UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

6-K

REPORT OF

FOREIGN ISSUER

PURSUANT TO RULE

13a-16

OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April, 2019

Commission file number:

1-10110

BANCO BILBAO VIZCAYA ARGENTARIA, S.A.

(Exact name of Registrant as specified in its charter)

BANK BILBAO VIZCAYA ARGENTARIA, S.A.

(Translation of Registrant’s name into English)

Calle Azul 4,

28050 Madrid

Spain

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form

20-F

or Form

40-F:

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form

6-K

in paper as permitted by

Regulation

S-T

Rule 101(b)(7):

Yes ☐ No ☒

|

|

|

|

|

|

Press Release

04.29.2019

|

January - March 2019

BBVA earns €1.16 billion in first quarter

|

|

•

|

|

Transformation

: BBVA continued to make progress in its transformation, with a clear impact on growth of

its customer base, productivity, efficiency and customer experience. Digital unit sales now account for 57 percent of the total and over half of the customers use digital channels to interact with the bank

|

|

|

•

|

|

Efficiency

: Positive

top-line

trends in the P&L account,

together with an ongoing focus on cost reduction, led to double-digit growth in operating income compared to the first quarter 2018 in constant euros, and an improvement in the efficiency ratio, which dropped 118 basis points since December, to

48.1 percent

|

|

|

•

|

|

Risk management

: The NPL ratio remained at 3.9 percent, while the coverage ratio improved to

74 percent. The cost of risk stood at 1.06 percent

|

|

|

•

|

|

Capital adequacy

: The fully-loaded CET1 capital ratio closed the quarter at 11.35 percent, inching

closer to the target of 11.5 to 12 percent, fully absorbing IFRS 16 impact

|

|

|

•

|

|

Profitability

: BBVA continued to be a leader in profitability, with ROE standing at 9.9 percent, and

ROTE at 11.9 percent, well above the average of its European peers

|

|

|

•

|

|

Value creation for the shareholder

: The tangible book value plus dividends per share rose 11 percent

from a year earlier

|

|

|

•

|

|

Board of Directors

: At its meeting today, the Board also approved a series of agreements related to

appointments and its committees

|

Between January and March 2019, the BBVA Group earned €1.16 billion, down 9.8 percent

compared to the same period a year earlier and up 16.2 percent from the previous quarter, at current exchange rates. Excluding BBVA Chile’s

Q1-18

earnings from the comparison (the unit was sold in

July 2018), the result was 7.7 percent lower

(-6.0 percent

in constant euros) versus a year ago.

“We started the year with positive dynamics. Operating income grew above 10 percent, thanks to strong core revenue generation and a significant

improvement in efficiency. Also, we continued to reap the benefits of our digital transformation in terms of customer growth and engagement,” said BBVA CEO Onur Genç.

|

|

|

|

|

|

04.29.2019

|

To ensure a better understanding of the yoy comparison, the figures detailed below exclude BBVA Chile. With

this homogenous perimeter, net interest income grew 5.8 percent yoy in the first three months of the year (+9.5 percent in constant terms), to €4.42 billion. Fees and commissions remained virtually flat yoy

(-0.6 percent

at current exchange rates), although they increased 2.6 percent excluding exchange rate effects. Both lines combined, considered the recurring revenues in the banking business, grew

8.0 percent yoy stripping out currency fluctuations. NTI results were up 8.7 percent (+13.5 percent in constant euros). Thus, the gross income improved by 3.3 percent yoy, or 7.0 percent in constant terms, to

€6.07 billion.

As for

operating expenses

, cost discipline efforts yielded positive results again across all geographies in the

quarter. At 0.7 percent (+3.7 percent in constant terms) the line’s growth was well below that of recurring revenues and the Group’s average inflation. Positive

top-line

trends in the

P&L account, combined with the ongoing focus on cost reduction, led to double digit growth in operating income (+10.2 percent at constant exchange rates, to €3.15 billion) and an improvement in the bank’s efficiency ratio, which

reached 48.1 percent (118 basis points less than in 2018), well below the average of its comparable European peers (65.4 percent).

