SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

SCHEDULE 13D/A

(Amendment No.

5)

(Rule

13d-101)

information

to be included in statements filed pursuant

to rules 13d-1(a) and

amendments thereto filed

pursuant to rule 13d-2(a)1

| CLS

Holdings USA, Inc. |

(Name

of Issuer)

Common

Stock, $0.0001 par value per share |

(Title

of Class of Securities)

12565J308 |

(CUSIP

Number)

Navy

Capital Green Management, LLC

28

Reichert Circle

Westport,

CT 06880 |

(Name,

Address and Telephone Number of Person Authorized to Receive Notice and Communications)

September 10, 2024 |

(Date

of Event Which Requires Filing of this Statement) |

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this

Schedule 13D/A, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g), check the following box. o

Note: Schedules

filed in paper format shall include a signed original and five copies of the Schedule, including all exhibits. See Rule

13d-7(b) for other parties to whom copies are to be sent.

1 The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior

cover page.

The

information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

| CUSIP

No. 12565J308 |

13D/A |

Page

2 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting person

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Management, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

AF |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

New

York, United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

IA |

| CUSIP

No. 12565J308 |

13D/A |

Page

3 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Management Partners, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

AF |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

New

York, United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

OO |

| CUSIP

No. 12565J308 |

13D/A |

Page

4 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Fund, LP

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

WC |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

Delaware,

United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

PN |

| CUSIP

No. 12565J308 |

13D/A |

Page

5 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Co-Invest Fund, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

WC |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

Delaware,

United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

OO |

| CUSIP

No. 12565J308 |

13D/A |

Page

6 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Navy

Capital Green Co-Invest Partners, LLC

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

AF |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

Delaware,

United States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

OO |

| CUSIP

No. 12565J308 |

13D/A |

Page

7 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

John

Kaden

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

OO |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

United

States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

IN |

| CUSIP

No. 12565J308 |

13D/A |

Page

8 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Sean

Stiefel

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

OO |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

United

States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

IN |

| CUSIP

No. 12565J308 |

13D/A |

Page

9 of 14 Pages |

|

|

|

|

|

| 1. |

names

of reporting persons

i.r.s.

identification no. of above persons (entities only)

Chetan

Gulati

|

| 2. |

check

the appropriate box if a group* |

(a)

x

(b) o |

| 3. |

sec

use only

|

| 4. |

sources

of funds

OO |

| 5. |

check

box if disclosure of legal proceedings is required pursuant to item 2(d)

or 2(e) |

o |

| 6. |

citizenship

or place of organization

United

States of America |

number

of

shares |

7. |

sole

voting power 0 |

beneficially

owned by |

8. |

shared

voting power 0 |

each

reporting |

9. |

sole

dispositive power 0 |

| person

with |

10. |

shared

dispositive power 0 |

| 11. |

aggregate

amount beneficially owned by each reporting person 0 |

| 12. |

check

box if the aggregate amount in row (11) excludes certain shares * |

o |

| 13. |

percent

of class represented by amount in row 11 0% |

| 14. |

type

of reporting person*

IN |

| CUSIP

No. 12565J308 |

13D/A |

Page

10 of 14 Pages |

ITEM 1 Security and Issuer

This

Schedule 13D/A relates to the common stock, par value $0.0001 (the “Common Stock”), of CLS Holdings USA, Inc. (the

“Issuer”) and amends and supplements the Schedule 13D dated February 8, 2019, as amended by Amendment No. 1 to Schedule

13D filed May 28, 2021, Amendment No. 2 to Schedule 13D filed August 9, 2021, Amendment No. 3 to Schedule 13D filed October 3,

2022 and Amendment No. 4 to Schedule 13D filed December 29, 2023 specifically set forth herein. The address of the principal executive

offices of the Issuer is 11767 South Dixie Highway, Suite 115, Miami, FL 33156. Defined terms not herein defined shall have the

meaning set forth in the Schedule 13D, Amendment No. 1, Amendment No. 2, Amendment No. 3 or Amendment No. 4.

