false

2023

FY

0001829966

0001829966

2022-10-01

2023-09-30

0001829966

2023-03-31

0001829966

2024-01-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

iso4217:EUR

iso4217:GBP

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C., 20549

FORM 10-K/A

(Amendment No. 1)

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended September 30, 2023

OR

| ☐ |

TRANSACTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________________

to ___________________

Commission File Number: 001-40334

EBET, Inc.

(Exact Name of Registrant as Specified in its

Charter)

| Nevada |

|

85-3201309 |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S.

Employer Identification No.) |

3960 Howard Hughes Parkway, Suite 500, Las Vegas,

NV 89169

(Address of Principal Executive Offices) (Zip

Code)

Registrant’s Telephone Number, including

Area Code: (888) 411-2726

Securities registered pursuant to Section 12(b) of the Exchange Act:

None.

Securities registered pursuant to Section 12(g) of the Exchange Act:

Common Stock, par value $0.001.

Indicate by check mark if the registrant is a well-known seasoned issuer,

as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No

☒

Indicate by check mark whether the registrant (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter

periods as the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No

☐

Indicate by check mark whether the registrant has submitted electronically

every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such

shorter period that the registrant was required to submit such files). Yes ☒ No

☐

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act. (check one)

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

|

Smaller reporting company ☒ |

| |

|

Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on

and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section

404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

☐

If securities are registered pursuant to Section 12(b) of the Act,

indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to

previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements

that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during

the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act). YES ☐ No ☒

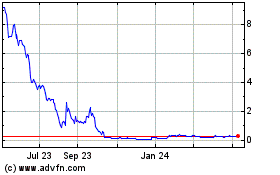

The aggregate market value of the registrant’s voting equity

held by non-affiliates of the registrant, computed by reference to the price at which the common stock was last sold as of the last business

day of the registrant’s most recently completed second fiscal quarter, was $5,189,593. In determining the market value of the voting

equity held by non-affiliates, securities of the registrant beneficially owned by directors, officers and 10% or greater shareholders

of the registrant have been excluded. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The number of shares of the registrant’s common stock outstanding

as of January 26, 2024 was 14,979,642.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Auditor Name: BFBorgers

CPA PC Auditor Firm ID: 5041

Auditor Location: Lakewood,CO

EXPLANATORY NOTE

The purpose of this Annual Report on Form

10-K/A is to amend Part III, Items 10 through 14 of EBET, Inc.’s (“Company,” “we,” “our,” “us”)

Annual Report on Form 10-K for the year ended September 30, 2023, which was filed with the Securities and Exchange Commission (the “SEC”)

on January 12, 2024 (the “2023 10-K”), to include information previously omitted from the 2023 10-K in reliance on General

Instruction G to Form 10-K, which provides that registrants may incorporate by reference certain information from a definitive proxy

statement filed with the SEC within 120 days after the end of the fiscal year. We will not file our definitive proxy statement before

January 29, 2024 (i.e., within 120 days after the end of our 2023 fiscal year) pursuant to Regulation 14A. The reference on the cover

of the Annual Report on Form 10-K to the incorporation by reference of the registrant's definitive proxy statement into Part III of the

Annual Report has been deleted.

For purposes of this Annual Report on Form

10-K/A, and in accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Items

10 through 14 of our 2023 10-K have been amended and restated in their entirety. Except as stated herein, this Form 10-K/A does not reflect

events occurring after the filing of the Form 10-K on January 12, 2024 and no attempt has been made in this Annual Report on Form 10-K/A

to modify or update other disclosures as presented in the 2021 10-K. Accordingly, this Form 10-K/A should be read in conjunction with

our filings with the SEC subsequent to the filing of the Form 10-K.

In addition, as required by Rule 12b-15 under

the Exchange Act, new certifications by our principal executive officer and principal financial officer are filed as exhibits to this

Annual Report on Form 10-K/A.

TABLE OF CONTENTS

PART III

| Item 10. |

Directors, Executive Officers and Corporate Governance. |

The following table sets

forth the names and ages of all of our directors and executive officers as of January 29, 2024. Our officers are appointed by, and serve

at the pleasure of, the Board of Directors.

| Name |

|

Age |

|

Position |

|

| |

|

|

|

|

|

| Aaron Speach |

|

35 |

|

Chairman of the Board,

President and Chief Executive Officer |

|

| Matthew Lourie |

|

43 |

|

Chief Financial Officer |

|

| Christopher S. Downs |

|

45 |

|

Director |

|

| Dennis Neilander |

|

62 |

|

Director |

|

| Michael Nicklas |

|

62 |

|

Director |

|

Set forth below is biographical

information about each of the individuals named in the tables above:

Aaron Speach, Founder,

President and CEO. Mr. Speach joined us in September 2020, but was one of the founding members of ESEG Limited in 2016,

which is now a wholly owned subsidiary of the Company. From April 2015 until June 2017, Mr. Speach was a Sales Director at Ninthlink,

which is a full service marketing agency, during which Mr. Speach managed various Fortune 500 clients. From June 2017 to June 2019, Mr.

Speach worked for Speachless Entertainment LLC, a marketing agency, which he owns and which provided services to ESEG Limited. From June

2019 until September 2020, Mr. Speach was a District Director of Stores at Pirch, which is a luxury appliance retailer. We believe Mr.

Speach’s history with our company and background, coupled with his extensive marketing experience in the esports industry, provide

him with the qualifications to serve as a director.

Matthew Lourie,

Chief Financial Officer. Mr. Lourie joined us in September 2022 as our Chief Financial Officer, after previously serving in such

position from October 2020 until March 2021. Mr. Lourie has extensive management, accounting and financial experience. Mr. Lourie currently

owns and operates (founded May 2017) Fresh Notion Financial Services and provides consulting and reporting services to other public and

private companies. Mr. Lourie served as an audit partner of the PCAOB registered firm MaloneBailey from November 2014 through April 2017,

where he oversaw audits and financial reporting of SEC registrants. In addition, he served as the Corporate Controller of a public company

with over 300 locations across the country from April 2013 through October 2014. Mr. Lourie is a graduate of the University of Houston

where he earned both his Bachelor of Business Administration Accounting and his Masters of Science in Accounting. Mr. Lourie is a Certified

Public Accountant in Texas.