Net

attributable profit

for BBVA Group was €1.16 billion in the first quarter, down 7.7 percent yoy

(-6.0 percent

excluding currency trends), as a result of increased impairments in the

United States and Turkey, compared to the same period a year earlier – although, in the case of

|

|

|

|

|

|

04.29.2019

|

Turkey, these impairments were significantly lower than in the preceding quarter – as well as the

provisions due to the worsening conditions in the macro environment in most geographies.

In terms of value

creation for the shareholder

, the ROE

and ROTE ratios stood again at favorable levels (9.9 percent and 11.9 percent in the quarter, respectively), keeping BBVA at the top of the European financial industry in terms of profitability. Also, tangible book value per share – the

indicator that represents the book value of the company for each share owned by shareholders – plus the dividends paid out against 2018 earnings increased to €6.20 per share, an 11 percent growth yoy.

Asset quality

metrics remained stable. In March the NPL ratio stood at the same levels of December (3.9 percent) and the coverage ratio improved to 74

percent, from 73 percent a quarter earlier. The cost of risk stood at 1.06 percent, an increase from Q1-18, which was exceptionally low, driven by provision releases and a more favorable macro environment.

The fully-loaded

CET1 capital ratio

showed significant resilience. After absorbing the full impact of the implementation of IFRS 16, following its

entry into force earlier this year, the fully-loaded CET1 ratio stood at 11.35 percent in March. This result inches closer to the bank’s target of 11.5 to 12 percent. Also, BBVA maintained its shareholder remuneration policy, with a 35 to 40

percent cash payout. The bank’s leverage ratio (6.4 percent) was once again the highest among European peers.

Regarding the

balance sheet and

lending activity

, customer loans grew 3.0 percent (at current exchange rates) over the past 12 months, to €393.32 billion. As for deposits, trends were also positive, driving the line to grow at 5.1 percent to €378.53 billion.

Transformation

BBVA continued to make progress in its

transformation, with a clear impact on growth of its customer base, productivity, efficiency and customer experience. With data as of the end of March, over half of customers (53 percent) were using digital channels to interact with the bank. Mobile

customers accounted for 45 percent of the total, and are expected to surpass the 50-percent threshold, in line with the target set for the year. Total unit sales through digital channels accounted for 57 percent of the total, more than double their

contribution from two years ago.

|

|

|

|

|

|

04.29.2019

|

The main highlights of each business area are detailed

below.

Following the transfer of the real estate business to Cerberus, the Non-Core Real Estate area has been integrated into the banking activity of

Spain and the area will now report as

Spain

. Good news in activity trends: lending grew 1.8 percent yoy, with notable growth in consumer lending and credit cards, up 19.7 percent, and medium-sized enterprises, up 7.0 percent. Customer

resources grew 4.3 percent, driven by demand deposits and investment funds. Spain earned €345 million in the first quarter, down 14.7 percent yoy, but 11.7 percent higher compared to the previous quarter. Asset quality continued to improve

thanks to lower levels of NPLs, with an NPL ratio that dropped from 5.10 percent in December to 4.95 percent in March. Coverage ratio rose to 58 percent.

In

the United States

, lending grew 6.6 percent yoy, while customer deposits grew 1.5 percent yoy. Net interest income benefited from these higher

volumes, especially in the most profitable business segments, and the interest rate hikes, growing 8.4 percent in the quarter in yoy terms excluding currency fluctuations (+17.4 percent in current euros). Efficiency improved thanks to the moderation

in expenses, which grew less than gross income. The area earned €127 million in the first three months, down 39.8 percent from a year ago (-34.8 percent considering currency impacts), due to higher impairments in some portfolios and the

negative macro economic impact from IFRS 9. In Q1-18, the area benefited from the release of provisions and the positive macro economic impact from the same IFRS 9. The NPL ratio stood at 1.4 percent, while the coverage ratio was 85 percent.

