. The

Company thanks Mr. Swiatek for his contributions.

About SugarBud Craft Growers

Corp.

SugarBud is a Calgary based emerging cannabis

and oil and natural gas company engaged in the development,

acquisition and production of cannabis and natural gas and crude

oil reserves in Alberta.

For further information regarding this news

release, please contact:

|

Craig KolochukPresident & Chief

Executive Officer SugarBud Craft Growers Corp. Phone:

(403) 875-5665 E-mail: craigk@sugarbud.ca |

Jeff SwainsonChief Financial

Officer SugarBud Craft Growers Corp. Phone: (403)

796-3640 E-mail: jeffs@sugarbud.ca |

Investor Relations ContactGary

Perkins, PresidentTekkfund Capital Corp.Tel: (416) 882-0020E-mail:

garyperkins@rogers.com

Website: http://www.sugarbud.ca/

Address: Suite 620, 634 ‐ 6th Avenue S.W.,

Calgary, Alberta T2P 0S4

Telephone: 403‐532‐4466Fax: 587‐955‐9668

Reader Advisory

Completion of the Transactions (including the

Rights Offering) is subject to a number of conditions, including

but not limited to, TSXV acceptance and Shareholder approval.

Investors are cautioned that, except as disclosed in the filing

statement to be filed in connection with the Transactions, any

information released or received with respect to the Transactions

may not be accurate or complete and should not be relied

upon. There can be no assurance that the Transactions will be

completed as proposed or at all. Trading in the securities of

SugarBud should be considered highly speculative. The TSXV has in

no way passed upon the merits of the Transactions and has neither

approved nor disapproved of the contents of this news release.

Neither the TSXV nor its regulation

services provider (as that term is defined in the policies of the

TSXV) accepts responsibility for the adequacy or accuracy of this

release.

Forward Looking and Cautionary

Statements

This news release may include forward-looking

statements including opinions, assumptions, estimates, the

Company’s assessment of future plans and operations, and, more

particularly, statements concerning the completion of the

Transactions (including the Rights Offering), the use of proceeds

of the Rights Offering and the trading in the common shares of the

Company under the new name and new symbol. When used in this

document, the words “will,” “anticipate,” “believe,” “estimate,”

“expect,” “intent,” “may,” “project,” “should,” and similar

expressions are intended to be among the statements that identify

forward-looking statements. The forward-looking statements are

founded on the basis of expectations and assumptions made by the

Company which include, but are not limited to, the timely receipt

of all required securityholder, TSXV and regulatory approvals and

the satisfaction of other closing conditions in accordance with the

terms of the amalgamation agreement entered into between SugarBud

and Grunewahl and the investment agreement entered into between

SugarBud and Inner Spirit. Forward-looking statements are subject

to a wide range of risks and uncertainties, and although the

Company believes that the expectations represented by such

forward-looking statements are reasonable, there can be no

assurance that such expectations will be realized. Any number of

important factors could cause actual results to differ materially

from those in the forward-looking statements including, but not

limited to: regulatory and third party approvals, including receipt

of cultivation and sales licenses from Health Canada, not being

obtained in the manner or timing anticipated; the ability to

implement corporate strategies; the state of domestic capital

markets; the ability to obtain financing; changes in general market

conditions; industry conditions and events; the size of the medical

marijuana market and the recreational marijuana market; government

regulations, including future legislative and regulatory

developments involving medical and recreational marijuana;

construction delays; competition from other industry participants;

and other factors more fully described from time to time in the

reports and filings made by the Company with securities regulatory

authorities. Please refer to the Company’s annual information form

(“AIF”) and management’s discussion and analysis (“MD&A”) for

the year ended December 31, 2017 for additional risk factors

relating to the Company. The AIF and MD&A can be accessed under

the Company’s profile on www.sedar.com.

Except as required by applicable laws, the Company does not

undertake any obligation to publicly update or revise any

forward-looking statements.

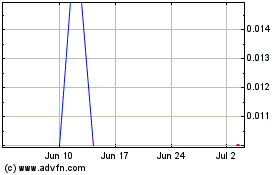

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Oct 2024 to Nov 2024

Resolute Resources (TSXV:RRL)

Historical Stock Chart

From Nov 2023 to Nov 2024