As filed with the Securities and Exchange Commission

on January 18, 2017

|

|

Registration No. 333-210686

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in

its charter)

Nevada

(State or other jurisdiction of incorporation

or organization)

1000

(Primary Standard Industrial Classification

Code Number)

88-0482413

(I.R.S. Employer Identification Number)

5871 Honeysuckle Road

Prescott, Arizona 86305-3764

Telephone: (928) 515-1942

(Address, including zip code, and telephone

number,

including area code, of registrant’s

principal executive offices)

InCorp Services, Inc.

3773 Howard Hughes Parkway

South Tower Suite 500

Las Vegas, NV 89169-6014

(Name and address of agent for service)

(800) 246-2677

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copy to:

William M. Mower, Esq.

Maslon LLP

3300 Wells Fargo Center, 90 South 7th

Street

Minneapolis, Minnesota 55402

Telephone: (612) 672-8200

Facsimile: (612) 672-8397

From time to time after the effective date

of this registration statement.

(Approximate date of commencement of proposed

sale to the public)

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box:

þ

If this Form is filed to register additional securities for an

offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule

462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering.

¨

If this Form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier

effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of

“

large

accelerated filer,”

“

accelerated filer” and

“

smaller reporting company”

in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer

¨

Accelerated

filer

¨

Non-accelerated filer

¨

Smaller reporting company

þ

Calculation of Registration Fee

|

Title

of Each Class of Securities

To Be Registered

|

Amount

To Be

Registered (1)

|

Proposed

Maximum

Offering Price

Per Share

|

Proposed

Maximum Aggregate

Offering Price

|

Amount

of

Registration Fee

|

|

|

|

|

|

|

|

Common

Stock, par value $.001 per share

|

25,000,000

|

$0.039

(2)(3)

|

$975,000

(2)(3)

|

$98.18

(3)(4)

|

____________

|

(1)

|

An

indeterminate number of additional shares of common stock shall be issuable pursuant to Rule 416 under the Securities Act

of 1933 to prevent dilution resulting from stock splits, stock dividends or similar transactions and in such an event the

number of shares registered shall automatically be increased to cover the additional shares in accordance with Rule 416.

|

|

|

|

|

(2)

|

Estimated

solely for the purpose of calculating the amount of the registration fee in accordance with Rule 457(c) under the Securities

Act of 1933.

|

|

|

|

|

(3)

|

Based

on the average of the high and low sales prices ($

0.039) for El Capitan Precious Metals, Inc.’s common stock

on April 7, 2016.

|

|

|

|

|

(4)

|

Registration fee previously

paid.

|

The registrant hereby amends this registration statement on such

date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically

states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act

of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

Explanatory Note

This Post-Effective Amendment No. 1 to the Registration Statement

on Form S-1 of El Capitan Precious Metals, Inc. (the “Company”), as originally declared effective by the Securities

and Exchange Commission on April 20, 2016 (Registration No. 333-210686) (the “Registration Statement”), is being filed

pursuant to the undertakings in Item 17 of the Registration Statement to include the information contained in the Company’s

Annual Report on Form 10-K for the fiscal year ended September 30, 2016 that was filed with the Securities and Exchange Commission

on January 13, 2017.

The information included in this filing amends the Registration Statement and the Prospectus contained therein.

No additional securities are being registered under this Post-Effective Amendment No. 1. All applicable registration fees were

paid at the time of the original filing of the Registration Statement.

|

The

information in this prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is declared effective. This prospectus is not an offer to sell

these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

|

Subject to Completion, Dated January 18,

2017

Prospectus

25,000,000 Shares

Common Stock

_________________________________

This prospectus relates to the offer and resale

of up to 25,000,000 shares of our common stock, par value $0.001 per share, by the selling stockholder, River North Equity, LLC

(“River North”). All of such shares represent shares that River North has agreed to purchase from us

pursuant to the terms and conditions of an Equity Purchase Agreement we entered into with them on March 16, 2016, as amended December

9, 2016 (the “Equity Purchase Agreement”). Subject to the terms and conditions of the Equity Purchase

Agreement, we have the right to “put,” or sell, up to $5,000,000 worth of shares of our common stock to River North. This

arrangement is also sometimes referred to herein as the “Equity Line.”

For more information on the selling stockholder,

please see the section of this prospectus entitled “Selling Stockholder” beginning on page 20.

River North may sell any shares offered

under this prospectus at fixed prices, prevailing market prices at the time of sale, at varying prices or negotiated prices.

River North is an “underwriter”

within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), in connection with the resale

of our common stock under the Equity Line, and any broker-dealers or agents that are involved in such resales may be deemed to

be “underwriters” within the meaning of the Securities Act in connection therewith. In such event, any commissions

received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act. For more information, please see the section of this prospectus

titled “Plan of Distribution” beginning on page 21.

We will not receive any proceeds from the resale

of shares of common stock by River North. We will, however, receive proceeds from the sale of shares directly to River

North pursuant to the Equity Line.

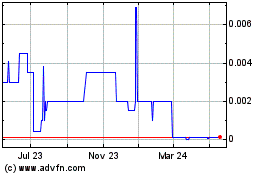

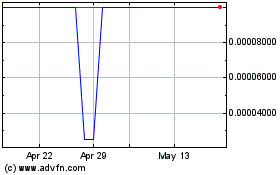

Our common stock is quoted on the OTCQB Marketplace

operated by the OTC Markets Group, Inc., or “OTCQB,” under the ticker symbol “ECPN.” On January 13, 2017,

the average of the high and low sales prices of our common stock was $0.06 per share.

Investing in our common stock involves risk.

See “Risk Factors” beginning on page 8 of this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2017.

TABLE

OF CONTENTS

You should rely only on the information that

we have provided in this prospectus and any applicable prospectus supplement. We have not authorized anyone to provide you with

different information. No dealer, salesperson or other person is authorized to give any information or to represent anything not

contained in this prospectus and any applicable prospectus supplement. You must not rely on any unauthorized information or representation.

This prospectus is an offer to sell only the securities offered hereby, but only under circumstances and in jurisdictions where

it is lawful to do so. You should assume that the information in this prospectus and any applicable prospectus supplement is accurate

only as of the date on the front of the document, regardless of the time of delivery of this prospectus, any applicable prospectus

supplement, or any sale of a security.

PROSPECTUS

SUMMARY

This summary highlights information

contained elsewhere in this prospectus; it does not contain all of the information you should consider before investing in our

common stock. You should read the entire prospectus before making an investment decision.

