UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 22, 2014

Xenonics Holdings, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Nevada |

|

001-32469 |

|

84-1433854 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 3186 Lionshead Avenue

Carlsbad, California |

|

92010 |

| (Address of principal executive offices) |

|

(Zip Code) |

|

| Registrant’s telephone number, including area code: (760) 477-8900 |

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On July 10, 2014, Xenonics Holdings, Inc. (the “Company”), closed the initial round in the aggregate sum of $90,000 of a private

placement by the Company of Secured Convertibles Notes (“Notes”) pursuant to Subscription Agreements (the “Subscription Agreements”) entered into by the Company with each of the accredited investors identified therein. The final

closing of the private placement occurred on September 10, 2014. A total of $981,000 of gross proceeds was raised in the Company’s private placement of secured convertible notes (including $100,000 raised in May 2014, as described below).

Sandlapper Securities LLC (“Sandlapper”) served as the placement agent for $343,000 of such notes (the “Sandlapper Notes”) issued between July 10, 2014 and September 10, 2014. The balance of the $981,000 of gross

proceeds from the sale of the notes was raised on the Company’s behalf by officers and directors of the Company (the “Company Notes”).

Sandlapper Notes

The Notes bear simple

interest at the rate of 13% per annum and mature three years following the date of issuance. The Notes (i) rank pari passu with all other prior secured indebtedness of the Company (“Prior Indebtedness”) and senior to all

unsecured indebtedness of the Company, and (ii) are convertible at the option of the holder thereof into shares of the Company’s common stock (the “Conversion Shares”) at the conversion rate of $0.07 per share (subject to

adjustment in the event of, among other specified events, stock splits, stock dividends and reclassifications) (the “Conversion Rate”). The number of Conversion Shares issuable upon conversion of the Notes will be determined by dividing

the part of the principal amount of the Notes to be converted, plus the accrued but unpaid interest thereon, by the Conversion Rate in effect on the date of conversion. The Company may redeem all or a portion of each Note at any time between the

first and second anniversary of the date of issuance of such Note at 110% of the principal amount of the Note, plus accrued and unpaid interest, provided that the holder of the Note has the option to convert the principal and unpaid interest of its

Note into common stock of the Company upon receipt of any redemption notice from the Company. Following the second anniversary of the issue date of a Note, the Company may redeem the Note without penalty.

Additionally, pursuant to the Notes, for so long as any portion of the principal or interest on the Notes is due and payable, the Company

agreed to not take any of the following actions, among others, without the prior written consent of the holders of at least 51% of the outstanding principal amount of the Sandlapper Notes:

| |

• |

|

Sell voting stock of the Company in any transaction resulting in the holders of the voting securities of the Company outstanding immediately prior to such transaction owning less than a majority of the total voting

power of the Company; |

| |

• |

|

Sell, lease, exclusively license, assign, transfer, convey or otherwise dispose of (i) all or substantially all of the Company’s assets, except to a direct or indirect wholly-owned subsidiary of the Company,

(ii) any capital stock or limited liability interests of any direct or indirect subsidiary of the Company, or (iii) any profits, losses, dividends or distributions of any kind of the Company or any direct or indirect subsidiary;

|

| |

• |

|

Acquire or dispose of any business or assets, except in the ordinary course of business or the sale of inventory on an arms-length basis; |

| |

• |

|

Liquidate, dissolve or wind-up the business and affairs of the Company or any direct or indirect subsidiary of the Company; |

2

| |

• |

|

Make any capital expenditure of the Company exceeding $50,000 individually or $150,000 in the aggregate which is not for the benefit of the Company; |

| |

• |

|

Enter into any agreement or arrangement to incur any indebtedness other than the Notes or unsecured debt; |

| |

• |

|

Enter into any agreement or arrangement that would result in the creation of any lien or encumbrance on any of the assets of the Company or any direct or indirect subsidiary; |

| |

• |

|

Redeem, purchase for cancellation or otherwise retire or pay off any of the Company’s outstanding securities other than the Notes; |

| |

• |

|

Declare or pay any dividends or make any distribution, whether in cash, in shares of stock, limited liability interests, or otherwise on any of the Company’s outstanding securities other than the Notes;

|

| |

• |

|

Alter, modify or amend the terms of employment or compensation to the Chairman of the Board of Directors or Chief Executive Officer of the Company, except if such alteration, amendment or modification is to reduce or

terminate the terms of such employment; |

| |

• |

|

Enter into any transaction, or make any amendment thereto, with any director or officer of the Company, or any immediate family member or affiliate of any director or officer of the Company; and |

| |

• |

|

Use all or any portion of the proceeds of the issuance of the Notes to pay any fees to affiliates of the Company, except as described in the Subscription Agreement. |

The payment obligations under the Notes may be accelerated upon certain events of default, including any uncured material breach of the Notes,

bankruptcy, the existence of an event of default of the Company on any obligation for the payment of borrowed money in excess of $50,000 individually, or $150,000 in the aggregate, subject to exceptions, or the entry of a judgment against the

Company that (i) exceeds by more than $50,000 any insurance coverage applicable thereto, or (ii) would be reasonably likely to have a material adverse effect (as defined) on the Company.

The May 2014 Notes (as defined under Item 3.02, below) and the Company Notes include the same $0.07 conversion rate and three-year term

as the Sandlapper Notes, and are also secured by the Company’s assets, but such notes do not contain the above covenants of the Company or any other provisions protecting the interests of the note holders that are contained in the Sandlapper

Notes.

Alan Magerman, the Chairman of the Board of Directors and Chief Executive Officer of the Company, and Jeffrey Kennedy, the

President and Chief Operating Officer of the Company, each purchased a Company Note in the principal amount of $50,000.

Security Agreement

The Notes are secured by a first priority lien and security interest on the Company’s assets, pursuant to a Security Agreement entered

into by the Company and purchasers of Notes (the “Security Agreement”).

3

Intercreditor Agreement

The Company entered into an intercreditor agreement (“Intercreditor Agreement”), effective as of July 10, 2014, with holders

(the “Other Secured Parties”) of Prior Indebtedness and Sandlapper, on behalf of purchasers of Sandlapper Notes (the “Sandlapper Parties”). Under the Intercreditor Agreement, among other things, the Other Secured Parties agreed

to not take any action with respect to the Prior Indebtedness without the written consent of holders of at least 75% of the outstanding aggregate principal amount owed to the Other Secured Parties and the Sandlapper Parties acting as a single class.

Additionally, under the Intercreditor Agreement, so long as the Company (i) remains current in its interest payments to the Sandlapper Parties, the Company may pay interest to the Other Secured Parties under the Prior Indebtedness, and

(ii) generates (a) at least $1,000,000 of revenue during any fiscal quarter of the Company, and (b) positive EBITDA during such quarter, the Company may, in its discretion, pay down the principal balance under the Prior Indebtedness

within 45 days after the end of any such quarter in an amount not to exceed 25% of such positive EBITDA on a cumulative basis; provided, however, that (i) no principal payments may be made unless the Company has “free cash” (as

defined) of at least $200,000, and (ii) no proceeds of the private placement may be used to make any of the foregoing interest and principal payments.

In connection with the foregoing private placement of notes other than the Company Notes, the Company paid to Sandlapper aggregate commissions

of $39,870 and $15,000 for expenses. Additionally, the Company issued to Sandlapper five-year Warrants (the “Sandlapper Warrants”) to purchase up to 1,582,143 shares of common stock of the Company at an exercise price of $0.12 per share.

The Sandlapper Warrants may be exercised in a cashless exercise.

