Current Report Filing (8-k)

29 April 2023 - 6:04AM

Edgar (US Regulatory)

0001652958

false

0001652958

2023-04-25

2023-04-25

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

April 25, 2023

Edgemode,

Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-55647 |

|

47-4046237 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

110 E. Broward Blvd., Suite 1700, Ft. Lauderdale,

FL 33301

(Address of Principal Executive Offices, and Zip

Code)

(707) 687-9093

Registrant’s Telephone Number, Including

Area Code

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| None |

Not Applicable |

Not Applicable |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material

Definitive Agreement.

On April 25, 2023, Edgemode, Inc.

(the “Company”) entered into a Securities Purchase Agreement (the “Promissory Note Purchase Agreement”) with an

accredited investor (the “Investor”), pursuant to which the Company sold the Investor an unsecured promissory note in the

principal amount of $60,000 (the “Promissory Note”). The Company received gross proceeds of $60,000 in consideration of issuance

of the Promissory Note.

In addition, on April 26, 2023,

the Company entered into a Promissory Note Purchase Agreement with another Investor, pursuant to which the Company sold the Investor an

unsecured convertible promissory note in the principal amount of $57,502 Promissory Note. The Company received gross proceeds of $57,502

in consideration of issuance of the Promissory Note.

The Promissory Notes shall bear

interest at a rate of ten percent (10%) and have a maturity date of May 25, 2023 and May 26, 2023, respectively. The Promissory Notes

are convertible into common shares of the Company beginning on the sixth-month anniversary if not repaid by the maturity date. The Promissory

Notes have a prepayment percentage of 130% for the period beginning on the issuance date and ending on the maturity date.

The Investors may

in their option, at any time following the 180-day anniversary from the issuance date, as defined in the Promissory Notes, convert all

or any part of the outstanding and unpaid amount of the Promissory Notes into fully paid and non-assessable shares of Common Stock. If

the Promissory Notes are not repaid on or prior to the maturity date, the conversion price will be $0.20 or 50% of the preceding five

day VWAP on the six month anniversary, which is lower, subject to a floor conversion price of $0.01 per share. Furthermore, the Notes

contain a “most favored nation” provision that allows each Investor to claim any preferable terms from any future securities,

excluding certain except issuances.

Additionally, the Company agreed

to reserve 11,750,200 shares of common stock for issuance upon full conversion of both Promissory Notes.

The Promissory Notes provide for

standard and customary events of default such as failing to timely make payments under the Promissory Notes when due, the failure of the

Company to timely comply with the Securities Exchange Act of 1934, as amended, reporting requirements and the failure to maintain a listing

on the OTC Markets. The Promissory Notes also contains customary covenants. At no time may the Promissory Notes be converted into shares

of the Company’s common stock if such conversion would result in the Investor, or its affiliates owning an aggregate of more than

4.99% of the then outstanding shares of the Company’s common stock.

The Promissory Notes were issued

in a private placement in reliance upon an exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended.

The description of the Promissory

Note Purchase Agreement and the Promissory Notes are not complete and are qualified in its entirety by the full text of the Promissory

Note Purchase Agreement and the Promissory Note, filed herewith as Exhibits 10.1 and 10.2, which are incorporated by reference into

this Item 1.01.

Item 2.03 Creation of a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information provided above

in Item 1.01 herein is incorporated by reference into this Item 2.03.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Edgemode, Inc. |

| |

|

|

| Dated: April 28, 2023 |

By: |

/s/ Charles Faulkner |

| |

Name: |

Charles Faulkner |

| |

Title: |

Chief Executive Officer |

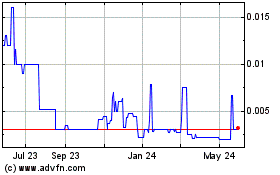

EdgeMode (CE) (USOTC:EDGM)

Historical Stock Chart

From Dec 2024 to Jan 2025

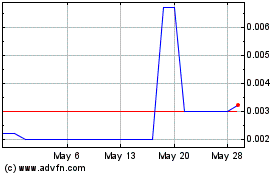

EdgeMode (CE) (USOTC:EDGM)

Historical Stock Chart

From Jan 2024 to Jan 2025