As used in this prospectus,

the terms “we,” “us,” the “Company” and “El Capitan” mean El Capitan Precious

Metals, Inc., and our consolidated subsidiaries. All dollar amounts refer to U.S. dollars unless otherwise indicated.

Our Business

El Capitan Precious Metals,

Inc., a Nevada corporation, is based in Prescott, Arizona. Together with its consolidated subsidiaries (collectively referred

to as the “Company,” “our” or “we”), the Company is an exploration stage company as defined

by the Securities and Exchange Commission’s (“SEC”) Industry Guide 7, as the Company has no established reserves

as required under the Industry Guide 7. We are principally engaged in the exploration of precious metals and other minerals. We

have owned interests in several properties located in the southwestern United States in the past. Currently, our primary asset

is a 100% equity ownership interest in El Capitan, Ltd., an Arizona corporation (“ECL”), which holds an interest in

the El Capitan property located near Capitan, New Mexico (the “El Capitan Property”). Our ultimate objective is to

market and sell the El Capitan Property to a major mining company or enter into a joint venture arrangement with a major mining

company to conduct mining operations.

Based on results from

testing conducted on mineralized material at the El Capitan Property during fiscal years 2013 and 2014, we determined the existence

and concentration of potentially commercially extractable precious metals or other minerals. We subsequently completed testing

and enhancement of our recovery process for such mineralized material and our evaluation as to the economic and legal feasibility

of the property. Employing our testing results, we determined to put the El Capitan Property into mineral exploration production

to assist us in marketing it for potential sale to a major mining company and to create potential cash flow for the Company through

the sale of mineralized material removed from the El Capitan Property and, separately, iron ore extracted from such mineralized

material.

We commenced mineral exploration

activity in the quarter ended December 2015 under our modified mining permit. However, we have not yet demonstrated the existence

of proven or probable reserves at our El Capitan Property. To date, we have not had any material revenue producing operations.

We have recorded nominal revenues during the fiscal year ended September 30, 2016 consisting of revenue for test loads of iron

ore to a construction contractor. There is no assurance that a commercially viable mineral deposit exists on our property.

“Mineralized

material” as used in this prospectus, although permissible under the Securities and Exchange Commission’s (“SEC’s”)

Industry Guide 7, does not indicate “reserves” by SEC standards. We cannot be certain that any part of the El Capitan

Property will ever be confirmed or converted into SEC Industry Guide 7 compliant “reserves.” Investors are cautioned

not to assume that all or any part of the mineralized material will ever be confirmed or converted into reserves or that mineralized

material can be economically or legally extracted. See “Cautionary Note Regarding Exploration Stage Status” and “SEC

Industry Guide 7 Definitions” on page 17.

Our principal executive office is located at 5871 Honeysuckle Road, Prescott, Arizona 86305. Our telephone number is (928) 515-1942 and our internet address is www.elcapitanpmi.com.

Unless expressly noted, none of the information on our website is part of this prospectus or any prospectus supplement. Our common

stock is quoted on the OTCQB Marketplace operated by the OTC Markets Group, Inc., or “OTCQB,” under the ticker symbol

“ECPN.”

The Offering

|

Common stock that may be

offered by selling stockholder

|

|

25,000,000 shares

|

|

|

|

|

|

Common stock outstanding

|

|

384,476,034 shares as of January 16, 2017

|

|

|

|

|

|

Total proceeds raised by offering

|

|

We will not receive any proceeds from the resale

or other disposition of the shares covered by this prospectus by River North, the selling stockholder. We will receive

proceeds from the sale of shares to River North. River North has committed to purchase up to $5,000,000 worth

of shares of our common stock over a period of time terminating on the earlier of the date on which River North shall

have purchased Company shares pursuant to the Equity Purchase Agreement for an aggregate purchase price of $5,000,000

or March 16, 2018.

River North will pay a purchase price equal to 85% of

the Market Price, which is defined as the average of the two lowest closing bid prices on the OTCQB Marketplace, as reported by

Bloomberg Finance L.P., during the five consecutive Trading Days including and immediately prior to the date on which the applicable

put notice is delivered to River North (the “Pricing Period”). The discount will increase to: (i) 75% of Market Price

if either (A) the Closing Price of the Common Stock on the Put Date is less than $0.10 per share, or (B) the average daily trading

volume in dollar amount for the Common Stock during the ten Trading Days including and immediately preceding the Put Date is less

than $50,000; (ii) 80% of Market Price if the Company is not deposit/withdrawal at custodian (“DWAC”) eligible; and

(iii) to 75% of Market Price if the Company is under DTC “chill” status. The number of shares to be purchased by River

North may not exceed the number of shares that, when added to the number of shares of our common stock then beneficially owned

by River North, would exceed 9.99% of our shares of common stock outstanding.

For further information, see “The Offering” beginning on page 18.

|

|

|

|

|

|

Plan of Distribution

|

|

The selling stockholder may, from time to time,

sell any or all of their shares of common stock on the stock exchange, market or trading facility on which the shares

are traded or in private transactions. These sales may be at fixed or negotiated prices.

For further information, see “Plan of Distribution” beginning on page 21.

|

|

|

|

|

|

Risk Factors

|

|

There are significant risks involved in

investing in our company. For a discussion of risk factors you should consider before buying our common stock, see “Risk

Factors” beginning on page 8

.

|

RISK FACTORS

An investment in our common stock involves

a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information

in this prospectus in evaluating our company and our business before purchasing our securities. Our business, operating results

and financial condition could be seriously harmed as a result of the occurrence of any of the following risks. You could lose

all or part of your investment due to any of these risks. You should invest in our common stock only if you can afford to lose

your entire investment.

Risks Relating to Our Business

The volatility of precious metal prices

may negatively affect our potential earnings.

We anticipate that a significant portion of

our future revenues will come from the sale of our El Capitan Property. Our earnings will be directly affected by the prices of

precious metals believed to be located on such property. Demand for precious metals can be influenced by economic conditions,

including worldwide production, attractiveness as an investment vehicle, the relative strength of the U.S. dollar and local investment

currencies, interest rates, exchange rates, inflation and political stability. The aggregate effect of these factors is not within

our control and is impossible to predict with accuracy. The price of precious metals has on occasion been subject to very rapid

short-term changes due to speculative activities. Downward fluctuations in precious metal prices may adversely affect the value

of any discoveries made at the site with which our Company is involved. If the market prices for these precious metals falls below

the mining and development costs we incur to produce such precious metals, we will experience the inability to sell our El Capitan

Property.

We have not had revenue-generating operations

and may never generate revenues.