ITEM 3 Source

and Amount of Funds or Other Consideration

Item

3 is hereby amended to add the following:

On September

10, 2024, the Issuer entered into a Redemption Agreement (the “Redemption Agreement”) with the Fund, the Co-Investment

Fund, and Navy Capital Green Holdings II, LLC, a Delaware limited liability company (“Holdings” and together with

the Fund and the Co-Investment Fund, the “Navy Funds”) whereby the Issuer desired to redeem and the Navy Funds desired

to sell (i) the Navy Funds’ collective shares of the Issuer’s common stock in the aggregate amount of 15,488,901 (the

“Shares”; (ii) The Navy Funds’ collective warrants to purchase an aggregate amount of 6,177,216 shares of the

Issuer’s common stock (the “Warrants”); (iii) The Fund’s right, title and interest to (x) the Third Amended

and Restated Debenture, dated December 29, 2023, by and between the Fund and the Issuer (the “Third Amended and Restated

Debenture”), and (y) that certain Second Amended and Restated Unsecured Debenture No. CLSH2023-AD6, dated December 31, 2023,

by and between the Fund and the Issuer (the “Second Amended and Restated Unsecured Debenture” and, together with the

Third Amended and Restated Debenture, the “Fund Debentures”); and (iv) the Co-Investment Fund’s right title,

and interest in that certain Third Amended and Restated Debenture, dated December 29, 2023, by and between the Issuer and the

Co-Investment Fund. The repurchase price for all of the Warrants and the Debentures was collectively $2,000,000. The repurchase

price for all of the Shares was $600,000.

The

foregoing description of the Redemption Agreement is a summary description of the material terms thereof and is qualified in its

entirety by reference to the full text of the Redemption Agreement, which is incorporated by reference hereto and filed as Exhibit

1 to this Schedule 13D/A.

ITEM 5 Interest

in Securities of the Issuer

Item

5 is hereby amended and restated to read as follows:

(a)-(b) The

Investment Manager, John Kaden, Sean Stiefel and Chetan Gulati may be deemed, for purposes of Rule 13d-3 under the Securities

Exchange Act of 1934, as amended, to be the beneficial owner of an aggregate of 0 shares of Common Stock as of September 10, 2024

which represent 0% of the Issuer’s outstanding shares of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 0

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 0

| CUSIP

No. 12565J308 |

13D/A |

Page

11 of 14 Pages |

The

Fund may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the beneficial owner

of an aggregate of 0 shares of Common Stock as of September 10, 2024, which represent 0% of the Issuer’s outstanding shares

of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 0

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 0

NCG

may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the beneficial owner of

an aggregate of 0 shares of Common Stock as of September 10, 2024, which represent 0% of the Issuer’s outstanding shares

of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 0

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 0

The

Co-Investment Fund may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the

beneficial owner of an aggregate of 0 shares of Common Stock as of September 10, 2024, which represent 0% of the Issuer’s

outstanding shares of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 0

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 0

NCGP

may be deemed, for purposes of Rule 13d-3 under the Securities Exchange Act of 1934, as amended, to be the beneficial owner of

an aggregate of 0 shares of Common Stock as of September 10, 2024, which represent 0% of the Issuer’s outstanding shares

of Common Stock.

(i)

Sole power to vote or direct vote: 0

(ii)

Shared power to vote or direct vote: 0

(iii)

Sole power to dispose of or direct the disposition: 0

(iv)

Shared power to dispose of or direct the disposition: 0

For

purposes of calculating the percentages set forth in this Item 5, the number of shares of Common Stock outstanding is assumed

to be the aggregate of (i) 137,675,276 shares of Common Stock outstanding (as disclosed on the Issuer’s Form 10-Q filed

with the SEC on April 8, 2024) and (ii) the number of shares of Common Stock that would be obtained by the Reporting Persons upon

the exercise of any convertible securities held by the Reporting Persons.

Each

Reporting Person, as a member of a “group” with the other Reporting Persons for the purposes of Section 13(d)(3) of

the Securities Exchange Act of 1934, as amended, may be deemed the beneficial owner of the shares of Common Stock directly owned

by the other Reporting Persons. Each Reporting Person disclaims beneficial ownership of such shares except to the extent of his

or its pecuniary interest therein.

(c) Except as

disclosed in Item 3 and Item 4, there have been no transactions in the shares of Common Stock by the Reporting Persons during

the past sixty days.

(d) The Fund

and the Co-Investment Fund have the right to receive or the power to direct the receipt of dividends from, or the proceeds from

the sale of, securities held in their accounts.