Transaction Documents

The Subscription Agreement, the Notes and, the Security Agreement contain ordinary and customary provisions for agreements of this nature, such

as representations, warranties, covenants, and indemnification obligations, as applicable. The foregoing descriptions of such documents do not purport to describe all of the terms and provisions thereof and are qualified in their entirety by

reference to the form of Subscription Agreement, the form of Note, the form of Security Agreement and the Company Note, which are filed as Exhibits 10.1, 10.2, 10.3 and 10.4, respectively, to this Current Report on Form 8-K and are incorporated

herein by reference.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

The disclosures set forth in Item 1.01 of this Current Report on Form 8-K with respect to the secured convertible notes issued by

the Company in the private placements are hereby incorporated by reference into this Item 2.03.

ITEM 3.02 UNREGISTERED SALES OF EQUITY

SECURITIES

The disclosures set forth in Item 1.01 of this Current Report on Form 8-K are hereby incorporated by reference into

this Item 3.02.

On May 12, 2014 and May 22, 2014, the Company issued and sold to accredited investors secured convertible

notes of the Company in an aggregate principal amount of $100,000 (the “May 2014 Notes”). From July 10, 2014, 2014 through September 10, 2014, the Company issued and sold to other accredited investors secured convertible notes of

the Company in an aggregate principal amount of $881,000. As described in Item 1.01, above, the notes are convertible at the option of the holder thereof into shares of the Company’s common stock at a conversion rate of $0.07 per share.

Additionally, the Company issued the Sandlapper Warrants to Sandlapper to purchase up to 1,582,143 shares of common stock of the Company.

4

The securities described in this Item 3.02 were not registered under the Securities Act of

1933, as amended (the “Act”), in reliance upon the exemption from registration contained in Section 4(2) of the Act and Regulation D promulgated thereunder. The investors in the private placement represented in writing that they were

accredited investors and acquired the securities for their own accounts for investment purposes. A legend will be placed on the common stock issuable upon conversion of the secured convertible notes of the Company, on the Sandlapper Warrants, and on

the common stock issuable upon the exercise of the Sandlapper Warrants stating that the securities have not been registered under the Act and cannot be sold or otherwise transferred without registration or an exemption therefrom.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

|

|

|

| Exhibit No. |

|

Description |

|

|

| 10.1 |

|

Form of Subscription Agreement entered into by the Company and investors between July 10, 2014 and September 10, 2014. |

|

|

| 10.2 |

|

Form of Secured Convertible Note issued by the Company to investors under the Subscription Agreement. |

|

|

| 10.3 |

|

Form of Security Agreement between the Company and investors under the Subscription Agreement. |

|

|

| 10.4 |

|

Form of Company Note. |

5

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

XENONICS HOLDINGS, INC. |

|

|

|

|

| September 16, 2014 |

|

|

|

By: |

|

/s/ Richard S. Kay |

|

|

|

|

|

|

Name: Richard S. Kay |

6

EXHIBIT 10.1

FORM OF CONFIDENTIAL SUBSCRIPTION AGREEMENT

XENONICS HOLDINGS, INC.

Private Sale of up to $1,000,000 of Convertible

Senior Secured Notes

THIS

SUBSCRIPTION AGREEMENT CONTAINS MATERIAL NONPUBLIC INFORMATION CONCERNING XENONICS HOLDINGS, INC. AND IS PREPARED SOLELY FOR THE USE OF THE OFFEREE NAMED ABOVE. ANY USE OF THIS INFORMATION FOR ANY PURPOSE OTHER THAN IN CONNECTION WITH THE

CONSIDERATION OF AN INVESTMENT IN THE SECURITIES OFFERED HEREBY MAY SUBJECT THE USER TO CRIMINAL AND CIVIL LIABILITY.

THE

SECURITIES OFFERED HEREBY ARE HIGHLY SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK AND IMMEDIATE DILUTION AND MAY BE PURCHASED ONLY BY PERSONS WHO QUALIFY AS “ACCREDITED SUBSCRIBERS” UNDER RULE 501 (a) OF REGULATION D UNDER THE

SECURITIES ACT.

THIS DOCUMENT HAS NOT BEEN FILED WITH OR REVIEWED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR ANY

OTHER COMMISSION OR REGULATORY AUTHORITY, AND HAS NOT BEEN FILED WITH OR REVIEWED BY THE ATTORNEY GENERAL OF ANY STATES NOR HAS ANY SUCH COMMISSION, AUTHORITY OR ATTORNEY GENERAL DETERMINED WHETHER IT IS ACCURATE OR COMPLETE OR PASSED UPON OR

ENDORSED THE MERITS OF THIS OFFERING. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

XENONICS HOLDINGS, INC.

3186 Lionshead Avenue

Carlsbad, CA

92010

June 23, 2014

CONFIDENTIAL SUBSCRIPTION AGREEMENT

INSTRUCTIONS:

Items to be delivered by all Subscribers:

| |

a. |

One (1) completed and executed Subscription Agreement, including the Investor Questionnaire. |

| |

b. |

One completed and executed Security Agreement. |

| |

c. |

Payment in the amount of subscription, by wire transfer of funds only. |

Wired funds should be

directed as follows:

California Bank & Trust

2501 Palomar Airport Rd.

Carlsbad, CA 92011

Routing#:

122232109

For credit to: Xenonics, Inc.

Account #:

THE SUBSCRIBER IS RESPONSIBLE

FOR ALL WIRE TRANSFER FEES IMPOSED BY THE SUBSCRIBER’S BANK.

ALL DOCUMENTS SHOULD BE RETURNED TO:

Sandlapper Securities LLC

Sandlapper Financial Center

29800

Agoura Rd Suite 205

Agoura Hills, CA 91301

Attn.: Scott Ozer

Fax 818 707 7201

In the event investor decides not to participate in this offering please return this Confidential Subscription Agreement to the address

set forth above.

THE FOLLOWING EXHIBITS AND SCHEDULES ARE ANNEXED TO

AND FORM PART OF THIS SUBSCRIPTION AGREEMENT:

DISCLOSURE SCHEDULE

|

|

|

| EXHIBIT A: |

|

INVESTOR QUESTIONNAIRE |

| EXHIBIT B: |

|

FORM OF CONVERTIBLE SENIOR SECURED NOTE |

| EXHIBIT C: |

|

FORM OF SECURITY AGREEMENT |

| EXHIBIT D: |

|

FORM OF INTERCREDITOR AGREEMENT |

2

SUBSCRIPTION AGREEMENT

The undersigned (the “Subscriber” or the “Purchaser”) hereby subscribes to purchase from Xenonics Holdings,

Inc., a Nevada corporation (the “Company”), Senior Secured Notes, on the terms as described herein. The Company is offering hereby (the “Offering”) up to a total aggregate principal amount of $1,000,000 of Senior

Secured Convertibles Notes on a “best efforts” basis in the principal amount of $25,000 (the “Convertible Note”).

Article I

SALE OF

CONVERTIBLE NOTES

1.1 Sale of Securities; Offering Period

(a) Subject to the terms and conditions hereof and on the basis of the representations and warranties hereinafter set forth, the Company

hereby agrees to issue and sell to the Subscriber and the Subscriber agrees to purchase from the Company, upon Closing, the principal amount of Convertible Notes as described herein for the purchase price as set forth on the signature page of this

Subscription Agreement executed by the Subscriber. The Convertible Notes are convertible into shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) or the “Conversion Securities”, as

defined below. The principal amount of Convertible Notes purchased hereunder by a Subscriber shall be as specified on the signature page of this Subscription Agreement executed by the Subscriber. The Company may reject any subscription in whole or

in part. The Company is offering the Convertible Notes on a “best efforts” basis as the total Offering amount. This Offering is only being made to “accredited Subscribers” (as defined in Rule 501 under the Securities Act of 1933,

as amended (the “Securities Act”)) in reliance upon an exemption from registration under Section 4(2) of the Securities Act and/or Regulation D promulgated thereunder, and on similar exemptions under applicable state laws. The

Convertible Notes may be purchased, in part or their entirety, by officers and directors of the Company or representatives of the Selling Agent (as defined below).