With the exception of immaterial revenue from

the sale of two dore’ bars and the sale of test loads of iron ore to a construction contractor, we have not yet had revenue-generating

operations, and it is possible that we will not find marketable amounts of minerals on our El Capitan Property or that the property

will ever be sold. Should we fail to obtain working capital through other avenues, our ability to continue to market our El Capitan

Property could be curtailed.

Until we confirm recoverable precious

metals on our El Capitan Property, we may not have any potential of generating any revenue.

Our ability to sell the El Capitan Property

depends on the success of our exploration programs and the development of a cost-effective process for recovering precious metals

and iron extracted from the mineralized materials at the El Capitan Property. We have not established proven or probable mineral

deposits at our El Capitan Property. Even if exploration leads to a valuable deposit, it might take several years for us to enter

into an agreement for sale or joint venture development of the property. During that time, depending on economic conditions and

the underlying market values of the precious metals that may be recovered, it might become financially or economically unfeasible

to extract the minerals at the property.

We may not be able to sell the El Capitan

Property or on terms acceptable to us.

We are concentrating our efforts on developing

a strategic plan to sell the El Capitan Property or potentially enter into a joint venture with a major mining company to operate

the mining operation. There is no guarantee that we will be able to find a potential acquirer or joint venture partner on terms

that are acceptable to us or at all.

Our inability to establish the existence

of mineral resources in commercially exploitable quantities on our El Capitan Property may cause our business to fail.

The El Capitan Property has transitioned from

an exploration stage to operations stage during the latter part of our current fiscal year. To date, we have not established a

mineral reserve on the El Capitan Property. A “reserve,” as defined by the Securities and Exchange Commission’s

Industry Guide 7, is that part of a mineral deposit that can be economically and legally extracted or produced at the time of

the reserve determination. A reserve requires a feasibility study demonstrating with reasonable certainty that the deposit can

be economically and legally extracted and produced. At this time it is not ascertainable or it is possible that the El Capitan

Property does not contain a reserve and all resources we spend on exploration of this property may be lost. We have not received

feasibility studies. As a result, we have no reserves at the El Capitan Property. In the event we are unable to establish reserves

or measured resources acceptable under industry standards, we may be unable to sell or enter into a joint venture with respect

to the development of the El Capitan Property, and the business of the Company may fail as a result.

Uncertainty of mineralization estimates

may diminish our ability to properly value our property.

We rely on estimates of the content of mineral

deposits on our properties, which estimates are inherently imprecise and depend to some extent on statistical inferences drawn

from both limited drilling on our properties and the placement of drill holes that may not be spaced close enough to one another

to enable us to establish probable or proven results. These estimates may prove unreliable. Additionally, we have previously relied

upon various certified independent laboratories to assay our samples, which may produce results that are not as consistent as

a larger commercial laboratory might produce. Reliance upon erroneous estimates may have an adverse effect upon the financial

success of the Company.

Any loss of the industry experience of

members of our Board and/or our officers may affect our ability to achieve our business objectives.

The skills of the Company’s directors

span mining, business and legal expertise. The Company relies on contractors and consultants for certain industry matters. All

of these relationships and the background of the directors would be difficult to replace. Fulfilling the Company’s objectives

might be negatively impacted or prove more costly to obtain if we were to lose the services of these directors, contractors or

consultants. The Company does not own life insurance on any of our officers, directors, contractors or consultants.

The nature of mineral exploration is

inherently risky, and we may not ever discover marketable amounts of precious minerals.

Exploration for minerals is highly speculative

and involves greater risk than many other businesses. Most exploration programs fail to result in the discovery of economically

feasible mineralization. Our exploration and mining efforts are subject to the operating hazards and risks common to the industry,

such as:

|

|

•

|

economically insufficient mineralized materials;

|

|

|

•

|

decrease in values due to lower metal prices;

|

|

|

•

|

fluctuations in production cost that may make mining uneconomical;

|

|

|

•

|

unanticipated variations in grade and other geologic problems;

|

|

|

•

|

unusual or unexpected formations;

|

|

|

•

|

difficult surface conditions;

|

|

|

•

|

metallurgical and other processing problems;

|

|

|

•

|

environmental hazards;

|

|

|

•

|

water conditions; and

|

|

|

•

|

government regulations.

|

Any of these risks can adversely affect the

feasibility of development of our El Capitan Property, production quantities and rates, and costs and expenditures. We currently

have no insurance to guard against any of these risks. If we determine that capitalized costs associated with our El Capitan Property

are likely not to be recovered, a write-down of our investment would be necessary. All of these factors may result in unrecoverable

losses or cause us to incur potential liabilities, which could have a material adverse effect on our financial position.

The effect of these factors cannot be accurately

predicted, and the combination of any of these factors may prevent us from selling or otherwise developing the El Capitan Property

and receiving an adequate return on our invested capital.

Extensive government regulation and environmental

risks may require us to discontinue or delay our marketing activities for the sale of El Capitan Property.

Our business is subject to extensive federal, state and local laws and regulations governing exploration,

development, production, labor standards, occupational health, waste disposal, use of toxic substances, environmental regulations,

mine safety and other matters. Additionally, new legislation and regulations may be adopted at any time that may affect our business.

Compliance with these changing laws and regulations could require increased capital and operating expenditures and could prevent

or delay the sale of the El Capitan Property.

Any failure to obtain government

approvals and permits may require us to discontinue future exploration on our El Capitan Property.

We are required to seek and maintain federal

and state government approvals and permits in order to conduct exploration and other activities on our El Capitan Property. The

permitting requirements for our respective claims and any future properties we may acquire will be somewhat dependent upon the

state in which the property is located, but generally will require an initial filing and fee (of approximately $20) relating to

giving notice of an intent to make a claim on such property, followed by a one-time initial filing of a location notice with respect

to such claim (approximately $192), an annual maintenance filing for each claim (generally $155 per claim per year), annual filings

for bulk fuel and water well permits (typically $5 per year each) and, to the extent we intend to take any significant action

on a property (other than casual, surface-level activity), a one-time payment of a reclamation bond to the BLM, which is to be

used for the reclamation of the property upon completion of exploration or other significant activity. In order to take any such

significant action on a property, we are required to provide the BLM with either a notice of operation or a plan of operation

setting forth our intentions. The amount of the reclamation bond is determined by the BLM based upon the scope of the activity

described in the notice or plan of operation. With respect to the current plan of operations on the El Capitan Property, the reclamation

bond was $15,000, but this amount has been increased to $74,499 with the approval of our modified mining permit in December 2014

and subsequently issued on March 25, 2015.