Christopher S. Downs

– Director. Mr. Downs joined Esports as a director in March 2021. Mr. Downs has served as chief financial officer

of CNS Pharmaceuticals, Inc. since November 2019. From March 2018 until September 2019, Mr. Downs served as vice president of finance

and treasurer of Innovative Aftermarket Systems, L.P., a privately held provider of finance and insurance solutions. Mr. Downs served

as director of finance (from June 2011 to September 2013), vice president and treasurer (October 2013 to August 2016), executive vice

president and interim chief financial officer (August 2016 to May 2017), and executive vice president, interim chief financial officer

and member of the office of the president (May 2017 to March 2018) for InfuSystem Holdings, Inc., a supplier of infusion services to

oncologists in the United States. Mr. Downs spent 10 years in investment banking with various firms including Citigroup. Mr. Downs is

a graduate of the United States Military Academy at West Point where he earned his Bachelor of Science. Mr. Downs earned his MBA at Columbia

Business School and his Master of Science in Accounting at the University of Houston-Clear Lake. Mr. Downs is a Certified Public Accountant

in Utah and Texas. We believe Mr. Downs’ financial and accounting background provide him with the qualifications to serve as a

director.

Dennis Neilander–

Director. Mr. Neilander joined Esports as a director in January 2021. Since June 2011, Mr. Neilander has been of counsel

at the law firm of Kaempfer Crowell. Mr. Neilander is the former Chairman of the Nevada State Gaming Control Board (GCB). His practice

focuses on gaming, administrative law and government affairs. Mr. Neilander served as a Member of the GCB from 1998 until the end of

2010, and was Chairman of the GCB for the last 10 years of his tenure. Mr. Neilander also served as Chairman of the GCB’s Audit

Committee that was responsible for full scope compliance and revenue audits for Nevada casinos. From July 1995 until September 1998,

Mr. Neilander was Chief of the GCB Corporate Securities Division, which regulates the publicly traded gaming companies that operate in

Nevada. Mr. Neilander holds a J.D. from the University of Denver College of Law and a B.A. from the University of Northern Colorado.

We believe Mr. Neilander’s gaming background and regulatory experience provide him with the qualifications to serve as a director.

Michael Nicklas

– Director. Mr. Nicklas joined Esports as a director in November 2020. Since 2003, Mr. Nicklas has served as the president

of Backflips Inc., a swimwear manufacturer. A C-suite executive working with major Brands that have included Nike, Reebok, Ralph Lauren,

Jennifer Lopez, Speedo and Anne Klein. Mr. Nicklas is a graduate of the University of New Hampshire Peter T. Paul College of Business

and Economics where he earned his Bachelor of Science degree in Business Administration. We believe Mr. Nicklas’ marketing background

and business experience with major brands provide him with the qualifications to serve as a director.

No director is related

to any other director or executive officer of our company or our subsidiaries, and, there are no arrangements or understandings between

a director and any other person pursuant to which such person was elected as director.

Code of Ethics

We have adopted a written

code of business conduct and ethics that applies to our directors, officers and employees, including our principal executive officer,

principal financial officer, principal accounting officer or controller, or persons performing similar functions. A copy of the code

of business conduct and ethics is available on the Corporate Governance section of our website, which is located at www.ebet.gg. If we

make any substantive amendments to, or grant any waivers from, the code of business conduct and ethics for any officer or director, we

will disclose the nature of such amendment or waiver on our website or in a current report on Form 8-K filed with the SEC. The inclusion

of our website address in this proxy statement does not include or incorporate by reference the information on our website into this

proxy statement.

Nomination of Director Candidates

We receive suggestions

for potential director nominees from many sources, including members of the Board, advisors, and stockholders. Any such nominations,

together with appropriate biographical information, should be submitted to the Secretary of the Company (the “Corporate Secretary”)

in the manner discussed below. Any candidates submitted by a stockholder or stockholder group are reviewed and considered in the same

manner as all other candidates.

Qualifications for consideration

as a Board nominee may vary according to the particular areas of expertise being sought as a complement to the existing board composition.

However, minimum qualifications include high level leadership experience in business activities, breadth of knowledge about issues affecting

the Company, experience on other boards of directors, preferably public company boards, and time available for meetings and consultation

on Company matters. Our Nominating and Governance Committee does not have a formal policy with regard to the consideration of diversity

in identifying director candidates, but seeks a diverse group of candidates who possess the background, skills and expertise to make

a significant contribution to the Board, to the Company and our stockholders. Candidates whose evaluations are favorable are recommended

by our Nominating and Governance Committee to the full Board for consideration. The full Board selects and recommends candidates for

nomination as directors for stockholders to consider and vote upon at the annual meeting.

A stockholder wishing

to nominate a candidate for election to our Board of Directors at any annual meeting at which the Board has determined that one or more

directors will be elected must submit a written notice of his or her nomination of a candidate to the Corporate Secretary, providing

the candidates name, biographical data and other relevant information together with a consent from the nominee. The submission must comply

with our Bylaws and must be received at our principal executive offices 120 days prior to the anniversary date of the mailing date of

our previous year’s proxy statement so as to permit the Board of Directors time to evaluate the qualifications of the nominee.

We have not employed an

executive search firm, or paid a fee to any other third party, to locate qualified candidates for director positions.

Board Committees

We established a Nominating

and Corporate Governance Committee, an Audit Committee and a Compensation Committee. Our Board of Directors has adopted and approved

a charter for each of these standing committees. The charters, which include the functions and responsibilities of each of the committees,

can be found in the “Investors - Corporate Governance” section on our web site at www.ebet.gg.

Audit Committee.

The members of the Audit Committee are Messrs. Nicklas, Neilander and Downs. Mr. Downs is the chairperson of the Audit Committee. Each

member of the Audit Committee is independent as defined by the Nasdaq Rules. In addition, each member of the Audit Committee satisfies

the additional requirements of the SEC and Nasdaq Rules for audit committee membership, including the additional independence requirements

and the financial literacy requirements. The Board has determined that at least one member of the Audit Committee, Mr. Downs, is an “audit

committee financial expert” as defined in the SEC’s rules and regulations. The primary purpose of the Audit Committee is

to oversee the quality and integrity of our accounting and financial reporting processes and the audit of our financial statements. The

Audit Committee is responsible for selecting, compensating, overseeing and terminating the selection of our independent registered public

accounting firm.

Nominating and Corporate

Governance Committee. The members of the Nominating and Corporate Governance Committee are Messrs. Nicklas, Neilander and Downs.

