- Production of 10,485 gold

ozs or 10,800 gold equivalent (AuEq) oz’s for the Quarter at a cost

of $576/gold oz or $590/ gold equivalent oz and an all-in

sustaining cost of $784/gold oz or $792/gold equivalent

oz1

- Revenue less Cost of Sales for the three months ended

June 30, 2018, was US$6,453,063

- Reaffirms production guidance issuance for 2018

expected to be between 42,000 and 46,000 gold equivalent

ozs

- Cash cost guidance for 2018 expected to be US$530 to

US$560 per gold equivalent oz, with all-in sustaining costs

expected to be US$720 to US$780 per gold equivalent

oz1

Note1 - a non-IFRS

measure computed in the Company’s MD&A in the non-IFRS

performance measures section.

VANCOUVER, British Columbia, Aug. 16, 2018

(GLOBE NEWSWIRE) -- K92 Mining Inc. (TSX-V: KNT; OTCQX:

KNTNF) (the “Company” or

“K92”) is pleased to announce second quarter

financial results and confirm 2018 production guidance.

For complete details of the unaudited condensed

consolidated interim financial statements and associated

management's discussion and analysis, please refer to the company's

filings on SEDAR. All amounts are in U.S. dollars unless

otherwise indicated.

Other Highlights

- An updated resource for Kora North, comprising a Measured

Resource of 242,900 tonnes @ 13.9 g/t Au, 19 g/t Ag and 1.0% Cu; an

Indicated Resource of 442,800 tonnes @ 11.8 g/t Au, 21 g/t Ag and

1.2% Cu and an Inferred Resources of 1,084,400 tonnes @ 13.6 g/t

Au, 15 g/t Ag and 1.0% Cu announced.

- Exploration drilling commenced on Yanobo/Yompassa porphyry

target.

- No lost time injuries recorded in the three months ended June

30, 2018.

John Lewins, K92 Chief Executive Officer and

Director, states, “The Second Quarter of 2018 saw a

continuation of the build-up in production from the Kora deposit,

with 10,800 ozs of gold equivalent ozs produced – an increase of

over 10% on the First Quarter. The Quarter also saw the Company

report a net income in excess of US$4 million with a Cash Cost of

US$576/oz and AISC of US$784/oz. The slight increase in the AISC

reflecting the increased expenditure on development and equipment

necessary to establish the access and infrastructure for the longer

term sustainable mining of the Kora deposit.

At the end of the quarter a fall of ground

(“FOG”) near muck bay 4 in the incline necessitated the

acceleration of the remediation and replacement of ground support

in this area. This work had been scheduled to be undertaken over an

extended period to spread the resultant disruption to operations

over the balance of the year. However, as a result of the FOG, this

work has been completed in a single period of approximately 3

weeks. This work has not changed the production guidance for

2018.”

MINE OPERATING ACTIVITIES

| |

| |

Three

months ended |

Six

months ended |

| |

June 30,

2018 |

June 30,

2018 |

| |

|

|

|

Operating data: |

|

| Head

grade (Au g/t) |

20.40 |

18.78 |

| Gold

Recovery (%) |

93.50% |

92.60% |

| Gold

ounces produced |

10,485 |

19,809 |

| Gold

ounces equivalent produced (1) |

10,800 |

20,529 |

|

Pounds of copper produced |

128,634 |

294,610 |

|

Silver ounces produced |

1,671 |

4,423 |

|

|

|

|

Financial data (in thousands of dollars): |

|

|

Revenues -- gold sales |

$13,734 |

$22,260 |

| Mine

operating expenses |

($6,665) |

($9,903) |

|

Depreciation and depletion |

($619) |

($1,145) |

|

|

|

|

Statistics (in dollars): |

|

|

Average realized selling price (per ounce) |

$1,301 |

$1,311 |

| Cash

cost (per ounce) (1) |

$576 |

$566 |

|

All-in sustaining cost (per ounce) (1) |

$784 |

$768 |

Review of financial results

Net income

The Company's net income for the three-month

period ended June 30, 2018, totalled $4,071,596 or income per share

of two cents compared with net loss of $1,035,441 or a loss per

share of one cent for the three-month period ended June 30,

2017.

Notes

(1) The Company provides some non-international

financial reporting standard measures as supplementary information

that management believes may be useful to investors to explain the

Company's financial results. Please refer to non-IFRS

financial performance measures of the Company's management's

discussion and analysis dated August 15, 2018, available on SEDAR,

for reconciliation of these measures.

K92 has not based its production decisions on

mineral reserve estimates or feasibility studies, and historically

such projects have increased uncertainty and risk of failure.

Mineral resources that are not mineral reserves do not have

demonstrated economic viability.

Qualified Person

K92 mine geology manager and mine exploration

manager, Andrew Kohler, PGeo, a qualified person under the meaning

of Canadian National Instrument 43-101 - Standards of

Disclosure for Mineral Projects, has reviewed and is

responsible for the technical content of this news release.

Data verification by Mr. Kohler includes significant time onsite

reviewing drill core, face sampling, underground workings, and

discussing work programs and results with geology and mining

personnel.

For further information regarding the Kainantu

gold mine, please refer to the technical report dated March 2,

2017, and entitled "Independent Technical Report, Mineral Resource

Update and Preliminary Economic Assessment of Irumafimpa and Kora

Gold Deposits, Kainantu Project, Papua New Guinea," available on

SEDAR.

On Behalf of the Company,

John Lewins, Chief Executive Officer and

Director

For further information, please contact the

Company at +1-604-687-7130.

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION

SERVICES PROVIDER (AS THAT TERM IS DEFINED IN POLICIES OF THE TSX

VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR

ACCURACY OF THIS RELEASE.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION: This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation. Forward-looking statements are necessarily based upon

a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward-looking statements. All statements that address future

plans, activities, events, or developments that the Company

believes, expects or anticipates will or may occur are

forward-looking information, including statements regarding the

realization of the preliminary economic analysis for the Project,

expectations of future cash flows, future production, estimated

cash costs, the proposed plant expansion, potential expansion of

resources and the generation of further drilling results which may

or may not occur. Forward-looking statements and information

contained herein are based on certain factors and assumptions

regarding, among other things, the market price of the Company’s

securities, metal prices, exchange rates, taxation, the estimation,

timing and amount of future exploration and development, capital

and operating costs, the availability of financing, the receipt of

regulatory approvals, environmental risks, title disputes, failure

of plant, equipment or processes to operate as anticipated,

accidents, labour disputes, claims and limitations on insurance

coverage and other risks of the mining industry, changes in

national and local government regulation of mining operations, and

regulations and other matters.. There can be no assurance that such

statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such

statements. Accordingly, readers should not place undue reliance on

forward-looking statements. The Company disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

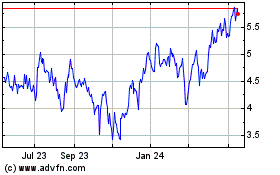

K92 Mining (QX) (USOTC:KNTNF)

Historical Stock Chart

From Dec 2024 to Jan 2025

K92 Mining (QX) (USOTC:KNTNF)

Historical Stock Chart

From Jan 2024 to Jan 2025