In

Mexico

, where BBVA is the market leader, lending grew 8.6 percent and customer deposits increased 6.5 percent. This dynamism also reflected in the

net interest income, which grew 7.8 percent in constant terms (+13.9 percent including FX effect). The area’s net attributable profit stood at €627 million (+4.7 percent in constant euros, +10.6 percent in current euros yoy), thanks

to the positive trend in recurring revenues. Risk indicators remained solid: the NPL ratio declined to 2.0 percent from 2.1 percent in December, and coverage ratio stood at 159 percent.

|

|

|

|

|

|

04.29.2019

|

In

Turkey

, the Turkish-lira loan portfolios grew 7.0 percent yoy, while loans in U.S. dollars

declined almost 20 percent in the same period. Deposits remained as the main source of funding for the balance sheet. Customer deposits in dollars fell 8.2 percent yoy, while deposits in Turkish liras increased by 12 percent, in line

with the trend from last year. Turkey earned €142 million, down 7.7 percent yoy

(-29.2 percent

at current exchange rates), but 54.8 percent more than in the last quarter of 2018,

mainly due to a significant reduction in impairments on financial assets and provisions.

In

South America

, activity continued to grow at a good

pace. Excluding BBVA Chile in the comparison, lending increased 7.5 percent yoy, with a notable performance in Argentina (+38.0 percent), followed by Peru (+6.5 percent) and Colombia (+2.1 percent). Customer deposits grew 12.2 percent,

with solid figures in Argentina (+61.6 percent), Peru (+12.6 percent) and Colombia (+4.3 percent). The area’s net attributable profit stood at €193 million, up 86.5 percent from a year earlier excluding currency effects, or

50.9 percent more including FX effect in the comparison. The results were supported both by positive trends in recurring revenues and the positive impact of the sale of approximately half the stake in Prisma in Argentina (€50 million

after taxes.) The area’s NPL ratio stood at 4.4 percent, with a coverage of 96 percent.

Board of Directors

The Board of Directors also approved a series of changes:

|

|

•

|

|

José Miguel Andrés Torrecillas has been appointed deputy chairman. As his replacement, Juan Pi

Llorens has been appointed lead independent director.

|

|

|

•

|

|

Redistribution of functions amongst certain committees, and subsequent changes to their denomination.

Compliance-related matters will now be addressed at the newly named Risk and Compliance Committee, while corporate governance topics will be added to the newly named Appointments and Corporate Governance Committee.

|

|

|

•

|

|

Certain changes in the composition of the committees.

|

Contact details:

BBVA Corporate Communications

Tel. +34 91 374 40 10

comunicacion.corporativa@bbva.com

For more financial information about BBVA visit:

http://shareholdersandinvestors.bbva.com

For more BBVA news

visit: https://www.bbva.com

|

|

|

|

|

|

04.29.2019

|

BBVA is a customer-centric global financial services group founded in 1857. The Group has a strong leadership position in

the Spanish market, is the largest financial institution in Mexico, it has leading franchises in South America and the Sunbelt Region of the United States. It is also the leading shareholder in Turkey’s BBVA Garanti. Its purpose is to bring the

age of opportunities to everyone, based on our customers’ real needs: provide the best solutions, helping them make the best financial decisions, through an easy and convenient experience. The institution rests in solid values: Customer comes

first, we think big and we are one team. Its responsible banking model aspires to achieve a more inclusive and sustainable society.