Obtaining the necessary permits can be a complex

and time-consuming process involving multiple jurisdictions, and requiring annual filings and the payment of annual fees. Additionally,

the duration and success of our efforts to obtain permits are contingent upon many variables outside of our control and may increase

costs of or cause delay to our mining endeavors. There can be no assurance that all necessary approvals and permits will be obtained,

and if they are obtained, that the costs involved will make it economically unfeasible to continue our exploration of the El Capitan

Property.

As of the filing this prospectus, we were issued

all our required permits.

Mineral exploration is extremely competitive,

and we may not have adequate resources to successfully compete.

There is a limited supply of desirable mineral

properties available for claim staking, lease or other acquisition in the areas where we contemplate participating in exploration

activities. We compete with numerous other companies and individuals, including competitors with greater financial, technical

and other resources than we possess, and that are in a better position than us to search for and acquire attractive mineral properties.

We have no intention to expand our mineral properties interest outside of the El Capitan Property.

Title to any of our properties may prove

defective, possibly resulting in a complete loss of our rights to such properties.

The primary portion of our holdings includes

unpatented mining claims. The validity of unpatented claims is often uncertain and may be contested. These claims are located

on federal land or involve mineral rights that are subject to the claims procedures established by the General Mining Law of 1872,

as amended. We are required to make certain filings with the county in which the land or mineral is situated and annually with

the BLM and pay an annual holding fee of $155 per claim. If we fail to make the annual holding payment or make the required filings,

our mining claims would become invalid. In accordance with the mining industry practice, generally a company will not obtain title

opinions until it is determined to sell a property. Also no title insurance is available for mining. Accordingly, it is possible

that title to some of our claims may be defective and in that event we would not have good and valid title to the El Capitan Property,

and we would be forced to curtail or cease our exploratory programs on the property site.

Risks Related to Our Common Stock

Our common stock is thinly traded, and

there is no guarantee of the prices at which the shares will trade.

Trading of our common stock is conducted on

the OTCQB Marketplace operated by the OTC Markets Group, Inc., or “OTCQB,” under the ticker symbol “ECPN.”

Not being listed for trading on an established securities exchange has an adverse effect on the liquidity of our common stock,

not only in terms of the number of shares that can be bought and sold at a given price, but also through delays in the timing

of transactions and reduction in security analysts’ and the media’s coverage of the Company. This may result in lower

prices for your common stock than might otherwise be obtained and could also result in a larger spread between the bid and asked

prices for our common stock. Historically, our common stock has been thinly traded, and there is no guarantee of the prices at

which the shares will trade, or of the ability of stockholders to sell their shares without having an adverse effect on market

prices.

Our stock price may be volatile

and as a result you could lose all or part of your investment.

In addition to volatility associated with securities

traded on the OTCQB in general, the value of your investment could decline due to the impact of any of the following factors upon

the market price of our common stock:

|

|

•

|

adverse changes in the worldwide prices for gold, silver or

iron ore;

|

|

|

•

|

disappointing results from our exploration or development

efforts;

|

|

|

•

|

failure to meet operating budget;

|

|

|

•

|

decline in demand for our common stock;

|

|

|

•

|

downward revisions in securities analysts’ estimates

or changes in general market conditions;

|

|

|

•

|

technological innovations by competitors or in competing technologies;

|

|

|

•

|

investor perception of our industry or our prospects; and

|

|

|

•

|

general economic trends.

|

In addition, stock markets have experienced

extreme price and volume fluctuations and the market prices of securities generally have been highly volatile. These fluctuations

commonly are unrelated to operating performance of a company and may adversely affect the market price of our common stock. As

a result, investors may be unable to resell their shares at a fair price.

We have never paid dividends on our common

stock and we do not anticipate paying any dividends in the foreseeable future.

We have not paid dividends on our common stock

to date, and we may not be in a position to pay dividends in the foreseeable future. Our ability to pay dividends depends on our

ability to successfully develop the El Capitan Property and generate revenue from future operations. Further, our initial earnings,

if any, will likely be retained to finance our growth. Any future dividends will depend upon our earnings, our then-existing financial

requirements and other factors and will be at the discretion of our Board of Directors.

Because our common stock is a “penny

stock,” it may be difficult to sell shares of our common stock at times and prices that are acceptable.

Our common stock is a “penny stock.”

Broker-dealers who sell penny stocks must provide purchasers of these stocks with a standardized risk disclosure document prepared

by the SEC. This document provides information about penny stocks and the nature and level of risks involved in investing in the

penny stock market. A broker must also give a purchaser, orally or in writing, bid and offer quotations and information regarding

broker and salesperson compensation, make a written determination that the penny stock is a suitable investment for the purchaser,

and obtain the purchaser’s written agreement to the purchase. The penny stock rules may make it difficult for you to sell

your shares of our common stock. Because of these rules, many brokers choose not to participate in penny stock transactions and

there is less trading in penny stocks. Accordingly, you may not always be able to resell shares of our common stock publicly at

times and prices that you feel are appropriate.

In addition to the “penny stock”

rules described above, the Financial Industry Regulatory Authority (known as “FINRA”) has adopted rules that require

that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment

is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers

must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives

and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative

low priced securities will not be suitable for at least some customers. FINRA requirements make it more difficult for broker-dealers

to recommend that their customers buy our common shares, which may limit your ability to buy and sell our stock and have an adverse

effect on the market for our shares.

We may raise additional capital to fund

our operations. The manner in which we raise any additional funds may affect the value of your investment in our common stock.

Although we have no current expectation to

pursue financings beyond those contemplated by the Equity Purchase Agreement with River North Equity LLC, we may be required to

do so if our circumstances change or opportunities requiring expenditures in excess of the proceeds available under the Equity

Purchase Agreement present themselves. We have no current committed sources of additional capital. We do not know whether additional

financing will be available on terms favorable or acceptable to us when needed, if at all. To the extent that we raise additional

capital by issuing equity securities, our stockholders may experience dilution. In addition, we may grant future investors rights

superior to those of our existing stockholders. If we raise additional funds by incurring debt, we could incur significant interest

expense and become subject to covenants in the related transaction documentation that could affect the manner in which we conduct

our business. If adequate additional capital is not available when required, we may be forced to reduce or eliminate our exploration

activities and our marketing efforts for the sale of the El Capitan Property, or suspend our operations entirely.

