Form 8-K - Current report

13 February 2024 - 8:06AM

Edgar (US Regulatory)

false

--05-31

0001718500

0001718500

2024-02-09

2024-02-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 9, 2024

REVIV3 PROCARE COMPANY

(Exact name of registrant as specified in its

charter)

| Delaware |

|

000-56351 |

|

47-4125218 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| 901 Fremont Avenue, Unit 158, Alhambra, CA |

|

91803 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (888) 638-8883

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| None |

N/A |

N/A |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year. |

On February 12, 2024, Reviv3

Procare Company (the “Company”) filed a Certificate of Amendment (the “Charter Amendment”) to the Company’s

Amended and Restated Certificate of Incorporation with the Delaware Secretary of State, which will become effective at

12:01 a.m. Eastern Time on February 14, 2024, the date of the Company’s expected listing

on the NYSE American Stock Exchange (the “NYSE American”) (the “Effective Date”). The Charter Amendment

is being filed pursuant to prior authorization of the Company’s Board of Directors and the requisite shareholders of the Company

as more fully described in the Company’s Schedule 14C filed with the Securities and Exchange Commission on December 4, 2023 to effect

the changes described below.

Name Change Amendment

The Charter Amendment

will change the Company’s name from “Reviv3 Procare Company” to “AXIL Brands, Inc.” (the “Name Change

Amendment”). The Name Change Amendment does not affect the rights of the Company’s stockholders. Following the Name Change

Amendment, existing stock certificates, which reflect the Company’s prior corporate name, will continue to be valid. Certificates reflecting

the new corporate name will be issued in due course as old stock certificates are tendered for exchange or transfer to the Company’s transfer

agent.

Classified Board Amendment, Charter Bylaws

Amendment, and Bylaws Amendment

The Charter Amendment will also increase the size

of the Board of Directors (the “Board”) of the Company and to create three (3) classes of directorships to the Board (the

“Classified Board Amendment”), as well as vest with the Board the authority to make, repeal, alter, amend or rescind any or

all of the Company’s Bylaws (the “Charter Bylaws Amendment”).

The Classified Board Amendment will divide the

Board into three classes: Class I, Class II and Class III. Each director will serve for a term ending on the date of the third annual

meeting following the annual meeting at which such director was elected. As of the Effective Date, the three classes of the Board will

be comprised as follows:

| · | Nancy Hundt shall serve in Class I of the Board for a term expiring at the company’s 2026 annual

meeting of stockholders or until her successor is duly elected and qualified, or until the earlier of her death, resignation or removal; |

| · | Peter Dunne and Manu Ohri shall serve in Class II of the Board for a term expiring at the company’s

2025 annual meeting of stockholders or until their successors are duly elected and qualified, or until the earlier of their death, resignation

or removal; and |

| · | Jeff Toghraie and Jeff Brown shall serve in Class III of the Board for a term expiring at the company’s

2024 annual meeting of stockholders or until their successors are duly elected and qualified, or until the earlier of their death, resignation

or removal. |

The Charter Bylaws Amendment will clarify and

confirm the Board’s authority to make, alter, or repel the Company’s Bylaws, in whole or in part. A corresponding amendment

will be made to the Company’s Bylaws (the “Bylaws Amendment”) that will also establish procedures for stockholders to

provide the Company with advance notice nominations of directors and proposals for matters they intend to bring up at a stockholder meeting.

The foregoing summary of the Charter Amendment

and the Bylaws Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Charter

Amendment and the Bylaws Amendment, copies of which are attached hereto as Exhibit 3.1 and Exhibit 3.2 and are incorporated herein by

reference.

On February 9, 2024, the Company issued a press

release announcing the Company’s expected listing on NYSE American on the Effective

Date. A copy of the press release is attached as Exhibit 99.1 to this report.

Cautionary Note Regarding

Forward Looking Statements

This Current Report

on Form 8-K contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933,

as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements represent our expectations,

beliefs, intentions or strategies concerning future events, including, but not limited to, any statements regarding the NYSE American

Listing, which are subject to various risks and uncertainties. When used in this Current Report and Form 8-K, the words or phrases

“will,” “expected,” or similar expressions and variations thereof are intended to identify such forward-looking

statements. However, any statements contained in this Current Report on Form 8-K that are not statements of historical fact may be deemed

to be forward-looking statements. Furthermore, such forward-looking statements speak only as of the date of this Current Report and Form

8-K. We caution that these statements by their nature involve risks and uncertainties, certain of which are beyond our control, and actual

results may differ materially depending on a variety of important factors. These forward-looking statements are not guarantees of our

future performance and involve risks, uncertainties, estimates and assumptions that are difficult to predict. We do not assume the obligation

to update any forward-looking statement, except as required by applicable law.

| Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

| |

REVIV3 PROCARE COMPANY |

| |

|

| Date: February 12, 2024 |

/s/ Jeff Toghraie |

| |

Name: |

Jeff Toghraie |

| |

Title: |

Chief Executive Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT

TO THE AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION

OF

REVIV3 PROCARE COMPANY

REVIV3 PROCARE COMPANY (the “Corporation”),

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”),

does hereby certify as follows:

| |

1. |

This Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s Amended and Restated Certificate of Incorporation filed with the Secretary of State of the State of Delaware on June 9, 2015, as amended by that Certificate of Amendment filed on June 13, 2022, and by that Certificate of Amendment filed on January 12, 2024 (the “Certificate of Incorporation”). |

| |

2. |

Article I of the Certificate of Incorporation of the Corporation shall be amended and restated as follows: |

“The name of this corporation is AXIL Brands,

Inc. (the “Corporation”).”

| |

3. |

Article V of the Certificate of Incorporation of the Corporation shall be amended and restated as follows: |

“Subject to any additional vote required

by this Amended and Restated Certificate of Incorporation or Bylaws, and in furtherance and not in limitation of the powers conferred

by statute, the Board of Directors is expressly authorized to make, repeal, alter, amend and rescind any or all of the Bylaws of the Corporation.”

| |

4. |

Article VI of the Certificate of Incorporation of the Corporation shall be amended and restated as follows: |

“The Board of Directors will be divided

into three classes: Class I, Class II and Class III. The number of directors in each class shall be the whole number contained in the

quotient arrived at by dividing the authorized number of directors by three, and if a fraction is also contained in such quotient, then

if such fraction is one-third (1/3) the extra director shall be a member of Class III and if the fraction is two-thirds (2/3) one of the

extra directors shall be a member of Class III and the other shall be a member of Class II. Each director shall serve for a term ending

on the date of the third annual meeting following the annual meeting at which such director was elected. In the event of any increase

or decrease in the authorized number of directors: (a) each director then serving as such shall nevertheless continue as a director of

the class of which he is a member until the expiration of his or her current term, or his or her prior death, resignation or removal,

and (b) the newly created or eliminated directorships resulting from such increase or decrease shall be apportioned by the Board of Directors

to such class or classes as shall, so far as possible, bring the number of directors in the respective classes into conformity with the

formula described herein, as applied to the new authorized number of directors. Each director shall be entitled to one vote on each matter

presented to the Board of Directors.”

| |

5. |

Pursuant to Section 242 of the DGCL, the Board of Directors of the Corporation has duly adopted, and a majority of the outstanding stock entitled to vote thereon has duly approved, the amendment to the Certificate of Incorporation set forth in this Certificate of Amendment. |

| |

6. |

This Certificate of Amendment shall become effective as of February 14, 2024 at 12:01 a.m. Eastern Time. |

| |

7. |

All other provisions of the Certificate of Incorporation shall remain in full force and effect. |

IN WITNESS WHEREOF, the Corporation has caused

this Certificate of Amendment to be executed by the undersigned duly authorized officer this 12th day of February, 2024.

| |

REVIV3 PROCARE COMPANY

|

|

| |

/s/ Jeff Toghraie |

|

| |

Name: Jeff Toghraie |

|

| |

Title: Chief Executive Officer |

|

Exhibit 3.2

AMENDMENT TO THE BYLAWS OF REVIV3 PROCARE COMPANY

AMENDMENT NO. 1

Article I of the Bylaws of Reviv3 Procare Company,

a Delaware Corporation (the “Company”) is hereby amended to include an additional provision:

“1.13 Notice of Stockholder Business

and Nominations.

| |

a. |

Nominations of persons for election to the Board of the Corporation and the proposal of business to be considered by the stockholders may be made at an annual meeting of stockholders only (A) pursuant to the Corporation’s notice of meeting (or any supplement thereto), (B) by or at the direction of the Board or (C) by any stockholder of the Corporation who is a stockholder of record at the time the notice provided for in this Section 1.13(i) is delivered to the Secretary of the Corporation and at the date of the meeting, who is entitled to vote at the meeting and who complies with the notice procedures set forth in this Section 1.13(i). |