BBVA Group highlights (Consolidated figures)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31-03-19

|

|

|

D

%

|

|

|

31-03-18

|

|

|

31-12-18

|

|

|

Balance sheet (millions of euros)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

691,200

|

|

|

|

0.8

|

|

|

|

685,688

|

|

|

|

676,689

|

|

|

Loans and advances to customers (gross)

|

|

|

393,321

|

|

|

|

3.0

|

|

|

|

381,683

|

|

|

|

386,225

|

|

|

Deposits from customers

|

|

|

378,527

|

|

|

|

5.1

|

|

|

|

360,213

|

|

|

|

375,970

|

|

|

Total customer funds

|

|

|

481,754

|

|

|

|

4.9

|

|

|

|

459,113

|

|

|

|

474,120

|

|

|

Total equity

|

|

|

53,547

|

|

|

|

2.9

|

|

|

|

52,043

|

|

|

|

52,874

|

|

|

Income statement (millions of euros)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income

|

|

|

4,420

|

|

|

|

3.1

|

|

|

|

4,287

|

|

|

|

17,591

|

|

|

Gross income

|

|

|

6,069

|

|

|

|

0.7

|

|

|

|

6,026

|

|

|

|

23,747

|

|

|

Operating income

|

|

|

3,147

|

|

|

|

3.2

|

|

|

|

3,050

|

|

|

|

12,045

|

|

|

Net attributable profit

|

|

|

1,164

|

|

|

|

(9.8

|

)

|

|

|

1,290

|

|

|

|

5,324

|

|

|

The BBVA share and share performance ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares (million)

|

|

|

6,668

|

|

|

|

—

|

|

|

|

6,668

|

|

|

|

6,668

|

|

|

Share price (euros)

|

|

|

5.09

|

|

|

|

(20.8

|

)

|

|

|

6.43

|

|

|

|

4.64

|

|

|

Earning per share (euros)

(1)

|

|

|

0.16

|

|

|

|

(9.7

|

)

|

|

|

0.18

|

|

|

|

0.76

|

|

|

Book value per share (euros)

|

|

|

7.20

|

|

|

|

5.4

|

|

|

|

6.83

|

|

|

|

7.12

|

|

|

Tangible book value per share (euros)

|

|

|

5.94

|

|

|

|

6.1

|

|

|

|

5.60

|

|

|

|

5.86

|

|

|

Market capitalization (millions of euros)

|

|

|

33,960

|

|

|

|

(20.8

|

)

|

|

|

42,868

|

|

|

|

30,909

|

|

|

Yield (dividend/price; %)

|

|

|

4.9

|

|

|

|

|

|

|

|

3.4

|

|

|

|

5.4

|

|

|

Significant ratios (%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ROE (net attributable profit/average shareholders’ funds +/-average accumulated other

comprehensive income)

(2)

|

|

|

9.9

|

|

|

|

|

|

|

|

11.5

|

|

|

|

11.5

|

|

|

ROTE (net attributable profit/average shareholders’ funds excluding average intangible assets

+/- average accumulated other comprehensive income)

(2)

|

|

|

11.9

|

|

|

|

|

|

|

|

14.0

|

|

|

|

14.1

|

|

|

ROA (Profit or loss for the year/average total assets)

|

|

|

0.84

|

|

|

|

|

|

|

|

0.93

|

|

|

|

0.91

|

|

|

RORWA (Profit or loss for the year/average risk-weighted assets - RWA)

|

|

|

1.60

|

|

|

|

|

|

|

|

1.75

|

|

|

|

1.74

|

|

|

Efficiency ratio

|

|

|

48.1

|

|

|

|

|

|

|

|

49.4

|

|

|

|

49.3

|

|

|

Cost of risk

|

|

|

1.06

|

|

|

|

|

|

|

|

0.85

|

|

|

|

1.01

|

|

|

NPL ratio

|

|

|

3.9

|

|

|

|

|

|

|

|

4.4

|

|

|

|

3.9

|

|

|

NPL coverage ratio

|

|

|

74

|

|

|

|

|

|

|

|

73

|

|

|

|

73

|

|

|

Capital adequacy ratios (%)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CET1 fully-loaded

|

|

|

11.3

|

|

|

|

|

|

|

|

10.9

|

|

|

|

11.3

|

|

|

CET1

phased-in

(3)

