UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) December 1, 2015

TAUTACHROME INC. |

(Exact name of registrant as specified in its charter) |

Delaware | | 333-141907 | | 20-5034780 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1846 E. Innovation Park Drive, Oro Valley, Arizona | | 85755 |

(Address of principal executive offices) | | (Zip Code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement

To the extent required by Item 1.01 of Form 8-K, the information set forth under Item 8.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On December 9, 2015, Tautachrome Inc. (the "Registrant") issued a press release in the form attached to this Current Report on Form 8-K as Exhibit 99.1 (the "Press Release").

The information in Item 7.01 of this Current Report on Form 8-K, including the Press Release, shall not be deemed "filed" for any purpose and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, regardless of any general incorporation language in such filing.

Item 8.01 Other Events

On December 1, 2015, the Registrant executed a term sheet the ("Term Sheet") with Blackbridge Capital, LLC, ("Blackbridge"), reflecting the intentions of the parties as to the principal terms of a commitment by Blackbridge (the "Facility") to purchase up to $50,000,000 of the Registrant's common stock (the "Shares") during a period of 36 months from the date upon which definitive documentation establishing the Facility is executed (the "Term").

The Facility will be subject to the Registrant registering the issuance of the Shares under the Securities Act of 1933, as amended, through an effective registration statement on Form S-1 or on such other form as may be available to the Registrant (the "Registration Statement"). The Facility is also subject to the execution of definitive documentation establishing the Facility and its review by legal counsel to the parties.

Under the terms of the Facility, the Registrant may, in its sole discretion, periodically draw upon the Facility during the Term (a "Draw Down"), by delivering written notice (a "Draw Down Notice") to Blackbridge requiring Blackbridge to purchase a dollar amount of Shares (a "Draw Down Amount").

On the date that each Draw Down Notice is delivered to Blackbridge, the Registrant will also deliver an estimated amount of Shares to Blackbridge equal to the Draw Down Amount divided by 85% of the lowest trading price of the Registrant's common stock during the five days prior to delivery of the Draw Down Notice ("Estimated Shares").

The purchase price for each of the Shares purchased under the Facility (the "Purchase Price") will be equal to 85% of the lowest trading price of the Registrant's common stock during a period of ten trading days following the date on which the Estimated Shares are delivered to Blackbridge's brokerage account and cleared for trading (the "Valuation Period").

At the end of the Valuation Period, if the number of Estimated Shares delivered to Blackbridge is greater than the Shares issuable pursuant to a Draw Down, then Blackbridge will be required to return to the Registrant the difference between the Estimated Shares and the actual number of Shares issuable pursuant to the Draw Down. If the number of Estimated Shares is less than the number of Shares issuable under the Draw Down, then the Registrant will issue additional Shares to Blackbridge equal to the difference.

The Registrant may deliver each Draw Down Notice at least one day after the end of the Valuation Period for a preceding Draw Down. The first Draw Down may be delivered ten trading days after the Registration Statement becomes effective.

The maximum Draw Down Amount will be equal to the lesser of $1,000,000, or 200% of the average daily trading volume of the Registrant's common stock for the ten trading days immediately prior to the date of the Draw Down Notice, though the Registrant may request an increase in the maximum Draw Down amount. At no time during the Term will Blackbridge hold more than 4.99% of the Registrant's issued and outstanding common stock.

The Registrant will be prohibited from entering into a similar financing arrangement with any other individual or entity during the Term.

The description of the terms and conditions of the Term Sheet set forth herein does not purport to be complete and is qualified in its entirety by reference to the Term Sheet, which is filed as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

99.1 | Press release of Tautachrome Inc., dated December 8, 2015 |

| |

99.2 | Term sheet dated December 1, 2015, between Tautachrome Inc. and Blackbridge Capital, LLC |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| TAUTACHROME INC. | |

| | | |

Date: December 9, 2015 | By: | /s/ Jon N. Leonard | |

| | Jon N. Leonard | |

| | President & CEO | |

4

EXHIBIT 99.1

FOR IMMEDIATE RELEASE: 9 December 2015 |

TAUTACHROME Inc. enters Equity Purchase Agreement with Blackbridge Capital

TUSCON, Arizona, December 9, 2015 Tautachrome, Inc. (OTC-PINK: TTCM) today announced that on December 1, 2015, Tautachrome executed a term sheet with Blackbridge Capital, LLC, reflecting the intentions of the parties as to the principal terms of a commitment by Blackbridge to purchase up to $50,000,000 of the Registrant's common stock during a period of 36 months from the date upon which definitive documentation establishing the Facility is executed.

The Facility will be subject to Tautachrome registering the issuance of the Shares under the Securities Act of 1933, as amended, through an effective registration statement on Form S-1 or on such other form as may be available to Tautachrome. The Facility has no commitment fee and is also subject to the execution of definitive documentation establishing the Facility and its review by legal counsel to the parties. | |

|

| | Pictured: Dr Jon N Leonard and Mr Alexander Dillon |

About Tautachrome, Inc.

Tautachrome, Inc. (OTC-PINK: TTCM) is an emerging growth company in the rapidly evolving digital imagery technology sector. Tautachrome is an Internet technology development company with operations in America and Australia. Tautachrome has a number of revolutionary patents pending, including Talk-to-the-Picture social networking and trustable imagery-based interaction.