(e) Not applicable.

ITEM 7 Material

to the Filed at Exhibits

Exhibit 1: The Redemption Agreement,

dated September 10, 2024, by and among Navy Capital Green Fund, LP, Navy Capital Green Co-Invest Fund, LLC, Navy Capital Green

Holdings II, LLC, and CLS Holdings USA, Inc.

| CUSIP

No. 12565J308 |

13D/A |

Page

12 of 14 Pages |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

| |

September 10, 2024 |

| |

Date |

| |

|

| |

NAVY CAPITAL GREEN MANAGEMENT LLC |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager |

| |

Name/Title |

| |

|

| |

/s/ Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan Gulati/Manager

|

| |

Name/Title

|

| |

|

| |

NAVY CAPITAL GREEN MANAGEMENT PARTNERS,

LLC |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager |

| |

Name/Title |

| |

|

| |

/s/ Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan Gulati/Manager

|

| |

Name/Title

|

| CUSIP

No. 12565J308 |

13D/A |

Page

13 of 14 Pages |

| |

NAVY CAPITAL GREEN FUND, LP |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager

of its General Partner |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager

of its General Partner |

| |

Name/Title |

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati/Manager of its General Partner

|

| |

Name/Title

|

| |

|

| |

NAVY CAPITAL GREEN CO-INVEST FUND LLC |

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John Kaden/Manager

of its Manager |

| |

Name/Title |

| |

|

| |

/s/ Sean

Stiefel |

| |

Signature |

| |

|

| |

Sean Stiefel/Manager

of its Manager |

| |

Name/Title |

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati/Manager of its Manager

|

| |

Name/Title |

| CUSIP

No. 12565J308 |

13D/A |

Page

14 of 14 Pages |

| |

NAVY CAPITAL GREEN

CO-INVEST PARTNERS, LLC

|

| |

|

| |

/s/ John

Kaden |

| |

Signature |

| |

|

| |

John

Kaden/Manager of its Manager

|

| |

Name/Title

|

| |

|

| |

/s/

Sean Stiefel

|

| |

Signature

|

| |

|

| |

Sean

Stiefel/Manager of its Manager

|

| |

Name/Title

|

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati/Manager of its Manager

|

| |

Name/Title

|

| |

|

| |

/s/

John Kaden

|

| |

Signature

|

| |

|

| |

John

Kaden

|

| |

Name

|

| |

|

| |

/s/

Sean Stiefel

|

| |

Signature

|

| |

|

| |

Sean

Stiefel

|

| |

Name

|

| |

|

| |

/s/

Chetan Gulati

|

| |

Signature

|

| |

|

| |

Chetan

Gulati

|

|

Name

|

The

original statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If

the statement is signed on behalf of a person by his authorized representative other than an executive officer or general partner

of the filing person, evidence of the representative’s authority to sign on behalf of such person shall be filed with the statement,

provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated

by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his signature.

NOTE:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§240.13d-7 for other parties for whom copies are to be sent.

EXHIBIT 99.1

EXHIBIT 1

REDEMPTION AGREEMENT

This

REDEMPTION AGREEMENT (this “Agreement”) is made as of September 10, 2024 (the “Effective Date”),

by and among Navy Capital Green Fund, LP, a Delaware limited partnership (“Green Fund”), Navy Capital Green

Co-Invest Fund, LLC, a Delaware limited liability company (“Co-Invest Fund”), and Navy Capital Green Holdings

II, LLC, a Delaware limited liability company (“Green Holdings,” and together with Green Fund and Co-Invest

Fund, “Navy Funds” or the “Seller”), and CLS Holdings USA, Inc., a Nevada corporation (the

“Company”).