| |

b. |

For nominations or other business to be properly brought before an annual meeting by a stockholder pursuant to clause (C) of the foregoing paragraph, the stockholder must have given timely notice thereof in writing to the Secretary of the Corporation and such business must constitute a proper matter for stockholder action. To be timely, a stockholder’s notice must be delivered to the Secretary at the principal executive office of the Corporation not later than the close of business on the sixtieth (60th) day nor earlier than the close of business on the ninetieth (90th) day prior to the first anniversary of the preceding year’s annual meeting; provided, however, that in the event that the date of the annual meeting is more than thirty (30) days before or more than seventy (70) days after such anniversary date or if the Corporation has not previously held an annual meeting, notice by the stockholder to be timely must be so delivered not earlier than the close of business on the ninetieth (90th) day prior to such annual meeting and not later than the close of business on the later of (x) the sixtieth (60th) day prior to such annual meeting or (y) the tenth (10th) day following the date on which public announcement of the date of such meeting is first made by the Corporation. In no event shall the public announcement of an adjournment or postponement of an annual meeting commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above. Such stockholder’s notice shall set forth: (A) as to each person whom the stockholder proposes to nominate for election as a director (w) all information relating to such person that is required to be disclosed in solicitations of proxies for election of directors in an election contest, or is otherwise required, in each case pursuant to and in accordance with Regulation 14A under the Securities Exchange Act of 1934, as amended (or any successor thereto) (the “Exchange Act”) and Rule 14a-19 thereunder (or any successor thereto), (x) such person’s written consent to being named in the proxy statement as a nominee and to serving as a director if elected, (y) the name and address of the person or persons to be nominated, and (z) a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder; (B) as to any other business that the stockholder proposes to bring before the meeting, a brief description of the business desired to be brought before the meeting, the text of the proposal or business (including the text of any resolutions proposed for consideration and in the event that such business includes a proposal to amend the bylaws of the Corporation, the language of the proposed amendment), the reasons for conducting such business at the meeting and any material interest in such business of such stockholder and the beneficial owner, if any, on whose behalf the proposal is made; and (C) as to the stockholder giving the notice and the beneficial owner, if any, on whose behalf the nomination or proposal is made (1) the name and address of such stockholder, as they appear on the Corporation’s books, and of such beneficial owner, (2) the class and number of shares of capital stock of the Corporation which are owned beneficially and of record by such stockholder and such beneficial owner, (3) a representation that the stockholder is a holder of record of stock of the Corporation entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to propose such business or nomination and (4) a representation whether the stockholder or the beneficial owner, if any, intends or is part of a group which intends (a) to deliver a proxy statement and/or form of proxy to holders of at least the percentage of the Corporation’s outstanding capital

stock required to approve or adopt the proposal or elect the nominee and/or (b) otherwise to solicit proxies from stockholders in support of such proposal or nomination. The foregoing notice requirements of this Section 1.13(i) shall be deemed satisfied by a stockholder if the stockholder has notified the Corporation of his or her intention to present a proposal or nomination at an annual meeting in compliance with applicable rules and regulations promulgated under the Exchange Act and such stockholder’s proposal or nomination has been included in a proxy statement that has been prepared by the Corporation to solicit proxies for such annual meeting. In addition, the stockholder making such proposal shall promptly provide any other information reasonably requested by the Corporation. The Corporation may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as a director of the Corporation. |

| |

c. |

Notwithstanding the foregoing provisions

of this Section 1.13, a stockholder shall also comply with all applicable requirements of the Exchange Act and the rules and regulations

promulgated thereunder with respect to the matters set forth in this Section 1.13. Nothing in this Section 1.13 shall be deemed to affect

any rights of stockholders to request inclusion of proposals or nominations in the Corporation’s proxy statement pursuant to applicable

rules and regulations promulgated under the Exchange Act or any rights of the holders of any series of preferred stock to elect directors

pursuant to any applicable provisions of the certificate of incorporation, as amended.”

|

| |

ii. |

Special Meeting. Only such business shall be conducted at a special meeting of stockholders as shall have been brought before the meeting pursuant to the Corporation’s notice of meeting. Nominations of persons for election to the Board may be made at a special meeting of stockholders at which directors are to be elected pursuant to the Corporation’s notice of meeting (A) by or at the direction of the Board or (B) provided that the Board has determined that directors shall be elected at such meeting, by any stockholder of the Corporation who is a stockholder of record at the time the notice provided for in this Section 1.13(ii) is delivered to the Secretary of the Corporation, who is entitled to vote at the meeting and who complies with the notice procedures set forth in this Section 1.13. In the event the Corporation calls a special meeting of stockholders for the purpose of electing one or more directors to the Board, any such stockholder entitled to vote in such election of directors may nominate a person or persons (as the case may be) for election to such position(s) as specified in the Corporation’s notice of meeting, if the stockholder’s notice required by paragraph (i)(b) of this Section 1.13 shall be delivered to the Secretary at the principal executive office of the Corporation not earlier than the close of business on the ninetieth (90th) day prior to such special meeting and not later than the close of business on the later of the sixtieth (60th) day prior to such special meeting or the tenth (10th) day following the day on which public announcement is first made of the date of the special meeting and of the nominees proposed by the Board to be elected at such meeting. In no event shall the public announcement of an adjournment or postponement of a special meeting commence a new time period (or extend any time period) for the giving of a stockholder’s notice as described above. |