Safe Harbor Statement Statements made in this press release are forward-looking and are made pursuant to the safe harbor provisions of the Securities Litigation Reform Act of 1995. Risk factors that could cause actual results to differ materially from those projected in forward-looking statements include, but are not limited to, general business conditions, managing growth, and political and other business risks. All forward-looking statements are expressly qualified in their entirety by this paragraph and the risks and other factors detailed in Tautachrome's reports filed with the Securities and Exchange Commission. Tautachrome undertakes no duty to update these forward-looking statements.

Contact;Tautachrome, Inc. | Contact; Polybia Studios Pty Ltd |

Tel; | +1 520 318 5578 | Tel; | +61 7 5554 5883 |

Cell; | +1 520 288 1908 |

Cell; | 0439 800 915 |

Email; | jon@tautochrone.com | Email; | anugent@polybiastudios.com |

Web; | www.tautachrome.com | Web; | www.polybiastudios.com |

EXHIBIT 99.2

November 18, 2015

EQUITY PURCHASE AGREEMENT STRATEGY (EZPAS)

Issuer: | Tautachrome Inc. |

| |

Purchaser: | Blackbridge Capital, LLC. |

| |

EzPAS Facility: | Commitment to purchase up to $50,000,000 of the Company's common stock (the "Commitment Amount"). |

| |

Securities: | Registered common stock issued in a private placement pursuant to the Securities Act of 1933. |

| |

Term: | 36 months |

| |

Draw Down: | The Company may draw upon the Facility periodically during the Term (a "Draw Down"), at their sole discretion, by the Company's delivery to the Purchaser of a written notice (a "Draw Down Notice") requiring the Purchaser to purchase a dollar amount in shares of common stock (a "Draw Down Amount"). In no event may the shares issuable pursuant to a Draw Down Notice, when aggregated with the shares then held by the Purchaser on the date of the Draw Down, exceed 4.99% of the Company's outstanding common stock. The Purchaser will be obligated to accept the Draw Down as long as the Issuer meets all conditions required in order to deliver a Draw Down Notice. |

| |

Maximum Drawdown: | The maximum Draw Down Amount shall be equal to the lesser of $1,000,000, or 200% of the average daily trading Volume for the ten (10) trading days immediately prior to the Draw Down Notice date. The company may request an increase in the maximum Draw Down amount from the Purchaser. |

| |

Draw Down Intervals: | The Company may deliver Draw Down Notices at least one day after the end of the Valuation Period from a preceding Draw Down. The first Draw Down can be delivered ten trading days after the S-1 becomes effective. |

Purchase Price: | The purchase price per share of common stock purchased under the EzPAS Facility shall equal 85% of the lowest trading price during the Valuation Period (the "Purchase Price"). On the date that a Draw Down Notice is delivered to Purchaser, the Company shall deliver an estimated amount of shares to Purchaser's brokerage account equal to the investment amount divided by 85% of the lowest trading price in the five days prior to the delivery of a Draw Down Notice ("Estimated Shares"). The Valuation Period shall begin the first trading day after the Estimated Shares have been delivered to Purchaser's brokerage account and have been cleared for trading. At the end of the Valuation Period, if the number of Estimated Shares delivered to Purchaser is greater than the shares issuable pursuant to a Draw Down, then Purchaser shall return to Company the difference between the Estimated Shares and the actual number of shares issuable pursuant to the Draw Down. If the number of Estimated Shares is less the shares issuable under the Draw Down, then the Company shall issue additional shares to Purchaser equal to the difference. |

| |

Valuation Period: | Ten trading days, commencing on the first trading day following delivery and clearing of the Purchase Shares. |

| |

Closings: | A Closing shall occur upon the settlement of the trades of the Put Shares associated with a Draw Down. |

| |

Conditions: | The obligation of the Purchaser to purchase shares pursuant to the EzPAS Facility during the Term will be subject to the satisfaction or waiver on each Closing of the conditions contained in the definitive documentation with respect to the EzPAS Facility. |

Effective Registration: | The registration statement shall remain effective at all times, not subject to any actual or threatened stop order or suspension at any time. |

| |

Absence of Material Adverse Change: | No material adverse change shall have occurred prior to a Closing or during a Valuation Period. |

| |

Continued Listing: | No material adverse change shall have occurred prior to a Closing or during a Valuation Period. |

| |

Exclusivity: | From the date definitive documentation is executed until the expiration of the Term, the Company will agree not to enter into a similar financing arrangement with any third-party. |

| |

Governing Law: | State of New York |

| |

| This term sheet reflects the present intentions of the parties as to the principal terms of the proposed transactions referenced herein and is subject to the execution of definitive documentation and review by legal counsel to the parties. |

| |

AGREED TO AND ACCEPTED: | Sincerely, |

| |

Tautachrome Inc. | Blackbridge Capital, LLC |

| |

By: | By: |

| |

Jon N. Leonard | Alexander Dillon |

CEO | Managing Member |

3

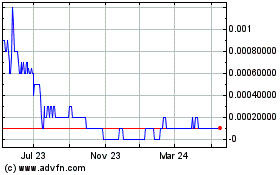

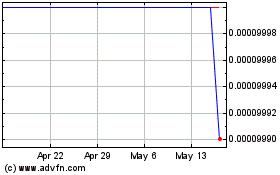

Tautachrome (CE) (USOTC:TTCM)

Historical Stock Chart

From Mar 2024 to May 2024

Tautachrome (CE) (USOTC:TTCM)

Historical Stock Chart

From May 2023 to May 2024