(b) The Securities are being offered during the offering period commencing on the date set forth on the cover page of this Subscription

Agreement and terminating on the earlier of (a) 5:00 p.m. (Los Angeles, California time) on July 31, 2014 or (b) the date on which all the Securities authorized for sale have been sold (the “Offering Period”). The

Company reserves the right to terminate or close the offering at any time.

(c) The Convertible Notes are convertible at the option

of the holder shares of the Company’s Common Stock (the “Conversion Shares”) at the initial conversion rate of $0.07 per share. The conversion rate is subject to adjustment as described in the Convertible Notes, including in

the event that the Company issued additional shares of Common Stock or other equity securities at a purchase price (or exercise price or conversion price for Convertible Securities) below the initial conversion rate. The principal amount of the

Convertible Notes shall bear interest at the rate of 13% per annum and shall have maturity date of there 3 years from the original issue date. The Convertible Notes are secured obligations of the Company and will be secured by a first priority

lien and security interest on the Company’s assets, which lien will be evidenced by the Security Agreement annexed hereto (the “Security Agreement. A summary of the material terms and conditions of the Convertible Notes is set forth

below under the caption “Summary of Offering.”

1.2 High Risk Investment. This investment is speculative and

should only be made by Subscribers who can afford the risk of loss of their entire investment. The proceeds from the sale of the Convertible Notes will be used to fund short term capital needs to enable the Company to maintain operations (including

certain limited payments to officers for accrued salaries) until additional funding is received. The Company has significant outstanding debt represented by promissory notes which is due and payable prior to the maturity date of the Convertible

Notes and although a substantial potion of the creditors holding these outstanding obligations will be required to agree to forgo collection efforts, for a period of time, it is possible that the Company’s revenue and income will be unable to

generate sufficient funds to repay all of the outstanding debt, including the Convertible Notes. The Company may be required to sell additional securities (whether debt or equity or equity linked) after the completion of this transaction to further

fund its operations. Unless the Company is successful in completing these additional funding transactions, or is able to generate sufficient revenue from operations, the Company may be forced to significantly curtail its operations, the Convertible

Notes may remain unpaid and Subscribers will lose their entire investment.

3

1.3 Selling Agents; Certain Expenses. The Company has engaged Sandlapper Securities LLC as

its exclusive selling agent (the “Selling Agent”), for the sale of the Convertible Notes and will pay commissions and other compensation to the Selling Agent based on the subscriptions procured by it in this Offering. The Company

will pay commissions to the Selling Agent of 9.0% of the gross proceeds from the sale of the Securities in this Offering to subscribers procured by Sandlapper Securities LLC and reimburse Sandlapper Securities LLC for their reasonable expenses up to

$15,000. The Company will also issue to the Selling Agent warrants (the “Agent Warrants”) to purchase such number of shares of Common Stock of the Company as equals 25% of the number of shares of Common Stock based upon the

principal amount of Convertible Notes and the conversion price of the Convertible Notes sold in the Offering to Subscribers procured by the Selling Agents. The Agent Warrants will be exercisable for a period of five (5) years at an exercise

price of $0.12 per share. Officers, directors and affiliates of the Selling Agent and the Company may purchase Convertible Notes in the Offering. The Company will also indemnify the Selling Agent against certain liabilities, including liabilities

under the Securities Act of 1933, and liabilities arising from breaches of representations and warranties contained in the agreement, or to contribute to payments that it may be required to make in respect of such liabilities.

Summary of Offering

|

|

|

| Securities Offered: |

|

The Company is offering a total of $1,000,000 of its Convertible Notes on a “best efforts” basis as to the entire Offering. As used herein the Convertible Notes and Conversion Shares may be collectively referred to as the

“Securities.” |

|

|

| Purchase Price: |

|

The Company is selling the Convertible Notes in this Offering at a Purchase Price of $25,000 principal amount. The Company may accept subscriptions for partial Convertible Notes in its sole discretion. |

|

|

| Offering Period: |

|

The Securities are being offered during the Offering Period commencing on the date set forth on the cover page of this Subscription Agreement and terminating on the earlier of (a) 5:00 p.m. (Los Angeles, California time) on July 31,

2014 or (b) the date on which maximum principal amount of Convertible Notes authorized for sale have been sold. The Company reserves the right to terminate or close the offering at any time. |

|

| Summary of Convertible Notes: |

|

|

| Principal Amount: |

|

Up to an aggregate principal amount of $1,000,000. |

|

|

| Interest: |

|

The Convertible Notes shall accrue simple interest at the rate of 13% per annum, payable semi-annually and at maturity. Interest shall be payable on September 30th and March 30th of each year. |

|

|

| Maturity: |

|

The Convertible Notes shall have a maturity date of three (3) years from the date of issuance. |

4

|

|

|

|

|

| Prepayment/

Redemption: |

|

The Convertible Notes may be prepaid in whole or in part at any time at the option of the Company between the first anniversary and second anniversary thereafter at 110% of the principal amount plus accrued and unpaid interest.

Holders of the Convertible Notes shall have the option to convert principal and unpaid interest into Common Stock at their option upon receipt of any prepayment notice received from the Company. After the second anniversary the Convertible Notes can

be prepaid without any prepayment penalty under the same terms. |

|

|

| Conversion Price: |

|

At the holder’s option the Convertible Notes will be convertible into shares of Common Stock at an initial conversion rate of $0.07 per share. |

|

|

| Anti-dilution protection: |

|

The conversion rate of the Convertible Notes will be adjusted on a “full ratchet” basis in the event that the Company issues additional shares of Common Stock or common stock equivalents (other than for stock option grants

and other customary exclusions) at a purchase price less than the initial conversion rate of the Convertible Notes. In addition, the Convertible Notes will be adjusted proportionally in the event of stock splits, stock dividends, combinations,

recapitalizations, and similar events. |

|

|

| Security Interest: |

|

The outstanding principal and interest outstanding under the Convertible Notes, and all other amounts due thereunder, shall be secured by a first priority lien on the assets of the Company as set forth in the Security Agreement

which lien is intended to be pari passu with all other secured Indebtedness. Holders of the Convertible Notes shall enter into an intercreditor agreement (“Intercreditor Agreement”) with other secured indebtedness. The Company has

approximately $2,375,000 (“Prior Debt”) amount of indebtedness secured by a lien on the Company’s assets which is intended to be pari passu which the lien granted in connection with the Convertible Notes. |

|

|

| Registration Rights: |

|

Subscribers shall not be entitled to registration rights and will be required to rely upon Rule 144 with respect to the resale of any shares of Common Stock upon conversion of the Convertible Notes. The Company, shall at its cost

and expense, provide on behalf of investor, any legal opinions with respect to sales, pursuant to Rule 144, of Conversion Shares as may be required by the Company’s stock transfer agent. |

|

|

| Use of Proceeds: |

|

The proceeds will be used to fund working capital and for general corporate purposes. No more than an aggregate of $50,000 of the proceeds will be used to repay accrued salaries or expenses of officers or directors or affiliates

thereof. After the final Closing, any such remaining accrued, but unpaid salaries and expenses shall be paid solely from positive cash flow from operations of the Company and not from any proceeds of the offering. |

|

|

| Escrow; No Offering Minimum: |

|

The Company and the Selling Agent have established a non-interest bearing escrow account for the deposit of funds in this Offering. However, each Subscriber acknowledges and understands that there is no minimum Offering amount

necessary to conduct a closing for the funds to be released to the Company. The escrow account will be established between the Company and the Selling Agent at California Bank & Trust. Funds may be released to the Company and closings held, from

time to time, as determined by the Company and the Selling Agent at any time during the Offering Period. |