Our management concluded that our internal

control over financial reporting was not effective as of September 30, 2016. Compliance with public company regulatory requirements,

including those relating to our internal control over financial reporting, have and will likely continue to result in significant

expenses and, if we are unable to maintain effective internal control over financial reporting in the future, investors may lose

confidence in the accuracy and completeness of our financial reports and the market price of our common stock may be negatively

affected.

As a public reporting company, we are subject

to the Sarbanes-Oxley Act of 2002, or Sarbanes-Oxley, as well as to the information and reporting requirements of the Securities

Exchange Act of 1934, as amended, or the Exchange Act, and other federal securities laws. As a result, we incur significant legal,

accounting, and other expenses, including costs associated with our public company reporting requirements and corporate governance

requirements. As an example of public reporting company requirements, we evaluate the effectiveness of disclosure controls and

procedures and of our internal control over financing reporting in order to allow management to report on such controls.

Our management concluded that our internal

control over financial reporting was not effective as of September 30, 2016 due to a failure to maintain sufficient personnel

with an appropriate level of technical accounting knowledge, experience, and training in the application of generally accepted

accounting principles commensurate with the complexity of our equity derivative financial instruments issued with certain debt

transactions. As a result, there is a lack of monitoring of the accounting and reporting process for these types of transactions.

To address these types of transactions and concur on their treatment, we will have qualified professional review the transaction

treatment prior to recording on the books of the Company.

If significant deficiencies or other material

weaknesses are identified in our internal control over financial reporting that we cannot remediate in a timely manner, investors

and others may lose confidence in the reliability of our financial statements and the trading price of our common stock and ability

to obtain any necessary equity or debt financing could suffer. This would likely have an adverse effect on the trading price of

our common stock and our ability to secure any necessary additional equity or debt financing.

Risks Relating to this Offering

Resales of shares purchased by River

North under the Equity Purchase Agreement may cause the market price of our common stock to decline.

Subject to the terms and conditions of the

Equity Purchase Agreement, we have the right to “put,” or sell, up to $5,000,000 worth of shares of our common stock

to River North. Unless terminated earlier, River North’s purchase commitment will automatically terminate on the earlier

of the date on which River North shall have purchased shares pursuant to the Equity Purchase Agreement for an aggregate purchase

price of $5,000,000 or March 16, 2018. The common stock to be issued to River North pursuant to the Equity Purchase Agreement

will be purchased at a price equal to 85% of the Market Price, which is defined as the average of the two lowest closing bid prices

on the OTCQB, as reported by Bloomberg Finance L.P., during the five consecutive trading days including and immediately prior

to the settlement date of the sale, which in most circumstances will be the trading day immediately following the date that a

put notice is delivered to River North (a “Put Date”); provided, however, that an additional (i) 5% will be added

to the discount if we are not DWAC eligible; (ii) 10% will be added to the discount if we are under DTC chill status on date of

the applicable put notice; and (iii) 10% will be added to the discount if either (A) the closing bid price the common stock is

less than $0.10 per share on the Put Date, or (B) the average daily trading volume in dollar amount for the common stock during

the ten trading days including and immediately preceding a Put Date is less than $50,000. River North will have the financial

incentive to sell the shares of our common stock issuable under the Equity Purchase Agreement in advance of or upon receiving

such shares and to realize the profit equal to the difference between the discounted price and the current market price of the

shares. This may cause the market price of our common stock to decline.

The foregoing description of the terms of the

Equity Purchase Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the

Equity Purchase Agreement itself.

Puts under Equity Purchase Agreement

may cause dilution to existing stockholders.

Under the terms of the Equity Purchase Agreement,

River North has committed to purchase up to $5,000,000 worth of shares of our common stock. This arrangement is also sometimes

referred to herein as the “Equity Line.” From time to time during the term of the Equity Purchase Agreement, and at

our sole discretion, we may present River North with a put notice requiring River North to purchase shares of our common stock.

As a result, our existing stockholders will experience immediate dilution upon the purchase of any of the shares by River North.

River North may resell some, if not all, of the shares that we issue to it under the Equity Purchase Agreement and such sales

could cause the market price of the common stock to decline significantly. To the extent of any such decline, any subsequent puts

would require us to issue and sell a greater number of shares to River North in exchange for each dollar of the put amount. Under

these circumstances, the existing stockholders of our company will experience greater dilution. The effect of this dilution may,

in turn, cause the price of our common stock to decrease further, both because of the downward pressure on the stock price that

would be caused by a large number of sales of our shares into the public market by River North, and because our existing stockholders

may disagree with a decision to sell shares to River North at a time when our stock price is low, and may in response decide to

sell additional shares, further decreasing our stock price. If we draw down amounts under the Equity Line when our share price

is decreasing, we will need to issue more shares to raise the same amount of funding.

There is no guarantee that we will satisfy

the conditions to the Equity Purchase Agreement.

Although the Equity Purchase Agreement provides

that we can require River North to purchase, at our discretion, up to $5,000,000 worth of shares of our common stock in the aggregate,

our ability to put shares to River North and obtain funds when requested is limited by the terms and conditions of the Equity

Purchase Agreement, including restrictions on when we may exercise our put rights, restrictions on the amount we may put to River

North at any one time, which is determined in part by the trading volume of our common stock, and a limitation on our ability

to put shares to River North to the extent that it would cause River North to beneficially own more than 9.99% of the outstanding

shares of our common stock.

We may not have access to the full amount

available under the Equity Purchase Agreement with River North.

Our ability to draw down funds and sell shares

under the Equity Purchase Agreement requires that a registration statement be declared effective and continue to be effective

registering the resale of shares issuable under the Equity Purchase Agreement. We filed a registration statement on Form S-1 registering

the resale of 25,000,000 shares of our common stock, and that registration statement was declared effective on April 20, 2016.

Our ability to sell any additional shares issuable under the Equity Purchase Agreement is subject to our ability to prepare and

file one or more additional registration statements registering the resale of such additional shares. These registration statements

(and any post-effective amendments thereto) may be subject to review and comment by the staff of the Securities and Exchange Commission,

and will require the consent of our independent registered public accounting firm. Therefore, the timing of effectiveness of these

registration statements (and any post-effective amendments thereto) cannot be assured. The effectiveness of these registration

statements is a condition precedent to our ability to sell all of the shares of our common stock to River North under the Equity

Purchase Agreement. Even if we are successful in causing one or more registration statements registering the resale of some or

all of the shares issuable under the Equity Purchase Agreement to be declared effective by the Securities and Exchange Commission

in a timely manner, we may not be able to sell the shares unless certain other conditions are met. For example, we might have

to increase the number of our authorized shares in order to issue the shares to River North. Increasing the number of our authorized

shares will require board and stockholder approval. Accordingly, because our ability to draw down any amounts under the Equity

Purchase Agreement with River North is subject to a number of conditions, there is no guarantee that we will be able to draw down

all of the proceeds of $5,000,000 under the Equity Purchase Agreement.