| |

|

|

|

|

| |

a. |

Only such persons who are nominated in accordance with the procedures set forth in this Section 1.13 shall be eligible to be elected at an annual or special meeting of stockholders of the Corporation to serve as directors and only such business shall be conducted at a meeting of stockholders as shall have been brought before the meeting in accordance with the procedures set forth in this Section 1.13. Except as otherwise provided by law, the Chairman of the meeting shall have the power and duty (a) to determine whether a nomination or any business proposed to be brought before the meeting was made or proposed, as the case may be, in accordance with the procedures set forth in this Section 1.13 (including whether the stockholder or beneficial owner, if any, on whose behalf the nomination or proposal is made solicited (or is part of a group which solicited) or did not so solicit, as the case may be, proxies in support of such stockholder’s nominee or proposal in compliance with such stockholder’s representation as required by clause (i)(b)(C)(4) of this Section 1.13) and (b) if any proposed nomination or business was not made or proposed in compliance with this Section 1.13, to declare that such nomination shall be disregarded or that such proposed business shall not be transacted. Notwithstanding the foregoing provisions of this Section 1.13, unless otherwise required by law, if the stockholder (or a qualified representative of the stockholder) does not appear at the annual or special meeting of stockholders of the Corporation to present a nomination or proposed business, such nomination shall be disregarded and such proposed business shall not be transacted, notwithstanding that proxies in respect of such vote may have been received by the Corporation. For purposes of this Section 1.13, to be considered a qualified representative of the stockholder, a person must be authorized by a writing executed by such stockholder or an electronic transmission delivered by such stockholder to act for such stockholder as proxy at the meeting of stockholders and such person must produce such writing or electronic transmission, or a reliable reproduction of the writing or electronic transmission, at the meeting of stockholders. |

| |

b. |

For purposes of this Section 1.13, a “public announcement” shall mean disclosure in a press release reported by the Associated Press or a comparable national news service or in a document publicly filed by the Corporation with the Securities and Exchange Commission pursuant to Sections 13, 14 or 15(d) of the Exchange Act. |

| |

c. |

Notwithstanding the foregoing provisions of this Section 1.13, a stockholder shall also comply with all applicable requirements of the Exchange Act and the rules and regulations promulgated thereunder with respect to the matters set forth in this Section 1.13. Nothing in this Section 1.13 shall be deemed to affect any rights of stockholders to request inclusion of proposals or nominations in the Corporation’s proxy statement pursuant to applicable rules and regulations promulgated under the Exchange Act or any rights of the holders of any series of preferred stock to elect directors pursuant to any applicable provisions of the certificate of incorporation, as amended.” |

AMENDMENT NO. 2

Article II, Section 2.3 of the Bylaws of the Company is hereby amended

and restated as follows:

“2.3 Election, Qualification and

Term of Office of Directors. Directors need not be stockholders unless so required by the certificate of incorporation or these

bylaws, as amended from time-to-time. The certificate of incorporation or these bylaws may prescribe other qualifications for directors.

The Board shall be and is divided into three classes: Class I, Class II and Class III. The number of directors in each class shall be

the whole number contained in the quotient arrived at by dividing the authorized number of directors by three, and if a fraction is also

contained in such quotient, then if such fraction is one-third (1/3) the extra director shall be a member of Class III and if the fraction

is two-thirds (2/3) one of the extra directors shall be a member of Class III and the other shall be a member of Class II. Each director

shall serve for a term ending on the date of the third annual meeting following the annual meeting at which such director was elected.

In the event of any increase or decrease in the authorized number of directors: (a) each director then serving as such shall nevertheless

continue as a director of the class of which he is a member until the expiration of his or her current term, or his or her prior death,

resignation or removal, and (b) the newly created or eliminated directorships resulting from such increase or decrease shall be apportioned

by the Board to such class or classes as shall, so far as possible, bring the number of directors in the respective classes into conformity

with the formula in this Section 2.3, as applied to the new authorized number of directors. Except as provided in Section 2.4 below, each

director shall continue in office until the next annual meeting at which such director’s class stands for election and his successor

is elected and qualified, or until such director’s earlier death, resignation, disqualification or removal from office.”