Mr. Neilander is the chairperson of the Nominating and Governance Committee. Each member of the Nominating and Corporate Governance Committee

is independent as defined by Nasdaq Rules. The primary functions and responsibilities of the Nominating and Corporate Governance Committee

are to: (a) determine the qualifications, qualities, skills, and other expertise required to be a director; (b) identify and screen individuals

qualified to become members of the Board; (c) make recommendations to the Board regarding the selection and approval of the nominees

for director; and (d) review and assess the adequacy of our corporate governance policies and procedures.

Compensation Committee.

The members of the Compensation Committee are Messrs. Nicklas, Neilander and Downs. Mr. Nicklas is the chairperson of the Compensation

Committee. Each member of the Compensation Committee is independent as defined by Nasdaq Rules.

The Compensation Committee

is responsible for, among other things, reviewing and making recommendations to the Board of Directors with respect to the annual compensation

for our Chief Executive Officer. The Compensation Committee also is responsible for reviewing and making recommendations to the Board

of Directors the annual compensation and benefits for our other executive officers. The Compensation Committee also, among other things,

reviews compensation of the Board, reviews and makes recommendations on all new executive compensation programs that are proposed for

adoption and administers the Company’s equity incentive plans. The Compensation Committee is responsible for reviewing director

compensation for service on the Board and Board committees at least once a year and to recommend any changes to the Board.

Our Chief Executive Officer

reviews the performance of our other executive officers (other than himself) and, based on that review, our Chief Executive Officer makes

recommendations to the Compensation Committee about the compensation of executive officers (other than himself). Our Chief Executive

Officer does not participate in any deliberations or approvals by the Board or the Compensation Committee with respect to his own compensation.

| Item 11. |

Executive Compensation. |

Executive Officer Compensation

Our named executive officers

for the years ended September 30, 2023 and 2022, which consist of our principal executive officer and principal financial officer are:

(i) Aaron Speech, Chief Executive Officer; and (ii) Matthew Lourie, Chief Financial Officer. No other officer or employee received compensation

in excess of $100,000.

Summary Compensation

Table – 2023

| Name and Principal Position |

|

Year |

|

Salary ($) |

|

Bonus ($) (1) |

|

Stock Awards

($) (2) |

|

All other compensation ($) |

|

Total ($) |

|

| Aaron Speach, Chief Executive Officer and President (4) |

|

2023 |

|

354,098 |

|

105,000 |

|

– |

|

1,589 (3) |

|

460,687 |

|

| |

|

2022 |

|

307,437 |

|

– |

|

2,056,000 |

|

6,236 (3) |

|

2,369,673 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Matthew Lourie, Interim Chief Financial Officer (5) |

|

2023 |

|

228,163 |

|

120,000 |

|

– |

|

72,658 (6) |

|

420,821 |

|

| |

|

2022 |

|

11,636 |

|

– |

|

94,500 |

|

18,723 (6) |

|

124,859 |

|

| (1) |

Includes retention bonus pursuant to June 30, 2023 Retention Letter |

| |

|

| (2) |

Amounts shown in the “Stock Awards” column reflect the

aggregate grant date fair value calculated in accordance with FASB ASC 718 for the respective fiscal year with respect to the stock

award granted to our named executive officers. Amounts reflect our accounting for these grants and do not necessarily correspond

to the actual values that may be realized by our named executive officers. The assumptions used for the valuations are set forth

in Note 5 – Stockholders’ Equity in the Notes included in the Annual Report. Pursuant to SEC rules, we disregarded the

estimates of forfeitures related to service-based vesting conditions. |

| |

|

| (3) |

Consists of travel stipend and healthcare stipend. |

| |

|

| (4) |

All amounts converted from Euro (€) to US Dollar ($) were converted

at exchange rate of €1.00 to $0.9439, which was the approximate weighted average exchange rate for the applicable year. |

| |

|

| (5) |

Mr. Lourie joined the Company in September 2022. |

| |

|

| (6) |

Includes $72,658 and $18,273 for the years ended September 30, 2023

and 2022, respectively, in financial reporting consulting fees incurred by the Company from a firm owned by Mr. Lourie. |

Narrative to Summary Compensation Table

Aaron Speach, Chief

Executive Officer and President

On November 5, 2021, we

entered into an amended and restated employment agreement, effective October 1, 2021, with Aaron Speach pursuant to which Mr. Speach

agreed to continue to serve as our Chief Executive Officer for an initial term of three years. The agreement provides for an initial

annual base salary of $315,000, which may be increased to $350,000 retroactively as of the effective date provided the closing and consummation

of the share purchase transaction by and between Company and Aspire Global plc occurs (which closing occurred on November 29, 2021).

Pursuant to the agreement, Mr. Speach is eligible for an annual bonus of up to 75% of his base salary, as determined solely at the discretion

of the Compensation Committee. Pursuant to the agreement, if Mr. Speach is required to be located outside of the United States for a

period of 30 consecutive days or more, we will pay him a pro-rated monthly travel stipend of $3,500 for each month that he is so required

to live outside of the United States. Pursuant to the agreement, Mr. Speach was eligible to receive the following potential performance

stock grants: (i) 3,334 shares of Company common stock at such date as the Company reaches total gross revenues of $10,000,000 in any

trailing 12 month period during the term of the employment agreement; and (ii) 3,334 shares of Company common stock at such date as the

Company reaches total gross revenues of $20,000,000 in any trailing 12 month period during the term of the employment agreement. These

goals were achieved in 2022. Contemporaneous with the execution of the agreement, Mr. Speach received a restricted stock unit award (the

“RSU Grant”) for 3,334 shares of Company common stock. The RSU Grant vests in four equal annual installments, provided Mr.

Speach is employed on each such vesting date. If Mr. Speach’s employment is terminated at our election without “cause”

(as defined in the agreement), Mr. Speach shall be entitled to receive severance payments equal to 150% of the balance due of Mr. Speach’s

base salary for the remainder of the initial term of three years.

On June 30, 2023, the

Company agreed to enter into amendments to the employment agreements with Messrs. Speach and Lourie (each, a “Retention Letter”).

Pursuant to the Retention

Letter with Mr. Speach, Mr. Speach was entitled to receive a cash retention bonus of $175,000 payable 20% upon execution of the Retention

Letter, 40% after three months, and the remainder after six months. Mr. Speech was paid $105,000 of the bonus during the fiscal year

ended September 30, 2023.