CAUTIONARY

STATEMENT ON FORWARD-LOOKING STATEMENTS

This prospectus may contain certain “forward-looking”

statements as such term is defined by the Securities and Exchange Commission in its rules, regulations and releases, which represent

the registrant’s expectations or beliefs, including but not limited to, statements concerning the registrant’s operations,

economic performance, financial condition, growth and acquisition strategies, investments, and future operational plans. For this

purpose, any statements contained herein that are not statements of historical fact may be deemed to be forward-looking statements.

Without limiting the generality of the foregoing, words such as “may,” “will,” “expect,” “believe,”

“anticipate,” “intent,” “could,” “estimate,” “might,” “plan,”

“predict” or “continue” or the negative or other variations thereof or comparable terminology are intended

to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, certain

of which are beyond the registrant’s control, and actual results may differ materially depending on a variety of important

factors, including uncertainty related to acquisitions, governmental regulation, managing and maintaining growth, the operations

of the company and its subsidiaries, volatility of stock price, commercial viability of any mineral deposits and any other factors

discussed in this and other registrant filings with the Securities and Exchange Commission.

These risks and uncertainties and other factors

include, but are not limited to those set forth under

“Risk Factors”

of this prospectus. Given these

risks and uncertainties, readers are cautioned not to place undue reliance on our forward-looking statements. All subsequent written

and oral forward-looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety

by these cautionary statements. Except as otherwise required by applicable law, we undertake no obligation to publicly update

or revise any forward-looking statements or the risk factors described in this prospectus or in the documents we incorporate by

reference, whether as a result of new information, future events, changed circumstances or any other reason after the date of

this prospectus.

This prospectus contains forward-looking statements,

including statements regarding, among other things:

|

|

•

|

our

ability to continue as a going concern;

|

|

|

•

|

we will require additional

financing in the future to start production at the El Capitan Property and to bring it into sustained commercial production;

|

|

|

•

|

our anticipated needs for

working capital;

|

|

|

•

|

our ability to secure financing;

|

|

|

•

|

our dependence on our El Capitan

Property for our future operating revenue, which property currently has no proven or probable reserves;

|

|

|

•

|

our mineralized material calculations

at the El Capitan Property are only estimates and are based principally on historic data;

|

|

|

•

|

actual capital costs, operating

costs, production and economic returns may differ significantly from those that we have anticipated;

|

|

|

•

|

exposure to all of the risks

associated with starting and establishing new mining operations, if the development of our mineral project is found to be

economically feasible;

|

|

|

•

|

title to some of our mineral

properties may be uncertain or defective;

|

|

|

•

|

land reclamation and mine

closure may be burdensome and costly;

|

|

|

•

|

significant risk and hazards

associated with mining operations;

|

|

|

•

|

the requirements that we obtain,

maintain and renew environmental, construction and mining permits, which is often a costly and time-consuming process and

may be opposed by local environmental group;

|

|

|

•

|

our exposure to material costs,

liabilities and obligations as a result of environmental laws and regulations (including changes thereto) and permits;

|

|

|

•

|

changes

in the price of silver, gold and iron ore;

|

|

|

•

|

extensive regulation by the

U.S. government as well as state and local governments;

|

|

|

•

|

our projected sales and profitability;

|

|

|

•

|

anticipated trends in our

industry;

|

|

|

•

|

unfavorable weather conditions;

|

|

|

•

|

the lack of commercial acceptance

of our product or by-products;

|

|

|

•

|

problems regarding availability

of materials and equipment; and

|

|

|

•

|

failure of equipment to process

or operate in accordance with specifications, including expected throughput, which could prevent the production of commercially

viable output.

|

Actual events or results may differ materially

from those discussed in forward-looking statements as a result of various factors, including, without limitation, the risks outlined

under “

Risk Factors

” and matters described in prospectus generally. In light of these risks and uncertainties,

there can be no assurance that the forward-looking statements contained in this prospectus will in fact occur. We caution you

not to place undue reliance on these forward-looking statements. In addition to the information expressly required to be included

in this prospectus, we will provide such further material information, if any, as may be necessary to make the required statements,

in light of the circumstances under which they are made, not misleading.

These risks and uncertainties and other factors

include, but are not limited to, those set forth under “

Risk Factors

.

” All subsequent written

and oral forward-looking statements attributable to the company or to persons acting on our behalf are expressly qualified in

their entirety by these cautionary statements. Except as required by federal securities laws, we do not intend to update or revise

any forward-looking statements, whether as a result of new information, future events or otherwise.

CAUTIONARY

NOTE REGARDING EXPLORATION STAGE STATUS

We are considered an “exploration

stage” company under the U.S. Securities and Exchange Commission (“SEC”) Industry Guide 7, Description of Property

by Issuers Engaged or to be Engaged in Significant Mining Operations (“Industry Guide 7”), because we do not have

reserves as defined under Industry Guide 7. Reserves are defined in Guide 7 as that part of a mineral deposit which

can be economically and legally extracted or produced at the time of the reserve determination. The establishment of

reserves under Guide 7 requires, among other things, certain spacing of exploratory drill holes to establish the required continuity

of mineralization and the completion of a detailed cost or feasibility study.

Because we have no reserves as defined in

Industry Guide 7, we have not exited the exploration stage and continue to report our financial information as an exploration

stage entity as required under Generally Accepted Accounting Principles (“GAAP”). Although for purposes of FASB

Accounting Standards Codification Topic 915, Development Stage Entities, we have exited the development stage and no longer report

inception to date results of operations, cash flows and other financial information, we will remain an exploration stage company

under Industry Guide 7 until such time as we demonstrate reserves in accordance with the criteria in Industry Guide 7.

Because we have no reserves, we have and

will continue to expense all mine construction costs, even though these expenditures are expected to have a future economic benefit

in excess of one year. We also expense our reclamation and remediation costs at the time the obligation is incurred. Companies

that have reserves and have exited the exploration stage typically capitalize these costs, and subsequently amortize them on a

units-of-production basis as reserves are mined, with the resulting depletion charge allocated to inventory, and then to cost

of sales as the inventory is sold. As a result of these and other differences, our financial statements will not be

comparable to the financial statements of mining companies that have established reserves and have exited the exploration stage.

