Xsunx Inc - Amended Current report filing (8-K/A)

05 November 2007 - 10:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

AMENDMENT #2

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 1, 2007

XsunX, Inc.

(Exact name of registrant as specified in its charter)

Colorado 000-29621 84-1384159

----------- --------- ----------

(State or other jurisdiction (Commission File Number) (IRS Employer

of incorporation) Identification No.)

|

65 Enterprise, Aliso Viejo, California 92656

(Address of principal executive offices and Zip Code)

Registrant's telephone number, including area code (949) 330-8060

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

|_| Written communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

|_| Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|_| Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b))

|_| Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On November 1, 2007, XsunX signed a $21 million common stock purchase agreement

with Fusion Capital Fund II, LLC, an Illinois limited liability company ("Fusion

Capital"). Upon signing the agreement, XsunX received $1,000,000 from Fusion

Capital as an initial purchase under the $21 million commitment in exchange for

3,333,332 shares of our common stock. Concurrently with entering into the common

stock purchase agreement, we entered into a registration rights agreement with

Fusion Capital. Under the registration rights agreement, we agreed to file a

registration statement related to the transaction with the U.S. Securities &

Exchange Commission ("SEC") covering the shares that have been issued or may be

issued to Fusion Capital under the common stock purchase agreement. After the

SEC has declared effective the registration statement related to the transaction

we have the right over a 25-month period to sell our shares of common stock to

Fusion Capital, from time to time, in amounts up to $1 million per sale,

depending on certain conditions as set forth in the agreement, up to the full

aggregate commitment of $21 million.

The purchase price of the shares related to the $20 million balance of future

funding will be based on the prevailing market prices of the Company's shares at

the time of sales without any fixed discount, and the Company will control the

timing and amount of any sale of shares to Fusion Capital. There are no upper

limits to the price Fusion Capital may pay to purchase our common stock.

However, Fusion Capital shall not be obligated to purchase any shares of our

common stock on any business day that the price of our common stock is below

$0.20. There are no negative covenants, restrictions on future fundings,

penalties or liquidated damages in the agreement. The common stock purchase

agreement may be terminated by us at any time at our discretion without any cost

to us.

In consideration for entering into the $21 million agreement we agreed to issue

to Fusion Capital 3,500,000 shares of our common stock as financing commitment

shares which Fusion Capital has agreed to hold for the term of the common stock

purchase agreement. Additionally, under the stock purchase agreement we granted

Fusion Capital common stock purchase warrants to purchase 1,666,666 shares of

our common stock at $0.50, and 1,666,666 shares of our common stock at $0.75.

The shares underlying the warrant grants do not carry mandatory registration

requirements under the terms of the common stock purchase agreement and

registration rights agreement.

The proceeds received by the Company under the common stock purchase agreement

are expected to be used to build an initial base production system delivering

full size commercial quality solar modules, and initiate the manufacture of the

first of four (4) planned 25 megawatt systems under the Company's planned 100

megawatt thin film solar module production facility. Proceeds may also be used

to lease and prepare manufacturing facilities with the necessary support systems

for the manufacturing line, inventory, staff, and general working capital.

The foregoing description of the common stock purchase agreement, the

registration rights agreement, and the common stock purchase warrants are

qualified in their entirety by reference to the full text of the common stock

purchase agreement, the registration rights agreement, and the common stock

purchase warrants, a copy of each of which is attached hereto as Exhibit 10.1,

10.2 and 10.3, respectively, and each of which is incorporated herein in its

entirety by reference.

Item 3.02 Unregistered Sales of Equity Securities.

The information contained above in Item 1.01 is hereby incorporated by reference

into this Item 3.02.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

10.1 Common Stock Purchase Agreement, dated as of November 1, 2007, by

and between the Company and Fusion Capital Fund II, LLC.

10.2 Registration Rights Agreement, dated as of November 1, 2007, by

and between the Company and Fusion Capital Fund II, LLC.

10.3 Form of Warrant, dated as of November 1, 2007

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

XSUNX, INC.

November 2, 2007 By: /s/ Tom Djokovich

------------------------------

Tom Djokovich, CEO

|

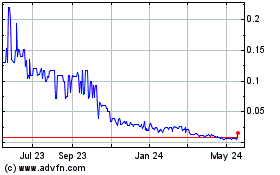

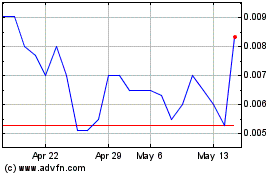

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Jun 2024 to Jul 2024

NovAccess Global (QB) (USOTC:XSNX)

Historical Stock Chart

From Jul 2023 to Jul 2024