Any unpaid retention bonus

will be paid earlier if the Company completes a strategic transaction (a “Transaction”), or if the executive is terminated

without “cause”.

In addition, pursuant

to the Retention Letter with Mr. Speach, Mr. Speach will be eligible to receive a cash transaction bonus equal to 0.95% of the gross

proceeds of any Transaction, provided that the net proceeds from the Transaction are at least $26.0 million; and further provided that

the executive may receive an additional 0.25% of the gross proceeds if the net proceeds from the Transaction are not less than the amount

that would result in (a) the Company repaying its outstanding debt and all trade creditors, and (b) the Series A preferred holders and

common shareholders receiving consideration of not less than the value of their equity holdings as of June 30, 2023 (the “Deal

Threshold”).

If Mr. Speech is terminated

without “cause” prior to June 30, 2024, the Company agreed to pay a cash severance payment of the greater of 1.0 times Mr.

Speach’s base salary or the severance payable pursuant to Mr. Speach’s current employment agreement.

Matthew Lourie, Chief Financial Officer

On September 9, 2022,

we entered into an employment agreement with Mr. Matthew Lourie pursuant to which Mr. Lourie agreed to serve as Chief Financial Officer

of the Company commencing on such date. The agreement provides for a monthly salary of $16,000. Mr. Lourie may receive a cash bonus of

$20,000 and a restricted stock unit grant for 667 shares of common stock upon a successful transition of services to a full time Chief

Financial Officer, provided that the final determination on the amount of the bonus and grant, if any, will be made by the Compensation

Committee of the Board of Directors, based on criteria established by the Compensation Committee. Pursuant to the agreement, Mr. Lourie

received a restricted stock unit award for 1,500 shares of our common stock, which shall vest in six equal monthly installments, provided

Mr. Lourie is employed on each such vesting date. We may terminate the agreement at any time during the term of the agreement on 30 days’

notice.

On June 30, 2023, the

Company agreed to enter a Retention Letter with Mr. Lourie.

Pursuant to the Retention

Letter with Mr. Lourie, Mr. Lourie was entitled to an increase in his base salary to $320,000 and to receive a cash retention bonus of

$240,000 payable 20% upon execution of the Retention Letter, 30% after three months, 30% after six months, and the remainder after nine

months. Mr. Lourie was paid $120,000 of the bonus during the fiscal year ended September 30, 2023.

Any unpaid retention bonus

will be paid earlier if the Company completes a Transaction, or if the executive is terminated without “cause”.

In addition, pursuant

to the Retention Letter with Mr. Lourie , Mr. Lourie will be eligible to receive a cash transaction bonus equal to 0.95% of the gross

proceeds of any Transaction, provided that the net proceeds from the Transaction are at least $26.0 million; and further provided that

the executive may receive an additional 0.25% of the gross proceeds if the net proceeds from the Transaction are not less than the amount

that would result in (a) the Company repaying its outstanding debt and all trade creditors, and (b) the Series A preferred holders and

common shareholders receiving consideration of not less than the value of their equity holdings as of June 30, 2023.

If Mr. Speech is terminated

without “cause” prior to June 30, 2024, the Company agreed to pay a cash severance payment of 50% of Mr. Lourie’s base

salary

Outstanding Equity Awards

The following table sets

forth certain information concerning our outstanding options for our named executive officers on September 30, 2023.

| | |

| Option

Awards | | |

| Stock

Awards | |

| Name | |

| Number

of Securities Underlying Unexercised Options (#) Exercisable | | |

| Number

of Securities Underlying Unexercised Options (#) Unexercisable | | |

| Equity

Incentive

Plan Awards: Number of Securities Underlying Unexercised Unearned Options

(#) | | |

| Option

Exercise Price

($) | | |

| Option

Expiration Date | | |

| Number

Of Shares or Units of Stock That Have Not Vested

(#) | | |

| Market

Value of Shares or Units of Stock That Have Not Vested

($)(1) | | |

| Equity

Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested

(#) | | |

| Equity

Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That

Have Not Vested

($) | |

| Aaron Speach

(2) | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| 2,500 | | |

| 2,400 | | |

| – | | |

| – | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Matthew Lourie | |

| 1,909 | | |

| – | | |

| – | | |

| 7.50 | | |

| 10/01/2030 | | |

| – | | |

| – | | |

| – | | |

| – | |

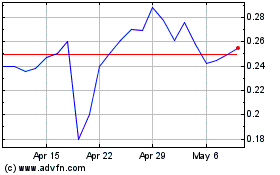

| (1) |

The market

values of the common stock reported in this table are calculated based on the closing market price of the common stock on Nasdaq

on September 30, 2023, which was $0.96 per share. |

| (2) |

The restricted

stock units vest evenly on an annual basis over 4 years from the date of grant. |

Director Compensation

The table below summarizes

all compensation of our non-employee directors for our last completed fiscal year.

| DIRECTOR

COMPENSATION | |

| Name | |

| Fees

Earned

or Paid

in Cash

($) | | |

| Total

($) | |

| Michael Nicklas | |

$ | 96,000 | | |

$ | 96,000 | |

| Dennis Neilander | |

$ | 93,500 | | |

$ | 93,500 | |

| Christopher S. Downs | |

$ | 107,500 | | |

$ | 107,500 | |

As of September 30, 2023,

the aggregate number of shares outstanding under all options to purchase our common stock held by our non-employee directors were: Mr.

Nicklas – 3,334 shares; Mr. Neilander – 2,500 shares; Mr. Downs – 2,500 shares. None of our non-employee directors

held stock awards other than options as of September 30, 2023.

On November 5, 2021, our

Board of Directors, upon recommendation of the Compensation Committee, approved the following policy for compensating non-employee members

of the Board. Each independent director shall receive annual cash compensation of $40,000. In addition, the chairperson of the Audit

Committee, Compensation Committee and Nominating and Governance Committee shall receive an annual compensation of $15,000, $10,000 and

$5,000, respectively; the other members of such committees shall receive an annual compensation of $7,500, $5,000 and $2,500, respectively.

In addition, we agreed to pay a one-time make-whole payment to the independent directors for services rendered since our initial public

offering of $27,000 during the fiscal year ended September 30, 2022.