WHEREAS,

(i) Green Fund owns 3,409,055, (ii) Co-Invest Fund owns 11,203,620 and (iii) Green Holdings owns 876,226 shares of the Company’s

common stock (together, the “Shares”);

WHEREAS,

Navy Funds hold warrants to purchase an aggregate of 6,177,216 shares of the Company’s common stock (the “Warrants”);

WHEREAS,

Green Fund purchased from the Company: (i) that certain Second Amended and Restated Unsecured Debenture No. CLSH2023-AD6, dated

December 31, 2023 in original principal amount of $500,000 (with a current outstanding balance of $347,120.63, after taking account

of the assignment of $89,219.57 of the principal amount of such Debenture to Green Holdings); (ii) that certain Third Amended

and Restated Debenture, dated December 29, 2023 in the original principal amount of $504,500.05 (with a current outstanding balance

of $375,000.70, after taking account of the assignment of $96,386.24 of the principal amount of such Debenture to Green Holdings);

and (iii) Co-Invest Fund purchased from the Company that certain Third Amended and Restated Debenture, dated December 29, 2023

in original principal amount of $2,018,007.24 (with a current outstanding balance of $1,885,555.37) (together, the debentures

described in this paragraph, the “Debentures”);

WHEREAS,

the Navy Funds desire to sell, and the Company desires to redeem, the Shares, Warrants and Debentures (together, the “Redeemed

Securities”) on the terms set forth in this Agreement;

NOW,

THEREFORE, in consideration of the mutual covenants herein contained, and for other good and valuable consideration the receipt

and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

| l. | Purchase

Price. The Company shall redeem the Redeemed Securities as of the Effective Date

for the aggregate purchase price of Two Million, Six Hundred Thousand and 00/100 Dollars

($2,600,000.00) (the “Purchase Price”). Six Hundred Thousand and 00/100

Dollars ($600,000.00) shall be allocated to the redemption of the Shares at a price of

$0.0387 per share. Two Million and 00/100 Dollars ($2,000,000.00) shall be allocated

to the redemption of the aggregate $2,793,282.51 (principal amount) of the Debentures

along with the warrant rights and any other rights under the Debentures. The Company

shall cancel the Warrants upon the completion of these redemptions. |

| 2. | Payment

of Purchase Price; Further Actions. |

| a. | Company

Payment. Two (2) business days prior to September 10, 2024 (the “Closing

Date”), the Company shall deposit the Purchase Price with Arizona Escrow, an

independent third party who will act as “Escrow Agent.” The Company

will pay all of the Escrow Agent’s fees in relation to this escrow. Promptly following

the confirmation from VStock Transfer, the Company’s transfer agent, that the Navy

Funds have transferred the Shares to the Company, the Company and Green Fund shall jointly

instruct the Escrow Agent, by electronic mail or other written communication, to pay

the Purchase Price to the Navy Funds by wire transfer of immediately available funds

to the accounts designated in writing by the Navy Funds. |

| b. | Share

Cancellation. The Navy Funds shall, or shall cause their broker to, deliver to VStock

Transfer a OWAC Withdrawal and Shares Cancellation Form (the “Cancellation Form”)

with respect to the shares of Company common stock held by each of Green Fund, Co-Invest

Fund, and Green Holdings using the form provided by VStock Transfer and attached hereto

as Exhibit A. The Navy Funds shall notify the Company, which

notification may be in the form

of electronic mail, when the Cancellation Form has been delivered to VStock Transfer. |

| c. | Debenture

and Warrant Cancellation. On or before the Effective Date, Seller shall send

the Warrants to the Company for cancellation. No later than two (2) business days following

the date the Company makes the payments of the Purchase Price to Seller, the Company

shall send copies of (i) the Debentures marked “Paid In Full” and (ii) the

Warrants marked “Cancelled” to Seller by electronic mail. |

| 4. | Representations

and Warranties. |

| a. | Representations

and Warranties by the Navy Funds. |

| • | The

Navy Funds represent and warrant to the Company that the Navy Funds are the absolute

beneficial owner of the Shares, the Debentures and the Warrants, with good and marketable

title thereto, free and clear of any liens, charges, encumbrances, security interests

or rights of others, and that the Navy Funds are exclusively entitled to possess and

dispose of same. |

| • | The

Navy Funds represent and warrant to the Company that the Shares, the Debentures and the

Warrants are the only securities of the Company owned by the Navy Funds, and that after

the transactions contemplated by this Agreement have been completed, the Navy Funds will

not own any securities of the Company. |

| b. | Representations

and Warranties by the Company. The Company represents and warrants to the Navy Funds

that the Company is not bound by any agreement that would prevent or prohibit the transactions

contemplated in this Agreement. This Agreement is not in violation of any applicable

federal or state law, rule, regulation, or judgment including applicable securities acts

and regulations. |

| 5. | Governing

Law; Venue. This Agreement, and all questions concerning the construction, validity,

and interpretation of this Agreement, shall be governed by and construed in accordance

with the internal laws of the State of Nevada, without giving effect to any choice of

law or conflict of law provision or rule (whether of the

State of Nevada or any other jurisdiction)

that would cause the application of the laws of any other jurisdiction. The Company and

the Navy Funds hereby submit to the jurisdiction of the state courts of Arizona and to

the jurisdiction of the United States District Court for the District of Nevada. |

| 6. | Attorneys’

Fees. The prevailing party in any action under this Agreement shall be entitled to

reasonable attorneys’ fees, costs, and necessary disbursements in addition to any

other relief to which such party may be entitled. |

| 7. | Waiver.

No waiver by any party of any right on any occasion shall be construed as a bar to or

waiver of any right or remedy on any future occasion. |

| 8. | Severability.

If any provision of this Agreement shall be held or deemed to

be invalid, inoperative, or unenforceable,

the remaining provisions herein contained shall nonetheless continue to be valid, operative,

and enforceable as though the invalid, inoperative or unenforceable provision had not

been included in this Agreement. |

| 9. | Captions.

All paragraph titles or captions contained in this Agreement are for convenience only

and shall not be deemed part of the content of this Agreement. |

| 10. | Agreement

Binding. This Agreement shall be binding upon and inure to the benefit of the respective

successors and assigns of the parties hereto. |

| 11. | Amendment.

This Agreement may be altered, amended, or modified only by a writing signed by the parties

hereto. |

| 12. | Further

Assurances. The parties hereto and their respective successors and assigns, officers,

and directors, shall do all such

things, execute all such documents,

and provide all such reasonable assurances as may be required to carry out the terms

and purposes of this Agreement. |

| 13. | Counterparts.

This Agreement may be executed in counterparts, all of which taken together shall be

deemed one original. |

[Signature

Page Follows]

IN

WITNESS WHEREOF, the Company and the Navy Funds have executed this Redemption Agreement as of the date first written above.

| COMPANY: |

|

NAVY FUNDS: |

| |

|

|

| CLS HOLDINGS USA, INC. |

|

NAVY CAPTIAL GREEN FUND, LP |

| |

|

|

| By: |

|

|

By: Navy Capital Green

Management, LLC |

| Name: Andrew Glashow |

|

Title: Investment Manager |

| Title: Chairman and CEO |

|

|

| |

NAVY CAPITAL GREEN CO-INVEST FUND, LLC |

| |

|

|

| |

By: |

Navy Capital Green Management,

LLC |

| |

Title: |

Investment Manager |

| |

NAVY CAPITAL GREEN HOLDINGS II, LLC |

| |

|

|

Exhibit 99.2

EXHIBIT

A

[See

attached]

18

Lafayette Place ¸ Woodmere,

NY 11598 ¸ (212)

828-8436 Main ¸ (646)

536-3179 Fax

DWAC

Withdrawal and Shares Cancellation Form

Company Name: Symbol: CUSIP

No:

Brokerage

Firm:

DTC Participant Number:

Account

Name:

Account Number:

Number of Shares

Being Withdrawn:

Current Shareholder:

Address:

SS or Tax

ID Number:

Telephone:

E-Mail:

REQUEST

TO CANCEL SHARES AND RETURN TO TREASURY:

You

are hereby authorized and directed to cancel on your books and return to treasury the above identified shares of common stock.

Please return the shares to Lans Holdings Inc. unissued status effective upon withdrawal.

Current

Owner(s) Signatures: Today’s

Date:

Medallion

Guarantee Stamp Area: For registration/ownership changes - the owner of the shares must have their signature “medallion

guaranteed” by an approved bank, broker, or other financial institution associated with the medallion program, such as STAMP,

SEMP or MSP.

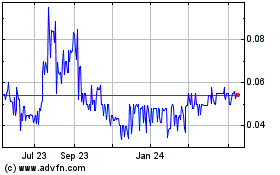

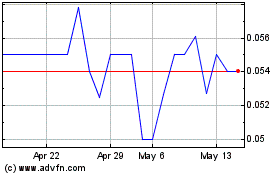

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Dec 2024 to Jan 2025

CLS Holdings USA (QB) (USOTC:CLSH)

Historical Stock Chart

From Jan 2024 to Jan 2025