SEC INDUSTRY GUIDE

7 DEFINITIONS

The following definitions are taken from the

mining industry guide entitled “Description of Property by Issuers Engaged or to be Engaged in Significant Mining Operations”

contained in the Securities Act Industry Guides published by the United States Securities and Exchange Commission, as amended.

|

Exploration

State

|

|

The term

“exploration state” (or “exploration stage”) includes all issuers engaged in the search for mineral

deposits (reserves) which are not in either the development or production stage.

|

|

|

|

|

|

Development Stage

|

|

The term “development

stage” includes all issuers engaged in the preparation of an established commercially mineable deposit (reserves) for

its extraction which are not in the production stage. This stage occurs after completion of a feasibility study.

|

|

|

|

|

|

Mineralized Material

|

|

The term “mineralized

material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate

demonstration for economic or legal extraction.

|

|

|

|

|

|

Probable (Indicated)

Reserve

|

|

The term “probable

reserve” or “indicated reserve” refers to reserves for which quantity and grade and/or quality are computed

from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement

are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves,

is high enough to assume continuity between points of observation.

|

|

|

|

|

|

Production Stage

|

|

The term “production

stage” includes all issuers engaged in the exploitation of a mineral deposit (reserve).

|

|

|

|

|

|

Proven (Measured)

Reserve

|

|

The term “proven reserve”

or “measured reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops,

trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites

for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape,

depth and mineral content of reserves are well-established.

|

|

|

|

|

|

Reserve

|

|

The term “reserve”

refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the

reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the

economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements

developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments

to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is

mined.

|

USE OF PROCEEDS

We will not receive any proceeds from the sale

of the common stock by the selling security holder. However, we will receive proceeds from the sale of shares of our common stock

pursuant to River North under the Equity Purchase Agreement. We will use these proceeds for general corporate and working capital

purposes, or for other purposes that our Board of Directors, in its good faith, deems to be in the best interest of our Company.

We have agreed to bear the expenses relating to the registration of the offer and resale by the selling security holder of the

shares issuable under the Equity Purchase Agreement.

THE OFFERING

The selling stockholder, River North, may offer

and resale of up to 25,000,000 shares of our common stock, par value $0.001 per share pursuant to this prospectus. All

of such shares represent shares that River North has agreed to purchase from us pursuant to the terms and conditions

of an Equity Purchase Agreement we entered into with them on March 16, 2016, as amended December 9, 2016 (the “Equity Purchase

Agreement”), which are described below.

Equity Purchase Agreement and Registration Rights Agreement

with River North Equity, LLC

Subject to the terms and conditions of the

Equity Purchase Agreement, we have the right to “put,” or sell, up to $5,000,000 worth of shares of our common stock

to River North. Unless terminated earlier, River North’s purchase commitment will automatically terminate on

the earlier of the date on which River North shall have purchased shares pursuant to the Equity Purchase Agreement for an aggregate

purchase price of $5,000,000 or March 16, 2018. The Company has no obligation to sell any shares under the Equity Purchase Agreement.

This arrangement is also sometimes referred to herein as the “Equity Line.”

As provided in the Equity Purchase Agreement,

the Company may require River North to purchase shares of common stock from time to time by delivering a put notice to River North

specifying the total number of shares to be purchased (such number of shares multiplied by the Purchase Price, the “Investment

Amount”); provided there must be a minimum of ten trading days between delivery of each put notice. The Company may determine

the Investment Amount, provided that such amount may not be more than the average daily trading volume in dollar amount for the

Company’s common stock during the 10 trading days preceding the date on which the Company delivers the applicable put notice.

Additionally, such amount may not be lower than $5,000 or higher than $150,000. River North will have no obligation to purchase

shares under the Equity Purchase Agreement to the extent that such purchase would cause River North to own more than 9.99% of

the Company’s common stock.

For each share of the Company’s common

stock purchased under the Equity Purchase Agreement, River North will pay a purchase price equal to 85% of the Market Price, which

is defined as the average of the two lowest closing bid prices on the OTCQB Marketplace, as reported by Bloomberg Finance L.P.,

during the five consecutive Trading Days including and immediately prior to the settlement date of the sale, which in most circumstances

will be the trading day immediately following the date that a put notice is delivered to River North (the “Pricing Period”).

The purchase price will be adjusted as follows: (i) to 75% of Market Price if either (A) the Closing Price of the Common Stock

on the Put Date is less than $0.10 per share, or (B) the average daily trading volume in dollar amount for the Common Stock during

the ten Trading Days including and immediately preceding the Put Date is less than $50,000; (ii) to 80% of Market Price if the

Company is not deposit/withdrawal at custodian (“DWAC”) eligible; and (iii) to 75% of Market Price if the Company

is under DTC “chill” status. On the first trading day after the Pricing Period, River North will purchase the applicable

number of shares subject to customary closing conditions, including without limitation a requirement that a registration statement

remain effective registering the resale by River North of the shares to issued pursuant to the Equity Purchase Agreement as contemplated

by the Registration Rights Agreement described below.

The Equity Purchase Agreement with River North

is not transferable and any benefits attached thereto may not be assigned. As of the date of this prospectus, we have issued and

sold an aggregate of 20,757,307 shares of common stock to River North for aggregate proceeds of $1,216,265.

In connection with the Equity Purchase Agreement,

we also entered into Registration Rights Agreement with River North requiring the Company to prepare and file, within 45 days

of the effective date of the Registration Rights Agreement, a registration statement registering the resale by River North of

the shares to be issued under the Equity Purchase Agreement, to use commercially reasonable efforts to cause such registration

statement to become effective, and to keep such registration statement effective until (i) three months after the last closing

of a sale of shares under the Equity Purchase Agreement, (ii) the date when River North may sell all the shares under Rule 144

without volume limitations, or (iii) the date River North no longer owns any of the shares. In accordance with the Registration

Rights Agreement, on April 11, 2016, we filed the registration statement of which this prospectus is a part registering the resale

by River North of up to 25,000,000 shares that may be issued and sold to River North under the Equity Purchase Agreement. Such

registration statement was declared effective by the SEC on April 20, 2016.

The 25,000,000 shares being offered pursuant

to this prospectus represent approximately 6.8% of our shares of common stock issued and outstanding held by non-affiliates of

our Company as of the date of this prospectus.