On

June 7, 2023, the Board created a Strategic Alternatives Committee to review and evaluate potential strategic alternatives in its sole

discretion and exercise related powers that are typical of such committees. The directors who are members of the Strategic Alternatives

Committee are Christopher Downs (the Chairman), Dennis Neilander and Michael Nicklas. On June 30, 2023, the Compensation Committee and

the Strategic Alternatives Committee reviewed and approved the payment of compensation to members of the Strategic Alternatives Committee

in addition to the Company’s standard compensation arrangements for non-employee directors, the Strategic Alternatives Committee

recommended that the full Board approve it, and the Board did so. Under this plan, the Chairman of the committee will receive a monthly

retainer of $15,000 and the other two members of the committee will receive a monthly retainer of $12,000.

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. |

The following table sets

forth information, as of January 26, 2024, regarding beneficial ownership of our common stock by:

| |

· |

each

of our directors; |

| |

|

|

| |

· |

each

of our named executive officers; |

| |

|

|

| |

· |

all

directors and executive officers as a group; and |

| |

|

|

| |

· |

each

person, or group of affiliated persons, known by us to beneficially own more than five percent of our shares of common stock. |

Beneficial ownership is

determined according to the rules of the SEC, and generally means that person has beneficial ownership of a security if he or she possesses

sole or shared voting or investment power of that security and includes options that are currently exercisable or exercisable within

60 days. Each director or officer, as the case may be, has furnished us with information with respect to beneficial ownership. Except

as otherwise indicated, we believe that the beneficial owners of common stock listed below, based on the information each of them has

given to us, have sole investment and voting power with respect to their shares, except where community property laws may apply.

| Name

and Address of Beneficial Owner (1) | |

Number

of Shares (2) | | |

Percent

of Class(2) | |

| | |

| | |

| |

| Directors and Named Executive Officers | |

| | | |

| | |

| Aaron Speach | |

| 18,955

(3) | | |

| * | |

| Matthew Lourie | |

| 3,409

(4) | | |

| * | |

| Michael Nicklas | |

| 3,334

(5) | | |

| * | |

| Dennis Neilander | |

| 2,500

(6) | | |

| * | |

| Christopher S. Downs | |

| 1,667

(7) | | |

| * | |

| Directors and Executive Officers as a Group (5 persons) | |

| 29,865 | | |

| * | |

| | |

| | | |

| | |

| 5% Stockholders | |

| | | |

| | |

| CP BF Lending, LLC | |

| 1,645,963(8) | | |

| 9.9% | |

* Indicates beneficial ownership of less than 1% of the outstanding

common stock.

(1) Unless otherwise indicated in the footnotes, the address of

the beneficial owners is c/o EBET, Inc., 3960 Howard Hughes Parkway, Suite 500, Las Vegas, NV 89169.

(2) A person is deemed to be the beneficial

owner of securities that can be acquired by him or her within 60 days from January 17, 2024 upon the exercise of options, warrants or

other convertible securities. Percentage is based on 14,979,642 shares of common stock outstanding as of January 17, 2024.

(3) Consists of 16,667 shares held by Speachless

Entertainment LLC. Also includes 1,667 vested but unissued shares pursuant to a restricted stock unit award that will vest in four equal

annual installments beginning on January 1, 2023. Does not include 1,667 remaining shares issuable to Mr. Speach pursuant to the award.

(4) Includes 1,909 shares underlying a ten-year

option issued to Mr. Lourie in October 2020 to purchase 1,909 shares at an exercise price of $7.50 per share.

(5) Includes 3,334 shares underlying a ten-year

option issued to Mr. Nicklas in November 2020 to purchase 3,334 shares at an exercise price of $60.00 per share, which vests in two equal

installments on each of the succeeding two anniversary dates of the option grant, provided Mr. Nicklas is serving as a director on each

such vesting date.

(6) Includes 2,500 shares underlying a ten-year

option issued to Mr. Neilander in January 2021 to purchase 2,500 shares at an exercise price of $60.00 per share, which vests in three

equal installments on each of the succeeding three anniversary dates of the option grant, provided Mr. Neilander is serving as a director

on each such vesting date.

(7) Includes 1,667 shares underlying a ten-year

option issued to Mr. Downs in February 2021 to purchase 2,500 shares at an exercise price of $60.00 per share, which vests in three equal

installments on each of the succeeding three anniversary dates of the option grant, provided Mr. Downs is serving as a director on each

such vesting date.

(8) Alexander Bryant Washburn and Stanley

Logan Baty may be deemed to beneficially own the securities held by CP BF Lending, LLC because they are the controlling members of the

Board of Managers of Columbia Pacific Advisors, LLC. Columbia Pacific Advisors LLC is the manager of CP Business Finance GP, LLC, the

manager of CP BF Lending, LLC. CP BF Lending, LLC holds convertible notes in aggregate principal amount of $31,929,644, which is convertible

at a conversion price of $0.116 per share. CP BF Lending, LLC is

prohibited from converting its debt to the extent that such conversion would result in the number of shares of common stock beneficially

owned by it and its affiliates exceeding 9.99% of the total number of shares of common stock outstanding immediately after giving effect

to the conversion. The amount set forth in the table represents the maximum number of shares currently issuable pursuant to the

convertible notes based on the foregoing restriction. The address of CP BF Lending, LLC is 1910 Fairview Ave. E., Suite 300, Seattle,

WA 98102.

Securities Authorized for Issuance under Equity Compensation

Plans

The following table sets

forth information regarding our equity compensation plans at September 30, 2023:

| Plan category | |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | | |

Weighted-average exercise price of outstanding options, warrants and rights (b) | | |

Number of securities (by class) remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) | |

| Equity compensation plans approved by security holders (1) | |

| 27,337 | | |

$ | 113.55 | | |

| 203,808 | |

| Equity compensation plans not approved by security holders (2) | |

| 73 | | |

$ | 90.00 | | |

| – | |

| |

(1) |

Represents shares of common stock issuable upon exercise of outstanding stock options and rights under our 2020 Stock Plan. |

| |

(2) |

Consists of warrants issued to consultants. |

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence. |

We engage a firm owned by Matthew Lourie, our

Chief Financial Officer, to provide financial reporting services. For the year ended September 30, 2023 and 2022, we incurred consulting

fees of $72,658 and $18,273, respectively.