5

|

|

|

|

|

| Subscription Procedure: |

|

In order to subscribe for the Securities, each prospective subscriber must complete, execute and deliver to the Company a signature page evidencing such prospective subscriber’s execution of this Subscription Agreement along

with a completed confidential Purchaser Questionnaire and a copy of the Security Agreement. The Agent appointed (Sandlapper Securities LLC on behalf of the subscribers) under the Security Agreement will execute the Intercreditor Agreement on behalf

of Subscribers. |

|

|

| Restrictions on

Transferability: |

|

There is no public market for the Convertible Notes and it is not anticipated that a market will develop after this Offering. Further, the Conversion Shares have not been registered under the Securities Act or under the securities

laws of the United States or of any state or other jurisdiction. As a result, the Convertible Notes and Conversion Shares (collectively, sometimes referred to as the “Securities”) are restricted securities under the Securities Act

and they may not be transferred without registration under the Securities Act, or, if applicable, the securities laws of any state or other jurisdiction, unless in the opinion of counsel to the Company, such registration is not then required because

of the availability of an exemption from registration. |

|

|

| Investment: |

|

An investment in the Company is highly speculative, and each investor bears the risk of losing his, her or its entire investment. All Purchasers must complete and execute a Subscription Agreement, the Security Agreement, and a

confidential Purchaser Questionnaire. Purchasers must set forth representations in such documents that he, she or it is purchasing the Securities for investment purposes only and without a view toward distribution. The Securities are suitable

investments only for sophisticated Subscribers for whom an investment in the Securities does not constitute a complete investment program and who fully understand, are willing to assume, and who have the financial resources necessary to withstand,

the risks involved in investing in the Securities and who can bear the potential loss of their entire investment. The Securities are being offered and sold only to persons who qualify as “accredited Subscribers,” as defined under

Regulation D of the Securities Act. |

|

|

| Risk Factors: |

|

An investment in the Securities involves a high degree of risk. Purchasers of the Securities should carefully review the factors under the heading “Risk Factors” herein and in the Company’s reports filed under the

Securities Exchange Act of 1934, as amended which are incorporated by reference. |

1.4 Escrow and No Minimum Offering Amount; Multiple Closings.

Each Subscriber acknowledges and agrees that all subscription amounts will be deposited in a non-interest bearing account established by the

Company and the Selling Agent at California Bank & Trust, but that there is no minimum Offering amount (or other conditions other than normal closing conditions) necessary to conduct a closing for the funds to be released to the Company.

Accordingly, funds may be released to the Company and closings held, from time to time, as determined by the Company at any time during the Offering Period. During the Offering Period, subscription funds will be placed into the escrow account and

closings will be held from time to time up to the sale of the maximum amount of Securities described in this Subscription Agreement or the expiration of the Offering Period. In the event a subscription is not accepted in whole or in part by the

Company, the full or ratable amount, as the case may be, of any subscription payment received will be promptly refunded to the Subscriber without deduction therefrom and without interest thereon. In the event a subscription is accepted by the

Company, in whole or in part, and subject to the conditions set forth in this Subscription Agreement, a closing may be held from time to time by the Company and the Company shall issue and deliver to subscriber, the Convertible Note dated the date

of closing on such funds, and a fully executed copy of this Subscription Agreement and the Security Agreement.

6

At each closing of the transactions contemplated herein (the “Closing”), the

Subscribers shall purchase, severally and not jointly, and the Company shall issue and sell, to the Subscribers the amount of Securities as indicated on the signature page of each Subscriber’s subscription agreement, up to the total Offering

amount. The Securities may be purchased, in part or their entirety, by officers and directors of the Company or representatives of the Selling Agent. Each Closing shall occur on the date determined by the Company and the Selling Agent at such times

and/or locations as the Company may set. A final Closing shall be held either on the date of which this Offering is fully subscribed or the last date during the Offering Period on which the Company accepts a subscription, whichever is latest. This

Offering shall terminate on the earlier of (a) 5:00 p.m. (New York time) on July 31, 2014 or (b) the date on which all the Securities authorized for sale have been sold, unless sooner terminated by the Company, in its sole discretion.

Each Closing of the transactions contemplated hereunder shall be deemed to occur at the offices of Becker & Poliakoff, LLP, 45 Broadway, 8th Floor, New York, New York 10006, or at such

other place as shall be mutually agreeable to the parties, at 12 noon, New York time, on such date or dates as may be mutually agreeable to the parties.

1.5 Closing Matters. At each Closing the following actions shall be taken:

(a) each Subscriber shall deliver its Purchase Price in immediately available United States funds to the escrow account established for the

Offering;

(b) the Company shall deliver the Convertible Notes subscribed for to each Subscriber; and

(c) each of the Company and the Subscriber shall deliver to the other signed copies of this Agreement and the Security Agreement and the

Subscriber shall deliver to the Selling Agent a completed and executed Purchaser Questionnaire.

1.6 Use of Proceeds. The Company

intends to use the proceeds derived from this Offering to satisfy its working capital requirements and general corporate purposes. No more than an aggregate of $50,000 of the proceeds will be used to repay accrued salaries or expenses of officers or

directors or affiliates thereof. After the Closing, any such remaining accrued, but unpaid salaries and expenses shall be paid solely from positive cash flow from operations of the Company and not from any proceeds of the offering. Management

reserves the right to utilize the net proceeds of the Offering in a manner in the best interests of the Company. Accordingly, management will have broad discretion in the application of the proceeds of the Offering. The amount of the net proceeds

that will be invested in particular areas of the Company’s business will depend upon future economic conditions and business opportunities. To the extent that the Company continues to incur losses from operations, such losses will be funded

from its general funds, including the net proceeds of this Offering. As reported in its Quarterly Report on Form 10-Q for the quarter ended March 31, 2014, filed on May 15, 2014, the Company had total liabilities of approximately

$3,499,000, including accounts payable of approximately $591,000. Holders of not less than $2,375,000 of outstanding notes (“Prior Debt”) are entitled, under the existing terms of such debt, to be repaid in October and December of

2014, which is prior to the maturity date of the Convertible Notes. The holders of such Prior Debt have entered into the Intercreditor Agreement with Subscribers in this Offering (the security agent shall execute the Intercreditor Agreement on

behalf of Subscribers) whereby the holders of the Prior Debt shall agree to postpone any collection efforts with respect to such Prior Debt except upon consent of at least 75% of the principal amount of all the Prior Debt and the Convertible Notes,

considered as a single class. Further, under the Interecreditor Agreement, the holders of the Prior Debt and the Convertible Notes shall share ratably as secured creditors in the assets of the Company upon any default. Additionally under the

Intercreditor Agreement, (i) no interest payments may be made on the Prior Debt or the convertible Notes unless both receive interest payments, (ii) so long as the Company generates (a) at least $1,000,000 of revenue during any fiscal

quarter of the Company, and (b) positive EBITDA during such quarter, the Company may, in its discretion, pay down the principal balance under the Prior Debt within 45 days after the end of any such quarter in an amount not to exceed 25% of such

positive EBITDA on a cumulative basis; provided, however, that no principal payments may be made unless the Company has free cash of at least $200,000. For purposes of this Agreement, (a) “EBITDA” means, for any period in question,

Company’s consolidated net income for such period plus, to the extent deducted in determining consolidated net income for such period, interest expense, income tax expense, and depreciation and amortization, and (b) “free cash”

means cash of the Company net of any principal payments that are contemplated to be made by the Company.

