UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 22, 2014 (September 10, 2014)

VIROPRO, INC.

(Exact Name of Registrant as Specified in

Charter)

| Nevada |

|

333-06718 |

|

13-3124057 |

| (State or Other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

2151 O'Toole Avenue, Suite 50,

San Jose, CA 95131

(Address of Principal

Executive Offices) (Zip Code)

650-300-5190

Registrant’s telephone number, including

area code

_________________________

(Former Name or

Former Address

if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4

(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.04 Triggering Events That Accelerate

or Increase a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement.

On September 10,

2014, Bank Pembangunan Malaysia Berhad ("BPMB") seized the assets of Alpha Biologics Sdn Bhd ("Alpha"),

located in Penang, Malaysia, a wholly owned subsidiary of the registrant ("Viropro"), as a result of Alpha being in

default of its payment obligations under two Debentures between Alpha and BPMB, one in the principal amount of RM 20,000,000

($6.2 million at current exchange rates) dated July 25, 2006, and the second one in the principal amount of RM 5,000,000

dated December 22, 2009. As of July 31, 2014, the outstanding principal balance on these two loans plus accrued interest and

penalties was RM 21,800,000 (US6.8 million). BPMB has appointed a receiver and manager of the Alpha property under Section

188(1)(a) of the Companies Act 1965 (Malaysia).

Viropro issued a press

release on September 19, 2014 to disclose this event, a copy of which is attached to this Current Report on Form 8-K as Exhibit

99.1.

Item 9.01 Financial Statements and Exhibits

| 99.1 | Press Release dated September

19, 2014 |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| Date: September 22, 2014 |

Viropro, Inc. |

|

| |

|

|

|

| |

By: |

/s/Bruce A. Cohen |

|

| |

|

Bruce A. Cohen |

|

| |

|

Chairman of the Board |

|

Exhibit 99.1

Alpha Biologics Assets Seized by Bank

Pembangunan Malaysia

SAN JOSE, CA, September 19, 2014 – Viropro, Inc. (OTCBB:

VPRO) today announced that Bank Pembangunan Malaysia Berhad (BPMB) has seized the assets of Alpha Biologics Sdn Bhd (Alpha), a

wholly owned subsidiary of Viropro located in Penang, Malaysia. The Bank has appointed Lim San Peen of PricewaterhouseCoopers Advisory

Services Sdn Bhd as Receiver and Manager of the Alpha property pursuant to Section 188(1)(a) of the Companies Act 1965 (Malaysia)

under the powers contained in the Debentures between Alpha and BPMB dated July 25, 2006 and December 22, 2009. The Receiver and

Manager has advised the Directors of Alpha that their powers to deal with the Company’s property or to manage its undertakings

are suspended.

On July 25, 2006, Alpha entered into a debenture agreement with

BPMB for RM 20 million (US$6.2 million at current exchange rates.). On December 22, 2009, Alpha entered in a debenture agreement

with BPMB for an additional RM 5 million. As of July 31, 2014, the outstanding balance on the loans plus accrued interest and penalties

was approximately RM 22.1 million (US$6.8 million). Representatives from Viropro, acting on behalf of Alpha, had previously met

with the members of the staff of the Credit Recovery Group at BPMB and presented a proposal for restructuring the Alpha debt. No

reference was made to the Company’s proposal in the notification regarding the appointment of the Receiver and Manager.

“We are deeply disappointed and dismayed by this unexpected

and counter-productive action by Bank Pembangunan,” commented Bruce Cohen, Viropro Chairman. “Having presented a restructuring

proposal in good faith, we were surprised by the lack of a response to our plan and the unexpected decision to appoint a Receiver

and Manager without any notice.”

Citing Sections 188(1)(b) and 189(2) of the aforementioned Companies

Act, Mr. Lim ordered the Alpha Directors to turn over all of its assets and records to him within 14 days. Mr. Lim also ordered

the Directors not to carry on Alpha’s business in any way nor enter into any commitment on behalf of Alpha with his prior

approval.

“This action by the Bank undermines our ability to enter

into negotiations with partners, restore the business of Alpha and house our new development programs in Malaysia,” said

Joseph Vallner, Viropro President and CEO. “At full capacity, the Alpha facility would have created as many as a hundred

good paying jobs for highly skilled graduates of Malaysia’s universities.”

Construction of the Alpha facility was completed in 2010. In

2014, the facility was vandalized on several occasions, resulting in significant damage to the building’s electrical system

and a number of specialized instruments. Coincident with the delivery of the notice regarding the appointment, representatives

from PricewaterhouseCoopers dismissed the security guards retained on behalf of Alpha and replaced them with guards of their own.

Viropro also announced today that the Company is undertaking

a comprehensive review of its strategy and operations to identify opportunities to enhance shareholder value and to determine the

best course of action.

###

About Viropro

Viropro is engaged in the development and manufacturing of biopharmaceuticals.

Viropro seeks to offer cost-effective and timely solutions to the biopharma industry from drug concept through to product manufacturing.

About Bank Pembangunan Malaysia Berhad

Bank Pembangunan Malaysia Berhad (BPMB) is wholly owned by the

Malaysia Government through the Minister of Finance. BPMB is mandated to provide medium to long term financing for Islamic and

conventional facilities to capital intensive industries, which include infrastructure projects, maritime, technology and oil &

gas sectors.

Contact: info@viropro.net

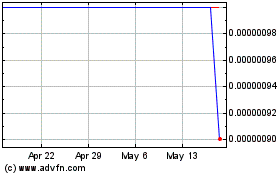

Viropro (CE) (USOTC:VPRO)

Historical Stock Chart

From Nov 2024 to Dec 2024

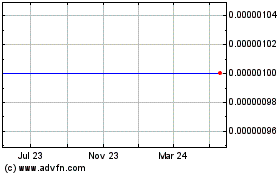

Viropro (CE) (USOTC:VPRO)

Historical Stock Chart

From Dec 2023 to Dec 2024