|

|

|

11.6

|

|

|

|

|

|

|

|

11.1

|

|

|

|

11.6

|

|

|

Total ratio

phased-in

(3)

|

|

|

15.2

|

|

|

|

|

|

|

|

15.4

|

|

|

|

15.7

|

|

|

Other information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of clients (million)

|

|

|

75.7

|

|

|

|

2.9

|

|

|

|

73.6

|

|

|

|

74.8

|

|

|

Number of shareholders

|

|

|

892,316

|

|

|

|

0.2

|

|

|

|

890,146

|

|

|

|

902,708

|

|

|

Number of employees

|

|

|

125,749

|

|

|

|

(4.6

|

)

|

|

|

131,745

|

|

|

|

125,627

|

|

|

Number of branches

|

|

|

7,844

|

|

|

|

(4.3

|

)

|

|

|

8,200

|

|

|

|

7,963

|

|

|

Number of ATMs

|

|

|

31,922

|

|

|

|

1.0

|

|

|

|

31,602

|

|

|

|

32,029

|

|

General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018

with accounting effects on January 1, 2018, recording the impact of the nine months in the third quarter. In order to make the 2019 information comparable to 2018, the income statements and balance sheets of the first three quarters of 2018

have been reexpressed to reflect these impacts.

|

(1)

|

Adjusted by additional Tier 1 instrument remuneration.

|

|

(2)

|

The ROE and ROTE ratios include, in the denominator, the Group’s average shareholders’ funds and take

into account the item called “Accumulated other comprehensive income”, which forms part of the equity. Excluding this item, the ROE would stand at 8.6%, in the first quarter of 2019; 10.1%, in 2018; and 10.1%, in the first quarter of 2018;

and the ROTE at 10.2%, 11.9% and 12.0%, respectively.

|

|

(3)

|

As of March 31, 2019,

phased-in

ratios include the temporary

treatment on the impact of IFRS 9, calculated in accordance with Article 473 bis of the Capital Requirements Regulation (CRR).

|

Consolidated income statement: quarterly evolution (Millions of euros)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

|

2018

|

|

|

|

|

1Q

|

|

|

4Q

|

|

|

3Q

|

|

|

2Q

|

|

|

1Q

|

|

|

Net interest income

|

|

|

4,420

|

|

|

|

4,692

|

|

|

|

4,309

|

|

|

|

4,302

|

|

|

|

4,287

|

|

|

Net fees and commissions

|

|

|

1,214

|

|

|

|

1,226

|

|

|

|

1,173

|

|

|

|

1,244

|

|

|

|

1,236

|

|

|

Net trading income

|

|

|

426

|

|

|

|

316

|

|

|

|

212

|

|

|

|

285

|

|

|

|

410

|

|

|

Other operating income and expenses

|

|

|

8

|

|

|

|

(83

|

)

|

|

|

38

|

|

|

|

6

|

|

|

|

92

|

|

|

Gross income

|

|

|

6,069

|

|

|

|

6,151

|

|

|

|

5,733

|

|

|

|

5,838

|

|

|

|

6,026

|

|

|

Operating expenses

|

|

|

(2,922

|

)

|

|

|

(2,981

|

)

|

|

|

(2,825

|

)

|

|

|

(2,921

|

)

|

|

|

(2,975

|

)

|

|

Personnel expenses

|

|

|

(1,553

|

)

|

|

|

(1,557

|

)

|

|

|

(1,459

|

)

|

|

|

(1,539

|

)

|

|

|

(1,565

|

)

|

|

Other administrative expenses

|

|

|

(977

|

)

|

|

|

(1,119

|

)

|

|

|

(1,061

|

)

|

|

|

(1,087

|

)

|

|

|

(1,106

|

)

|

|

Depreciation

|

|

|

(392

|

)

|

|

|

(305

|

)

|

|

|

(304

|

)

|

|

|

(295

|

)

|

|

|

(304

|

)

