Current Report Filing (8-k)

10 May 2019 - 6:08AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported):

May 9, 2019 (May 3, 2019)

GLASSBRIDGE

ENTERPRISES, INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-14310

|

|

41-1838504

|

|

(State

or other jurisdiction

|

|

(Commission

|

|

(IRS

Employer

|

|

of

incorporation)

|

|

File

Number)

|

|

Identification

Number)

|

510

Madison Avenue, Ninth Floor, New York, NY 10022

(Address of principal executive offices, including zip code)

(212)

825-0400

(Registrant’s

telephone number, including area code)

1099

Helmo Ave. N., Suite 250, Oakdale, Minnesota 55128

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement

Background

As

previously disclosed, on July 1, 1996, GlassBridge Enterprises, Inc., formerly known as Imation Corp., a Delaware corporation

(the “Company”) adopted the Imation Cash Balance Pension Plan, now known as the GlassBridge Enterprises Cash Balance

Pension Plan (the “Plan”), an employee benefit plan formed pursuant to 29 U.S.C. § 1321(a). Beginning in September

2018, the Company entered into discussions with the U.S. Pension Benefit Guaranty Corporation (the “

PBGC

”),

a United States government agency established by Title IV of the Employee Retirement Income Security Act of 1974 (“

ERISA

”)

which insures certain pension plans., for the purpose of obtaining certain relief from the Company’s obligations under the

Plan. On April 16, 2019, the Company received notice from the PBGC, that the Company’s application for termination of the

Plan had been approved by the PBGC, with the termination date of the Plan to occur on April 30, 2019, the PBGC finding that (i)

the Plan did not meet the minimum funding standard required under section 412 of the Internal Revenue Code; (ii) the Plan would

be unable to pay benefits when due and (iii) the Plan should be terminated in order to protect the interests of the Plan participants

(the “

Notice of Determination

”). Pursuant to the Notice of Determination, any settlement reached by the Company

with the PBGC may be accomplished by an agreement between the Company and the PBGC. Together with the Notice of Determination,

the PBGC furnished to the Company an Agreement for Appointment of Trustee and Termination of Plan (the “

Appointment Agreement

Agreement

”). The Plan was terminated effective April 30, 2019 and the PBGC was appointed trustee of the Plan (the “

PBGC

Arrangement

”). The foregoing is merely a summary of the Appointment Agreement and the PBGC Arrangement, and is qualified

in its entirety by reference to the full text of the Appointment Agreement, which is attached hereto as

Exhibit 10.1

.

Related-Party

Transactions

In

connection with the successful consummation of the PBGC Arrangement, the Company’s Board of Directors (the “

Board

”)

voted on May 3, 2019 to furnish to Clinton Group, Inc. (“

Clinton

”) a one-time cash payment of $250,000 in consideration

of Clinton’s efforts regarding the same. Clinton is an investment adviser registered with the U.S. Securities and Exchange

Commission, and is a stockholder of the Company.

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The

information disclosed under Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 2.03.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

GLASSBRIDGE

ENTERPRISES, INC.

|

|

|

|

|

|

Dated:

May 9, 2019

|

By:

|

/s/

Daniel Strauss

|

|

|

Name:

|

Daniel

Strauss

|

|

|

Title:

|

Chief

Executive Officer

|

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From Jun 2024 to Jul 2024

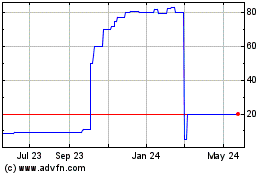

GlassBridge Enterprises (CE) (USOTC:GLAE)

Historical Stock Chart

From Jul 2023 to Jul 2024