Policies and Procedures for Related Party

Transactions

Our audit committee charter

provides that our audit committee is responsible for reviewing and approving in advance any related party transaction. This will cover,

with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act, any transaction, arrangement or relationship,

or any series of similar transactions, arrangements or relationships in which we were or are to be a participant, where the amount involved

exceeds $120,000 and a related person had or will have a direct or indirect material interest, including, without limitation, purchases

of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees

of indebtedness and employment by us of a related person. In determining whether to approve a proposed transaction, our Audit Committee

will consider all relevant facts and circumstances including: (i) the materiality and character of the related party’s direct or

indirect interest; (ii) the commercial reasonableness of the terms; (iii) the benefit or perceived benefit, or lack thereof, to us; (iv)

the opportunity cost of alternate transactions; and (v) the actual or apparent conflict of interest of the related party.

Director Independence

Our board of directors

undertook a review of the composition of our board of directors and its committees and the independence of each director. In determining

independence, although we are not listed on a national securities exchange, our board of directors utilized the rules of the Nasdaq Stock

Market, or the Nasdaq Rules, which require a majority of a listed company’s board of directors to be composed of independent directors.

Under the Nasdaq Rules, a director will only qualify as an independent director if, in the opinion of our board of directors, that person

does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a

director. The Nasdaq Rules also require that audit committee members satisfy independence criteria set forth in Rule 10A-3 under the

Securities Exchange Act of 1934, as amended, or the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a

member of an audit committee of a listed company may not, other than in his or her capacity as a member of the audit committee, the board

of directors, or any other board committee, accept, directly or indirectly, any consulting, advisory, or other compensatory fee from

the listed company or any of its subsidiaries or otherwise be an affiliated person of the listed company or any of its subsidiaries.

In considering the independence of compensation committee members, the Nasdaq Rules require that our board of directors must consider

additional factors relevant to the duties of a compensation committee member, including the source of any compensation we pay to the

director and any affiliations with our company. Based upon information requested from and provided by each director concerning his background,

employment and affiliations, including family relationships, our board of directors has determined that each of our directors, with the

exception of Mr. Speach, are independent as defined under the Nasdaq Rules.

| Item 14. |

Principal Accounting Fees and Services. |

On November 21, 2022,

the Audit Committee of the Board of Directors (the “Audit Committee”) of the Company dismissed PWR CPA, LLP (“PWR”)

as its independent registered public accounting firm, effective as of such date.

Aggregate fees for professional

services rendered by PWR CPA, LLP and BF Borgers CPA, PC for their services for the fiscal years ended September 30, 2022 and 2023, respectively,

were as follows:

| |

|

2022 |

|

|

2023 |

|

| Audit Fees |

|

$ |

145,425 |

|

|

$ |

203,500 |

|

| Audit-related fees |

|

|

– |

|

|

|

– |

|

| Tax fees |

|

|

5,009 |

|

|

|

6,000 |

|

| All other fees |

|

|

– |

|

|

|

– |

|

| TOTAL |

|

$ |

150,434 |

|

|

$ |

209,500 |

|

Audit Fees

Audit fees represent the aggregate fees billed

for professional services rendered by our independent accounting firm for the audit of our annual financial statements, review of financial

statements included in our quarterly reports, review of registration statements or services that are normally provided in connection

with statutory and regulatory filings or engagements for those fiscal years. The Audit Fees for 2022 includes $93,500 from BF Borgers

CPA, PC and $51,925 from PWR CPA, LLP.

Audit-Related Fees

Audit-related fees represent the aggregate

fees billed for assurance and related services that are reasonably related to the performance of the audit or review of our financial

statements and are not reported under Audit Fees.

Tax Fees

Tax fees represent the aggregate fees billed

for professional services rendered by our principal accountants for tax compliance, tax advice, and tax planning for such years. Tax

fees for fiscal years ended September 30, 2023 and 2022 were for services rendered by PWR CPA, LLP.

All Other Fees

All other fees represent the aggregate fees

billed for products and services other than the services reported in the other categories.

Audit Committee Pre-Approval Policies and

Procedures

The Audit Committee on an annual basis reviews

audit and non-audit services performed by the independent auditors. All audit and non-audit services are pre-approved by the Audit Committee,

which considers, among other things, the possible effect of the performance of such services on the auditors’ independence.

PART IV

| Item 15. |

Exhibits, Financial Statement Schedules. |

(a) The

following documents are filed or furnished as part of this Form 10-K:

| |

1. |

Financial Statements. The

financial statements and notes thereto which are attached hereto have been included by reference into Item 8 of this part of the

annual report on Form 10-K. See the Index to Financial Statements on page 32. |

| |

|

|

| |

2. |

Financial Statement Schedules. The Financial Statement Schedules have been omitted either because they are not required or because the information has been included in the financial statements or the notes thereto included in this Annual Report on Form 10-K. |

| |

|

|

| |

3. |

Exhibits |

EXHIBIT INDEX

Exhibit

Number |

Description

of Document |

| 2.1 |

Share

Purchase Agreement, dated as of September 30, 2021 (incorporated

by reference to the exhibit 2.1 of the Form 8-K filed October 1, 2021) |

| |

|

| 3.1 |

Articles

of Incorporation of EBET, Inc. (incorporated

by reference to exhibit 3.1 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 3.2 |

Amended

and Restated Bylaws of EBET, Inc. (incorporated

by reference to exhibit 3.2 to the Company’s Form 8-K filed May 5, 2022) |

| |

|

| 3.3 |

Amended

and Restated Certificate of Designation of Preferences, Rights and Limitations of Series A Convertible Preferred Stock

(incorporated by reference to exhibit 3.1 to the Company’s

Form 8-K filed January 3, 2023) |

| |

|

| 3.4 |

Articles

of Merger (incorporated by reference to exhibit

3.1 to the Company’s Form 8-K filed May 5, 2022) |

| |

|

| 3.5 |

Certificate

of Amendment of the Articles of Incorporation of EBET, Inc. (incorporated by reference to exhibit 3.1 to the Company’s

Form 8-K filed July 28, 2023) |

| |

|

| 3.6 |

Amendment

to EBET, Inc. Articles of Incorporation (incorporated by reference to exhibit 3.1 to the Company’s Form 8-K filed October

2, 2023) |

| |

|

| 4.1 |

Form

of Common Stock Certificate (incorporated by

reference to exhibit 4.1 to the Company’s Form S-1/A file no. 333-254068) |

| |

|

| 4.2 |

Form

of Warrant issued in connection with Domain Purchase Agreements (incorporated

by reference to exhibit 4.3 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 4.3 |

Form

of Convertible Note issued in connection with Domain Purchase Agreements (incorporated

by reference to exhibit 4.4 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 4.4 |