|

|

Operating income

|

|

|

3,147

|

|

|

|

3,170

|

|

|

|

2,908

|

|

|

|

2,916

|

|

|

|

3,050

|

|

|

Impairment on financial assets not measured at fair value through profit or loss

|

|

|

(1,023

|

)

|

|

|

(1,353

|

)

|

|

|

(1,023

|

)

|

|

|

(783

|

)

|

|

|

(823

|

)

|

|

Provisions or reversal of provisions

|

|

|

(144

|

)

|

|

|

(66

|

)

|

|

|

(123

|

)

|

|

|

(85

|

)

|

|

|

(99

|

)

|

|

Other gains (losses)

|

|

|

(22

|

)

|

|

|

(183

|

)

|

|

|

(36

|

)

|

|

|

67

|

|

|

|

41

|

|

|

Profit/(loss) before tax

|

|

|

1,957

|

|

|

|

1,568

|

|

|

|

1,727

|

|

|

|

2,115

|

|

|

|

2,170

|

|

|

Income tax

|

|

|

(559

|

)

|

|

|

(421

|

)

|

|

|

(419

|

)

|

|

|

(605

|

)

|

|

|

(617

|

)

|

|

|

|

|

|

|

|

|

Profit/(loss) after tax from ongoing operations

|

|

|

1,398

|

|

|

|

1,147

|

|

|

|

1,308

|

|

|

|

1,510

|

|

|

|

1,553

|

|

|

|

|

|

|

|

|

|

Results from corporate operations

(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

633

|

|

|

|

—

|

|

|

|

—

|

|

|

Profit/(loss) for the year

|

|

|

1,398

|

|

|

|

1,147

|

|

|

|

1,941

|

|

|

|

1,510

|

|

|

|

1,553

|

|

|

Non-controlling

interests

|

|

|

(234

|

)

|

|

|

(145

|

)

|

|

|

(154

|

)

|

|

|

(265

|

)

|

|

|

(262

|

)

|

|

Net attributable profit

|

|

|

1,164

|

|

|

|

1,001

|

|

|

|

1,787

|

|

|

|

1,245

|

|

|

|

1,290

|

|

|

Net attributable profit excluding results from corporate operations

|

|

|

1,164

|

|

|

|

1,001

|

|

|

|

1,154

|

|

|

|

1,245

|

|

|

|

1,290

|

|

|

Earning per share (euros)

(2)

|

|

|

0.16

|

|

|

|

0.14

|

|

|

|

0.26

|

|

|

|

0.17

|

|

|

|

0.18

|

|

General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018

with accounting effects on January 1, 2018, recording the impact of the 9 months in the third quarter. In order to make the 2019 information comparable to 2018, the income statements for the first three quarters of 2018 have been reexpressed to

reflect the impacts of inflation on their income and expenses.

|

(1)

|

Includes net capital gains from the sale of BBVA Chile.

|

|

(2)

|

Adjusted by additional Tier 1 instrument remuneration.

|

Consolidated income statement (Millions of euros)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1Q19

|

|

|

D

%

|

|

|

D

% at constant

exchange rates

|

|

|

1Q18

|

|

|

Net interest income

|

|

|

4,420

|

|

|

|

3.1

|

|

|

|

6.7

|

|

|

|

4,287

|

|

|

Net fees and commissions

|

|

|

1,214

|

|

|

|

(1.8

|

)

|

|

|

1.3

|

|

|

|

1,236

|

|

|

Net trading income

|

|

|

426

|

|

|

|

3.9

|

|

|

|

8.4

|

|

|

|

410

|

|

|

Other operating income and expenses

|

|

|

8

|

|

|

|

(91.3

|

)

|

|

|

(90.2

|

)

|

|

|

92

|

|

|

Gross income

|

|

|

6,069

|

|

|

|

0.7

|

|

|

|

4.3

|

|

|

|

6,026

|

|

|

Operating expenses

|

|

|

(2,922

|

)

