Nighthawk Systems, Inc. (OTCBB: NIHK), a leading provider of

wireless and IP-based control devices and solutions, reported a

decline in revenues for the fiscal quarter ending March 31, 2009

with the filing of its Form 10-Q with the Securities and Exchange

Commission yesterday. After producing record results during 2008,

revenues fell during the first quarter as the Company was

negatively impacted by poor economic conditions in the hospitality

industry and tighter credit conditions throughout the Company�s

supply chain.

Nighthawk�s CEO, Doug Saathoff, commented, �We entered 2009 on a

very positive trend, but were almost immediately hit by

difficulties due to the downturn in the economy during the first

quarter. Orders for set-top boxes were negligible during the

quarter as compared to last year as the hospitality industry

stopped or delayed projects due to lower than expected occupancy

rates. We received orders from utilities during the quarter, but

nearly every supplier of parts for the Company�s products was

forced to reduce inventory levels due to tighter credit conditions.

As a result, lead times for critical parts doubled or tripled

during the quarter, making it nearly impossible for the Company to

complete and ship orders for power control products that we

received during the quarter. In some cases, lead times for parts

expanded to 12 weeks.�

Mr. Saathoff continued, �Coming off of a record year in 2008, it

was disappointing to be affected so significantly and so quickly in

ways that were difficult for us to control. However, I think the

negative impact for 2009 as a whole may be limited to sales of

set-top boxes, as we began to see momentum build in our power

control division during the quarter. Ironically, I believe the

economy has begun to help generate orders for these products, as

companies are looking harder than ever for ways to cut costs, and

electric utilities look to limit their exposure to delinquent

accounts. We started shipping products on a steady basis in the

latter part of April, have continued to receive more orders and

have a current order backlog of approximately $730,000 for power

control products. This is quite significant when considering that

the Company produced a total of approximately $1.25 million in

revenues from power control product sales in all of 2008.

Government incentives and new regulations are spurring interest in

the utility industry just as we are bringing new products into the

market. We cut overhead costs to new lows during the quarter, so I

remain optimistic that we�ll continue to experience growth this

year past historical revenue levels, and positive cash flows remain

our near-term goal.�

Revenues generated during the first quarter of 2009 were

$101,362 as compared to $826,321 million for the first quarter of

2008, as demand for set-top boxes was very light and long lead

times for critical components lengthened production schedules for

the Company�s products. Selling, general and administrative costs

decreased 37% from last year�s quarter to this year�s quarter. As a

result, the loss before non-cash items such as interest,

depreciation and amortization, taxes and preferred dividends

improved from $471,465 last year to $394,988 this year. The

Company�s net loss also improved from $770,197 in the 2008 quarter

to $706,594 in the 2009 quarter, while the net loss per common

share remained at $0.01 from quarter to quarter.

About Nighthawk Systems,

Inc.

Nighthawk is a leading provider of intelligent devices and

systems that allow for the centralized, on-demand management of

assets and processes. Nighthawk products are used throughout the

United States in a variety of mission critical applications,

including remotely turning on and off and rebooting devices,

activating alarms, and emergency notification, including the

display of custom messages. Nighthawk�s IPTV set top boxes are

utilized by the hospitality industry to provide in-room standard

and high definition television and video on demand. Individuals

interested in Nighthawk Systems can sign up to receive email alerts

by visiting the Company�s website at www.nighthawksystems.com.

Statements contained in this release, which are not

historical facts, including statements about plans and expectations

regarding business areas and opportunities, acceptance of new or

existing businesses, capital resources and future business or

financial results are "forward-looking" statements. You

should not place undue reliance on these forward-looking

statements. Such forward-looking statements are subject to risks

and uncertainties, including, but not limited to, customer

acceptance of our products, our ability to raise capital to fund

our operations, our ability to develop and protect proprietary

technology, government regulation, competition in our industry,

general economic conditions and other risk factors which could

cause actual results to differ materially from those projected or

implied in the forward-looking statements. Although we believe the

expectations reflected in the forward-looking statements are

reasonable, they relate only to events as of the date on which the

statements are made, and our future results, levels of activity,

performance or achievements may not meet these expectations.