The foregoing description of the terms of the

Equity Purchase Agreement (as amended) and Registration Rights Agreement does not purport to be complete and is subject to and

qualified in its entirety by reference to the agreements and instruments themselves, copies of which are filed as Exhibit 10.1

to our Current Report on Form 8-K dated March 16, 2016, Exhibit 10.1 to our Current Report on Form 8-K dated December 9, 2016,

and Exhibit 10.2 to our Form 8-K dated March 16, 2016, respectively, and incorporated into this prospectus by reference. The benefits

and representations and warranties set forth in such agreements and instruments are not intended to and do not constitute continuing

representations and warranties of the Company or any other party to persons not a party thereto.

We intend to sell River North periodically

our common stock under the Equity Purchase Agreement and River North will, in turn, sell such shares to investors in the market

at the market price or at negotiated prices. This may cause our stock price to decline, which will require us to issue increasing

numbers of common shares to River North to raise the intended amount of funds, as our stock price declines.

Likelihood of Accessing the Full Amount of the Equity Line

Notwithstanding that the Equity Line is in

an amount of $5,000,000, we anticipate that the actual likelihood that we will be able access the full $5,000,000 is low due to

several factors, including that our ability to access the Equity Line is impacted by our average daily trading volume, which may

limit the maximum dollar amount of each put we deliver to River North, and our stock price. As of the date of this prospectus,

we have received an aggregate of $1,216,265 from our sale of 20,757,307 shares under the Equity Line. If the price of our stock

remains at $0.06 per share (which represents the average of the high and low reported sales prices of our common stock on January

13, 2017), the sale by the selling stockholder of all 25,000,000 of the shares registered in this prospectus would mean we would

receive an additional $254,561.56 from our sale of shares under the Equity Line. Our use of the Equity Line will continue to be

limited and restricted if our share trading volume or and market price of our stock continue at their current levels or decrease

further in the future from the volume and stock prices reported over the past year.

In addition, we have had to increase the number

of our authorized shares in order to issue the shares to River North, and we may have to do so again in the future. At our annual

meeting of stockholders held September 28, 2016, our stockholders approved an increase in the number of authorized shares of the

Company’s common stock from 400,000,000 to 500,000,000 shares. Further increasing the number of our authorized shares will

require further board and stockholder approval. Our ability to issue shares in excess of the 25,000,000 shares covered by the

registration statement, of which this prospectus is a part, will be subject to our filing a subsequent registration statement

with the SEC and the SEC declaring it effective. Accordingly, because our ability to deliver puts to River North under the Equity

Purchase Agreement is subject to a number of conditions, there is no guarantee that we will receive any portion or all of the

proceeds of $5,000,000 under the Equity Purchase Agreement with River North.

SELLING

STOCKHOLDER

This prospectus covers the resale by River

North of 25,000,000 shares of our common stock that may be issued by us to River North under the Equity Purchase Agreement. River

North is an “underwriter” within the meaning of the Securities Act in connection with the resale of our common stock

pursuant to this prospectus. River North has not had any position or office, or other material relationship with us or any of

our affiliates over the past three years. The following table sets forth certain information regarding the beneficial ownership

of shares of common stock by River North as of January 18, 2017 and the number of shares of our common stock being offered pursuant

to this prospectus.

|

Name

of selling

stockholder

|

Shares

beneficially

owned as of the date of this prospectus

(1)

|

Number

of shares

being offered

|

Number

of shares to be beneficially owned and percentage of beneficial ownership after the offering (1)(2)

|

|

Number

of

shares

|

Percentage

of

class (2)(3)

|

|

River

North Equity LLC (4)

|

501,803

|

25,000,000

|

0

|

0%

|

_______________

|

*

|

Less than 1%.

|

|

|

|

|

(1)

|

Beneficial ownership is determined in

accordance with Securities and Exchange Commission rules and generally includes voting or investment power with respect to

shares of common stock. Shares of common stock subject to options and warrants currently exercisable, or exercisable within

60 days, are counted as outstanding for computing the percentage of the person holding such options or warrants but are not

counted as outstanding for computing the percentage of any other person.

|

|

|

|

|

(2)

|

The amount and percentage of shares of

our common stock that will be beneficially owned by River North after completion of the offering assume that River North will

sell all of its shares of our common stock being offered pursuant to this prospectus.

|

|

|

|

|

(3)

|

Based on 384,476,034 shares of our common

stock issued and outstanding as of January 16, 2017. All shares of our common stock being offered pursuant to this prospectus

by River North are counted as outstanding for computing the percentage beneficial ownership of River North.

|

|

|

|

|

(4)

|

Edward M. Liceaga possesses voting and

investment power over shares owned by River North.

|

PLAN

OF DISTRIBUTION

The selling stockholder may, from time to time,

sell any or all of shares of our common stock covered hereby on the OTCQB Marketplace operated by the OTC Markets Group, Inc.,

or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. The selling

stockholder may sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market

prices at the time of sale, at varying prices or at negotiated prices. The selling stockholder may use any one or more of the

following methods when selling securities:

|

|

•

|

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block

as principal to facilitate the transaction;

|

|

|

•

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

an

exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

privately

negotiated transactions;

|

|

|

•

|

in

transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such securities

at a stipulated price per security;

|

|

|

•

|

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

•

|

a

combination of any such methods of sale; or

|

|

|

•

|

any

other method permitted pursuant to applicable law.

|

The selling stockholder may also sell securities

under Rule 144 under the Securities Act, if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholder

may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling

stockholder (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts to be negotiated,

provided such amounts are in compliance with FINRA Rule 2121.

River North Equity, LLC is an underwriter within

the meaning of the Securities Act and any broker-dealers or agents that are involved in selling the shares may be deemed to be

“underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions

received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting

commissions or discounts under the Securities Act. Because the selling stockholder is an underwriter within the meaning of the

Securities Act, it will be subject to the prospectus delivery requirements of the Securities Act. Discounts, concessions, commissions

and similar selling expenses, if any, that can be attributed to the sale of common stock will be paid by the selling stockholder

and/or the purchasers.

Under applicable rules and regulations under

the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market making

activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the selling stockholder will be subject to applicable provisions of the Exchange Act and the

rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of securities of the

common stock by the selling stockholder or any other person. We will make copies of this prospectus available to the selling security

holders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the

sale.

Although River North has agreed not to enter

into any “short sales” of our common stock, sales after delivery of a put notice of a number of shares reasonably

expected to be purchased under a put notice shall not be deemed a “short sale.” Accordingly, River North may enter

into arrangements it deems appropriate with respect to sales of shares of our common stock after it receives a put notice under

the Equity Purchase Agreement so long as such sales or arrangements do not involve more than the number of put shares reasonably

expected to be purchased by River North under such put notice.

DESCRIPTION

OF SECURITIES

Capital Stock

Pursuant to our articles of incorporation,