Form

of Promissory Note between EBET, Inc., Esports Product Technologies Malta Ltd. and Aspire Global Plc (incorporated

by reference to exhibit 4.1 to the Company’s Form 8-K filed December 1, 2021) |

| 4.5 |

Form

of Preferred Stock Investor Warrant (incorporated

by reference to exhibit 4.2 to the Company’s Form 8-K filed December 1, 2021) |

| |

|

| 4.6 |

Form

of Lender Warrant (incorporated by reference

to exhibit 4.3 to the Company’s Form 8-K filed December 1, 2021) |

| |

|

| 4.7 |

Description of Securities of EBET, Inc. (incorporated by reference to exhibit 4.7 to the Company’s Form 10-K filed January 12, 2024) |

| |

|

| 4.8 |

Form

of June 2022 Investor Warrant (incorporated by

reference to exhibit 4.1 to the Company’s Form 8-K filed June 8, 2022) |

| |

|

| 4.9 |

Form

of February 2023 Investor Warrant (incorporated by reference to exhibit 4.1 to the Company’s Form 8-K filed February 2,

2023) |

| |

|

| 10.1 ** |

2020

Stock Plan of EBET, Inc., as amended, and forms of award agreements thereunder (incorporated

by reference to exhibit 10.1 to the Company’s Form 8-K filed July 28, 2023) |

| |

|

| 10.2 |

Domain

Purchase Agreement between ESEG Limited and Dover Hill LLC (incorporated

by reference to exhibit 10.7 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 10.3 |

Domain

Purchase Agreement between ESEG Limited and Esports Group LLC (incorporated

by reference to exhibit 10.8 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 10.4 |

Domain

Purchase Agreement between ESEG Limited and YSW Holdings, Inc. (incorporated

by reference to exhibit 10.9 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 10.5 ** |

Form

of Independent Director Agreement (incorporated

by reference to exhibit 10.10 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 10.6 + |

Software

License Agreement between Galaxy Group Ltd. and ESEG Limited Dated September 28, 2020 (incorporated

by reference to exhibit 10.11 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 10.7 + |

White

Label Agreement by and between Splash Technology Limited, and EBET, Inc. dated February 5, 2021 (incorporated

by reference to exhibit 10.12 to the Company’s Form S-1 file no. 333-254068) |

| |

|

| 10.8 |

License

Agreement between EBET, Inc. and Colossus (IOM) Limited dated May 6, 2021 (incorporated

by reference to exhibit 10.1 to the Company’s Form 8-K filed May 12, 2021) |

| |

|

| 10.9 ** |

First

Amended and Restated Employment Agreement between EBET, Inc. and Aaron Speach dated November 5, 2021 (incorporated

by reference to exhibit 10.1 to the Company’s Form 8-K filed November 9, 2021) |

| |

|

| 10.10 ** |

Non-Employee

Director Compensation Policy (incorporated by

reference to exhibit 10.3 to the Company’s Form 8-K filed November 9, 2021) |

| |

|

| 10.11 + |

Credit

Agreement dated November 29, 2021 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC (incorporated

by reference to the Exhibit 10.2 of the Form 8-K filed December 1, 2021) |

| |

|

| 10.12 |

Note

Conversion Option Agreement between EBET, Inc. and CP BF LENDING, LLC (incorporated

by reference to exhibit 10.2 to the Company’s Form 8-K filed June 8, 2022) |

| |

|

| 10.13 |

Amendment

to Note Conversion Option Agreement between EBET, Inc. and CP BF LENDING, LLC (incorporated

by reference to exhibit 10.1 to the Company’s Form 8-K filed June 17, 2022) |

| 10.14 |

Employment

Agreement between EBET, Inc. and Matthew Lourie (incorporated

by reference to exhibit 10.1 to the Company’s Form 8-K filed September 9, 2022) |

| |

|

| 10.15 ¥ |

Forbearance

Agreement dated June 30, 2023 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC (incorporated by

reference to exhibit 10.1 to the Company’s Form 8-K filed July 3, 2023) |

| |

|

| 10.16 |

Form

of Revolving Note issuable by EBET, Inc. to CP BF Lending, LLC (incorporated by reference to exhibit 10.2 to the Company’s

Form 8-K filed July 3, 2023) |

| |

|

| 10.17 |

Forbearance

Agreement Amendment No. 1 dated September 15, 2023 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC

(incorporated by reference to exhibit 10.2 to the Company’s Form 8-K filed September 19, 2023) |

| |

|

| 10.18 ¥ |

Forbearance

Agreement Amendment No. 2 dated October 2, 2023 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC

(incorporated by reference to exhibit 10.3 to the Company’s Form 8-K filed October 2, 2023) |

| |

|

| 10.19 |

Amended

and Restated Note Conversion Option Agreement dated October 2, 2023 between EBET, Inc. and CP BF Lending, LLC (incorporated by

reference to exhibit 10.5 to the Company’s Form 8-K filed October 2, 2023) |

| |

|

| 10.20 |

Amendment No. 3 to Credit Agreement dated January 9, 2024 between EBET, Inc., certain subsidiaries of EBET, Inc., and CP BF Lending, LLC (incorporated by reference to exhibit 10.20 to the Company’s Form

10-K filed January 12, 2024) |

| |

|

| 10.21 |

Second Amended and Restated Note Conversion Option Agreement dated January 9, 2024 between EBET, Inc. and CP BF Lending, LLC (incorporated by reference to exhibit 10.21 to the Company’s Form 10-K

filed January 12, 2024) |

| |

|

| 21 |

List

of Subsidiaries (incorporated by reference to

exhibit 21 to the Company’s Form 10-K filed December 23, 2021) |

| |

|

| 31.1 * |

Certification of Principal Executive Officer pursuant to Rule 13a-14 of the Securities Exchange Act of 1934, as amended |

| |

|

| 31.2 * |

Certification of Principal Financial Officer pursuant to Rule 13a-14 of the Securities Exchange Act of 1934, as amended |

| |

|

| 32.1 * |

Certification of Principal Executive Officer Pursuant to Section 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

| 32.2 * |

Certification of Principal Financial Officer Pursuant to Section 18 U.S.C. Section 1350, as Adopted Pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

| |

|

| 101.INS |

Inline XBRL Instance Document

(the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document) |

| 101.SCH |

Inline XBRL Taxonomy Extension

Schema Document |

| 101.CAL |

Inline XBRL Taxonomy Extension

Calculation Linkbase Document |

| 101.DEF |

Inline XBRL Taxonomy Extension

Definition Linkbase Document |

| 101.LAB |

Inline XBRL Taxonomy Extension

Label Linkbase Document |

| 101.PRE |

Inline XBRL Taxonomy Extension

Presentation Linkbase Document |

| 104 |

Cover Page Interactive Data File (formatted in IXBRL,

and included in exhibit 101). |

| * |

Filed herewith. |

| ** |

Management contract or compensatory plan, contract or arrangement. |

| + |

Pursuant to Item 601(b)(10)(iv) of Regulation S-K promulgated by the SEC, certain portions of this exhibit have been redacted. The Company hereby agrees to furnish supplementally to the SEC, upon its request, an unredacted copy of this exhibit. |

| ¥ |

Schedules and exhibits omitted pursuant to Item 601(b)(2) of Regulation S-K. The Company will furnish a copy of any omitted schedule or exhibit to the SEC upon request. |

None.