7

1.7 Certain Reports Filed Under the Securities Exchange Act of 1934.

(a) Annual Report on Form 10-K for the year ended September 30, 2013. On December 19, 2013, the Company filed its Annual

Report on Form 10-K for the year ended September 30, 2013 (the “2013 Annual Report”) with the United States Securities and Exchange Commission (the “SEC”).

(b) Quarterly Reports on Form 10-Q. On May 15, 2014, the Company filed with the SEC its Quarterly Report on Form 10-Q for the

quarter ended March 31, 2014 (the “2013 Quarterly Reports”).

(c) Current Reports on Form 8-K. The Company has

filed Current Reports on Form 8-K with the SEC on the following dates during the current fiscal year: February 14, 2013 and May 19, 2014 (the “Current Reports”).

(d) Acknowledgement and Confirmation. The undersigned hereby agrees and acknowledges that it has been advised that the Company

has filed with the SEC the 2013 Annual Report, the 2014 Quarterly Reports and the Current Reports (collectively, the “SEC Reports”) and that it has either obtained or has access to (through the public website of the SEC or

otherwise) the SEC Reports. The SEC Reports comprise an integral part of this Agreement and each Subscriber is urged to read each such report in its entirety including the “Risk Factors” stated therein. The undersigned further agrees that

the SEC Reports are incorporated herein by reference, that it has taken the opportunity to review such reports in their entirety, including the risk factors described therein, and that it has considered all factors that it deems material in deciding

on the advisability of investing in the Company’s Convertible Notes.

1.8 Subscriber Information

|

|

|

| (a) |

|

Name(s) of

SUBSCRIBER(s):

|

|

|

|

|

|

|

|

|

|

|

| (b) Principal Amount of Convertible |

|

|

| Notes Subscribed for: |

|

$ |

|

|

| (c) Accredited Investor Status |

|

|

The Subscriber acknowledges and agrees that the offering and sale of the Securities are intended to be

exempt from registration under the Securities Act, by virtue of Section 4(2) thereof and/or Regulation D promulgated thereunder. In accordance therewith and in furtherance thereof, the Subscriber represents and warrants to and agrees with the

Company as follows [Please check statements applicable to the Subscriber]:

The Subscriber is an Accredited Investor because the

Subscriber is (check appropriate item):

| |

¨ |

a bank as defined in Section 3(a)(2) of the Securities Act; |

| |

¨ |

a savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act; |

8

| |

¨ |

a broker or dealer registered pursuant to Section 15 of the Securities Exchange Act of 1934 as amended (the “Exchange Act”); |

| |

¨ |

an insurance company as defined in Section 2(13) of the Securities Act; |

| |

¨ |

an investment company registered under the Investment Company Act of 1940, as amended or a business development company as defined in Section 2(a)(48) of such act; |

| |

¨ |

a Small Business Investment Company licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958; |

| |

¨ |

an employee benefit plan within the meaning of Title I of the Employee Retirement Income Security Act of 1974, as amended, if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such

Act, which is either a bank, savings and loan association, insurance company, or registered investment adviser, or if the employee benefit plan has total assets in excess of $5,000,000 or, if a self-directed plan, with investment decisions made

solely by persons that are accredited Subscribers; |

| |

¨ |

a private business development company as defined in Section 202(a)(22) of the Investment Advisers Act of 1940, as amended; |

| |

¨ |

an organization described in Section 501(c)(3) of the Internal Revenue Code, a corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of acquiring the securities

offered, with total assets in excess of $5,000,000; |

| |

¨ |

a natural person whose individual net worth or joint net worth with that person’s spouse, at the time of his purchase exceeds $l,000,000 (excluding the value of such person’s primary residence);

|

| |

¨ |

a natural person who had an individual income in excess of $200,000 in each of the two most recent years or joint income with that person’s spouse in excess of $300,000 in each of those years and has a reasonable

expectation of reaching the same income level in the current year; |

| |

¨ |

a trust, with total assets in excess of $5,000,000, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in Rule 506(b)(2)(ii) of the

Exchange Act; |

| |

¨ |

an entity in which all of the equity owners are accredited Subscribers. (If this alternative is checked, the Subscriber must identify each equity owner and provide statements signed by each demonstrating how each

qualifies as an accredited investor); |

| |

¨ |

a plan established and maintained by a state, its political subdivisions, or any agency or instrumentality thereof, for the benefit of its employees, if such plan has total assets in excess of $5,000,000; or

|

| |

¨ |

a director or officer of the Company. |

9

(d) Additional Information.

The Subscriber has completed the signature page to this Subscription Agreement and the Questionnaire annexed at Exhibit A to this

Subscription Agreement and the signature page to the Security Agreement annexed as Exhibit C.

10

1.9 Risk Factors

Investing in the Company’s Convertible Notes involves risks and the Company’s operating results and financial condition have varied in the past

and may in the future vary significantly depending on a number of factors. Investors should consider the following risk factors in evaluating whether to invest in the Securities. However, the risks described below are not the only risks facing the

Company. In addition to these risk factors and other risks described elsewhere in this Agreement, including the Disclosure Schedule to this Agreement, investors should carefully consider the risk factors described in the Company’s SEC Reports,

each of which has been filed with the Securities and Exchange Commission and which are all incorporated by reference in this Agreement. These risks could have a material adverse effect on the Company’s business, results of operations, financial

condition or liquidity and cause the Company’s actual operating results to materially differ from those contained in forward-looking statements made in this Agreement, in the Company’s SEC Reports and elsewhere by management. Before making

an investment decision, investor should carefully consider these risks as well as other information contained or incorporated by reference in this Agreement. Additional risks and uncertainties not currently known to the Company or that the Company

currently deems to be immaterial also may materially adversely affect the Company’s business, financial condition and/or operating results.

General Risks Related to the Company’s Business

The Company has only Limited Revenue and has a history of Losses.

Revenues for the quarter ended March 31, 2014 were $16,000 compared to revenues of $961,000 for the quarter ended March 31, 2013. In the quarter

ended March 31, 2014, 100% of revenues were from sales of the Company’s NightHunter products to the military (U.S. Army, U.S. Marines and military distributors). In the quarter ended March 31, 2013, 98% of revenues were from sales of

the NightHunter products to the military. The Company had, in the quarter ended March 31, 2014 net losses of $576,000 compared to a net loss of $293,000 for the quarter ended March 31, 2013. Unless the amount of revenue and net profit

increase, we will be unable to repay the Convertible Notes and Subscribers may lose their investment.

The Company’s financial statements include

a “Going Concern” qualification.

The Company’s financial statements for the three and six months ended March 31, 2014 and for the

fiscal year ended September 30, 2013, include an explanatory paragraph relating to the Company’s ability to continue as a going concern. Based on the amount of working capital that on hand on March 31, 2014 and the amount of unfilled

and potential orders that are pending, management is optimistic about its ability to obtain sales orders and/or additional equity or debt financing to continue to support planned operations and satisfy obligations. However, due to the nature of the

Company’s business, and its dependence upon US and Foreign military spending, business, there is no assurance that the Company will receive new orders if ever or when anticipated.

Risks Related to this Offering

This Offering may result in dilution to common shareholders.

Dilution of the per share value of the Company’s Common Stock could result from the issuance of the Securities in this Offering. If this

Offering is fully subscribed and excluding the Agent Warrants, the Company will issue an aggregate of $1,000,000 of Convertible Notes, which are initially convertible into a total of 14,285,714 Conversion Shares. In addition, the Company may be

required to issue additional Conversion Shares pursuant to the anti-dilution provision of the Convertible Notes. The issuance of a substantial number of shares of the Company’s Common Stock will dilute the equity interests of the Company’s

current stockholders.

11

The Company does not currently have necessary Revenue or Income to Repay its Outstanding Debt; Certain

Proceeds will be used to repay Officers Salaries; Subscribers of Convertible Notes will be limited in rights to collect upon collateral in the event of default or non payment.

The Company has secured debt and other liabilities in excess of its ability to pay currently. The Company’s primary goal is to use the

funds from this Offering to help it obtain additional contracts and revenue although the Company may use up to $50,000 for officers’ salaries. Holders of the Convertible Notes will be required, under the terms of the Intercreditor Agreement, to

forego certain rights as secured creditors or share in assets of the Company with other secured creditors, and this may result in less proceeds being available, if the Company defaults under the Convertible Notes, to repay the holders of the

Convertible Notes in full.

The Company will require additional financing.

The Company anticipates that it will need to raise additional financing following the completion of this Offering. The net proceeds from the

sale of the Convertible Notes will not satisfy all of our working capital needs. Further, the Company outstanding debt of approximately $[2,385,000] as of June 1, 2014, all of which has due date for payment prior to the maturity date of

the Convertible Notes. The Company would be unable to repay such Prior Debt with the proceeds of this Offering and may be unable to generate income in an amount necessary to repay the Prior Debt of the Convertible Notes. If the Company is unable to

generate sufficient income or cancel the due dates or terms of the Prior Debt, it may also be required to raise additional funds. Accordingly, the purchasers of the Securities should expect to experience substantial dilution in their percentage of

ownership of the Company and, possibly, the value of their investment. Any future offerings will dilute the percentage ownership of the Company for purchasers of Securities in this Offering. The Company currently has no commitments or arrangement

with respect to any additional financings, and cannot provide any assurances as to whether such additional financing will be available or as to the terms upon which it may be available. If the Company raises additional funds by selling common stock

or convertible securities, the ownership of the Company’s existing shareholders will be diluted

The Securities offered hereby are

“restricted securities” and may not be transferred or resold absent registration or an exemption therefrom.

The

Securities offered hereby will be issued pursuant to an exemption from registration under the Securities Act and therefore have not been and will not be registered under that act or any applicable state securities laws. Consequently, the Securities

may be sold, transferred, or otherwise disposed of by the Purchasers hereunder only if, among other things, the Securities are registered or, in the opinion of counsel acceptable to us, registration is not required under the Securities Act or any

applicable state securities laws. Accordingly, Subscribers will need to rely on exemptions to the registration requirements under the Securities Act and the “blue sky” laws in order to be able to resell the Securities offered hereby.

Purchasers of the Company’s Securities must be aware of the long-term nature of their investment and be able to bear the economic risks

of their investment for an indefinite period of time. The Securities have not been registered under the Securities Act or the securities or “blue sky” laws of any state. The right of any Subscriber to sell, transfer, pledge or otherwise

dispose of the Securities offered herein will be limited by the Securities Act and state securities laws and the regulations promulgated thereunder. Accordingly, under the Securities Act, the Securities offered herein may not be resold unless a

registration statement is filed and becomes effective or an exemption from registration is available. The Company is not under any affirmative obligation to file a registration statement covering the Securities and even if the Company did file a

registration statement covering the Securities, there can be no assurance that any such registration statement would be declared effective. Further, there can be no assurance that a liquid market for the Company’s Common Stock will be

sustained. Rule 144 promulgated under the Securities Act requires, among other conditions, a holding period prior to the resale of securities acquired in a non-public offering without having to satisfy the registration requirements of the Securities

Act. There can be no assurance that the Company will fulfill in the future any reporting requirements under the Exchange Act, or disseminate to the public any current financial or other information concerning the Company, as required by Rule 144 as

one of the conditions of its availability.

12

No assurances that enough Securities will be sold to pursue business strategies or to repay the Convertible

Notes.

No person or entity is committed to purchase any of the Securities offered pursuant to this Offering, and no assurance is

or can be given that all or any of the Securities offered hereunder will be sold. Further, although the Company has established an escrow account for the subscription amounts from Subscribers, no minimum amounts of Securities are required to be

sold. Proceeds received from the Offering will be available to the Company upon receipt, which the Company intends to promptly utilize in accordance with the terms of the “Use of Proceeds” section of this Subscription Agreement, including

the payment of outstanding obligations. The application of the proceeds of the Offering to the payment of current obligations would reduce the ability of the Company to utilize such proceeds for other business purposes. In the event that the Company

is unable to sell all or a significant portion of the Securities pursuant to the Offering, the Company may have insufficient capital after making the aforesaid payments to proceed with the Company’s business strategies and thus may be forced to

seek additional capital sooner than would have been the case had the Offering been fully subscribed. The Company also may need additional funds from loans and/or the sale of securities to repay the Convertible Notes at their maturity date. There can

be no assurance that such additional funds will be available to the Company when required on terms acceptable to the Company. The Company’s inability to obtain financing on favorable terms could restrict its operations and could materially harm

an investment in the Company. The Company has not entered into any agreement or letter of intent for the Next Financing or any other subsequent financing. In the event the Next Financing is not consummated or other financing obtained, the Company

may not have adequate funds available to repay the Convertible Notes.

This Offering is being made on a best efforts basis and there is no minimum

amount of funds required to hold a closing.

This Offering is being made on a “best efforts” rather than a firm

commitment basis. No commitment exists by anyone, including the Selling Agent, to purchase all or any part of the Securities being offered pursuant to this Offering. There can be no assurance that any Securities offered hereby will be sold. Although

the Company has established an escrow account for this Offering, there is no “minimum offering” amount required in this Offering and closings may be held and funds released to the Company at such times and in such amounts, up to the

maximum Offering amount, as determined by the Company and Selling Agent in their discretion once the holders of Prior Debt have executed the Intercreditor Agreement.

No independent counsel for Purchasers.

Each of the Company and the Selling Agent has employed its own legal counsel in connection with this Offering. The Purchasers have not been

represented by independent counsel in connection with the preparation of this Subscription Agreement or the terms of this Offering and no investigation of the merits or fairness of this Offering has been conducted on behalf of the Purchasers.

Company Counsel has not conducted due diligence on behalf of the Purchasers. Prospective Subscribers should consult with their own legal, tax and financial advisors with respect to the Offering made hereby.

The Company’s management will have broad discretion with respect to the use of the proceeds of this Offering.

The Company has highlighted the intended use of proceeds for this Offering, including repayment of outstanding accounts payable. No proceeds

shall be used to repay indebtedness or accrued expenses of officers or directors or affiliates thereof; provided however, the Company may utilize up to $50,000 to pay officers and directors accrued salaries and expenses. The Company’s

management will have broad discretion as to the application of these net proceeds and could use them for purposes other than those contemplated at the time of this Offering. The Company’s note holders may not agree with the manner in which the

Company’s management chooses to allocate and spend the net proceeds.

13

Availability of Securities Act exemption.

The Securities are being offered pursuant to various available exemptions from registration from U.S. federal and state securities law

registration requirements. It is intended that the offering of the Convertible Notes will be conducted in a manner so as to comply with Section 4(2) of the Securities Act of 1933, as amended and Rule 506 (b) of Regulation D promulgated by

the SEC. Compliance with such laws, which must be met in order for such exemptions to be available to us, is highly technical and to some extent involves elements beyond the Company’s control. If the proper exemptions do not ultimately prove to

be available, we could be subject to the claims of all or only some of the Company’s shareholders for violations of federal or state securities laws, which could materially adversely affect the Company’s profitability or operations or make

an investment in the Securities worthless.

Risks Related to the Company’s Securities

Exercise or conversion of outstanding options, warrants and shares of convertible preferred stock will dilute stockholders and could decrease the market

price of the Company’s common stock.

As of May 1, 2014, there were issued and outstanding options to purchase 2,305,000

shares of Common Stock and warrants to purchase an aggregate of 7,187,000 additional shares of Common Stock. To the extent that these securities are exercised or converted, dilution to the Company’s shareholders will occur. Further, there are

no outstanding shares of Common Stock pursuant to unvested restricted stock awards or any additional shares of Common Stock or warrants to certain third parties pursuant to consulting or other business arrangements that are not described in the

Company’s SEC filings. The exercise and conversion of these securities by the holders and issuance of these additional shares of Common Stock may adversely affect the market price of the Company’s Common Stock and the terms under which we

could obtain additional equity capital.

We do not anticipate paying dividends in the foreseeable future, and the lack of dividends may have a

negative effect on the price of the Company’s Common Stock.

The Company currently intends to retain our future earnings, if

any, to support operations and to finance expansion and therefore, the Company does not anticipate paying any cash dividends on its Company’s Common Stock in the foreseeable future.

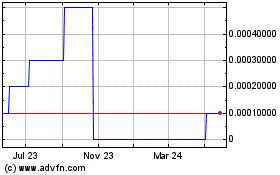

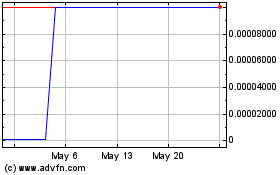

The Company’s Common Stock is traded on the OTC Bulletin Board, which may be detrimental to Subscribers.

The Company’s Common Stock is currently traded on the OTC Bulletin Board under the symbol XNNH. Stocks traded on the OTC Bulletin Board

generally have limited trading volume and are therefore susceptible to exhibiting a wide spread between the bid/ask quotations. The Company cannot predict whether a more active market for the Company’s Common Stock will develop in the future.

In the absence of an active trading market, Subscribers may have difficulty buying and selling the Company’s Common Stock or obtaining market quotations; market visibility for the Company’s Common Stock may be limited; and a lack of

visibility for the Company’s Common Stock may have a depressive effect on the market price for the Company’s Common Stock.

14

Shares of the Company’s Common Stock are subject to restrictions on sales by broker-dealers and penny

stock rules, which may be detrimental to Subscribers; Penny Stock Disclosure

The Company’s Common Stock is subject to Rules

15g-1 through 15g-9 under the Exchange Act, which imposes certain sales practice requirements on broker-dealers who sell the Company’s Common Stock to persons other than established customers and “accredited Subscribers” (as defined

in Rule 501(c) of the Securities Act). For transactions covered by this rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to the

sale. This rule adversely affects the ability of broker-dealers to sell the Company’s Common Stock and purchasers of the Company’s Common Stock to sell their shares.

Additionally, the Company’s Common Stock is subject to SEC regulations applicable to “penny stocks.” Penny stocks include any

non-Nasdaq equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Penny stocks are low-priced shares of small companies. Penny stocks may trade infrequently – which means that it may be difficult to

sell penny stock shares once a Subscriber owns them. Because it may also be difficult to find quotations for penny stocks, they may be impossible to accurately price. Investors in penny stock should be prepared for the possibility that they may lose

their whole investment. For the 52 weeks ending June 20, 2014, the Company’s had a high of $0.20 and a low of $0.05 per share and on June 20, 2014, the Company’s Common Stock had a closing price of $0.09 per share. The

regulations require that prior to any non-exempt buy/sell transaction in a penny stock, a disclosure schedule proscribed by the SEC relating to the penny stock market must be delivered by a broker-dealer to the purchaser of such penny stock. This

disclosure must include the amount of commissions payable to both the broker-dealer and the registered representative and current price quotations for the Company’s Common Stock. The regulations also require that monthly statements be sent to

holders of a penny stock that disclose recent price information for the penny stock and information of the limited market for penny stocks. These requirements adversely affect the market liquidity of the Company’s Common Stock. Under U.S.

Securities and Exchange Commission rules, the Selling Agent is required to provide purchasers of penny stocks the following disclosure statement available at: http://www.sec.gov/investor/schedule15g.htm. The link explains some of the risks of

investing in penny stocks. The Company and the Selling Agent advise each Subscriber to read it carefully before agreeing to purchase or sell a penny stock.

There are outstanding a significant number of shares available for future sales under Rule 144.

As of May 1, 2014, of the 24,975,929 issued and outstanding shares of the Company’s Common Stock, approximately 1,061,935 shares may

be deemed “restricted shares” and, in the future, may be sold in compliance with Rule 144 under the securities Act of 1933, as amended. In general, under Rule 144 under the Securities Act, a person (or persons whose shares are

aggregated) who is not deemed to have been an affiliate of ours at any time during the three months preceding a sale, and who has beneficially owned restricted securities within the meaning of Rule 144 for at least six months (including any period

of consecutive ownership of preceding non-affiliated holders) would be entitled to sell those shares, subject only to the availability of current public information about us. A non-affiliated person who has beneficially owned restricted securities

within the meaning of Rule 144 for at least one year would be entitled to sell those shares without regard to the provisions of Rule 144. A person (or persons whose shares are aggregated) who is deemed to be an affiliate of ours and who

has beneficially owned restricted securities within the meaning of Rule 144 for at least six months would be entitled to sell within any three-month period a number of shares that does not exceed the greater of one percent of the then

outstanding shares of the Company’s common stock or the average weekly trading volume of the Company’s common stock during the Company’s calendar weeks preceding such sale. Such sales are also subject to certain manner of sale

provisions, notice requirements and the availability of current public information about us. Possible or actual sales of the Company’s Common Stock by certain of the Company’s present shareholders under Rule 144 may, in the future, have a

depressive effect on the price of the Company’s Common Stock in any market which may develop for such shares. Such sales at that time may have a depressive effect on the price of the Company’s Common Stock in the open market.

15

A substantial number of shares may be sold in the market following this offering, which will further dilute

the Company’s common shareholders and may depress the market price for the Company’s common stock.

Sales of a

substantial number of shares of the Company’s Common Stock in the public market following this offering could cause the market price of the Company’s common stock to decline. If the total Offering is completed, the Company will issue to

Subscribers (a) an aggregate of $1,000,000 principal amount of Convertible Notes, which are initially convertible into 14,285,714 Conversion Shares. The Company will also issue to the Selling Agent a maximum of 3,571,429 Agent Warrants. Based

on a total of 24,975,929 shares of Common Stock outstanding, if the total Offering is completed and the Convertible Notes converted into Conversion Shares at a conversion rate of $0.07 per share, the total number of outstanding shares of Common

Stock would be 39,261,643 shares, assuming no interest on the principal amount of the Convertible Notes or exercise of outstanding options or warrants or of Agent Warrants. The issuance of a substantial number of the Company’s Common Stock will

dilute the equity interests of the Company’s current stockholders. Further, as a substantial majority of the outstanding shares of the Company’s Common Stock are, tradable without restriction or further registration under the Securities

Act of 1933 unless these shares are purchased by affiliates, the issuance of the Common Stock offered hereby may further depress the market price of the Company’s Common Stock.

Preferred Stock as an anti-takeover device.

The Company is authorized to issue 5,000,000 shares of preferred stock, $0.001 par value. Presently, the Company does not have any shares of

preferred stock outstanding. The preferred stock may be issued in series from time to time with such designation, voting and other rights, preferences and limitations as the Company’s Board of Directors may determine by resolution. Unless the

nature of a particular transaction and applicable statutes require such approval, the Board of Directors has the authority to issue these shares without stockholder approval subject to approval of the holders of the Company’s preferred stock.

The issuance of preferred stock may have the effect of delaying or preventing a change in control of the Company without any further action by the Company’s stockholders.

Forward Looking Statements

This Subscription Agreement and the exhibits and schedules annexed hereto contain certain forward looking information within the meaning of

the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934, as amended. These statements relate to future events or future predictions, including events or predictions relating to the Company’s future financial performance,

and are generally identifiable by use of the use of forward-looking terminology such as “believes”, “expects”, “may”, “will”, “should”, “plan”, “intend”, or

“anticipates” or the negative thereof or other variations thereon or comparable terminology, or by discussion of strategy that involve risks an uncertainties. Management wishes to caution each Subscriber that these forward-looking

statements and other statements contained herein regarding matters that are not historical facts, are only predictions and estimates regarding future events and circumstances and involve known and unknown risks, uncertainties and other factors,

including the risks described under “Risk Factors” that may cause the Company’s or its industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of

activity, performance or achievements expressed or implied by such forward-looking statements. This information is based on various assumptions by the management which may not prove to be correct.

In addition to the risks described in Risk Factors, important factors to consider and evaluate in such forward-looking statements include:

(i) changes in the external competitive market factors which might impact the Company’s results of operations; (ii) unanticipated working capital or other cash requirements including those created by the failure of the Company to

adequately anticipate the costs associated with clinical trials, manufacturing and other critical activities; (iii) changes in the Company’s business strategy or an inability to execute its strategy due to the occurrence of unanticipated

events; (iv) the inability or failure of the Company’s management to devote sufficient time and energy to the Company’s business; and (v) the failure of the Company to complete any or all of the transactions described herein on

the terms currently contemplated. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained or incorporated by reference in this Agreement will in fact transpire.

16

All of these assumptions are inherently subject to significant uncertainties and contingencies,

many of which are beyond the control of the Company. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or

achievements. Accordingly, there can be no assurance that actual results will meet expectations or will not be materially lower than the results contemplated in this Agreement. Subscribers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of the date of this document or, in the case of documents referred to or incorporated by reference, the dates of those documents. The Company does not undertake any obligation to release publicly any

revisions to these forward-looking statements to reflect events or circumstances after the date of this document or to reflect the occurrence of unanticipated events, except as may be required under applicable U.S. securities law.

Article II

REPRESENTATIONS AND WARRANTIES OF COMPANY

Except as set forth under the corresponding section of the Disclosure Schedule, which Disclosure Schedule shall be deemed a part hereof and to

qualify any representation or warranty otherwise made herein to the extent of such disclosure, the Company hereby represents and warrants to the Purchasers as of the date of this Subscription Agreement as follows:

(A) Organization. The Company is duly organized, validly existing and in good standing under the laws of its state of incorporation,

with all requisite power and authority to own, lease, license, and use its properties and assets and to carry out the business in which it is engaged, except where the failure to have or be any of the foregoing may not be expected to have a material

adverse effect on the Company’s presently conducted businesses. The Company is not in violation of any of the provisions of its articles of incorporation, bylaws or other organizational or charter documents. The Company is duly qualified to

transact the business in which it is engaged and is in good standing as a foreign corporation in every jurisdiction in which its ownership, leasing, licensing or use of property or assets or the conduct of its business make such qualification

necessary, except where the failure to be so qualified or in good standing, as the case may be, could not, individually or in the aggregate, have or reasonably be expected to result in (i) a material and adverse effect on the legality, validity

or enforceability of this Agreement, (ii) a material and adverse effect on the results of operations, assets, prospects, business or condition (financial or otherwise) of the Company, taken as a whole, or (iii) an adverse impairment to the

Company’s ability to perform on a timely basis its obligations hereunder (any of (i), (ii) or (iii), a “Material Adverse Effect”).

(B) Capitalization. The Company is currently authorized to issue 50,000,000 shares of Common Stock, $0.001 par value per share and

5,000,000 shares of Preferred Stock, $0.001 par value per share. Except as may be described in this Agreement, no securities of the Company are entitled to preemptive or similar rights, and no entity or person has any right of first refusal,

preemptive right, right of participation, or any similar right to participate in the transactions contemplated by this Agreement unless any such rights have been waived. The issue and sale of the Securities will not (except pursuant to their terms

thereunder), immediately or with the passage of time, obligate the Company to issue shares of Common Stock or other securities to any entity or person and will not result in a right of any holder of Company securities to adjust the exercise,

conversion, exchange or reset price under such securities. As of May 1, 2014, there are outstanding 24,975,929 shares of Common Stock. Further, as of such date there are (i) outstanding an aggregate of 2,305,000 options to purchase shares

of Common Stock under the Company’s stock option plans, (ii) outstanding an aggregate of 7,187,000 common stock purchase warrants, (iii) reserved for issuance an aggregate of zero shares of Common Stock pursuant to restricted stock

awards granted to certain of the Company’s employees under the Company’s stock option plans; and (iv) no other shares of Common Stock which are issuable pursuant to arrangements we have agreed to with consultants or vendors.

17

(C) Authorization; Enforceability. The Company has the requisite corporate power and

authority to enter into, deliver and consummate the transactions contemplated by this Subscription Agreement, to issue, sell and deliver the Securities, and otherwise to carry out its obligations hereunder. The execution and delivery of this

Subscription Agreement and the consummation by it of the transactions contemplated thereby have been duly authorized by the Company and no further action is required by the Company in connection therewith. When executed and delivered by the Company,

this Subscription Agreement, the Convertible Notes will constitute the legal, valid and binding obligations of the Company, enforceable as to the Company in accordance with their respective terms, except as enforcement may be limited by bankruptcy,

insolvency, reorganization, arrangement, fraudulent conveyance or transfer, moratorium or other laws or court decisions, now or hereinafter in effect, relating to or affecting the rights of creditors generally and as may be limited by general

principles of equity and the discretion of the court having jurisdiction in an enforcement action (regardless of whether such enforceability is considered in a proceeding in equity or at law).

(D) Consents. The Company is not required to obtain any consent, waiver, authorization, approval or order of, give any notice to, or

make any filing or registration with, any court or other federal, state, local or other governmental authority or other person or entity in connection with the execution, delivery and performance by the Company of this Agreement or the issuance,

sale or delivery of the Securities other than (i) any filings required by state securities laws, (ii) the filing of a Notice of a Sale of Securities on Form D with the Commission under Regulation D of the Securities Act, (iii) those

that have been made or obtained prior to or contemporaneously with the initial Closing, (iv) filings pursuant to the Exchange Act upon closing of the offering and (v) UCC filings to evidence the security interest granted under the Security