We do not intend to update any of the forward-looking

statements after the date of this press release to conform these

statements to actual results or to changes in our expectations,

except as required by law.

****Financial Statements

Follow****

NIGHTHAWK SYSTEMS, INC.

CONSOLIDATED BALANCE

SHEETS

� �

March 31, December 31, 2009 2008

�

(unaudited)

(audited)

ASSETS

CURRENT ASSETS Cash $ 4,046 $ 36,199 Accounts receivable, net

28,033 251,392 Inventories 189,098 179,258 Prepaid expenses 105,129

� 87,747 � TOTAL CURRENT ASSETS 326,306 554,596 � FIXED ASSETS

Furniture, fixtures and equipment, net 299,253 318,070 Debt

issuance cost 321,136 316,567 Intangible assets, net 755,369

848,031 Goodwill 1,837,138 1,837,138 Other assets 4,320 � 4,320 �

NET FIXED ASSETS $ 3,217,216 $ 3,324,126 � �

TOTAL ASSETS

$ 3,543,522 �

$ 3,878,722 � �

LIABILITIES AND STOCKHOLDERS' EQUITY CURRENT LIABILITIES

Accounts payable $ 464,176 $ 553,202 Accrued interest 776,435

652,323 Accrued expenses 176,551 186,763 Deposits and other 20,523

13,107 Line of credit and notes Payable: Line of credit 5,821 6,221

Convertible notes, net of discount

of $716,954 in 2009 and $645,509 in 2008

1,945,108 1,716,553 Other notes 689,594 � 767,295 � TOTAL CURRENT

LIABILITIES 4,078,208 3,895,464 Long-term notes payable 24,631 �

26,240 � � STOCKHOLDERS' EQUITY (DEFICIT) Series A Preferred stock;

$0.001 par value; 5,000,000 shares authorized; no shares issued and

outstanding - Series B Preferred stock; $0.001 par value; 1,000,000

shares authorized; 672,000 shares issued and outstanding at

September 30, 2008 and December 31, 2007; liquidation preference of

$6,000,000 6,332,000 6,152,000

Common stock; $0.001 par value;

200,000,000 shares authorized; 140,128,013 issued and outstanding

at March 31, 2009 and 138,513,727 issued and outstanding at

December 31, 2008

140,128 138,514 Additional paid in capital 12,789,021 12,780,376

Accumulated deficit (19,820,466 ) (19,113,872 ) � TOTAL

STOCKHOLDERS' DEFICIT (559,317 ) (42,982 )

TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY $ 3,543,522 �

$

3,878,722 � �

NIGHTHAWK SYSTEMS, INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(unaudited)

� �

Three Months Ended

March 31,

2009 �

2008 � Revenue $ 101,362 $ 826,321 � Cost of

revenue � 97,777 � � � 668,497 � � Gross profit 3,585 157,824 �

Selling, general and administrative expenses � 398,573 � � �

629,289 � � EBITDA (394,988 ) (471,465 ) � Depreciation and

amortization � 96,695 � � � 107,388 � Loss from operations �

(491,683 ) � � (578,853 ) � Interest expense � 214,911 � � �

191,344 � Net loss (706,594 ) (770,197 ) � Dividends on preferred

stock � (180,000 ) � � (179,507 ) � Net loss applicable to common

stockholders $ (886,594 ) � $ (949,704 ) � Net loss per basic and

diluted common share $ (0.01 ) � $ (0.01 ) �

Weighted average number of common

shares outstanding, basic and diluted

� 139,518,172 � � � 134,433,060 � �

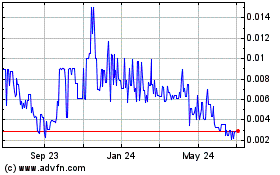

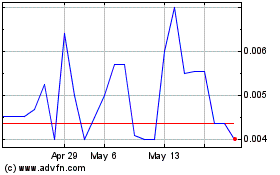

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Video River Networks (PK) (USOTC:NIHK)

Historical Stock Chart

From Feb 2024 to Feb 2025