Exhibit 99.1

REVIV3 Announces

Uplist to the NYSE American Exchange and Corporate Name Change to “AXIL Brands, Inc.”

Trading on NYSE American

Expected to be Effective on or about February 14, 2024, Under symbol “AXIL”

LOS ANGELES, CA, February 9, 2024 (GLOBE NEWSWIRE)

-- Reviv3 Procare Company (“Reviv3,” “we,” “us,” “our,” or the “Company”)

(OTCQB: RVIV), an emerging global consumer products company for AXIL® hearing protection and enhancement products and Reviv3®

hair and skin care products, today announced that, subject to meeting all requirements at the time of listing, its common stock, par value

$0.0001 per share (the “Common Stock”), has been approved for listing on the NYSE American LLC (the “NYSE American”).

In connection with its listing on the NYSE American and as part of the Company’s ongoing rebranding efforts, the Company will change

its corporate name to “AXIL Brands, Inc.,” effective February 14, 2024. Additionally, the Company will change its ticker symbol

from “RVIV” to “AXIL” upon listing on the NYSE American.

The Company is expected to begin trading on the NYSE

American when the market opens on February 14, 2024. The Common Stock will continue to trade on the OTCQB until the close of the market

on February 13, 2024. Upon effectiveness of the listing on the NYSE American, trading of the Common Stock on the OTCQB will terminate.

Current stockholders of the Company do not need to take any action prior to the Company’s expected listing on the NYSE American.

“We are excited to execute on another two major

steps in our corporate rebranding with the milestone achievement of being listed on the NYSE American and the official change of our company’s

name to AXIL Brands, Inc.,” stated Jeff Toghraie, Chief Executive Officer of the Company. “We believe that listing on the

NYSE American Exchange will help diversify our stockholder base, provide greater liquidity for our stockholders, and improve our ability

to increase stockholder value. Renaming our company to AXIL Brands, Inc. reflects our focus on the global hearing enhancement and protection

devices market and we believe will allow us to capitalize on the recognition of the AXIL brand in the hearing protection and enhancement

market.”

This communication does not constitute an offer, or

a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any vote or approval,

nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

About Reviv3

Reviv3 Procare Company (OTCQB: RVIV) is an emerging

global e-commerce consumer products company. The Company is a manufacturer and marketer of premium hearing enhancement and protection

products, including ear plugs, earmuffs, and ear buds, under the AXIL® brand and premium hair and skincare products under its in-house

Reviv3 Procare brand - selling products in the United States, Canada, the European Union and throughout Asia. To learn more, please visit

the Company's website at www.reviv3.com and, for the AXIL® brand, visit www.goaxil.com.

Forward-Looking Statements

This press release contains a number of forward-looking

statements within the meaning of the federal securities laws. The use of words such as “believe,” “expect,” “continue,”

“will,” “prepare,” “should,” and ”focus,” among others, generally identify forward-looking

statements. These forward-looking statements are based on currently available information, and management’s beliefs, projections,

and current expectations, and are subject to a number of significant risks and uncertainties, many of which are beyond management’s

control and may cause Reviv3’s results, performance or achievements to differ materially from any future results, performance or

achievements expressed or implied by these forward-looking statements including risks associated with listing our shares on the NYSE American..

There can be no assurance as to any of these matters, and potential investors are urged to consider these factors carefully in evaluating

the forward-looking statements. Other important factors that may cause actual results to differ materially from those expressed in the

forward-looking statements are discussed in the Company’s filings with the Securities and Exchange Commission (the “SEC”).

These forward-looking statements speak only as of the date hereof. Except as required by law, Reviv3 does not assume any obligation to

update or revise these forward-looking statements for any reason, even if new information becomes available in the future.

For a discussion of these risks and uncertainties,

please see our filings with the SEC. Our public filings with the SEC are available from commercial document retrieval services and at

the website maintained by the SEC at http://www.sec.gov.

Investor Relations:

Reviv3 Investor Relations Team

(888) 638-8883

investors@reviv3.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

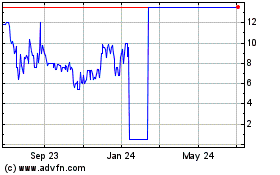

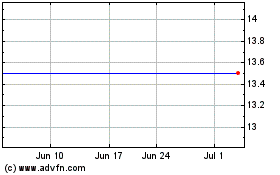

Reviv3 Procare (QB) (USOTC:RVIV)

Historical Stock Chart

From Apr 2024 to May 2024

Reviv3 Procare (QB) (USOTC:RVIV)

Historical Stock Chart

From May 2023 to May 2024