|

|

|

(1.8

|

)

|

|

|

1.1

|

|

|

|

(2,975

|

)

|

|

Personnel expenses

|

|

|

(1,553

|

)

|

|

|

(0.8

|

)

|

|

|

2.1

|

|

|

|

(1,565

|

)

|

|

Other administrative expenses

|

|

|

(977

|

)

|

|

|

(11.6

|

)

|

|

|

(8.6

|

)

|

|

|

(1,106

|

)

|

|

Depreciation

|

|

|

(392

|

)

|

|

|

28.9

|

|

|

|

31.2

|

|

|

|

(304

|

)

|

|

Operating income

|

|

|

3,147

|

|

|

|

3.2

|

|

|

|

7.4

|

|

|

|

3,050

|

|

|

Impairment on financial assets not measured at fair value through profit or loss

|

|

|

(1,023

|

)

|

|

|

24.4

|

|

|

|

27.2

|

|

|

|

(823

|

)

|

|

Provisions or reversal of provisions

|

|

|

(144

|

)

|

|

|

45.1

|

|

|

|

52.7

|

|

|

|

(99

|

)

|

|

Other gains (losses)

|

|

|

(22

|

)

|

|

|

n.s.

|

|

|

|

n.s.

|

|

|

|

41

|

|

|

Profit/(loss) before tax

|

|

|

1,957

|

|

|

|

(9.8

|

)

|

|

|

(5.3

|

)

|

|

|

2,170

|

|

|

Income tax

|

|

|

(559

|

)

|

|

|

(9.4

|

)

|

|

|

(5.7

|

)

|

|

|

(617

|

)

|

|

|

|

|

|

|

|

Profit/(loss) after tax from ongoing operations

|

|

|

1,398

|

|

|

|

(10.0

|

)

|

|

|

(5.1

|

)

|

|

|

1,553

|

|

|

|

|

|

|

|

|

Results from corporate operations

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Profit/(loss) for the year

|

|

|

1,398

|

|

|

|

(10.0

|

)

|

|

|

(5.1

|

)

|

|

|

1,553

|

|

|

Non-controlling

interests

|

|

|

(234

|

)

|

|

|

(10.8

|

)

|

|

|

13.9

|

|

|

|

(262

|

)

|

|

Net attributable profit

|

|

|

1,164

|

|

|

|

(9.8

|

)

|

|

|

(8.1

|

)

|

|

|

1,290

|

|

|

Net attributable profit excluding results from corporate operations

|

|

|

1,164

|

|

|

|

(9.8

|

)

|

|

|

(8.1

|

)

|

|

|

1,290

|

|

|

Earning per share (euros)

(1)

|

|

|

0.16

|

|

|

|

|

|

|

|

|

|

|

|

0.18

|

|

General note: the application of accounting for hyperinflation in Argentina was performed for the first time in September 2018

with accounting effects on January 1, 2018, recording the impact of the 9 months in the third quarter. In order to make the 2019 information comparable to 2018, the income statements for the first three quarters of 2018 have been reexpressed to

reflect the impacts of inflation on their income and expenses.

|

(1)

|

Adjusted by additional Tier 1 instrument remuneration.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Banco Bilbao Vizcaya Argentaria, S.A.

|

|

|

|

|

|

Date: April 29, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ María Angeles Peláez Morón

|

|

|

|

|

|

|

|

|

|

|

Name:

|

|

María Angeles Peláez Morón

|

|

|

|

|

|

|

|

|

|

|

Title:

|

|

Authorized representative

|

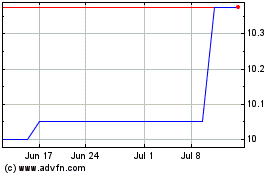

Banco Bilbao Vizcaya Arg... (PK) (USOTC:BBVXF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Banco Bilbao Vizcaya Arg... (PK) (USOTC:BBVXF)

Historical Stock Chart

From Jul 2023 to Jul 2024