SIGNATURES

Pursuant to the requirements of Section 13

or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

EBET, INC. |

| |

|

|

| |

By: |

/s/ Aaron Speach |

| |

|

Aaron Speach, |

| |

|

Chief Executive Officer and Chairman |

Date:

January 29, 2024

Pursuant to the requirements of the Securities

Exchange Act of 1934, this report has been signed by the following persons on behalf of the Registrant in the capacities and on the dates

indicated.

| Signature |

|

Title |

|

Date |

| |

|

|

|

|

| /s/ Aaron Speach |

|

Chief Executive Officer and Chairman |

|

January 29, 2024 |

| Aaron Speach |

|

(Principal Executive Officer) |

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Matthew Lourie |

|

Chief Financial Officer |

|

January 29, 2024 |

| Matthew Lourie |

|

(Principal Financial and Accounting Officer) |

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Michael Nicklas |

|

Director |

|

January 29, 2024 |

| Michael Nicklas |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Dennis Neilander |

|

Director |

|

January 29, 2024 |

| Dennis Neilander |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| /s/ Christopher S. Downs |

|

Director |

|

January 29, 2024 |

| Christopher S. Downs |

|

|

|

|

EXHIBIT 31.1

CERTIFICATION BY OFFICER

I, Aaron Speach, certify that:

| 1. |

I have reviewed this Form 10-K/A for the year ended September 30, 2023 of EBET, Inc.; |

| 2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| Date: January 29, 2024 |

By: |

/s/ Aaron Speach |

| |

|

Aaron Speach |

| |

|

Chief Executive Officer |

EXHIBIT 31.2

CERTIFICATION BY OFFICER

I, Matthew Lourie, certify that:

| 1. |

I have reviewed this Form 10-K/A for the year ended September 30, 2023 of EBET, Inc.; |

| 2. |

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report; |

| Date: January 29, 2024 |

By: |

/s/ Matthew Lourie |

| |

|

Matthew Lourie |

| |

|

Chief Financial Officer |

EXHIBIT 32.1

CERTIFICATION OF OFFICER

Pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002

(Subsections (a) and (b) of Section 1350,

Chapter 63 of Title 18, United States Code)

Pursuant to section 906 of the Sarbanes-Oxley Act

of 2002 (subsections (a) and (b) of section 1350, chapter 63 of title 18, United States Code), the undersigned officer

of EBET, Inc., a Nevada corporation (the “Company”), does hereby certify, to such officer’s knowledge, that:

The Form 10-K/A for the year ended September

30, 2023 (the “Report”) of the Company fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange

Act of 1934, as amended, and information contained in the Report fairly presents, in all material respects, the financial condition and

results of operations of the Company.

| Date: January 29, 2024 |

By: |

/s/ Aaron Speach |

| |

|

Aaron Speach |

| |

|

Chief Executive Officer |

EXHIBIT 32.2

CERTIFICATION OF OFFICER

Pursuant to Section 906 of the Sarbanes-Oxley

Act of 2002

(Subsections (a) and (b) of Section 1350,

Chapter 63 of Title 18, United States Code)

Pursuant to section 906 of the Sarbanes-Oxley Act

of 2002 (subsections (a) and (b) of section 1350, chapter 63 of title 18, United States Code), the undersigned officer

of EBET, Inc., a Nevada corporation (the “Company”), does hereby certify, to such officer’s knowledge, that:

The Form 10-K/A for the year ended September

30, 2023 (the “Report”) of the Company fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange

Act of 1934, as amended, and information contained in the Report fairly presents, in all material respects, the financial condition and

results of operations of the Company.

| Date: January 29, 2024 |

By: |

/s/ Matthew Lourie |

| |

|

Matthew Lourie |

| |

|

|

v3.24.0.1

Cover - USD ($)

|

12 Months Ended |

|

|

Sep. 30, 2023 |

Jan. 26, 2024 |

Mar. 31, 2023 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Amendment Flag |

false

|

|

|

| Document Annual Report |

true

|

|

|

| Document Transition Report |

false

|

|

|

| Document Period End Date |

Sep. 30, 2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Current Fiscal Year End Date |

--09-30

|

|

|

| Entity File Number |

001-40334

|

|

|

| Entity Registrant Name |

EBET, Inc.

|

|

|

| Entity Central Index Key |

0001829966

|

|

|

| Entity Tax Identification Number |

85-3201309

|

|

|

| Entity Incorporation, State or Country Code |

NV

|

|

|

| Entity Address, Address Line One |

3960 Howard Hughes Parkway, Suite 500

|

|

|

| Entity Address, City or Town |

Las Vegas

|

|

|

| Entity Address, State or Province |

NV

|

|

|

| Entity Address, Postal Zip Code |

89169

|

|

|

| City Area Code |

(888)

|

|

|

| Local Phone Number |

411-2726

|

|

|

| Title of 12(g) Security |

Common Stock, par value $0.001

|

|

|

| Entity Well-known Seasoned Issuer |

No

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Non-accelerated Filer

|

|

|

| Entity Small Business |

true

|

|

|

| Entity Emerging Growth Company |

true

|

|

|

| Elected Not To Use the Extended Transition Period |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 5,189,593

|

| Entity Common Stock, Shares Outstanding |

|

14,979,642

|

|

| ICFR Auditor Attestation Flag |

false

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Auditor Name |

BFBorgers

CPA PC

|

|

|

| Auditor Firm ID |

5041

|

|

|

| Auditor Location |

Lakewood,CO

|

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |