- Current report filing (8-K)

01 November 2008 - 5:40AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of

Report (Date of earliest event reported): October 27, 2008

|

China

Solar & Clean Energy Solutions, Inc.

|

|

(Exact

name of registrant as specified in its

charter)

|

|

Nevada

|

|

000-12561

|

|

95-3819300

|

|

(State

of Incorporation)

|

|

(Commission

File No.)

|

|

(IRS

Employer

|

|

|

|

|

|

Identification

No.)

|

|

Building

3 No. 28, Feng Tai North Road, Beijing China, 100071

|

|

(Address

of principal executive offices, including zip

code)

|

|

+86-10-63850516

|

|

(Registrant's

telephone number, including area

code)

|

Check

the

appropriate box below if the Form 8-K filing is intended to

simultaneously

satisfy the filing obligation of the registrant under any of the

following

provisions (see General Instruction A.2. below):

|

o

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR

230.425)

|

|

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act

(17 CFR

240.14d-2(b))

|

|

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act

(17 CFR

240.13e-4(c))

|

|

Item

1.01

|

Entry

into a Material Definitive

Agreement

|

On

October 27, 2008, Beijing Deli Solar Technology Development Co., Ltd., our

wholly-owned subsidiary (“

Deli

Solar (Beijing

)”),

entered into an Equity Interest Purchase Agreement (hereinafter the

“

Agreement

”)

to

acquire approximately 29.97% of the outstanding equity interest of Tianjin

Huaneng Group Energy Equipment Co., Ltd., a majority-owned subsidiary of

the

Company (“

Tianjin

Huaneng

”),

from

the 29 minority shareholders of Tianjin Huaneng named therein (the “

Tianjin

Huaneng Shareholders

”).

Cash

Purchase Price

:

Under

the Agreement, Deli Solar (Beijing) agreed to purchase 29.97% of the current

equity interest of Tianjin Huaneng from the Tianjin Huaneng Shareholders

for RMB

10.68 million ($1,557,578 US Dollars) payable in cash within seven days of

the

execution of the Agreement.

Warrants

Purchase Price

.

In

addition to the cash purchase price, the Company also agreed to issue to

the

Tianjin Huaneng Shareholders or their designated beneficiaries a total of

1,000,000 five year warrants to purchase the Company’s common stock at an

exercise of $1.10 per share.

Moreover,

the Company decided to increase its equity interest in Tianjin Huaneng

Corporation by contributing an additional RMB 15,740,000 ($2,295,531 US

Dollars), which increased the registered capital of Tianjin Huaneng from

RMB

5.94 million to RMB 21.68 million following the consummation of the Agreement.

On

July

1, 2007, Deli Solar (Beijing) previously purchased 51% of the equity in Tianjin

Huaneng for a purchase price of approximately $1,689,741. Following consummation

of the Agreement and the additional capital contribution, the Company will

own

approximately 91.82% of the equity interest in Tianjin Huaneng.

Tianjin

Huaneng manufactures and installs waste heat recovery systems primarily for

use

in manufacturing facilities whose manufacturing processes require the generation

of large amounts of heat, such as steel and chemical plants. The waste heat

can

be used to generate hot water at the manufacturing facilities. Tianjin Huaneng’s

products include heating pipes, heat exchangers, specialty heating pipes

and

tubes, high temperature hot blast stoves, heating filters, normal pressure

water

boilers, solar energy water heaters and radiators. Products and systems

manufactured and sold by Tianjin Huaneng during the period from July 1, 2007

(the date of acquisition) through December 31, 2007 represented 19% of our

sales

revenues for the fiscal year ended December 31, 2007. Tianjin Huaneng’s products

are sold in more than 28 provinces in the PRC as well as Singapore and

Taiwan.

On

October 31, 2008, the Company issued a press release announcing that it had

signed a definitive agreement to acquire approximately 29.97% of the equity

interest of Tianjin Huaneng and it had contributed an additional RMB 15,740,000

capital to Tianjin Huaneng. The text of the press release issued by the Company

is furnished as Exhibit 99.1.

|

Item

9.01

|

Financial

Statements and Exhibits

|

The

following are filed as exhibits to this report:

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

Exhibit

1.1

|

|

Equity

Interest Purchase Agreement, between Beijing Deli Solar Technology

Development Co. Ltd. and

Tianjin

Huaneng Group Energy Equipment Co., Ltd.,

dated as of October 27, 2008.

|

|

|

|

|

|

Exhibit

99.1

|

|

Press

release dated October 31, 2008.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant

has

duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

|

|

|

|

Date:

October 31, 2008

|

China

Solar &

Clean Energy Solutions, Inc.

|

|

|

(Registrant)

|

|

|

|

|

|

|

By:

|

/s/

Deli

Du

|

|

|

Deli

Du

|

|

|

President

and Chief Executive

Officer

|

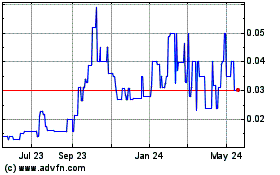

China Solar and Clean En... (PK) (USOTC:CSOL)

Historical Stock Chart

From Jun 2024 to Jul 2024

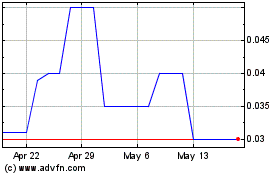

China Solar and Clean En... (PK) (USOTC:CSOL)

Historical Stock Chart

From Jul 2023 to Jul 2024