Hellyer Production Rate Significantly Increased

29 September 2020 - 12:00AM

OTC Markets

London, United Kingdom September 28, 2020 NQ Minerals Plc

(AQSE:NQMI, OTCQB:NQMLF, US ADR OTCQB:NQMIY) (NQ or the Company) is

pleased to announce that the Companys flagship Hellyer Mine in

Tasmania, Australia, has successfully increased production and

processing rates up to 165 tonnes per hour (tph) and plans are

being finalised to increase production further to 180 tph (about

1.5 million tonnes per annum (Mtpa)).

As previously announced, the operations have been undergoing

processing circuit modifications since the end of June 2020 and

this work has since achieved an average annualised production rate

of 1.23 Mtpa for the months of July and August 2020. This is a very

significant increase from Q1 2020 performance of 0.905 Mtpa and Q2

2020 rates of 1.01 Mtpa and compares to 2019 Hellyers full year

plant throughput totalling 0.84 million tonnes (an average of 103

tph and 92% plant availability).

During this transition to higher production rates, it has become

evident that production levels in excess of 1.2 Mtpa might be

possible, and as a consequence NQ Minerals has agreed with Hellyer

management to continue this throughput increase initiative and

associated investment with a view to a revised long term maximum

production target of 1.5 Mtpa.

NQ Minerals Executive Chairman, Mr David Lenigas,

said;

This is an outstanding result for our Hellyer

Operations. The Board and I are highly

impressed by the systematic and pragmatic approach taken by the

Hellyer management and site staff in preparing for and then

delivering this program to increase throughput at Hellyer. We have

seen very significant improvements in a relatively short period of

time and this significant increase in performance is well ahead of

our original mining and processing schedule and has been completed

with minimal capital outlay. The opportunity to continue this

initiative and further increase our lead

and zinc concentrates output will certainly improve financial

returns and manage our business risk.

Competent Persons Statement

The information in this report that relates to the Hellyer

project is based on information compiled by Mr. Roger Jackson, an

Executive Director of the Company, who is a 25+ year Member of the

Australasian Institute of Mining and Metallurgy (MAusIMM) and a

Member of Australian Institute of Company Directors. Mr. Jackson

has sufficient experience which is relevant to the style of

mineralisation and type of deposits under consideration and to the

activity which he is undertaking to qualify as a Competent Person

as defined in the 2012 Edition of the Australasian Code for

Reporting of Exploration results, Mineral Resources and Ore

Reserves. Mr. Jackson consents to the inclusion of the data

contained in relevant resource reports used for this announcement

as well as the matters, form and context in which the relevant data

appears.

-END-

About NQ Minerals

NQ Minerals Plc is listed on Londons Aquis Stock Exchange (AQSE)

under the ticker NQMI and has its 1:100 ADR traded on the US OTC QB

under ticker NQMIY and its ordinary shares are dual traded on the

US OTC QB under the ticker NQMLF.

NQ Minerals operations are in Australia. NQ commenced base metal

and precious metal production in 2018 at its 100% owned flagship

Hellyer Gold Mine in Tasmania. Hellyer has a published JORC

compliant Mineral Resource estimated at 9.25 Mt which is host to

Gold at 2.57 g/t Au for 764,300 oz Au, Silver at 92 g/t Ag for

27,360,300 oz Ag, Lead at 2.99% Pb for 276,600 tonnes and Zinc at

2.57% Zn for 217,400 tonnes. In addition to these resources, the

Hellyer assets include a large mill facility and full supporting

infrastructure, including a direct rail line to port. The Company

is also planning to re-open the historic high-grade Beaconsfield

Gold Mine in Tasmania, which has a JORC (2012) compliant Mineral

Resource Estimate of 1.454 Mt at 10.3 g/t Au for 483,000 ounces of

gold. Regular updates on the progress of the Hellyer Gold Mine and

Beaconsfield can be viewed on NQs website at

www.nqminerals.com.

For more information, please contact:

NQ Minerals plc

David Lenigas, Chairman

lenigas@nqminerals.com

Colin Sutherland, Chief Financial Officer

colin.sutherland@nqminerals.com

Tel: +1 416 452 2166 (North America)

Media Enquiries

IFC Advisory Limited

Graham Herring / Tim Metcalfe

graham.herring@investor-focus.co.uk

Tel: +44 (0) 203 934 6630 (United Kingdom)

Corporate Adviser

First Sentinel Corporate Finance Limited

Brian Stockbridge / Gabrielle Cordeiro

Tel: +44 (0) 207 183 7407 (United Kingdom)

Corporate Broker

VSA Capital Limited

Andrew Monk/Maciek Szymanski

+ 44 (0) 203 005 5000 (United Kingdom)

The Following section relates to NQ Minerals Plcs news

releases distributed in the United States:

Cautionary Note to US Investors

The United States Securities and Exchange Commission ("SEC")

permits US Mining companies, in their filings with the SEC, to

disclose only those mineral deposits that a company can

economically and legally extract or produce. Any estimates of

mineral resources shown in this press release or on NQ Minerals

PLC'swebsite have been prepared in accordance with definition

standards of the Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves produced by the

Australasian Joint Ore Reserves Committee, which may differ from

definition standards of the United States Securities and Exchange

Commission ("SEC") Industry Guide 7. We may use certain termswhich

the SEC guidelines strictly prohibit US registered companies from

including in their filings with the SEC.

Cautionary Note Regarding Forward-Looking

Statements

This press release may contain "forward-looking statements" within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Such statements

include, but are not limited to, any statements based on current

expectations, estimates, forecasts, and projections, including

those related to our growth strategy, mineral estimates and any

other statements that are not historical facts. Forward-looking

statements are based on management's current expectations and are

subject to risks and uncertainties that could negatively affect our

business, operating results, financial condition and stock price.

Factors that could cause actual results to differ materially from

those currently anticipated are: risks related to our growth

strategy; risks relating to exploration, development and/or

extraction; our ability to obtain, perform under, and maintain

financing and strategic agreements and relationships; our ability

to attract, integrate, and retain key personnel; global demand for

mineral resources; our need for substantial additional funds;

government regulation; as well as other risks. We expressly

disclaim any obligation or undertaking to release publicly any

updates or revisions to any forward-looking statements contained

herein to reflect any change in our expectations or any changes in

events, conditions, or circumstances on which any such statement is

based, except as required by law.

NQ Minerals (CE) (USOTC:NQMLF)

Historical Stock Chart

From Nov 2024 to Dec 2024

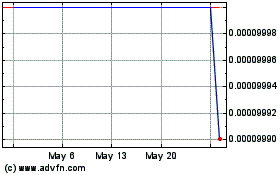

NQ Minerals (CE) (USOTC:NQMLF)

Historical Stock Chart

From Dec 2023 to Dec 2024